Reports

Reports

The food purchasing behavior of many individuals around the globe has changed drastically over the years. The rising disposable income and the growing rural-to-urban migration have contributed to this drastic change. The trend of on-the-go and convenience foods has increased considerably over the years due to these aspects. Processed meat is one of the major foods that are in great demand due to the convenience and taste they offer. Thus, these factors will serve as prime growth factors for the GCC processed meat market during the forecast period of 2016-2024.

Processed meat is referred to as meat that has been preserved through various techniques such as salting, drying, curing, smoking, or canning. Processed meats also contain flavor-enhancing items that helps attract a large consumer base. Furthermore, many meat types are available in this category. Lamb, beef, and poultry are the major ones.

Transparency Market Research has delved deeper into the GCC processed meat market through extensive research activities. From competitive insights to the latest developments of the GCC processed meat market, the TMR report covers all aspects necessary for formulating future business strategies. According to the projections of TMR, the GCC processed meat market is estimated to expand at a CAGR of 8.4% during the forecast period of 2016-2024. The regional GCC processed meat market stood at US$ 760.7 Mn in 2015 and is prognosticated to reach US$ 1.5 Bn by 2024.

The trend of snacking and on-the-go food items has seen rapid rise over the years. This trend is hugely popular among a large chunk of the global populace, especially among the millennial category. Hectic work schedules, long office hours, and change in lifestyle are some of the factors that have influenced the snacking and on-the-go food items trend. Processed meats are consumed on a large scale as they are tasty and ready-to-cook or ready-to-eat. Therefore, these factors have a positive impact on the growth of the GCC processed meat market.

Key quick service restaurants (QSRs) such as McDonalds and KFC are a favorite among various age groups. The hassle-free food items available at QSRs attract substantial customers. These QSRs are partnering with the players in the GCC processed meat market. The extensive popularity of QSRs among numerous individuals has a large impact on the growth of the GCC processed meat market. During the COVID-19 pandemic, the demand for fast food increased and automatically expanded the growth trajectory of the GCC processed meat market. Hence, the increasing influence of QSRs is projected to bring profitable growth for the GCC processed meat market.

Red meat, according to many studies, is harmful for the human health. Red meat contains more cholesterol as compared to white meat. Furthermore, the trans fat content is also more in red meat than white meat. These factors are encouraging white meat consumption to a great extent. Hence, in terms of meat type, the poultry segment may account for a leading growth share of the GCC processed meat market during the forecast period.

The COVID-19 pandemic has changed the growth projections of many industries and sectors. The GCC processed meat market has also been affected due to the pandemic. The lockdown restrictions forced many countries to impose restrictions on the movement of the people. Manufacturing facilities, retail stores, restaurants, malls, and many establishments were closed for a brief period. Many players in the GCC processed meat market had to shut down their processing facilities due to the pandemic.

On the brighter side, the demand for processed meats increased during the lockdown period. Many people went into the panic buying mode due to the restrictions. Although low production and high demand had a negative impact in the early stages of the lockdown, the production facilities were revamped and improved by the players to cater to the increasing demand.

Due to the COVID-19 pandemic, many people switched to online shopping. The players in the GCC processed meat market are focusing on improving their presence on the online arena as the e-commerce trend is expected to enjoy the same popularity in the coming years. Thus, e-commerce platforms are anticipated to bring maximum growth to the GCC processed meat market during the forecast period.

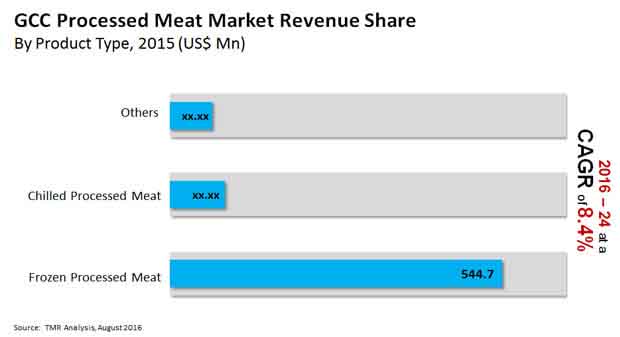

Among all the product types, the frozen processed meat segment is estimated to hold the largest share. This segment dominated the GCC processed meat market in 2015 too. The growing demand for chilled processed meat, especially salami and hotdogs is extrapolated to invite profitable growth avenues for the GCC processed meat market. In addition, the shelf-stable meat segment is also expected to expand at a faster rate during the forecast period. The ‘affordability’ quotient will play a crucial role.

The trend of consuming organic food has reached the GCC processed meat market rapidly. Antibiotic-free meat is gaining considerable traction among a large chunk of the populace. The replacement of harmful additions to process the meat is expanding the horizon of the growth of the GCC processed meat market. Curing agents such as nitrates and nitrites are replaced with celery powder to prevent the risk of cancer. Thus, these factors will propel the demand for organic processed meat, eventually increasing the growth rate of the GCC processed meat market.

In the context of the demographic landscape of the GCC processed meat market, Qatar is projected to emerge as a dominant region followed by the United Arab Emirates (UAE). According to the estimates by TMR, Qatar is expected to expand at a CAGR of 8.8% during the forecast period.

In 2015, GCC Processed Meat Market was valued at US$ 760.7 Mn

GCC Processed Meat Market is expected to reach US$ 1.5 Bn by 2024

GCC Processed Meat Market is estimated to rise at a CAGR of 8.4% during forecast period

Growing demand for chilled processed meat, especially salami and hotdogs is expected to drive the GCC Processed Meat Market

Asia Pacific is more attractive for vendors in the GCC Processed Meat Market

Chapter 1 GCC Processed Meat Market: Preface

1.1 Market Definition and Scope

1.2 Market Segmentation

1.3 Key Research Objectives

1.4 Research Highlights

Chapter 2 GCC Processed Meat Market: Assumptions and Research Methodology

2.1 Assumptions

2.2 Research Methodology

Chapter 3 GCC Processed Meat Market: Executive Summary

3.1 GCC Processed Meat Market Revenue and Volume, 2016-2024 (US$ Mn and Million Kg)

3.2 Market Snapshot

Chapter 4 GCC Processed Meat Market : Market Overview

4.1 Introduction

4.1.1 Industry Overview

4.2 Processed Meat Market Overview

4.3 Key Trends Analysis

4.4 Market Attractiveness Analysis, by Product Type, 2015

4.5 Market Dynamics: Market Drivers & Restraints

4.5.1 Market Drivers

4.5.2 Market Restraints

4.5.3 Market Opportunities

4.6 GCC Processed Meat Price Trend Analysis, By Package Type (Retail Price) 2010-2024 (US$/ Kg)

4.7 Competitive Landscape

4.7.1 Market share of key players, 2015 (%)

4.7.2 Competitive strategies adopted by leading players

Chapter 5 GCC Processed Meat Market, By Meat Type 2010 – 2024

5.1 By Meat Type: Overview

5.1.1 GCC Processed Meat Market Revenue Share, by Meat, 2010-2024 (%)

5.1.2 GCC Processed Meat Market Volume Share, by Meat, 2010-2024 (%)

5.2 GCC Lamb Processed Meat Market, 2010-2024: Revenue and Volume Forecast

5.3 GCC Beef Processed Meat Market, 2010-2024: Revenue and Volume Forecast

5.4 GCC Poultry Processed Meat Market, 2010-2024: Revenue and Volume Forecast

Chapter 6 GCC Processed Meat Market, By Product Type 2010 – 2024

6.1 By Product Type: Overview

6.1.1 GCC Processed Meat Market Revenue Share, by Product Type, 2010-2024

6.1.2 GCC Processed Meat Market Volume Share, by Product Type, 2010-2024

6.2 GCC Chilled Processed Meat Market, 2010-2024: Revenue and Volume Forecast

6.2.1 GCC chilled processed meat market, 2010-2024: revenue forecast

6.2.2 GCC chilled processed meat market, 2010-2024: volume forecast

6.3 GCC Frozen Processed Meat Market, 2010-2024: Revenue and Volume Forecast

6.3.1 GCC frozen processed meat market, 2010-2024: revenue forecast

6.3.2 GCC frozen processed meat market, 2010-2024: volume forecast

6.4 GCC Shelf Stable Processed Meat Market, 2010-2024: Revenue and Volume Forecast

Chapter 7 GCC Processed Meat Market, By Package Type 2010 – 2024

7.1 By Package Type: Overview

7.1.1 GCC Processed Meat Market Revenue Share, by Package Type, 2010-2024 (%)

7.1.2 GCC Processed Meat Market Volume Share, by Package Type, 2010-2024 (%)

7.2 GCC Retail Packaged Processed Meat Market, 2010-2024: Revenue and Volume Forecast

7.3 GCC Bulk Packaged Processed Meat Market, 2010-2024: Revenue and Volume Forecast

Chapter 8 GCC Processed Meat Market, By Country Type,2010 – 2024 8.1: By Country Type: Overview

8.1 GCC Processed Meat Market Revenue Share, by Country, 2010-2024

8.2 GCC Processed Meat Market Volume Share, by Country, 2010-2024

8.2.1 Qatar Processed Meat Market, by 2010-2024: Revenue and Volume Forecast

8.2.2 Qatar processed meat market, by meat type, 2010-2024: revenue forecast

8.2.3 Qatar processed meat market, by meat type, 2010-2024: volume forecast

8.2.4 Qatar processed meat market, by product type, 2010-2024: revenue forecast

8.2.5 Qatar processed meat market, by product type, 2010-2024: volume forecast

8.2.6 Qatar processed meat market, by package type, 2010-2024: revenue forecast

8.2.7 Qatar processed meat market, by package type, 2010-2024: volume forecast

8.2.8 Qatar Processed Meat Price Trend Analysis, By Package Type (Retail Price) 2010-2024

8.3 Rest of GCC Processed Meat Market, 2010-2024: Revenue and Volume Forecast

8.3.1 Rest of GCC processed meat market, by meat type, 2010-2024: revenue forecast

8.3.2 Rest of GCC processed meat market, by meat type, 2010-2024: volume forecast

8.3.3 Rest of GCC processed meat market, by product type, 2010-2024: revenue forecast

8.3.4 Rest of GCC processed meat market, by product type, 2010-2024: volume forecast

8.3.5 Rest of GCC processed meat market, by package type, 2010-2024: revenue forecast

8.3.6 Rest of GCC processed meat market, by package type, 2010-2024: volume forecast

8.3.7 Rest of GCC Processed Meat Price Trend Analysis, By Package Type (Retail Price) 2010-2024 (US$/ Kg)

Chapter 9 Company Profiles

9.1 Yum Brands

9.1.1 Company Details (HQ, Foundation Year, Employee Strength)

9.1.2 Market Presence, By Segment and Geography

9.1.3 Key Developments

9.1.4 Strategy and Historical Roadmap

9.1.5 Revenue and Operating Profits

9.2 Mc Donalds

9.2.1 Company Details (HQ, Foundation Year, Employee Strength)

9.2.2 Market Presence, By Segment and Geography

9.2.3 Key Developments

9.2.4 Strategy and Historical Roadmap

9.2.5 Revenue and Operating Profits

9.3 Tyson Foods

9.3.1 Company Details (HQ, Foundation Year, Employee Strength)

9.3.2 Market Presence, By Segment and Geography

9.3.3 Key Developments

9.3.4 Strategy and Historical Roadmap

9.3.5 Revenue and Operating Profits

9.4 Cargill Inc.

9.4.1 Company Details (HQ, Foundation Year, Employee Strength)

9.4.2 Market Presence, By Segment and Geography

9.4.3 Key Developments

9.4.4 Strategy and Historical Roadmap

9.4.5 Revenue and Operating Profits

9.5 B.R.F. S.A.

9.5.1 Company Details (HQ, Foundation Year, Employee Strength)

9.5.2 Market Presence, By Segment and Geography

9.5.3 Key Developments

9.5.4 Strategy and Historical Roadmap

9.5.5 Revenue and Operating Profits

9.6 National Food Company

9.6.1 Company Details (HQ, Foundation Year, Employee Strength)

9.6.2 Market Presence, By Segment and Geography

9.6.3 Key Developments

9.6.4 Strategy and Historical Roadmap

9.6.5 Revenue and Operating Profits

9.7 Al Islami Foods

9.7.1 Company Details (HQ, Foundation Year, Employee Strength)

9.7.2 Market Presence, By Segment and Geography

9.7.3 Key Developments

9.7.4 Strategy and Historical Roadmap

9.7.5 Revenue and Operating Profits

9.8 Sunbullah Group

9.8.1 Company Details (HQ, Foundation Year, Employee Strength)

9.8.2 Market Presence, By Segment and Geography

9.8.3 Key Developments

9.8.4 Strategy and Historical Roadmap

9.8.5 Revenue and Operating Profits

List of Tables

1 Market Snapshot

2 GCC Processed Meat Price Trend Analysis, By Package Type (Retail Price) 2010-2024 (US$/ Million Kg)

3 GCC chilled processed meat market, 2010-2024: revenue forecast

4 GCC chilled processed meat market, 2010-2024: volume forecast

5 GCC frozen processed meat market, 2010-2024: revenue forecast

6 GCC frozen processed meat market, 2010-2024: volume forecast

7 Qatar processed meat market, by meat type, 2010-2024: revenue forecast

8 Qatar processed meat market, by meat type, 2010-2024: volume forecast

9 Qatar processed meat market, by product type, 2010-2024: revenue forecast

10 Qatar processed meat market, by product type, 2010-2024: volume forecast

11 Qatar processed meat market, by package type, 2010-2024: revenue forecast

12 Qatar processed meat market, by package type, 2010-2024: volume forecast

13 Qatar Processed Meat Price Trend Analysis, By Package Type (Retail Price) 2010-2024 (US$/ Million Kg)

14 Rest of GCC processed meat market, by meat type, 2010-2024: revenue forecast

15 Rest of GCC processed meat market, by meat type, 2010-2024: volume forecast

16 Rest of GCC processed meat market, by product type, 2010-2024: revenue forecast

17 Rest of GCC processed meat market, by product type, 2010-2024: volume forecast

18 Rest of GCC processed meat market, by package type, 2010-2024: revenue forecast

19 Rest of GCC processed meat market, by package type, 2010-2024: volume forecast

20 Rest of GCC Processed Meat Price Trend Analysis, By Package Type (Retail Price) 2010-2024 (US$/ Million Kg)

List of Figures

1 GCC Processed Meat Market Revenue and Volume, 2016-2024 (US$ Mn and Million Kg)

2 Market Attractiveness Analysis, by Product Type, 2015

3 Saudi Arabia Retail Sales Market for Processes Meat Industry

4 Tourist Arrivals in Saudi Arabia

5 Market share of key players, 2015 (%)

6 GCC Processed Meat Market Revenue Share, by Meat, 2010-2024 (%)

7 GCC Processed Meat Market Volume Share, by Meat, 2010-2024 (%)

8 GCC Lamb Processed Meat Market, 2010-2024: Revenue and Volume Forecast

9 GCC Beef Processed Meat Market, 2010-2024: Revenue and Volume Forecast

10 GCC Poultry Processed Meat Market, 2010-2024: Revenue and Volume Forecast

11 GCC Processed Meat Market Revenue Share, by Product Type, 2010-2024 (%)

12 GCC Processed Meat Market Volume Share, by Product Type, 2010-2024

13 GCC Chilled Processed Meat Market, 2010-2024: Revenue and Volume Forecast

14 GCC Frozen Processed Meat Market, 2010-2024: Revenue and Volume Forecast

15 GCC Shelf Stable Processed Meat Market, 2010-2024: Revenue and Volume Forecast

16 GCC Processed Meat Market Revenue Share, by Package Type, 2010-2024 (%)

17 GCC Processed Meat Market Volume Share, by Package Type, 2010-2024 (%)

18 GCC Retail Packaged Processed Meat Market, 2010-2024: Revenue and Volume Forecast

19 GCC Bulk Packaged Processed Meat Market, 2010-2024: Revenue and Volume Forecast

20 GCC Processed Meat Market Revenue Share, by Country, 2010-2024

21 GCC Processed Meat Market Volume Share, by Country, 2010-2024

22 Qatar Processed Meat Market, by 2010-2024: Revenue and Volume Forecast

23 Rest of GCC Processed Meat Market, 2010-2024: Revenue and Volume Forecast