Reports

Reports

The gas turbine market is witnessing consistency as a result of global shift toward more efficient and cleaner energy generation technologies. A fundamental driver to continued market growth is the demand for decentralized power systems and combined cycle plants with better efficiency and lower emissions. In addition, the higher rate of replacement of aging power plants infrastructure in the developed regions will only add to the growth opportunity of this segment.

Key players are also shaping the direction of the market, with new technologies, collaboration, and long-term service agreements for revenue. Key players are developing more efficient turbines focused on higher thermal efficiencies and digital monitoring features rounding out their utility-scale project capabilities.

Furthermore, their engagement in service and maintenance contracts provides additional long-term cash flows and resiliency to the overall market. The competitive field remains concentrated, but with the entry of manufacturers targeting specific regions. Overall, the outlook for the gas turbine market is positive, underpinned by energy security driving policies, industrial engagement, and emissions controls requiring alternatives to coal-based systems to gas innovations.

The global shift toward efficient energy systems and less carbon emissions is the primary driver to the gas turbine marketplace. With more number of countries pursuing cleaner energy options and incentivizing investment with respect to low-carbon infrastructure, gas turbines are seen as a transitional phase between conventional and renewable energy. It is pertinent to mention the increase in developing countries' industrialization as a factor in their search for reliable energy resources that gas turbines can provide.

Career and engineering advancements in aeroderivative and heavy-duty turbines have increased the applications of gas turbines beyond traditional use in power plants into mechanical drive and marine propulsion. Continued rise in energy demand through more urban settlements, data centers, and large-scale manufacturing applications is maintaining market growth.

When combined with the high flexibility and scalability offered by gas turbines, these factors are positioning gas turbines as one amongst the modern energy solutions, when grid reliability and peak load management are with regards to strategy and energy application.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Energy systems are transforming around the world, switching to alternatives to coal that are cleaner and more efficient. As concerns about climate change continue to rise, governments and regulators are mandating strict environmental regulations, carbon pricing or carbon tax, and incentives for users to adopt less emission generation options.

For instance, in a major industrial area, installation of combined-cycle gas turbines has increased, as older coal units are retiring, to assist utilities with meeting both - the reliability and environmental requirements. The installed combined cycle gas turbines improve thermal efficiency while greenhouse gas emissions are decreased based on national net-zero strategies.

Furthermore, gas turbines offer a reliable baseload source and a flexible partner to working with intermittent sources of renewables (solar and wind). Their ability to quick start help grid operators maintain storage reliability with greater amounts of intermittent renewable generation, allowing projected grid reliability while reducing emissions, enhancing the perceived role of gas turbines in transitional technology in decarbonization pathways.

The advancements of gas turbine technology over the last few decades have changed the science of combustion due to advancements in materials science, and the designs of turbine blades. Since the inception of gas turbines, the advancements have been made on a decade by decade basis, which have led to operating temperatures, pressures, and overall efficiency at levels not accessible with older technologies. The agility of future operation will improve fuel efficiency and emissions, as well as enhance the overall environmental story of the operational footprint.

While there are mechanical advancements, there also the introduction of digital technologies have initiated the overhauls in gas turbine operations, and is an expectation within the industry. Predictive maintenance tools along with remote diagnostics have created opportunities for operators to perform real time monitoring, as well as early identification of issues prior to failures, and to spike their maintenance to timeframes that mitigate down-time, and reliability increases that have not been feasible to this point. These aspects have injected an infinite level of reliability operations of gas turbines in mission critical markets or in isolated environments of remote microgrids and industrial plants.

Another area of innovation is modern gas turbines' capability of firing on multiple fuels, although with a contingent blend with hydrogen. Modern gas turbines have the capacity to fuel blends that do not require natural gas only as a feed media. As a result, Steam turbines which solely utilize natural gas as a fuel source appear almost destined for obsolescence, particularly in the context of a world that has an energy preference towards transitioning to lower carbon energy sources. There appears to be a momentum to lean towards hydrogen in turbine fuel blends to improve the optics for a sustainable future by taking a place in the pillars of sustainability by enabling the progress of gas turbines. Contemporary efficient upgrades should indicate the need to incorporate more fuel, therefore the evidence should show an increase in hydrogen as these fuel sets emerge in future use cases and enhance the evolution of gas turbine technologies into the beckoning development of the infrastructure. They stand as the mainstay for future clean energy enablers.

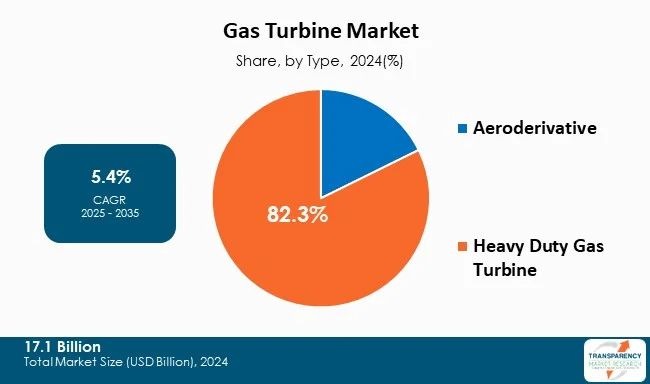

The global gas turbine market is considerably dominated by heavy-duty gas turbines, as they are designed for large power production and continuous operation. Heavy-duty turbines have high capacity and durability and are finished with exceptional thermal and mechanical endurance, making them ideal for base-load generation within utilities, combined cycle plants and large industrial applications. In these applications, performance and reliability over long periods of operation are essential.

The expansion of combined cycle manufacturing has increased the demand for heavy-duty turbines, based on the efficiency that combined cycle plants provide into the future. In this scenario, gas turbines are installed with steam turbines to capture waste heat for generating steam, thus representing a significant advance in plant efficiency. Heavy-duty turbines are also employed in cogeneration, which simultaneously take on the job of exporting electricity while providing useful heat either for an industrial application or to provide a district heating scheme.

When new turbine plants replace older plants, heavy-duty turbines continue to be the choice of operators. Heavy-duty turbines meet utilities and industry long-term needs due to their ability to provide part of the grid stabilization, operational efficiencies, with high capacity and their long-term sustainability, reliability and efficiencies allows them to meet increased operational demands in the transitioning sustainable energy marketplace.

| Attribute | Detail |

|---|---|

| Leading Region |

|

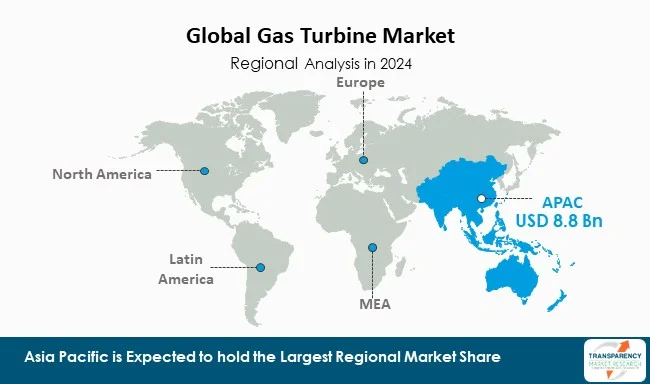

Asia Pacific leads the worldwide gas turbine market due to growing industrialization, urbanization, and desire for reliable energy alternatives in key economies. The countries of Asia Pacific see large investments in infrastructure, manufacturing, and energy security, which have created an ongoing need for gas based power generation. The major-use economies are now relying upon the integration of gas turbines as a more carbon-friendly and flexible energy option.

Policy initiatives surrounding grid modernization and energy efficiency have led to installation of gas turbines in natural gas-fired power plants, industrial facilities, and district energy systems. For instance, in one Southeast Asian country, a number of gas-fired combined cycle projects have been introduced in order to satisfy a growing urban energy system by obtaining energy in near proximity instead of importing and burning a highly carbon intense, imported fuel (coal).

The additional advantage of available LNG import infrastructure also allows for gas turbine operation in areas without domestic natural gas resources. The viability of regional investment into local manufacturing and service facilities also means that end-users do not necessarily need to procure equipment and parts from in-country foreign manufacturers, in turn, enhancing community involvement. As population and industrial energy requirements are set to increase, Asia Pacific will remain an active base for gas turbine deployment, backed by cooperative government supply chain efforts.

General Electric, Siemens, Mitsubishi Hitachi Power Systems, Ltd, Ansaldo Energia, Kawasaki Heavy Industries, Ltd., Capstone Turbine Corporation, MAN Energy Solutions, OPRA Turbines, Caterpillar, Centrax Gas Turbines are some of the leading manufacturers operating in the global gas turbine market.

Each of these companies has been profiled in the gas turbine market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

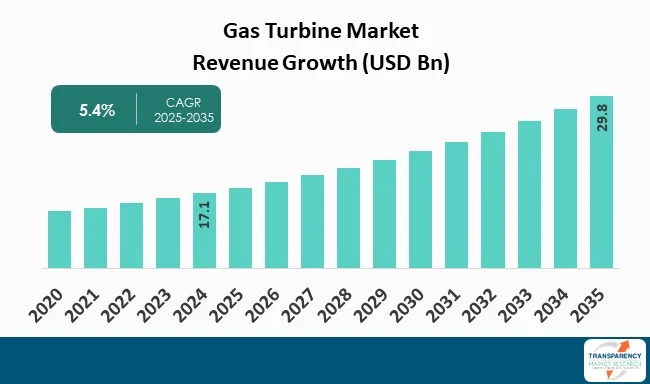

| Market Size Value in 2024 (Base Year) | US$ 17.1 Bn |

| Market Forecast Value in 2035 | US$ 29.8 Bn |

| Growth Rate (CAGR 2025 to 2035) | 5.4% |

| Forecast Period | 2025-2035 |

| Historical data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value and Thousand Units for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player Competition Dashboard and Revenue Share Analysis 2024 Company Profiles (Details Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentations | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global gas turbine market was valued at US$ 17.1 Bn in 2024

The global gas turbine industry is projected to reach at US$ 29.8 Bn by the end of 2035

Transition towards cleaner energy, and technological advancements in gas turbines are some of the factors driving the expansion of gas turbine market.

The CAGR is anticipated to be 5.4% from 2025 to 2035

General Electric, Siemens, Mitsubishi Hitachi Power Systems, Ltd, Ansaldo Energia, Kawasaki Heavy Industries, Ltd, Capstone Turbine Corporation, MAN Energy Solutions, OPRA Turbines, Caterpillar, Centrax Gas Turbines and others are some of the leading manufacturers operating in the global gas turbine market

Table 1: Global Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 2: Global Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 3: Global Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 4: Global Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 5: Global Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 6: Global Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 7: Global Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 8: Global Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 9: Global Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Region

Table 10: Global Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Region

Table 11: North America Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 12: North America Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 13: North America Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 14: North America Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 15: North America Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 16: North America Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 17: North America Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 18: North America Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 19: North America Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 20: North America Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 21: U.S. Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 22: U.S. Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 23: U.S. Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 24: U.S. Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 25: U.S. Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 26: U.S. Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 27: U.S. Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 28: U.S. Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 29: Canada Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 30: Canada Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 31: Canada Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 32: Canada Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 33: Canada Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 34: Canada Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 35: Canada Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 36: Canada Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 37: Europe Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 38: Europe Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 39: Europe Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 40: Europe Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 41: Europe Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 42: Europe Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 43: Europe Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 44: Europe Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 45: Europe Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 46: Europe Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 47: U.K. Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 48: U.K. Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 49: U.K. Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 50: U.K. Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 51: U.K. Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 52: U.K. Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 53: U.K. Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 54: U.K. Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 55: Germany Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 56: Germany Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 57: Germany Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 58: Germany Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 59: Germany Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 60: Germany Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 61: Germany Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 62: Germany Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 63: France Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 64: France Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 65: France Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 66: France Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 67: France Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 68: France Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 69: France Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 70: France Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 71: Italy Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 72: Italy Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 73: Italy Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 74: Italy Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 75: Italy Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 76: Italy Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 77: Italy Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 78: Italy Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 79: Spain Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 80: Spain Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 81: Spain Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 82: Spain Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 83: Spain Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 84: Spain Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 85: Spain Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 86: Spain Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 87: The Netherlands Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 88: The Netherlands Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 89: The Netherlands Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 90: The Netherlands Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 91: The Netherlands Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 92: The Netherlands Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 93: The Netherlands Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 94: The Netherlands Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 95: Asia Pacific Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 96: Asia Pacific Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 97: Asia Pacific Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 98: Asia Pacific Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 99: Asia Pacific Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 100: Asia Pacific Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 101: Asia Pacific Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 102: Asia Pacific Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 103: Asia Pacific Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 104: Asia Pacific Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 105: China Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 106: China Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 107: China Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 108: China Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 109: China Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 110: China Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 111: China Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 112: China Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 113: India Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 114: India Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 115: India Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 116: India Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 117: India Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 118: India Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 119: India Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 120: India Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 121: Japan Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 122: Japan Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 123: Japan Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 124: Japan Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 125: Japan Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 126: Japan Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 127: Japan Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 128: Japan Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 129: Australia Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 130: Australia Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 131: Australia Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 132: Australia Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 133: Australia Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 134: Australia Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 135: Australia Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 136: Australia Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 137: South Korea Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 138: South Korea Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 139: South Korea Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 140: South Korea Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 141: South Korea Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 142: South Korea Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 143: South Korea Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 144: South Korea Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 145: ASEAN Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 146: ASEAN Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 147: ASEAN Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 148: ASEAN Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 149: ASEAN Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 150: ASEAN Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 151: ASEAN Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 152: ASEAN Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 153: Middle East & Africa Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 154: Middle East & Africa Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 155: Middle East & Africa Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 156: Middle East & Africa Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 157: Middle East & Africa Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 158: Middle East & Africa Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 159: Middle East & Africa Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 160: Middle East & Africa Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 161: Middle East & Africa Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 162: Middle East & Africa Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 163: GCC Countries Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 164: GCC Countries Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 165: GCC Countries Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 166: GCC Countries Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 167: GCC Countries Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 168: GCC Countries Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 169: GCC Countries Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 170: GCC Countries Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 171: South Africa Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 172: South Africa Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 173: South Africa Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 174: South Africa Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 175: South Africa Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 176: South Africa Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 177: South Africa Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 178: South Africa Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 179: Latin America Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 180: Latin America Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 181: Latin America Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 182: Latin America Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 183: Latin America Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 184: Latin America Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 185: Latin America Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 186: Latin America Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 187: Latin America Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Country

Table 188: Latin America Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Country

Table 189: Brazil Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 190: Brazil Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 191: Brazil Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 192: Brazil Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 193: Brazil Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 194: Brazil Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 195: Brazil Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 196: Brazil Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 197: Argentina Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 198: Argentina Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 199: Argentina Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 200: Argentina Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 201: Argentina Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 202: Argentina Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 203: Argentina Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 204: Argentina Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Table 205: Mexico Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Type

Table 206: Mexico Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Type

Table 207: Mexico Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Output Range

Table 208: Mexico Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Output Range

Table 209: Mexico Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Fuel Type

Table 210: Mexico Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Fuel Type

Table 211: Mexico Gas Turbine Market Value (US$ Bn) Projection, 2020 to 2035 By Application

Table 212: Mexico Gas Turbine Market Volume (Thousand Units) Projection, 2020 to 2035 By Application

Figure 1: Global Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 2: Global Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 3: Global Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 4: Global Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 5: Global Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 6: Global Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 7: Global Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 8: Global Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 9: Global Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 10: Global Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 11: Global Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 12: Global Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 13: Global Gas Turbine Market Value (US$ Bn) Projection, By Region 2020 to 2035

Figure 14: Global Gas Turbine Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Figure 15: Global Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Region 2025 to 2035

Figure 16: North America Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 17: North America Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 18: North America Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 19: North America Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 20: North America Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 21: North America Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 22: North America Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 23: North America Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 24: North America Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 25: North America Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 26: North America Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 27: North America Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 28: North America Gas Turbine Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 29: North America Gas Turbine Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 30: North America Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 31: U.S. Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 32: U.S. Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 33: U.S. Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 34: U.S. Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 35: U.S. Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 36: U.S. Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 37: U.S. Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 38: U.S. Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 39: U.S. Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 40: U.S. Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 41: U.S. Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 42: U.S. Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 43: Canada Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 44: Canada Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 45: Canada Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 46: Canada Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 47: Canada Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 48: Canada Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 49: Canada Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 50: Canada Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 51: Canada Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 52: Canada Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 53: Canada Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 54: Canada Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 55: Europe Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 56: Europe Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 57: Europe Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 58: Europe Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 59: Europe Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 60: Europe Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 61: Europe Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 62: Europe Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 63: Europe Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 64: Europe Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 65: Europe Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 66: Europe Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 67: Europe Gas Turbine Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 68: Europe Gas Turbine Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 69: Europe Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 70: U.K. Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 71: U.K. Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 72: U.K. Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 73: U.K. Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 74: U.K. Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 75: U.K. Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 76: U.K. Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 77: U.K. Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 78: U.K. Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 79: U.K. Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 80: U.K. Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 81: U.K. Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 82: Germany Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 83: Germany Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 84: Germany Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 85: Germany Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 86: Germany Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 87: Germany Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 88: Germany Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 89: Germany Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 90: Germany Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 91: Germany Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 92: Germany Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 93: Germany Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 94: France Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 95: France Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 96: France Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 97: France Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 98: France Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 99: France Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 100: France Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 101: France Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 102: France Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 103: France Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 104: France Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 105: France Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 106: Italy Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 107: Italy Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 108: Italy Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 109: Italy Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 110: Italy Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 111: Italy Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 112: Italy Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 113: Italy Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 114: Italy Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 115: Italy Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 116: Italy Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 117: Italy Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 118: Spain Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 119: Spain Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 120: Spain Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 121: Spain Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 122: Spain Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 123: Spain Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 124: Spain Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 125: Spain Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 126: Spain Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 127: Spain Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 128: Spain Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 129: Spain Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 130: The Netherlands Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 131: The Netherlands Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 132: The Netherlands Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 133: The Netherlands Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 134: The Netherlands Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 135: The Netherlands Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 136: The Netherlands Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 137: The Netherlands Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 138: The Netherlands Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 139: The Netherlands Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 140: The Netherlands Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 141: The Netherlands Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 142: Asia Pacific Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 143: Asia Pacific Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 144: Asia Pacific Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 145: Asia Pacific Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 146: Asia Pacific Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 147: Asia Pacific Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 148: Asia Pacific Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 149: Asia Pacific Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 150: Asia Pacific Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 151: Asia Pacific Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 152: Asia Pacific Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 153: Asia Pacific Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 154: Asia Pacific Gas Turbine Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 155: Asia Pacific Gas Turbine Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 156: Asia Pacific Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 157: China Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 158: China Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 159: China Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 160: China Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 161: China Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 162: China Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 163: China Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 164: China Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 165: China Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 166: China Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 167: China Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 168: China Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 169: India Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 170: India Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 171: India Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 172: India Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 173: India Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 174: India Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 175: India Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 176: India Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 177: India Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 178: India Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 179: India Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 180: India Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 181: Japan Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 182: Japan Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 183: Japan Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 184: Japan Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 185: Japan Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 186: Japan Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 187: Japan Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 188: Japan Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 189: Japan Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 190: Japan Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 191: Japan Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 192: Japan Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 193: Australia Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 194: Australia Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 195: Australia Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 196: Australia Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 197: Australia Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 198: Australia Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 199: Australia Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 200: Australia Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 201: Australia Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 202: Australia Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 203: Australia Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 204: Australia Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 205: South Korea Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 206: South Korea Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 207: South Korea Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 208: South Korea Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 209: South Korea Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 210: South Korea Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 211: South Korea Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 212: South Korea Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 213: South Korea Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 214: South Korea Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 215: South Korea Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 216: South Korea Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 217: ASEAN Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 218: ASEAN Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 219: ASEAN Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 220: ASEAN Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 221: ASEAN Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 222: ASEAN Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 223: ASEAN Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 224: ASEAN Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 225: ASEAN Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 226: ASEAN Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 227: ASEAN Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 228: ASEAN Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 229: Middle East & Africa Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 230: Middle East & Africa Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 231: Middle East & Africa Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 232: Middle East & Africa Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 233: Middle East & Africa Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 234: Middle East & Africa Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 235: Middle East & Africa Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 236: Middle East & Africa Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 237: Middle East & Africa Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 238: Middle East & Africa Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 239: Middle East & Africa Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 240: Middle East & Africa Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 241: Middle East & Africa Gas Turbine Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 242: Middle East & Africa Gas Turbine Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 243: Middle East & Africa Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 244: GCC Countries Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 245: GCC Countries Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 246: GCC Countries Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 247: GCC Countries Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 248: GCC Countries Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 249: GCC Countries Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 250: GCC Countries Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 251: GCC Countries Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 252: GCC Countries Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 253: GCC Countries Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 254: GCC Countries Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 255: GCC Countries Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 256: South Africa Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 257: South Africa Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 258: South Africa Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 259: South Africa Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 260: South Africa Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 261: South Africa Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 262: South Africa Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 263: South Africa Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 264: South Africa Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 265: South Africa Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 266: South Africa Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 267: South Africa Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 268: Latin America Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 269: Latin America Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 270: Latin America Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 271: Latin America Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 272: Latin America Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 273: Latin America Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 274: Latin America Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 275: Latin America Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 276: Latin America Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 277: Latin America Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 278: Latin America Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 279: Latin America Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 280: Latin America Gas Turbine Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 281: Latin America Gas Turbine Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 282: Latin America Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 283: Brazil Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 284: Brazil Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 285: Brazil Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 286: Brazil Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 287: Brazil Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 288: Brazil Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 289: Brazil Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 290: Brazil Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 291: Brazil Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 292: Brazil Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 293: Brazil Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 294: Brazil Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 295: Argentina Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 296: Argentina Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 297: Argentina Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 298: Argentina Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 299: Argentina Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 300: Argentina Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 301: Argentina Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 302: Argentina Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 303: Argentina Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 304: Argentina Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 305: Argentina Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 306: Argentina Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 307: Mexico Gas Turbine Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 308: Mexico Gas Turbine Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 309: Mexico Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 310: Mexico Gas Turbine Market Value (US$ Bn) Projection, By Output Range 2020 to 2035

Figure 311: Mexico Gas Turbine Market Volume (Thousand Units) Projection, By Output Range 2020 to 2035

Figure 312: Mexico Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Output Range 2025 to 2035

Figure 313: Mexico Gas Turbine Market Value (US$ Bn) Projection, By Fuel Type 2020 to 2035

Figure 314: Mexico Gas Turbine Market Volume (Thousand Units) Projection, By Fuel Type 2020 to 2035

Figure 315: Mexico Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Fuel Type 2025 to 2035

Figure 316: Mexico Gas Turbine Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 317: Mexico Gas Turbine Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 318: Mexico Gas Turbine Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035