Reports

Reports

Analysts’ Viewpoint

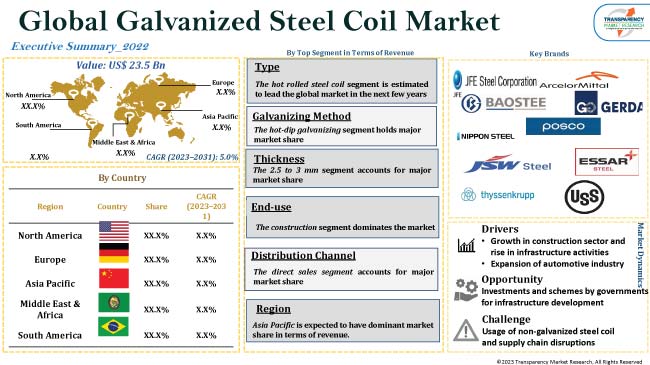

Increase in usage of galvanized steel coil for construction applications is driving the market. Rise in infrastructure activities globally is also augmenting the galvanized steel coil demand.

Galvanized steel coil production has increased owing to growth in its demand in the automotive industry. Various automobile industries are looking for corrosion & rust resistant and durable steel sheets to minimize damage and get more high strength materials for vehicles in the long run.

Galvanized steel coil companies are focusing on research and development of a combination of different coatings or films for metal surfaces. This is likely to boost the galvanized steel coil market share of players and also create lucrative opportunities in the market.

Galvanized steel coil is a zinc-coated steel coil, which goes through several processing steps and procedures to enhance its corrosion resistance and service life. Steel nowadays is galvanized by applying a thick layer of zinc on its surface, which makes it look attractive, prevents its corrosion, and also extends its lifespan than untreated steel materials.

Galvanized coils are frequently utilized in the industrial sector, in home decor, and construction industries owing to their easy cutting, bending, and welding capabilities. These coils are made up of different materials, such as commercial steel, forming steel, high strength low alloy steel, and deep drawing steel.

Rapid urbanization and growth in construction industries globally with increase in need for new residential properties, apartments, and commercial complexes primarily drives the galvanized steel coil business growth.

Galvanized steel coils are corrosion-resistant steel coils and thus widely used in building and construction applications, such as roofing, walling, and framing, due to their durability and strength. They are coated with layers of zinc, which make them ideal for use in various construction activities, especially in places with high moisture and humidity. The construction industry is estimated to reach a value of US$ 15 Trn by 2030, with extensive construction activities in Asian countries, such as China and India.

Governments of various countries worldwide are investing heavily on infrastructure projects, such as roads, bridges, and railways, which require large quantities of galvanized steel coils. Various government schemes, such as the revolutionary Smart City Mission and SIP-EIT formulated by the Government of India, are estimated to create opportunities for players to strengthen their market share.

Usage of galvanized steel coil for automotive applications is substantial, backed by the high growth in demand for vehicles.

Galvanized steel coils are extensively used in manufacturing automotive parts, such as chassis and body panels. Galvanized steel is corrosion and rust resistant, which expands the lifespan of automotive parts. With high demand for vehicles, the automotive industry is likely to rapidly expand in the next few years, which is likely boost the galvanized steel coil market growth.

According to galvanized steel coil market analysis, the hot-dip galvanizing segment is estimated to lead the global market during the forecast period. It is the most preferred method for applying zinc coating, as the metal is dipped in molten zinc, forming a metallurgical bonded coating, which is more durable and cost-effective. it is also a sustainable method as zinc coating is simple to recycle compared to other methods, which makes it a popular process. Various galvanized steel coils are available with numerous coatings, such as zinc-coated steel coil, electro-galvanized steel coil, and corrosion-resistant steel coil for different applications.

The construction sector is more likely to lead the global market in terms of end-use during the forecast period. Galvanized steel is widely used in the construction sector owing to its durability. Furthermore, its appearance, especially shine, makes galvanized steel an ideal material for latest architecture designs, leading to its market expansion.

Galvanized steel can be used for large as well as small structural components, such as fencing, gutters, rails, tubes, and poles. It is mostly utilized in the construction of building frames, ceilings, and doors. These characteristics act as further market catalysts.

According to the galvanized steel coil market forecast, Asia Pacific is likely to dominate the global industry during the forecast period owing to the establishment of a large number of commercial industries, such as automotive and construction in the region. Growth in number of residential and commercial buildings and increase in investments by government on infrastructural activities and projects are the major drivers of the market across the region.

Construction and automotive sectors in India are likely to grow exponentially in the next few years, thus boosting the regional galvanized steel coil market size.

The global galvanized steel coil Industry is fragmented due to the presence of several local and global players. Competition is expected to intensify in the next few years due to the entry of local players. Various marketing strategies are being adopted by industry players to generate lucrative galvanized steel coil business opportunities.

Manufacturers are focusing on product developments and are trying to meet the demands of customers as per latest galvanized steel coil market trends, by introducing more efficient galvanized steel coils with effective coating at reasonable prices.

Considering the galvanized steel coil market demand, manufacturers are focusing on industry research and studying market drivers for further growth.

Prominent players operating in the global galvanized steel coil market include JFE Steel Corporation, Baosteel Co.Ltd., ArcelorMittal, Gerdau S/A, Nippon Steel Corporation, POSCO, JSW Steel Ltd, Essar Steel, Thyssenkrupp AG, and United States Steel Corporation.

Key players have been profiled in the galvanized steel coil market report based on parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Value in 2022 (Base Year) |

US$ 23.5 Bn |

|

Market Value in 2031 |

US$ 38.2 Bn |

|

Growth Rate (CAGR) |

5.0% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand lbs for Volume |

|

Market Analysis |

Qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 23.5 Bn in 2022.

It is estimated to reach US$ 38.2 Bn by 2031.

It is projected to grow at a CAGR of 5.0% from 2023 to 2031.

Growth in construction activities & rise in infrastructural activities, and expansion of the automotive industry.

Hot-dip is a major galvanizing method.

Asia Pacific is estimated to witness high demand for galvanized steel coil.

JFE Steel Corporation, Baosteel Co. Ltd., ArcelorMittal, Gerdau S/A, Nippon Steel Corporation, POSCO, JSW Steel Ltd, Essar Steel, Thyssenkrupp AG, and United States Steel Corporation.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. COVID-19 Impact Analysis

5.6. Regulatory Framework

5.7. Porter’s Five Forces Analysis

5.8. Value Chain Analysis

5.9. Industry SWOT Analysis

5.10. Global Galvanized Steel Coil Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Revenue Projections (US$ Mn)

5.10.2. Market Revenue Projections (Thousand lbs)

6. Global Galvanized Steel Coil Market Analysis and Forecast, By Type

6.1. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Type, 2017 - 2031

6.1.1. Hot Rolled Steel Coil

6.1.2. Cold Rolled Steel Coil

6.2. Incremental Opportunity, By Type

7. Global Galvanized Steel Coil Market Analysis and Forecast, By Galvanizing Method

7.1. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Galvanizing Method, 2017 - 2031

7.1.1. Hot-dip Galvanizing

7.1.2. Electroplating

7.1.3. Thermal Spray

7.1.4. Zinc Rich Paint

7.1.5. Others

7.2. Incremental Opportunity, By Galvanizing Method

8. Global Galvanized Steel Coil Market Analysis and Forecast, By Thickness

8.1. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Thickness, 2017 - 2031

8.1.1. Below 0.5 mm

8.1.2. 0.5 - 1 mm

8.1.3. 1 - 1.5 mm

8.1.4. 1.5 - 2 mm

8.1.5. 2 - 2.5 mm

8.1.6. 2.5 - 3 mm

8.1.7. Above 3 mm

8.2. Incremental Opportunity, By Thickness

9. Global Galvanized Steel Coil Market Analysis and Forecast, By End-use

9.1. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By End-use, 2017 - 2031

9.1.1. Wind & Solar

9.1.2. Automotive

9.1.3. Construction

9.1.4. Telecommunication

9.1.5. Others

9.2. Incremental Opportunity, By End-use

10. Global Galvanized Steel Coil Market Analysis and Forecast, By Distribution Channel

10.1. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Distribution Channel, 2017 - 2031

10.1.1. Direct Sales

10.1.2. Indirect Sales

10.2. Incremental Opportunity, By Distribution Channel

11. Global Galvanized Steel Coil Market Analysis and Forecast, By Region

11.1. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs), By Region, 2017 - 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Global Incremental Opportunity, By Region

12. North America Galvanized Steel Coil Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Price

12.4. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Type, 2017 - 2031

12.4.1. Hot Rolled Steel Coil

12.4.2. Cold Rolled Steel Coil

12.5. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Galvanizing Method, 2017 - 2031

12.5.1. Hot-dip Galvanizing

12.5.2. Electroplating

12.5.3. Thermal Spray

12.5.4. Zinc Rich Paint

12.5.5. Others

12.6. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Thickness, 2017 - 2031

12.6.1. Below 0.5 mm

12.6.2. 0.5 - 1 mm

12.6.3. 1 - 1.5 mm

12.6.4. 1.5 - 2 mm

12.6.5. 2 - 2.5 mm

12.6.6. 2.5 - 3 mm

12.6.7. Above 3 mm

12.7. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By End-use, 2017 - 2031

12.7.1. Wind & Solar

12.7.2. Automotive

12.7.3. Construction

12.7.4. Telecommunication

12.7.5. Others

12.8. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Distribution Channel, 2017 - 2031

12.8.1. Direct Sales

12.8.2. Indirect Sales

12.9. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, by Country/Sub-region, 2017 - 2031

12.9.1. U.S.

12.9.2. Canada

12.9.3. Rest of North America

12.10. Incremental Opportunity Analysis

13. Europe Galvanized Steel Coil Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Price Trend Analysis

13.3.1. Weighted Average Price

13.4. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Type, 2017 - 2031

13.4.1. Hot Rolled Steel Coil

13.4.2. Cold Rolled Steel Coil

13.5. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Galvanizing Method, 2017 - 2031

13.5.1. Hot-dip Galvanizing

13.5.2. Electroplating

13.5.3. Thermal Spray

13.5.4. Zinc Rich Paint

13.5.5. Others

13.6. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Thickness, 2017 - 2031

13.6.1. Below 0.5 mm

13.6.2. 0.5 - 1 mm

13.6.3. 1 - 1.5 mm

13.6.4. 1.5 - 2 mm

13.6.5. 2 - 2.5 mm

13.6.6. 2.5 - 3 mm

13.6.7. Above 3 mm

13.7. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By End-use, 2017 - 2031

13.7.1. Wind & Solar

13.7.2. Automotive

13.7.3. Construction

13.7.4. Telecommunication

13.7.5. Others

13.8. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Distribution Channel, 2017 - 2031

13.8.1. Direct Sales

13.8.2. Indirect Sales

13.9. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, by Country/Sub-region, 2017 - 2031

13.9.1. U.K.

13.9.2. Germany

13.9.3. France

13.9.4. Rest of Europe

13.10. Incremental Opportunity Analysis

14. Asia Pacific Galvanized Steel Coil Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Price

14.4. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Type, 2017 - 2031

14.4.1. Hot Rolled Steel Coil

14.4.2. Cold Rolled Steel Coil

14.5. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Galvanizing Method, 2017 - 2031

14.5.1. Hot-dip Galvanizing

14.5.2. Electroplating

14.5.3. Thermal Spray

14.5.4. Zinc Rich Paint

14.5.5. Others

14.6. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Thickness, 2017 - 2031

14.6.1. Below 0.5 mm

14.6.2. 0.5 - 1 mm

14.6.3. 1 - 1.5 mm

14.6.4. 1.5 - 2 mm

14.6.5. 2 - 2.5 mm

14.6.6. 2.5 - 3 mm

14.6.7. Above 3 mm

14.7. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By End-use, 2017 - 2031

14.7.1. Wind & Solar

14.7.2. Automotive

14.7.3. Construction

14.7.4. Telecommunication

14.7.5. Others

14.8. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Distribution Channel, 2017 - 2031

14.8.1. Direct Sales

14.8.2. Indirect Sales

14.9. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, by Country/Sub-region, 2017 - 2031

14.9.1. China

14.9.2. India

14.9.3. Japan

14.9.4. Rest of Asia Pacific

14.10. Incremental Opportunity Analysis

15. Middle East & Africa Galvanized Steel Coil Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Price

15.4. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Type, 2017 - 2031

15.4.1. Hot Rolled Steel Coil

15.4.2. Cold Rolled Steel Coil

15.5. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Galvanizing Method, 2017 - 2031

15.5.1. Hot-dip Galvanizing

15.5.2. Electroplating

15.5.3. Thermal Spray

15.5.4. Zinc Rich Paint

15.5.5. Others

15.6. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Thickness, 2017 - 2031

15.6.1. Below 0.5 mm

15.6.2. 0.5 - 1 mm

15.6.3. 1 - 1.5 mm

15.6.4. 1.5 - 2 mm

15.6.5. 2 - 2.5 mm

15.6.6. 2.5 - 3 mm

15.6.7. Above 3 mm

15.7. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By End-use, 2017 - 2031

15.7.1. Wind & Solar

15.7.2. Automotive

15.7.3. Construction

15.7.4. Telecommunication

15.7.5. Others

15.8. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Distribution Channel, 2017 - 2031

15.8.1. Direct Sales

15.8.2. Indirect Sales

15.9. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, by Country/Sub-region, 2017 - 2031

15.9.1. GCC

15.9.2. South Africa

15.9.3. Rest of Middle East & Africa

15.10. Incremental Opportunity Analysis

16. South America Galvanized Steel Coil Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Supplier Analysis

16.3. Price Trend Analysis

16.3.1. Weighted Average Price

16.4. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Type, 2017 - 2031

16.4.1. Hot Rolled Steel Coil

16.4.2. Cold Rolled Steel Coil

16.5. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Galvanizing Method, 2017 - 2031

16.5.1. Hot-dip Galvanizing

16.5.2. Electroplating

16.5.3. Thermal Spray

16.5.4. Zinc Rich Paint

16.5.5. Others

16.6. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Thickness, 2017 - 2031

16.6.1. Below 0.5 mm

16.6.2. 0.5 - 1 mm

16.6.3. 1 - 1.5 mm

16.6.4. 1.5 - 2 mm

16.6.5. 2 - 2.5 mm

16.6.6. 2.5 - 3 mm

16.6.7. Above 3 mm

16.7. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By End-use, 2017 - 2031

16.7.1. Wind & Solar

16.7.2. Automotive

16.7.3. Construction

16.7.4. Telecommunication

16.7.5. Others

16.8. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, By Distribution Channel, 2017 - 2031

16.8.1. Direct Sales

16.8.2. Indirect Sales

16.9. Galvanized Steel Coil Market Size (US$ Mn and Thousand lbs) Forecast, by Country/Sub-region, 2017 - 2031

16.9.1. Brazil

16.9.2. Rest of South America

16.10. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Market Player - Competition Dashboard

17.2. Market Share Analysis (%)-2022

17.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Manufacturing Location, Revenue, Strategy & Business Process Overview)

17.3.1. JFE Steel Corporation

17.3.1.1. Company Overview

17.3.1.2. Sales Area/Geographical Presence

17.3.1.3. Manufacturing Location

17.3.1.4. Revenue

17.3.1.5. Strategy & Business Process Overview

17.3.2. Baosteel Co.Ltd.

17.3.2.1. Company Overview

17.3.2.2. Sales Area/Geographical Presence

17.3.2.3. Manufacturing Location

17.3.2.4. Revenue

17.3.2.5. Strategy & Business Process Overview

17.3.3. ArcelorMittal

17.3.3.1. Company Overview

17.3.3.2. Sales Area/Geographical Presence

17.3.3.3. Manufacturing Location

17.3.3.4. Revenue

17.3.3.5. Strategy & Business Process Overview

17.3.4. Gerdau S/A

17.3.4.1. Company Overview

17.3.4.2. Sales Area/Geographical Presence

17.3.4.3. Manufacturing Location

17.3.4.4. Revenue

17.3.4.5. Strategy & Business Process Overview

17.3.5. Nippon Steel Corporation

17.3.5.1. Company Overview

17.3.5.2. Sales Area/Geographical Presence

17.3.5.3. Manufacturing Location

17.3.5.4. Revenue

17.3.5.5. Strategy & Business Process Overview

17.3.6. POSCO

17.3.6.1. Company Overview

17.3.6.2. Sales Area/Geographical Presence

17.3.6.3. Manufacturing Location

17.3.6.4. Revenue

17.3.6.5. Strategy & Business Process Overview

17.3.7. JSW Steel Ltd

17.3.7.1. Company Overview

17.3.7.2. Sales Area/Geographical Presence

17.3.7.3. Manufacturing Location

17.3.7.4. Revenue

17.3.7.5. Strategy & Business Process Overview

17.3.8. Essar Steel

17.3.8.1. Company Overview

17.3.8.2. Sales Area/Geographical Presence

17.3.8.3. Manufacturing Location

17.3.8.4. Revenue

17.3.8.5. Strategy & Business Process Overview

17.3.9. Thyssenkrupp AG

17.3.9.1. Company Overview

17.3.9.2. Sales Area/Geographical Presence

17.3.9.3. Manufacturing Location

17.3.9.4. Revenue

17.3.9.5. Strategy & Business Process Overview

17.3.10. United States Steel Corporation

17.3.10.1. Company Overview

17.3.10.2. Sales Area/Geographical Presence

17.3.10.3. Manufacturing Location

17.3.10.4. Revenue

17.3.10.5. Strategy & Business Process Overview

18. Go to Market Strategy

18.1. Identification of Potential Market Spaces

18.1.1. By Type

18.1.2. By Galvanizing Method

18.1.3. By Thickness

18.1.4. By End-use

18.1.5. Distribution Channel

18.1.6. By Region

18.2. Understanding the Procurement Process of End-users

18.3. Prevailing Market Risks

18.4. Preferred Sales and Marketing Strategy

List of Tables

Table 1: Global Galvanized Steel Coil Market by Type, Thousand lbs 2017-2031

Table 2: Global Galvanized Steel Coil Market by Type, US$ Mn 2017-2031

Table 3: Global Galvanized Steel Coil Market by Galvanizing Method, Thousand lbs 2017-2031

Table 4: Global Galvanized Steel Coil Market by Galvanizing Method, US$ Mn 2017-2031

Table 5: Global Galvanized Steel Coil Market by Thickness, Thousand lbs 2017-2031

Table 6: Global Galvanized Steel Coil Market by Thickness, US$ Mn 2017-2031

Table 7: Global Galvanized Steel Coil Market End-use, Thousand lbs, 2017-2031

Table 8: Global Galvanized Steel Coil Market End-use, US$ Mn 2017-2031

Table 9: Global Galvanized Steel Coil Market by Distribution Channel, Thousand lbs, 2017-2031

Table 10: Global Galvanized Steel Coil Market by Distribution Channel, US$ Mn 2017-2031

Table 11: Global Galvanized Steel Coil Market by Region, Thousand lbs, 2017-2031

Table 12: Global Galvanized Steel Coil Market by Region, US$ Mn 2017-2031

Table 13: North America Galvanized Steel Coil Market by Type, Thousand lbs 2017-2031

Table 14: North America Galvanized Steel Coil Market by Type, US$ Mn 2017-2031

Table 15: North America Galvanized Steel Coil Market by Galvanizing Method, Thousand lbs 2017-2031

Table 16: North America Galvanized Steel Coil Market by Galvanizing Method, US$ Mn 2017-2031

Table 17: North America Galvanized Steel Coil Market by Thickness, Thousand lbs 2017-2031

Table 18: North America Galvanized Steel Coil Market by Thickness, US$ Mn 2017-2031

Table 19: North America Galvanized Steel Coil Market End-use, Thousand lbs, 2017-2031

Table 20: North America Galvanized Steel Coil Market End-use, US$ Mn 2017-2031

Table 21: North America Galvanized Steel Coil Market by Distribution Channel, Thousand lbs, 2017-2031

Table 22: North America Galvanized Steel Coil Market by Distribution Channel, US$ Mn 2017-2031

Table 23: Europe Galvanized Steel Coil Market by Type, Thousand lbs 2017-2031

Table 24: Europe Galvanized Steel Coil Market by Type, US$ Mn 2017-2031

Table 25: Europe Galvanized Steel Coil Market by Galvanizing Method, Thousand lbs 2017-2031

Table 26: Europe Galvanized Steel Coil Market by Galvanizing Method, US$ Mn 2017-2031

Table 27: Europe Galvanized Steel Coil Market by Thickness, Thousand lbs 2017-2031

Table 28: Europe Galvanized Steel Coil Market by Thickness, US$ Mn 2017-2031

Table 29: Europe Galvanized Steel Coil Market End-use, Thousand lbs, 2017-2031

Table 30: Europe Galvanized Steel Coil Market End-use, US$ Mn 2017-2031

Table 31: Europe Galvanized Steel Coil Market by Distribution Channel, Thousand lbs, 2017-2031

Table 32: Europe Galvanized Steel Coil Market by Distribution Channel, US$ Mn 2017-2031

Table 33: Asia Pacific Galvanized Steel Coil Market by Type, Thousand lbs 2017-2031

Table 34: Asia Pacific Galvanized Steel Coil Market by Type, US$ Mn 2017-2031

Table 35: Asia Pacific Galvanized Steel Coil Market by Galvanizing Method, Thousand lbs 2017-2031

Table 36: Asia Pacific Galvanized Steel Coil Market by Galvanizing Method, US$ Mn 2017-2031

Table 37: Asia Pacific Galvanized Steel Coil Market by Thickness, Thousand lbs 2017-2031

Table 38: Asia Pacific Galvanized Steel Coil Market by Thickness, US$ Mn 2017-2031

Table 39: Asia Pacific Galvanized Steel Coil Market End-use, Thousand lbs, 2017-2031

Table 40: Asia Pacific Galvanized Steel Coil Market End-use, US$ Mn 2017-2031

Table 41: Asia Pacific Galvanized Steel Coil Market by Distribution Channel, Thousand lbs, 2017-2031

Table 42: Asia Pacific Galvanized Steel Coil Market by Distribution Channel, US$ Mn 2017-2031

Table 43: Middle East & Africa Galvanized Steel Coil Market by Type, Thousand lbs 2017-2031

Table 44: Middle East & Africa Galvanized Steel Coil Market by Type, US$ Mn 2017-2031

Table 45: Middle East & Africa Galvanized Steel Coil Market by Galvanizing Method, Thousand lbs 2017-2031

Table 46: Middle East & Africa Galvanized Steel Coil Market by Galvanizing Method, US$ Mn 2017-2031

Table 47: Middle East & Africa Galvanized Steel Coil Market by Thickness, Thousand lbs 2017-2031

Table 48: Middle East & Africa Galvanized Steel Coil Market by Thickness, US$ Mn 2017-2031

Table 49: Middle East & Africa Galvanized Steel Coil Market End-use, Thousand lbs, 2017-2031

Table 50: Middle East & Africa Galvanized Steel Coil Market End-use, US$ Mn 2017-2031

Table 51: Middle East & Africa Galvanized Steel Coil Market by Distribution Channel, Thousand lbs, 2017-2031

Table 52: Middle East & Africa Galvanized Steel Coil Market by Distribution Channel, US$ Mn 2017-2031

Table 53: South America Galvanized Steel Coil Market by Type, Thousand lbs 2017-2031

Table 54: South America Galvanized Steel Coil Market by Type, US$ Mn 2017-2031

Table 55: South America Galvanized Steel Coil Market by Galvanizing Method, Thousand lbs 2017-2031

Table 56: South America Galvanized Steel Coil Market by Galvanizing Method, US$ Mn 2017-2031

Table 57: South America Galvanized Steel Coil Market by Thickness, Thousand lbs 2017-2031

Table 58: South America Galvanized Steel Coil Market by Thickness, US$ Mn 2017-2031

Table 59: South America Galvanized Steel Coil Market End-use, Thousand lbs, 2017-2031

Table 60: South America Galvanized Steel Coil Market End-use, US$ Mn 2017-2031

Table 61: South America Galvanized Steel Coil Market by Distribution Channel, Thousand lbs, 2017-2031

Table 62: South America Galvanized Steel Coil Market by Distribution Channel, US$ Mn 2017-2031

List of Figures

Figure 1: Global Galvanized Steel Coil Market Projections, by Type, Thousand lbs 2017-2031

Figure 2: Global Galvanized Steel Coil Market Projections, by Type, US$ Mn 2017-2031

Figure 3: Global Galvanized Steel Coil Market, Incremental Opportunity, by Type, US$ Mn 2023-2031

Figure 4: Global Galvanized Steel Coil Market Projections, Galvanizing Method, Thousand lbs, 2017-2031

Figure 5: Global Galvanized Steel Coil Market Projections, Galvanizing Method, US$ Mn 2017-2031

Figure 6: Global Galvanized Steel Coil Market, Incremental Opportunity, Galvanizing Method, US$ Mn 2023-2031

Figure 7: Global Galvanized Steel Coil Market Projections, by Thickness, Thousand lbs, 2017-2031

Figure 8: Global Galvanized Steel Coil Market Projections, by Thickness, US$ Mn 2017-2031

Figure 9: Global Galvanized Steel Coil Market, Incremental Opportunity, by Thickness, US$ Mn 2023-2031

Figure 10: Global Galvanized Steel Coil Market Projections, by End-use, Thousand lbs, 2017-2031

Figure 11: Global Galvanized Steel Coil Market Projections, by End-use, US$ Mn 2017-2031

Figure 12: Global Galvanized Steel Coil Market, Incremental Opportunity, by End-use, US$ Mn 2023-2031

Figure 13: Global Galvanized Steel Coil Market Projections, by Distribution Channel, Thousand lbs, 2017-2031

Figure 14: Global Galvanized Steel Coil Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 15: Global Galvanized Steel Coil Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023-2031

Figure 16: Global Galvanized Steel Coil Market Projections, by Region, Thousand lbs, 2017-2031

Figure 17: Global Galvanized Steel Coil Market Projections, by Region, US$ Mn 2017-2031

Figure 18: Global Galvanized Steel Coil Market, Incremental Opportunity, by Region, US$ Mn 2023-2031

Figure 19: North America Galvanized Steel Coil Market Projections, by Type, Thousand lbs 2017-2031

Figure 20: North America Galvanized Steel Coil Market Projections, by Type, US$ Mn 2017-2031

Figure 21: North America Galvanized Steel Coil Market, Incremental Opportunity, by Type, US$ Mn 2023-2031

Figure 22: North America Galvanized Steel Coil Market Projections, Galvanizing Method, Thousand lbs, 2017-2031

Figure 23: North America Galvanized Steel Coil Market Projections, Galvanizing Method, US$ Mn 2017-2031

Figure 24: North America Galvanized Steel Coil Market, Incremental Opportunity, Galvanizing Method, US$ Mn 2023-2031

Figure 25: North America Galvanized Steel Coil Market Projections, by Thickness, Thousand lbs, 2017-2031

Figure 26: North America Galvanized Steel Coil Market Projections, by Thickness, US$ Mn 2017-2031

Figure 27: North America Galvanized Steel Coil Market, Incremental Opportunity, by Thickness, US$ Mn 2023-2031

Figure 28: North America Galvanized Steel Coil Market Projections, by End-use, Thousand lbs, 2017-2031

Figure 29: North America Galvanized Steel Coil Market Projections, by End-use, US$ Mn 2017-2031

Figure 30: North America Galvanized Steel Coil Market, Incremental Opportunity, by End-use, US$ Mn 2023-2031

Figure 31: North America Galvanized Steel Coil Market Projections, by Distribution Channel, Thousand lbs, 2017-2031

Figure 32: North America Galvanized Steel Coil Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 33: North America Galvanized Steel Coil Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023-2031

Figure 34: Europe Galvanized Steel Coil Market Projections, by Type, Thousand lbs 2017-2031

Figure 35: Europe Galvanized Steel Coil Market Projections, by Type, US$ Mn 2017-2031

Figure 36: Europe Galvanized Steel Coil Market, Incremental Opportunity, by Type, US$ Mn 2023-2031

Figure 37: Europe Galvanized Steel Coil Market Projections, Galvanizing Method, Thousand lbs, 2017-2031

Figure 38: Europe Galvanized Steel Coil Market Projections, Galvanizing Method, US$ Mn 2017-2031

Figure 39: Europe Galvanized Steel Coil Market, Incremental Opportunity, Galvanizing Method, US$ Mn 2023-2031

Figure 40: Europe Galvanized Steel Coil Market Projections, by Thickness, Thousand lbs, 2017-2031

Figure 41: Europe Galvanized Steel Coil Market Projections, by Thickness, US$ Mn 2017-2031

Figure 42: Europe Galvanized Steel Coil Market, Incremental Opportunity, by Thickness, US$ Mn 2023-2031

Figure 43: Europe Galvanized Steel Coil Market Projections, by End-use, Thousand lbs, 2017-2031

Figure 44: Europe Galvanized Steel Coil Market Projections, by End-use, US$ Mn 2017-2031

Figure 45: Europe Galvanized Steel Coil Market, Incremental Opportunity, by End-use, US$ Mn 2023-2031

Figure 46: Europe Galvanized Steel Coil Market Projections, by Distribution Channel, Thousand lbs, 2017-2031

Figure 47: Europe Galvanized Steel Coil Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 48: Europe Galvanized Steel Coil Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023-2031

Figure 49: Asia Pacific Galvanized Steel Coil Market Projections, by Type, Thousand lbs 2017-2031

Figure 50: Asia Pacific Galvanized Steel Coil Market Projections, by Type, US$ Mn 2017-2031

Figure 51: Asia Pacific Galvanized Steel Coil Market, Incremental Opportunity, by Type, US$ Mn 2023-2031

Figure 52: Asia Pacific Galvanized Steel Coil Market Projections, Galvanizing Method, Thousand lbs, 2017-2031

Figure 53: Asia Pacific Galvanized Steel Coil Market Projections, Galvanizing Method, US$ Mn 2017-2031

Figure 54: Asia Pacific Galvanized Steel Coil Market, Incremental Opportunity, Galvanizing Method, US$ Mn 2023-2031

Figure 55: Asia Pacific Galvanized Steel Coil Market Projections, by Thickness, Thousand lbs, 2017-2031

Figure 56: Asia Pacific Galvanized Steel Coil Market Projections, by Thickness, US$ Mn 2017-2031

Figure 57: Asia Pacific Galvanized Steel Coil Market, Incremental Opportunity, by Thickness, US$ Mn 2023-2031

Figure 58: Asia Pacific Galvanized Steel Coil Market Projections, by End-use, Thousand lbs, 2017-2031

Figure 59: Asia Pacific Galvanized Steel Coil Market Projections, by End-use, US$ Mn 2017-2031

Figure 60: Asia Pacific Galvanized Steel Coil Market, Incremental Opportunity, by End-use, US$ Mn 2023-2031

Figure 61: Asia Pacific Galvanized Steel Coil Market Projections, by Distribution Channel, Thousand lbs, 2017-2031

Figure 62: Asia Pacific Galvanized Steel Coil Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 63: Asia Pacific Galvanized Steel Coil Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023-2031

Figure 64: Middle East & Africa Galvanized Steel Coil Market Projections, by Type, US$ Mn 2017-2031

Figure 65: Middle East & Africa Galvanized Steel Coil Market, Incremental Opportunity, by Type, US$ Mn 2023-2031

Figure 66: Middle East & Africa Galvanized Steel Coil Market, Incremental Opportunity, by Type, US$ Mn 2023-2031

Figure 67: Middle East & Africa Galvanized Steel Coil Market Projections, Galvanizing Method, Thousand lbs, 2017-2031

Figure 68: Middle East & Africa Galvanized Steel Coil Market Projections, Galvanizing Method, US$ Mn 2017-2031

Figure 69: Middle East & Africa Galvanized Steel Coil Market, Incremental Opportunity, Galvanizing Method, US$ Mn 2023-2031

Figure 70: Middle East & Africa Galvanized Steel Coil Market Projections, by Thickness, Thousand lbs, 2017-2031

Figure 71: Middle East & Africa Galvanized Steel Coil Market Projections, by Thickness, US$ Mn 2017-2031

Figure 72: Middle East & Africa Galvanized Steel Coil Market, Incremental Opportunity, by Thickness, US$ Mn 2023-2031

Figure 73: Middle East & Africa Galvanized Steel Coil Market Projections, by End-use, Thousand lbs, 2017-2031

Figure 74: Middle East & Africa Galvanized Steel Coil Market Projections, by End-use, US$ Mn 2017-2031

Figure 75: Middle East & Africa Galvanized Steel Coil Market, Incremental Opportunity, by End-use, US$ Mn 2023-2031

Figure 76: Middle East & Africa Galvanized Steel Coil Market Projections, by Distribution Channel, Thousand lbs, 2017-2031

Figure 77: Middle East & Africa Galvanized Steel Coil Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 78: Middle East & Africa Galvanized Steel Coil Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023-2031

Figure 79: South America Galvanized Steel Coil Market Projections, by Type, Thousand lbs, 2017-2031

Figure 80: South America Galvanized Steel Coil Market Projections, by Type, US$ Mn 2017-2031

Figure 81: South America Galvanized Steel Coil Market, Incremental Opportunity, by Type, US$ Mn 2023-2031

Figure 82: South America Galvanized Steel Coil Market Projections, Galvanizing Method, Thousand lbs, 2017-2031

Figure 83: South America Galvanized Steel Coil Market Projections, Galvanizing Method, US$ Mn 2017-2031

Figure 84: South America Galvanized Steel Coil Market, Incremental Opportunity, Galvanizing Method, US$ Mn 2023-2031

Figure 85: South America Galvanized Steel Coil Market Projections, by Thickness, Thousand lbs, 2017-2031

Figure 86: South America Galvanized Steel Coil Market Projections, by Thickness, US$ Mn 2017-2031

Figure 87: South America Galvanized Steel Coil Market, Incremental Opportunity, by Thickness, US$ Mn 2023-2031

Figure 88: South America Galvanized Steel Coil Market Projections, by End-use, Thousand lbs, 2017-2031

Figure 89: South America Galvanized Steel Coil Market Projections, by End-use, US$ Mn 2017-2031

Figure 90: South America Galvanized Steel Coil Market, Incremental Opportunity, by End-use, US$ Mn 2023-2031

Figure 91: South America Galvanized Steel Coil Market Projections, by Distribution Channel, Thousand lbs, 2017-2031

Figure 92: South America Galvanized Steel Coil Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 93: South America Galvanized Steel Coil Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023-2031