Reports

Reports

Analyst Viewpoint

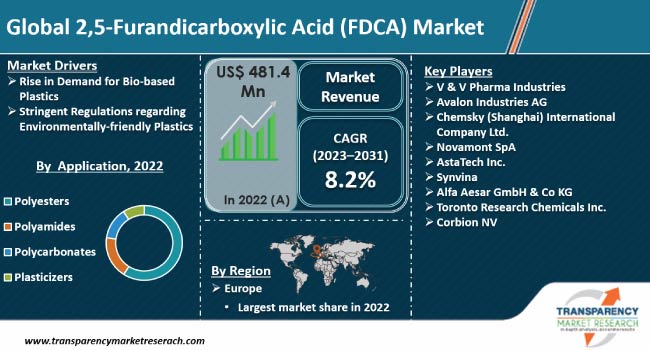

Rise in demand for biobased packaging across the globe is expected to propel the 2,5-furandicarboxylic acid (FDCA) market growth during the forecast period. Demand for 2,5-furandicarboxylic acid is considerably high in automotive, pharmaceutical, and fast moving consumer goods (FMCG) sectors owing to the increase in demand for environment-friendly plastics.

Enactment of stringent regulations by governments regarding reduction of plastic waste and shift in focus toward sustainable and environment-friendly industrial practices are projected to boost the demand for renewable chemical compounds. Furthermore, FDCA has been gaining traction as a significant chemical that can potentially replace petroleum-derived terephthalate acid (TPA) and produce green polymers. This is estimated to create lucrative business growth opportunities for manufacturers of 2,5-furandicarboxylic acid (FDCA).

2,5-furandicarboxylic acid comes across as a highly stable, oxidized furan derivative. Synthesis of 2,5-furandicarboxylic acid is simpler in comparison with synthesis of HMF (5-hydroxymethylfurfural), as the challenges related to the latter’s synthesis include need of expensive catalysts, HMF’s decomposition into formic and levulinic acid, high pressure conditions, and complexities related to separation of DMSO (Dimethyl sulfoxide) as a solvent, apart from concerns regarding the toxicity of by-products.

Biobased furandicarboxylic acid could also replace purified terephthalic acid (PTA), as it could be used as renewable feedstock for production of polyester. This is estimated to propel the 2,5-furandicarboxylic acid (FDCA) market value during the forecast period.

The conventional approach to manufacture FDCA requires long processing time, high temperatures and noble metal catalysts, which make the process uneconomic. This, in turn, is estimated to negatively impact the 2,5-furandicarboxylic acid (FDCA) market dynamics in the next few years.

2,5-furandicarboxylic acid is increasingly being used as substitute to adipic acid and terephthalic acid owing to its ability to be recycled entirely and also produce polyamides, polyesters, plasticizers, and polycarbonates. The end-products include food packaging, carpets, electronic materials, automotive materials, and electronic materials.

The U.S. Department of Energy has classified 2,5-furandicarboxylic acid as one among 12 priority chemicals for establishing ‘green chemistry industry’ for the future. This bio-based alternative holds a higher potential to replace several petroleum-based chemicals and bio-based intermediates such as succinic acid and levulinic acid.

FDCA is highly preferred to manufacture polyesters such as polyethylene 2,5-Furandicarboxylate (PEF), as it is a fully recyclable high-performance plastic. Furthermore, demand for biobased plastics is significantly high in the packaging industry and the beverages industry due to the need to reduce waste and positively impact the environment.

The major advantage of environmentally-friendly packaging, better known as sustainable packaging, is that it breaks down entirely into advantageous organic compost. Biomass-based polyethylene furandicarboxylate (PEF) derived from FDCA not only exhibits excellent thermochemical properties with biodegradability, but also excellent gas barrier performance, recyclability, and extended mechanical properties. These benefits further highlight the benefits of biodegradable polymers and the role of FDCA is meeting future sustainability goals.

Stringent regulations on the use of plastics and carbon emissions coupled with growing preference for sustainable alternatives are expected to propel the 2,5-furandicarboxylic acid (FDCA) market revenue in the near future.

Europe accounted for around 45% of the market share in 2022. This is attributed to 2,5-furandicarboxylic acid increasingly being used to manufacture biobased polymers such as PEF. These green polymers offer superlative barrier properties and could be a food eco-friendly alternatives to conventional packaging materials.

2,5-furandicarboxylic acid (FDCA) business opportunities in Asia Pacific are expected to grow at a rapid pace during the forecast period owing to the manufacturing sector switching to bio-based packaging plastics in the wake of growing awareness regarding environmentally-friendliness. According to McKinsey Packaging Survey (2020), India and China are at the forefront about willingness to adapt to sustainable packaging.

The 2,5-furandicarboxylic acid industry is fragmented with the presence of several players operating across the globe. Leading manufacturers are engaging in expansion of their production lines by establishing new plants. A few prominent players operating in the global 2,5-furandicarboxylic acid (FDCA) market are Avantium Holding BV, Corbion NV, Toronto Research Chemicals Inc., Alfa Aesar GmbH & Co KG, Synvina, Asta Tech Inc., Novamont SpA, Chemsky (Shanghai) International Company Ltd., Avalon Industries AG, V & V Pharma Industries.

Key players in the 2,5-furandicarboxylic acid market report have been profiled based on various parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 481.4 Mn |

| Market Forecast Value in 2031 | US$ 980.3 Mn |

| Growth Rate (CAGR) | 8.2% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Mn for Value and Kilo Tons for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Regions Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Scope for Customization | Available upon Request |

| Pricing | Available upon Request |

The global market was valued at US$ 481.4 Mn in 2022

It is projected to grow at a CAGR of 8.2% from 2023 to 2031

Rise in demand for bio-based plastics and stringent regulations regarding environmentally-friendly plastics

In terms of application, the plasticizers segment held largest share in 2022

Europe is estimated to dominate the global business the next few years

Avantium Holding BV, Corbion NV, Toronto Research Chemicals Inc., Alfa Aesar GmbH & Co KG, Synvina, Asta Tech Inc., Novamont SpA, Chemsky (Shanghai) International Company Ltd., Avalon Industries AG, V & V Pharma Industries

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global 2,5-Furandicarboxylic Acid (FDCA) Market Analysis and Forecasts, 2022-2031

2.6.1. Global 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons)

2.6.2. Global 2,5-Furandicarboxylic Acid (FDCA) Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of the 2,5-Furandicarboxylic Acid

3.2. Impact on the Demand of 2,5-Furandicarboxylic Acid – Pre & Post Crisis

4. Production Output Analysis(Tons), 2021

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2022-2031

6.1. Price Trend Analysis by Application

6.2. Price Trend Analysis by Region

7. 2,5-Furandicarboxylic Acid (FDCA) Market Analysis and Forecast, by Application, 2023–2031

7.1. Introduction and Definitions

7.2. Global 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

7.2.1. Polyesters

7.2.2. Polyamides

7.2.3. Polycarbonates

7.2.4. Plasticizers

7.3. Global 2,5-Furandicarboxylic Acid (FDCA) Market Attractiveness, by Application

8. Global 2,5-Furandicarboxylic Acid (FDCA) Market Analysis and Forecast, by Region, 2023–2031

8.1. Key Findings

8.2. Global 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2023–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Global 2,5-Furandicarboxylic Acid (FDCA) Market Attractiveness, by Region

9. North America 2,5-Furandicarboxylic Acid (FDCA) Market Analysis and Forecast, 2023–2031

9.1. Key Findings

9.2. North America 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

9.3. North America 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2023–2031

9.3.1. U.S. 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

9.3.2. Canada 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

9.4. North America 2,5-Furandicarboxylic Acid (FDCA) Market Attractiveness Analysis

10. Europe 2,5-Furandicarboxylic Acid (FDCA) Market Analysis and Forecast, 2023–2031

10.1. Key Findings

10.2. Europe 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.3. Europe 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

10.3.1. Germany 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.3.2. France 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.3.3. U.K. 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.3.4. Italy 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.3.5. Russia & CIS 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.3.6. Rest of Europe 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.4. Europe 2,5-Furandicarboxylic Acid (FDCA) Market Attractiveness Analysis

11. Asia Pacific 2,5-Furandicarboxylic Acid (FDCA) Market Analysis and Forecast, 2023–2031

11.1. Key Findings

11.2. Asia Pacific 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application

11.3. Asia Pacific 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

11.3.1. China 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.3.2. Japan 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.3.3. India 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.3.4. ASEAN 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.3.5. Rest of Asia Pacific 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.4. Asia Pacific 2,5-Furandicarboxylic Acid (FDCA) Market Attractiveness Analysis

12. Latin America 2,5-Furandicarboxylic Acid (FDCA) Market Analysis and Forecast, 2023–2031

12.1. Key Findings

12.2. Latin America 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.3. Latin America 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

12.3.1. Brazil 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.3.2. Mexico 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.3.3. Rest of Latin America 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.4. Latin America 2,5-Furandicarboxylic Acid (FDCA) Market Attractiveness Analysis

13. Middle East & Africa 2,5-Furandicarboxylic Acid (FDCA) Market Analysis and Forecast, 2023–2031

13.1. Key Findings

13.2. Middle East & Africa 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

13.3. Middle East & Africa 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

13.3.1. GCC 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

13.3.2. South Africa 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

13.3.3. Rest of Middle East & Africa 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

13.4. Middle East & Africa 2,5-Furandicarboxylic Acid (FDCA) Market Attractiveness Analysis

14. Competition Landscape

14.1. Global Green Cement Company Market Share Analysis, 2021

14.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

14.2.1. Avantium Holding BV

14.2.1.1. Company Revenue

14.2.1.2. Business Overview

14.2.1.3. Product Segments

14.2.1.4. Geographic Footprint

14.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.2.2. Corbion NV

14.2.2.1. Company Revenue

14.2.2.2. Business Overview

14.2.2.3. Product Segments

14.2.2.4. Geographic Footprint

14.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.2.3. Toronto Research Chemicals Inc.

14.2.3.1. Company Revenue

14.2.3.2. Business Overview

14.2.3.3. Product Segments

14.2.3.4. Geographic Footprint

14.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.2.4. Alfa Aesar GmbH & Co KG

14.2.4.1. Company Revenue

14.2.4.2. Business Overview

14.2.4.3. Product Segments

14.2.4.4. Geographic Footprint

14.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.2.5. Synvina

14.2.5.1. Company Revenue

14.2.5.2. Business Overview

14.2.5.3. Product Segments

14.2.5.4. Geographic Footprint

14.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.2.6. Asta Tech Inc.

14.2.6.1. Company Revenue

14.2.6.2. Business Overview

14.2.6.3. Product Segments

14.2.6.4. Geographic Footprint

14.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.2.7. Novamont SpA

14.2.7.1. Company Revenue

14.2.7.2. Business Overview

14.2.7.3. Product Segments

14.2.7.4. Geographic Footprint

14.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.2.8. Chemsky (Shanghai) International Company Ltd.

14.2.8.1. Company Revenue

14.2.8.2. Business Overview

14.2.8.3. Product Segments

14.2.8.4. Geographic Footprint

14.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.2.9. Avalon Industries AG

14.2.9.1. Company Revenue

14.2.9.2. Business Overview

14.2.9.3. Product Segments

14.2.9.4. Geographic Footprint

14.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

14.2.10. V & V Pharma Industries

14.2.10.1. Company Revenue

14.2.10.2. Business Overview

14.2.10.3. Product Segments

14.2.10.4. Geographic Footprint

14.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 1: Global 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 2: Global 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 3: Global 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Region, 2023–2031

Table 4: Global 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Region, 2023–2031

Table 5: North America 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 6: North America 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 7: North America 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Country, 2023–2031

Table 8: North America 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Country, 2023–2031

Table 9: U.S. 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 10: U.S. 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 11: Canada 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 12: Canada 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 13: Europe 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 14: Europe 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 15: Europe 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 16: Europe 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 17: Germany 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 18: Germany 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 19: France 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 20: France 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 21: U.K. 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 22: U.K. 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 23: Italy 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 24: Italy 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 25: Spain 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 26: Spain 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 27: Russia & CIS 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 28: Russia & CIS 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 29: Rest of Europe 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 30: Rest of Europe 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 31: Asia Pacific 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 32: Asia Pacific 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 33: Asia Pacific 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 34: Asia Pacific 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 35: China 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 36: China 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 37: Japan 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 38: Japan 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 39: India 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 40: India 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 41: ASEAN 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 42: ASEAN 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 43: Rest of Asia Pacific 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 44: Rest of Asia Pacific 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 45: Latin America 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 46: Latin America 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 47: Latin America 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 48: Latin America 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 49: Brazil 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 50: Brazil 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 51: Mexico 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 52: Mexico 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 53: Rest of Latin America 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 54: Rest of Latin America 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 55: Middle East & Africa 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 56: Middle East & Africa 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 57: Middle East & Africa 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 58: Middle East & Africa 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 59: GCC 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 60: GCC 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 61: South Africa 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 62: South Africa 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 63: Rest of Middle East & Africa 2,5-Furandicarboxylic Acid (FDCA) Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 64: Rest of Middle East & Africa 2,5-Furandicarboxylic Acid (FDCA) Market Value (US$ Mn) Forecast, by Application, 2023–2031

List of Figures

Figure 1: Global 2,5-Furandicarboxylic Acid (FDCA) Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 2: Global 2,5-Furandicarboxylic Acid (FDCA) Market Attractiveness, by Application

Figure 3: Global 2,5-Furandicarboxylic Acid (FDCA) Market Volume Share Analysis, by Region, 2021, 2027, and 2031

Figure 4: Global 2,5-Furandicarboxylic Acid (FDCA) Market Attractiveness, by Region

Figure 5: North America 2,5-Furandicarboxylic Acid (FDCA) Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 6: North America 2,5-Furandicarboxylic Acid (FDCA) Market Attractiveness, by Application

Figure 7: North America 2,5-Furandicarboxylic Acid (FDCA) Market Attractiveness, by Application

Figure 8: North America 2,5-Furandicarboxylic Acid (FDCA) Market Attractiveness, by Country and Sub-region

Figure 9: Europe 2,5-Furandicarboxylic Acid (FDCA) Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 10: Europe 2,5-Furandicarboxylic Acid (FDCA) Market Attractiveness, by Application

Figure 11: Europe 2,5-Furandicarboxylic Acid (FDCA) Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 12: Europe 2,5-Furandicarboxylic Acid (FDCA) Market Attractiveness, by Country and Sub-region

Figure 13: Asia Pacific 2,5-Furandicarboxylic Acid (FDCA) Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 14: Asia Pacific 2,5-Furandicarboxylic Acid (FDCA) Market Attractiveness, by Application

Figure 15: Asia Pacific 2,5-Furandicarboxylic Acid (FDCA) Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 16: Asia Pacific 2,5-Furandicarboxylic Acid (FDCA) Market Attractiveness, by Country and Sub-region

Figure 17: Latin America 2,5-Furandicarboxylic Acid (FDCA) Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 18: Latin America 2,5-Furandicarboxylic Acid (FDCA) Market Attractiveness, by Application

Figure 19: Latin America 2,5-Furandicarboxylic Acid (FDCA) Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 20: Latin America 2,5-Furandicarboxylic Acid (FDCA) Market Attractiveness, by Country and Sub-region

Figure 21: Middle East & Africa 2,5-Furandicarboxylic Acid (FDCA) Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 22: Middle East & Africa 2,5-Furandicarboxylic Acid (FDCA) Market Attractiveness, by Application

Figure 23: Middle East & Africa 2,5-Furandicarboxylic Acid (FDCA) Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 24: Middle East & Africa 2,5-Furandicarboxylic Acid (FDCA) Market Attractiveness, by Country and Sub-region