Reports

Reports

The forklift rental market is being propelled by several major factors. Cost-efficiency is one of the biggest drivers. Renting allows customers to avoid the large-scale capital decisions associated with purchasing and the cost of maintenance. In addition to overall cost efficiency, many industries such as retail, construction, and logistics are cyclical in demand and therefore a short-term rental offers both - a more flexible and practical approach and allows for the business to better size its fleet for just-in-time productivity.

The rapid expansion of supporting services and warehousing operations has further accelerated the demand for improved material handling, along with the ongoing infrastructure development in some of the emerging economies. Additionally, businesses of all sizes are increasingly operating from a rental model to provide businesses with flexibility to react in the demand decisions during the uncertain economic times.

Environmental pressures and tougher standards on emissions are driving the industry toward electric forklifts. On the other hand, businesses are incurring significant additions to all of their fleets by deploying smart, connected assets along with IoT and telematics capabilities for real-time tracking and predictive maintenance.

The forklift rental market has developed into an important sub-sector of the worldwide material handling and logistics domain, benefiting from an increasing emphasis on flexible, economical, and scalable alternatives for transporting and lifting goods. With a greater emphasis on efficiency and cost management in business, renting forklifts has emerged as a more practical strategy than outright purchases.

Additionally, settlements can easily be made by businesses experiencing variable workload, seasonal activities, projects of limited length, etc. This trend is evident in manufacturing, warehousing, construction, logistics, retail, e-Commerce, and shipping industries, where the need for effective material handling is continuous while the tonnage required to support the need may not justify the fixed costs associated with fleet ownership.

The rental forklift market features a broad spectrum of equipment types designed for distinct operational applications. The major types are counterbalance forklifts, generally the most utilized and fit for most general-purpose lifting; reach trucks and intended for high stacking inside narrow aisles, primarily in a warehouse setting; pallet jacks and pallet stackers. They are primarily utilized for light-duty operations or small spaces; rough terrain forklifts, used collectively for outdoor construction and agricultural locations and tele handlers that are versatile in the capacity to effectively lift heavy loads to increased heights and widely used in both - construction and industrial applications. The variety of forklift types capable of being rented supports rental companies in supporting customers with the needs specific to their environment or jobs.

Rental lift trucks’ users range from the small to mid-sized companies (SMEs) right up through the largest of the multinational corporations. SMEs tend to use rentals to control cash flow more efficiently, with the result being access to up-to-date, well-maintained machines without ownership or depreciation responsibilities (e.g. ownership/maintenance). Large companies will want to rent forklifts in Portland as a way of increasing their fleet size during times of high use, when they are involved in special projects or working on short term contracts.

| Attribute | Detail |

|---|---|

| Forklift Rental Market Drivers |

|

Forklift many need change based on the season or times of the year based on the work to be accomplished, especially for retailers with holidays or sales events. In these times, they may need more fork trucks to keep up with all of the inventory movement and order fulfillment. Construction and agricultural businesses may also need to rent heavy-duty fork trucks for several peak months and later occasionally during heavy construction projects or peak planting to harvest seasons.

Fork truck rentals are capable of completely eliminating the tie-up regarding funds that could otherwise be used for capital expenditures that may arise in rapid business demands.

Maintaining forklifts is one of the most difficult parts of owning a forklift due to the repair and downtime. Planned maintenance and testing are expensive, time-consuming tasks, and other equipment can break down, resulting in delay in production or shipping schedules. Rental forklifts remove this anxiety since the rental company takes care of the equipment’s servicing and maintenance.

In the event of a breakdown, rental companies offer fast replacement and repair services too, making for very little impact to day-to-day operational workflows. Maintenance services are usually the responsibility of the rental company, leaving the business more focused on their main course of operations.

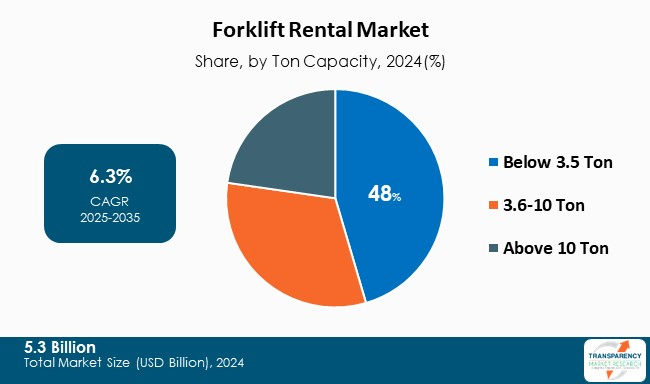

The forklift rental market is dominated by the 3.6-10-ton forklift group as it offers the best combination of lifting capacity and maneuverability across a range of operational needs.

For instance, in warehousing applications, these forklifts support soft horizontal stacking, loading, and unloading merchandise to assist with inventory management while minimizing downtime. In industrial settings, they are used to transport raw materials and finished products for people who work in production.

They are also critical to construction sites where bulky materials and equipment need to be moved, whether over rough terrain or tight quarters. Their versatility even extends to logistics and distribution companies, for whom fast and reliable material handling is essential in order to meet due dates. Their multi-sector applicability is why this range of forklift is a pillar of the rental market, as organizations desire strength, efficiency, and flexibility in their equipment.

| Attribute | Detail |

|---|---|

| Leading Region |

|

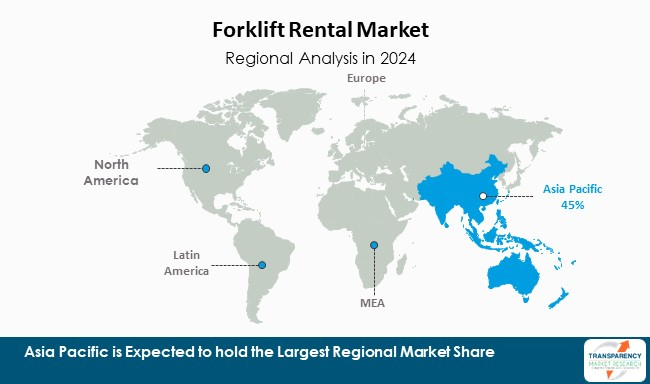

The global market is currently dominated by the Asia Pacific region, where rapid industrialization, urbanization, and the growth of the manufacturing and logistics sectors is driving its growth. In China, India, Japan, and South Korea, a significant growth is foreseen in warehousing, construction, and e-Commerce activity.

Additionally, investments in rental equipment are driven by governments’ infrastructure development initiatives and perspectives to grow the industrial base and related businesses.

Forklift rental companies are expanding their fleets, with focus on electric models, while also making use of telematics and the other digital technology to better manage their fleets. Moreover, to compete against existing industrial supply chains or if new demand arises, forklift rental companies are introducing flexible rental plans, and entering emerging markets with increased industrial demand.

United Rentals, Inc., Sunbelt Rentals, Inc., Boels Rental, KION GROUP AG, Caterpillar, Herc Rentals Inc., Nishio Rent All (M) Sdn Bhd, Toyota, Crown Equipment Corporation, Komatsu America Corp., Combillift Depot, H&E Rentals, Jungheinrich AG, MLE B.V., and Bobcat Company are the key players in forklift rental market.

Each of these players has been profiled in the forklift rental market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

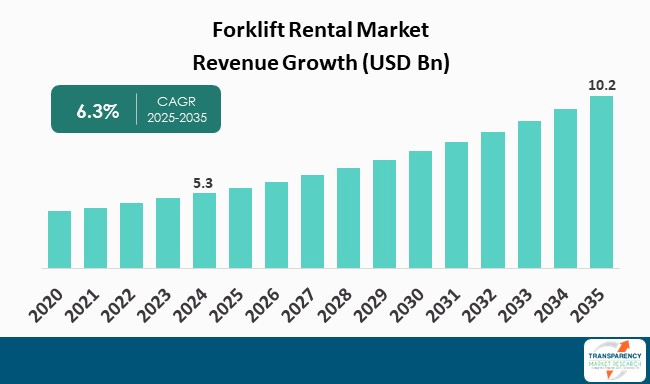

| Size in 2024 | US$ 5.3 Bn |

| Forecast Value in 2035 | US$ 10.2 Bn |

| CAGR | 6.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Forklift Rental Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Ton Capacity

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The forklift rental market was valued at US$ 5.3 Bn in 2024

The forklift rental market is projected to cross US$ 10.2 Bn by the end of 2035

Seasonal & project-based demand and maintenance & downtime reduction

The CAGR is anticipated to be 6.3% from 2025 to 2035

Asia Pacific is expected to account for the largest share from 2025 to 2035

United Rentals, Inc., Sunbelt Rentals, Inc., Boels Rental, KION GROUP AG, Caterpillar, Herc Rentals Inc., Nishio Rent All (M) Sdn Bhd, Toyota, Crown Equipment Corporation, Komatsu America Corp., Combillift Depot, H&E Rentals, Jungheinrich AG, MLE B.V., and Bobcat Company, among others

Table 01: Global Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 02: Global Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 03: Global Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 04: Global Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 05: Global Forklift Rental Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 06: Global Forklift Rental Market Volume (Units) Forecast, by Region, 2020 to 2035

Table 07: North America Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 08: North America Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 09: North America Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 10: North America Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 11: North America Forklift Rental Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 12: North America Forklift Rental Market Volume (Units) Forecast, by Country, 2020 to 2035

Table 13: U.S. Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 14: U.S. Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 15: U.S. Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 16: U.S. Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 17: Canada Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 18: Canada Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 19: Canada Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 20: Canada Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 21: Europe Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 22: Europe Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 23: Europe Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 24: Europe Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 25: Europe Forklift Rental Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 26: Europe Forklift Rental Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 27: Germany Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 28: Germany Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 29: Germany Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 30: Germany Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 31: U.K. Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 32: U.K. Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 33: U.K. Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 34: U.K. Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 35: France Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 36: France Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 37: France Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 38: France Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 39: Italy Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 40: Italy Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 41: Italy Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 42: Italy Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 43: Spain Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 44: Spain Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 45: Spain Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 46: Spain Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 47: Switzerland Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 48: Switzerland Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 49: Switzerland Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 50: Switzerland Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 51: The Netherlands Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 52: The Netherlands Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 53: The Netherlands Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 54: The Netherlands Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 55: Rest of Europe Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 56: Rest of Europe Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 57: Rest of Europe Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 58: Rest of Europe Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 59: Asia Pacific Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 60: Asia Pacific Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 61: Asia Pacific Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 62: Asia Pacific Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 63: Asia Pacific Forklift Rental Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 64: Asia Pacific Forklift Rental Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 65: China Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 66: China Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 67: China Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 68: China Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 69: Japan Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 70: Japan Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 71: Japan Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 72: Japan Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 73: India Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 74: India Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 75: India Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 76: India Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 77: South Korea Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 78: South Korea Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 79: South Korea Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 80: South Korea Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 81: Australia and New Zealand Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 82: Australia and New Zealand Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 83: Australia and New Zealand Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 84: Australia and New Zealand Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 85: Rest of Asia Pacific Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 86: Rest of Asia Pacific Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 87: Rest of Asia Pacific Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 88: Rest of Asia Pacific Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 89: Latin America Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 90: Latin America Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 91: Latin America Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 92: Latin America Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 93: Latin America Forklift Rental Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 94: Latin America Forklift Rental Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 95: Brazil Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 96: Brazil Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 97: Brazil Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 98: Brazil Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 99: Mexico Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 100: Mexico Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 101: Mexico Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 102: Mexico Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 103: Argentina Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 104: Argentina Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 105: Argentina Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 106: Argentina Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 107: Rest of Latin America Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 108: Rest of Latin America Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 109: Rest of Latin America Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 110: Rest of Latin America Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 111: Middle East and Africa Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 112: Middle East and Africa Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 113: Middle East and Africa Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 114: Middle East and Africa Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 115: Middle East and Africa Forklift Rental Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 116: Middle East and Africa Forklift Rental Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 117: GCC Countries Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 118: GCC Countries Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 119: GCC Countries Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 120: GCC Countries Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 121: South Africa Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 122: South Africa Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 123: South Africa Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 124: South Africa Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Table 125: Rest of Middle East and Africa Forklift Rental Market Value (US$ Bn) Forecast, by Ton Capacity, 2020 to 2035

Table 126: Rest of Middle East and Africa Forklift Rental Market Volume (Units) Forecast, by Ton Capacity, 2020 to 2035

Table 127: Rest of Middle East and Africa Forklift Rental Market Value (US$ Bn) Forecast, by End Use, 2020 to 2035

Table 128: Rest of Middle East and Africa Forklift Rental Market Volume (Units) Forecast, by End Use, 2020 to 2035

Figure 01: Global Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 03: Global Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 04: Global Forklift Rental Market Revenue (US$ Bn), by Below 3.5 Ton, 2020 to 2035

Figure 05: Global Forklift Rental Market Revenue (US$ Bn), by 3.6-10 Ton, 2020 to 2035

Figure 06: Global Forklift Rental Market Revenue (US$ Bn), by Above 10 Ton, 2020 to 2035

Figure 07: Global Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 08: Global Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 09: Global Forklift Rental Market Revenue (US$ Bn), by Construction, 2020 to 2035

Figure 10: Global Forklift Rental Market Revenue (US$ Bn), by Automotive, 2020 to 2035

Figure 11: Global Forklift Rental Market Revenue (US$ Bn), by Aerospace & Defense, 2020 to 2035

Figure 12: Global Forklift Rental Market Revenue (US$ Bn), by Warehouse and Logistics, 2020 to 2035

Figure 13: Global Forklift Rental Market Revenue (US$ Bn), by Other End Use, 2020 to 2035

Figure 14: Global Forklift Rental Market Value Share Analysis, by Region, 2024 and 2035

Figure 15: Global Forklift Rental Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 16: North America Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 17: North America Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 18: North America Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 19: North America Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 20: North America Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 21: North America Forklift Rental Market Value Share Analysis, by Country, 2024 and 2035

Figure 22: North America Forklift Rental Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 23: U.S. Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 24: U.S. Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 25: U.S. Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 26: U.S. Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 27: U.S. Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 28: Canada Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 29: Canada Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 30: Canada Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 31: Canada Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 32: Canada Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 33: Europe Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 34: Europe Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 35: Europe Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 36: Europe Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 37: Europe Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 38: Europe Forklift Rental Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 39: Europe Forklift Rental Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 40: Germany Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 41: Germany Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 42: Germany Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 43: Germany Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 44: Germany Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 45: U.K. Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 46: U.K. Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 47: U.K. Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 48: U.K. Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 49: U.K. Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 50: France Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 51: France Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 52: France Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 53: France Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 54: France Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 55: Italy Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 56: Italy Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 57: Italy Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 58: Italy Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 59: Italy Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 60: Spain Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 61: Spain Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 62: Spain Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 63: Spain Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 64: Spain Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 65: Switzerland Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 66: Switzerland Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 67: Switzerland Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 68: Switzerland Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 69: Switzerland Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 70: The Netherlands Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 71: The Netherlands Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 72: The Netherlands Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 73: The Netherlands Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 74: The Netherlands Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 75: Rest of Europe Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 76: Rest of Europe Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 77: Rest of Europe Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 78: Rest of Europe Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 79: Rest of Europe Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 80: Asia Pacific Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 81: Asia Pacific Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 82: Asia Pacific Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 83: Asia Pacific Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 84: Asia Pacific Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 85: Asia Pacific Forklift Rental Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 86: Asia Pacific Forklift Rental Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 87: China Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 88: China Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 89: China Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 90: China Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 91: China Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 92: Japan Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 93: Japan Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 94: Japan Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 95: Japan Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 96: Japan Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 97: India Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 98: India Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 99: India Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 100: India Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 101: India Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 102: South Korea Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 103: South Korea Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 104: South Korea Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 105: South Korea Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 106: South Korea Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 107: Australia and New Zealand Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 108: Australia and New Zealand Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 109: Australia and New Zealand Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 110: Australia and New Zealand Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 111: Australia and New Zealand Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 112: Rest of Asia Pacific Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 113: Rest of Asia Pacific Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 114: Rest of Asia Pacific Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 115: Rest of Asia Pacific Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 116: Rest of Asia Pacific Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 117: Latin America Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 118: Latin America Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 119: Latin America Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 120: Latin America Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 121: Latin America Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 122: Latin America Forklift Rental Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 123: Latin America Forklift Rental Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 124: Brazil Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 125: Brazil Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 126: Brazil Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 127: Brazil Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 128: Brazil Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 129: Mexico Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 130: Mexico Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 131: Mexico Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 132: Mexico Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 133: Mexico Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 134: Argentina Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 135: Argentina Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 136: Argentina Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 137: Argentina Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 138: Argentina Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 139: Rest of Latin America Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 140: Rest of Latin America Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 141: Rest of Latin America Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 142: Rest of Latin America Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 143: Rest of Latin America Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 144: Middle East and Africa Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 145: Middle East and Africa Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 146: Middle East and Africa Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 147: Middle East and Africa Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 148: Middle East and Africa Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 149: Middle East and Africa Forklift Rental Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 150: Middle East and Africa Forklift Rental Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 151: GCC Countries Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 152: GCC Countries Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 153: GCC Countries Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 154: GCC Countries Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 155: GCC Countries Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 156: South Africa Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 157: South Africa Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 158: South Africa Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 159: South Africa Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 160: South Africa Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035

Figure 161: Rest of Middle East and Africa Forklift Rental Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 162: Rest of Middle East and Africa Forklift Rental Market Value Share Analysis, by Ton Capacity, 2024 and 2035

Figure 163: Rest of Middle East and Africa Forklift Rental Market Attractiveness Analysis, by Ton Capacity, 2025 to 2035

Figure 164: Rest of Middle East and Africa Forklift Rental Market Value Share Analysis, by End Use, 2024 and 2035

Figure 165: Rest of Middle East and Africa Forklift Rental Market Attractiveness Analysis, by End Use, 2025 to 2035