Reports

Reports

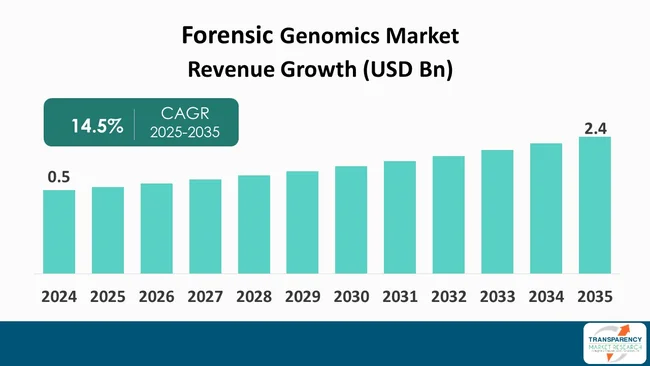

The global forensic genomics market size was valued at US$ 0.5 Bn in 2024 and is projected to reach US$ 2.4 Bn by 2035, expanding at a CAGR of 14.5 % from 2025 to 2035. The expansion of the market has been largely driven by various factors including the increasing globally incidence of violent crimes, cross-border forensic investigations and hence the requirement for accurate DNA profiling. Overall, the development of genomic technologies like next generation sequencing (NGS), AI/ML-based bioinformatics and portable forensic DNA devices has also been a major factor.

Advancements in DNA sequencing technology is one of the major factors driving the global forensic genomics industry. The other factors contributing to the increase of the market size are the increased need for the exact identification of criminals and widening the use of paternity testing, human identification, and disaster victim identification.

The implementation of next-generation sequencing (NGS) technologies and bioinformatics tools is the main factor dealing with the accuracy and rapidity of forensic investigations. Moreover, governments’ programs aimed at improving forensic infrastructure and the widespread use of genomic databases are likely to increase the market volume. The implementation of portable automated genomic analysis systems enables faster on-site investigations, which leads to better operational efficiency and reduced time for case resolution. The forensic genomics market will transform into a standardized system through analyst predictions. This will connect artificial intelligence with digital forensics platforms and achieve interoperability.

The forensics genomics market includes the use of genomic technologies such as DNA sequencing, genotyping, and molecular biology tools in the cases of criminal investigations, human identification, and analysis of legal evidence. DNA fingerprinting is central to modern forensic sciences in the first place as it grants the identification of persons with precision, contributes to the establishment of biological relationships, and allows the examination of minute materials collected at the scenes of crimes.

The demand has substantially increased with the revolutionary changes in the next-generation sequencing (NGS), polymerase chain reaction (PCR), and bioinformatics, which have made the forensic analysis faster and more accurate.

Moreover, the forensic genomics realm has grown extensively due to the escalated adoption of genomic data in ethical systems of criminal justice, identification of disaster victims, and ancestry tracing. This extension of forensic genomics covers various sectors such as law enforcement, research, and the government.

For instance, Dubai Police General Department of Forensic Science and Criminology has officially opened the Dubai Police Genome Centre, a state-of-the-art lab that will focus on forensic and genomic research. The center houses the specialized cells of the human genome, metagenomics, bioinformatics, and biotechnology, corresponding to the National Genomics Strategy of the UAE.

| Attribute | Detail |

|---|---|

| Forensic Genomics Market Drivers |

|

DNA analysis has become less time-consuming and more accurate due to rapid technological innovations in forensic genomics. The biggest change, in fact, is the use of next-generation sequencing (NGS) in conjunction with a new technique such as Reverse Complement PCR (RC-PCR), which together have opened the doors for the study of complex, mixed, or even degraded DNA samples to be done at a level of accuracy that has never been achieved before.

For instance, The FBI gave its green light for the NGS-based workflow by QIAGEN (ForenSeq MainstAY) to be uploaded to the U.S. National DNA Index System (NDIS). With this consent, forensic DNA labs that are accredited in the U.S. can go ahead and introduce NGS methods as a standard in their caseworks. This results in quicker DNA profiling with more details (in particular from complicated or degraded samples) and also makes it possible to receive federal grants for such changes.

Such technologies can dive deeper into genetics, require less time, and give better clarity when recognizing people or biological relationships. Moreover, the use of automation, small-scale sequencing devices, and bioinformatics instruments is making the processes more efficient, lessening the chances of mistakes, and increasing the use of forensic genomics in police investigations, identification of victims of disasters, and tracing of ancestry.

For instance, the Standardization Administration of China (SAC) has approved and issued the national standards named "Forensic Sciences — Basic Requirements for Quality of Next-Generation Sequencing-Based Reagents" (GB/T 44322-2024) and "Nomenclature for Sequence-Based STR Alleles" (GB/T 44393-2024). The standards were established by a group that comprised public security authorities and industry players (for instance - iGeneTech Biotechnology Co., Ltd.) to define strict criteria for NGS reagents used in forensic DNA analysis.

A primary cause of the escalating call for more accurate and advanced forensic testing has been the worldwide increase in incidences of crimes such as murders, kidnappings, and sexual assaults. To provide justice system with the needed strength, police departments are employing increasingly sophisticated genomic technologies for the precise identification of criminals, comprehension of biological evidence, and the production of the justice system of the required power.

For instance, as per the data provided by UNODC, 40% of the murders involved the use of firearms. In 22% of the cases sharp objects were used, and the rest of the murders involved the other methods. Male individuals, especially those within the age range of 15-29, made up 81% of the homicide victims. On the other hand, it is estimated that close partners or family members caused around 19 % of the murders.

The increasing demand for accurate and fast forensic methods is the main reason behind genetic profiling, DNA sequencing, and bioinformatics tools receiving more funding, which, in turn, is leading the forensic genomics to be widely used in the sectors of the investigation, law, and public safety. For instance, the United Nations Office on Drugs and Crime (UNODC) states that the Global Study on Homicide 2023 showed that 458,000 people died from homicide worldwide in 2021. This means one person died every 52 seconds.

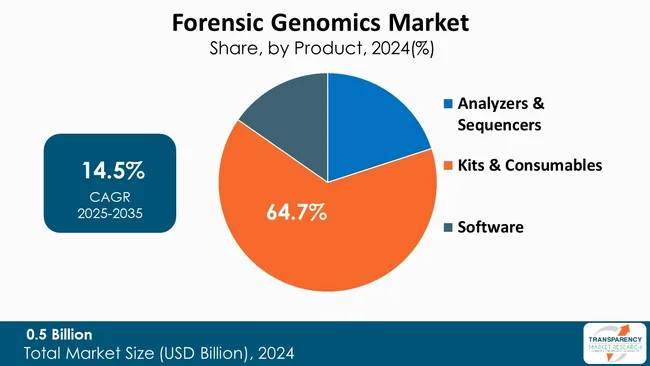

The Kits & Consumables segment leads the worldwide forensic genomics market in terms of product category with market share of 64.7%. This leadership position is mainly due to the continuous demand for DNA extraction kits, quantification reagents, amplification kits, and sequencing consumables that are used in the standard forensic casework and criminal investigations.

Continuous utilization of the products in different phases of sample processing, i.e., from collection to profiling, is the primary reason for the persistent generation of revenue as opposed to one-time equipment purchases. Besides, innovations in reagent chemistry, lyophilized formats, and ready-to-use multiplex PCR kits have significantly impacted the efficiency and accuracy of workflows in forensic laboratories.

The increasing number of crime investigations, paternity tests, and identification of victims in disasters, on a global scale, are the main factors that continuously keep up the demand for consumables which is the top segment in the market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America currently leads the global forensic genomics market with 44.7% market share. The region maintains its lead position as it has a well-developed forensic system, along with strong governments’ monetary support, and advanced genomic research centers. The market position of the region is further solidified by the widespread use of high-throughput next-generation sequencing (NGS) technologies, advanced DNA databases, and strong law enforcement measures.

Additionally, higher expenditures on public safety, an uptrend in crime rates, and a vigorous emphasis on research and development are the major factors that keep North America on top for a long time and turn it into a major center for innovation and growth in forensic genomics.

The strict regulatory systems, together with standardized forensic methods produce dependable and trustworthy forensic investigation outcomes. Government agencies in the region work with private laboratories and academic institutions to create partnerships. These drive ongoing technological progress. For instance, Canadian Genomics Strategy was a bold step taken by the Government of Canada to position Canada as an innovation leader and attract economic growth.

The plan is to invest in the country’s capacity to turn advanced genomics research into practical applications that have a positive impact on key sectors such as personalized medicine, advanced diagnostics, and novel therapeutics.

Illumina, Inc., Thermo Fisher Scientific Inc., Merck KGaA, Agilent Technologies, Inc., Promega Corporation, QIAGEN, Bio-Rad Laboratories, Inc., LGC Genomics Limited, Tri Tech Forensics, Hamilton Company, LGC Limited, Bode Cellmark Forensics, Inc., Eurofins Genomics LLC, NicheVision, INNOGENOMICS TECHNOLOGIES, LLC are some of the leading manufacturers operating in the global forensic genomics market.

Each of these companies has been profiled in the forensic genomics market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 0.5 Bn |

| Forecast Value in 2035 | More than US$ 2.4 Bn |

| CAGR | 14.5 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Product

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global forensic genomics market was valued at US$ 0.5 Bn in 2024

The global forensic genomics industry is projected to reach more than US$ 2.4 Bn by the end of 2035

Advance genomic technologies boost accuracy and speed in forensics and rising crime drives demand for advanced forensic solutions are some of the factors driving the expansion of forensic genomics market.

The CAGR is anticipated to be 14.5 % from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Illumina, Inc., Thermo Fisher Scientific Inc., Merck KGaA, Agilent Technologies, Inc., Promega Corporation, QIAGEN, Bio-Rad Laboratories, Inc., LGC Genomics Limited, Tri Tech Forensics, Hamilton Company, LGC Limited, Bode Cellmark Forensics, Inc., Eurofins Genomics LLC, NicheVision, INNOGENOMICS TECHNOLOGIES, LLC, and other prominent players.

Table 01: Global Forensic Genomics Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 02: Global Forensic Genomics Market Value (US$ Bn) Forecast, By Method, 2020 to 2035

Table 03: Global Forensic Genomics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 04: Global Forensic Genomics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 05: Global Forensic Genomics Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America Forensic Genomics Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 07: North America Forensic Genomics Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 08: North America Forensic Genomics Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 09: North America Forensic Genomics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 10: North America Forensic Genomics Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 11: Europe Forensic Genomics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 12: Europe Forensic Genomics Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 13: Europe Forensic Genomics Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 14: Europe Forensic Genomics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 15: Europe Forensic Genomics Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 16: Asia Pacific Forensic Genomics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 17: Asia Pacific Forensic Genomics Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 18: Asia Pacific Forensic Genomics Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 19: Asia Pacific Forensic Genomics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 20: Asia Pacific Forensic Genomics Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 21: Latin America Forensic Genomics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 22: Latin America Forensic Genomics Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 23: Latin America Forensic Genomics Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 24: Latin America Forensic Genomics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 25: Latin America Forensic Genomics Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 26: Middle East and Africa Forensic Genomics Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 27: Middle East and Africa Forensic Genomics Market Value (US$ Bn) Forecast, by Product, 2020 to 2035

Table 28: Middle East and Africa Forensic Genomics Market Value (US$ Bn) Forecast, by Method, 2020 to 2035

Table 29: Middle East and Africa Forensic Genomics Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 30: Middle East and Africa Forensic Genomics Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Figure 01: Global Forensic Genomics Market Value Share Analysis, by Product, 2024 and 2035

Figure 02: Global Forensic Genomics Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 03: Global Forensic Genomics Market Revenue (US$ Bn), by Analyzers & Sequencers, 2020 to 2035

Figure 04: Global Forensic Genomics Market Revenue (US$ Bn), by Kits & Consumables, 2020 to 2035

Figure 05: Global Forensic Genomics Market Revenue (US$ Bn), by Software, 2020 to 2035

Figure 06: Global Forensic Genomics Market Value Share Analysis, by Method, 2024 and 2035

Figure 07: Global Forensic Genomics Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 08: Global Forensic Genomics Market Revenue (US$ Bn), by Capillary Electrophoresis, 2020 to 2035

Figure 09: Global Forensic Genomics Market Revenue (US$ Bn), by Next-generation Sequencing, 2020 to 2035

Figure 10: Global Forensic Genomics Market Revenue (US$ Bn), by PCR Amplification, 2020 to 2035

Figure 11: Global Forensic Genomics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 12: Global Forensic Genomics Market Value Share Analysis, by Application, 2024 and 2035

Figure 13: Global Forensic Genomics Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 14: Global Forensic Genomics Market Revenue (US$ Bn), by Criminal Testing, 2020 to 2035

Figure 15: Global Forensic Genomics Market Revenue (US$ Bn), by Forensic SNP and STR Sequencing, 2020 to 2035

Figure 16: Global Forensic Genomics Market Revenue (US$ Bn), by Disaster Victim Identification, 2020 to 2035

Figure 17: Global Forensic Genomics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 18: Global Forensic Genomics Market Value Share Analysis, by End-user, 2024 and 2035

Figure 19: Global Forensic Genomics Market Attractiveness Analysis, by End-user, 2024 and 2035

Figure 20: Global Forensic Genomics Market Revenue (US$ Bn), by Forensic Laboratories, 2025 to 2035

Figure 21: Global Forensic Genomics Market Revenue (US$ Bn), by Law Enforcement Agencies, 2020 to 2035

Figure 22: Global Forensic Genomics Market Revenue (US$ Bn), by Research and Academic Institutes, 2020 to 2035

Figure 23: Global Forensic Genomics Market Revenue (US$ Bn), by Government Agencies, 2020 to 2035

Figure 24: Global Forensic Genomics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 25: Global Forensic Genomics Market Value Share Analysis, By Region, 2024 and 2035

Figure 26: Global Forensic Genomics Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 27: North America Forensic Genomics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 28: North America Forensic Genomics Market Value Share Analysis, by Country, 2024 and 2035

Figure 29: North America Forensic Genomics Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 30: North America Forensic Genomics Market Value Share Analysis, by Product, 2024 and 2035

Figure 31: North America Forensic Genomics Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 32: North America Forensic Genomics Value Share Analysis, by Method, 2025 to 2035

Figure 33: North America Forensic Genomics Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 34: North America Forensic Genomics Market Value Share Analysis, by Application, 2025 to 2035

Figure 35: North America Forensic Genomics Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 36: North America Forensic Genomics Market Value Share Analysis, by End-user, 2024 and 2035

Figure 37: North America Forensic Genomics Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 38: Europe Forensic Genomics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 39: Europe Forensic Genomics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 40: Europe Forensic Genomics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 41: Europe Forensic Genomics Market Value Share Analysis, by Product, 2024 and 2035

Figure 42: Europe Forensic Genomics Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 43: Europe Forensic Genomics Market Value Share Analysis, by Method, 2024 and 2035

Figure 44: Europe Forensic Genomics Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 45: Europe Forensic Genomics Market Value Share Analysis, By Application, 2024 and 2035

Figure 46: Europe Forensic Genomics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 47: Europe Forensic Genomics Market Value Share Analysis, by End-user, 2024 and 2035

Figure 48: Europe Forensic Genomics Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 49: Asia Pacific Forensic Genomics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 50: Asia Pacific Forensic Genomics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 51: Asia Pacific Forensic Genomics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 52: Asia Pacific Forensic Genomics Market Value Share Analysis, by Product, 2024 and 2035

Figure 53: Asia Pacific Forensic Genomics Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 54: Asia Pacific Forensic Genomics Market Value Share Analysis, by Method, 2024 and 2035

Figure 55: Asia Pacific Forensic Genomics Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 56: Asia Pacific Forensic Genomics Market Value Share Analysis, By Application, 2024 and 2035

Figure 57: Asia Pacific Forensic Genomics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 58: Asia Pacific Forensic Genomics Market Value Share Analysis, by End-user, 2024 and 2035

Figure 59: Asia Pacific Forensic Genomics Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 60: Latin America Forensic Genomics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 61: Latin America Forensic Genomics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 62: Latin America Forensic Genomics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 63: Latin America Forensic Genomics Market Value Share Analysis, by Product, 2024 and 2035

Figure 64: Latin America Forensic Genomics Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 65: Latin America Forensic Genomics Market Value Share Analysis, by Method, 2024 and 2035

Figure 66: Latin America Forensic Genomics Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 67: Latin America Forensic Genomics Market Value Share Analysis, By Application, 2024 and 2035

Figure 68: Latin America Forensic Genomics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 69: Latin America Forensic Genomics Market Value Share Analysis, by End-user, 2024 and 2035

Figure 70: Latin America Forensic Genomics Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 71: Middle East and Africa Forensic Genomics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 72: Middle East and Africa Forensic Genomics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 73: Middle East and Africa Forensic Genomics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 74: Middle East and Africa Forensic Genomics Market Value Share Analysis, by Product, 2024 and 2035

Figure 75: Middle East and Africa Forensic Genomics Market Attractiveness Analysis, by Product, 2025 to 2035

Figure 76: Middle East and Africa Forensic Genomics Market Value Share Analysis, by Method, 2024 and 2035

Figure 77: Middle East and Africa Forensic Genomics Market Attractiveness Analysis, by Method, 2025 to 2035

Figure 78: Middle East and Africa Forensic Genomics Market Value Share Analysis, by Application, 2024 and 2035

Figure 79: Middle East and Africa Forensic Genomics Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 80: Middle East and Africa Forensic Genomics Market Value Share Analysis, by End-user, 2024 and 2035

Figure 81: Middle East and Africa Forensic Genomics Market Attractiveness Analysis, by End-user, 2025 to 2035