Reports

Reports

The multiplex PCR market is driven by rise in incidence of various diseases and new investments in outbreak readiness and surveillance. Public health agencies and hospital systems are increasingly seeking syndromic panels that combine respiratory, gastrointestinal, or sepsis workups into standard protocols that streamline turnaround times for action-oriented results at the clinical front line.

Funding cycles controlling antimicrobial resistance and genomic epidemiology monitoring spur laboratories to move toward multiplex assays to identify organisms and resistance markers quickly. Concurrent development in food safety, environmental, and animal testing offers complementary uses outside the clinical laboratory, and generates diversified demand with regulators, contract testing houses, and industrial QA/QC schemes worldwide.

The regulatory and reimbursement dynamics are another driver. Improved routes under FDA regulation and Europe's IVDR are encouraging shifts from research-use-only assays to compliant IVD kits with clinically proven performance. Reference labs and hospitals are choosing high inclusivity/exclusivity claim assays, traceable controls, and external quality assessment compatibility to satisfy accreditation requirements. Procurement organizations prefer vendors that offer continuity of key reagents and deliver assay menu extensions compatible with general thermocyclers that have been tested.

Innovation has ensured the potential for usability, robustness, and better design. Primer/probe design reflects a growing focus on machine learning and the use of large pathogen databases to facilitate inclusivity while limiting primer dimer formation and cross-reactivity. Lyophilized, room temperature oriented master mixes, and cartridge-based consumables create logistical ease and reduce reliance on cold chain movements. Microfluidic arrays and sealed reaction partitions help to reduce contamination.

Cloud connected instruments facilitate remote QC, audit trails, and software updates. Vendors are also progressing where legacy lineage aware panels can include tracking of variant-defining mutations and build in internal process controls and reference standards for added robustness and comparability between laboratories.

The competitive landscape is primarily constructed around range of assay menus, regulatory breadth, and workflow application from beginning to end. Vendors are expanding their manufacturing capacity, localizing assembly of kits, and dual-sourcing oligos and enzymes that are critical to their supply.

Market entry primarily includes key strategies based on partnering with existing distributors, opening training academies, and bundling instruments with reagents and software through service contracts. Product roadmaps are poised to prioritize automation friendly plates, barcodes, connectivity to LIS systems, and a subscription model to access their analysis modules.

Multiplex PCR is a robust molecular biology method that enables amplification of numerous DNA targets within one reaction. In contrast to standard PCR, where a single sequence is amplified per reaction, multiplex PCR utilizes greater than one primer set in one tube. It is effective as less quantity of reagent is utilized, and time is conserved since scientists can identify or examine more than one genetic marker simultaneously. It has proved to be an effective tool in every clinical diagnosis, microbiology, forensic, and genetics research where quick and large-scale analysis of DNA is essential.

The multiplex PCR is one of the key benefits of providing large-scale information from small input sample. It is particularly helpful in the clinic where there is only a patient sample that is small. For instance, infectious disease diagnosis usually involves detection of various pathogens or resistance genes within a single test and therefore multiplex PCR proves to be very useful. It also minimizes the risk of contamination as there are fewer reactions and handling steps as compared to carrying out various individual PCR tests.

Nonetheless, careful primer design and optimization of the reaction conditions to avert possible non-specific amplification and dimerization of the primers are necessary. It is important to balance proper conditions such as annealing temperatures, magnesium ion concentrations, and the number of cycles. These considerations are important for reliable and reproducible results. While primer design programs along with new enzyme formulations have reduced these issues. the sensitivity and specificity have been improved.

With the advancements in molecular biology, the use of multiplex PCR has grown tremendously. Multiplex PCR is rightly being utilized for a variety of applications including verifying genetic mutations, tracing foodborne pathogens (i.e., Salmonella), and conducting forensic DNA profiling. In its use as a research technique, multiplex PCR has proven to be very useful for various gene expression studies and for study of disease biomarkers (e.g. cancer, diabetes, atherosclerosis).

| Attribute | Detail |

|---|---|

| Multiplex PCR Market Drivers |

|

The emerging multiplex PCR market is mostly driven by the demand for rapid and effective diagnostic testing. Healthcare professionals in clinical care settings while dealing with difficult cases and managing a room full of patients are attracted toward such fast and accurate results.

Multiplex PCR allows for a rapid turnaround time as multiple targets can be amplified in a single reaction more efficiently than running multiple single-plex tests. These characteristics of multiplex PCR allow for not only routine diagnostics but also situations involving outbreaks where testing for many samples quickly is needed.

The concerns regarding diagnostic efficiency are heightened by the increasing risk of antibiotic resistance and a rise in infections. The ability to easily locate a pathogen, along with its resistance gene, could enable clinically relevant information to assist the clinician's decision-making process to manage the patient and begin treatment in a timely manner.

Diagnostic accuracy can be improved based on testing for more than one pathogen from a single patient sample, thereby ultimately resulting in better patient care. There are collateral advantages including improvements to clinical workflow and efficiencies, as the overall efficiency of laboratory tests reduces.

The ontology of high-throughput is not limited to a clinical context, and high-throughput demands are also apparent in large-scale screening and surveillance programs. Public health agencies, research institutions employing large-scale screening, and diagnostic laboratories are increasingly employing multiplex PCR platforms that efficiently analyze and report on hundreds of samples in a single process. The expanded availability of PCR testing capabilities will lead to a faster turnaround time to support epidemiological monitoring during outbreaks, all in an effort to successfully contain a disease.

Additionally, with the growth of automation and multi-component assays, multiplex platforms will continue to expand the reach and effectiveness of high-throughput testing. Cheap liquid-handling robots, laboratory information systems, and automated reporting methods could help improve workflow and increase testing capacity through the entire lab process, right from registration to result reporting to the client. These features contribute to the increasing significance of multiplex PCR in satisfying the demand for effective testing solutions, and this increasing availability of testing solutions will ultimately contribute to continuing and sustained growth of the marketplace.

The expansion of personalized medicine is significantly contributing to the development of the multiplex PCR market. Personalized medicine uses an individual's genetic profile, customs, and illnesses to dictate treatment strategies. The multiplex PCR methods can facilitate the move toward a personalized medicine strategy. This is a system by which one assay can identify several genetic markers, mutations, or variations in a single assay.

With the use of multiplex technologies by ability, a physician can potentially have a better idea about the genetic susceptibility of a patient followed by a better ability to decide on particular treatments and to enhance patient outcomes.

Personalized medicine has advanced significantly in the field of oncology. Multiplex PCR technology is commonly used to detect mutations related to cancer and monitor disease progression. An example of a personalized medicine approach in oncology is the one that involves multiplex detection of gene alterations in a number of genes telling a physician the best treatment plan for the individual patient.

Consequently, multiplex PCR technology does not only speed up diagnosis, but it also ensures that the therapies are targeted, which reduces the number of unnecessary treatments and adverse effects associated with treatment plans.

The implications of personalized medicine with respect to multiplex PCR are not only seen in oncology but infectious disease applications, pharmacogenomics, and rare genetic diseases also continue to expand multiplex PCR technology.

Ongoing advancements in assays design, automation, and reagents formulations have continued to raise accuracy and performance in multiplex PCR for personalized medicine. As personalized medicine gains interest and the demand for genetic testing increases, multiplex PCR is becoming an important component of the precision medicine landscape. As longitudinal patient therapy practices become the norm for healthcare systems, multiplex PCR will gain a steadily increasing demand and provide several avenues for market growth.

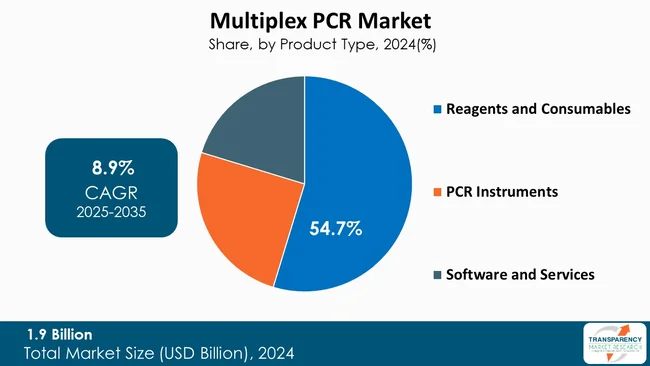

Reagents and consumables are the dominant segment in the multiplex PCR (mPCR) market as they are necessary components of every diagnostic or research assay. Reagents including primers, probes, master mixes, and buffers are repeatedly consumed, leading to continuous usage and demand. Also, since they are in continuous use for routine testing and clinical diagnostics and are staple items for high throughout research capacity as well, they will always generate recurring revenue.

Ultimately, innovation in reagent formulations such as lyophilized mixes and contamination-resistant chemistries will increase reliability and efficiency of assays using these items allowing for greater use. mPCR labs and researchers are just as dependent on high-quality validated consumables, and continuity of supply, just like they are reagent workflows with mPCR, making this category the leading segment for the mPCR market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

As per the latest multiplex PCR market analysis, North America dominated in 2024. North America is leading the market due to its established healthcare structure and sophisticated research ecosystem that drives implementation of new technologies in diagnostics. Furthermore, North America sees significant funding toward molecular diagnostics, well-established and equipped laboratory networks, and strong investments supporting genomics and precision medicine funding. North America is an attractive market for the rapid advancement and acceptance of multiplex PCR in clinical laboratories and research environments.

The rising burden of infectious diseases, cancer, and genetic disorders in North America leads to follow-up, thereby signaling the need for efficient solutions. Coupled with supportive regulation and reimbursement, and strong competition to become leaders in multiplex PCR technology, North America will continue to lead this market.

Market players within the multiplex PCR market are focused on expanding their offerings, securing regulatory approval, and investing in platforms that are amenable to automation.

Companies are reinforcing their distribution networks, thereby collaborating with research college institutions and developing online protocols to manage data. The continual exploration of new ways to improve primer design quality process, reagent stability, and simplification of the workflow continues to push adoption and growth in this market.

Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., QIAGEN N.V., Illumina, Inc., F. Hoffmann-La Roche Ltd., Agilent Technologies, Inc., Merck KGaA, Takara Bio Inc., Becton, Dickinson and Company (BD), Fluidigm Corporation, DiaSorin S.p.A., BioMérieux, Abbott Laboratories, Seegene Inc., Analytik Jena GmbH+Co. KG, QuantuMDx Group Ltd., ALPCO, and AUSDIAGNOSTICS are some of the leading players operating in the global multiplex PCR market.

Each of these players has been profiled in the multiplex PCR market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 1.9 Bn |

| Forecast Value in 2035 | US$ 4.8 Bn |

| CAGR | 8.9% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Multiplex PCR Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global multiplex PCR market was valued at US$ 1.9 Bn in 2024

The global multiplex PCR industry is projected to reach more than US$ 4.8 Bn by the end of 2035

Rising demand for high-throughput & efficient diagnostics, growth of personalized medicine, rising prevalence of chronic and genetic diseases, and the advancements in genomics and proteomics are some of the factors driving the expansion of multiplex PCR market.

The CAGR is anticipated to be 8.9% from 2025 to 2035

Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., QIAGEN N.V., Illumina, Inc., F. Hoffmann-La Roche Ltd., Agilent Technologies, Inc., Merck KGaA, Takara Bio Inc., Becton, Dickinson and Company (BD), Fluidigm Corporation, DiaSorin S.p.A., BioMérieux, Abbott Laboratories, Seegene Inc., Analytik Jena GmbH+Co. KG, QuantuMDx Group Ltd., ALPCO, and AUSDIAGNOSTICS

Table 01: Global Multiplex PCR Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Multiplex PCR Market Value (US$ Bn) Forecast, By PCR Instruments, 2020 to 2035

Table 03: Global Multiplex PCR Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 04: Global Multiplex PCR Market Value (US$ Bn) Forecast, By Assay Type, 2020 to 2035

Table 05: Global Multiplex PCR Market Value (US$ Bn) Forecast, By Planar Assay, 2020 to 2035

Table 06: Global Multiplex PCR Market Value (US$ Bn) Forecast, By Bead-based Assay, 2020 to 2035

Table 07: Global Multiplex PCR Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 08: Global Multiplex PCR Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 09: Global Multiplex PCR Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 10: North America - Multiplex PCR Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 11: North America - Multiplex PCR Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 12: North America - Multiplex PCR Market Value (US$ Bn) Forecast, By PCR Instruments, 2020 to 2035

Table 13: North America - Multiplex PCR Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 14: North America - Multiplex PCR Market Value (US$ Bn) Forecast, By Assay Type, 2020 to 2035

Table 15: North America - Multiplex PCR Market Value (US$ Bn) Forecast, By Planar Assay, 2020 to 2035

Table 16: North America - Multiplex PCR Market Value (US$ Bn) Forecast, By Bead-based Assay, 2020 to 2035

Table 17: North America - Multiplex PCR Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 18: North America - Multiplex PCR Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 19: Europe - Multiplex PCR Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 20: Europe - Multiplex PCR Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 21: Europe - Multiplex PCR Market Value (US$ Bn) Forecast, By PCR Instruments, 2020 to 2035

Table 22: Europe - Multiplex PCR Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 23: Europe - Multiplex PCR Market Value (US$ Bn) Forecast, By Assay Type, 2020 to 2035

Table 24: Europe - Multiplex PCR Market Value (US$ Bn) Forecast, By Planar Assay, 2020 to 2035

Table 25: Europe - Multiplex PCR Market Value (US$ Bn) Forecast, By Bead-based Assay, 2020 to 2035

Table 26: Europe - Multiplex PCR Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 27: Europe - Multiplex PCR Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 28: Asia Pacific - Multiplex PCR Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 29: Asia Pacific - Multiplex PCR Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 30: Asia Pacific - Multiplex PCR Market Value (US$ Bn) Forecast, By PCR Instruments, 2020 to 2035

Table 31: Asia Pacific - Multiplex PCR Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 32: Asia Pacific - Multiplex PCR Market Value (US$ Bn) Forecast, By Assay Type, 2020 to 2035

Table 33: Asia Pacific - Multiplex PCR Market Value (US$ Bn) Forecast, By Planar Assay, 2020 to 2035

Table 34: Asia Pacific - Multiplex PCR Market Value (US$ Bn) Forecast, By Bead-based Assay, 2020 to 2035

Table 35: Asia Pacific - Multiplex PCR Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 36: Asia Pacific - Multiplex PCR Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 37: Latin America - Multiplex PCR Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 38: Latin America - Multiplex PCR Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 39: Latin America - Multiplex PCR Market Value (US$ Bn) Forecast, By PCR Instruments, 2020 to 2035

Table 40: Latin America - Multiplex PCR Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 41: Latin America - Multiplex PCR Market Value (US$ Bn) Forecast, By Assay Type, 2020 to 2035

Table 42: Latin America - Multiplex PCR Market Value (US$ Bn) Forecast, By Planar Assay, 2020 to 2035

Table 43: Latin America - Multiplex PCR Market Value (US$ Bn) Forecast, By Bead-based Assay, 2020 to 2035

Table 44: Latin America - Multiplex PCR Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 45: Latin America - Multiplex PCR Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 46: Middle East & Africa - Multiplex PCR Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 47: Middle East & Africa - Multiplex PCR Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 48: Middle East & Africa - Multiplex PCR Market Value (US$ Bn) Forecast, By PCR Instruments, 2020 to 2035

Table 49: Middle East & Africa - Multiplex PCR Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 50: Middle East & Africa - Multiplex PCR Market Value (US$ Bn) Forecast, By Assay Type, 2020 to 2035

Table 51: Middle East & Africa - Multiplex PCR Market Value (US$ Bn) Forecast, By Planar Assay, 2020 to 2035

Table 52: Middle East & Africa - Multiplex PCR Market Value (US$ Bn) Forecast, By Bead-based Assay, 2020 to 2035

Table 53: Middle East & Africa - Multiplex PCR Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 54: Middle East & Africa - Multiplex PCR Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Multiplex PCR Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Multiplex PCR Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 03: Global Multiplex PCR Market Revenue (US$ Bn), by Reagents and Consumables, 2020 to 2035

Figure 04: Global Multiplex PCR Market Revenue (US$ Bn), by PCR Instruments, 2020 to 2035

Figure 05: Global Multiplex PCR Market Revenue (US$ Bn), by Software and Services, 2020 to 2035

Figure 06: Global Multiplex PCR Market Value Share Analysis, By Technology, 2024 and 2035

Figure 07: Global Multiplex PCR Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 08: Global Multiplex PCR Market Revenue (US$ Bn), by Conventional Multiplex PCR, 2020 to 2035

Figure 09: Global Multiplex PCR Market Revenue (US$ Bn), by Real-Time Multiplex PCR, 2020 to 2035

Figure 10: Global Multiplex PCR Market Revenue (US$ Bn), by Nested Multiplex PCR, 2020 to 2035

Figure 11: Global Multiplex PCR Market Value Share Analysis, By Assay Type, 2024 and 2035

Figure 12: Global Multiplex PCR Market Attractiveness Analysis, By Assay Type, 2025 to 2035

Figure 13: Global Multiplex PCR Market Revenue (US$ Bn), by Planar Assay, 2020 to 2035

Figure 14: Global Multiplex PCR Market Revenue (US$ Bn), by Bead-based Assay, 2020 to 2035

Figure 15: Global Multiplex PCR Market Value Share Analysis, By Application, 2024 and 2035

Figure 16: Global Multiplex PCR Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 17: Global Multiplex PCR Market Revenue (US$ Bn), by Clinical Diagnostics, 2020 to 2035

Figure 18: Global Multiplex PCR Market Revenue (US$ Bn), by Mutation Analysis, 2020 to 2035

Figure 19: Global Multiplex PCR Market Revenue (US$ Bn), by Antibiotic Resistance Gene Identification, 2020 to 2035

Figure 20: Global Multiplex PCR Market Revenue (US$ Bn), by Gene Deletion Analysis 2020 to 2035

Figure 21: Global Multiplex PCR Market Revenue (US$ Bn), by RNA Detection, 2020 to 2035

Figure 22: Global Multiplex PCR Market Revenue (US$ Bn), by High Throughput SNP Genotyping, 2020 to 2035

Figure 23: Global Multiplex PCR Market Revenue (US$ Bn), by Forensic Testing, 2020 to 2035

Figure 24: Global Multiplex PCR Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 25: Global Multiplex PCR Market Value Share Analysis, By End-user, 2024 and 2035

Figure 26: Global Multiplex PCR Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 27: Global Multiplex PCR Market Revenue (US$ Bn), by Hospitals and Diagnostic Laboratories, 2020 to 2035

Figure 28: Global Multiplex PCR Market Revenue (US$ Bn), by Research Institutes and Universities, 2020 to 2035

Figure 29: Global Multiplex PCR Market Revenue (US$ Bn), by Forensic Laboratories, 2020 to 2035

Figure 30: Global Multiplex PCR Market Revenue (US$ Bn), by Pharmaceutical and Biotechnology Companies, 2020 to 2035

Figure 31: Global Multiplex PCR Market Value Share Analysis, By Region, 2024 and 2035

Figure 32: Global Multiplex PCR Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 33: North America - Multiplex PCR Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 34: North America - Multiplex PCR Market Value Share Analysis, by Country, 2024 and 2035

Figure 35: North America - Multiplex PCR Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 36: North America - Multiplex PCR Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 37: North America - Multiplex PCR Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 38: North America - Multiplex PCR Market Value Share Analysis, By Technology, 2024 and 2035

Figure 39: North America - Multiplex PCR Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 40: North America - Multiplex PCR Market Value Share Analysis, By Assay Type, 2024 and 2035

Figure 41: North America - Multiplex PCR Market Attractiveness Analysis, By Assay Type, 2025 to 2035

Figure 42: North America - Multiplex PCR Market Value Share Analysis, By Application, 2024 and 2035

Figure 43: North America - Multiplex PCR Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 44: North America - Multiplex PCR Market Value Share Analysis, By End-user, 2024 and 2035

Figure 45: North America - Multiplex PCR Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 46: Europe - Multiplex PCR Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 47: Europe - Multiplex PCR Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 48: Europe - Multiplex PCR Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 49: Europe - Multiplex PCR Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 50: Europe - Multiplex PCR Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 51: Europe - Multiplex PCR Market Value Share Analysis, By Technology, 2024 and 2035

Figure 52: Europe - Multiplex PCR Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 53: Europe - Multiplex PCR Market Value Share Analysis, By Assay Type, 2024 and 2035

Figure 54: Europe - Multiplex PCR Market Attractiveness Analysis, By Assay Type, 2025 to 2035

Figure 55: Europe - Multiplex PCR Market Value Share Analysis, By Application, 2024 and 2035

Figure 56: Europe - Multiplex PCR Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 57: Europe - Multiplex PCR Market Value Share Analysis, By End-user, 2024 and 2035

Figure 58: Europe - Multiplex PCR Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 59: Asia Pacific - Multiplex PCR Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 60: Asia Pacific - Multiplex PCR Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 61: Asia Pacific - Multiplex PCR Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 62: Asia Pacific - Multiplex PCR Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 63: Asia Pacific - Multiplex PCR Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 64: Asia Pacific - Multiplex PCR Market Value Share Analysis, By Technology, 2024 and 2035

Figure 65: Asia Pacific - Multiplex PCR Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 66: Asia Pacific - Multiplex PCR Market Value Share Analysis, By Assay Type, 2024 and 2035

Figure 67: Asia Pacific - Multiplex PCR Market Attractiveness Analysis, By Assay Type, 2025 to 2035

Figure 68: Asia Pacific - Multiplex PCR Market Value Share Analysis, By Application, 2024 and 2035

Figure 69: Asia Pacific - Multiplex PCR Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 70: Asia Pacific - Multiplex PCR Market Value Share Analysis, By End-user, 2024 and 2035

Figure 71: Asia Pacific - Multiplex PCR Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 72: Latin America - Multiplex PCR Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 73: Latin America - Multiplex PCR Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 74: Latin America - Multiplex PCR Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 75: Latin America - Multiplex PCR Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 76: Latin America - Multiplex PCR Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 77: Latin America - Multiplex PCR Market Value Share Analysis, By Technology, 2024 and 2035

Figure 78: Latin America - Multiplex PCR Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 79: Latin America - Multiplex PCR Market Value Share Analysis, By Assay Type, 2024 and 2035

Figure 80: Latin America - Multiplex PCR Market Attractiveness Analysis, By Assay Type, 2025 to 2035

Figure 81: Latin America - Multiplex PCR Market Value Share Analysis, By Application, 2024 and 2035

Figure 82: Latin America - Multiplex PCR Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 83: Latin America - Multiplex PCR Market Value Share Analysis, By End-user, 2024 and 2035

Figure 84: Latin America - Multiplex PCR Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 85: Middle East & Africa - Multiplex PCR Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 86: Middle East & Africa - Multiplex PCR Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 87: Middle East & Africa - Multiplex PCR Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 88: Middle East & Africa - Multiplex PCR Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 89: Middle East & Africa - Multiplex PCR Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 90: Middle East & Africa - Multiplex PCR Market Value Share Analysis, By Technology, 2024 and 2035

Figure 91: Middle East & Africa - Multiplex PCR Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 92: Middle East & Africa - Multiplex PCR Market Value Share Analysis, By Assay Type, 2024 and 2035

Figure 93: Middle East & Africa - Multiplex PCR Market Attractiveness Analysis, By Assay Type, 2025 to 2035

Figure 94: Middle East & Africa - Multiplex PCR Market Value Share Analysis, By Application, 2024 and 2035

Figure 95: Middle East & Africa - Multiplex PCR Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 96: Middle East & Africa - Multiplex PCR Market Value Share Analysis, By End-user, 2024 and 2035

Figure 97: Middle East & Africa - Multiplex PCR Market Attractiveness Analysis, By End-user, 2025 to 2035