Reports

Reports

Analysts’ Viewpoint on Market Scenario

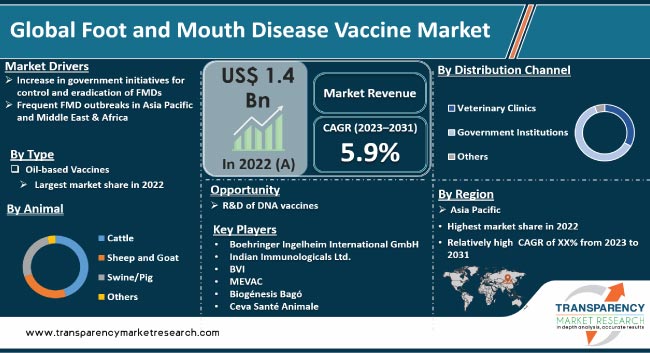

The foot and mouth disease vaccine market size is expected to increase at a steady pace in the next few years due to rise in number of foot and mouth disease (FMD) outbreaks. Increase in demand for livestock products is also projected to boost market expansion in the near future.

Rise in demand for animal protein, surge in government initiatives to control FMD outbreaks, and increase in awareness about animal health are propelling the demand for FMD vaccines. Animal protein is gaining traction among the populace due to changes in dietary habits and increase in disposable income.

FMD virus is highly contagious and outbreaks can cause significant economic losses due to restrictions on the movement of livestock and animal products. Thus, governments across the globe are focused on controlling FMD outbreaks. India and Brazil are implementing FMD control programs to prevent the spread of the disease.

Key players are developing advanced and effective FMD vaccines, including recombinant vaccines, virus-like particle vaccines, and synthetic peptide vaccines. They are also investing in improving the vaccine production process and expanding their distribution networks to broaden their customer base.

Foot and mouth disease (FMD) is a highly contagious viral disease that affects cloven-hoofed animals, including cattle, pigs, sheep, goats, and deer. The disease causes significant economic losses due to decreased milk and meat production, death of infected animals, and trade restrictions. Vaccines are widely used to prevent the spread of FMD in countries where the disease is endemic or where there is a high risk of outbreaks.

The global foot and mouth disease vaccine industry includes both oil-based and aluminum hydroxide-based vaccines. Oil-based vaccines are more commonly used due to their longer-lasting immunity and fewer booster requirements.

Livestock products are gaining traction worldwide. The demand for animal products in emerging countries, such as India and Brazil, is expected to more than double by 2030. Thus, governments and vendors are seeking robust vaccines to prevent any FMD outbreaks that can affect livestock production.

Government initiatives play a vital role in the control and eradication of FMDs during an outbreak and during the time of routine vaccination. FMD-endemic countries and regions are constantly implementing various programs to control and eradicate the disease.

In 2019, the Food and Agriculture Organization (FAO) and the World Organization for Animal Health launched the Progressive Control Pathway for FMD (PCP-FMD). The program aims to help countries improve their FMD control measures, including the distribution of vaccines. The PCP-FMD provides a step-by-step approach for countries to progressively improve their FMD control measures, with the ultimate goal of achieving FMD-free status. Thus, implementation of various FMD control and eradication programs is expected to spur the foot and mouth disease vaccine market growth in the near future.

FMD is a highly contagious disease and spreads rapidly from one animal to another within a short time. Therefore, countries that are threatened by sudden outbreaks of viral infection are taking specific initiatives to control FMD outbreaks. They are investing significantly in routine vaccination to completely eradicate FMD from their respective regions. Such initiatives are driving the foot and mouth disease vaccine market value.

Several FMD outbreaks have occurred, worldwide, in the past few years, affecting livestock populations and causing economic losses. In May 2022, an outbreak of FMD was reported in cattle in Indonesia. It was the first outbreak since the country was declared FMD-free in 1986.

The Government of Indonesia launched a nationwide rollout of vaccinations in mid-June. It also restricted the movement of livestock and launched a campaign to educate farmers on the risks of FMD. Thus, repeated outbreaks of FMD cases in Asia Pacific and Middle East & Africa are augmenting the foot and mouth disease vaccine market trajectory.

According to the latest foot and mouth disease vaccine market trends, the oil-based vaccines type segment is expected to dominate the industry during the forecast period. Oil-based FMD vaccines provide long-term immunity against multiple FMD virus strains. These vaccines contain a killed virus that is emulsified in oil, which allows for a slow release of the virus and a longer duration of immunity.

Oil-based vaccines are more thermally stable than other types of FMD vaccines, which means they can withstand a wider range of temperatures during transport and storage without losing their potency. Additionally, these vaccines offer cross-protection against different FMD virus serotypes, meaning they can protect against multiple strains of the virus with a single vaccine. This is particularly important in regions where there are multiple circulating strains of FMD virus, as it can be difficult and expensive to produce individual vaccines for each strain. Oil-based vaccines are also considered safe and effective for use in pregnant animals, which is an important factor in maintaining a healthy livestock population.

According to the latest foot and mouth disease vaccine market analysis, the cattle animal segment is projected to hold major share from 2023 to 2031. FMD affects cloven-hoofed animals, including cattle, pigs, sheep, goats, and buffalo. However, cattle are particularly susceptible to FMD due to their high levels of viral replication and shedding. They also can remain asymptomatic carriers of the virus for extended periods of time.

Use of cattle for dairy and beef production is a significant contributor to the global economy. Outbreaks of FMD can have a significant impact on trade and exports, as several countries have stringent import regulations on animals and animal products from FMD-endemic countries. Therefore, there is a significant financial incentive for farmers, producers, and governments to invest in FMD vaccines for cattle.

According to the latest foot and mouth disease vaccine market research, the government institutions distribution channel segment is estimated to dominate the industry during the forecast period.

Government institutions are one of the major distribution channels for FMD vaccines due to several reasons. Firstly, FMD is a highly contagious viral disease that affects cloven-hoofed animals. This makes it a significant public health concern, and governments are often responsible for controlling and preventing its spread. Consequently, governments play a critical role in the distribution of FMD vaccines and are often the primary purchasers of vaccines for their livestock populations.

Secondly, government institutions have a wide network of distribution channels that allows them to reach a large number of livestock farmers and producers. Governments often have established veterinary departments and agencies that oversee the distribution and administration of vaccines to livestock populations. They also have the resources to develop and implement vaccination programs, which may include mass vaccination campaigns or targeted vaccination programs in areas where outbreaks are occurring.

According to the latest foot and mouth disease vaccine market forecast, Asia Pacific is anticipated to hold largest share from 2023 to 2031. The region accounted for the largest share in 2022. Presence of a large population of livestock and growth in the agriculture sector are fueling market dynamics in the region.

Several countries in Asia Pacific, such as China, India, and South Korea, have a well-established agricultural sector. Governments in these countries are actively implementing programs to control the spread of FMD, including vaccination campaigns. Rise in the export of livestock products is also driving market statistics in the region. China, India, and Hong Kong are one of the major exporters of beef and pork to the Americas and Europe.

Surge in investment in animal health programs, which include the development and use of FMD vaccines, is projected to augment market progress in Latin America during the forecast period. The Pan American Foot-and-Mouth Disease Center (PANAFTOSA) in Brazil has been at the forefront of FMD vaccine development and production in the region.

Implementation of various regulations and vaccination programs to control and eradicate FMD, with support from the World Organization for Animal Health (OIE), is also boosting the market revenue in Latin America.

Rise in outbreaks of FMD is likely to fuel the foot and mouth disease vaccine market share of Middle East & Africa in the near future. FMD is endemic in many parts of the region, with frequent outbreaks occurring due to various factors such as the presence of multiple FMD virus serotypes, inadequate biosecurity measures, and movement of animals across borders. These outbreaks can lead to significant economic losses, making FMD vaccination a priority for governments and farmers in Middle East & Africa.

The global industry is fragmented, with the presence of several foot and mouth disease vaccine manufacturers including BVI, Indian Immunologicals Ltd, Ceva Santé Animale, MEVAC, National Veterinary Institute, Limor de Colombia SAS, Brilliant Bio Pharma, VETAL Animal Health Products, Inc., Biogénesis Bagó, Kenya Veterinary Vaccines Production Institute, Boehringer Ingelheim International GmbH, Zoetis, Inc., and Ourofino Saúde Animal.

Key players in the foot and mouth disease vaccine market report have been profiled based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|---|---|

|

Market Size in 2022 |

US$ 1.4 Bn |

|

Market Forecast Value in 2031 |

More than US$ 2.4 Bn |

|

CAGR |

5.9% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

The global market was valued at US$ 1.4 Bn in 2022

It is projected to surpass a value of US$ 2.4 Bn by the end of 2031

It is anticipated to be 5.9% from 2023 to 2031

The oil-based vaccines type segment held more than 60.0% share in 2022

Asia Pacific is expected to record highest demand from 2023 to 2031

BVI, Indian Immunologicals Ltd, Ceva Santé Animale, MEVAC, National Veterinary Institute, Limor de Colombia SAS, Brilliant Bio Pharma, VETAL Animal Health Products, Inc., Biogénesis Bagó, Kenya Veterinary Vaccines Production Institute, Boehringer Ingelheim International GmbH, Zoetis, Inc., and Ourofino Saúde Animal

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Foot and Mouth Disease Vaccine Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Foot and Mouth Disease Vaccine Market Analysis and Forecast, 2017-2031

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Foot and Mouth Disease Overview

5.2. Disease Prevalence & Incidence Rate Overview

5.3. Regulatory Scenario

5.4. Key Industry Events

5.5. COVID-19 Pandemic Impact on Industry (Value Chain and Short/Mid/Long-term Impact)

6. Global Foot and Mouth Disease Vaccine Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Type, 2017-2031

6.3.1. Aluminum Hydroxide and Saponin Vaccines

6.3.2. Oil-based Vaccines

6.3.2.1. Single-oil Emulsion

6.3.2.2. Double-oil Emulsion

6.4. Market Attractiveness, by Type

7. Global Foot and Mouth Disease Vaccine Market Analysis and Forecast, by Animal

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Animal, 2017-2031

7.3.1. Cattle

7.3.2. Sheep and Goat

7.3.3. Swine/Pig

7.3.4. Others

7.4. Market Attractiveness, by Animal

8. Global Foot and Mouth Disease Vaccine Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Distribution Channel, 2017-2031

8.3.1. Veterinary Clinics

8.3.2. Government Institutions

8.3.3. Others

8.4. Market Attractiveness, by Distribution Channel

9. Global Foot and Mouth Disease Vaccine Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. Asia Pacific

9.2.2. Latin America

9.2.3. Middle East & Africa

9.2.4. Rest of the World

9.3. Market Attractiveness, by Country/Region

10. Asia Pacific Foot and Mouth Disease Vaccine Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type, 2017-2031

10.2.1. Aluminum Hydroxide and Saponin Vaccines

10.2.2. Oil-based Vaccines

10.2.2.1. Single-oil Emulsion

10.2.2.2. Double-oil Emulsion

10.3. Market Value Forecast, by Animal, 2017-2031

10.3.1. Cattle

10.3.2. Sheep and Goat

10.3.3. Swine/Pig

10.3.4. Others

10.4. Market Value Forecast, by Distribution Channel, 2017-2031

10.4.1. Veterinary Clinics

10.4.2. Government Institutions

10.4.3. Others

10.5. Market Value Forecast, by Country/Sub-region, 2017-2031

10.5.1. China

10.5.2. India

10.5.3. Rest of Asia Pacific

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Animal

10.6.3. By Distribution Channel

10.6.4. By Country/Sub-region

11. Latin America Foot and Mouth Disease Vaccine Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2017-2031

11.2.1. Aluminum Hydroxide and Saponin Vaccines

11.2.2. Oil-based Vaccines

11.2.2.1. Single-oil Emulsion

11.2.2.2. Double-oil Emulsion

11.3. Market Value Forecast, by Animal, 2017-2031

11.3.1. Cattle

11.3.2. Sheep and Goat

11.3.3. Swine/Pig

11.3.4. Others

11.4. Market Value Forecast, by Distribution Channel, 2017-2031

11.4.1. Veterinary Clinics

11.4.2. Government Institutions

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Brazil

11.5.2. Argentina

11.5.3. Rest of Latin America

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Animal

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Middle East & Africa Foot and Mouth Disease Vaccine Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2017-2031

12.2.1. Aluminum Hydroxide and Saponin Vaccines

12.2.2. Oil-based Vaccines

12.2.2.1. Single-oil Emulsion

12.2.2.2. Double-oil Emulsion

12.3. Market Value Forecast, by Animal, 2017-2031

12.3.1. Cattle

12.3.2. Sheep and Goat

12.3.3. Swine/Pig

12.3.4. Others

12.4. Market Value Forecast, by Distribution Channel, 2017-2031

12.4.1. Veterinary Clinics

12.4.2. Government Institutions

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. GCC Countries

12.5.2. South Africa

12.5.3. Rest of Middle East & Africa

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Animal

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Rest of the World Foot and Mouth Disease Vaccine Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2017-2031

13.2.1. Aluminum Hydroxide and Saponin Vaccines

13.2.2. Oil-based Vaccines

13.2.2.1. Single-oil Emulsion

13.2.2.2. Double-oil Emulsion

13.3. Market Value Forecast, by Animal, 2017-2031

13.3.1. Cattle

13.3.2. Sheep and Goat

13.3.3. Swine/Pig

13.3.4. Others

13.4. Market Value Forecast, by Distribution Channel, 2017-2031

13.4.1. Veterinary Clinics

13.4.2. Government Institutions

13.4.3. Others

13.5. Market Attractiveness Analysis

13.5.1. By Type

13.5.2. By Animal

13.5.3. By Distribution Channel

14. Competition Landscape

14.1. Market Player - Competition Matrix (By Tier and Size of companies)

14.2. Company Profiles

14.2.1. BVI

14.2.1.1. Company Overview

14.2.1.2. Financial Overview

14.2.1.3. Product Portfolio

14.2.1.4. Business Strategies

14.2.1.5. Recent Developments

14.2.2. Indian Immunologicals Ltd.

14.2.2.1. Company Overview

14.2.2.2. Financial Overview

14.2.2.3. Product Portfolio

14.2.2.4. Business Strategies

14.2.2.5. Recent Developments

14.2.3. Ceva Santé Animale

14.2.3.1. Company Overview

14.2.3.2. Financial Overview

14.2.3.3. Product Portfolio

14.2.3.4. Business Strategies

14.2.3.5. Recent Developments

14.2.4. MEVAC

14.2.4.1. Company Overview

14.2.4.2. Financial Overview

14.2.4.3. Product Portfolio

14.2.4.4. Business Strategies

14.2.4.5. Recent Developments

14.2.5. National Veterinary Institute

14.2.5.1. Company Overview

14.2.5.2. Financial Overview

14.2.5.3. Product Portfolio

14.2.5.4. Business Strategies

14.2.5.5. Recent Developments

14.2.6. Limor de Colombia SAS

14.2.6.1. Company Overview

14.2.6.2. Financial Overview

14.2.6.3. Product Portfolio

14.2.6.4. Business Strategies

14.2.6.5. Recent Developments

14.2.7. Brilliant Bio Pharma

14.2.7.1. Company Overview

14.2.7.2. Financial Overview

14.2.7.3. Product Portfolio

14.2.7.4. Business Strategies

14.2.7.5. Recent Developments

14.2.8. VETAL Animal Health Products, Inc.

14.2.8.1. Company Overview

14.2.8.2. Financial Overview

14.2.8.3. Product Portfolio

14.2.8.4. Business Strategies

14.2.8.5. Recent Developments

14.2.9. Biogénesis Bagó

14.2.9.1. Company Overview

14.2.9.2. Financial Overview

14.2.9.3. Product Portfolio

14.2.9.4. Business Strategies

14.2.9.5. Recent Developments

14.2.10. Kenya Veterinary Vaccines Production Institute

14.2.10.1. Company Overview

14.2.10.2. Financial Overview

14.2.10.3. Product Portfolio

14.2.10.4. Business Strategies

14.2.10.5. Recent Developments

14.2.11. Boehringer Ingelheim International GmbH

14.2.11.1. Company Overview

14.2.11.2. Financial Overview

14.2.11.3. Product Portfolio

14.2.11.4. Business Strategies

14.2.11.5. Recent Developments

14.2.12. Zoetis, Inc.

14.2.12.1. Company Overview

14.2.12.2. Financial Overview

14.2.12.3. Product Portfolio

14.2.12.4. Business Strategies

14.2.12.5. Recent Developments

14.2.13. Ourofino Saúde Animal

14.2.13.1. Company Overview

14.2.13.2. Financial Overview

14.2.13.3. Product Portfolio

14.2.13.4. Business Strategies

14.2.13.5. Recent Developments

List of Tables

Table 01: Global Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 02: Global Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Oil-based Vaccines, 2017-2031

Table 03: Global Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Animal, 2017-2031

Table 04: Global Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Table 05: Global Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 06: Asia Pacific Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 07: Asia Pacific Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Oil-based Vaccines, 2017-2031

Table 08: Asia Pacific Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Animal, 2017-2031

Table 09: Asia Pacific Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Table 10: Asia Pacific Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 11: Latin America Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 12: Latin America Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Oil-based Vaccines, 2017-2031

Table 13: Latin America Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Animal, 2017-2031

Table 14: Latin America Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Table 15: Latin America Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 16: Middle East & Africa Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 17: Middle East & Africa Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Oil-based Vaccines, 2017-2031

Table 18: Middle East & Africa Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Animal, 2017-2031

Table 19: Middle East & Africa Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

Table 20: Middle East & Africa Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Country/Sub-region, 2017-2031

Table 21: Rest of the World Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Type, 2017-2031

Table 22: Rest of the World Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Oil-based Vaccines, 2017-2031

Table 23: Rest of the World Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Animal, 2017-2031

Table 24: Rest of the World Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, by Distribution Channel, 2017-2031

List of Figures

Figure 01: Global Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, 2017-2031

Figure 02: Foot and Mouth Disease Vaccine Market Value Share, by Type, 2022

Figure 03: Foot and Mouth Disease Vaccine Market Value Share, by Animal, 2022

Figure 04: Foot and Mouth Disease Vaccine Market Value Share, by Distribution Channel, 2022

Figure 05: Global Foot and Mouth Disease Vaccine Market Value Share Analysis, by Type, 2022 and 2031

Figure 06: Global Foot and Mouth Disease Vaccine Market Attractiveness Analysis, by Type, 2023-2031

Figure 07: Global Foot and Mouth Disease Vaccine Market Value (US$ Bn), by Aluminum Hydroxide and Saponin Vaccines, 2017‒2031

Figure 08: Global Foot and Mouth Disease Vaccine Market Value (US$ Bn), by Oil-based Vaccines, 2017‒2031

Figure 09: Global Foot and Mouth Disease Vaccine Market Value Share Analysis, by Animal, 2022 and 2031

Figure 10: Global Foot and Mouth Disease Vaccine Market Attractiveness Analysis, by Animal, 2023-2031

Figure 11: Global Foot and Mouth Disease Vaccine Market Revenue (US$ Bn), by Cattle, 2017-2031

Figure 12: Global Foot and Mouth Disease Vaccine Market Revenue (US$ Bn), by Sheep and Goat, 2017-2031

Figure 13: Global Foot and Mouth Disease Vaccine Market Revenue (US$ Bn), by Swine/Pig, 2017-2031

Figure 14: Global Foot and Mouth Disease Vaccine Market Revenue (US$ Bn), by Others, 2017-2031

Figure 15: Global Foot and Mouth Disease Vaccine Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 16: Global Foot and Mouth Disease Vaccine Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 17: Global Foot and Mouth Disease Vaccine Market Revenue (US$ Bn), by Veterinary Clinics, 2017-2031

Figure 18: Global Foot and Mouth Disease Vaccine Market Revenue (US$ Bn), by Government Institutions, 2017-2031

Figure 19: Global Foot and Mouth Disease Vaccine Market Revenue (US$ Bn), by Others, 2017-2031

Figure 20: Global Foot and Mouth Disease Vaccine Market Value Share Analysis, by Region, 2022 and 2031

Figure 21: Global Foot and Mouth Disease Vaccine Market Attractiveness Analysis, by Region, 2023-2031

Figure 22: Asia Pacific Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, 2017-2031

Figure 23: Asia Pacific Foot and Mouth Disease Vaccine Market Value Share Analysis, by Type, 2022 and 2031

Figure 24: Asia Pacific Foot and Mouth Disease Vaccine Market Attractiveness Analysis, by Type, 2023-2031

Figure 25: Asia Pacific Foot and Mouth Disease Vaccine Market Value Share Analysis, by Animal, 2022 and 2031

Figure 26: Asia Pacific Foot and Mouth Disease Vaccine Market Attractiveness Analysis, by Animal, 2023-2031

Figure 27: Asia Pacific Foot and Mouth Disease Vaccine Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 28: Asia Pacific Foot and Mouth Disease Vaccine Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 29: Asia Pacific Foot and Mouth Disease Vaccine Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 30: Asia Pacific Foot and Mouth Disease Vaccine Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 31: Latin America Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, 2017-2031

Figure 32: Latin America Foot and Mouth Disease Vaccine Market Value Share Analysis, by Type, 2022 and 2031

Figure 33: Latin America Foot and Mouth Disease Vaccine Market Attractiveness Analysis, by Type, 2023-2031

Figure 34: Latin America Foot and Mouth Disease Vaccine Market Value Share Analysis, by Animal, 2022 and 2031

Figure 35: Latin America Foot and Mouth Disease Vaccine Market Attractiveness Analysis, by Animal, 2023-2031

Figure 36: Latin America Foot and Mouth Disease Vaccine Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 37: Latin America Foot and Mouth Disease Vaccine Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 38: Latin America Foot and Mouth Disease Vaccine Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 39: Latin America Foot and Mouth Disease Vaccine Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 40: Middle East & Africa Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, 2017-2031

Figure 41: Middle East & Africa Foot and Mouth Disease Vaccine Market Value Share Analysis, by Type, 2022 and 2031

Figure 42: Middle East & Africa Foot and Mouth Disease Vaccine Market Attractiveness Analysis, by Type, 2023-2031

Figure 43: Middle East & Africa Foot and Mouth Disease Vaccine Market Value Share Analysis, by Animal, 2022 and 2031

Figure 44: Middle East & Africa Foot and Mouth Disease Vaccine Market Attractiveness Analysis, by Animal, 2023-2031

Figure 45: Middle East & Africa Foot and Mouth Disease Vaccine Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 46: Middle East & Africa Foot and Mouth Disease Vaccine Market Attractiveness Analysis, by Distribution Channel, 2023-2031

Figure 47: Middle East & Africa Foot and Mouth Disease Vaccine Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 48: Middle East & Africa Foot and Mouth Disease Vaccine Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 49: Rest of the World Foot and Mouth Disease Vaccine Market Value (US$ Bn) Forecast, 2017-2031

Figure 50: Rest of the World Foot and Mouth Disease Vaccine Market Value Share Analysis, by Type, 2022 and 2031

Figure 51: Rest of the World Foot and Mouth Disease Vaccine Market Attractiveness Analysis, by Type, 2023-2031

Figure 52: Rest of the World Foot and Mouth Disease Vaccine Market Value Share Analysis, by Animal, 2022 and 2031

Figure 53: Rest of the World Foot and Mouth Disease Vaccine Market Attractiveness Analysis, by Animal, 2023-2031

Figure 54: Rest of the World Foot and Mouth Disease Vaccine Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 55: Rest of the World Foot and Mouth Disease Vaccine Market Attractiveness Analysis, by Distribution Channel, 2023-2031