Reports

Reports

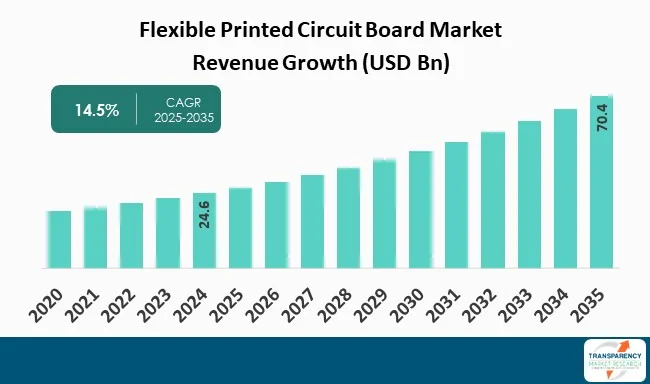

Flexible printed circuit board market is witnessing a double-digit CAGR due to growing needs of small electronics, wearable devices, electronics evolution, flexible/foldable displays, etc. With the growing need for flexible and lightweight electronic products, the trend of flexible printed circuit boards has increased tremendously in recent years. Flexible PCBs are used extensively across different industries such as medical, automotive, aerospace, and consumer electronics as they can twist and bend without any damage.

The driving force of the market comes from the growing demand for high-performance and miniaturized electronic devices in consumer electronics, automotive, and healthcare. FPCBs provide the benefits of flexibility, minimal space requirement, and removal of bulky wiring, which are best-suited for small and complicated devices. Individuals are becoming more inclined toward compact and miniaturized devices as they are portable, convenient, and include advanced functionality in tiny form factors.

Advancements in technology with flexible/foldable displays is the other force driving the market, with growth in foldable smartphones and wearable devices. As thinner, lighter, and more flexible electronics are increasingly being asked for by consumers, flex PCBs play a crucial role in allowing bending and folding of such next-generation devices without compromising on performance or durability.

The FPCB industry is expanding as there's an increasing demand within consumer electronics, automotive, and medical sector. The major trends are the implementation of rigid-flex designs, the use of advanced materials such as polyimide, and AI-based manufacturing. There is also increasing emphasis on green and biocompatible solutions.

A flexible printed circuit board (FPCB) is a form of PCB constructed with a flexible substrate, enabling it to bend, fold, or twist when in use. In contrast to rigid PCBs, FPCBs are constructed to bend to various shapes, providing an excellent fit for small and dynamic electronic uses. Also known as flex circuits, flex PCBs, or flexible printed circuits, they use the same electronic components as rigid boards but are constructed to provide more mechanical flexibility.

FPCBs are formed by several printed circuits and components placed on a flexible base material and may be tailored into different layer structures and configurations. According to configuration, two principal types exist: Rigid-Flex PCBs that integrate rigid and flexible layers into a single board, and HDI Flexible PCBs that are high-density interconnect boards with micro-vias and ultra-thin substrates for improved performance and space savings. As per the layers, FPCBs are also classified into double-sided, single-sided, and multilayer categories.

These boards can be used in both - static and dynamic purposes. For static use, the board is bent once at the time of installation, whereas dynamic usage entails repeat bending at the time of use. FPCBs are widely applied in products like printers, foldable smartphones, and robots, wherein space limitation and mobility necessitate flexible electronic solutions.

| Attribute | Detail |

|---|---|

| Flexible Printed Circuit Board Market Drivers |

|

The trend toward lighter, smaller, and more powerful devices is a key driver to the growth of flexible printed circuit board (FPCB) market. As of now the consumers demand their smartwatches, smartphones, fitness trackers, and the other wearable devices to be light and slim yet not compromise on battery life and performance.

Likewise, verticals such as automotive and medical are driving the need for miniature components that could be installed in non-conventional or cramped areas—such as within diagnostic equipment, medical implants, or within advanced vehicle control systems. FPCBs are suitable for this as they are flexible, lightweight, and capable to be bent or folded to accommodate cramped areas—something a rigid PCB cannot achieve.

They are also lighter and minimize the use of heavy wires and connectors, saving space within devices. This makes it possible for designers to obtain high-density layouts with signal reliability and integrity. For instance, in foldable smartphones, FPCBs are employed for interconnecting components on hinges, where power and data can seamlessly flow with repeated folding.

As the need for miniaturized electronics keeps growing, especially with the growth of IoT and mobile technology.

The demand for reduced-size and compact electronics is not just redefining product design norms but also cementing FPCBs as one of the central elements in the future of electronics production. Their capacity to enable high-performance circuitry in reduced, more adaptable forms does make them indispensable in the quest for streamlined, intelligent, and more integrated devices.

The fast expansion of consumer electronics as well as smart devices is a major driver to the growth of the flexible printed circuit board (FPCB) market. Devices such as tablets, smartphones, smartwatches, AR/VR headsets, wireless earbuds, and smart home systems demand lightweight, compact, and highly reliable circuit solutions. FPCBs do offer the ideal solution by facilitating tight lightweight designs, component integration, and the flexibility needed for unconventional form factors-especially in wearable or foldable technologies.

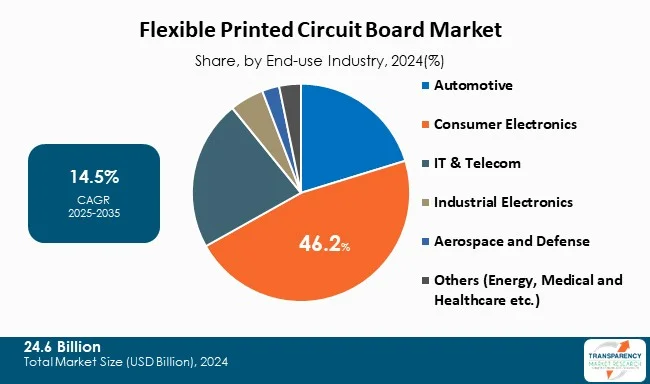

In all the end user industries, consumer electronics industry is holding enormous amount of revenue in 2024. Consumer electronics industry-particularly devices such as smartphones, wearables, tablets, and smart accessories-is the largest consumer of flexible printed circuit boards (FPCBs). The reason is that gadget manufacturers are always looking for ways to reduce the size of devices, make them lighter, and more powerful. Flexible PCBs are ideal for such requirements as they can bend and accommodate compact spaces but also maintain complex electronic functions.

The rising demand for space-efficient, smart electronics and the advantages of flexible PCBs are going hand in hand-making FPCBs an integral technology behind the future of consumer electronics.

| Attribute | Detail |

|---|---|

| Leading Region |

|

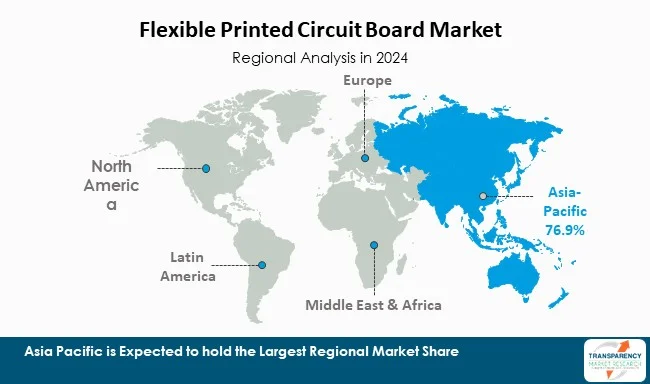

As per the latest flexible printed circuit board market analysis, Asia‑Pacific dominated in 2024 due to several key factors like increasing demand for warble and compact devices in the region. Its dominance comes from having a strong electronics manufacturing setup and the major production centers in China, South Korea, Japan, and Taiwan. This region benefits from large-scale production of wearables, smartphones, and other compact electronics.

North America is growing at the fastest rate in the flexible PCB market as more companies there are using FPCBs in cars, airplanes, medical equipment, and telecom systems. Europe and Latin America are also seeing growth, but at a slower rate. This is mostly due to rising demand for flexible PCBs in factories and the automotive industry.

Several companies engaged in the flexible printed circuit board industry are driving advancements in 5G, IoT, medical devices, and automotive applications.

Career Technology (Mfg.) Co., Ltd., Daeduck GDS, Flexcom Inc, Fujikura Ltd., Multi-Fineline Electronix, Inc. (MFLEX), Sumitomo Electric Industries, Ltd. (SEI), Interflex Co. Ltd., NewFlex Technology Co., Ltd., Nitto Denko Corporation, NOK Corporation, JLCPCB.COM, and OKI Circuit Technology Co. Ltd. are some of the leading players operating in the global Flexible Printed Circuit Board Market.

Each of these players has been profiled in the flexible printed circuit board market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 24.6 Bn |

| Forecast Value in 2035 | US$ 70.4 Bn |

| CAGR | 14.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, etc. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The flexible printed circuit board market was valued at US$ 24.6 Bn in 2024

The flexible printed circuit board market is projected to reach US$ 70.4 Bn by the end of 2035

Rising demand for miniaturization & compact electronics and expansion of consumer electronics & smart devices

The CAGR is anticipated to be 14.5% from 2025 to 2035

Asia Pacific is expected to account for the largest share from 2025 to 2035

Career Technology (Mfg.) Co., Ltd., Daeduck GDS, Flexcom Inc, Fujikura Ltd., Multi-Fineline Electronix, Inc. (MFLEX), Sumitomo Electric Industries, Ltd. (SEI), Interflex Co. Ltd., NewFlex Technology Co., Ltd., Nitto Denko Corporation, NOK Corporation, JLCPCB.COM, and OKI Circuit Technology Co. Ltd.

Table 01: Global Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 02: Global Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 03: Global Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 04: North America Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 05: North America Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 06: North America Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 07: U.S. Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 08: U.S. Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 09: Canada Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 10: Canada Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 11: Europe Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 12: Europe Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 13: Europe Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 14: Germany Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 15: Germany Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 16: U.K. Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 17: U.K. Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 18: France Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 19: France Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 20: Italy Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 21: Italy Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 22: Spain Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 23: Spain Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 24: Switzerland Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 25: Switzerland Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 26: The Netherlands Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 27: The Netherlands Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 28: Rest of Europe Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 29: Rest of Europe Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 30: Asia Pacific Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 31: Asia Pacific Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 32: Asia Pacific Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 33: China Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 34: China Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 35: Japan Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 36: Japan Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 37: India Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 38: India Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 39: South Korea Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 40: South Korea Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 41: Australia and New Zealand Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 42: Australia and New Zealand Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 43: Rest of Asia Pacific Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 44: Rest of Asia Pacific Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 45: Latin America Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 46: Latin America Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 47: Latin America Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 48: Brazil Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 49: Brazil Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 50: Mexico Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 51: Mexico Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 52: Argentina Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 53: Argentina Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 54: Rest of Latin America Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 55: Rest of Latin America Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 56: Middle East and Africa Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 57: Middle East and Africa Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 58: Middle East and Africa Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 59: GCC Countries Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 60: GCC Countries Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 61: South Africa Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 62: South Africa Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Table 63: Rest of Middle East and Africa Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 64: Rest of Middle East and Africa Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, by End-use Industry, 2020 to 2035

Figure 01: Global Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 02: Global Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 03: Global Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 04: Global Flexible Printed Circuit Board Market Revenue (US$ Mn), by Multi-layer FPCBs, 2020 to 2035

Figure 05: Global Flexible Printed Circuit Board Market Revenue (US$ Mn), by Rigid-flex FPCBs, 2020 to 2035

Figure 06: Global Flexible Printed Circuit Board Market Revenue (US$ Mn), by Single-sided FPCBs, 2020 to 2035

Figure 07: Global Flexible Printed Circuit Board Market Revenue (US$ Mn), by Double-sided FPCBs, 2020 to 2035

Figure 08: Global Flexible Printed Circuit Board Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 09: Global Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 10: Global Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 11: Global Flexible Printed Circuit Board Market Revenue (US$ Mn), by Automotive, 2020 to 2035

Figure 12: Global Flexible Printed Circuit Board Market Revenue (US$ Mn), by Consumer Electronics, 2020 to 2035

Figure 13: Global Flexible Printed Circuit Board Market Revenue (US$ Mn), by IT & Telecom, 2020 to 2035

Figure 14: Global Flexible Printed Circuit Board Market Revenue (US$ Mn), by Industrial Electronics, 2020 to 2035

Figure 15: Global Flexible Printed Circuit Board Market Revenue (US$ Mn), by Aerospace and Defense, 2020 to 2035

Figure 16: Global Flexible Printed Circuit Board Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 17: Global Flexible Printed Circuit Board Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 18: Global Flexible Printed Circuit Board Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 19: North America Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 20: North America Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 21: North America Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 22: North America Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 23: North America Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 24: North America Flexible Printed Circuit Board Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 25: North America Flexible Printed Circuit Board Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 26: U.S. Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 27: U.S. Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 28: U.S. Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 29: U.S. Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 30: U.S. Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 31: Canada Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 32: Canada Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 33: Canada Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 34: Canada Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 35: Canada Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 36: Europe Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 37: Europe Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 38: Europe Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 39: Europe Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 40: Europe Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 41: Europe Flexible Printed Circuit Board Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 42: Europe Flexible Printed Circuit Board Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 43: Germany Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 44: Germany Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 45: Germany Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 46: Germany Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 47: Germany Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 48: U.K. Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 49: U.K. Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 50: U.K. Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 51: U.K. Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 52: U.K. Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 53: France Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 54: France Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 55: France Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 56: France Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 57: France Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 58: Italy Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 59: Italy Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 60: Italy Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 61: Italy Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 62: Italy Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 63: Spain Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 64: Spain Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 65: Spain Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 66: Spain Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 67: Spain Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 68: Switzerland Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 69: Switzerland Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 70: Switzerland Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 71: Switzerland Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 72: Switzerland Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 73: The Netherlands Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 74: The Netherlands Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 75: The Netherlands Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 76: The Netherlands Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 77: The Netherlands Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 78: Rest of Europe Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 79: Rest of Europe Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 80: Rest of Europe Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 81: Rest of Europe Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 82: Rest of Europe Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 83: Asia Pacific Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 84: Asia Pacific Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 85: Asia Pacific Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 86: Asia Pacific Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 87: Asia Pacific Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 88: Asia Pacific Flexible Printed Circuit Board Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 89: Asia Pacific Flexible Printed Circuit Board Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 90: China Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 91: China Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 92: China Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 93: China Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 94: China Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 95: Japan Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 96: Japan Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 97: Japan Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 98: Japan Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 99: Japan Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 100: India Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 101: India Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 102: India Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 103: India Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 104: India Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 105: South Korea Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 106: South Korea Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 107: South Korea Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 108: South Korea Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 109: South Korea Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 110: Australia and New Zealand Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 111: Australia and New Zealand Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 112: Australia and New Zealand Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 113: Australia and New Zealand Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 114: Australia and New Zealand Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 115: Rest of Asia Pacific Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 116: Rest of Asia Pacific Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 117: Rest of Asia Pacific Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 118: Rest of Asia Pacific Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 119: Rest of Asia Pacific Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 120: Latin America Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 121: Latin America Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 122: Latin America Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 123: Latin America Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 124: Latin America Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 125: Latin America Flexible Printed Circuit Board Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 126: Latin America Flexible Printed Circuit Board Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 127: Brazil Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 128: Brazil Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 129: Brazil Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 130: Brazil Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 131: Brazil Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 132: Mexico Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 133: Mexico Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 134: Mexico Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 135: Mexico Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 136: Mexico Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 137: Argentina Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 138: Argentina Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 139: Argentina Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 140: Argentina Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 141: Argentina Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 142: Rest of Latin America Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 143: Rest of Latin America Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 144: Rest of Latin America Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 145: Rest of Latin America Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 146: Rest of Latin America Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 147: Middle East and Africa Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 148: Middle East and Africa Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 149: Middle East and Africa Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 150: Middle East and Africa Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 151: Middle East and Africa Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 152: Middle East and Africa Flexible Printed Circuit Board Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 153: Middle East and Africa Flexible Printed Circuit Board Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 154: GCC Countries Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 155: GCC Countries Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 156: GCC Countries Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 157: GCC Countries Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 158: GCC Countries Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 159: South Africa Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 160: South Africa Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 161: South Africa Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 162: South Africa Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 163: South Africa Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 164: Rest of Middle East and Africa Flexible Printed Circuit Board Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 165: Rest of Middle East and Africa Flexible Printed Circuit Board Market Value Share Analysis, by Type, 2024 and 2035

Figure 166: Rest of Middle East and Africa Flexible Printed Circuit Board Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 167: Rest of Middle East and Africa Flexible Printed Circuit Board Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 168: Rest of Middle East and Africa Flexible Printed Circuit Board Market Attractiveness Analysis, by End-use Industry, 2025 to 2035