Reports

Reports

The femoral heads industry is witnessing a substantial growth, driven by increasing incidences of hip-related disorders and the aging population. With increase in aging population, demand for orthopedic implants like femoral heads is also on the rise. Enhancements in the design of materials enhance the performance and shelf life of the implant, making it attractive to surgeons and patients alike.

Rising frequency of sports injury and increased interest in hip health are also propelling the market.

However, stringent regulatory requirements and potential complications from the implant procedures are bound to restrain the market.

Femoral heads are used in hip joint implants and total hip arthroplasty (THA) surgical interventions for the management of rheumatoid arthritis, osteoarthritis, and fracture. The implants replace the natural femoral head, thereby enabling movement and pain relief in patients with hip disorders. Femoral heads are usually made of titanium, cobalt-chromium alloys, or polyethylene and are anatomically designed for corresponding with the natural shape of the hip joint to ensure stability and compatibility.

Femoral head market is growing due to increasing incidences of hip disorders, rising aging population, and improved surgical techniques. Advancements in technology such as surface coating and modular design make the femoral heads more efficient and useful.

| Attribute | Detail |

|---|---|

| Femoral Heads Market Drivers |

|

Higher incidences of hip diseases are a primary determinant of market growth for femoral heads. Rheumatoid arthritis, osteoarthritis, and hip fractures have risen more rapidly, especially among the elderly. With increased life expectancy, joint deterioration happens, which is resulting in greater need for surgical interventions such as total hip arthroplasty (THA). research states that the incidences of hip osteoarthritis is likely to increase with the aging process of the population, which itself is expected to hold a major percentage of the world's population in the upcoming period.

Lifestyle factors such as obesity and physical inactivity are also the etiological factors for hip disorders and hence call for accurate treatment methods. These factors lead healthcare professionals to utilize femoral heads as a first choice for the restoration of mobility and pain relief.

With enhanced surgical techniques and better prognosis, there is a likelihood of higher numbers of patients undergoing joint replacement surgeries. Increase in demand for femoral heads is likely to drive the market growth, thereby urging the manufacturing companies to innovate and deliver better quality and performance in these critical orthopedic implants. Thus, the market for femoral heads can be expected to thrive in light of this increasing rate of hip disorders.

The femoral heads market is primarily fueled by growing rates of sports injuries, especially among sportsmen and active users who engage in conducting sports and exercises. As more numbers of individuals engage in conducting sports and physical exercise globally, the threat of injury also rises, such as hip injury that may require correction through surgical processes.

Besides, sports such as soccer, basketball, and football are most prominently associated with high risk of hip injury. Increased popularity for fitness through a healthy lifestyle in the same way creates demand for effective treatment of hip injury. Improved surgical techniques and rehabilitation programs have progressively allowed athletes to return to sport, creating demand for femoral heads.

This is backed by technology advancements in the implants that increase surgical expertise and patient satisfaction. As more number of healthcare professionals are now aware of the significance of early reporting of sports injuries, the femoral heads industry can enjoy long-term growth specifically targeting professional and amateur players who require successful recovery interventions.

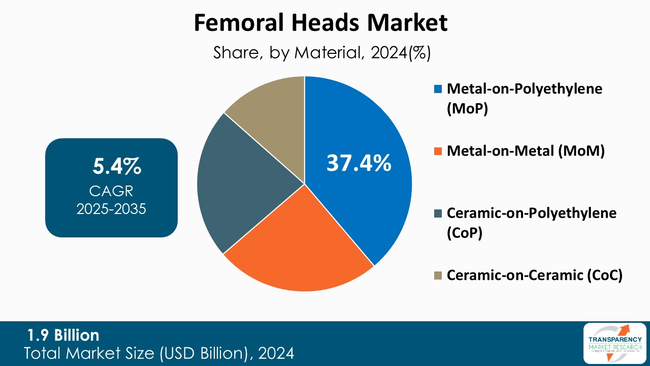

Metal-on-Polyethylene (MoP) material is dominating the femoral heads market as it has a few major benefits that improve its performance and durability in hip replacement arthroplasty. First, the interaction between metal and polyethylene creates a congruent pairing of low friction and durability, resulting in lower wear rates. That's important as joint component wear debris can cause osteolysis and failure of the implant.

Moreover, modern advances in polyethylene including cross-linking technologies have notably enhanced the material's wear resistance properties, further entrenching MoP in the market. The cost-effectiveness of MoP implants in relation to the other materials like ceramic further places it at the top, particularly under healthcare systems where budgetary concerns are of significant importance while still maintaining patient outcomes.

In addition, the fact that MoP is accessible to be used in many surgical methods and is compatible with many patient anatomies contributes to its popularity. While the need for total hip arthroplasties continues to increase worldwide, the reliability, usefulness, and affordability of MoP materials guarantee their number one place in the femoral heads market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America is dominating the femoral heads industry due to numerous deciding factors such as superior healthcare infrastructure, high incidence of orthopedic ailments, and robust research and development efforts. The region has good medical facilities and access to advanced technologies, which allow superior surgical outcome and patient treatment. A rising geriatric population further adds to the incidence of high hip disease rates, thus translating into higher demand for total hip arthroplasties.

Moreover, North America has an established orthopedic implants market, thanks to huge investments from leading manufacturers. The presence of the major players in the industry and ongoing innovations in material and techniques enhance the market growth prospects. The regulatory environment in the region also facilitates easy clearance of new products so that patients can access new technologies. Collectively, these position North America at the vanguard of the femoral heads market as physicians and patients alike are concerned with quality and functionality when it comes to hip replacement solutions.

Key players in the global femoral heads market are investing in innovation, technological advancements, and forming alliances. Their objective is to improve the precision of testing, diversify their products, and gain a stronger market presence in order to be ahead of the curve in the evolving healthcare market.

Exactech, Inc., Mathys, Double Medical Technology Inc., Just Medical Devices (Tianjin) Co., Ltd., United Orthopedics Limited, Stryker Corporation, Corin Group PLC, Meril Life Sciences Pvt. Ltd., Medacta International SA, Altimed JSC, Zimmer Biomet Holdings, Inc., MicroPort Scientific Corporation are some of the leading players.

Each of these players has been profiled in the femoral heads market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

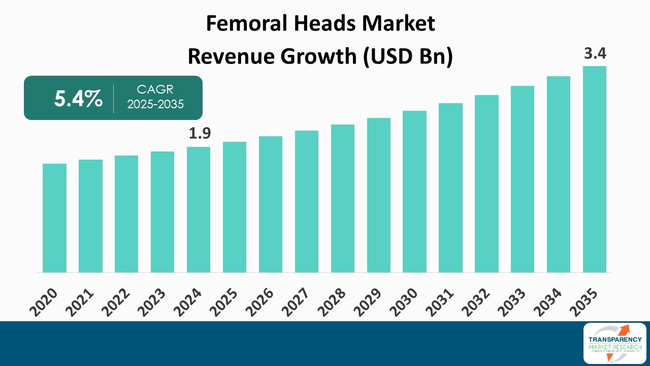

| Size in 2024 | US$ 1.9 Bn |

| Forecast Value in 2035 | US$ 3.4 Bn |

| CAGR | 5.4% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Femoral Heads Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

Type

Material

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 1.9 Bn in 2024

It is projected to cross US$ 3.4 Bn by the end of 2035

Increasing incidence of hip disorders and rising sports-related injuries

It is anticipated to grow at a CAGR of 5.4% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Exactech, Inc., Mathys, Double Medical Technology Inc., Just Medical Devices (Tianjin) Co., Ltd., United Orthopedics Limited, Stryker Corporation, Corin Group PLC, Meril Life Sciences Pvt. Ltd., Medacta International SA, Altimed JSC, Zimmer Biomet Holdings, Inc., MicroPort Scientific Corporation, and Others

Table 01: Global Femoral Heads Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 02: Global Femoral Heads Market Value (US$ Bn) Forecast, By Material, 2020 to 2035

Table 03: Global Femoral Heads Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 04: Global Femoral Heads Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 05: Global Femoral Heads Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America Femoral Heads Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 07: North America Femoral Heads Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 08: North America Femoral Heads Market Value (US$ Bn) Forecast, By Material, 2020 to 2035

Table 09: North America Femoral Heads Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 10: North America Femoral Heads Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 11: Europe Femoral Heads Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 12: Europe Femoral Heads Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 13: Europe Femoral Heads Market Value (US$ Bn) Forecast, By Material, 2020 to 2035

Table 14: Europe Femoral Heads Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 15: Europe Femoral Heads Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 16: Asia Pacific Femoral Heads Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 17: Asia Pacific Femoral Heads Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 18: Asia Pacific Femoral Heads Market Value (US$ Bn) Forecast, By Material, 2020 to 2035

Table 19: Asia Pacific Femoral Heads Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 20: Asia Pacific Femoral Heads Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 21: Latin America Femoral Heads Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 22: Latin America Femoral Heads Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 23: Latin America Femoral Heads Market Value (US$ Bn) Forecast, By Material, 2020 to 2035

Table 24: Latin America Femoral Heads Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 25: Latin America Femoral Heads Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 26: Middle East & Africa Femoral Heads Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 27: Middle East & Africa Femoral Heads Market Value (US$ Bn) Forecast, By Type, 2020 to 2035

Table 28: Middle East & Africa Femoral Heads Market Value (US$ Bn) Forecast, By Material, 2020 to 2035

Table 29: Middle East & Africa Femoral Heads Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 30: Middle East & Africa Femoral Heads Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Femoral Heads Market Value Share Analysis, By Type, 2024 and 2035

Figure 02: Global Femoral Heads Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 03: Global Femoral Heads Market Revenue (US$ Bn), by Biarticular Femoral Head, 2020 to 2035

Figure 04: Global Femoral Heads Market Revenue (US$ Bn), by Standard Femoral Head, 2020 to 2035

Figure 05: Global Femoral Heads Market Value Share Analysis, By Material, 2024 and 2035

Figure 06: Global Femoral Heads Market Attractiveness Analysis, By Material, 2025 to 2035

Figure 07: Global Femoral Heads Market Revenue (US$ Bn), by Metal-on-Polyethylene (MoP), 2020 to 2035

Figure 08: Global Femoral Heads Market Revenue (US$ Bn), by Metal-on-Metal (MoM), 2020 to 2035

Figure 09: Global Femoral Heads Market Revenue (US$ Bn), by Ceramic-on-Polyethylene (CoP), 2020 to 2035

Figure 10: Global Femoral Heads Market Revenue (US$ Bn), by Ceramic-on-Ceramic (CoC), 2020 to 2035

Figure 11: Global Femoral Heads Market Value Share Analysis, By Application, 2024 and 2035

Figure 12: Global Femoral Heads Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 13: Global Femoral Heads Market Revenue (US$ Bn), by Femoral Head Necrosis, 2020 to 2035

Figure 14: Global Femoral Heads Market Revenue (US$ Bn), by Hip Dysplasia, 2020 to 2035

Figure 15: Global Femoral Heads Market Revenue (US$ Bn), by Femoral Neck Fracture, 2020 to 2035

Figure 16: Global Femoral Heads Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 17: Global Femoral Heads Market Value Share Analysis, By End-user, 2024 and 2035

Figure 18: Global Femoral Heads Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 19: Global Femoral Heads Market Revenue (US$ Bn), by Hospitals, 2020 to 2035

Figure 20: Global Femoral Heads Market Revenue (US$ Bn), by Ambulatory Surgical Centers, 2020 to 2035

Figure 21: Global Femoral Heads Market Revenue (US$ Bn), by Orthopedic Clinics, 2020 to 2035

Figure 22: Global Femoral Heads Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 23: Global Femoral Heads Market Value Share Analysis, By Region, 2024 and 2035

Figure 24: Global Femoral Heads Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 25: North America Femoral Heads Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 26: North America Femoral Heads Market Value Share Analysis, by Country, 2024 and 2035

Figure 27: North America Femoral Heads Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 28: North America Femoral Heads Market Value Share Analysis, By Type, 2024 and 2035

Figure 29: North America Femoral Heads Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 30: North America Femoral Heads Market Value Share Analysis, By Material, 2024 and 2035

Figure 31: North America Femoral Heads Market Attractiveness Analysis, By Material, 2025 to 2035

Figure 32: North America Femoral Heads Market Value Share Analysis, By Application, 2024 and 2035

Figure 33: North America Femoral Heads Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 34: North America Femoral Heads Market Value Share Analysis, By End-user, 2024 and 2035

Figure 35: North America Femoral Heads Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 36: Europe Femoral Heads Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 37: Europe Femoral Heads Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 38: Europe Femoral Heads Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 39: Europe Femoral Heads Market Value Share Analysis, By Type, 2024 and 2035

Figure 40: Europe Femoral Heads Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 41: Europe Femoral Heads Market Value Share Analysis, By Material, 2024 and 2035

Figure 42: Europe Femoral Heads Market Attractiveness Analysis, By Material, 2025 to 2035

Figure 43: Europe Femoral Heads Market Value Share Analysis, By Application, 2024 and 2035

Figure 44: Europe Femoral Heads Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 45: Europe Femoral Heads Market Value Share Analysis, By End-user, 2024 and 2035

Figure 46: Europe Femoral Heads Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 47: Asia Pacific Femoral Heads Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 48: Asia Pacific Femoral Heads Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 49: Asia Pacific Femoral Heads Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 50: Asia Pacific Femoral Heads Market Value Share Analysis, By Type, 2024 and 2035

Figure 51: Asia Pacific Femoral Heads Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 52: Asia Pacific Femoral Heads Market Value Share Analysis, By Material, 2024 and 2035

Figure 53: Asia Pacific Femoral Heads Market Attractiveness Analysis, By Material, 2025 to 2035

Figure 54: Asia Pacific Femoral Heads Market Value Share Analysis, By Application, 2024 and 2035

Figure 55: Asia Pacific Femoral Heads Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 56: Asia Pacific Femoral Heads Market Value Share Analysis, By End-user, 2024 and 2035

Figure 57: Asia Pacific Femoral Heads Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 58: Latin America Femoral Heads Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 59: Latin America Femoral Heads Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 60: Latin America Femoral Heads Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 61: Latin America Femoral Heads Market Value Share Analysis, By Type, 2024 and 2035

Figure 62: Latin America Femoral Heads Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 63: Latin America Femoral Heads Market Value Share Analysis, By Material, 2024 and 2035

Figure 64: Latin America Femoral Heads Market Attractiveness Analysis, By Material, 2025 to 2035

Figure 65: Latin America Femoral Heads Market Value Share Analysis, By Application, 2024 and 2035

Figure 66: Latin America Femoral Heads Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 67: Latin America Femoral Heads Market Value Share Analysis, By End-user, 2024 and 2035

Figure 68: Latin America Femoral Heads Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 69: Middle East & Africa Femoral Heads Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 70: Middle East & Africa Femoral Heads Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 71: Middle East & Africa Femoral Heads Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 72: Middle East & Africa Femoral Heads Market Value Share Analysis, By Type, 2024 and 2035

Figure 73: Middle East & Africa Femoral Heads Market Attractiveness Analysis, By Type, 2025 to 2035

Figure 74: Middle East & Africa Femoral Heads Market Value Share Analysis, By Material, 2024 and 2035

Figure 75: Middle East & Africa Femoral Heads Market Attractiveness Analysis, By Material, 2025 to 2035

Figure 76: Middle East & Africa Femoral Heads Market Value Share Analysis, By Application, 2024 and 2035

Figure 77: Middle East & Africa Femoral Heads Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 78: Middle East & Africa Femoral Heads Market Value Share Analysis, By End-user, 2024 and 2035

Figure 79: Middle East & Africa Femoral Heads Market Attractiveness Analysis, By End-user, 2025 to 2035