Reports

Reports

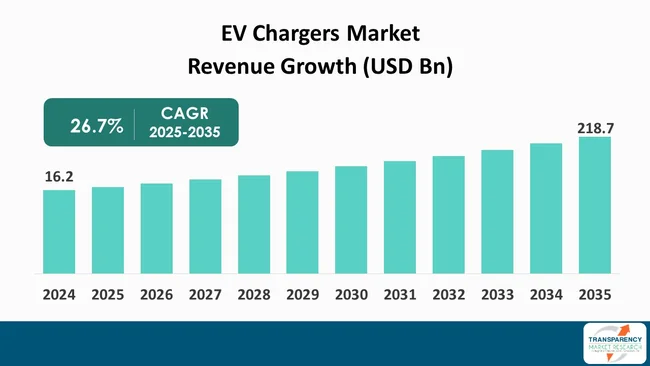

The global EV chargers market size was valued at US$ 16.2 Bn in 2024 and is projected to reach US$ 218.7 Bn by 2035, expanding at a CAGR of 26.7% from 2025 to 2035. The market growth is driven by rising adoption of electric vehicles and growth of renewable energy sources.

The electric vehicle (EV) chargers industry is undergoing significant expansion, which is primarily influenced by the ongoing trend of electric vehicle adoption. The growth of the market is attributed to a plethora of factors such as the incentives offered by the government, concern for the environment, and improvements in the battery technology. The demand for a charging infrastructure that is easily accessible and efficient becomes essential as the number of consumers who choose to buy an electric vehicle increases.

The availability of charging infrastructure through public charging stations, home chargers, and workplace installations constitute the necessary elements of the ecosystem where the users are getting benefits from innovations like ultra-fast chargers.

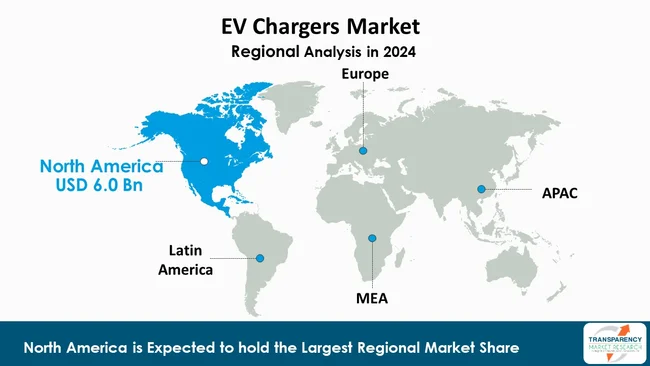

In a geographical context, the regions of North America and Europe are at the forefront of the developments in the EV infrastructure as a result of their tightly controlled emissions regulations and large-scale investments in green technologies. Nevertheless, the developing markets in Asia Pacific are predicted to witness an exponential increase in demand as a result of the process of urbanization and the heightened consciousness of the necessity for sustainable transportation alternatives.

The issues of range anxiety and the need for the standardization of charging protocols still linger. However, the general forecast for the market for EV chargers is still upbeat, as the projections point to a significant expansion accompanying the technology evolvement, which, in turn, will facilitate the transition to a cleaner future in the transport sector.

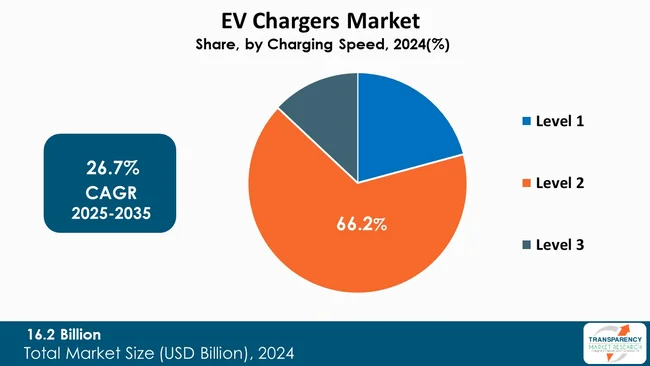

The landscape of the electric vehicle (EV) charger market is changing fast as the movement pertaining to sustainable transportation is getting stronger. EV chargers are the essential parts of the electric vehicle ecosystem. Thus they should be able to satisfy charging demands of a rapidly growing number of electric cars on the road in a pretty efficient way. The market consists of several types of chargers, among them Level 1, Level 2, and DC fast chargers, each are created for different ranges of uses and charging speeds.

Level 1 chargers, which are most likely to be found in homes, provide charging at a very slow rate through normal household outlets. On the other hand, Level 2 chargers deliver charge capable of charging at homes as well as public stations. Direct current fast chargers are answering the call for the quickest charging need, which is why they enable electric vehicles to recharge up to a considerable portion of their batteries within a very short time thus making long trips possible.

Growing the number of publicly accessible charging stations is very important in letting people not be worried about fuel range problems. Besides, there are also new developments such as wireless and solar-powered charging technologies. Government programs and incentives serve as a push for the installation of chargers in the urban areas where the demand for them is the highest. While battery technologies keep on being enhanced, the EV charger market has a promising future that will see it not only becoming able to support the electric vehicles, but also be in line with the global environmental goals of carbon footprint reduction.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The increasing use of electric vehicles (EVs) is a major factor in the EV chargers market, which has a visible effect on the demand for reliable charging solutions. As consumers realize the negative impact of standard fossil fuel-powered vehicles on the environment, they choose EVs as a clean alternative.

This change is supported by the technological advances in EVs, which include the improvement of battery life and driving range, thus making electric cars attractive to a larger group of people.

Electric vehicles are the focal point of the manufacturers, who are planning to change their fleet to electric vehicles only within the next ten years. Besides, the government policies that are advantageous to the consumers, like tax credits and subsidies, are the reasons why the consumers are purchasing EVs.

The surge in need for EV chargers not only makes electric vehicle (EV) ownership more convenient and accessible but also, through the charging networks, allows for a higher inflow of investment. The urbanization trend will still go on, and more number of charging stations will be set up in the public and residential areas; hence, the EV chargers market will experience a significant increase in demand, which will be beneficial for both - the automotive and energy sectors to move forward to a sustainable future.

The expansion of renewable energy projects is one of the main reasons the EV chargers market has been growing. It is due to that fact that a cleaner way of transportation goes hand in hand with the use of renewable energy for charging electric vehicles. Thus, renewable energy remains the main supply to electric vehicles, since it is the cleanest way to power an electric car.

On top of it all, renewable energy is even more important as it lays the foundation for a sustainable EV future: solar, wind, or hydro-based power is not only zero-emission but also more readily available as compared to the other sources of energy be it fossil-based or nuclear.

The use of renewable sources for powering the road will be more resource-friendly than ever before, thanks to new charging networks becoming more integrated with renewables. For example, there are quite a few solar charging stations already available, which harness the sun to deliver to users a clean and independent energy source. It thus requires little or no energy from the grid. The two make a perfect match and the fear of significantly increasing electricity consumption may be considered partially addressed.

Besides, they can pump extra power to the grid during high peaks and therefore might potentially lower the electricity prices apart from easing the grid's security of supply situation. Consequently, the combination of renewables and EVs does not only underpin the whole infrastructure, which will be required for the future of electric mobility, it also creates an energy background for the EV chargers market that is far more sustainable and less vulnerable than before.

Compared to Level 1 chargers, Level 2 chargers provide a quicker charging solution and generally they are capable of offering up to 25 miles of range per hour of charging. Such a speed is vital for both - residential and public charging stations, as it helps EV owners to recharge their vehicles during normal daily activities such as at home (even overnight) or while shopping.

Besides, the comfort of use with Level 2 chargers is what attracts consumers who need their vehicles quickly charged and ready for use. The demand for efficient charging solutions is rising alongside the electric vehicle market expansion and it is becoming a very serious issue especially in urban areas where the charging time affects the whole user experience. The installation of Level 2 chargers at workplaces and in public charging stations thus helps in the proliferation of electric vehicles as it gives the users the feeling of security and therefore less anxiety over the range.

Furthermore, the segment's attractiveness is further enhanced by the technological advancements in Level 2 charging such as smart charging capabilities and the ability to integrate with renewable energy sources. The role of the segment in driving the EV chargers market growth will be significant when more businesses and municipalities decide to invest in Level 2 charging infrastructure. More number of people will be able to use sustainable transportation as it becomes easier.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America is at the forefront of the EV chargers market, holding the largest revenue share of 37.2%, this is attributed to supportive government policies, an expanding electric vehicle (EV) market, and a large-scale investment in charging infrastructure. Canada and the U.S. have rolled out several incentive programs such as tax rebates and subsidies for electric vehicle purchases and charger installations, which, in turn, stimulate consumer interest and the adoption of electric vehicles.

In addition, automakers in North America are turning over a new leaf and moving to electrification by launching a variety of electric models to the market. The flood of EV choices, along with the growing awareness of the harm caused by the use of traditional vehicles, in a virtuous cycle, leads to the acceleration of the demand for EV chargers.

Besides, a large part of the investment needed for the next few years will be made in the public and private sectors to ensure that the infrastructures are available in the city and on the highways and the countryside and that charging stations will be easy to reach. Meanwhile, companies that are into charging technology are innovating fast to provide the best solutions that meet the requirements of different users, whether they are a homeowner or a business. Hence, North America is a breeding ground for the growth of EV chargers and is thus leading the way in the global transition to technological sustainable energy solutions.

ABB Ltd, Siemens AG, Schneider Electric, ChargePoint Holdings, Inc., EVBox Group, Wallbox N.V., Tesla, Inc., Blink Charging Co., BYD Company Ltd., Delta Electronics, Inc., Tritium DCFC Ltd., Alfen N.V., Efacec Electric Mobility, Webasto Group, Leviton Manufacturing Co. are the key players governing the global EV Chargers Market.

Each of these players has been profiled in the EV chargers market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 16.2 Bn |

| Forecast Value in 2035 | More than US$ 218.7 Bn |

| CAGR | 26.7% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Type of Charger

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 16.2 Bn in 2024

It is projected to cross US$ 218.7 Bn by the end of 2035

Rising adoption of electric vehicles and growth of renewable energy sources

It is anticipated to grow at a CAGR of 26.7% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

ABB Ltd, Siemens AG, Schneider Electric, ChargePoint Holdings, Inc., EVBox Group, Wallbox N.V., Tesla, Inc., Blink Charging Co., BYD Company Ltd., Delta Electronics, Inc., Tritium DCFC Ltd., Alfen N.V., Efacec Electric Mobility, Webasto Group, Leviton Manufacturing Co., and others

Table 01: Global EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 02: Global EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 03: Global EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 04: Global EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 05: Global EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 06: Global EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 07: Global EV Chargers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 08: North America EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 09: North America EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 10: North America EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 11: North America EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 12: North America EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 13: North America EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 14: North America EV Chargers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 15: U.S. EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 16: U.S. EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 17: U.S. EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 18: U.S. EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 19: U.S. EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 20: U.S. EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 21: Canada EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 22: Canada EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 23: Canada EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 24: Canada EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 25: Canada EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 26: Canada EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 27: Europe EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 28: Europe EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 29: Europe EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 30: Europe EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 31: Europe EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 32: Europe EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 33: Europe EV Chargers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 34: Germany EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 35: Germany EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 36: Germany EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 37: Germany EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 38: Germany EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 39: Germany EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 40: U.K. EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 41: U.K. EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 42: U.K. EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 43: U.K. EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 44: U.K. EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 45: U.K. EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 46: France EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 47: France EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 48: France EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 49: France EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 50: France EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 51: France EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 52: Italy EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 53: Italy EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 54: Italy EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 55: Italy EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 56: Italy EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 57: Italy EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 58: Spain EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 59: Spain EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 60: Spain EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 61: Spain EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 62: Spain EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 63: Spain EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 64: The Netherlands EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 65: The Netherlands EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 66: The Netherlands EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 67: The Netherlands EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 68: The Netherlands EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 69: The Netherlands EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 70: Rest of Europe EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 71: Rest of Europe EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 72: Rest of Europe EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 73: Rest of Europe EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 74: Rest of Europe EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 75: Rest of Europe EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 76: Asia Pacific EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 77: Asia Pacific EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 78: Asia Pacific EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 79: Asia Pacific EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 80: Asia Pacific EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 81: Asia Pacific EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 82: Asia Pacific EV Chargers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 83: China EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 84: China EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 85: China EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 86: China EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 87: China EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 88: China EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 89: Japan EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 90: Japan EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 91: Japan EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 92: Japan EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 93: Japan EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 94: Japan EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 95: India EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 96: India EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 97: India EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 98: India EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 99: India EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 100: India EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 101: South Korea EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 102: South Korea EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 103: South Korea EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 104: South Korea EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 105: South Korea EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 106: South Korea EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 107: ASEAN EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 108: ASEAN EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 109: ASEAN EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 110: ASEAN EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 111: ASEAN EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 112: ASEAN EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 113: ASEAN and New Zealand EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 114: Australia and New Zealand EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 115: Australia and New Zealand EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 116: Australia and New Zealand EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 117: Australia and New Zealand EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 118: Australia and New Zealand EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 119: Rest of Asia Pacific EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 120: Rest of Asia Pacific EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 121: Rest of Asia Pacific EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 122: Rest of Asia Pacific EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 123: Rest of Asia Pacific EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 124: Rest of Asia Pacific EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 125: Latin America EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 126: Latin America EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 127: Latin America EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 128: Latin America EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 129: Latin America EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 130: Latin America EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 131: Latin America EV Chargers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 132: Brazil EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 133: Brazil EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 134: Brazil EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 135: Brazil EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 136: Brazil EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 137: Brazil EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 138: Mexico EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 139: Mexico EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 140: Mexico EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 141: Mexico EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 142: Mexico EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 143: Mexico EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 144: Argentina EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 145: Argentina EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 146: Argentina EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 147: Argentina EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 148: Argentina EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 149: Argentina EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 150: Rest of Latin America EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 151: Rest of Latin America EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 152: Rest of Latin America EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 153: Rest of Latin America EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 154: Rest of Latin America EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 155: Rest of Latin America EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 156: Middle East and Africa EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 157: Middle East and Africa EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 158: Middle East and Africa EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 159: Middle East and Africa EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 160: Middle East and Africa EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 161: Middle East and Africa EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 162: Middle East and Africa EV Chargers Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 163: GCC Countries EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 164: GCC Countries EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 165: GCC Countries EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 166: GCC Countries EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 167: GCC Countries EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 168: GCC Countries EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 169: South Africa EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 170: South Africa EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 171: South Africa EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 172: South Africa EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 173: South Africa EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 174: South Africa EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 175: Rest of Middle East and Africa EV Chargers Market Value (US$ Mn) Forecast, by Type of Charger, 2020 to 2035

Table 176: Rest of Middle East and Africa EV Chargers Market Value (US$ Mn) Forecast, by AC Chargers, 2020 to 2035

Table 177: Rest of Middle East and Africa EV Chargers Market Value (US$ Mn) Forecast, by Charging Speed, 2020 to 2035

Table 178: Rest of Middle East and Africa EV Chargers Market Value (US$ Mn) Forecast, by Connector Type, 2020 to 2035

Table 179: Rest of Middle East and Africa EV Chargers Market Value (US$ Mn) Forecast, by Installation, 2020 to 2035

Table 180: Rest of Middle East and Africa EV Chargers Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Figure 01: Global EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 02: Global EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 03: Global EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 04: Global EV Chargers Market Revenue (US$ Mn), by AC Chargers, 2020 to 2035

Figure 05: Global EV Chargers Market Revenue (US$ Mn), by DC Chargers, 2020 to 2035

Figure 06: Global EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 07: Global EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 08: Global EV Chargers Market Revenue (US$ Mn), by Level 1, 2020 to 2035

Figure 09: Global EV Chargers Market Revenue (US$ Mn), by Level 2, 2020 to 2035

Figure 10: Global EV Chargers Market Revenue (US$ Mn), by Level 3, 2020 to 2035

Figure 11: Global EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 12: Global EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 13: Global EV Chargers Market Revenue (US$ Mn), by Type 1, 2020 to 2035

Figure 14: Global EV Chargers Market Revenue (US$ Mn), by Type 2, 2020 to 2035

Figure 15: Global EV Chargers Market Revenue (US$ Mn), by CCS, 2020 to 2035

Figure 16: Global EV Chargers Market Revenue (US$ Mn), by CHAdeMO, 2020 to 2035

Figure 17: Global EV Chargers Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 18: Global EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 19: Global EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 20: Global EV Chargers Market Revenue (US$ Mn), by Fixed, 2020 to 2035

Figure 21: Global EV Chargers Market Revenue (US$ Mn), by Portable, 2020 to 2035

Figure 22: Global EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 23: Global EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 24: Global EV Chargers Market Revenue (US$ Mn), by Commercial, 2020 to 2035

Figure 25: Global EV Chargers Market Revenue (US$ Mn), by Residential, 2020 to 2035

Figure 26: Global EV Chargers Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 27: Global EV Chargers Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 28: North America EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 29: North America EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 30: North America EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 31: North America EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 32: North America EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 33: North America EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 34: North America EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 35: North America EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 36: North America EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 37: North America EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 38: North America EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 39: North America EV Chargers Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 40: North America EV Chargers Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 41: U.S. EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 42: U.S. EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 43: U.S. EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 44: U.S. EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 45: U.S. EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 46: U.S. EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 47: U.S. EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 48: U.S. EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 49: U.S. EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 50: U.S. EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 51: U.S. EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 52: Canada EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 53: Canada EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 54: Canada EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 55: Canada EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 56: Canada EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 57: Canada EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 58: Canada EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 59: Canada EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 60: Canada EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 61: Canada EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 62: Canada EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 63: Europe EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 64: Europe EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 65: Europe EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 66: Europe EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 67: Europe EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 68: Europe EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 69: Europe EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 70: Europe EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 71: Europe EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 72: Europe EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 73: Europe EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 74: Europe EV Chargers Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 75: Europe EV Chargers Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 76: Germany EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 77: Germany EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 78: Germany EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 79: Germany EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 80: Germany EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 81: Germany EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 82: Germany EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 83: Germany EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 84: Germany EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 85: Germany EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 86: Germany EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 87: U.K. EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 88: U.K. EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 89: U.K. EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 90: U.K. EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 91: U.K. EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 92: U.K. EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 93: U.K. EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 94: U.K. EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 95: U.K. EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 96: U.K. EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 97: U.K. EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 98: France EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 99: France EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 100: France EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 101: France EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 102: France EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 103: France EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 104: France EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 105: France EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 106: France EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 107: France EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 108: France EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 109: Italy EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 110: Italy EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 111: Italy EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 112: Italy EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 113: Italy EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 114: Italy EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 115: Italy EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 116: Italy EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 117: Italy EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 118: Italy EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 119: Italy EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 120: Spain EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 121: Spain EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 122: Spain EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 123: Spain EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 124: Spain EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 125: Spain EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 126: Spain EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 127: Spain EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 128: Spain EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 129: Spain EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 130: Spain EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 131: The Netherlands EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 132: The Netherlands EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 133: The Netherlands EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 134: The Netherlands EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 135: The Netherlands EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 136: The Netherlands EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 137: The Netherlands EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 138: The Netherlands EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 139: The Netherlands EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 140: The Netherlands EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 141: The Netherlands EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 142: Rest of Europe EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 143: Rest of Europe EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 144: Rest of Europe EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 145: Rest of Europe EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 146: Rest of Europe EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 147: Rest of Europe EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 148: Rest of Europe EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 149: Rest of Europe EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 150: Rest of Europe EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 151: Rest of Europe EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 152: Rest of Europe EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 153: Asia Pacific EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 154: Asia Pacific EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 155: Asia Pacific EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 156: Asia Pacific EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 157: Asia Pacific EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 158: Asia Pacific EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 159: Asia Pacific EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 160: Asia Pacific EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 161: Asia Pacific EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 162: Asia Pacific EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 163: Asia Pacific EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 164: Asia Pacific EV Chargers Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 165: Asia Pacific EV Chargers Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 166: China EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 167: China EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 168: China EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 169: China EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 170: China EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 171: China EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 172: China EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 173: China EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 174: China EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 175: China EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 176: China EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 177: Japan EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 178: Japan EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 179: Japan EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 180: Japan EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 181: Japan EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 182: Japan EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 183: Japan EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 184: Japan EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 185: Japan EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 186: Japan EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 187: Japan EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 188: India EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 189: India EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 190: India EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 191: India EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 192: India EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 193: India EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 194: India EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 195: India EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 196: India EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 197: India EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 198: India EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 199: South Korea EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 200: South Korea EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 201: South Korea EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 202: South Korea EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 203: South Korea EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 204: South Korea EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 205: South Korea EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 206: South Korea EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 207: South Korea EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 208: South Korea EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 209: South Korea EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 210: ASEAN EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 211: ASEAN EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 212: ASEAN EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 213: ASEAN EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 214: ASEAN EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 215: ASEAN EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 216: ASEAN EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 217: ASEAN EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 218: ASEAN EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 219: ASEAN EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 220: ASEAN EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 221: Australia and New Zealand EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 222: Australia and New Zealand EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 223: Australia and New Zealand EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 224: Australia and New Zealand EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 225: Australia and New Zealand EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 226: Australia and New Zealand EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 227: Australia and New Zealand EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 228: Australia and New Zealand EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 229: Australia and New Zealand EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 230: Australia and New Zealand EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 231: Australia and New Zealand EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 232: Rest of Asia Pacific EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 233: Rest of Asia Pacific EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 234: Rest of Asia Pacific EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 235: Rest of Asia Pacific EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 236: Rest of Asia Pacific EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 237: Rest of Asia Pacific EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 238: Rest of Asia Pacific EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 239: Rest of Asia Pacific EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 240: Rest of Asia Pacific EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 241: Rest of Asia Pacific EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 242: Rest of Asia Pacific EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 243: Latin America EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 244: Latin America EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 245: Latin America EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 246: Latin America EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 247: Latin America EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 248: Latin America EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 249: Latin America EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 250: Latin America EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 251: Latin America EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 252: Latin America EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 253: Latin America EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 254: Latin America EV Chargers Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 255: Latin America EV Chargers Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 256: Brazil EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 257: Brazil EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 258: Brazil EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 259: Brazil EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 260: Brazil EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 261: Brazil EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 262: Brazil EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 263: Brazil EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 264: Brazil EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 265: Brazil EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 266: Brazil EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 267: Mexico EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 268: Mexico EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 269: Mexico EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 270: Mexico EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 271: Mexico EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 272: Mexico EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 273: Mexico EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 274: Mexico EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 275: Mexico EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 276: Mexico EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 277: Mexico EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 278: Argentina EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 279: Argentina EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 280: Argentina EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 281: Argentina EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 282: Argentina EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 283: Argentina EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 284: Argentina EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 285: Argentina EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 286: Argentina EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 287: Argentina EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 288: Argentina EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 289: Rest of Latin America EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 290: Rest of Latin America EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 291: Rest of Latin America EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 292: Rest of Latin America EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 293: Rest of Latin America EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 294: Rest of Latin America EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 295: Rest of Latin America EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 296: Rest of Latin America EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 297: Rest of Latin America EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 298: Rest of Latin America EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 299: Rest of Latin America EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 300: Middle East and Africa EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 301: Middle East and Africa EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 302: Middle East and Africa EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 303: Middle East and Africa EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 304: Middle East and Africa EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 305: Middle East and Africa EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 306: Middle East and Africa EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 307: Middle East and Africa EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 308: Middle East and Africa EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 309: Middle East and Africa EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 310: Middle East and Africa EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 311: Middle East and Africa EV Chargers Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 312: Middle East and Africa EV Chargers Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 313: GCC Countries EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 314: GCC Countries EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 315: GCC Countries EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 316: GCC Countries EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 317: GCC Countries EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 318: GCC Countries EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 319: GCC Countries EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 320: GCC Countries EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 321: GCC Countries EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 322: GCC Countries EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 323: GCC Countries EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 324: South Africa EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 325: South Africa EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 326: South Africa EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 327: South Africa EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 328: South Africa EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 329: South Africa EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 330: South Africa EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 331: South Africa EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 332: South Africa EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 333: South Africa EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 334: South Africa EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 335: Rest of Middle East and Africa EV Chargers Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 336: Rest of Middle East and Africa EV Chargers Market Value Share Analysis, by Type of Charger, 2024 and 2035

Figure 337: Rest of Middle East and Africa EV Chargers Market Attractiveness Analysis, by Type of Charger, 2025 to 2035

Figure 338: Rest of Middle East and Africa EV Chargers Market Value Share Analysis, by Charging Speed, 2024 and 2035

Figure 339: Rest of Middle East and Africa EV Chargers Market Attractiveness Analysis, by Charging Speed, 2025 to 2035

Figure 340: Rest of Middle East and Africa EV Chargers Market Value Share Analysis, by Connector Type, 2024 and 2035

Figure 341: Rest of Middle East and Africa EV Chargers Market Attractiveness Analysis, by Connector Type, 2025 to 2035

Figure 342: Rest of Middle East and Africa EV Chargers Market Value Share Analysis, by Installation, 2024 and 2035

Figure 343: Rest of Middle East and Africa EV Chargers Market Attractiveness Analysis, by Installation, 2025 to 2035

Figure 344: Rest of Middle East and Africa EV Chargers Market Value Share Analysis, by End-user, 2024 and 2035

Figure 345: Rest of Middle East and Africa EV Chargers Market Attractiveness Analysis, by End-user, 2025 to 2035