Reports

Reports

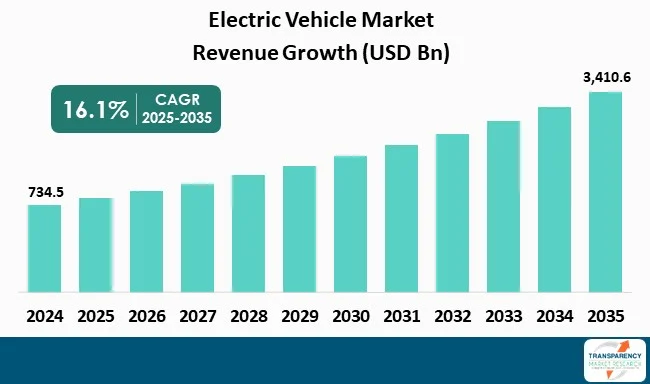

The global electric vehicle market size was valued at US$ 734.5 Bn in 2024 and is projected to reach US$ 3,410.6 Bn by 2035, expanding at a CAGR of 16.1% from 2025 to 2035. The market growth is driven by expansion of battery technology and energy storage solutions; and strategic investments and partnerships to scale EV production.

The electric vehicle market functions through the combined effects of rising environmental awareness, stringent emission regulations, and expanding public funding programs for sustainable transportation. The falling battery prices combined with improving electric vehicle range capabilities, and fluctuating fuel costs make electric vehicles more appealing to individual consumers and fleet operators. The market growth receives positive backing through both - the development of charging infrastructure and the creation of supportive policy frameworks.

The market shows three main trends, which include fast progress in battery chemistry and energy storage systems, expanded software connectivity in vehicles, and increasing electric vehicle usage for commercial and public transportation needs. The automotive industry now focuses on three main trends, which include localized manufacturing and platform-based vehicle development. Affordable electric vehicle models for emerging market consumers.

The industry operations center around battery production and development, as well as raw material supply chain integration and strategic partnerships, which enable electric vehicle manufacturing capacity growth and reduce production expenses. The company operates a national charging network expansion program, which simultaneously creates new services and digital features to boost customer satisfaction.

Organizations in the electric vehicle industry need to create strategic plans, which support their sustainability objectives. The plans meet all regulatory requirements. This preserves their market standing for extended durations.

The electric vehicle market implies vehicles that operate through complete or partial electric propulsion systems that use electric motors and rechargeable energy storage in place of traditional internal combustion engines. Electric vehicles consist of physical products, which include electric cars, buses, trucks, and two-wheelers together with supporting services like battery management systems, charging solutions, software platforms, and energy management services. The market operates as people want environmentally-friendly transportation solutions that produce fewer emissions. They use energy resources in a more efficient way.

Electric vehicles exist in various categories as their powertrain design determines their classification as battery electric vehicles, plug-in hybrid electric vehicles, hybrid electric vehicles, or fuel cell electric vehicles. The different categories operate through distinct power systems and electrical system configurations. These support multiple customer and business applications.

Electric vehicles operate in various ways through passenger transport and public transit systems, shared mobility services, logistics operations, last-mile delivery, and commercial fleet operations and industrial applications. The main purpose of EVs in cities serves two goals to lower both - environmental pollution and urban noise pollution. Commercial fleets achieve financial gains through their ability to reduce operating expenses while maintaining compliance with all required regulations. The advancement of charging infrastructure and battery technology development enables electric vehicles to function as essential building blocks for creating worldwide sustainable transportation networks.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The electric vehicle market experiences its main growth through fast battery technology development and energy storage system breakthroughs, which enhance electric vehicle performance and extend their range and lower costs. The advancement of battery chemistry together with energy density, charging efficiency, and charging efficiency enables electric vehicles to reach extended ranges while reducing the time needed for charging. These enhanced features provide consumers with an increased level of appeal and utility. Furthermore, the addition of upgraded energy storage systems has allowed for improved connectivity between electricity grids and renewable energy systems.

In December 2025, Samsung SDI introduced its upcoming battery technology, which delivers better energy storage capacity and enhanced safety features for electric vehicles. The development shows that the major industry players continue their work to improve battery performance and reduce costs, and enhance electric vehicle reliability, which drives worldwide electric vehicle market expansion.

The electric vehicle sector experiences substantial expansion due to the fact that car manufacturers form purposeful alliances to establish new production facilities for electric vehicles. The combination of local manufacturing investments with supply chain security for essential components, and strategic technology partnerships enables companies to boost production efficiency and lower costs while speeding up new electric model releases. The programs operate to satisfy growing EV consumer demand as they establish necessary infrastructure for extensive adoption throughout various territories.

In December 2025, Maruti Suzuki introduced a broad scheme to enter the Indian electric vehicle market through their plan to produce EVs, and establish local manufacturing operations. The program offers monetary backing to develop new vehicle models, while establishing extra charging infrastructure. The initiative demonstrates how car manufacturers employ strategic partnerships and financial backing to expand their production capacity. This leads to increased market penetration.

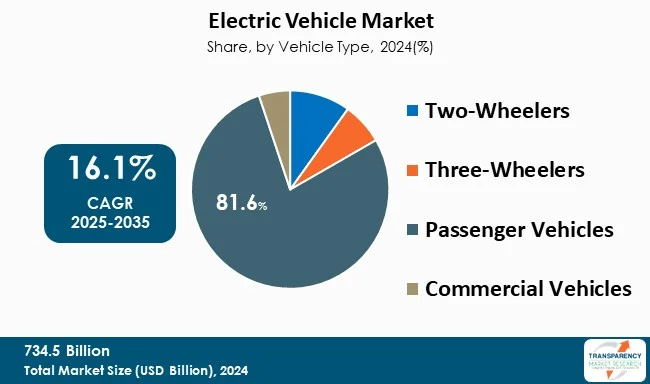

The global electric vehicle market shows strong leadership from the passenger vehicles segment that held 81.6% global revenue share in 2024 as more people want environmentally-friendly transportation solutions, which need to be both - efficient and affordable. The shift toward electric passenger vehicles continue to grow as people understand environmental problems better and governments provide incentives, and charging networks keep expanding.

The market position of this segment continues to expand because battery technology keeps advancing and electric vehicles now offer longer distances between charges. Multiple affordable electric car options exist for consumers. The automotive industry puts its efforts into developing better comfort features and modern connectivity systems, and advanced safety technology in electric passenger vehicles to draw in more customers.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia Pacific leads the global electric vehicle market with 58.2% share in 2024 because governments provide strong backing, the area experiences fast urban growth, and the major investments are witnessed in EV production and battery manufacturing facilities. The Asia Pacific region has established supportive policies and incentive programs, and built infrastructure to promote electric vehicle usage at both consumer and industrial levels.

The leadership of the region receives additional support through strong market demand for electric passenger vehicles and two-wheelers, together with cost-effective production methods and ongoing battery and charging system improvements. The Asia Pacific region has become the leading center for electric vehicle development and adoption as automakers work closely with battery suppliers and technology providers to speed up innovation.

The leading companies in the electric vehicle sector keep expanding their electric vehicle offerings while advancing battery system technology and creating more efficient energy-saving drivetrain systems. The organization allocates its financial resources to establish charging infrastructure, create connected vehicle systems, and software solutions that improve user satisfaction. The organizations collaborate through partnerships to decrease costs and accelerate innovation. They modify their approaches to comply with regulatory requirements and environmental sustainability targets.

Ather Energy, General Motors, BYD Company Ltd., Tesla, XPENG INC., Polestar, BMW AG, Hyundai Motor Group, Volkswagen AG, TOYOTA MOTOR CORPORATION, Nissan Motor Co., Ltd., Mercedes-Benz Group AG, Honda Motor Co., Ltd., NIO, Rivian Europe B.V., Mahindra Electric Automobile Ltd, Bajaj Auto Ltd., and TVS Motor Company are the key players in electric vehicle market.

Each of these players has been profiled in the electric vehicle market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 734.5 Bn |

| Forecast Value in 2035 | US$ 3,410.6 Bn |

| CAGR | 16.1% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Electric Vehicle Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Technology

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The electric vehicle market was valued at US$ 734.5 Bn in 2024

The electric vehicle market is projected to cross US$ 3,410.6 Bn by the end of 2035

Expansion of battery technology and energy storage solutions; and strategic investments and partnerships to scale EV production

The CAGR is anticipated to be 16.1% from 2025 to 2035

Asia Pacific is expected to account for the largest share from 2025 to 2035

Ather Energy, General Motors, BYD Company Ltd., Tesla, XPENG INC., Polestar, BMW AG, Hyundai Motor Group, Volkswagen AG, TOYOTA MOTOR CORPORATION, Nissan Motor Co., Ltd., Mercedes-Benz Group AG, Honda Motor Co., Ltd., NIO, Rivian Europe B.V., Mahindra Electric Automobile Ltd, Bajaj Auto Ltd., and TVS Motor Company among others.

Table 01: Global Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 02: Global Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 03: Global Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 04: Global Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 05: Global Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 06: Global Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 07: Global Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 08: Global Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 09: Global Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 10: Global Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 11: Global Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 12: Global Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 13: Global Electric Vehicle Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 14: Global Electric Vehicle Market Volume (Mn Units) Forecast, by Region, 2020 to 2035

Table 15: North America Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 16: North America Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 17: North America Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 18: North America Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 19: North America Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 20: North America Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 21: North America Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 22: North America Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 23: North America Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 24: North America Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 25: North America Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 26: North America Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 27: North America Electric Vehicle Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 28: North America Electric Vehicle Market Volume (Mn Units) Forecast, by Country, 2020 to 2035

Table 29: U.S. Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 30: U.S. Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 31: U.S. Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 32: U.S. Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 33: U.S. Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 34: U.S. Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 35: U.S. Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 36: U.S. Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 37: U.S. Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 38: U.S. Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 39: U.S. Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 40: U.S. Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 41: Canada Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 42: Canada Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 43: Canada Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 44: Canada Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 45: Canada Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 46: Canada Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 47: Canada Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 48: Canada Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 49: Canada Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 50: Canada Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 51: Canada Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 52: Canada Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 53: Europe Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 54: Europe Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 55: Europe Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 56: Europe Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 57: Europe Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 58: Europe Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 59: Europe Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 60: Europe Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 61: Europe Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 62: Europe Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 63: Europe Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 64: Europe Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 65: Europe Electric Vehicle Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 66: Europe Electric Vehicle Market Volume (Mn Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 67: Germany Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 68: Germany Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 69: Germany Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 70: Germany Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 71: Germany Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 72: Germany Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 73: Germany Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 74: Germany Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 75: Germany Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 76: Germany Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 77: Germany Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 78: Germany Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 79: U.K. Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 80: U.K. Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 81: U.K. Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 82: U.K. Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 83: U.K. Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 84: U.K. Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 85: U.K. Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 86: U.K. Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 87: U.K. Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 88: U.K. Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 89: U.K. Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 90: U.K. Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 91: France Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 92: France Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 93: France Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 94: France Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 95: France Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 96: France Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 97: France Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 98: France Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 99: France Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 100: France Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 101: France Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 102: France Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 103: Italy Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 104: Italy Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 105: Italy Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 106: Italy Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 107: Italy Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 108: Italy Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 109: Italy Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 110: Italy Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 111: Italy Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 112: Italy Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 113: Italy Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 114: Italy Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 115: Spain Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 116: Spain Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 117: Spain Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 118: Spain Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 119: Spain Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 120: Spain Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 121: Spain Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 122: Spain Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 123: Spain Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 124: Spain Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 125: Spain Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 126: Spain Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 127: Switzerland Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 128: Switzerland Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 129: Switzerland Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 130: Switzerland Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 131: Switzerland Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 132: Switzerland Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 133: Switzerland Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 134: Switzerland Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 135: Switzerland Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 136: Switzerland Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 137: Switzerland Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 138: Switzerland Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 139: The Netherlands Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 140: The Netherlands Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 141: The Netherlands Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 142: The Netherlands Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 143: The Netherlands Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 144: The Netherlands Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 145: The Netherlands Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 146: The Netherlands Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 147: The Netherlands Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 148: The Netherlands Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 149: The Netherlands Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 150: The Netherlands Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 151: Rest of Europe Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 152: Rest of Europe Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 153: Rest of Europe Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 154: Rest of Europe Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 155: Rest of Europe Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 156: Rest of Europe Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 157: Rest of Europe Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 158: Rest of Europe Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 159: Rest of Europe Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 160: Rest of Europe Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 161: Rest of Europe Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 162: Rest of Europe Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 163: Asia Pacific Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 164: Asia Pacific Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 165: Asia Pacific Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 166: Asia Pacific Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 167: Asia Pacific Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 168: Asia Pacific Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 169: Asia Pacific Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 170: Asia Pacific Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 171: Asia Pacific Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 172: Asia Pacific Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 173: Asia Pacific Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 174: Asia Pacific Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 175: Asia Pacific Electric Vehicle Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 176: Asia Pacific Electric Vehicle Market Volume (Mn Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 177: China Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 178: China Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 179: China Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 180: China Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 181: China Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 182: China Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 183: China Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 184: China Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 185: China Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 186: China Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 187: China Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 188: China Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 189: Japan Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 190: Japan Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 191: Japan Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 192: Japan Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 193: Japan Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 194: Japan Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 195: Japan Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 196: Japan Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 197: Japan Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 198: Japan Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 199: Japan Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 200: Japan Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 201: India Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 202: India Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 203: India Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 204: India Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 205: India Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 206: India Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 207: India Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 208: India Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 209: India Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 210: India Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 211: India Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 212: India Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 213: South Korea Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 214: South Korea Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 215: South Korea Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 216: South Korea Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 217: South Korea Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 218: South Korea Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 219: South Korea Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 220: South Korea Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 221: South Korea Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 222: South Korea Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 223: South Korea Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 224: South Korea Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 225: Australia and New Zealand Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 226: Australia and New Zealand Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 227: Australia and New Zealand Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 228: Australia and New Zealand Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 229: Australia and New Zealand Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 230: Australia and New Zealand Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 231: Australia and New Zealand Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 232: Australia and New Zealand Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 233: Australia and New Zealand Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 234: Australia and New Zealand Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 235: Australia and New Zealand Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 236: Australia and New Zealand Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 237: Rest of Asia Pacific Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 238: Rest of Asia Pacific Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 239: Rest of Asia Pacific Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 240: Rest of Asia Pacific Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 241: Rest of Asia Pacific Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 242: Rest of Asia Pacific Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 243: Rest of Asia Pacific Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 244: Rest of Asia Pacific Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 245: Rest of Asia Pacific Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 246: Rest of Asia Pacific Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 247: Rest of Asia Pacific Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 248: Rest of Asia Pacific Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 249: Latin America Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 250: Latin America Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 251: Latin America Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 252: Latin America Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 253: Latin America Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 254: Latin America Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 255: Latin America Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 256: Latin America Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 257: Latin America Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 258: Latin America Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 259: Latin America Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 260: Latin America Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 261: Latin America Electric Vehicle Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 262: Latin America Electric Vehicle Market Volume (Mn Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 263: Brazil Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 264: Brazil Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 265: Brazil Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 266: Brazil Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 267: Brazil Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 268: Brazil Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 269: Brazil Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 270: Brazil Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 271: Brazil Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 272: Brazil Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 273: Brazil Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 274: Brazil Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 275: Mexico Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 276: Mexico Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 277: Mexico Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 278: Mexico Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 279: Mexico Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 280: Mexico Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 281: Mexico Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 282: Mexico Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 283: Mexico Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 284: Mexico Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 285: Mexico Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 286: Mexico Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 287: Argentina Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 288: Argentina Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 289: Argentina Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 290: Argentina Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 291: Argentina Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 292: Argentina Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 293: Argentina Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 294: Argentina Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 295: Argentina Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 296: Argentina Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 297: Argentina Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 298: Argentina Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 299: Rest of Latin America Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 300: Rest of Latin America Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 301: Rest of Latin America Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 302: Rest of Latin America Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 303: Rest of Latin America Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 304: Rest of Latin America Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 305: Rest of Latin America Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 306: Rest of Latin America Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 307: Rest of Latin America Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 308: Rest of Latin America Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 309: Rest of Latin America Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 310: Rest of Latin America Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 311: Middle East and Africa Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 312: Middle East and Africa Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 313: Middle East and Africa Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 314: Middle East and Africa Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 315: Middle East and Africa Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 316: Middle East and Africa Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 317: Middle East and Africa Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 318: Middle East and Africa Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 319: Middle East and Africa Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 320: Middle East and Africa Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 321: Middle East and Africa Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 322: Middle East and Africa Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 323: Middle East and Africa Electric Vehicle Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 324: Middle East and Africa Electric Vehicle Market Volume (Mn Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 325: GCC Countries Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 326: GCC Countries Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 327: GCC Countries Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 328: GCC Countries Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 329: GCC Countries Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 330: GCC Countries Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 331: GCC Countries Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 332: GCC Countries Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 333: GCC Countries Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 334: GCC Countries Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 335: GCC Countries Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 336: GCC Countries Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 337: South Africa Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 338: South Africa Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 339: South Africa Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 340: South Africa Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 341: South Africa Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 342: South Africa Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 343: South Africa Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 344: South Africa Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 345: South Africa Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 346: South Africa Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 347: South Africa Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 348: South Africa Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Table 349: Rest of Middle East and Africa Electric Vehicle Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 350: Rest of Middle East and Africa Electric Vehicle Market Volume (Mn Units) Forecast, by Technology, 2020 to 2035

Table 351: Rest of Middle East and Africa Electric Vehicle Market Value (US$ Bn) Forecast, by Battery Type, 2020 to 2035

Table 352: Rest of Middle East and Africa Electric Vehicle Market Volume (Mn Units) Forecast, by Battery Type, 2020 to 2035

Table 353: Rest of Middle East and Africa Electric Vehicle Market Value (US$ Bn) Forecast, by Charging Type, 2020 to 2035

Table 354: Rest of Middle East and Africa Electric Vehicle Market Volume (Mn Units) Forecast, by Charging Type, 2020 to 2035

Table 355: Rest of Middle East and Africa Electric Vehicle Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 356: Rest of Middle East and Africa Electric Vehicle Market Volume (Mn Units) Forecast, by Vehicle Type, 2020 to 2035

Table 357: Rest of Middle East and Africa Electric Vehicle Market Value (US$ Bn) Forecast, by Range, 2020 to 2035

Table 358: Rest of Middle East and Africa Electric Vehicle Market Volume (Mn Units) Forecast, by Range, 2020 to 2035

Table 359: Rest of Middle East and Africa Electric Vehicle Market Value (US$ Bn) Forecast, by End User, 2020 to 2035

Table 360: Rest of Middle East and Africa Electric Vehicle Market Volume (Mn Units) Forecast, by End User, 2020 to 2035

Figure 01: Global Electric Vehicle Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Electric Vehicle Market Value Share Analysis, by Technology, 2024 and 2035

Figure 03: Global Electric Vehicle Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 04: Global Electric Vehicle Market Revenue (US$ Bn), by Battery Electric Vehicle (BEV), 2020 to 2035

Figure 05: Global Electric Vehicle Market Revenue (US$ Bn), by Hybrid Electric Vehicle (HEV), 2020 to 2035

Figure 06: Global Electric Vehicle Market Revenue (US$ Bn), by Plug-In Hybrid Electric Vehicle (PHEV), 2020 to 2035

Figure 07: Global Electric Vehicle Market Revenue (US$ Bn), by Fuel Cell Electric Vehicle (FCEV), 2020 to 2035

Figure 08: Global Electric Vehicle Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 09: Global Electric Vehicle Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 10: Global Electric Vehicle Market Revenue (US$ Bn), by Lead-Acid Battery, 2020 to 2035

Figure 11: Global Electric Vehicle Market Revenue (US$ Bn), by Lithium-Ion Battery, 2020 to 2035

Figure 12: Global Electric Vehicle Market Revenue (US$ Bn), by Nickel Metal Hydride Batteries, 2020 to 2035

Figure 13: Global Electric Vehicle Market Revenue (US$ Bn), by Solid State Batteries, 2020 to 2035

Figure 14: Global Electric Vehicle Market Revenue (US$ Bn), by Other, 2020 to 2035

Figure 15: Global Electric Vehicle Market Value Share Analysis, by Charging Type, 2024 and 2035

Figure 16: Global Electric Vehicle Market Attractiveness Analysis, by Charging Type, 2025 to 2035

Figure 17: Global Electric Vehicle Market Revenue (US$ Bn), by AC Charging, 2020 to 2035

Figure 18: Global Electric Vehicle Market Revenue (US$ Bn), by DC Fast Charging, 2020 to 2035

Figure 19: Global Electric Vehicle Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 20: Global Electric Vehicle Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 21: Global Electric Vehicle Market Revenue (US$ Bn), by Two-Wheelers, 2020 to 2035

Figure 22: Global Electric Vehicle Market Revenue (US$ Bn), by Three-Wheelers, 2020 to 2035

Figure 23: Global Electric Vehicle Market Revenue (US$ Bn), by Passenger Vehicles, 2020 to 2035

Figure 24: Global Electric Vehicle Market Revenue (US$ Bn), by Commercial Vehicles, 2020 to 2035

Figure 25: Global Electric Vehicle Market Value Share Analysis, by Range, 2024 and 2035

Figure 26: Global Electric Vehicle Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 27: Global Electric Vehicle Market Revenue (US$ Bn), by Below 150 km, 2020 to 2035

Figure 28: Global Electric Vehicle Market Revenue (US$ Bn), by 150-300 km, 2020 to 2035

Figure 29: Global Electric Vehicle Market Revenue (US$ Bn), by 300-500 km, 2020 to 2035

Figure 30: Global Electric Vehicle Market Revenue (US$ Bn), by Above 500 km, 2020 to 2035

Figure 31: Global Electric Vehicle Market Value Share Analysis, by End User, 2024 and 2035

Figure 32: Global Electric Vehicle Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 33: Global Electric Vehicle Market Revenue (US$ Bn), by Private Consumers, 2020 to 2035

Figure 34: Global Electric Vehicle Market Revenue (US$ Bn), by Commercial User, 2020 to 2035

Figure 35: Global Electric Vehicle Market Revenue (US$ Bn), by Government, 2020 to 2035

Figure 36: Global Electric Vehicle Market Revenue (US$ Bn), by Ride-Sharing, 2020 to 2035

Figure 37: Global Electric Vehicle Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 38: Global Electric Vehicle Market Value Share Analysis, by Region, 2024 and 2035

Figure 39: Global Electric Vehicle Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 40: North America Electric Vehicle Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 41: North America Electric Vehicle Market Value Share Analysis, by Technology, 2024 and 2035

Figure 42: North America Electric Vehicle Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 43: North America Electric Vehicle Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 44: North America Electric Vehicle Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 45: North America Electric Vehicle Market Value Share Analysis, by Charging Type, 2024 and 2035

Figure 46: North America Electric Vehicle Market Attractiveness Analysis, by Charging Type, 2025 to 2035

Figure 47: North America Electric Vehicle Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 48: North America Electric Vehicle Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 49: North America Electric Vehicle Market Value Share Analysis, by Range, 2024 and 2035

Figure 50: North America Electric Vehicle Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 51: North America Electric Vehicle Market Value Share Analysis, by End User, 2024 and 2035

Figure 52: North America Electric Vehicle Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 53: North America Electric Vehicle Market Value Share Analysis, by Country, 2024 and 2035

Figure 54: North America Electric Vehicle Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 55: U.S. Electric Vehicle Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 56: U.S. Electric Vehicle Market Value Share Analysis, by Technology, 2024 and 2035

Figure 57: U.S. Electric Vehicle Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 58: U.S. Electric Vehicle Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 59: U.S. Electric Vehicle Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 60: U.S. Electric Vehicle Market Value Share Analysis, by Charging Type, 2024 and 2035

Figure 61: U.S. Electric Vehicle Market Attractiveness Analysis, by Charging Type, 2025 to 2035

Figure 62: U.S. Electric Vehicle Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 63: U.S. Electric Vehicle Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 64: U.S. Electric Vehicle Market Value Share Analysis, by Range, 2024 and 2035

Figure 65: U.S. Electric Vehicle Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 66: U.S. Electric Vehicle Market Value Share Analysis, by End User, 2024 and 2035

Figure 67: U.S. Electric Vehicle Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 68: Canada Electric Vehicle Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 69: Canada Electric Vehicle Market Value Share Analysis, by Technology, 2024 and 2035

Figure 70: Canada Electric Vehicle Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 71: Canada Electric Vehicle Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 72: Canada Electric Vehicle Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 73: Canada Electric Vehicle Market Value Share Analysis, by Charging Type, 2024 and 2035

Figure 74: Canada Electric Vehicle Market Attractiveness Analysis, by Charging Type, 2025 to 2035

Figure 75: Canada Electric Vehicle Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 76: Canada Electric Vehicle Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 77: Canada Electric Vehicle Market Value Share Analysis, by Range, 2024 and 2035

Figure 78: Canada Electric Vehicle Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 79: Canada Electric Vehicle Market Value Share Analysis, by End User, 2024 and 2035

Figure 80: Canada Electric Vehicle Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 81: Europe Electric Vehicle Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 82: Europe Electric Vehicle Market Value Share Analysis, by Technology, 2024 and 2035

Figure 83: Europe Electric Vehicle Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 84: Europe Electric Vehicle Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 85: Europe Electric Vehicle Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 86: Europe Electric Vehicle Market Value Share Analysis, by Charging Type, 2024 and 2035

Figure 87: Europe Electric Vehicle Market Attractiveness Analysis, by Charging Type, 2025 to 2035

Figure 88: Europe Electric Vehicle Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 89: Europe Electric Vehicle Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 90: Europe Electric Vehicle Market Value Share Analysis, by Range, 2024 and 2035

Figure 91: Europe Electric Vehicle Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 92: Europe Electric Vehicle Market Value Share Analysis, by End User, 2024 and 2035

Figure 93: Europe Electric Vehicle Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 94: Europe Electric Vehicle Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 95: Europe Electric Vehicle Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 96: Germany Electric Vehicle Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 97: Germany Electric Vehicle Market Value Share Analysis, by Technology, 2024 and 2035

Figure 98: Germany Electric Vehicle Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 99: Germany Electric Vehicle Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 100: Germany Electric Vehicle Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 101: Germany Electric Vehicle Market Value Share Analysis, by Charging Type, 2024 and 2035

Figure 102: Germany Electric Vehicle Market Attractiveness Analysis, by Charging Type, 2025 to 2035

Figure 103: Germany Electric Vehicle Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 104: Germany Electric Vehicle Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 105: Germany Electric Vehicle Market Value Share Analysis, by Range, 2024 and 2035

Figure 106: Germany Electric Vehicle Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 107: Germany Electric Vehicle Market Value Share Analysis, by End User, 2024 and 2035

Figure 108: Germany Electric Vehicle Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 109: U.K. Electric Vehicle Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 110: U.K. Electric Vehicle Market Value Share Analysis, by Technology, 2024 and 2035

Figure 111: U.K. Electric Vehicle Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 112: U.K. Electric Vehicle Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 113: U.K. Electric Vehicle Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 114: U.K. Electric Vehicle Market Value Share Analysis, by Charging Type, 2024 and 2035

Figure 115: U.K. Electric Vehicle Market Attractiveness Analysis, by Charging Type, 2025 to 2035

Figure 116: U.K. Electric Vehicle Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 117: U.K. Electric Vehicle Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 118: U.K. Electric Vehicle Market Value Share Analysis, by Range, 2024 and 2035

Figure 119: U.K. Electric Vehicle Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 120: U.K. Electric Vehicle Market Value Share Analysis, by End User, 2024 and 2035

Figure 121: U.K. Electric Vehicle Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 122: France Electric Vehicle Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 123: France Electric Vehicle Market Value Share Analysis, by Technology, 2024 and 2035

Figure 124: France Electric Vehicle Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 125: France Electric Vehicle Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 126: France Electric Vehicle Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 127: France Electric Vehicle Market Value Share Analysis, by Charging Type, 2024 and 2035

Figure 128: France Electric Vehicle Market Attractiveness Analysis, by Charging Type, 2025 to 2035

Figure 129: France Electric Vehicle Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 130: France Electric Vehicle Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 131: France Electric Vehicle Market Value Share Analysis, by Range, 2024 and 2035

Figure 132: France Electric Vehicle Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 133: France Electric Vehicle Market Value Share Analysis, by End User, 2024 and 2035

Figure 134: France Electric Vehicle Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 135: Italy Electric Vehicle Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 136: Italy Electric Vehicle Market Value Share Analysis, by Technology, 2024 and 2035

Figure 137: Italy Electric Vehicle Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 138: Italy Electric Vehicle Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 139: Italy Electric Vehicle Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 140: Italy Electric Vehicle Market Value Share Analysis, by Charging Type, 2024 and 2035

Figure 141: Italy Electric Vehicle Market Attractiveness Analysis, by Charging Type, 2025 to 2035

Figure 142: Italy Electric Vehicle Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 143: Italy Electric Vehicle Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 144: Italy Electric Vehicle Market Value Share Analysis, by Range, 2024 and 2035

Figure 145: Italy Electric Vehicle Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 146: Italy Electric Vehicle Market Value Share Analysis, by End User, 2024 and 2035

Figure 147: Italy Electric Vehicle Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 148: Spain Electric Vehicle Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 149: Spain Electric Vehicle Market Value Share Analysis, by Technology, 2024 and 2035

Figure 150: Spain Electric Vehicle Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 151: Spain Electric Vehicle Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 152: Spain Electric Vehicle Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 153: Spain Electric Vehicle Market Value Share Analysis, by Charging Type, 2024 and 2035

Figure 154: Spain Electric Vehicle Market Attractiveness Analysis, by Charging Type, 2025 to 2035

Figure 155: Spain Electric Vehicle Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 156: Spain Electric Vehicle Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 157: Spain Electric Vehicle Market Value Share Analysis, by Range, 2024 and 2035

Figure 158: Spain Electric Vehicle Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 159: Spain Electric Vehicle Market Value Share Analysis, by End User, 2024 and 2035

Figure 160: Spain Electric Vehicle Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 161: Switzerland Electric Vehicle Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 162: Switzerland Electric Vehicle Market Value Share Analysis, by Technology, 2024 and 2035

Figure 163: Switzerland Electric Vehicle Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 164: Switzerland Electric Vehicle Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 165: Switzerland Electric Vehicle Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 166: Switzerland Electric Vehicle Market Value Share Analysis, by Charging Type, 2024 and 2035

Figure 167: Switzerland Electric Vehicle Market Attractiveness Analysis, by Charging Type, 2025 to 2035

Figure 168: Switzerland Electric Vehicle Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 169: Switzerland Electric Vehicle Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 170: Switzerland Electric Vehicle Market Value Share Analysis, by Range, 2024 and 2035

Figure 171: Switzerland Electric Vehicle Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 172: Switzerland Electric Vehicle Market Value Share Analysis, by End User, 2024 and 2035

Figure 173: Switzerland Electric Vehicle Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 174: The Netherlands Electric Vehicle Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 175: The Netherlands Electric Vehicle Market Value Share Analysis, by Technology, 2024 and 2035

Figure 176: The Netherlands Electric Vehicle Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 177: The Netherlands Electric Vehicle Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 178: The Netherlands Electric Vehicle Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 179: The Netherlands Electric Vehicle Market Value Share Analysis, by Charging Type, 2024 and 2035

Figure 180: The Netherlands Electric Vehicle Market Attractiveness Analysis, by Charging Type, 2025 to 2035

Figure 181: The Netherlands Electric Vehicle Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 182: The Netherlands Electric Vehicle Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 183: The Netherlands Electric Vehicle Market Value Share Analysis, by Range, 2024 and 2035

Figure 184: The Netherlands Electric Vehicle Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 185: The Netherlands Electric Vehicle Market Value Share Analysis, by End User, 2024 and 2035

Figure 186: The Netherlands Electric Vehicle Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 187: Rest of Europe Electric Vehicle Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 188: Rest of Europe Electric Vehicle Market Value Share Analysis, by Technology, 2024 and 2035

Figure 189: Rest of Europe Electric Vehicle Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 190: Rest of Europe Electric Vehicle Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 191: Rest of Europe Electric Vehicle Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 192: Rest of Europe Electric Vehicle Market Value Share Analysis, by Charging Type, 2024 and 2035

Figure 193: Rest of Europe Electric Vehicle Market Attractiveness Analysis, by Charging Type, 2025 to 2035

Figure 194: Rest of Europe Electric Vehicle Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 195: Rest of Europe Electric Vehicle Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 196: Rest of Europe Electric Vehicle Market Value Share Analysis, by Range, 2024 and 2035

Figure 197: Rest of Europe Electric Vehicle Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 198: Rest of Europe Electric Vehicle Market Value Share Analysis, by End User, 2024 and 2035

Figure 199: Rest of Europe Electric Vehicle Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 200: Asia Pacific Electric Vehicle Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 201: Asia Pacific Electric Vehicle Market Value Share Analysis, by Technology, 2024 and 2035

Figure 202: Asia Pacific Electric Vehicle Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 203: Asia Pacific Electric Vehicle Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 204: Asia Pacific Electric Vehicle Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 205: Asia Pacific Electric Vehicle Market Value Share Analysis, by Charging Type, 2024 and 2035

Figure 206: Asia Pacific Electric Vehicle Market Attractiveness Analysis, by Charging Type, 2025 to 2035

Figure 207: Asia Pacific Electric Vehicle Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 208: Asia Pacific Electric Vehicle Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 209: Asia Pacific Electric Vehicle Market Value Share Analysis, by Range, 2024 and 2035

Figure 210: Asia Pacific Electric Vehicle Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 211: Asia Pacific Electric Vehicle Market Value Share Analysis, by End User, 2024 and 2035

Figure 212: Asia Pacific Electric Vehicle Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 213: Asia Pacific Electric Vehicle Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 214: Asia Pacific Electric Vehicle Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 215: China Electric Vehicle Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 216: China Electric Vehicle Market Value Share Analysis, by Technology, 2024 and 2035

Figure 217: China Electric Vehicle Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 218: China Electric Vehicle Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 219: China Electric Vehicle Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 220: China Electric Vehicle Market Value Share Analysis, by Charging Type, 2024 and 2035

Figure 221: China Electric Vehicle Market Attractiveness Analysis, by Charging Type, 2025 to 2035

Figure 222: China Electric Vehicle Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 223: China Electric Vehicle Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 224: China Electric Vehicle Market Value Share Analysis, by Range, 2024 and 2035

Figure 225: China Electric Vehicle Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 226: China Electric Vehicle Market Value Share Analysis, by End User, 2024 and 2035

Figure 227: China Electric Vehicle Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 228: Japan Electric Vehicle Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 229: Japan Electric Vehicle Market Value Share Analysis, by Technology, 2024 and 2035

Figure 230: Japan Electric Vehicle Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 231: Japan Electric Vehicle Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 232: Japan Electric Vehicle Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 233: Japan Electric Vehicle Market Value Share Analysis, by Charging Type, 2024 and 2035

Figure 234: Japan Electric Vehicle Market Attractiveness Analysis, by Charging Type, 2025 to 2035

Figure 235: Japan Electric Vehicle Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 236: Japan Electric Vehicle Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 237: Japan Electric Vehicle Market Value Share Analysis, by Range, 2024 and 2035

Figure 238: Japan Electric Vehicle Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 239: Japan Electric Vehicle Market Value Share Analysis, by End User, 2024 and 2035

Figure 240: Japan Electric Vehicle Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 241: India Electric Vehicle Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 242: India Electric Vehicle Market Value Share Analysis, by Technology, 2024 and 2035

Figure 243: India Electric Vehicle Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 244: India Electric Vehicle Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 245: India Electric Vehicle Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 246: India Electric Vehicle Market Value Share Analysis, by Charging Type, 2024 and 2035

Figure 247: India Electric Vehicle Market Attractiveness Analysis, by Charging Type, 2025 to 2035

Figure 248: India Electric Vehicle Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 249: India Electric Vehicle Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 250: India Electric Vehicle Market Value Share Analysis, by Range, 2024 and 2035

Figure 251: India Electric Vehicle Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 252: India Electric Vehicle Market Value Share Analysis, by End User, 2024 and 2035

Figure 253: India Electric Vehicle Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 254: South Korea Electric Vehicle Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 255: South Korea Electric Vehicle Market Value Share Analysis, by Technology, 2024 and 2035

Figure 256: South Korea Electric Vehicle Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 257: South Korea Electric Vehicle Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 258: South Korea Electric Vehicle Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 259: South Korea Electric Vehicle Market Value Share Analysis, by Charging Type, 2024 and 2035

Figure 260: South Korea Electric Vehicle Market Attractiveness Analysis, by Charging Type, 2025 to 2035

Figure 261: South Korea Electric Vehicle Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 262: South Korea Electric Vehicle Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 263: South Korea Electric Vehicle Market Value Share Analysis, by Range, 2024 and 2035

Figure 264: South Korea Electric Vehicle Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 265: South Korea Electric Vehicle Market Value Share Analysis, by End User, 2024 and 2035

Figure 266: South Korea Electric Vehicle Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 267: Australia and New Zealand Electric Vehicle Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 268: Australia and New Zealand Electric Vehicle Market Value Share Analysis, by Technology, 2024 and 2035

Figure 269: Australia and New Zealand Electric Vehicle Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 270: Australia and New Zealand Electric Vehicle Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 271: Australia and New Zealand Electric Vehicle Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 272: Australia and New Zealand Electric Vehicle Market Value Share Analysis, by Charging Type, 2024 and 2035

Figure 273: Australia and New Zealand Electric Vehicle Market Attractiveness Analysis, by Charging Type, 2025 to 2035

Figure 274: Australia and New Zealand Electric Vehicle Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 275: Australia and New Zealand Electric Vehicle Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 276: Australia and New Zealand Electric Vehicle Market Value Share Analysis, by Range, 2024 and 2035

Figure 277: Australia and New Zealand Electric Vehicle Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 278: Australia and New Zealand Electric Vehicle Market Value Share Analysis, by End User, 2024 and 2035

Figure 279: Australia and New Zealand Electric Vehicle Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 280: Rest of Asia Pacific Electric Vehicle Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 281: Rest of Asia Pacific Electric Vehicle Market Value Share Analysis, by Technology, 2024 and 2035

Figure 282: Rest of Asia Pacific Electric Vehicle Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 283: Rest of Asia Pacific Electric Vehicle Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 284: Rest of Asia Pacific Electric Vehicle Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 285: Rest of Asia Pacific Electric Vehicle Market Value Share Analysis, by Charging Type, 2024 and 2035

Figure 286: Rest of Asia Pacific Electric Vehicle Market Attractiveness Analysis, by Charging Type, 2025 to 2035

Figure 287: Rest of Asia Pacific Electric Vehicle Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 288: Rest of Asia Pacific Electric Vehicle Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 289: Rest of Asia Pacific Electric Vehicle Market Value Share Analysis, by Range, 2024 and 2035

Figure 290: Rest of Asia Pacific Electric Vehicle Market Attractiveness Analysis, by Range, 2025 to 2035

Figure 291: Rest of Asia Pacific Electric Vehicle Market Value Share Analysis, by End User, 2024 and 2035

Figure 292: Rest of Asia Pacific Electric Vehicle Market Attractiveness Analysis, by End User, 2025 to 2035

Figure 293: Latin America Electric Vehicle Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 294: Latin America Electric Vehicle Market Value Share Analysis, by Technology, 2024 and 2035

Figure 295: Latin America Electric Vehicle Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 296: Latin America Electric Vehicle Market Value Share Analysis, by Battery Type, 2024 and 2035

Figure 297: Latin America Electric Vehicle Market Attractiveness Analysis, by Battery Type, 2025 to 2035

Figure 298: Latin America Electric Vehicle Market Value Share Analysis, by Charging Type, 2024 and 2035