Reports

Reports

Analysts’ Viewpoint

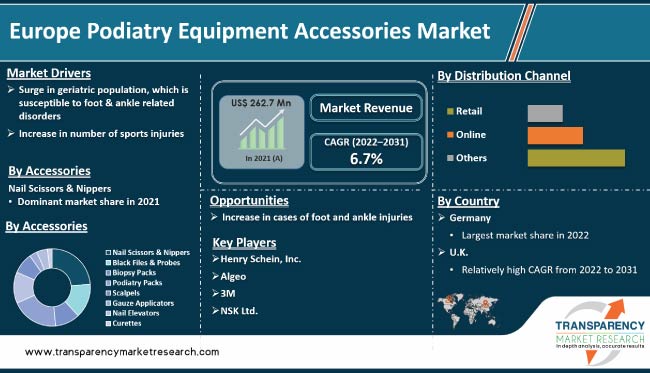

Podiatry equipment is primarily used in foot and ankle healthcare. The podiatry equipment accessories market in Europe is driven by the rise adoption of sedentary lifestyle and growth in obesity rate, which increases foot and ankle issues. Surge in geriatric population, which is more susceptible to foot and ankle problems such as arthritis and osteoporosis, is likely to fuel market expansion in the region.

Increase in awareness about foot & ankle problems and rise in need for specialized care are creating lucrative opportunities for market players. Companies are focusing on the development of new and innovative products, such as 3D printing technology, to increase their market share.

Podiatry equipment includes products related to foot care such as surgical curettes, chisels & osteotomes, cuticle & tissue nippers, and nail splitters. It is used to remove corns and callous, cut and trim nails, and shave corns.

Technological advances in 3D printing technology have made it possible for podiatry equipment to be produced more quickly and accurately. Demand for wearable devices that can monitor foot health and gait analysis has increased in the past few years. Smart insoles with pressure sensing technology are becoming more popular, and various portable, handheld devices are available for in-home foot care.

Manufacturers are focusing on ergonomic and anti-fatigue insoles for improved comfort and support. Furthermore, telemedicine services are becoming widely available for remote consultations and monitoring. This helps improve patient access to podiatry services.

Increase in geriatric population is driving the demand for podiatry equipment and services, which is fueling podiatry equipment accessories market growth. Older individuals are more susceptible to foot and ankle conditions, which may require medical intervention.

The geriatric population is more likely to develop conditions such as arthritis, diabetes, and peripheral neuropathy, which could affect their feet and ankles. These conditions require specialized medical attention and equipment such as orthotics, braces, and other accessories.

Older individuals are more likely to have difficulty with mobility and balance, which could lead to foot and ankle injuries. Increase in demand for podiatry equipment accessories among this population is accelerating market development.

Rise in sports injuries is a significant factor driving the demand for podiatry machines. Growth in popularity of sports and physical activities has led to an increase in number of sports-related injuries, particularly those related to the feet and ankles.

Sports injuries are common among athletes and active individuals, and could range from minor sprains and strains to more serious conditions such as fracture and ligament tear. These injuries often require specialized medical attention and treatment, including podiatry equipment and supplies. These include products such as orthotics, braces, and other accessories used to support and protect injured feet and ankles. Orthotics, for example, are custom-made inserts designed to support and stabilize feet and ankles, and could be used to treat various sports-related injuries.

Advances in technology and materials have improved the design and functionality of podiatry surgical instruments and accessories, making them more comfortable and effective for the treatment of sports injuries.

In terms of accessories, the nail scissors & nippers segment accounted for the largest market share in 2021. Nail scissors and nippers are essential tools used in the treatment of various foot and nail conditions such as ingrown toenails, fungal nail infections, and thick or brittle nails. These accessories are commonly used to trim and shape the nails. They help reduce the risk of injury and promote good foot health.

Demand for nail scissors and nippers is high due to their versatility and effectiveness in the treatment of common foot and nail conditions. Low cost of these devices makes them an accessible option for both podiatrists and patients. Furthermore, advances in technology have led to the development of new and improved nail scissors and nippers, with features such as ergonomic handles, sharp blades, and durable construction.

Based on distribution channel, the retail segment accounted for significant share of the podiatry equipment accessories market in Europe in 2021. Availability of podiatry equipment and accessories through retail channels such as drugstores, supermarkets, and online retailers has increased in the past few years. This has made it easier for consumers to access these products, which in turn is increasing their popularity.

The retail segment offers a range of products, including over-the-counter orthotics and braces as well as other podiatry equipment accessories such as nail scissors and nippers. This, combined with the convenience of retail distribution, contributes to the growth of the retail segment. The trend of self-care and self-treatment is rising, as people are becoming more involved in managing their health and wellness. This is leading to an increase in demand for podiatry equipment and accessories that can be easily purchased and used at home.

Germany is projected to dominate the market in Europe during the forecast period. This can be ascribed to robust healthcare infrastructure and highly developed medical industry in the region. The country is home to a large number of specialized medical facilities, including clinics and hospitals, that focus on the treatment of foot and ankle conditions.

The U.K. is the fastest-growing market for podiatry equipment accessories. Rise of e-commerce in the country has led to an increase in availability of podiatry equipment and accessories through online channels, which provide consumers easy access to these products. Manufacturers are focusing on ergonomic design of podiatry equipment accessories, with an emphasis on products that are comfortable and easy to use for both patients and practitioners.

France is likely to gain market share in the next few years. Surge in geriatric population is driving the incidence of foot and ankle injuries in the country. This is boosting the demand for podiatry services and equipment in France.

The podiatry equipment accessories market in Europe is fragmented, with the presence of a large number of manufacturers. Expansion of product portfolio and merger & acquisition are the key strategies adopted by the leading players in the market.

Key players of the podiatry equipment accessories market are Henry Schein, Inc., Algeo, NSK Ltd., FAS Healthcare Ltd., 3M, DJO, LLC, Vernacare, TendoNova, U.S. Foot & Ankle Specialists, LLC, and Namrol Group.

Each of these players has been profiled in the report based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2021 |

US$ 262.7 Mn |

|

Forecast (Value) in 2031 |

More than US$ 497.8 Mn |

|

Growth Rate (CAGR) |

6.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

|

|

Pricing |

|

The industry was valued at US$ 262.7 Mn in 2021.

It is projected to reach more than US$ 497.8 Mn by 2031.

The CAGR is anticipated to be 6.7% from 2022 to 2031.

The retail distribution channel segment held more than 50.0% share in 2021.

Germany is expected to account for the largest share from 2022 to 2031.

Henry Schein, Inc., Algeo, NSK Ltd., FAS Healthcare Ltd., 3M, DJO, LLC, Vernacare, TendoNova, U.S. Foot & Ankle Specialists, LLC, and Namrol Group.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Europe Podiatry Equipment Accessories Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Europe Podiatry Equipment Accessories Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Overview: Digital Transformation in Healthcare

5.3. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. Europe Podiatry Equipment Accessories Market Analysis and Forecast, by Accessories

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Accessories, 2017–2031

6.3.1. Nail Scissors & Nippers

6.3.2. Black Files & Probes

6.3.3. Biopsy Packs

6.3.4. Podiatry Packs

6.3.5. Podiatry Burs

6.3.6. Scalpels

6.3.7. Gauze Applicators

6.3.8. Nail Elevators

6.3.9. Curettes

6.4. Market Attractiveness Analysis, by Accessories

7. Europe Podiatry Equipment Accessories Market Analysis and Forecast, by Distribution Channel

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Distribution Channel, 2017–2031

7.3.1. Retail

7.3.2. Online

7.3.3. Others

7.4. Market Attractiveness Analysis, by Distribution Channel

8. Europe Podiatry Equipment Accessories Market Analysis and Forecast, by Country

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. Germany

8.2.2. U.K.

8.2.3. France

8.2.4. Italy

8.2.5. Spain

8.2.6. Rest of Europe

8.3. Market Attractiveness Analysis, by Country

9. Germany Podiatry Equipment Accessories Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Accessories, 2017–2031

9.2.1. Nail Scissors & Nippers

9.2.2. Black Files & Probes

9.2.3. Biopsy Packs

9.2.4. Podiatry Packs

9.2.5. Podiatry Burs

9.2.6. Scalpels

9.2.7. Gauze Applicators

9.2.8. Nail Elevators

9.2.9. Curettes

9.3. Market Value Forecast, by Distribution Channel, 2017–2031

9.3.1. Retail

9.3.2. Online

9.3.3. Others

9.4. Market Attractiveness Analysis

9.4.1. By Accessories

9.4.2. By Distribution Channel

10. U.K. Podiatry Equipment Accessories Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Accessories, 2017–2031

10.2.1. Nail Scissors & Nippers

10.2.2. Black Files & Probes

10.2.3. Biopsy Packs

10.2.4. Podiatry Packs

10.2.5. Podiatry Burs

10.2.6. Scalpels

10.2.7. Gauze Applicators

10.2.8. Nail Elevators

10.2.9. Curettes

10.3. Market Value Forecast, by Distribution Channel, 2017–2031

10.3.1. Retail

10.3.2. Online

10.3.3. Others

10.4. Market Attractiveness Analysis

10.4.1. By Accessories

10.4.2. By Distribution Channel

11. France Podiatry Equipment Accessories Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Accessories, 2017–2031

11.2.1. Nail Scissors & Nippers

11.2.2. Black Files & Probes

11.2.3. Biopsy Packs

11.2.4. Podiatry Packs

11.2.5. Podiatry Burs

11.2.6. Scalpels

11.2.7. Gauze Applicators

11.2.8. Nail Elevators

11.2.9. Curettes

11.3. Market Value Forecast, by Distribution Channel, 2017–2031

11.3.1. Retail

11.3.2. Online

11.3.3. Others

11.4. Market Attractiveness Analysis

11.4.1. By Accessories

11.4.2. By Distribution Channel

12. Italy Podiatry Equipment Accessories Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Accessories, 2017–2031

12.2.1. Nail Scissors & Nippers

12.2.2. Black Files & Probes

12.2.3. Biopsy Packs

12.2.4. Podiatry Packs

12.2.5. Podiatry Burs

12.2.6. Scalpels

12.2.7. Gauze Applicators

12.2.8. Nail Elevators

12.2.9. Curettes

12.3. Market Value Forecast, by Distribution Channel, 2017–2031

12.3.1. Retail

12.3.2. Online

12.3.3. Others

12.4. Market Attractiveness Analysis

12.4.1. By Accessories

12.4.2. By Distribution Channel

13. Spain Podiatry Equipment Accessories Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Accessories, 2017–2031

13.2.1. Nail Scissors & Nippers

13.2.2. Black Files & Probes

13.2.3. Biopsy Packs

13.2.4. Podiatry Packs

13.2.5. Podiatry Burs

13.2.6. Scalpels

13.2.7. Gauze Applicators

13.2.8. Nail Elevators

13.2.9. Curettes

13.3. Market Value Forecast, by Distribution Channel, 2017–2031

13.3.1. Retail

13.3.2. Online

13.3.3. Others

13.4. Market Attractiveness Analysis

13.4.1. By Accessories

13.4.2. By Distribution Channel

14. Rest of Europe Podiatry Equipment Accessories Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Accessories, 2017–2031

14.2.1. Nail Scissors & Nippers

14.2.2. Black Files & Probes

14.2.3. Biopsy Packs

14.2.4. Podiatry Packs

14.2.5. Podiatry Burs

14.2.6. Scalpels

14.2.7. Gauze Applicators

14.2.8. Nail Elevators

14.2.9. Curettes

14.3. Market Value Forecast, by Distribution Channel, 2017–2031

14.3.1. Retail

14.3.2. Online

14.3.3. Others

14.4. Market Attractiveness Analysis

14.4.1. By Accessories

14.4.2. By Distribution Channel

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2021)

15.3. Company Profiles

15.3.1. Henry Schein, Inc.

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Algeo

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. NSK Ltd.

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. FAS Healthcare Ltd.

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. 3M

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. DJO, LLC

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Vernacare

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Namrol Group TendoNova

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. TendoNova

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. U.S. Foot & Ankle Specialists, LLC

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

List of Tables

Table 01: Europe Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, by Accessories, 2017‒2031

Table 02: Europe Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, by Distribution Channel, 2017‒2031

Table 03: Europe Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, by Country 2017–2031

Table 04: U.K. Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, by Accessories, 2017‒2031

Table 05: U.K. Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, by Distribution Channel, 2017‒2031

Table 06: Germany Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, by Accessories, 2017‒2031

Table 07: Germany Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, by Distribution Channel, 2017‒2031

Table 08: France Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, by Accessories, 2017‒2031

Table 09: France Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, by Distribution Channel, 2017‒2031

Table 10: Italy Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, by Accessories, 2017‒2031

Table 11: Italy Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, by Distribution Channel, 2017‒2031

Table 12: Spain Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, by Accessories, 2017‒2031

Table 13: Spain Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, by Distribution Channel, 2017‒2031

Table 14: Rest of Europe Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, by Accessories, 2017‒2031

Table 15: Rest of Europe Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, by Distribution Channel, 2017‒2031

List of Figures

Figure 01: Europe Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Europe Podiatry Equipment Accessories Market Value Share, by Accessories 2021

Figure 03: Europe Podiatry Equipment Accessories Market Value Share, by Distribution Channel, 2021

Figure 04: Europe Podiatry Equipment Accessories Market Value Share, by Country, 2021

Figure 05: Europe Podiatry Equipment Accessories Market Value Share Analysis, by Accessories 2021 and 2031

Figure 06: Europe Podiatry Equipment Accessories Market Attractiveness Analysis, by Accessories 2022–2031

Figure 07: Europe Podiatry Equipment Accessories Market Value (US$ Mn), by Nail Scissors & Nippers, 2017‒2031

Figure 08: Europe Podiatry Equipment Accessories Market Value (US$ Mn), by Black Files & Probes, 2017‒2031

Figure 09: Europe Podiatry Equipment Accessories Market Value (US$ Mn), by Biopsy Packs, 2017‒2031

Figure 10: Europe Podiatry Equipment Accessories Market Value (US$ Mn), by Podiatry Packs, 2017‒2031

Figure 11: Europe Podiatry Equipment Accessories Market Value (US$ Mn), by Podiatry Burs, 2017‒2031

Figure 12: Europe Podiatry Equipment Accessories Market Value (US$ Mn), by Scalpels, 2017‒2031

Figure 13: Europe Podiatry Equipment Accessories Market Value (US$ Mn), by Gauze Applicators, 2017‒2031

Figure 14: Europe Podiatry Equipment Accessories Market Value (US$ Mn), by Nail Elevators, 2017‒2031

Figure 15: Europe Podiatry Equipment Accessories Market Value (US$ Mn), by Curettes, 2017‒2031

Figure 16: Europe Podiatry Equipment Accessories Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 17: Europe Podiatry Equipment Accessories Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 18: Europe Podiatry Equipment Accessories Market Value (US$ Mn), by Retail, 2017‒2031

Figure 19: Europe Podiatry Equipment Accessories Market Value (US$ Mn), by Online, 2017‒2031

Figure 20: Europe Podiatry Equipment Accessories Market Value (US$ Mn), by Others, 2017‒2031

Figure 21: Europe Podiatry Equipment Accessories Market Value Share Analysis, by Country 2021 and 2031

Figure 22: Europe Podiatry Equipment Accessories Market Attractiveness Analysis, by Country, 2022–2031

Figure 23: U.K. Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, 2017–2031

Figure 24: U.K. Podiatry Equipment Accessories Market Value Share Analysis, by Accessories 2021 and 2031

Figure 25: U.K. Podiatry Equipment Accessories Market Attractiveness Analysis, by Accessories 2022–2031

Figure 26: U.K. Podiatry Equipment Accessories Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 27: U.K. Podiatry Equipment Accessories Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 28: Germany Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, 2017–2031

Figure 29: Germany Podiatry Equipment Accessories Market Value Share Analysis, by Accessories 2021 and 2031

Figure 30: Germany Podiatry Equipment Accessories Market Attractiveness Analysis, by Accessories 2022–2031

Figure 31: Germany Podiatry Equipment Accessories Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 32: Germany Podiatry Equipment Accessories Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 33: Asia Pacific Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, 2017–2031

Figure 34: France Podiatry Equipment Accessories Market Value Share Analysis, by Accessories 2021 and 2031

Figure 35: France Podiatry Equipment Accessories Market Attractiveness Analysis, by Accessories 2022–2031

Figure 36: France Podiatry Equipment Accessories Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 37: France Podiatry Equipment Accessories Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 38: Italy Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, 2017–2031

Figure 39: Italy Podiatry Equipment Accessories Market Value Share Analysis, by Accessories 2021 and 2031

Figure 40: Italy Podiatry Equipment Accessories Market Attractiveness Analysis, by Accessories 2022–2031

Figure 41: Italy Podiatry Equipment Accessories Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 42: Italy Podiatry Equipment Accessories Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 43: Spain Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, 2017–2031

Figure 44: Spain Podiatry Equipment Accessories Market Value Share Analysis, by Accessories 2021 and 2031

Figure 45: Spain Podiatry Equipment Accessories Market Attractiveness Analysis, by Accessories 2022–2031

Figure 46: Spain Podiatry Equipment Accessories Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 47: Spain Podiatry Equipment Accessories Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 48: Rest of Europe Podiatry Equipment Accessories Market Value (US$ Mn) Forecast, 2017–2031

Figure 49: Rest of Europe Podiatry Equipment Accessories Market Value Share Analysis, by Accessories 2021 and 2031

Figure 50: Rest of Europe Podiatry Equipment Accessories Market Attractiveness Analysis, by Accessories 2022–2031

Figure 51: Rest of Europe Podiatry Equipment Accessories Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 52: Rest of Europe Podiatry Equipment Accessories Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 53: Company Share Analysis