Reports

Reports

The Europe biomethane sector is growing due to conducive policies, decarbonization targets, and adoption of a circular economy. Biomethane uses include power generation, domestic heating, industrial processes, and increasingly as a green fuel for transport and gas grid injection.

Government regulations imposed by the EU Green Deal, Renewable Energy Directive (RED II), and Fit for 55 program are driving biomethane uptake through feed-in tariffs, subsidization, and renewable gas blending mandates. Industry leaders such as Engie, Gasum, and Veolia are increasing production through investments in infrastructure, tie-ups with waste management companies, and cross-border partnerships.

Biomethane is a renewable source of natural gas that is obtained by upgrading biogas, which is produced through the anaerobic digestion of organic wastes like agricultural residues, food waste, and sewage sludge. During this process, the biogas is cleaned to eliminate impurities such as hydrogen sulfide and carbon dioxide to obtain high-purity biomethane that is identical in properties to commercial natural gas.

In Europe, biomethane is being used increasingly for the production of electricity, space heating in households, industry, and as a green fuel for transport. Biomethane can also be fed directly into the natural gas grid. As a source of clean energy, biomethane helps achieve decarbonization objectives and waste management strategies and is, therefore, an essential part of the shift to a circular and low-carbon economy in Europe.

| Attribute | Detail |

|---|---|

| Drivers |

|

Europe's biomethane industry growth is largely driven by the European Union's strict renewable energy and decarbonization regulations. Central to this regulatory drive are the EU's Renewable Energy Directive II (RED II) and the recently tabled RED III revision proposal, which implement binding targets for the use of renewable energy across sectors. Under RED II, member states are bound to ensure a minimum of 14% renewable energy share in transport by the year 2030, a target that pushes the adoption of biomethane as a cleaner fuel option directly.

The Fit for 55 package is further set to lower greenhouse gas emissions by 55% by the year 2030 from levels recorded in 1990, thereby putting added pressure on industries, transport, and energy sectors to turn to cleaner options such as biomethane.

Biomethane, as a chemically identical fossil natural gas but renewable origin alternative, is seen as a drop-in option for decarbonizing the hard-to-abate sectors of heavy-duty transport, industrial heat, and residential gas grids. The transition is made easier by the EU policies through promotion of grid injection of biomethane, stimulating cross-border trade in renewable gas, and the issuance of GoOs for its sustainability assurance. These policy instruments provide a clear, systematic framework that is favorable to investment in biomethane production facilities, R&D, and supply chain development.

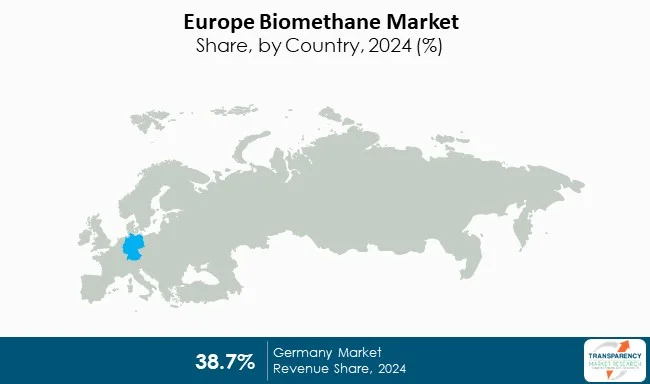

Furthermore, the EU green taxonomy of sustainable activities already encompasses biomethane-related projects in green investments, and now there is a way to the climate finance and ESG funding. Various nations such as Germany, France, Denmark, and the Netherlands have shifted EU-level mandates into national strategies, with individual production goals, feed-in tariffs, and subsidies.

The rapid expansion of biomethane injection into natural gas grids is also acting as a robust driving force for the development of the Europe biomethane market. Governments and authorities in many EU member states are promoting the application of renewable gases in the current energy networks to aid decarbonization of transportation, industrial processes, and heating. Biomethane, being chemically equivalent to natural gas, can be injected into gas grids hassle-free after upgrading from raw biogas. This harmonization with existing infrastructure provides a cost-effective and scalable route to lower fossil fuel dependency. The growth of grid injection points is facilitating more widespread, standardized, and reliable use of biomethane by sectors, thereby driving demand and investment in biogas upgrading facilities and associated technologies.

In addition, policy tools like the EU Directive on Renewable Energy (RED II & RED III), renewable gas targets at the national level, and subsidies for grid injection schemes are driving this shift. France, Germany, Denmark, and the Netherlands are investing heavily in the creation of hub centralized biomethane injection facilities and enhancing grid interconnection. These initiatives are developing an enabling environment for producers by minimizing transmission bottlenecks, securing off-take agreements, and ensuring market access. This is, in turn, motivating the owners of biogas plants and agricultural co-operatives to enhance the facilities to upgrade them to produce biomethane instead of low-value raw biogas.

Big energy corporates are also themselves signing large Power Purchase Agreements (PPAs) or Gas Purchase Agreements (GPAs) with the producers of the biomethane, promoting its financial viability and lasting financial returns.

.webp)

| Attribute | Detail |

|---|---|

| Leading country |

|

| Attribute | Detail |

|---|---|

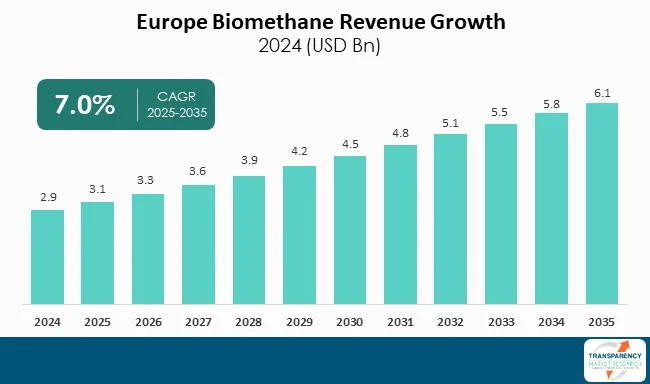

| Market Size Value in 2024 | US$ 2.9 Bn |

| Market Forecast Value in 2035 | US$ 6.1 Bn |

| Growth Rate (CAGR) | 7.0% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value and Thousand Cubic Meter for Volume |

| Market Analysis | It includes cross-segment analysis at the Europe as well as country level. Furthermore, the qualitative analysis includes drivers, restraints, Biomethane market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Feedstock

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The Europe biomethane market was valued at US$ 2.9 Bn in 2024

The Europe biomethane industry is expected to grow at a CAGR of 7.0% from 2025 to 2035

Stringent EU renewable energy and decarbonization directives and rapid expansion of biomethane injection into natural gas grids.

Agriculture waste was the largest feedstock segment and its value is anticipated to grow at a CAGR of 7.2% during the forecast period

Germany was the most lucrative country in 2024

EnviTec Biogas AG, VERBIO Vereinigte BioEnergie AG, Future Biogas Limited, PlanET Biogas Group, CNG Services Ltd, LANDWARME GMBH, Qila Energy, Evergaz, WELTEC BIOPOWER GmbH, ETW ENERGIETECHNIK GMBH are the major players in the biomethane market

Table 1 Europe Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Feedstock, 2025 to 2035

Table 2 Europe Biomethane Market Value (US$ Mn) Forecast, by Feedstock, 2025 to 2035

Table 3 Europe Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Production Methodology, 2025 to 2035

Table 4 Europe Biomethane Market Value (US$ Mn) Forecast, by Production Methodology, 2025 to 2035

Table 5 Europe Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Application, 2025 to 2035

Table 6 Europe Biomethane Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 7 Europe Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Country and Sub-region, 2025 to 2035

Table 8 Europe Biomethane Market Value (US$ Mn) Forecast, by Country and Sub-region, 2025 to 2035

Table 9 Germany Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Feedstock, 2025 to 2035

Table 10 Germany Biomethane Market Value (US$ Mn) Forecast, by Feedstock, 2025 to 2035

Table 11 Germany Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Production Methodology, 2025 to 2035

Table 12 Germany Biomethane Market Value (US$ Mn) Forecast, by Production Methodology, 2025 to 2035

Table 13 Germany Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Application, 2025 to 2035

Table 14 Germany Biomethane Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 15 U.K. Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Feedstock, 2025 to 2035

Table 16 U.K. Biomethane Market Value (US$ Mn) Forecast, by Feedstock, 2025 to 2035

Table 17 U.K. Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Production Methodology, 2025 to 2035

Table 18 U.K. Biomethane Market Value (US$ Mn) Forecast, by Production Methodology, 2025 to 2035

Table 19 U.K. Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Application, 2025 to 2035

Table 20 U.K. Biomethane Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 21 France Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Feedstock, 2025 to 2035

Table 22 France Biomethane Market Value (US$ Mn) Forecast, by Feedstock, 2025 to 2035

Table 23 France Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Production Methodology, 2025 to 2035

Table 24 France Biomethane Market Value (US$ Mn) Forecast, by Production Methodology, 2025 to 2035

Table 25 France Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Application, 2025 to 2035

Table 26 France Biomethane Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 27 Sweden Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Feedstock, 2025 to 2035

Table 28 Sweden Biomethane Market Value (US$ Mn) Forecast, by Feedstock, 2025 to 2035

Table 29 Sweden Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Production Methodology, 2025 to 2035

Table 30 Sweden Biomethane Market Value (US$ Mn) Forecast, by Production Methodology, 2025 to 2035

Table 31 Sweden Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Application, 2025 to 2035

Table 32 Sweden Biomethane Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 33 Italy Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Feedstock, 2025 to 2035

Table 34 Italy Biomethane Market Value (US$ Mn) Forecast, by Feedstock, 2025 to 2035

Table 35 Italy Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Production Methodology, 2025 to 2035

Table 36 Italy Biomethane Market Value (US$ Mn) Forecast, by Production Methodology, 2025 to 2035

Table 37 Italy Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Application, 2025 to 2035

Table 38 Italy Biomethane Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 39 The Netherland Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Feedstock, 2025 to 2035

Table 40 The Netherland Biomethane Market Value (US$ Mn) Forecast, by Feedstock, 2025 to 2035

Table 41 The Netherland Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Production Methodology, 2025 to 2035

Table 42 The Netherland Biomethane Market Value (US$ Mn) Forecast, by Production Methodology, 2025 to 2035

Table 43 The Netherland Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Application, 2025 to 2035

Table 44 The Netherland Biomethane Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 45 Rest of Europe Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Feedstock, 2025 to 2035

Table 46 Rest of Europe Biomethane Market Value (US$ Mn) Forecast, by Feedstock, 2025 to 2035

Table 47 Rest of Europe Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Production Methodology, 2025 to 2035

Table 48 Rest of Europe Biomethane Market Value (US$ Mn) Forecast, by Production Methodology, 2025 to 2035

Table 49 Rest of Europe Biomethane Market Volume (Thousand Cubic Meters) Forecast, by Application, 2025 to 2035

Table 50 Rest of Europe Biomethane Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Figure 1 Europe Biomethane Market Volume Share Analysis, by Feedstock, 2024, 2028, and 2035

Figure 2 Europe Biomethane Market Attractiveness, by Feedstock

Figure 3 Europe Biomethane Market Volume Share Analysis, by Production Methodology, 2024, 2028, and 2035

Figure 4 Europe Biomethane Market Attractiveness, by Production Methodology

Figure 5 Europe Biomethane Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 6 Europe Biomethane Market Attractiveness, by Application

Figure 7 Europe Biomethane Market Volume Share Analysis, by Country, 2024, 2028, and 2035

Figure 8 Europe Biomethane Market Attractiveness, by Country