Reports

Reports

The epoxy resins market is expected to experience steadiness over the next few years owing to the rising consumption of epoxy resins in a variety of industries verticals such as wind energy, automotive, electronics, and construction. Epoxy resin has better mechanical strength, chemical resistivity and bond strength, thereby making it applicable in applications likes turbine blades, electrical insulation, structural adhesive, protective coating, etc. This can include aspects such as wind farms that are providing the infrastructure for renewable energy, automobile industry demands for lighter cars to improve fuel economy, and developing electronics industries.

Currently, the major players in the epoxy resins market are trying to invest more in their research and development department to come up with bio-based epoxy resins and low volatile organic compounds water-borne systems due to the highly facilitated environmental standards. The focus on increasing production capacity, improving the supply chain, and the development of improved greener and high-performance materials and products are primary market objectives. Organizations are also working closely with the end-users to develop epoxy resins for various industries’, let it be flame retardant for the aerospace industry or fast curing in the construction industry. These anticipative innovations and strategic actions are enhancing the general viability and health of the epoxy resins Industry.

Epoxy resins are thermosetting polymers that exhibit excellent adhesive characteristics, chemical and mechanical properties. Epoxies are thermosetting polymers formed by the reaction between epoxide compounds referred to as curing agents usually amines. These resins are applied widely in construction, electronics, automotive, aerospace, and the marine industry among others. Epoxy resins are popular in coating, adhesive as well as in composite structures that require high strength and durability studies in functional applications.

Epoxy resins are quite versatile as they have a wide application in bonding, sealing and for protective coatings. They can be used in the construction industry for high-performance floor coatings, adhesives, and repair compounds. They find a wide usage in electronic applications as an insulator and encapsulating layer for parts such as circuit boards.

In automotive and aerospace industry, epoxy resins are used in composite lightweight parts and structural bonding agents. These common uses involve the combination of the epoxy with a curing agent, which causes a cross-linking reaction to occur. It hardens to a rigid and durable surface after curing, and it is chemically non-reactionary.

| Attribute | Detail |

|---|---|

| Epoxy Resins Market Drivers |

|

The need for epoxy resin in the construction sector has increasingly become an important growth propeller for this market. Epoxy resins are widely utilized in various construction applications as a result of their excellent properties such as excellent strength, resilience to wear and tear caused by the environment. Applications of these resins are mainly within adhesives, coatings, flooring systems, and repair materials in construction industry.

The demand for building materials with improved performance is increasing as urbanization is increasing at a rapid pace all over the world, but alongside the increase in residential and commercial construction. Epoxy resin fulfills all these needs as it offers outstanding adhesive strength and great adhesion to a myriad of substrates including steel, wood, and concrete.

High-performance coatings that prevent corrosion, chemical exposure, and weathering are further integral in the production of infrastructure ranges from bridges to buildings and road, thanks to epoxy resins. These are vital when it comes to increasing the longevity of the structures especially where the conditions are extreme.

Due to the growth of sustainability and the requirements for long life of infrastructure, the construction industry is ever attracted to epoxy-coatings for their exceptional durability and resistance. Moreover, bio-based epoxy resins correspond well to the emerging environmental issues. They are widely used in those construction projects that promote sustainable activities.

Automotive and aerospace industries are some of the major drivers to the epoxy resins since these industries use materials with high performance, durability, and weight reduction abilities. Epoxy resins are known in the industry for their excellent mechanical properties that include excellent adhesion, high-temperature resistance, and structural integrity, hence they are suitable for manufacturing of components on both - automotive and aerospace applications.

In the automotive industry, the manufacturers are more concerned about the need to enhance fuel efficiency as well as reduce the level of carbon emission and hence a move to lighter encasement materials. Epoxy resins combined with a carbon fiber and the other composite materials contributes to the decrease in the total weight of the vehicles without sacrificing the strength and safety.

Such lightweight composites are rapidly finding their way in the manufacture of body panels, structural parts or interior parts of cars; especially in the high performance cars and the electric vehicle (EV) where weight is important to increase battery life and overall efficiency.

The automotive industry’s inclination toward sustainability also leads to the demand for epoxy resins. Faced with increasing consumer and regulatory pressure to decrease the impacts on the environment, manufacturers are embracing the epoxy based composites that have the potential to deliver long-lasting, corrosion resistant parts that increase the lifespan of the vehicles.

Epoxy resins have excellent environmental resistance from such aspects of the environment as moisture, chemicals, and UV radiation that makes them suitable for both - exterior and the other internal parts of vehicles. The growing acceptability of electric and autonomous cars which need light but strong elements for enhanced performance is also enhancing the uptake of epoxy resins in the automobile industry.

Epoxy resins are important for the paints and coatings application where they are known for their robust nature, high adhesions, and chemical resistance. As for the coatings industry, epoxy resins are majorly applied as binders and these form the backbone of various high performance coatings intended to be used as protection and decoration materials on surfaces.

A number of substrates such as metals, concrete, wood, and plastics may be subjected to these coatings that offer long-term resistance to corrosion, weather effects, chemicals, and wear. Epoxy-based coatings are in high demand in industrial, automotive, marine, and infrastructure development businesses, where the performance of coatings determines the equipment’s life-time and preservation of their structural stability.

In the field of automotive, the epoxy resins are exploited as they display strong adhesion properties, chemical resistance, and a smooth finish, therefore, rendering them as suitable examples for the protection of automobiles and components.

Epoxy coatings are commonly used in the construction industry to floors, walls, and machines to provide high resistance to abrasion or moisture as well as an improvement of the esthetics. The marine industry also relies on epoxy coatings to provide protection of the ships and offshore structures from corrosive impacts of seawater.

| Attribute | Detail |

|---|---|

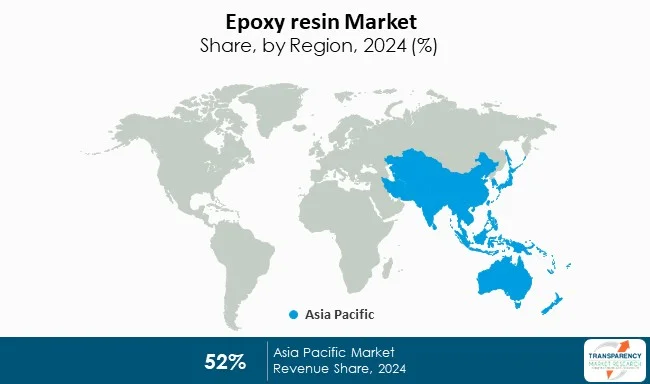

| Leading Region | Asia-Pacific |

Asia Pacific has the largest share for the world epoxy resins market due to a wide-scale industrialization, increased urbanization, and the emergence of a strong middle class in the region, especially in China, India, and Indonesia. Growth in the region’s economy has provided great demand for the construction, automotive and electronics industries, which are all the major customers for epoxy resins. In the construction industry, epoxy resins find wide applications in coatings, adhesives, and flooring material providing durability against wear and long-term protection even in severe environments. During massive development of residential, commercial, and infrastructure projects throughout Asia, the demand for these high-performance materials is exploding.

In the automotive industry, the adoption of electric vehicles in China and India, with the increased preference for the lightweight and durable material have further pushed the demand for epoxy resins. These resins play an important role in manufacturing high strength low weight composite products used in making of parts of vehicles. Also, increasing sustainability and environmental interest in the area have increased the uptake of eco-friendly epoxy formulations within the region, and low-VOC and water-based resins are being formulated to comply with the local regulations.

There are many global and regional players present in various geographies. Although the leading few mount the production volume and the technological advancements, the trends of decentralization are quite visible in the market, from local and regional creators, especially in the emerging markets.

The key players in the epoxy resins market include Huntsman Corporation, BASF SE, Dow Inc., Momentive Performance Materials, and Hexion Inc. These are the companies at the top of the industry, concentrating on product innovation, strategic partnerships, capacity expansion and cost optimization to address the increased need from such industries as automotive, construction, aerospace and electronics.

Accompanying global leaders, there has been an emerging influence of regional players, especially in the Asia Pacific region, considering the rise in industrialization in countries such as China and India with a spike in demand for epoxy-based solutions. These regional manufacturers are oriented to producing epoxy resins at an affordable price and customized to local needs while responding to the regional regulatory demand and preference of consumers.

The epoxy resins market’s strategies include the large-scale investment in R&D where the companies constantly innovate to produce high-performing sustainable as well as low-VOC epoxy resins. Such innovation is essential in serving adhesives, coatings, composite materials, and electronics applications with high emphasis on reducing the environmental imprint without compromising the efficiency of the products. In order to cope with increasing demand, players are also increasing their production capacities and improving their supply chain efficiency.

In February 2024, DCM Shriram released the information about the investment into the production of advanced material products of more than US$ 10 Billion in the form of the establishment of a greenfield plant in the years to come. The wide variety of high-end materials will include liquid epoxy resins, solvent, cuts, hardeners, formulated resins, and reactive diluents. These products will be utilized in different industries, such as electronics, wind turbines, electric vehicle (EV), fireproofing and lightweight industries.

In April 2024, a new line of epoxy products, which are used for preventing yellowing, were introduced by Westlake Corporation. The company’s desire to develop the lower-yellowing resins for epoxy material is based on the demand for higher-performance resolutions that could comply with the ever-increasing rules in numerous industries such as electronics, car-building, and construction, where the epoxy resins are broadly used.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 13.2 Bn |

| Market Forecast Value in 2035 | US$ 23.5 Bn |

| Growth Rate (CAGR) | 5.4% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | Tons For Volume and US$ Bn For Value |

| Market Analysis | It includes cross segment analysis at Global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

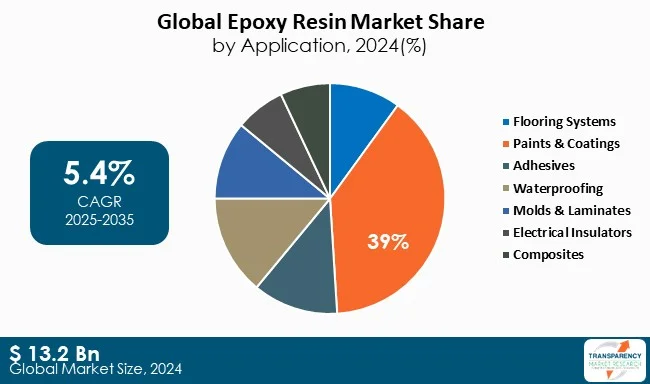

The market stood at US$ 13.2 Bn in 2024

The market is expected to grow at a CAGR of 5.4% from 2025 to 2035

Growing demand from the construction industry and growth in the automotive and aerospace sectors

Paints & Coatings application held the largest share in 2024

Asia Pacific was the most lucrative region for the Epoxy Resin market in 2024

Kukdo Chemicals Co. Ltd., The 3M Company, Dow Inc., Solvay SA, Hexion Inc., BASF SE, Sinopec, Aditya Birla Chemicals, Olin Corporation, Huntsman Corporation, and Nan Ya Plastics Corporation

Table 1 Global Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 2 Global Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 3 Global Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 4 Global Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 5 Global Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 6 Global Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 7 Global Epoxy Resins Market Volume (Tons) Forecast, by Region, 2020 to 2035

Table 8 Global Epoxy Resins Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 9 North America Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 10 North America Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 11 North America Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 12 North America Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 13 North America Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 14 North America Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 15 North America Epoxy Resins Market Volume (Tons) Forecast, by Country, 2020 to 2035

Table 16 North America Epoxy Resins Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 17 USA Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 18 USA Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 19 USA Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 20 USA Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 21 USA Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 22 USA Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 23 Canada Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 24 Canada Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 25 Canada Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 26 Canada Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 27 Canada Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 28 Canada Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 29 Europe Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 30 Europe Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 31 Europe Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 32 Europe Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 33 Europe Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 34 Europe Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 35 Europe Epoxy Resins Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 36 Europe Epoxy Resins Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 37 Germany Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 38 Germany Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 39 Germany Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 40 Germany Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 41 Germany Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 42 Germany Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 43 France Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 44 France Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 45 France Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 46 France Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 47 France Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 48 France Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 49 UK Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 50 UK Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 51 UK Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 52 UK Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 53 UK Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 54 UK Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 55 Italy Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 56 Italy Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 57 Italy Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 58 Italy Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 59 Italy Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 60 Italy Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 61 Spain Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 62 Spain Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 63 Spain Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 64 Spain Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 65 Spain Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 66 Spain Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 67 Russia & CIS Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 68 Russia & CIS Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 69 Russia & CIS Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 70 Russia & CIS Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 71 Russia & CIS Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 72 Russia & CIS Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 73 Rest of Europe Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 74 Rest of Europe Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 75 Rest of Europe Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 76 Rest of Europe Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 77 Rest of Europe Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 78 Rest of Europe Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 79 Asia Pacific Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 80 Asia Pacific Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 81 Asia Pacific Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 82 Asia Pacific Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 83 Asia Pacific Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 84 Asia Pacific Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 85 Asia Pacific Epoxy Resins Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 86 Asia Pacific Epoxy Resins Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 87 China Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 88 China Epoxy Resins Market Value (US$ Bn) Forecast, by Type 2020 to 2035

Table 89 China Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 90 China Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 91 China Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 92 China Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 93 Japan Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 94 Japan Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 95 Japan Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 96 Japan Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 97 Japan Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 98 Japan Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 99 India Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 100 India Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 101 India Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 102 India Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 103 India Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 104 India Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 105 India Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 106 India Epoxy Resins Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 107 ASEAN Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 108 ASEAN Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 109 ASEAN Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 110 ASEAN Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 111 ASEAN Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 112 ASEAN Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 113 Rest of Asia Pacific Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 114 Rest of Asia Pacific Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 115 Rest of Asia Pacific Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 116 Rest of Asia Pacific Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 117 Rest of Asia Pacific Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 118 Rest of Asia Pacific Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 119 Latin America Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 120 Latin America Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 121 Latin America Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 122 Latin America Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 123 Latin America Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 124 Latin America Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 125 Latin America Epoxy Resins Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 126 Latin America Epoxy Resins Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 127 Brazil Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 128 Brazil Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 129 Brazil Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 130 Brazil Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 131 Brazil Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 132 Brazil Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 133 Mexico Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 134 Mexico Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 135 Mexico Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 136 Mexico Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 137 Mexico Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 138 Mexico Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 139 Rest of Latin America Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 140 Rest of Latin America Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 141 Rest of Latin America Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 142 Rest of Latin America Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 143 Rest of Latin America Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 144 Rest of Latin America Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 145 Middle East & Africa Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 146 Middle East & Africa Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 147 Middle East & Africa Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 148 Middle East & Africa Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 149 Middle East & Africa Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 150 Middle East & Africa Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 151 Middle East & Africa Epoxy Resins Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 152 Middle East & Africa Epoxy Resins Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 153 GCC Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 154 GCC Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 155 GCC Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 156 GCC Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 157 GCC Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 158 GCC Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 159 South Africa Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 160 South Africa Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 161 South Africa Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 162 South Africa Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 163 South Africa Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 164 South Africa Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 165 Rest of Middle East & Africa Epoxy Resins Market Volume (Tons) Forecast, by Type, 2020 to 2035

Table 166 Rest of Middle East & Africa Epoxy Resins Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 167 Rest of Middle East & Africa Epoxy Resins Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 168 Rest of Middle East & Africa Epoxy Resins Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 169 Rest of Middle East & Africa Epoxy Resins Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 170 Rest of Middle East & Africa Epoxy Resins Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Figure 1 Global Epoxy Resins Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 2 Global Epoxy Resins Market Attractiveness, by Type

Figure 3 Global Epoxy Resins Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 4 Global Epoxy Resins Market Attractiveness, by Application

Figure 5 Global Epoxy Resins Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 6 Global Epoxy Resins Market Attractiveness, by End-use

Figure 7 Global Epoxy Resins Market Volume Share Analysis, by Region, 2024, 2027, and 2035

Figure 8 Global Epoxy Resins Market Attractiveness, by Region

Figure 9 North America Epoxy Resins Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 10 North America Epoxy Resins Market Attractiveness, by Type

Figure 11 North America Epoxy Resins Market Attractiveness, by Type

Figure 12 North America Epoxy Resins Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 13 North America Epoxy Resins Market Attractiveness, by Application

Figure 14 North America Epoxy Resins Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 15 North America Epoxy Resins Market Attractiveness, by End-use

Figure 16 North America Epoxy Resins Market Attractiveness, by Country and Sub-region

Figure 17 Europe Epoxy Resins Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 18 Europe Epoxy Resins Market Attractiveness, by Type

Figure 19 Europe Epoxy Resins Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 20 Europe Epoxy Resins Market Attractiveness, by Application

Figure 21 Europe Epoxy Resins Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 22 Europe Epoxy Resins Market Attractiveness, by End-use

Figure 23 Europe Epoxy Resins Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 24 Europe Epoxy Resins Market Attractiveness, by Country and Sub-region

Figure 25 Asia Pacific Epoxy Resins Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 26 Asia Pacific Epoxy Resins Market Attractiveness, by Type

Figure 27 Asia Pacific Epoxy Resins Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 28 Asia Pacific Epoxy Resins Market Attractiveness, by Application

Figure 29 Asia Pacific Epoxy Resins Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 30 Asia Pacific Epoxy Resins Market Attractiveness, by End-use

Figure 31 Asia Pacific Epoxy Resins Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 32 Asia Pacific Epoxy Resins Market Attractiveness, by Country and Sub-region

Figure 33 Latin America Epoxy Resins Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 34 Latin America Epoxy Resins Market Attractiveness, by Type

Figure 35 Latin America Epoxy Resins Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 36 Latin America Epoxy Resins Market Attractiveness, by Application

Figure 37 Latin America Epoxy Resins Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 38 Latin America Epoxy Resins Market Attractiveness, by End-use

Figure 39 Latin America Epoxy Resins Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 40 Latin America Epoxy Resins Market Attractiveness, by Country and Sub-region

Figure 41 Middle East & Africa Epoxy Resins Market Volume Share Analysis, by Type, 2024, 2027, and 2035

Figure 42 Middle East & Africa Epoxy Resins Market Attractiveness, by Type

Figure 43 Middle East & Africa Epoxy Resins Market Volume Share Analysis, by Application, 2024, 2027, and 2035

Figure 44 Middle East & Africa Epoxy Resins Market Attractiveness, by Application

Figure 45 Middle East & Africa Epoxy Resins Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 46 Middle East & Africa Epoxy Resins Market Attractiveness, by End-use

Figure 47 Middle East & Africa Epoxy Resins Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 48 Middle East & Africa Epoxy Resins Market Attractiveness, by Country and Sub-region