Reports

Reports

Analysts’ Viewpoint on Global Market Scenario

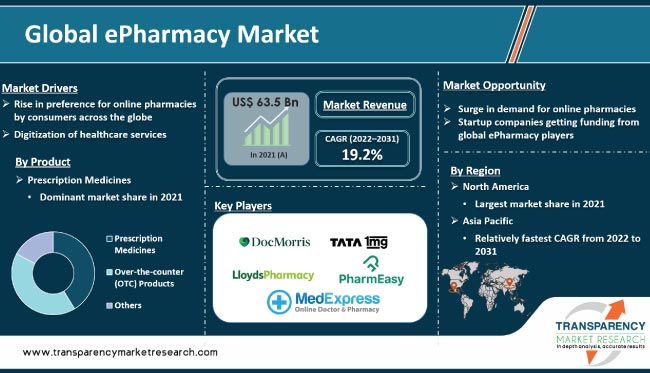

The global e-Pharmacy market is estimated to grow at a rapid pace during the forecast period, due to the rise in awareness about online pharmacies, increase in digital penetration, and growth in consumer comfort level with online transactions. The ePharmacy model is simple to use and has begun to replace traditional pharmacies. ePharmacy includes medications and medical services. e-pharmacies experienced an overnight increase in site traffic and sales due to the COVID-19 pandemic. Government officials became aware of telemedicine and the value of such services for the general population. However, lack of clearly stated laws and clear-cut guidelines to regulate, control, and monitor e-pharmacies is a concern. Leading players in the market are tapping into incremental opportunities in the global market to broaden their revenue streams.

The term 'ePharmacy' refers to an online pharmacy that provides medical care and allows patients to buy prescribed medications online. E-pharmacy is a branch of pharmacy that primarily operates online. It makes use of the Internet and sends medications to customers via dedicated delivery companies. Online pharmacies include independent Internet-only outlets, electronic subsidiaries of "brick-and-mortar" hospitals, and platforms serving pharmacy companies. It makes up 8% to 10% of the pharmaceutical market; however, there exists significant room for growth due to the rise in awareness about online pharmacies. People are able to access labs and medications from the security of their homes, as online pharmacies are primed and prepared for home delivery of medicines.

Electronic pharmacy systems, including online shopping and the sale of prescribed and non-prescribed drugs and medicines, are growing rapidly. Some of India's largest conglomerates and multinational e-commerce firms are striving to establish a presence in the sector, which is also undergoing consolidation among existing players. E-commerce is becoming increasingly important in wholesale and retail trade. Orders have increased by approximately 20% to 30% for e-commerce companies. The concept of electronic pharmacies and online drug sales has been popular across the world for more than two decades. Online pharmacy has experienced exponential growth across categories due to the rise in the availability of smartphones and the Internet. People have started purchasing various things online including groceries, apparel, and medicines. E-pharmacy has emerged as a promising industry as a result of this significant change in consumer shopping habits. E-pharmacies also offer online services such as doctor consultations as well as a number of offline services (including diagnostics). The global ePharmacy market size is anticipated to increase during the forecast period owing to the rise in the number of smartphone users and growth in penetration of the Internet across the globe. An increase in the adoption of electronic signature pharmacies is also likely to augment the market during the forecast period.

An increase in online medicine sales has caused significant disruption in the pharmacy market. The growth of mail orders and online pharmacies is another factor that has the potential to have a significant impact on pharmacy service structures and medicine costs. The COVID-19 pandemic has had a significant effect on consumer purchasing behavior. It has induced more people to buy healthcare products from online retailers or dedicated ePharmacies.

According to a study published in the Pharmaceutical Journal, the number of items dispensed from distance-selling pharmacies in the U.K. increased by 45% in 2020. Using dispensing data and lists of distance-selling pharmacies obtained through the Freedom of Information Act from the NHS Business Services Authority, it was discovered that these pharmacies dispensed 42 million items in 2020.

In Denmark, pharmacies have the exclusive right to sell prescription-only medicines to consumers. Several over-the-counter (OTC) drugs are available only at pharmacies. Denmark had 227 pharmacies and two online pharmacies as of January 1, 2021. Moreover, one of the pharmacies has 80 branches, 209 voluntarily established branches, 24 pharmacy outlets, approximately 350 OTC outlets, and around 400 medicine delivery facilities.

People look for convenience, dependability, and affordability in every online transaction. They are already at ease in purchasing categories such as music, food, and media from online retailers. They are now seeking the same level of service for more complex categories (OTC, medical devices, and prescription medicines). Hence, the trend of online pharmacies is expected to increase during the forecast period.

In terms of product, the prescription medicines segment accounted for the largest global ePharmacy market share in 2021. The segment is expected to maintain its leading position in the market during the forecast period. Patients benefit significantly from online pharmacies, as these offer a much wider variety of options than conventional pharmacies. Several drugs are available in regular drug stores, but it is not always possible to find prescribed medicines at a local physical pharmacy. The Internet makes everything simple and practical. Patients can now order medicines online with a registered medical practitioner's prescription and have them delivered right to their door. This is a popular practice of ordering drugs prescribed by doctors. People are likely to opt for online pharmacies instead of visiting a nearby pharmacy owing to the rise in penetration of smartphones and the Internet. They can also order their prescriptions from the convenience of their homes by comparing the prices of medications. They can have their medications delivered right to their doorstep with just a few clicks. This convenience is a key selling point that is likely to fuel the e-Pharmacy market growth in the next few years.

North America accounted for the largest share of the global market for e-Pharmacy in 2021. The region is expected to maintain its share during the forecast period. An increase in the number of Internet users has led to a rise in the adoption of digital technologies, thus offering unprecedented growth opportunities to the ePharmacy market in the region.

The U.K. and Germany are the major hotspots of the e-pharmacy industry in Europe, led by the rise in inclination toward the online mode of medicine purchase among the people in these countries. According to a YouGov survey for the General Pharmaceutical Council (2021), 25% of people in the U.K. are likely to use an online pharmacy in the future. The country has more than 350 registered online pharmacies. Over the last 12 months, 300,000 patients have used Pharmacy2U's NHS prescription service to have their medication delivered, with a new facility in Leicestershire capable of dispensing 7.5 million items per month.

The market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period. Large population base in emerging economies such as China and India; an increase in government initiatives to encourage the adoption of digital technologies; and a rise in preference of customers to use ePharmacy solutions have led to a steady growth in investor interest in e-pharmacies, with the sector attracting US$ 700 Mn in investments in 2020 alone. Some of the leading players in the market in Asia Pacific include Pharmeasy, Medlife, 1Mg, and Netmeds.

The global market for e-Pharmacy is consolidated, with the presence of a small number of leading players that control the majority of the share. Expansion of product portfolio and mergers & acquisitions are the key strategies adopted by the leading players in the global market. Chemist Direct, DocMorris, Express Scripts Holding Company, Giant Eagle, Inc., Healthxchange Pharmacy, LloydsPharmacy, MedExpress, Netmeds, Optum Rx, Inc., PharmEasy, 1Mg, Rowlands Pharmacy, The Kroger Co., Walgreen Co., and Well Pharmacy are the prominent players operating in the global ePharmacy business.

Each of these players has been profiled in the e-Pharmacy industry report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2021 | US$ 63.5 Bn |

| Market Forecast Value in 2031 | More than US$ 362.8 Bn |

| Growth Rate (CAGR) | 19.2% |

| Forecast Period | 2022-2031 |

| Historical Data Available for | 2017-2020 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional-level analysis. Moreover, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global market was valued at US$ 63.5 Bn in 2021

The global e-Pharmacy market is projected to reach more than US$ 362.8 Bn by 2031

The global e-Pharmacy market is anticipated to advance at a CAGR of 19.2% from 2022 to 2031

Increase in digitization of healthcare services, rise in smartphone availability & internet penetration, and growth in consumer preference for online pharmacies

North America is expected to account for a major share of the global e-Pharmacy market during the forecast period.

Chemist Direct, DocMorris, Express Scripts Holding Company, Giant Eagle, Inc., Healthxchange Pharmacy, LloydsPharmacy, MedExpress, Netmeds, Optum Rx, Inc., and PharmEasy

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global ePharmacy Market

4. Market Overview

4.1. Introduction

4.1.1. Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global ePharmacy Market Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Pricing Analysis

5.2. Key Industry Events (mergers, acquisitions, collaborations, approvals, etc.)

5.3. COVID-19 Impact Analysis

5.4. Regulatory Scenario

6. Global ePharmacy Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017-2031

6.3.1. Prescription Medicine

6.3.2. Over-the-counter (OTC) Products

6.3.3. Other (Diagnostic Services)

6.4. Market Attractiveness Analysis, by Product

7. Global ePharmacy Market Analysis and Forecast, by Region

7.1. Key Findings

7.2. Market Value Forecast, by Region

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Latin America

7.2.5. Middle East & Africa

7.3. Market Attractiveness Analysis, by Region

8. North America ePharmacy Market Analysis and Forecast

8.1. Introduction

8.1.1. Key Findings

8.2. Market Value Forecast, by Product, 2017-2031

8.2.1. Prescription Medicine

8.2.2. Over-the-counter (OTC) Products

8.2.3. Other

8.3. Market Value Forecast, by Country, 2017-2031

8.3.1. U.S.

8.3.2. Canada

8.4. Market Attractiveness Analysis

8.4.1. By Product

8.4.2. By Country

9. Europe ePharmacy Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product, 2017-2031

9.2.1. Prescription Medicine

9.2.2. Over-the-counter (OTC) Products

9.2.3. Other

9.3. Market Value Forecast, by Country/Sub-region, 2017-2031

9.3.1. Germany

9.3.2. U.K.

9.3.3. France

9.3.4. Italy

9.3.5. Spain

9.3.6. Rest of Europe

9.4. Market Attractiveness Analysis

9.4.1. By Product

9.4.2. By Country/Sub-region

10. Asia Pacific ePharmacy Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017-2031

10.2.1. Prescription Medicine

10.2.2. Over-the-counter (OTC) Products

10.2.3. Other

10.3. Market Value Forecast, by Country/Sub-region, 2017-2031

10.3.1. China

10.3.2. Japan

10.3.3. India

10.3.4. Australia & New Zealand

10.3.5. Rest of Asia Pacific

10.4. Market Attractiveness Analysis

10.4.1. By Product

10.4.2. By Country/Sub-region

11. Latin America ePharmacy Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017-2031

11.2.1. Prescription Medicine

11.2.2. Over-the-counter (OTC) Products

11.2.3. Other

11.3. Market Value Forecast, by Country/Sub-region, 2017-2031

11.3.1. Brazil

11.3.2. Mexico

11.3.3. Rest of Latin America

11.4. Market Attractiveness Analysis

11.4.1. By Product

11.4.2. By Country/Sub-region

12. Middle East & Africa ePharmacy Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017-2031

12.2.1. Prescription Medicine

12.2.2. Over-the-counter (OTC) Products

12.2.3. Other

12.3. Market Value Forecast, by Country/Sub-region, 2017-2031

12.3.1. GCC Countries

12.3.2. South Africa

12.3.3. Rest of Middle East & Africa

12.4. Market Attractiveness Analysis

12.4.1. By Product

12.4.2. By Country/Sub-region

13. Competition Landscape

13.1. Market Player - Competitive Matrix (by tier and size of companies

13.2. Market Share Analysis, by Company (2021)

13.3. Company Profiles

13.3.1. Chemist Direct

13.3.1.1. Company Overview

13.3.1.2. Product Portfolio

13.3.1.3. SWOT Analysis

13.3.1.4. Financial Overview

13.3.1.5. Strategic Overview

13.3.2. DocMorris

13.3.2.1. Company Overview

13.3.2.2. Product Portfolio

13.3.2.3. SWOT Analysis

13.3.2.4. Financial Overview

13.3.2.5. Strategic Overview

13.3.3. Express Scripts Holding Company

13.3.3.1. Company Overview

13.3.3.2. Product Portfolio

13.3.3.3. SWOT Analysis

13.3.3.4. Financial Overview

13.3.3.5. Strategic Overview

13.3.4. Giant Eagle, Inc.

13.3.4.1. Company Overview

13.3.4.2. Product Portfolio

13.3.4.3. SWOT Analysis

13.3.4.4. Financial Overview

13.3.4.5. Strategic Overview

13.3.5. Healthxchange Pharmacy

13.3.5.1. Company Overview

13.3.5.2. Product Portfolio

13.3.5.3. SWOT Analysis

13.3.5.4. Financial Overview

13.3.5.5. Strategic Overview

13.3.6. LloydsPharmacy

13.3.6.1. Company Overview

13.3.6.2. Product Portfolio

13.3.6.3. SWOT Analysis

13.3.6.4. Financial Overview

13.3.6.5. Strategic Overview

13.3.7. MedExpress

13.3.7.1. Company Overview

13.3.7.2. Product Portfolio

13.3.7.3. SWOT Analysis

13.3.7.4. Financial Overview

13.3.7.5. Strategic Overview

13.3.8. Netmeds

13.3.8.1. Company Overview

13.3.8.2. Product Portfolio

13.3.8.3. SWOT Analysis

13.3.8.4. Financial Overview

13.3.8.5. Strategic Overview

13.3.9. Optum Rx, Inc.

13.3.9.1. Company Overview

13.3.9.2. Product Portfolio

13.3.9.3. SWOT Analysis

13.3.9.4. Financial Overview

13.3.9.5. Strategic Overview

13.3.10. PharmEasy

13.3.10.1. Company Overview

13.3.10.2. Product Portfolio

13.3.10.3. SWOT Analysis

13.3.10.4. Financial Overview

13.3.10.5. Strategic Overview

13.3.11. 1Mg

13.3.11.1. Company Overview

13.3.11.2. Product Portfolio

13.3.11.3. SWOT Analysis

13.3.11.4. Financial Overview

13.3.11.5. Strategic Overview

13.3.12. Rowlands Pharmacy

13.3.12.1. Company Overview

13.3.12.2. Product Portfolio

13.3.12.3. SWOT Analysis

13.3.12.4. Financial Overview

13.3.12.5. Strategic Overview

13.3.13. The Kroger Co.

13.3.13.1. Company Overview

13.3.13.2. Product Portfolio

13.3.13.3. SWOT Analysis

13.3.13.4. Financial Overview

13.3.13.5. Strategic Overview

13.3.14. Walgreen Co.

13.3.14.1. Company Overview

13.3.14.2. Product Portfolio

13.3.14.3. SWOT Analysis

13.3.14.4. Financial Overview

13.3.14.5. Strategic Overview

13.3.15. Well Pharmacy

13.3.15.1. Company Overview

13.3.15.2. Product Portfolio

13.3.15.3. SWOT Analysis

13.3.15.4. Financial Overview

13.3.15.5. Strategic Overview

List of Tables

Table 01: Global ePharmacy Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 02: Global ePharmacy Market Size (US$ Mn) Forecast, by Region, 2017-2031

Table 03: North America ePharmacy Market Size (US$ Mn) Forecast, by Country, 2017-2031

Table 04: North America ePharmacy Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 05: Europe ePharmacy Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 06: Europe ePharmacy Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 07: Asia Pacific ePharmacy Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 08: Asia Pacific ePharmacy Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 09: Latin America ePharmacy Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 10: Latin America ePharmacy Market Size (US$ Mn) Forecast, by Product, 2017-2031

Table 11: Middle East & Africa ePharmacy Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 12: Middle East & Africa ePharmacy Market Size (US$ Mn) Forecast, by Product, 2017-2031

List of Figures

Figure 01: Global ePharmacy Market Size (US$ Mn) and Distribution (%), by Region, 2017 and 2031

Figure 02: Global ePharmacy Market Revenue (US$ Mn), by Product, 2021

Figure 03: Global ePharmacy Market Value Share, by Product, 2021

Figure 04: Global ePharmacy Market Value Share, by Region, 2021

Figure 05: Global ePharmacy Market Value (US$ Mn) Forecast, 2017-2031

Figure 06: Global ePharmacy Market Value Share Analysis, by Product, 2017 and 2031

Figure 07: Global ePharmacy Market Attractiveness Analysis, by Product, 2022-2031

Figure 08: Global ePharmacy Market Attractiveness Analysis, by Region, 2022-2031

Figure 09: North America ePharmacy Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017-2031

Figure 10: North America ePharmacy Market Attractiveness Analysis, by Country, 2017-2031

Figure 11: North America ePharmacy Market Value Share Analysis, by Country, 2017 and 2031

Figure 12: North America ePharmacy Market Value Share Analysis, by Product, 2017 and 2031

Figure 13: North America ePharmacy Market Attractiveness Analysis, by Product, 2022-2031

Figure 14: Europe ePharmacy Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017-2031

Figure 15: Europe ePharmacy Market Attractiveness Analysis, by Country/Sub-region, 2017-2031

Figure 16: Europe ePharmacy Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 17: Europe ePharmacy Market Value Share Analysis, by Product, 2017 and 2031

Figure 18: Europe ePharmacy Market Attractiveness Analysis, by Product, 2022-2031

Figure 19: Asia Pacific ePharmacy Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017-2031

Figure 20: Asia Pacific ePharmacy Market Attractiveness Analysis, by Country/Sub-region, 2017-2031

Figure 21: Asia Pacific ePharmacy Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 22: Asia Pacific ePharmacy Market Value Share Analysis, by Product, 2017 and 2031

Figure 23: Asia Pacific ePharmacy Market Attractiveness Analysis, by Product, 2022-2031

Figure 24: Latin America ePharmacy Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017-2031

Figure 25: Latin America ePharmacy Market Attractiveness Analysis, by Country/Sub-region, 2017-2031

Figure 26: Latin America ePharmacy Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 27: Latin America ePharmacy Market Value Share Analysis, by Product, 2017 and 2031

Figure 28: Latin America ePharmacy Market Attractiveness Analysis, by Product, 2022-2031

Figure 29: Middle East & Africa ePharmacy Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017-2031

Figure 30: Middle East & Africa ePharmacy Market Attractiveness Analysis, by Country/Sub-region, 2017-2031

Figure 31: Middle East & Africa ePharmacy Market Value Share Analysis, by Country/Sub-region, 2017 and 2031

Figure 32: Middle East & Africa ePharmacy Market Value Share Analysis, by Product, 2017 and 2031

Figure 33: Middle East & Africa ePharmacy Market Attractiveness Analysis, by Product, 2022-2031