Reports

Reports

Analyst Viewpoint

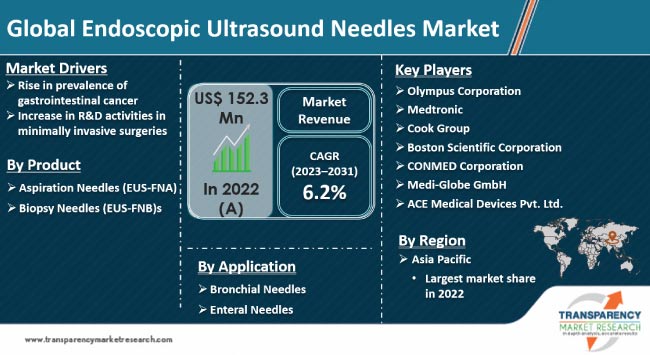

Rise in prevalence of gastrointestinal cancer is driving the global endoscopic ultrasound needles industry. Endoscopic ultrasound needles are extensively used to acquire visual and ultrasonic images on abdominal areas. Rise in prevalence of stomach cancer due to aging, improper diet, and excessive alcohol consumption is propelling market progress. Furthermore, increase in R&D activities in minimally invasive surgeries is expected to bolster the global endoscopic ultrasound needles market size during the forecast period.

Surge in popularity of robotic surgeries and technological advancements in cancer treatments offer lucrative opportunities to market players. Leading companies in the market are focusing on seeking product approvals to increase business reach. They are launching new endoscopic ultrasound needles with narrow-band imaging technologies to ensure accuracy and efficiency.

Endoscopic needle is specifically designed for safe injection of the endoscopic marker at the correct depth. Endoscopic ultrasound-guided fine-needle is attached to an endoscopic tube used to remove fluid or tissue samples for examination.

Aspiration and biopsy are two basic types of endoscopic ultrasound needles utilized in disease diagnosis procedures. These needles collect tissues and fluid to identify the abnormal cells and detect the affected area.

Physicians and surgeons prefer using endoscopic ultrasound needles in the field of gastroenterology and pulmonology to examine the inner walls of the gut. This provides ultrasound imaging of abdominal area to diagnose the infection and provide appropriate treatment. Endoscopic ultrasound needles are selected according to the application and organ to be examined, such as liver, pancreas, and lungs.

Gastrointestinal cancer develops in the digestive tract and could cause various issues, including nausea, loss of appetite, weakness, pain & discomfort in the abdomen, and bleeding. Excessive smoking, consumption of alcohol, obesity, low intake of fresh fruits & vegetables, and highly salted diet are some of the major causes on gastrointestinal cancer.

Endoscopic ultrasound needles are utilized to diagnose the abdominal area and capture its ultrasound images and detect the infectious organs. Thus, rise in incidence of gastrointestinal cancer due to improper diet and excessive alcohol consumption among young adults is driving the endoscopic ultrasound needles market value.

Surge in prevalence of chronic diseases, such as pancreatic, liver, hepatobiliary, and lung cancers is propelling demand for minimally invasive surgical procedures. Endoscopic ultrasound needles are used as drug delivery stents in these surgeries.

According to the National Cancer Institute, around 26,500 new stomach cancer cases are estimated in 2023, which is around 1.4% of all new cancer cases, and around 11,130 fatalities are projected in 2023.

Minimally invasive surgeries have fewer incisions, less blood flow, and faster recovery time. Technological developments in robotic surgeries allow physicians and surgeons to use high-definition endoscopic ultrasound needles to get accurate images of thoracic and abdominal areas. Thus, rise in investments in research & development activities in minimally invasive surgeries is fueling the endoscopic ultrasound needles market revenue.

Surge in demand for minimally invasive surgeries among the geriatric population is fueling the endoscopic ultrasound needles market dynamics. Geriatric population in more prone to pancreatic and abdominal cancers due to weak immune system and lack of digestive fluids in the body.

Healthcare professionals conduct minimally invasive surgeries on elder patients to ensure faster recovery and reduce patient trauma. According to the American Cancer Society, around 64,050 people will be diagnosed with pancreatic cancer in the U.S. in 2023, of which nearly 50,550 fatalities could be registered.

As per the regional endoscopic ultrasound needles industry analysis, Asia Pacific dominated the global industry in 2022. Increase in healthcare expenditure and ongoing developments in cancer treatment are likely to propel the endoscopic ultrasound needles market share in the next few years. Rise in prevalence of chronic diseases among the population is driving demand for endoscopic ultrasound needles in disease diagnosis and therapeutic procedures.

According to the National Institutes of Health, the incidence and mortality of gastric cancer are exceptionally high in Asia due to high helicobacter pylori infection, dietary habits, smoking behaviors, and excessive alcohol consumption. Thus, increase in prevalence of gastric cancer in the region is boosting market statistics.

Endoscopic ultrasound needles are gaining acceptance in the healthcare sector. Leading manufacturers in the market are incorporating advanced technologies to develop precise biopsy needles utilized in various treatments and diagnostic procedures. Key players in the market are investing in redefining their existing products to meet changing demand from healthcare practitioners and surgeons.

Olympus Corporation, Medtronic, Cook Group, Boston Scientific Corporation, CONMED Corporation, Medi-Globe GmbH, and ACE Medical Devices Pvt. Ltd. are the prominent players in the market.

These companies have been profiled in the endoscopic ultrasound needles market report based on various parameters including company overview, business segments, product portfolio, recent developments, business strategies, and financial overview.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 152.3 Mn |

| Forecast (Value) in 2031 | US$ 266.1 Mn |

| Growth Rate (CAGR) | 6.2% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Tons | US$ Mn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 152.3 Mn in 2022.

It is projected to expand at a CAGR of 6.2% from 2023 to 2031.

Rise in prevalence of gastrointestinal cancer and increase in R&D activities in minimally invasive surgeries.

Asia Pacific was the most lucrative region in 2022.

Olympus Corporation, Medtronic, Cook Group, Boston Scientific Corporation, CONMED Corporation, Medi-Globe GmbH, and ACE Medical Devices Pvt. Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Endoscopic Ultrasound Needles Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution/Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Endoscopic Ultrasound Needles Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Product/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Endoscopic Ultrasound Needles Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Aspiration Needles (EUS-FNA)

6.3.2. Biopsy Needles (EUS-FNB)

6.4. Market Attractiveness Analysis, by Product

7. Global Endoscopic Ultrasound Needles Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Bronchial Needles

7.3.2. Enteral Needles

7.4. Market Attractiveness Analysis, by Application

8. Global Endoscopic Ultrasound Needles Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals

8.3.2. Specialty Clinics

8.3.3. Ambulatory Surgery Centers

8.4. Market Attractiveness Analysis, by End-user

9. Global Endoscopic Ultrasound Needles Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Endoscopic Ultrasound Needles Market Analysis and Forecast

10.1. Introduction

10.2. Key Findings

10.3. Market Value Forecast, by Product, 2017–2031

10.3.1. Aspiration Needles (EUS-FNA)

10.3.2. Biopsy Needles (EUS-FNB)

10.4. Market Value Forecast, by Application, 2017–2031

10.4.1. Bronchial Needles

10.4.2. Enteral Needles

10.5. Market Value Forecast, by End-user, 2017–2031

10.5.1. Hospitals

10.5.2. Specialty Clinics

10.5.3. Ambulatory Surgery Centers

10.6. Market Value Forecast, by Country, 2017–2031

10.6.1. U.S.

10.6.2. Canada

10.7. Market Attractiveness Analysis

10.7.1. By Product

10.7.2. By Application

10.7.3. By End-user

10.7.4. By Country

11. Europe Endoscopic Ultrasound Needles Market Analysis and Forecast

11.1. Introduction

11.2. Key Findings

11.3. Market Value Forecast, by Product, 2017–2031

11.3.1. Aspiration Needles (EUS-FNA)

11.3.2. Biopsy Needles (EUS-FNB)

11.4. Market Value Forecast, by Application, 2017–2031

11.4.1. Bronchial Needles

11.4.2. Enteral Needles

11.5. Market Value Forecast, by End-user, 2017–2031

11.5.1. Hospitals

11.5.2. Specialty Clinics

11.5.3. Ambulatory Surgery Centers

11.6. Market Value Forecast, by Country/Sub-region, 2017–2031

11.6.1. Germany

11.6.2. U.K.

11.6.3. France

11.6.4. Italy

11.6.5. Spain

11.6.6. Rest of Europe

11.7. Market Attractiveness Analysis

11.7.1. By Product

11.7.2. By Application

11.7.3. By End-user

11.7.4. By Country/Sub-region

12. Asia Pacific Endoscopic Ultrasound Needles Market Analysis and Forecast

12.1. Introduction

12.2. Key Findings

12.3. Market Value Forecast, by Product, 2017–2031

12.3.1. Aspiration Needles (EUS-FNA)

12.3.2. Biopsy Needles (EUS-FNB)

12.4. Market Value Forecast, by Application, 2017–2031

12.4.1. Bronchial Needles

12.4.2. Enteral Needles

12.5. Market Value Forecast, by End-user, 2017–2031

12.5.1. Hospitals

12.5.2. Specialty Clinics

12.5.3. Ambulatory Surgery Centers

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. Australia & New Zealand

12.6.5. Rest of Asia Pacific

12.7. Market Attractiveness Analysis

12.7.1. By Product

12.7.2. By Application

12.7.3. By End-user

12.7.4. By Country/Sub-region

13. Latin America Endoscopic Ultrasound Needles Market Analysis and Forecast

13.1. Introduction

13.2. Key Findings

13.3. Market Value Forecast, by Product, 2017–2031

13.3.1. Aspiration Needles (EUS-FNA)

13.3.2. Biopsy Needles (EUS-FNB)

13.4. Market Value Forecast, by Application, 2017–2031

13.4.1. Bronchial Needles

13.4.2. Enteral Needles

13.5. Market Value Forecast, by End-user, 2017–2031

13.5.1. Hospitals

13.5.2. Specialty Clinics

13.5.3. Ambulatory Surgery Centers

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Mexico

13.6.3. Rest of Latin America

13.7. Market Attractiveness Analysis

13.7.1. By Product

13.7.2. By Application

13.7.3. By End-user

13.7.4. By Country/Sub-region

14. Middle East & Africa Endoscopic Ultrasound Needles Market Analysis and Forecast

14.1. Introduction

14.2. Key Findings

14.3. Market Value Forecast, by Product, 2017–2031

14.3.1. Aspiration Needles (EUS-FNA)

14.3.2. Biopsy Needles (EUS-FNB)

14.4. Market Value Forecast, by Application, 2017–2031

14.4.1. Bronchial Needles

14.4.2. Enteral Needles

14.5. Market Value Forecast, by End-user, 2017–2031

14.5.1. Hospitals

14.5.2. Specialty Clinics

14.5.3. Ambulatory Surgery Centers

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. GCC Countries

14.6.2. South Africa

14.6.3. Rest of Middle East & Africa

14.7. Market Attractiveness Analysis

14.7.1. By Product

14.7.2. By Application

14.7.3. By End-user

14.7.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competitive Matrix (by Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. Olympus Corporation

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. Medtronic

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. Cook Group

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.3.5. Strategic Overview

15.3.4. Boston Scientific Corporation

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. CONMED Corporation

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. Medi-Globe GmbH

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Financial Overview

15.3.6.5. Strategic Overview

15.3.7. ACE Medical Devices Pvt. Ltd.

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Financial Overview

15.3.7.5. Strategic Overview

List of Tables

Table 01: Global Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 07: North America Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 08: North America Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 11: Europe Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 12: Europe Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 13: Asia Pacific Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 15: Asia Pacific Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 16: Asia Pacific Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 17: Latin America Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 19: Latin America Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 20: Latin America Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Middle East & Africa Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by Product, 2017–2031

Table 23: Middle East & Africa Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by Application, 2017–2031

Table 24: Middle East & Africa Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Endoscopic Ultrasound Needles Market Size (US$ Mn) and Distribution (%), by Region, 2022 and 2031

Figure 02: Global Endoscopic Ultrasound Needles Market Revenue (US$ Mn), by Product, 2022

Figure 03: Global Endoscopic Ultrasound Needles Market Value Share, by Product, 2022

Figure 04: Global Endoscopic Ultrasound Needles Market Revenue (US$ Mn), by Application, 2022

Figure 05: Global Endoscopic Ultrasound Needles Market Value Share, by Application, 2022

Figure 06: Global Endoscopic Ultrasound Needles Market Revenue (US$ Mn), by End-user, 2022

Figure 07: Global Endoscopic Ultrasound Needles Market Value Share, by End-user, 2022

Figure 08: Global Endoscopic Ultrasound Needles Market Value Share, by Region, 2022

Figure 09: Global Endoscopic Ultrasound Needles Market Value (US$ Mn) Forecast, 2017–2031

Figure 10: Global Endoscopic Ultrasound Needles Market Value Share Analysis, by Product, 2022 and 2031

Figure 11: Global Endoscopic Ultrasound Needles Market Attractiveness Analysis, by Product, 2023-2031

Figure 12: Global Endoscopic Ultrasound Needles Market Value Share Analysis, by Application, 2022 and 2031

Figure 13: Global Endoscopic Ultrasound Needles Market Attractiveness Analysis, by Application, 2023-2031

Figure 14: Global Endoscopic Ultrasound Needles Market Value Share Analysis, by End-user, 2022 and 2031

Figure 15: Global Endoscopic Ultrasound Needles Market Attractiveness Analysis, by End-user, 2022-2031

Figure 16: Global Endoscopic Ultrasound Needles Market Value Share Analysis, by Region, 2022 and 2031

Figure 17: Global Endoscopic Ultrasound Needles Market Attractiveness Analysis, by Region, 2022-2031

Figure 18: North America Endoscopic Ultrasound Needles Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 19: North America Endoscopic Ultrasound Needles Market Attractiveness Analysis, by Country, 2023–2031

Figure 20: North America Endoscopic Ultrasound Needles Market Value Share Analysis, by Country, 2022 and 2031

Figure 21: North America Endoscopic Ultrasound Needles Market Value Share Analysis, by Product, 2022 and 2031

Figure 22: North America Endoscopic Ultrasound Needles Market Value Share Analysis, by Application, 2022 and 2031

Figure 23: North America Endoscopic Ultrasound Needles Market Value Share Analysis, by End-user, 2022 and 2031

Figure 24: North America Endoscopic Ultrasound Needles Market Attractiveness Analysis, by Product, 2023–2031

Figure 25: North America Endoscopic Ultrasound Needles Market Attractiveness Analysis, by Application, 2023–2031

Figure 26: North America Endoscopic Ultrasound Needles Market Attractiveness Analysis, by End-user, 2023–2031

Figure 27: Europe Endoscopic Ultrasound Needles Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 28: Europe Endoscopic Ultrasound Needles Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 29: Europe Endoscopic Ultrasound Needles Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 30: Europe Endoscopic Ultrasound Needles Market Value Share Analysis, by Product, 2022 and 2031

Figure 31: Europe Endoscopic Ultrasound Needles Market Value Share Analysis, by Application, 2022 and 2031

Figure 32: Europe Endoscopic Ultrasound Needles Market Value Share Analysis, by End-user, 2022 and 2031

Figure 33: Europe Endoscopic Ultrasound Needles Market Attractiveness Analysis, by Product, 2023–2031

Figure 34: Europe Endoscopic Ultrasound Needles Market Attractiveness Analysis, by Application, 2023–2031

Figure 35: Europe Endoscopic Ultrasound Needles Market Attractiveness Analysis, by End-user, 2023–2031

Figure 36: Asia Pacific Endoscopic Ultrasound Needles Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 37: Asia Pacific Endoscopic Ultrasound Needles Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 38: Asia Pacific Endoscopic Ultrasound Needles Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 39: Asia Pacific Endoscopic Ultrasound Needles Market Value Share Analysis, by Product, 2022 and 2031

Figure 40: Asia Pacific Endoscopic Ultrasound Needles Market Value Share Analysis, by Application, 2022 and 2031

Figure 41: Asia Pacific Endoscopic Ultrasound Needles Market Value Share Analysis, by End-user, 2022 and 2031

Figure 42: Asia Pacific Endoscopic Ultrasound Needles Market Attractiveness Analysis, by Product, 2023–2031

Figure 43: Asia Pacific Endoscopic Ultrasound Needles Market Attractiveness Analysis, by Application, 2023–2031

Figure 44: Asia Pacific Endoscopic Ultrasound Needles Market Attractiveness Analysis, by End-user, 2023–2031

Figure 45: Latin America Endoscopic Ultrasound Needles Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 46: Latin America Endoscopic Ultrasound Needles Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 47: Latin America Endoscopic Ultrasound Needles Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 48: Latin America Endoscopic Ultrasound Needles Market Value Share Analysis, by Product, 2022 and 2031

Figure 49: Latin America Endoscopic Ultrasound Needles Market Value Share Analysis, by Application, 2022 and 2031

Figure 50: Latin America Endoscopic Ultrasound Needles Market Value Share Analysis, by End-user, 2022 and 2031

Figure 51: Latin America Endoscopic Ultrasound Needles Market Attractiveness Analysis, by Product, 2023–2031

Figure 52: Latin America Endoscopic Ultrasound Needles Market Attractiveness Analysis, by Application, 2023–2031

Figure 53: Latin America Endoscopic Ultrasound Needles Market Attractiveness Analysis, by End-user, 2023–2031

Figure 54: Middle East & Africa Endoscopic Ultrasound Needles Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2017–2031

Figure 55: Middle East & Africa Endoscopic Ultrasound Needles Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 56: Middle East & Africa Endoscopic Ultrasound Needles Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 57: Middle East & Africa Endoscopic Ultrasound Needles Market Value Share Analysis, by Product, 2022 and 2031

Figure 58: Middle East & Africa Endoscopic Ultrasound Needles Market Value Share Analysis, by Application, 2022 and 2031

Figure 59: Middle East & Africa Endoscopic Ultrasound Needles Market Value Share Analysis, by End-user, 2022 and 2031

Figure 60: Middle East & Africa Endoscopic Ultrasound Needles Market Attractiveness Analysis, by Product, 2023–2031

Figure 61: Middle East & Africa Endoscopic Ultrasound Needles Market Attractiveness Analysis, by Application, 2023–2031

Figure 62: Middle East & Africa Endoscopic Ultrasound Needles Market Attractiveness Analysis, by End-user, 2023–2031