Reports

Reports

Analysts’ Viewpoint

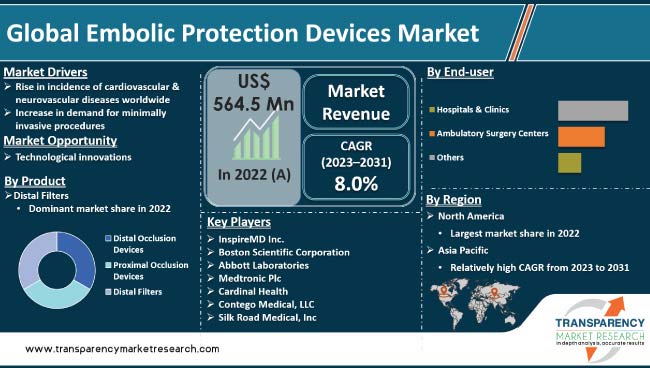

Increase in incidence of cardiovascular & neurovascular diseases across the world and rise in demand for minimally invasive procedures are the major factors driving the global embolic protection devices market. Embolic protection devices are useful in reducing the risk of complications during interventional procedures including angioplasty. Educational initiatives, training programs, and conferences focused on interventional cardiology and neurology have helped disseminate knowledge about the importance of embolic protection devices in preventing complications and improving patient outcomes.

Technological advancements in embolic protection devices have significantly improved their efficacy and safety profiles. Leading manufacturers in the embolic protection devices industry are developing safe, efficient, and innovative devices as well as next-generation devices with enhanced features, such as improved retrieval systems, better filter designs, and advanced imaging capabilities.

Embolic protection device (EPD) has emerged as a significant advancement in interventional cardiology and vascular procedures. Embolic protection devices are specifically designed to minimize the risk of embolization, a condition where debris or clots break loose from a treatment site and travel through the bloodstream, potentially causing blockages and complications in vital organs.

Introduction of embolic protection devices has revolutionized the field of cardiovascular interventions, particularly in complex procedures such as carotid artery stenting and transcatheter aortic valve replacement (TAVR).

These procedures involve the manipulation of diseased vessels and carry a risk of dislodging plaque or debris, leading to embolic events. EPDs provide a valuable solution by capturing and containing these embolic materials, thereby reducing the risk of embolization and related complications.

EPDs typically consist of a filter-based system that is deployed distal to the treatment site. These filters act as a mechanical barrier, catching embolic debris while allowing the passage of blood. After the intervention is completed, the EPD is retrieved, ensuring the captured material is safely removed from the patient's circulation.

Advancements in technology have made embolic protection devices more efficient and user-friendly. Newer devices offer enhanced capture capabilities, ensuring a higher success rate in capturing embolic debris. Moreover, rise in awareness among healthcare professionals about the importance of embolic protection is contributing to the increased demand for these devices.

Cardiovascular & neurovascular diseases are the leading causes of disability and mortality across the globe. Factors such as sedentary lifestyles, poor dietary habits, smoking, and aging population have contributed to rise in prevalence of these conditions. Hence, there is a growing need for advanced medical devices and treatments to address these health issues.

Embolic protection devices are designed to prevent emboli, which are blood clots or other foreign bodies, from traveling to critical organs such as the heart or brain during certain medical procedures. Embolic protection devices act as a barrier, capturing and removing these particles before they can cause damage or block blood flow in vital arteries.

Demand for embolic protection devices is rising due to increase in number of cardiovascular & neurovascular interventions, such as stenting and angioplasty. These procedures carry a risk of dislodging plaque or thrombi, leading to potential stroke or heart attack. By using embolic protection devices, physicians can minimize the risk of such complications, improving patient outcomes.

As technology continues to evolve, embolic protection devices are expected to play an increasingly vital role in cardiovascular interventions, offering enhanced safety, expanded treatment options, and improved patient outcomes.

Minimally invasive procedures offer several advantages over traditional open surgeries, including smaller incisions, reduced pain & scarring, shorter hospital stay, and faster recovery. Hence, more patients and healthcare providers are opting for these procedures across various medical specialties.

People are increasingly seeking alternatives to invasive surgeries that require large incisions and longer recovery period. Minimally invasive procedures offer them the opportunity to undergo treatments with fewer complications, minimal disruption to their daily lives, and quicker return to normal activities. This has fueled the adoption of minimally invasive procedures, which, in turn, is propelling demand for embolic protection devices.

Embolic protection devices play a crucial role in ensuring the safety and effectiveness of minimally invasive procedures. These devices are used during interventions such as transcatheter aortic valve replacement (TAVR), carotid artery stenting, and endovascular aneurysm repair (EVAR), where the risk of embolic events is higher.

By using embolic protection devices, physicians can minimize the risk of emboli dislodgment and subsequent complications, making these procedures safer and more successful. Hence, demand for embolic protection devices is rising significantly with the increase in adoption of minimally invasive procedures.

Manufacturers are developing more advanced and efficient embolic protection devices to meet the growing market needs. Technological advancements are expected to propel the embolic protection devices market progress during the forecast period.

In terms of product, the distal filters segment accounted for the largest global embolic protection devices market share in 2022. This segment is projected to lead the global market during the forecast period.

Distal filters have been widely adopted in various interventional procedures, including percutaneous coronary intervention (PCI) and carotid artery stenting. These devices are designed to capture and prevent embolic debris from reaching distal vessels, thereby reducing the risk of complications such as stroke or organ damage.

High prevalence of cardiovascular diseases, particularly coronary artery disease and carotid artery stenosis, has led to substantial demand for distal filter devices in these specific procedures. Product innovations have further propelled the growth of this segment.

Based on indication, the cardiovascular diseases segment dominated the global market in 2022. Cardiovascular diseases, including coronary artery disease and peripheral artery disease, are among the leading causes of morbidity and mortality worldwide. These conditions often require interventional procedures such as percutaneous coronary intervention (PCI) and angioplasty to restore blood flow to the affected vessels.

During these procedures, embolic protection devices play a crucial role in preventing the release of embolic debris, such as blood clots or plaque fragments, into the bloodstream. By capturing and removing these emboli, these devices help reduce the risk of complications such as myocardial infarction, stroke, or distal vessel occlusion.

The cardiovascular system is highly susceptible to embolic events. The heart and major blood vessels are intricately interconnected, making them vulnerable to embolization from various sources, including dislodged plaque, thrombi, or foreign material. Usage of embolic protection devices provides an added layer of safety by acting as a barrier and preventing embolic debris from reaching critical vessels or organs.

Development of advanced embolic protection devices specifically tailored for cardiovascular procedures has further reinforced their predominant use in this field. These devices are designed to be compatible with the anatomy and physiology of the cardiovascular system, providing optimal protection and ease of use during interventions.

Extensive research and clinical evidence supporting the efficacy and safety of embolic protection devices in cardiovascular procedures have contributed to their widespread adoption.

Based on end-user, the hospitals & clinics segment is projected to account for major share of the global market in the next few years.

Hospitals and clinics are equipped with specialized catheterization laboratories and operating rooms where various cardiovascular and neurovascular interventions are performed. Embolic protection devices are primarily used in these procedures; hence, hospitals & clinics naturally become the primary consumers of these devices.

Large number of patients undergoing interventional procedures for cardiovascular diseases, peripheral artery diseases, and other conditions in hospitals & clinics contributes to the substantial embolic protection devices market demand.

Hospitals and clinics tend to have comprehensive cardiac and vascular care departments, housing specialized healthcare professionals who are familiar with these devices.

Hospitals often have access to the necessary infrastructure and resources to procure and stock medical devices, including embolic protection devices. Hospitals establish relationships with manufacturers and distributors for a steady supply of these devices. The institutional purchasing power of hospitals & clinics allows them to negotiate favorable pricing and procurement contracts, further consolidating their position as major consumers in the market.

According to the latest embolic protection devices market forecast, North America is projected to account for major share of the global industry during the forecast period. The U.S. is the largest contributor to market revenue in the region.

Rise in incidence of cardiovascular & neurovascular diseases and presence of prominent manufacturers are contributing to embolic protection devices market growth in the region.

The embolic protection devices market size in Asia Pacific is projected to be propelled by high prevalence of CVDs and emergence of local companies. Multiple strategic initiatives implemented by innovative companies are anticipated to bolster market expansion in Asia Pacific in the near future.

The latest embolic protection devices market research report provides profiles of leading players operating in the global industry.

InspireMD, Inc., Boston Scientific Corporation, Abbott Laboratories, Medtronic plc, Cardinal Health, Contego Medical, LLC, Silk Road Medical, Inc., Edwards Lifesciences Corporation, and Lepu Medical Technology are the prominent players operating in the global market.

These players are focusing on merger & acquisition, strategic collaborations, and new product launches to expand presence and gain lucrative embolic protection devices industry share. Moreover, these players are following the embolic protection devices market trends to gain revenue benefits.

Each of these players has been profiled in the embolic protection devices market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 564.5 Mn |

|

Forecast (Value) in 2031 |

More than US$ 1.1 Bn |

|

Growth Rate (CAGR) |

8.0% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Mn/Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 564.5 Mn in 2022

It is projected to reach more than US$ 1.1 Bn by 2031

It is expected to advance at a CAGR of 8.0% from 2023 to 2031

The distal filters product segment accounted for the largest share in 2022

North America is the more lucrative region

InspireMD, Inc., Boston Scientific Corporation, Abbott Laboratories, Medtronic plc, Cardinal Health, Contego Medical, LLC, Silk Road Medical, Inc., Edwards Lifesciences Corporation, and Lepu Medical Technology are the prominent players in the market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Embolic Protection Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Embolic Protection Devices Market Analysis and Forecast, 2020-2031

5. Key Insights

5.1. Technological Advancements

5.2. Disease Prevalence & Incidence Rate Globally With Key Countries

5.3. Regulatory Scenario by Region/Globally

5.4. COVID-19 Impact Analysis

6. Global Embolic Protection Devices Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Product, 2020-2031

6.3.1. Distal Occlusion Devices

6.3.2. Proximal Occlusion Devices

6.3.3. Distal Filters

6.4. Market Attractiveness Analysis, by Product

7. Global Embolic Protection Devices Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2020-2031

7.3.1. Cardiovascular Diseases

7.3.2. Neurovascular Diseases

7.3.3. Peripheral Vascular Diseases

7.4. Market Attractiveness Analysis, by Application

8. Global Embolic Protection Devices Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2020-2031

8.3.1. Hospitals & Clinics

8.3.2. Ambulatory Surgery Centers

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Embolic Protection Devices Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2020-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America (LATAM)

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Embolic Protection Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2020-2031

10.2.1. Distal Occlusion Devices

10.2.2. Proximal Occlusion Devices

10.2.3. Distal Filters

10.3. Market Value Forecast, by Application, 2020-2031

10.3.1. Cardiovascular Diseases

10.3.2. Neurovascular Diseases

10.3.3. Peripheral Vascular Diseases

10.4. Market Value Forecast, by End-user, 2020-2031

10.4.1. Hospitals & Clinics

10.4.2. Ambulatory Surgery Centers

10.4.3. Others

10.5. Market Value Forecast, by Country, 2020-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Embolic Protection Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2020-2031

11.2.1. Distal Occlusion Devices

11.2.2. Proximal Occlusion Devices

11.2.3. Distal Filters

11.3. Market Value Forecast, by Application, 2020-2031

11.3.1. Cardiovascular Diseases

11.3.2. Neurovascular Diseases

11.3.3. Peripheral Vascular Diseases

11.4. Market Value Forecast, by End-user, 2020-2031

11.4.1. Hospitals & Clinics

11.4.2. Ambulatory Surgery Centers

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2020-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Embolic Protection Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2020-2031

12.2.1. Distal Occlusion Devices

12.2.2. Proximal Occlusion Devices

12.2.3. Distal Filters

12.3. Market Value Forecast, by Application, 2020-2031

12.3.1. Cardiovascular Diseases

12.3.2. Neurovascular Diseases

12.3.3. Peripheral Vascular Diseases

12.4. Market Value Forecast, by End-user, 2020-2031

12.4.1. Hospitals & Clinics

12.4.2. Ambulatory Surgery Centers

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2020-2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America (LATAM) Embolic Protection Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2020-2031

13.2.1. Distal Occlusion Devices

13.2.2. Proximal Occlusion Devices

13.2.3. Distal Filters

13.3. Market Value Forecast, by Application, 2020-2031

13.3.1. Cardiovascular Diseases

13.3.2. Neurovascular Diseases

13.3.3. Peripheral Vascular Diseases

13.4. Market Value Forecast, by End-user, 2020-2031

13.4.1. Hospitals & Clinics

13.4.2. Ambulatory Surgery Centers

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2020-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of LATAM

13.6. Market Attractiveness Analysis

13.6.1. By Product

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Embolic Protection Devices Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product, 2020-2031

14.2.1. Distal Occlusion Devices

14.2.2. Proximal Occlusion Devices

14.2.3. Distal Filters

14.3. Market Value Forecast, by Application, 2020-2031

14.3.1. Cardiovascular Diseases

14.3.2. Neurovascular Diseases

14.3.3. Peripheral Vascular Diseases

14.4. Market Value Forecast, by End-user, 2020-2031

14.4.1. Hospitals & Clinics

14.4.2. Ambulatory Surgery Centers

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2020-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of MEA

14.6. Market Attractiveness Analysis

14.6.1. By Product

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competitive Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. InspireMD, Inc.

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Financial Overview

15.3.1.5. Strategic Overview

15.3.2. Boston Scientific Corporation

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Financial Overview

15.3.2.5. Strategic Overview

15.3.3. Abbott Laboratories

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Financial Overview

15.3.3.5. Strategic Overview

15.3.4. Medtronic plc

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Financial Overview

15.3.4.5. Strategic Overview

15.3.5. Cardinal Health

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Financial Overview

15.3.5.5. Strategic Overview

15.3.6. Contego Medical, LLC

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Financial Overview

15.3.6.5. Strategic Overview

15.3.7. Silk Road Medical, Inc.

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Financial Overview

15.3.7.5. Strategic Overview

15.3.8. Edwards Lifesciences Corporation

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Financial Overview

15.3.8.5. Strategic Overview

15.3.9. Lepu Medical Technology

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. SWOT Analysis

15.3.9.4. Financial Overview

15.3.9.5. Strategic Overview

List of Tables

Table 01: Global Embolic Protection Devices Market Size (US$ Mn) Forecast, by Product, 2020-2031

Table 02: Global Embolic Protection Devices Market Size (US$ Mn) Forecast, by Application, 2020-2031

Table 03: Global Embolic Protection Devices Market Size (US$ Mn) Forecast, by End-user, 2020-2031

Table 04: Global Embolic Protection Devices Market Size (US$ Mn) Forecast, by Region, 2020-2031

Table 05: North America Embolic Protection Devices Market Size (US$ Mn) Forecast, by Country, 2020-2031

Table 06: North America Embolic Protection Devices Market Size (US$ Mn) Forecast, by Product, 2020-2031

Table 07: North America Embolic Protection Devices Market Size (US$ Mn) Forecast, by Application, 2020-2031

Table 08: North America Embolic Protection Devices Market Size (US$ Mn) Forecast, by End-user, 2020-2031

Table 09: Europe Embolic Protection Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2020-2031

Table 10: Europe Embolic Protection Devices Market Size (US$ Mn) Forecast, by Product, 2020-2031

Table 11: Europe Embolic Protection Devices Market Size (US$ Mn) Forecast, by Application, 2020-2031

Table 12: Europe Embolic Protection Devices Market Size (US$ Mn) Forecast, by End-user, 2020-2031

Table 13: Asia Pacific Embolic Protection Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2020-2031

Table 14: Asia Pacific Embolic Protection Devices Market Size (US$ Mn) Forecast, by Product, 2020-2031

Table 15: Asia Pacific Embolic Protection Devices Market Size (US$ Mn) Forecast, by Application, 2020-2031

Table 16: Asia Pacific Embolic Protection Devices Market Size (US$ Mn) Forecast, by End-user, 2020-2031

Table 17: Latin America Embolic Protection Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2020-2031

Table 18: Latin America Embolic Protection Devices Market Size (US$ Mn) Forecast, by Product, 2020-2031

Table 19: Latin America Embolic Protection Devices Market Size (US$ Mn) Forecast, by Application, 2020-2031

Table 20: Latin America Embolic Protection Devices Market Size (US$ Mn) Forecast, by End-user, 2020-2031

Table 21: Middle East & Africa Embolic Protection Devices Market Size (US$ Mn) Forecast, by Country/Sub-region, 2020-2031

Table 22: Middle East & Africa Embolic Protection Devices Market Size (US$ Mn) Forecast, by Product, 2020-2031

Table 23: Middle East & Africa Embolic Protection Devices Market Size (US$ Mn) Forecast, by Application, 2020-2031

Table 24: Middle East & Africa Embolic Protection Devices Market Size (US$ Mn) Forecast, by End-user, 2020-2031

List of Figures

Figure 01: Global Embolic Protection Devices Market Size (US$ Mn) and Distribution (%), by Region, 2021 and 2031

Figure 02: Global Embolic Protection Devices Market Revenue (US$ Mn), by Product, 2021

Figure 03: Global Embolic Protection Devices Market Value Share, by Product, 2021

Figure 04: Global Embolic Protection Devices Market Revenue (US$ Mn), by Application, 2021

Figure 05: Global Embolic Protection Devices Market Value Share, by Application, 2021

Figure 06: Global Embolic Protection Devices Market Revenue (US$ Mn), by End-user, 2021

Figure 07: Global Embolic Protection Devices Market Value Share, by End-user, 2021

Figure 08: Global Embolic Protection Devices Market Value Share, by Region, 2021

Figure 09: Global Embolic Protection Devices Market Value (US$ Mn) Forecast, 2020-2031

Figure 10: Global Embolic Protection Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 11: Global Embolic Protection Devices Market Attractiveness Analysis, by Product, 2022-2031

Figure 12: Global Embolic Protection Devices Market Value Share Analysis, by Application, 2021 and 2031

Figure 13: Global Embolic Protection Devices Market Attractiveness Analysis, by Application, 2022-2031

Figure 14: Global Embolic Protection Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 15: Global Embolic Protection Devices Market Attractiveness Analysis, by End-user, 2022-2031

Figure 16: Global Embolic Protection Devices Market Value Share Analysis, by Region, 2021 and 2031

Figure 17: Global Embolic Protection Devices Market Attractiveness Analysis, by Region, 2022-2031

Figure 18: North America Embolic Protection Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2020-2031

Figure 19: North America Embolic Protection Devices Market Attractiveness Analysis, by Country, 2020-2031

Figure 20: North America Embolic Protection Devices Market Value Share Analysis, by Country, 2021 and 2031

Figure 21: North America Embolic Protection Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 22: North America Embolic Protection Devices Market Value Share Analysis, by Application, 2021 and 2031

Figure 23: North America Embolic Protection Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 24: North America Embolic Protection Devices Market Attractiveness Analysis, by Product, 2022-2031

Figure 25: North America Embolic Protection Devices Market Attractiveness Analysis, by Application, 2022-2031

Figure 26: North America Embolic Protection Devices Market Attractiveness Analysis, by End-user, 2022-2031

Figure 27: Europe Embolic Protection Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2020-2031

Figure 28: Europe Embolic Protection Devices Market Attractiveness Analysis, by Country/Sub-region, 2020-2031

Figure 29: Europe Embolic Protection Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 30: Europe Embolic Protection Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 31: Europe Embolic Protection Devices Market Value Share Analysis, by Application, 2021 and 2031

Figure 32: Europe Embolic Protection Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 33: Europe Embolic Protection Devices Market Attractiveness Analysis, by Product, 2022-2031

Figure 34: Europe Embolic Protection Devices Market Attractiveness Analysis, by Application, 2022-2031

Figure 35: Europe Embolic Protection Devices Market Attractiveness Analysis, by End-user, 2022-2031

Figure 36: Asia Pacific Embolic Protection Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2020-2031

Figure 37: Asia Pacific Embolic Protection Devices Market Attractiveness Analysis, by Country/Sub-region, 2020-2031

Figure 38: Asia Pacific Embolic Protection Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 39: Asia Pacific Embolic Protection Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 40: Asia Pacific Embolic Protection Devices Market Value Share Analysis, by Application, 2021 and 2031

Figure 41: Asia Pacific Embolic Protection Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 42: Asia Pacific Embolic Protection Devices Market Attractiveness Analysis, by Product, 2022-2031

Figure 43: Asia Pacific Embolic Protection Devices Market Attractiveness Analysis, by Application, 2022-2031

Figure 44: Asia Pacific Embolic Protection Devices Market Attractiveness Analysis, by End-user, 2022-2031

Figure 45: Latin America Embolic Protection Devices Market Value (US$ Mn) Forecast and Y-o-Y Growth (%), 2020-2031

Figure 46: Latin America Embolic Protection Devices Market Attractiveness Analysis, by Country/Sub-region, 2020-2031

Figure 47: Latin America Embolic Protection Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 48: Latin America Embolic Protection Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 49: Latin America Embolic Protection Devices Market Value Share Analysis, by Application, 2021 and 2031

Figure 50: Latin America Embolic Protection Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 51: Latin America Embolic Protection Devices Market Attractiveness Analysis, by Product, 2022-2031

Figure 52: Latin America Embolic Protection Devices Market Attractiveness Analysis, by Application, 2022-2031

Figure 53: Latin America Embolic Protection Devices Market Attractiveness Analysis, by End-user, 2022-2031

Figure 54: Middle East & Africa Embolic Protection Devices Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2020-2031

Figure 55: Middle East & Africa Embolic Protection Devices Market Attractiveness Analysis, by Country/Sub-region, 2020-2031

Figure 56: Middle East & Africa Embolic Protection Devices Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 57: Middle East & Africa Embolic Protection Devices Market Value Share Analysis, by Product, 2021 and 2031

Figure 58: Middle East & Africa Embolic Protection Devices Market Value Share Analysis, by Application, 2021 and 2031

Figure 59: Middle East & Africa Embolic Protection Devices Market Value Share Analysis, by End-user, 2021 and 2031

Figure 60: Middle East & Africa Embolic Protection Devices Market Attractiveness Analysis, by Product, 2022-2031

Figure 61: Middle East & Africa Embolic Protection Devices Market Attractiveness Analysis, by Application, 2022-2031

Figure 62: Middle East & Africa Embolic Protection Devices Market Attractiveness Analysis, by End-user, 2022-2031