Reports

Reports

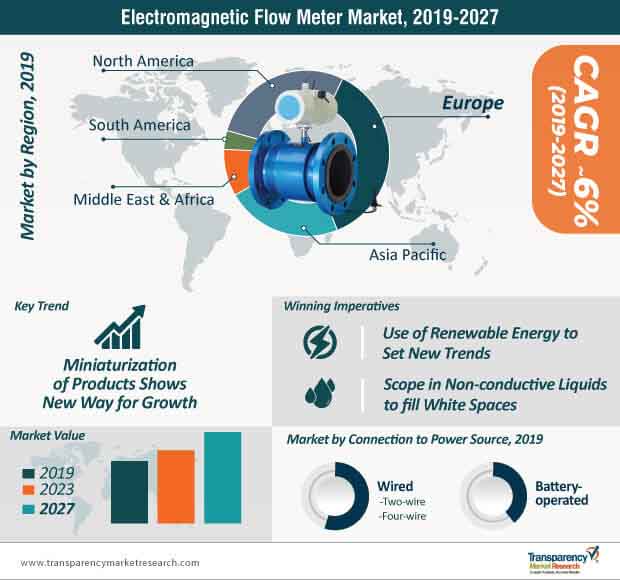

Commonly known as magmeters, electromagnetic flow meters are at the forefront of miniaturization of both, electronics and sensors. The need for achieving improved performance and high geometrical stability with electromagnetic flow meter diagnostics is behind this change in the size of flow meters, altogether. With the increasing adoption of compact electronic circuits in various industrial applications, the emerging trend of miniaturization is expected to have a significant influence on the factors shaping the future of the electromagnetic flow meter market in the coming years.

Prior to this, the expanse of the flow meter industry mostly remained stagnant. It simply involved the trends of expansion and updates & refinements of the existing technology. The imminent adoption of smart technology is another major trend that the electromagnetic flow meter industry is banking on, which will enable improved access, communication, and, in the near-future, improved displays attached to electromagnetic flow meters.

In terms of construction, electromagnetic flow meters are flanged and are available with a choice of liner and electrode material. Featuring this, electromagnetic flow meters are free of obstructions in the pipe, thereby expanding scope of the types of liquids that can be measured for their volumetric flow.

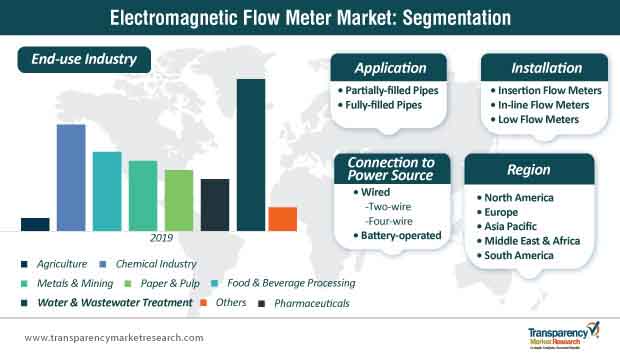

Resultantly, industrial applications of electromagnetic flow meters are extensive. For example, measure of the volumetric flow of juices, milk, and industrial water are some applications where electromagnetic flow meters are used in the food industry. This mostly involves clean and conductive liquids. Besides this, electromagnetic flow meters are used for liquids with suspended particles. This includes sewage, chemicals, wastewater, and slurries, which has expanded the range of industrial applications for electromagnetic flow meters.

With such industrial applications, the growth of electromagnetic flow meter market is predicted to be notable in the coming years. Sensing opportunities in this space, Transparency Market Research (TMR) recently published a study on the growth of the electromagnetic flow meter market, which opines that, the market will reach a valuation of ~US$ 1.4 billion in 2019, and will expand at a notable ~6% CAGR during the forecast period of 2019 and 2027.

Owing to their design and operational features, the scope of applications of electromagnetic flow meters is also vast, including in the water and wastewater treatment, chemical, and agriculture industries, to name a few. Among the key applications, water and wastewater treatment is expected to continue to hold a leading share in the electromagnetic flow meter market in the near term.

Vis-à-vis revenue, the water and wastewater treatment industry accounts for ~one-fourth revenue share of the electromagnetic flow meter market, and its share will continue to rise at a remarkable CAGR over the forecast period. Technological advances in processes of water and wastewater treatment plants are also surging the adoption of electromagnetic flow meters, so much so, that electromagnetic flow meters are now an integral part of process control systems in wastewater treatment plants.

In addition to this, chemicals, pharma, pulp and paper, and food and beverages are some other industrial areas where electromagnetic flow meters find use for industrial control processes. This is because most of these industrial sectors need to measure the flow of liquids in the presence of high levels of solids. This is not easily attained by most flow methodologies.

Whilst the undercurrents for the measuring of conductive liquids are solid in the electromagnetic flow meter market, there lies vast scope for the measuring of hydrocarbons, distilled water, and non-aqueous solutions for industrial applications. Besides this, the electromagnetic flow meters available are mostly unsuitable for the measuring of compressed liquids, which leaves an immense white space for market players to capitalize on.

Variations in terms of harnessing the capability and results of electromagnetic flow meters further provides ample opportunities for participants in the electromagnetic flow meter market. These variations are due to the type of fluid being measured, corrosive or non-corrosive nature of liquids, and whether the liquid being measured is clean or contaminated.

To address this, the scope for the introduction of innovative electromagnetic flow meters is enormous. R&D efforts leading to product innovation can translate into notable gains for participants in the electromagnetic flow meter market. In addition, Europe will remain the prime revenue pocket for stakeholders, with ~one-third revenue share of the global market for electromagnetic flow meters. The introduction of innovative products with added capabilities for various biopharmaceutical applications is a key reason behind this. However, Asia Pacific is predicted to register a higher growth rate over the forecast period.

Meanwhile, factors such as the placement of flow meters hamper their performance as well. Proximity to mechanical pumps, valve, and other obstructions, as well as the unstable flow of liquids can impact the performance of electromagnetic flow meters.

Innovation in energy sources for electromagnetic flow meters is another key growth space for players in the electromagnetic flow meter market. Currently, electromagnetic flow meters are wired or powered conventionally. With the rise of renewable energy sources and the emergence of efficient batteries, battery-operated electromagnetic flow meters are increasingly gaining adoption for most industrial applications.

In this quest, the introduction of solar-powered electromagnetic flow meters is what the entire flow meter industry is turning its ear toward. Solar-powered devices that are backed by battery transmitters are deemed to be extensively suitable for remote areas that do not have field electric supply. Solar-powered flow meters are best used for the display and output of flow measurement at these locations.

The scope of innovation of electromagnetic flow meters for wastewater treatment remains compelling. Initiatives undertaken by government agencies, scientific bodies, and industrial organizations for comprehensive and effective tools and policy mechanism lay strong foundation for sustainable programs for wastewater management woes. This widens the expanse for the requirement of electromagnetic flow meters.

Electromagnetic Flow Meter Market – Competitive Landscape

From a competitive perspective, the electromagnetic flow meter market is mostly consolidated. Top five players, namely, ABB Ltd., Siemens AG, Yogokawa Electric Corp, Toshiba Corporation, and General Electric Co., hold ~60% of the overall electromagnetic flow meter market share.

However, the emergence of new players is changing the competitive dynamics in this market. Innovative products offered by emerging players that supersede predecessor products in terms of technology, abrasion and corrosion resistance, and outstanding electrical insulation provide exceptionally reliable and durable flow measurement solutions.

Design modifications introduced by savvy players consolidate their position in the electromagnetic flow meter market. This enables the easy installation of magnetic flow meters across a wide range of applications and varying pipe sizes, which paves the way for an expanded share of these players. Such moves are likely to spawn new ambits of growth for participants in the electromagnetic flow meter market in the coming future.

Moving Parts and Maintenance-free Design: A Key Driver

Increasing Need for Electromagnetic Flow Meters in Wastewater Treatment

The salinity of freshwater bodies has been increasing, which, in turn, is boosting the demand for seawater desalination projects. This would require various types of flow meters. The demand for clean and safe water in various manufacturing and processing industries, such as power & energy and pharmaceutical, is increasing.

Non-compatibility with Non-conductive Liquids a Major Challenge

Electromagnetic flow meters generally do not work with hydrocarbons, distilled water, and several non-aqueous solutions. Electromagnetic flow meters cannot be used in cases wherein the flow of compressible fluids (gases) needs to be determined. This factor is restraining the electromagnetic flow meter market.

Electromagnetic Flow Meter Market: Competition Landscape

Electromagnetic Flow Meter Market: Key Developments

Key manufacturers operating in the global electromagnetic flow meter market, such as General Electric Co. and Endress+Hauser Management AG, are strengthening their overseas sales structure by increasing their production capacities. Some other key developments in the global electromagnetic flow meter market are as follows:

In the report on the global electromagnetic flow meter market, we have discussed individual strategies, followed by company profiles of manufacturers of electromagnetic flow meters. The ‘Competition Landscape’ section has been included in the global electromagnetic flow meter market report to provide readers with a dashboard view and company market share analysis of key players operating in the global electromagnetic flow meter market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Electromagnetic Flow Meter Market

4. Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Key Trend Analysis

4.4. Key Market Indicators

4.5. Global Electromagnetic Flow Meter Market Analysis and Forecast, 2017–2027

4.5.1. Market Revenue Projection (US$ Mn)

4.5.2. Market Volume Projection (Million Units)

4.5.3. Price Trend Analysis

4.6. Porter’s Five Forces Analysis - Global Electromagnetic Flow Meter Market

4.7. Value Chain Analysis - Global Electromagnetic Flow Meter Market

4.8. Market Outlook

5. Global Electromagnetic Flow Meter Market Analysis and Forecast, by Connection to Power Source

5.1. Overview & Definitions

5.2. Global Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Connection to Power Source, 2017–2027

5.2.1. Wired

5.2.1.1. Two-wire

5.2.1.2. Four-wire

5.2.2. Battery-operated

5.3. Connection to Power Source Comparison Matrix

5.4. Global Electromagnetic Flow Meter Market Attractiveness, by Connection to Power Source

6. Global Electromagnetic Flow Meter Market Analysis and Forecast, by Installation

6.1. Overview & Definitions

6.2. Global Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Installation, 2017–2027

6.2.1. Insertion Flow Meters

6.2.2. Low Flow Meters

6.2.3. In-line Flow Meters

6.3. Installation Comparison Matrix

6.4. Global Electromagnetic Flow Meter Market Attractiveness, by Installation

7. Global Electromagnetic Flow Meter Market Analysis and Forecast, by Application

7.1. Overview & Definitions

7.2. Global Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Application, 2017–2027

7.2.1. Partially-filled Pipes

7.2.2. Fully-filled Pipes

7.3. Application Comparison Matrix

7.4. Global Electromagnetic Flow Meter Market Attractiveness, by Application

8. Global Electromagnetic Flow Meter Market Analysis and Forecast, by End-use Industry

8.1. Overview & Definitions

8.2. Key Trends

8.3. Global Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by End-use Industry, 2017–2027

8.3.1. Agriculture

8.3.2. Chemicals

8.3.3. Food & Beverages

8.3.4. Metals & Mining

8.3.5. Paper & Pulp

8.3.6. Pharmaceuticals

8.3.7. Water & Wastewater Treatment

8.3.8. Others

8.4. End-use Industry Comparison Matrix

8.5. Global Electromagnetic Flow Meter Market Attractiveness, by End-use Industry

9. Global Electromagnetic Flow Meter Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Global Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Region, 2017–2027

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

9.3. Global Electromagnetic Flow Meter Market Attractiveness, by Region

10. North America Electromagnetic Flow Meter Market Analysis and Forecast

10.1. Key Findings

10.2. Key Trends

10.3. North America Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Connection to Power Source, 2017–2027

10.3.1. Wired

10.3.1.1. Two-wire

10.3.1.2. Four-wire

10.3.2. Battery-operated

10.4. North America Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Installation, 2017–2027

10.4.1. Insertion Flow Meters

10.4.2. Low Flow Meters

10.4.3. In-line Flow Meters

10.5. North America Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Application, 2017–2027

10.5.1. Partially-filled Pipes

10.5.2. Fully-filled Pipes

10.6. North America Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by End-use Industry, 2017–2027

10.6.1. Agriculture

10.6.2. Chemicals

10.6.3. Food & Beverages

10.6.4. Metals & Mining

10.6.5. Paper & Pulp

10.6.6. Pharmaceuticals

10.6.7. Water & Wastewater Treatment

10.6.8. Others

10.7. North America Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Country/Sub-region, 2017–2027

10.7.1. The U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. North America Electromagnetic Flow Meter Market Attractiveness Analysis

10.8.1. By Connection to Power Source

10.8.2. By Installation

10.8.3. By Application

10.8.4. By End-use Industry

10.8.5. By Country/Sub-region

11. Europe Electromagnetic Flow Meter Market Analysis and Forecast

11.1. Key Findings

11.2. Key Trends

11.3. Europe Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Connection to Power Source, 2017–2027

11.3.1. Wired

11.3.1.1. Two-wire

11.3.1.2. Four-wire

11.3.2. Battery-operated

11.4. Europe Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Installation, 2017–2027

11.4.1. Insertion Flow Meters

11.4.2. Low Flow Meters

11.4.3. In-line Flow Meters

11.5. Europe Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Application, 2017–2027

11.5.1. Partially-filled Pipes

11.5.2. Fully-filled Pipes

11.6. Europe Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by End-use Industry, 2017–2027

11.6.1. Agriculture

11.6.2. Chemicals

11.6.3. Food & Beverages

11.6.4. Metals & Mining

11.6.5. Paper & Pulp

11.6.6. Pharmaceuticals

11.6.7. Water & Wastewater Treatment

11.6.8. Others

11.7. Europe Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Country/Sub-region, 2017–2027

11.7.1. Germany

11.7.2. France

11.7.3. U.K.

11.7.4. Rest of Europe

11.8. Europe Electromagnetic Flow Meter Market Attractiveness Analysis

11.8.1. By Connection to Power Source

11.8.2. By Installation

11.8.3. By Application

11.8.4. By End-use Industry

11.8.5. By Country/Sub-region

12. Asia Pacific Electromagnetic Flow Meter Market Analysis and Forecast

12.1. Key Findings

12.2. Key Trends

12.3. Asia Pacific Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Connection to Power Source, 2017–2027

12.3.1. Wired

12.3.1.1. Two-wire

12.3.1.2. Four-wire

12.3.2. Battery-operated

12.4. Asia Pacific Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Installation, 2017–2027

12.4.1. Insertion Flow Meters

12.4.2. Low Flow Meters

12.4.3. In-line Flow Meters

12.5. Asia Pacific Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Application, 2017–2027

12.5.1. Partially-filled Pipes

12.5.2. Fully-filled Pipes

12.6. Asia Pacific Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by End-use Industry, 2017–2027

12.6.1. Agriculture

12.6.2. Chemicals

12.6.3. Food & Beverages

12.6.4. Metals & Mining

12.6.5. Paper & Pulp

12.6.6. Pharmaceuticals

12.6.7. Water & Wastewater Treatment

12.6.8. Others

12.7. Asia Pacific Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Country/Sub-region, 2017–2027

12.7.1. China

12.7.2. Japan

12.7.3. India

12.7.4. Rest of Asia Pacific

12.8. Asia Pacific Electromagnetic Flow Meter Market Attractiveness Analysis

12.8.1. By Connection to Power Source

12.8.2. By Installation

12.8.3. By Application

12.8.4. By End-use Industry

12.8.5. By Country/Sub-region

13. Middle East & Africa (MEA) Electromagnetic Flow Meter Market Analysis and Forecast

13.1. Key Findings

13.2. Key Trends

13.3. Price Trend Analysis

13.4. Middle East & Africa Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Connection to Power Source, 2017–2027

13.4.1. Wired

13.4.1.1. Two-wire

13.4.1.2. Four-wire

13.4.2. Battery-operated

13.5. Middle East & Africa Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Installation, 2017–2027

13.5.1. Insertion Flow Meters

13.5.2. Low Flow Meters

13.5.3. In-line Flow Meters

13.6. Middle East & Africa Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Application, 2017–2027

13.6.1. Partially-filled Pipes

13.6.2. Fully-filled Pipes

13.7. Middle East & Africa Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by End-use Industry, 2017–2027

13.7.1. Agriculture

13.7.2. Chemicals

13.7.3. Food & Beverages

13.7.4. Metals & Mining

13.7.5. Paper & Pulp

13.7.6. Pharmaceuticals

13.7.7. Water & Wastewater Treatment

13.7.8. Others

13.8. Middle East & Africa Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Country/Sub-region, 2017–2027

13.8.1. GCC

13.8.2. South Africa

13.8.3. Rest of MEA

13.9. Electromagnetic Flow Meter Market Attractiveness Analysis

13.9.1. By Connection to Power Source

13.9.2. By Installation

13.9.3. By Application

13.9.4. By End-use Industry

13.9.5. By Country/Sub-region

14. South America Global Electromagnetic Flow Meter Market Analysis and Forecast

14.1. Key Findings

14.2. Key Trends

14.3. Price Trend Analysis

14.4. South America Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Connection to Power Source, 2017–2027

14.4.1. Wired

14.4.1.1. Two-wire

14.4.1.2. Four-wire

14.4.2. Battery-operated

14.5. South America Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Installation, 2017–2027

14.5.1. Insertion Flow Meters

14.5.2. Low Flow Meters

14.5.3. In-line Flow Meters

14.6. South America Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Application, 2017–2027

14.6.1. Partially-filled Pipes

14.6.2. Fully-filled Pipes

14.7. South America Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by End-use Industry, 2017–2027

14.7.1. Agriculture

14.7.2. Chemicals

14.7.3. Food & Beverages

14.7.4. Metals & Mining

14.7.5. Paper & Pulp

14.7.6. Pharmaceuticals

14.7.7. Water & Wastewater Treatment

14.7.8. Others

14.8. South America Electromagnetic Flow Meter Market Size (US$ Mn & Million Units) Forecast, by Country/Sub-region, 2017–2027

14.8.1. Brazil

14.8.2. Rest of South America

14.9. South America Electromagnetic Flow Meter Market Attractiveness Analysis

14.9.1. By Connection to Power Source

14.9.2. By Installation

14.9.3. By Application

14.9.4. By End-use Industry

14.9.5. By Country/Sub-region

15. Competition Landscape

15.1. Market Players – Competition Matrix

15.2. Global Electromagnetic Flow Meter Market Share Analysis (%), by Company (2017)

15.3. Company Profiles (Details – Basic Overview, Manufacturing Bases, Sales Area/Geographical Presence, Gross Margin, SWOT Analysis, Strategy)

15.3.1. ABB Ltd.

15.3.1.1. Basic Overview,

15.3.1.2. Manufacturing Bases,

15.3.1.3. Sales Area/Geographical Presence,

15.3.1.4. Gross Margin,

15.3.1.5. SWOT Analysis,

15.3.1.6. Strategy

15.3.2. Badger Meter, Inc.

15.3.2.1. Basic Overview,

15.3.2.2. Manufacturing Bases,

15.3.2.3. Sales Area/Geographical Presence,

15.3.2.4. Gross Margin,

15.3.2.5. SWOT Analysis,

15.3.2.6. Strategy

15.3.3. Emerson Electric Co.

15.3.3.1. Basic Overview,

15.3.3.2. Manufacturing Bases,

15.3.3.3. Sales Area/Geographical Presence,

15.3.3.4. Gross Margin,

15.3.3.5. SWOT Analysis,

15.3.3.6. Strategy

15.3.4. Endress+Hauser AG

15.3.4.1. Basic Overview,

15.3.4.2. Manufacturing Bases,

15.3.4.3. Sales Area/Geographical Presence,

15.3.4.4. Gross Margin,

15.3.4.5. SWOT Analysis,

15.3.4.6. Strategy

15.3.5. General Electric Co.

15.3.5.1. Basic Overview,

15.3.5.2. Manufacturing Bases,

15.3.5.3. Sales Area/Geographical Presence,

15.3.5.4. Gross Margin,

15.3.5.5. SWOT Analysis,

15.3.5.6. Strategy

15.3.6. Honeywell International Inc.

15.3.6.1. Basic Overview,

15.3.6.2. Manufacturing Bases,

15.3.6.3. Sales Area/Geographical Presence,

15.3.6.4. Gross Margin,

15.3.6.5. SWOT Analysis,

15.3.6.6. Strategy

15.3.7. KROHNE Messtechnik GmbH

15.3.7.1. Basic Overview,

15.3.7.2. Manufacturing Bases,

15.3.7.3. Sales Area/Geographical Presence,

15.3.7.4. Gross Margin,

15.3.7.5. SWOT Analysis,

15.3.7.6. Strategy

15.3.8. McCrometer, Inc.

15.3.8.1. Basic Overview,

15.3.8.2. Manufacturing Bases,

15.3.8.3. Sales Area/Geographical Presence,

15.3.8.4. Gross Margin,

15.3.8.5. SWOT Analysis,

15.3.8.6. Strategy

15.3.9. Omega Engineering Inc.

15.3.9.1. Basic Overview,

15.3.9.2. Manufacturing Bases,

15.3.9.3. Sales Area/Geographical Presence,

15.3.9.4. Gross Margin,

15.3.9.5. SWOT Analysis,

15.3.9.6. Strategy

15.3.10. Siemens AG

15.3.10.1. Basic Overview,

15.3.10.2. Manufacturing Bases,

15.3.10.3. Sales Area/Geographical Presence,

15.3.10.4. Gross Margin,

15.3.10.5. SWOT Analysis,

15.3.10.6. Strategy

15.3.11. Toshiba Corporation

15.3.11.1. Basic Overview,

15.3.11.2. Manufacturing Bases,

15.3.11.3. Sales Area/Geographical Presence,

15.3.11.4. Gross Margin,

15.3.11.5. SWOT Analysis,

15.3.11.6. Strategy

15.3.12. Yokogawa Electric Corp

15.3.12.1. Basic Overview,

15.3.12.2. Manufacturing Bases,

15.3.12.3. Sales Area/Geographical Presence,

15.3.12.4. Gross Margin,

15.3.12.5. SWOT Analysis,

15.3.12.6. Strategy

16. Key Takeaways

List of Tables

Table 01: Global Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Installation, 2017–2027

Table 02: Global Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Installation, 2017–2027

Table 03: Global Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Connection to Power Source, 2017–2027

Table 04: Global Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Connection to Power Source, 2017–2027

Table 05: Global Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Connection to Power Source, Wired 2017–2027

Table 06: Global Electromagnetic Flow Meter Market Volume (Mn Thousand Units) Forecast, by Connection to Power Source, Wired 2017–2027

Table 07: Global Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

Table 08: Global Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Application, 2017–2027

Table 09: Global Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 10: Global Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by End-use Industry, 2017–2027

Table 11: Global Electromagnetic Flow Meter Market Revenue Forecast, by Region, 2017– 2027 (US$ Mn)

Table 12: Global Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Region, 2017–2027

Table 13: North America Electromagnetic Flow Meter Market Revenue (US$ Mn)Forecast, by Installation, 2017–2027

Table 14: North America Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Installation, 2017–2027

Table 15: North America Electromagnetic Flow Meter Market Revenue (US$ Mn)Forecast, by Connection to Power Source, 2017–2027

Table 16: North America Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Connection to Power Source, 2017–2027

Table 17: North America Electromagnetic Flow Meter Market Revenue (US$ Mn)Forecast, by Connection to Power Source, Wired, 2017–2027

Table 18: North America Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Connection to Power Source, Wired, 2017–2027

Table 19: North America Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Application, 2017–2027

Table 19: North America Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Application, 2017–2027

Table 21: North America Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by End-use Industry, 2017–2027

Table 22: North America Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 23: North America Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Country/Sub-region, 2017–2027

Table 24: Europe Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Installation, 2017–2027

Table 25: Europe Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Installation, 2017–2027

Table 26: Europe Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Connection to Power Source, 2017–2027

Table 27: Europe Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Connection to Power Source, Wired, 2017–2027

Table 28: Europe Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Connection to Power Source, Wired, 2017–2027

Table 29: Europe Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

Table 30: Europe Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Application, 2017–2027

Table 31: Europe Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 32: Europe Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by End-use Industry, 2017–2027

Table 33: Europe Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 34: Europe Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Country/Sub-region, 2017–2027

Table 35: Asia Pacific Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Installation, 2017–2027

Table 36: Asia Pacific Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Installation, 2017–2027

Table 37: Asia Pacific Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Connection to Power Source, 2017–2027

Table 38: Asia Pacific Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Connection to Power Source, 2017–2027

Table 38: Asia Pacific Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Connection to Power Source, Wired, 2017–2027

Table 39: Asia Pacific Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

Table 40: Asia Pacific Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Application, 2017–2027

Table 41: Asia Pacific Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 43: Asia Pacific Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 44: Asia Pacific Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Country/Sub-region, 2017–2027

Table 45: Middle East & Africa Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Installation, 2017–2027

Table 46: Middle East & Africa Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Installation, 2017–2027

Table 47: Middle East & Africa Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Connection to Power Source, 2017–2027

Table 48: Middle East & Africa Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Connection to Power Source, 2017–2027

Table 49: Middle East & Africa Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Connection to Power Source, Wired, 2017–2027

Table 50: Middle East & Africa Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Connection to Power Source, Wired, 2017–2027

Table 51: Middle East & Africa Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

Table 52: Middle East & Africa Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Application, 2017–2027

Table 53: Middle East & Africa Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 53: Middle East & Africa Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by End-use Industry, 2017–2027

Table 53: Middle East & Africa Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 56: Middle East & Africa Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Country/Sub-region, 2017–2027

Table 57: South America Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Installation, 2017–2027

Table 58: South America Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Installation, 2017–2027

Table 59: South America Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Connection to Power Source, 2017–2027

Table 60: South America Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Connection to Power Source, 2017–2027

Table 61: South America Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Connection to Power Source, Wired, 2017–2027

Table 62: South America Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Connection to Power Source, Wired, 2017–2027

Table 63: South America Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by Application, 2017–2027

Table 64: South America Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Application, 2017–2027

Table 65: South America Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 66: South America Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by End-use Industry, 2017–2027

Table 67: South America Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, By Country, 2017–2027

Table 68: South America Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, by Country/Sub-region, 2017–2027

List of Figures

Figure 01: Global Electromagnetic Flow Meter Market Size, Historical and Forecast, 2017–2027

Figure 02: Global Electromagnetic Flow Meter Market Size, Historical and Forecast, 2017–2027

Figure 03: North America Electromagnetic Flow Meter Market CAGR

Figure 04: Europe Electromagnetic Flow Meter Market CAGR

Figure 05: Asia Pacific Electromagnetic Flow Meter Market CAGR

Figure 06: South America Electromagnetic Flow Meter Market CAGR

Figure 07: Middle East & Africa Electromagnetic Flow Meter Market CAGR

Figure 08: Global Electromagnetic Flow Meter Market Revenue Share, by Region, 2018

Figure 09: Global Electromagnetic Flow Meter Market Revenue Forecast and Y-o-Y Growth Projection, 2017–2027 (US$ Mn and %)

Figure 10: Global Electromagnetic Flow Meter Market Volume Forecast and Y-o-Y Growth Projection, 2017–2027 (Thousand Units)

Figure 11: Porter’s Five Forces Analysis

Figure 12: Value Chain Analysis

Figure 13: Global Electromagnetic Flow Meter Market Revenue (US$ Mn)

Figure 14: Global Electromagnetic Flow Meter Market, by Installation (2019)

Figure 15: Global Electromagnetic Flow Meter Market, by Connection to Power Source (2019)

Figure 16: Global Electromagnetic Flow Meter Market, by Application (2019)

Figure 17: Global Electromagnetic Flow Meter Market, by End-use Industry (2019)

Figure 18: Global Electromagnetic Flow Meter Market Revenue Share Analysis, by Installation, 2019 and 2027

Figure 19: Global Electromagnetic Flow Meter Market, by Installation, Insertion

Figure 20: Global Electromagnetic Flow Meter Market, by Installation, In-line

Figure 21: Global Electromagnetic Flow Meter Market, by Installation, Low Flow Rate

Figure 22: Global Electromagnetic Flow Meter Market Comparison Matrix, by Installation

Figure 23: Global Electromagnetic Flow Meter Market Attractiveness Analysis, by Installation

Figure 24: Global Electromagnetic Flow Meter Market Revenue Share Analysis, by Connection to Power Source, 2019 and 2027

Figure 25: Global Electromagnetic Flow Meter Market, by Connection to Power Source, Wired

Figure 26: Global Electromagnetic Flow Meter Market, by Connection to Power Source, Battery-operated

Figure 27: Global Electromagnetic Flow Meter Market Comparison Matrix, by Connection to Power Source

Figure 28: Global Electromagnetic Flow Meter Market Attractiveness Analysis, by Connection to Power Source

Figure 29: Global Electromagnetic Flow Meter Market Revenue Share Analysis, by Application, 2019 and 2027

Figure 30: Global Electromagnetic Flow Meter Market, by Application, Partially-filled Pipes

Figure 31: Global Electromagnetic Flow Meter Market, by Application, Fully-filled Pipes

Figure 32: Global Electromagnetic Flow Meter Market Comparison Matrix, by Application

Figure 33: Electromagnetic Flow Meter Market Attractiveness Analysis, by Application

Figure 34: Global Electromagnetic Flow Meter Market Revenue Share Analysis, by End-use Industry, 2019 and 2027

Figure 35: Global Electromagnetic Flow Meter Market, by End-use Industry, Agriculture

Figure 36: Global Electromagnetic Flow Meter Market, by End-use Industry, Chemicals

Figure 37: Global Electromagnetic Flow Meter Market, by End-use Industry, Food & Beverages

Figure 38: Global Electromagnetic Flow Meter Market, by End-use Industry, Metals & Mining

Figure 39: Global Electromagnetic Flow Meter Market, by End-use Industry, Paper & Pulp

Figure 40: Global Electromagnetic Flow Meter Market, by End-use Industry, Pharmaceuticals

Figure 41: Global Electromagnetic Flow Meter Market, by End-use Industry, Water & Wastewater Treatment

Figure 42: Global Electromagnetic Flow Meter Market, by End-use Industry, Others

Figure 43: Segment Growth Matrix, 2019–27 (%) , by End-use Industry

Figure 44: Segment Revenue Contribution, 2019–27 (%), by End-use Industry

Figure 45: Segment Compounded Growth Matrix (CAGR %), by End-use Industry

Figure 46: Global Electromagnetic Flow Meter Market Attractiveness Analysis, by End-use Industry

Figure 47: Global Electromagnetic Flow Meter Market, by Region, North America

Figure 48: Global Electromagnetic Flow Meter Market, by Region, Europe

Figure 49: Global Electromagnetic Flow Meter Market, by Region, Asia Pacific

Figure 50: Global Electromagnetic Flow Meter Market, by Region, Middle East & Africa

Figure 51: Global Electromagnetic Flow Meter Market, by Region, South America

Figure 52: Global Electromagnetic Flow Meter Market Attractiveness Analysis, by Region

Figure 53: North America Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 54: North America Electromagnetic Flow Meter Market Revenue, Y-o-Y Growth Forecast, 2017–2027

Figure 55(a): North America Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, 2017–2027

Figure 55(b): North America Electromagnetic Flow Meter Market Volume, Y-o-Y Growth Forecast, 2017–2027

Figure 56: North America Electromagnetic Flow Meter Market Revenue Share Analysis, By Installation, 2019 and 2027

Figure 57: North America Electromagnetic Flow Meter Market Revenue Share Analysis, by Connection to Power Source, 2019 and 2027

Figure 58: North America Electromagnetic Flow Meter Market Revenue Share Analysis, by Application, 2019 and 2027

Figure 59: North America Electromagnetic Flow Meter Market Revenue Share Analysis, by End-use Industry, 2019 and 2027

Figure 60: North America Electromagnetic Flow Meter Market Revenue Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 61(a): North America Electromagnetic Flow Meter Market Attractiveness Analysis, By Installation

Figure 61(b): North America Electromagnetic Flow Meter Market Attractiveness Analysis, by Connection to Power Source

Figure 62: North America Electromagnetic Flow Meter Market Attractiveness Analysis, by Application

Figure 63: North America Electromagnetic Flow Meter Market Attractiveness Analysis, by End-use Industry

Figure 64: North America Electromagnetic Flow Meter Market Attractiveness Analysis, by Country/Sub-region

Figure 65: Europe Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 66: Europe Electromagnetic Flow Meter Market Revenue, Y-o-Y Growth Forecast, 2017–2027

Figure 67: Europe Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, 2017–2027

Figure 68: Europe Electromagnetic Flow Meter Market Volume, Y-o-Y Growth Forecast, 2017–2027

Figure 69: Europe Electromagnetic Flow Meter Market Revenue Share Analysis, By Installation, 2019 and 2027

Figure 70: Europe Electromagnetic Flow Meter Market Revenue Share Analysis, by Connection to Power Source, 2019 and 2027

Figure 71: Europe Electromagnetic Flow Meter Market Revenue Share Analysis, by Application, 2019 and 2027

Figure 72: Europe Electromagnetic Flow Meter Market Revenue Share Analysis, by End-use Industry, 2019 and 2027

Figure 73: Europe Electromagnetic Flow Meter Market Revenue Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 74(a): Europe Electromagnetic Flow Meter Market Attractiveness Analysis, By Installation

Figure 74(b): Europe Electromagnetic Flow Meter Market Attractiveness Analysis, by Connection to Power Source

Figure 75: Europe Electromagnetic Flow Meter Market Attractiveness Analysis, by Application

Figure 76: Europe Electromagnetic Flow Meter Market Attractiveness Analysis, by End-use Industry

Figure 77: Europe Electromagnetic Flow Meter Market Attractiveness Analysis, by Country/Sub-region

Figure 78: Asia Pacific Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 79: Asia Pacific Electromagnetic Flow Meter Market Revenue, Y-o-Y Growth Forecast, 2017–2027

Figure 80: Asia Pacific Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, 2017–2027

Figure 81: Asia Pacific Electromagnetic Flow Meter Market Volume, Y-o-Y Growth Forecast, 2017–2027

Figure 82: Asia Pacific Electromagnetic Flow Meter Market Revenue Share Analysis, By Installation, 2019 and 2027

Figure 83: Asia Pacific Electromagnetic Flow Meter Market Revenue Share Analysis, by Connection to Power Source, 2019 and 2027

Figure 84: Asia Pacific Electromagnetic Flow Meter Market Revenue Share Analysis, by Application, 2019 and 2027

Figure 85: Asia Pacific Electromagnetic Flow Meter Market Revenue Share Analysis, by End-use Industry, 2019 and 2027

Figure 86: Asia Pacific Electromagnetic Flow Meter Market Revenue Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 87: Asia Pacific Electromagnetic Flow Meter Market Attractiveness Analysis, By Installation

Figure 88(a): Asia Pacific Electromagnetic Flow Meter Market Attractiveness Analysis, by Connection to Power Source

Figure 88(b): Asia Pacific Electromagnetic Flow Meter Market Attractiveness Analysis, by Application

Figure 89: Asia Pacific Electromagnetic Flow Meter Market Attractiveness Analysis, by End-use Industry

Figure 90: Asia Pacific Electromagnetic Flow Meter Market Attractiveness Analysis, by Country/Sub-region

Figure 91: Middle East & Africa Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 92: Middle East & Africa Electromagnetic Flow Meter Market Revenue, Y-o-Y Growth Forecast, 2017–2027

Figure 93: Middle East & Africa Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, 2017–2027

Figure 94: Middle East & Africa Electromagnetic Flow Meter Market Volume, Y-o-Y Growth Forecast, 2017–2027

Figure 95: Middle East & Africa Electromagnetic Flow Meter Market Revenue Share Analysis, By Installation, 2019 and 2027

Figure 96 : Middle East & Africa Electromagnetic Flow Meter Market Revenue Share Analysis, by Connection to Power Source, 2019 and 2027

Figure 97: Middle East & Africa Electromagnetic Flow Meter Market Revenue Share Analysis, by Application, 2019 and 2027

Figure 98: Middle East & Africa Electromagnetic Flow Meter Market Revenue Share Analysis, by End-use Industry, 2019 and 2027

Figure 99: Middle East & Africa Electromagnetic Flow Meter Market Revenue Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 100: Middle East & Africa Electromagnetic Flow Meter Market Attractiveness Analysis, By Installation

Figure 101: Middle East & Africa Electromagnetic Flow Meter Market Attractiveness Analysis, by Connection to Power Source

Figure 102: Middle East & Africa Electromagnetic Flow Meter Market Attractiveness Analysis, by Application

Figure 103: Middle East & Africa Electromagnetic Flow Meter Market Attractiveness Analysis, by End-use Industry

Figure 104: Middle East & Africa Electromagnetic Flow Meter Market Attractiveness Analysis, by Country/Sub-region

Figure 105: South America Electromagnetic Flow Meter Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 106: South America Electromagnetic Flow Meter Market Revenue, Y-o-Y Growth Forecast, 2017–2027

Figure 107: South America Electromagnetic Flow Meter Market Volume (Thousand Units) Forecast, 2017–2027

Figure 108: South America Electromagnetic Flow Meter Market Volume, Y-o-Y Growth Forecast, 2017–2027

Figure 109: South America Electromagnetic Flow Meter Market Revenue Share Analysis, By Installation, 2019 and 2027

Figure 110: South America Electromagnetic Flow Meter Market Revenue Share Analysis, by Connection to Power Source, 2019 and 2027

Figure 111: South America Electromagnetic Flow Meter Market Revenue Share Analysis, by Application, 2019 and 2027

Figure 112: South America Electromagnetic Flow Meter Market Revenue Share Analysis, by End-use Industry, 2019 and 2027

Figure 113: South America Electromagnetic Flow Meter Market Revenue Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 114: South America Electromagnetic Flow Meter Market Attractiveness Analysis, By Installation

Figure 115: South America Electromagnetic Flow Meter Market Attractiveness Analysis, by Connection to Power Source

Figure 116: South America Electromagnetic Flow Meter Market Attractiveness Analysis, by Application

Figure 117: South America Electromagnetic Flow Meter Market Attractiveness Analysis, by End-use Industry

Figure 118: South America Electromagnetic Flow Meter Market Attractiveness Analysis, by Country/Sub-region