Reports

Reports

Electric vehicle motor (EVM) controller market is driven by the increasing adoption of electric mobility and the rising demand for smart and energy efficient vehicle systems. EVM controllers can be used in all types of EVs like passenger cars, two-wheelers, commercial vehicles, and marine transport, hence the demand continues to rise. Increasing demand of EVs also serves the purpose of reducing greenhouse gas emission. Governments are implementing environmental regulations to encourage the adoption of EVs.

Technological advancement in battery systems, power electronics, and semiconductor devices have made the EVs more affordable and reliable. This has also increased the production of EVs, leading to greater demand for sophisticated controllers. Innovations within the motor controller industry also drives the market. Features such as regenerative braking, which recovers energy during deceleration and feeds it back into the battery, enhance vehicle range and efficiency. Modern controllers integrate fault detection and protection mechanism that helps to improve safety and reliability. The growing integration of motor controllers with vehicle communication networks and autonomous driving technologies is creating smarter, more connected electric vehicles.

Companies are working on cutting-edge EV motor controller technology by making R&D investments to design more efficient, smaller, and smarter systems. They are partnering with technology and semiconductor companies to add advanced software and AI, thereby creating scalable controller platforms that can be used for various vehicle applications. They are also embracing sustainable manufacturing processes to drive sustainability efforts, thereby driving market growth and innovation altogether.

Electric vehicle motor controllers are also becoming more cost-effective through better design efficiency, increased production volume, and technological innovation. They decrease total operating costs of a vehicle by optimizing energy efficiency through finer motor control and regenerative braking - both of which increase driving range and decrease energy use. Safety features that are integrated into the controller decrease the maintenance requirements, while their versatility across different types of EV decreases manufacturing and development costs. This increasing cost-effectiveness makes EVs more appealing and enables them to be mass-adopted.

An electric vehicle motor controller unit is an electronic device that regulates the flow of electricity to the motor in EVs. The motor controller receives commands from interfaces such as the throttle, brake, and forward/reverse control switches. The motor controller processes these commands and precisely controls the speed, torque, direction, and consequent horsepower of a motor in the vehicle.

Motor controllers can reverse the energy from the motor and transfer it from the battery to the motor to accelerate the vehicle’s return to the battery, which gives electric vehicles a more effective braking system than a standard mechanical brake system. The motor controller serves as the brain of the powertrain system.

Electric vehicle motor controllers comprise the essential elements of power electronics for electrical flow conversion and management, a microprocessor to analyze sensor data and manage motor output, and regenerative braking capabilities to reclaim energy in the event of deceleration. Controllers also have communication interfaces to connect to outside systems and sensors to monitor and protect against failures, all for efficient and safe operation of motors. Direct Torque Control (DTC), Field Oriented Control (FOC), Silicon Carbide (SiC), inverter-less, and hybrid.

EV motor controllers are used in electric vehicles, e – bikes, scooters, and boats to regulate speed, enhance performance, and facilitate energy efficiency. EV motor controllers carry out important functions like converting DC power from the battery to AC power for the motor, regulating speed and torque according to the driver's input, recovering energy during braking to charge the battery, and protecting the system against faults such as over-voltage or overheating.

| Attribute | Detail |

|---|---|

| Electric Vehicle Motor (EVM) Controller Market Drivers |

|

The increasing need for high-performance and long-range electric vehicles (EVs) is the major factor promoting the growth of the market. The customers desire EVs with great acceleration, high top speed, silky-smooth handling, and higher driving ranges. Achieving this requires not only some enhancements in battery capacity but also highly efficient motor controllers that can control complex power delivery systems accurately. EVM controllers are key to delivering maximum motor performance by managing speed, torque, and direction in real time according to driver input and road conditions.

With automakers driving the limits with electric sports cars, SUVs, and luxury sedans, controllers that can run under stressful conditions without sacrificing safety, reliability, or efficiency are in increasing demand. Incorporating intelligence technologies like AI-based optimization, predictive diagnostics, and real-time data analysis in motor controllers is becoming increasingly prevalent to address such high-performance requirements.

Government subsidies and emission controls are the major market drivers to the electric vehicle motor (EVM) controller market, with global moves to curtail carbon emissions and fuel dependency are gaining momentum. Tighter emissions are persuading manufacturers to speed up the transition from internal combustion engine (ICE) cars to electric vehicles (EVs), thereby boosting demand for high-efficiency motor controllers.

To further facilitate this transition, the governments are providing economic incentives in the form of subsidies, tax credits, reduced registration fees, and investments in charging infrastructure. Such initiatives not only promote consumer take-up but also allow manufacturers to invest in R&D activities pertaining to cutting-edge, high-performance motor controllers that meet new safety, energy, and environmental standards.

In addition, emission goals specified by international climate agreements and local regulations (like the European Union's CO₂ emissions regulation or California's zero-emission vehicle rule) are mandating manufacturers regarding incorporation of more effective and sustainable systems into their EVs. As the EVM controller plays a vital part in controlling the powertrain and optimizing energy efficiency, its design as well as implementation are directly affected by these regulatory frameworks.

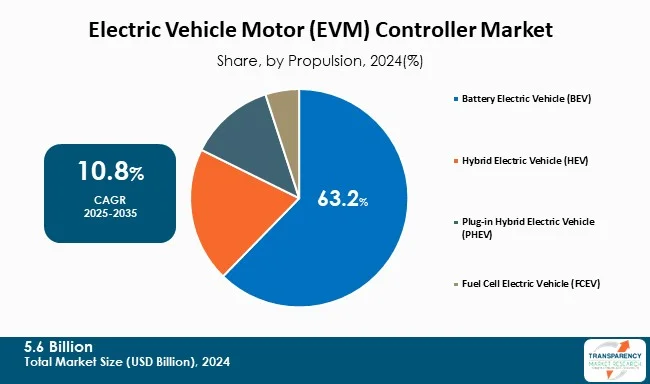

Due to the increasing migration toward 100% electric transportation solutions, the battery electric vehicle (BEV) category is already exceeding the electric vehicle motor (EVM) controller market globally. Unlike hybrid vehicles, BEVs rely on electric motors and have batteries with high capacities, so the electric motor controller is the sole core component of a BEV's powertrain. As demand for zero-emission vehicle continues to grow, BEVs all over the world continue to gain a larger share of the market.

The demand for BEVs is driven by reduction of carbon footprint concerns, current and future government regulation, and battery technology improvements, all impacting power conversion efficiency and energy efficient controllers that provide maximum driving range and improve overall vehicle performance.

Prominent, long-established automakers are expanding their vehicle lines of BEVs increasing further the development and application of advanced EVM controllers that are accommodating higher voltage, faster charging, and more sophisticated control.

| Attribute | Detail |

|---|---|

| Leading Region | Asia Pacific |

Growth in the global electric vehicle motor (EVM) controller market is being led by the Asia-Pacific region, primarily due to the increase in EV uptake in many of the region's countries, such as China, Japan, and South Korea. China is the region's leader, since it has government-wide support and investment of significant capital into EV infrastructure and capabilities, as well as a more evolved domestic EV manufacturing ecosystem. In addition, it has local supply chains of existing manufacturers and battery producers within the region that help create demand for evolving motor controllers.

Europe and North America are emerging as key regions in the electric vehicle motor (EVM) controller market. Stringent emission regulations, climate change targets, and government incentives to purchase EVs, particularly in countries such as Germany and Norway, are driving growth in Europe. North American markets, which are led by the U.S. and Canada, are evolving from supportive policy decisions, a higher volume of EV production, and innovative companies such as Tesla.

Players are trying to create sophisticated and energy-saving motor controllers in response to growing EV performance requirements. They are undertaking R&D activities, partnering with technology companies, and adopting scalable designs to fit a range of vehicles. Many companies are also adopting green manufacturing techniques that demonstrate commitment to global sustainability agendas.

Suzhou Veichi Electric Co., Ltd., A Bacancy Company, Embitel, ADVANCED Motion Controls, Tesla, Air International Thermal Systems, Continental Engineering Services, Fuji Electric FA Components & Systems Co., Ltd., Robert Bosch GmbH., Tata AutoComp Systems Ltd, ABB, DENSO CORPORATION, Attron Automotive, and Kinetic Communications LTD are the key players in market.

Each of these players has been profiled in the electric vehicle motor (EVM) controller market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

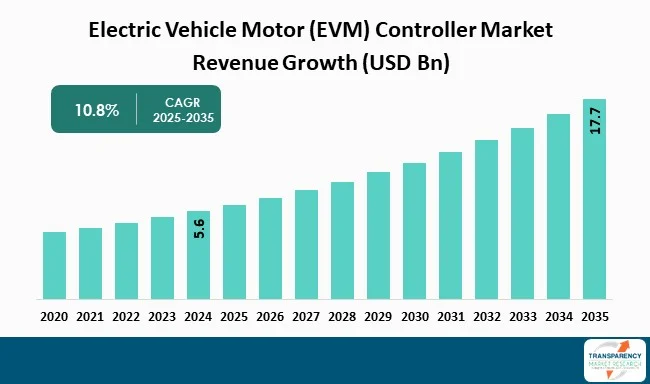

| Size in 2024 | US$ 5.6 Bn |

| Forecast Value in 2035 | US$ 17.7 Bn |

| CAGR | 10.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Electric Vehicle Motor (EVM) Controller Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Propulsion

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The Electric Vehicle Motor (EVM) controller market was valued at US$ 5.6 Bn in 2024

The Electric Vehicle Motor (EVM) controller market is projected to reach US$ 17.7 Bn by 2035

Growing demand for high-performance & long-range EVs and government incentives and emission regulations

The CAGR is anticipated to be 10.8% from 2025 to 2035

Asia Pacific is expected to account for the largest share from 2025 to 2035

Suzhou Veichi Electric Co., Ltd., A Bacancy Company, Embitel, ADVANCED Motion Controls, Tesla, Air International Thermal Systems, Continental Engineering Services, Fuji Electric FA Components & Systems Co., Ltd., Robert Bosch GmbH., Tata AutoComp Systems Ltd, ABB, DENSO CORPORATION., Attron Automotive, and Kinetic Communications LTD, among others

Table 01: Global Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 02: Global Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 03: Global Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 04: Global Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 05: Global Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 06: Global Electric Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 07: North America Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 08: North America Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 09: North America Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 10: North America Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 11: North America Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 12: North America Electric Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 13: U.S. Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 14: U.S. Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 15: U.S. Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 16: U.S. Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 17: U.S. Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 18: Canada Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 19: Canada Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 20: Canada Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 21: Canada Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 22: Canada Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 23: Europe Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 24: Europe Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 25: Europe Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 26: Europe Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 27: Europe Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 28: Europe Electric Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 29: Germany Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 30: Germany Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 31: Germany Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 32: Germany Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 33: Germany Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 34: U.K. Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 35: U.K. Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 36: U.K. Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 37: U.K. Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 38: U.K. Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 39: France Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 40: France Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 41: France Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 42: France Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 43: France Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 44: Italy Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 45: Italy Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 46: Italy Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 47: Italy Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 48: Italy Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 49: Spain Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 50: Spain Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 51: Spain Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 52: Spain Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 53: Spain Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 54: Switzerland Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 55: Switzerland Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 56: Switzerland Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 57: Switzerland Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 58: Switzerland Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 59: The Netherlands Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 60: The Netherlands Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 61: The Netherlands Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 62: The Netherlands Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 63: The Netherlands Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 64: Rest of Europe Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 65: Rest of Europe Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 66: Rest of Europe Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 67: Rest of Europe Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 68: Rest of Europe Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 69: Asia Pacific Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 70: Asia Pacific Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 71: Asia Pacific Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 72: Asia Pacific Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 73: Asia Pacific Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 74: Asia Pacific Electric Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 75: China Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 76: China Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 77: China Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 78: China Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 79: China Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 80: Japan Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 81: Japan Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 82: Japan Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 83: Japan Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 84: Japan Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 85: India Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 86: India Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 87: India Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 88: India Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 89: India Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 90: South Korea Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 91: South Korea Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 92: South Korea Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 93: South Korea Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 94: South Korea Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 95: Australia and New Zealand Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 96: Australia and New Zealand Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 97: Australia and New Zealand Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 98: Australia and New Zealand Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 99: Australia and New Zealand Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 100: Rest of Asia Pacific Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 101: Rest of Asia Pacific Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 102: Rest of Asia Pacific Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 103: Rest of Asia Pacific Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 104: Rest of Asia Pacific Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 105: Latin America Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 106: Latin America Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 107: Latin America Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 108: Latin America Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 109: Latin America Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 110: Latin America Electric Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 111: Brazil Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 112: Brazil Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 113: Brazil Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 114: Brazil Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 115: Brazil Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 116: Mexico Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 117: Mexico Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 118: Mexico Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 119: Mexico Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 120: Mexico Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 121: Argentina Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 122: Argentina Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 123: Argentina Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 124: Argentina Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 125: Argentina Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 126: Rest of Latin America Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 127: Rest of Latin America Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 128: Rest of Latin America Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 129: Rest of Latin America Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 130: Rest of Latin America Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 131: Middle East and Africa Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 132: Middle East and Africa Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 133: Middle East and Africa Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 134: Middle East and Africa Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 135: Middle East and Africa Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 136: Middle East and Africa Electric Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 137: GCC Countries Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 138: GCC Countries Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 139: GCC Countries Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 140: GCC Countries Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 141: GCC Countries Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 142: South Africa Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 143: South Africa Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 144: South Africa Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 145: South Africa Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 146: South Africa Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 147: Rest of Middle East and Africa Electric Market Value (US$ Bn) Forecast, by Propulsion, 2020 to 2035

Table 148: Rest of Middle East and Africa Electric Market Value (US$ Bn) Forecast, by Motor Type, 2020 to 2035

Table 149: Rest of Middle East and Africa Electric Market Value (US$ Bn) Forecast, by Controller Type/Technology, 2020 to 2035

Table 150: Rest of Middle East and Africa Electric Market Value (US$ Bn) Forecast, by Vehicle Type, 2020 to 2035

Table 151: Rest of Middle East and Africa Electric Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Figure 01: Global Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 03: Global Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 04: Global Electric Market Revenue (US$ Bn), by Battery Electric Vehicle (BEV), 2020 to 2035

Figure 05: Global Electric Market Revenue (US$ Bn), by Hybrid Electric Vehicle (HEV), 2020 to 2035

Figure 06: Global Electric Market Revenue (US$ Bn), by Plug-in Hybrid Electric Vehicle (PHEV), 2020 to 2035

Figure 07: Global Electric Market Revenue (US$ Bn), by Fuel Cell Electric Vehicle (FCEV), 2020 to 2035

Figure 08: Global Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 09: Global Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 10: Global Electric Market Revenue (US$ Bn), by Alternating Current (AC), 2020 to 2035

Figure 11: Global Electric Market Revenue (US$ Bn), by Direct Current (DC), 2020 to 2035

Figure 12: Global Electric Market Revenue (US$ Bn), by Permanent Magnet Synchronous Motor (PMSM), 2020 to 2035

Figure 13: Global Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 14: Global Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 15: Global Electric Market Revenue (US$ Bn), by Direct Torque Control (DTC), 2020 to 2035

Figure 16: Global Electric Market Revenue (US$ Bn), by Field Oriented Control (FOC), 2020 to 2035

Figure 17: Global Electric Market Revenue (US$ Bn), by Silicon Carbide (SiC), 2020 to 2035

Figure 18: Global Electric Market Revenue (US$ Bn), by Vector Control, 2020 to 2035

Figure 19: Global Electric Market Revenue (US$ Bn), by Inverterless, 2020 to 2035

Figure 20: Global Electric Market Revenue (US$ Bn), by Hybrid, 2020 to 2035

Figure 21: Global Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 22: Global Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 23: Global Electric Market Revenue (US$ Bn), by Passenger Vehicles, 2020 to 2035

Figure 24: Global Electric Market Revenue (US$ Bn), by Commercial Vehicles, 2020 to 2035

Figure 25: Global Electric Market Revenue (US$ Bn), by Two-wheelers, 2020 to 2035

Figure 26: Global Electric Market Revenue (US$ Bn), by Off-road Vehicles, 2020 to 2035

Figure 27: Global Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 28: Global Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 29: Global Electric Market Revenue (US$ Bn), by OEM, 2020 to 2035

Figure 30: Global Electric Market Revenue (US$ Bn), by After market, 2020 to 2035

Figure 31: Global Electric Market Value Share Analysis, by Region, 2024 and 2035

Figure 32: Global Electric Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 33: North America Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 34: North America Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 35: North America Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 36: North America Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 37: North America Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 38: North America Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 39: North America Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 40: North America Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 41: North America Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 42: North America Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 43: North America Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 44: North America Electric Market Value Share Analysis, by Country, 2024 and 2035

Figure 45: North America Electric Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 46: U.S. Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 47: U.S. Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 48: U.S. Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 49: U.S. Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 50: U.S. Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 51: U.S. Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 52: U.S. Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 53: U.S. Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 54: U.S. Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 55: U.S. Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 56: U.S. Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 57: Canada Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 58: Canada Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 59: Canada Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 60: Canada Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 61: Canada Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 62: Canada Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 63: Canada Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 64: Canada Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 65: Canada Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 66: Canada Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 67: Canada Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 68: Europe Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 69: Europe Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 70: Europe Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 71: Europe Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 72: Europe Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 73: Europe Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 74: Europe Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 75: Europe Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 76: Europe Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 77: Europe Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 78: Europe Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 79: Europe Electric Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 80: Europe Electric Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 81: Germany Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 82: Germany Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 83: Germany Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 84: Germany Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 85: Germany Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 86: Germany Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 87: Germany Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 88: Germany Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 89: Germany Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 90: Germany Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 91: Germany Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 92: U.K. Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 93: U.K. Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 94: U.K. Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 95: U.K. Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 96: U.K. Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 97: U.K. Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 98: U.K. Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 99: U.K. Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 100: U.K. Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 101: U.K. Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 102: U.K. Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 103: France Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 104: France Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 105: France Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 106: France Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 107: France Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 108: France Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 109: France Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 110: France Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 111: France Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 112: France Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 113: France Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 114: Italy Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 115: Italy Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 116: Italy Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 117: Italy Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 118: Italy Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 119: Italy Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 120: Italy Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 121: Italy Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 122: Italy Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 123: Italy Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 124: Italy Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 125: Spain Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 126: Spain Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 127: Spain Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 128: Spain Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 129: Spain Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 130: Spain Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 131: Spain Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 132: Spain Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 133: Spain Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 134: Spain Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 135: Spain Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 136: Switzerland Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 137: Switzerland Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 138: Switzerland Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 139: Switzerland Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 140: Switzerland Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 141: Switzerland Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 142: Switzerland Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 143: Switzerland Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 144: Switzerland Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 145: Switzerland Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 146: Switzerland Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 147: The Netherlands Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 148: The Netherlands Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 149: The Netherlands Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 150: The Netherlands Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 151: The Netherlands Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 152: The Netherlands Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 153: The Netherlands Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 154: The Netherlands Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 155: The Netherlands Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 156: The Netherlands Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 157: The Netherlands Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 158: Rest of Europe Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 159: Rest of Europe Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 160: Rest of Europe Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 161: Rest of Europe Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 162: Rest of Europe Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 163: Rest of Europe Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 164: Rest of Europe Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 165: Rest of Europe Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 166: Rest of Europe Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 167: Rest of Europe Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 168: Rest of Europe Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 169: Asia Pacific Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 170: Asia Pacific Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 171: Asia Pacific Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 172: Asia Pacific Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 173: Asia Pacific Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 174: Asia Pacific Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 175: Asia Pacific Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 176: Asia Pacific Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 177: Asia Pacific Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 178: Asia Pacific Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 179: Asia Pacific Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 180: Asia Pacific Electric Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 181: Asia Pacific Electric Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 182: China Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 183: China Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 184: China Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 185: China Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 186: China Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 187: China Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 188: China Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 189: China Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 190: China Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 191: China Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 192: China Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 193: Japan Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 194: Japan Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 195: Japan Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 196: Japan Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 197: Japan Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 198: Japan Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 199: Japan Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 200: Japan Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 201: Japan Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 202: Japan Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 203: Japan Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 204: India Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 205: India Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 206: India Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 207: India Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 208: India Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 209: India Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 210: India Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 211: India Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 212: India Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 213: India Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 214: India Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 215: South Korea Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 216: South Korea Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 217: South Korea Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 218: South Korea Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 219: South Korea Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 220: South Korea Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 221: South Korea Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 222: South Korea Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 223: South Korea Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 224: South Korea Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 225: South Korea Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 226: Australia and New Zealand Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 227: Australia and New Zealand Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 228: Australia and New Zealand Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 229: Australia and New Zealand Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 230: Australia and New Zealand Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 231: Australia and New Zealand Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 232: Australia and New Zealand Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 233: Australia and New Zealand Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 234: Australia and New Zealand Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 235: Australia and New Zealand Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 236: Australia and New Zealand Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 237: Rest of Asia Pacific Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 238: Rest of Asia Pacific Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 239: Rest of Asia Pacific Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 240: Rest of Asia Pacific Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 241: Rest of Asia Pacific Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 242: Rest of Asia Pacific Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 243: Rest of Asia Pacific Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 244: Rest of Asia Pacific Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 245: Rest of Asia Pacific Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 246: Rest of Asia Pacific Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 247: Rest of Asia Pacific Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 248: Latin America Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 249: Latin America Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 250: Latin America Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 251: Latin America Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 252: Latin America Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 253: Latin America Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 254: Latin America Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 255: Latin America Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 256: Latin America Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 257: Latin America Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 258: Latin America Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 259: Latin America Electric Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 260: Latin America Electric Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 261: Brazil Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 262: Brazil Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 263: Brazil Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 264: Brazil Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 265: Brazil Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 266: Brazil Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 267: Brazil Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 268: Brazil Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 269: Brazil Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 270: Brazil Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 271: Brazil Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 272: Mexico Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 273: Mexico Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 274: Mexico Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 275: Mexico Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 276: Mexico Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 277: Mexico Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 278: Mexico Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 279: Mexico Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 280: Mexico Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 281: Mexico Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 282: Mexico Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 283: Argentina Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 284: Argentina Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 285: Argentina Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 286: Argentina Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 287: Argentina Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 288: Argentina Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 289: Argentina Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 290: Argentina Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 291: Argentina Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 292: Argentina Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 293: Argentina Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 294: Rest of Latin America Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 295: Rest of Latin America Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 296: Rest of Latin America Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 297: Rest of Latin America Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 298: Rest of Latin America Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 299: Rest of Latin America Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 300: Rest of Latin America Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 301: Rest of Latin America Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 302: Rest of Latin America Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 303: Rest of Latin America Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 304: Rest of Latin America Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 305: Middle East and Africa Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 306: Middle East and Africa Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 307: Middle East and Africa Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 308: Middle East and Africa Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 309: Middle East and Africa Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 310: Middle East and Africa Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 311: Middle East and Africa Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 312: Middle East and Africa Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 313: Middle East and Africa Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 314: Middle East and Africa Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 315: Middle East and Africa Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 316: Middle East and Africa Electric Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 317: Middle East and Africa Electric Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 318: GCC Countries Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 319: GCC Countries Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 320: GCC Countries Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 321: GCC Countries Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 322: GCC Countries Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 323: GCC Countries Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 324: GCC Countries Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 325: GCC Countries Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 326: GCC Countries Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 327: GCC Countries Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 328: GCC Countries Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 329: South Africa Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 330: South Africa Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 331: South Africa Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 332: South Africa Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 333: South Africa Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 334: South Africa Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 335: South Africa Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 336: South Africa Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 337: South Africa Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 338: South Africa Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 339: South Africa Electric Market Attractiveness Analysis, by End-use, 2025 to 2035

Figure 340: Rest of Middle East and Africa Electric Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 341: Rest of Middle East and Africa Electric Market Value Share Analysis, by Propulsion, 2024 and 2035

Figure 342: Rest of Middle East and Africa Electric Market Attractiveness Analysis, by Propulsion, 2025 to 2035

Figure 343: Rest of Middle East and Africa Electric Market Value Share Analysis, by Motor Type, 2024 and 2035

Figure 344: Rest of Middle East and Africa Electric Market Attractiveness Analysis, by Motor Type, 2025 to 2035

Figure 345: Rest of Middle East and Africa Electric Market Value Share Analysis, by Controller Type/Technology, 2024 and 2035

Figure 346: Rest of Middle East and Africa Electric Market Attractiveness Analysis, by Controller Type/Technology, 2025 to 2035

Figure 347: Rest of Middle East and Africa Electric Market Value Share Analysis, by Vehicle Type, 2024 and 2035

Figure 348: Rest of Middle East and Africa Electric Market Attractiveness Analysis, by Vehicle Type, 2025 to 2035

Figure 349: Rest of Middle East and Africa Electric Market Value Share Analysis, by End-use, 2024 and 2035

Figure 350: Rest of Middle East and Africa Electric Market Attractiveness Analysis, by End-use, 2025 to 2035