Reports

Reports

The electric motor market is currently witnessing a high growth pace with transition towards automation, clean energy, and electrification of transport. Durable, efficient, and low-maintenance electric motors have found usage in hordes of industries, including robotics, automotive and HVAC, renewable energy, and consumer appliances. AC motors are the most dominant products in the market, especially the induction motors, due to their low cost, reliability, and universal use.

In the regional market, North America is the prime electric motor market with voluminous manufacturing, fast urbanization, and leadership in electric vehicle manufacture. Europe and North America are also the major shareholders, driven by industrial automation, integration of renewable energy, and the use of motor technology innovation. The market is also very competitive and thus has international companies such as Siemens, ABB, Nidec, Bosch, Johnson Electric, and WeG, which are investing in research and development, new technologies, and strategic alliances. The electric motor continues to expand and achieve long-term growth with the global trends toward electrification, sustainability, and energy-efficient infrastructure.

Electric motor is an electromechanical machine that transforms electrical energy into mechanical energy by electromagnetism and hence it is one of the most important parts in contemporary technology. Electric motors are characterized by efficiency, high durability, and the capability to perform in different conditions, which makes them popular in the industrial field and daily life.

Their strengths (i.e. low maintenance, high power-to-weight ratio, and friendliness to environment, as compared to combustion systems) makes them a necessity in propelling sustainable solutions to both - industrial and consumer demands.

The two broad categories are the AC motors that include induction and synchronous motors and the DC motors including the brushed and brushless types. Besides, special motors like stepper motors and servo motors are also commonly used in fields that need accuracy and control. They are used in a wide range of industries including industrial machines such as pumps, compressors, and robotics; automobile internal combustion engines such as electric cars, HVAC, and power steering; consumer devices such as a fridge, washing machine, and air conditioner; and commercial systems such as elevators, escalators, and medical equipment.

Electric motor market is growing rapidly and it is due to the world moving towards clean energy, transport electrification, and automation within industries. This growth is being driven by growing need to have more energy-efficient systems, favourable government policies, and the development of technology in motor design.

Furthermore, the increase in the use of electric cars, connectivity with intelligent systems, and utilization in renewable energy devices is generating considerable opportunities to players in the market. Overall, the market for electric motors is seeing rapid growth, and the prospects of strong growth are observed in automotive, industrial automation, and next-generation energy solutions.

| Attribute | Detail |

|---|---|

| Electric Motor Market Drivers |

|

The electric motor market is heavily driven by the high adoption of HVAC (heating, ventilation, and air conditioning) systems. They are now viewed as necessities in residential, commercial, and industrial applications, including air conditioners and refrigerators, large-scale ventilation and climate control in office buildings, hospitals, and factories.

The core of these systems is electric motors, which supply power to important elements such as compressors, pumps, and fans that provide the control of air and temperature. As the world urbanizes, population rises, indoor air quality and comfort become priorities, the demand of HVAC systems is rising towards a necessity to have efficient electric motors.

Furthermore, the need for energy-saving and environmentally-friendly building systems increases the rate at which traditional HVAC equipment is being replaced with the new motor-driven systems. There is an increasing dependency on high efficiency motors like brushless DC motors and variable frequency drive (VFD)-based systems. With

Energy-saving has emerged as one of the most important priorities of the world and electric motors are significant in attaining these objectives. Approximately 45% of the global electricity is consumed by electric motors (IEA- International Energy Agency). So efficiency gains in motors are a significant source of curtailing total energy demand.

International organizations and governments are enacting tougher policies and efficiency ratings, thereby pushing industries to use IE3, IE4, and even IE5 efficiency class motors that use less energy and save on operational expenses. It is especially critical in industries like manufacturing, utilities, and transport as electric motors are applied at a huge scale to drive pumps, compressors, and machinery.

The emerging policy efforts also reflect the increased focus on efficiency. To illustrate, the Union Budget 2025 of India proposes a National Manufacturing Mission, which has an estimate of 100 crore of the budget allocation in 2025-2026 in 2025 to enhance manufacturing of solar PV cells, wind turbines, batteries, and electrolyzers domestically, in line with the vision of “Make in India” and in support of the long-term goals of the country toward energy security and sustainable growth (Ember Energy, 2025).

Likewise, with LNG projects, the U.S., which is the largest producer and exporter of natural gas in the world, has approved LNG projects that have a combined export capacity of more than 13.8 billion cubic feet per day (Bcf/d), surpassing the current rates of the second-largest exporter in the world (U.S. Department of Energy, 2025).

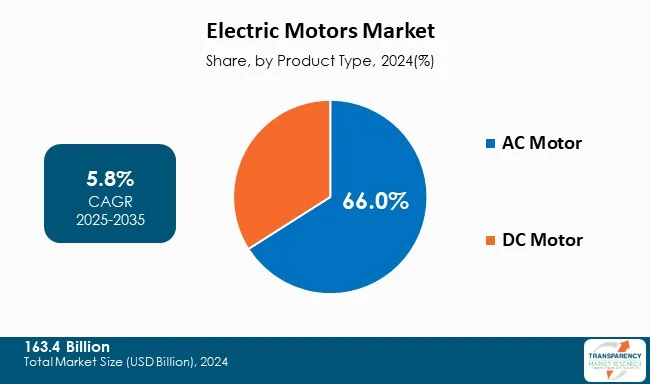

The segment of AC motor dominates the market for electric motors with the intensity of induction and synchronous motors application in industries. Induction motors, in particular, accounts for the largest share due to their simple design, durability, low maintenance requirements, and cost-effectiveness. They can be found extensively in HVAC systems, pumps, compressors, conveyors, domestic appliances, and to an increasing degree in electric vehicles.

Although more expensive and complicated, synchronous motors are more popular when there is a need to have control over speed and position, like in robotics, conveyor belts, and elevators. The fact that small household appliances can be upsized to large industrial machines and that the use of high efficiency models (IE3, IE4 and IE5) is also growing, only served to entrench AC motors as market leaders.

Conversely, DC motors are equally important but are of a lesser priority when it comes to having a market dominance over AC motors. These include brushless DC (BLDC) motors experiencing a high growth owing to high efficiency, low maintenance, and long life. Electric vehicles, drones, consumer electronics, and medical devices are becoming significantly more popular with these motors and are thus the fastest-growing sub-segments.

Brushed DC motors, which are less expensive, have shortcomings as they are expensive to maintain and are less efficient, so their application is limited. Although DC motors are infiltrating specific markets, they continue to be under the AC motors in terms of general demand, size, and cost-effectiveness.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The electric motor market is dominated by North America, which possesses a highly developed industrial background, well-developed automotive industry, and increased integration of energy-saving technologies. The United States is one of the most significant contributors to the rapid adoption of electric motors in the manufacturing sector, HVAC, aerospace, and, most prominently, electric vehicles. Stringent energy-saving policies like that of the U.S. Department of Energy (DOE) also increase the need to develop high-performance electric motors, which makes the area a world leader.

North America continues to be in control due to its technological development, emphasis on automation, and the availability of the major firms such as Rockwell Automation, Regal Beloit Corporation, AMETEK, and TECO-Westinghouse. On the other hand, Asia Pacific is undergoing fast development due to mass production in China.

North America is characterized by the strong research and development skills, superior product acceptance, and established industrial base. This combination of regulatory push, industrial strength, and innovation keeps North America at the forefront of the electric motor market.

Prominent electric motor manufacturers are spending significant amount of capital on comprehensive research and development to develop products. Electric motor industry statistics indicates expansion of product portfolios and mergers and acquisitions are the main strategies adopted by key players

Nidec Corporation, Rockwell Automation, Regal Beloit Corporation, Wolong Electric Group, AMETEK, Johnson Electric Holdings Ltd., TECO-Westinghouse, Siemens, Bosch Electric, WEG S.A., ABB, Arc Systems Inc., DENSO, and Regal Rexnord and other key players.

Each of these players has been profiled in the electric motor market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

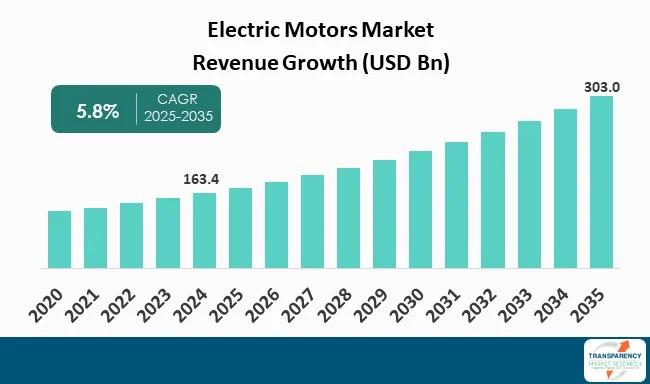

| Size in 2024 | US$ 163.4 Bn |

| Forecast Value in 2035 | US$ 303.0 Bn |

| CAGR | 5.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value & Thousand Units for Volume |

| Electric Motor Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | By Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The electric motor market was valued at US$ 163.4 Bn in 2024

The electric motor industry is projected to reach at US$ 303.0 Bn by the end of 2035

Increasing Adoption of HVAC Application, and rising demand of energy efficiency are some of the factors driving the expansion of electric motor market.

The CAGR is anticipated to be 5.8% from 2025 to 2035

Nidec Corporation, Rockwell Automation, Regal Beloit Corporation, Wolong Electric Group, AMETEK, Johnson Electric Holdings Ltd., TECO-Westinghouse, Siemens, Bosch Electric, WEG S.A., ABB, Arc Systems Inc., DENSO, and Regal Rexnord and other key players.

Table 01: Global Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 02: Global Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 03: Global Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 04: Global Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 05: Global Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 06: Global Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 07: Global Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 08: Global Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 09: Global Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 10: Global Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 11: Global Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 12: Global Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 13: Global Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 14: Global Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 15: Global Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 16: Global Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 17: Global Electric Motor Market Value (US$ Bn) Projection, By Region 2020 to 2035

Table 18: Global Electric Motor Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Table 19: North America Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 20: North America Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 21: North America Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 22: North America Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 23: North America Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 24: North America Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 25: North America Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 26: North America Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 27: North America Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 28: North America Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 29: North America Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 30: North America Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 31: North America Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 32: North America Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 33: North America Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 34: North America Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 35: North America Electric Motor Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 36: North America Electric Motor Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 37: U.S. Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 38: U.S. Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 39: U.S. Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 40: U.S. Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 41: U.S. Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 42: U.S. Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 43: U.S. Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 44: U.S. Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 45: U.S. Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 46: U.S. Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 47: U.S. Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 48: U.S. Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 49: U.S. Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 50: U.S. Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 51: U.S. Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 52: U.S. Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 53: Canada Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 54: Canada Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 55: Canada Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 56: Canada Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 57: Canada Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 58: Canada Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 59: Canada Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 60: Canada Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 61: Canada Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 62: Canada Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 63: Canada Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 64: Canada Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 65: Canada Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 66: Canada Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 67: Canada Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 68: Canada Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 69: Europe Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 70: Europe Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 71: Europe Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 72: Europe Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 73: Europe Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 74: Europe Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 75: Europe Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 76: Europe Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 77: Europe Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 78: Europe Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 79: Europe Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 80: Europe Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 81: Europe Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 82: Europe Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 83: Europe Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 84: Europe Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 85: Europe Electric Motor Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 86: Europe Electric Motor Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 87: U.K. Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 88: U.K. Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 89: U.K. Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 90: U.K. Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 91: U.K. Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 92: U.K. Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 93: U.K. Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 94: U.K. Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 95: U.K. Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 96: U.K. Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 97: U.K. Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 98: U.K. Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 99: U.K. Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 100: U.K. Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 101: U.K. Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 102: U.K. Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 103: Germany Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 104: Germany Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 105: Germany Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 106: Germany Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 107: Germany Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 108: Germany Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 109: Germany Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 110: Germany Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 111: Germany Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 112: Germany Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 113: Germany Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 114: Germany Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 115: Germany Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 116: Germany Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 117: Germany Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 118: Germany Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 119: France Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 120: France Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 121: France Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 122: France Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 123: France Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 124: France Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 125: France Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 126: France Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 127: France Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 128: France Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 129: France Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 130: France Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 131: France Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 132: France Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 133: France Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 134: France Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 135: Italy Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 136: Italy Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 137: Italy Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 138: Italy Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 139: Italy Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 140: Italy Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 141: Italy Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 142: Italy Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 143: Italy Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 144: Italy Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 145: Italy Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 146: Italy Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 147: Italy Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 148: Italy Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 149: Italy Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 150: Italy Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 151: Spain Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 152: Spain Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 153: Spain Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 154: Spain Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 155: Spain Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 156: Spain Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 157: Spain Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 158: Spain Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 159: Spain Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 160: Spain Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 161: Spain Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 162: Spain Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 163: Spain Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 164: Spain Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 165: Spain Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 166: Spain Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 167: The Netherlands Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 168: The Netherlands Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 169: The Netherlands Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 170: The Netherlands Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 171: The Netherlands Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 172: The Netherlands Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 173: The Netherlands Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 174: The Netherlands Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 175: The Netherlands Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 176: The Netherlands Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 177: The Netherlands Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 178: The Netherlands Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 179: The Netherlands Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 180: The Netherlands Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 181: The Netherlands Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 182: The Netherlands Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 183: Asia Pacific Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 184: Asia Pacific Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 185: Asia Pacific Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 186: Asia Pacific Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 187: Asia Pacific Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 188: Asia Pacific Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 189: Asia Pacific Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 190: Asia Pacific Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 191: Asia Pacific Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 192: Asia Pacific Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 193: Asia Pacific Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 194: Asia Pacific Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 195: Asia Pacific Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 196: Asia Pacific Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 197: Asia Pacific Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 198: Asia Pacific Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 199: Asia Pacific Electric Motor Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 200: Asia Pacific Electric Motor Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 201: China Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 202: China Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 203: China Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 204: China Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 205: China Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 206: China Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 207: China Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 208: China Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 209: China Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 210: China Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 211: China Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 212: China Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 213: China Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 214: China Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 215: China Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 216: China Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 217: Japan Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 218: Japan Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 219: Japan Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 220: Japan Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 221: Japan Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 222: Japan Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 223: Japan Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 224: Japan Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 225: Japan Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 226: Japan Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 227: Japan Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 228: Japan Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 229: Japan Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 230: Japan Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 231: Japan Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 232: Japan Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 233: India Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 234: India Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 235: India Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 236: India Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 237: India Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 238: India Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 239: India Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 240: India Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 241: India Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 242: India Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 243: India Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 244: India Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 245: India Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 246: India Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 247: India Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 248: India Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 249: Australia Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 250: Australia Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 251: Australia Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 252: Australia Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 253: Australia Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 254: Australia Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 255: Australia Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 256: Australia Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 257: Australia Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 258: Australia Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 259: Australia Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 260: Australia Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 261: Australia Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 262: Australia Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 263: Australia Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 264: Australia Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 265: South Korea Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 266: South Korea Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 267: South Korea Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 268: South Korea Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 269: South Korea Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 270: South Korea Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 271: South Korea Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 272: South Korea Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 273: South Korea Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 274: South Korea Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 275: South Korea Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 276: South Korea Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 277: South Korea Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 278: South Korea Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 279: South Korea Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 280: South Korea Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 281: ASEAN Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 282: ASEAN Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 283: ASEAN Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 284: ASEAN Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 285: ASEAN Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 286: ASEAN Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 287: ASEAN Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 288: ASEAN Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 289: ASEAN Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 290: ASEAN Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 291: ASEAN Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 292: ASEAN Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 293: ASEAN Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 294: ASEAN Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 295: ASEAN Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 296: ASEAN Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 297: Middle East & Africa Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 298: Middle East & Africa Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 299: Middle East & Africa Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 300: Middle East & Africa Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 301: Middle East & Africa Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 302: Middle East & Africa Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 303: Middle East & Africa Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 304: Middle East & Africa Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 305: Middle East & Africa Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 306: Middle East & Africa Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 307: Middle East & Africa Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 308: Middle East & Africa Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 309: Middle East & Africa Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 310: Middle East & Africa Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 311: Middle East & Africa Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 312: Middle East & Africa Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 313: Middle East & Africa Electric Motor Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 314: Middle East & Africa Electric Motor Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 315: GCC Countries Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 316: GCC Countries Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 317: GCC Countries Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 318: GCC Countries Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 319: GCC Countries Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 320: GCC Countries Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 321: GCC Countries Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 322: GCC Countries Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 323: GCC Countries Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 324: GCC Countries Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 325: GCC Countries Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 326: GCC Countries Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 327: GCC Countries Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 328: GCC Countries Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 329: GCC Countries Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 330: GCC Countries Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 331: South Africa Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 332: South Africa Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 333: South Africa Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 334: South Africa Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 335: South Africa Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 336: South Africa Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 337: South Africa Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 338: South Africa Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 339: South Africa Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 340: South Africa Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 341: South Africa Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 342: South Africa Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 343: South Africa Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 344: South Africa Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 345: South Africa Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 346: South Africa Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 347: Latin America Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 348: Latin America Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 349: Latin America Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 350: Latin America Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 351: Latin America Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 352: Latin America Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 353: Latin America Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 354: Latin America Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 355: Latin America Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 356: Latin America Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 357: Latin America Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 358: Latin America Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 359: Latin America Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 360: Latin America Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 361: Latin America Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 362: Latin America Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 363: Latin America Electric Motor Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 364: Latin America Electric Motor Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 365: Brazil Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 366: Brazil Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 367: Brazil Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 368: Brazil Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 369: Brazil Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 370: Brazil Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 371: Brazil Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 372: Brazil Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 373: Brazil Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 374: Brazil Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 375: Brazil Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 376: Brazil Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 377: Brazil Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 378: Brazil Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 379: Brazil Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 380: Brazil Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 381: Mexico Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 382: Mexico Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 383: Mexico Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 384: Mexico Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 385: Mexico Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 386: Mexico Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 387: Mexico Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 388: Mexico Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 389: Mexico Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 390: Mexico Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 391: Mexico Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 392: Mexico Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 393: Mexico Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 394: Mexico Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 395: Mexico Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 396: Mexico Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 397: Argentina Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 398: Argentina Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 399: Argentina Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Table 400: Argentina Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Table 401: Argentina Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Table 402: Argentina Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Table 403: Argentina Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Table 404: Argentina Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Table 405: Argentina Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Table 406: Argentina Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Table 407: Argentina Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 408: Argentina Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 409: Argentina Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 410: Argentina Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 411: Argentina Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 412: Argentina Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 01: Global Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 02: Global Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 03: Global Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 04: Global Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Figure 05: Global Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Figure 06: Global Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Power Rating 2025 to 2035

Figure 07: Global Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Figure 08: Global Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Figure 09: Global Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Voltage 2025 to 2035

Figure 10: Global Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Figure 11: Global Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Figure 12: Global Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Speed 2025 to 2035

Figure 13: Global Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Figure 14: Global Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Figure 15: Global Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Output Power 2025 to 2035

Figure 16: Global Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 17: Global Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 18: Global Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 19: Global Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 20: Global Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 21: Global Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 22: Global Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 23: Global Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 24: Global Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 25: Global Electric Motor Market Value (US$ Bn) Projection, By Region 2020 to 2035

Figure 26: Global Electric Motor Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Figure 27: Global Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Region 2025 to 2035

Figure 28: North America Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 29: North America Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 30: North America Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 31: North America Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Figure 32: North America Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Figure 33: North America Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Power Rating 2025 to 2035

Figure 34: North America Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Figure 35: North America Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Figure 36: North America Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Voltage 2025 to 2035

Figure 37: North America Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Figure 38: North America Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Figure 39: North America Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Speed 2025 to 2035

Figure 40: North America Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Figure 41: North America Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Figure 42: North America Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Output Power 2025 to 2035

Figure 43: North America Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 44: North America Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 45: North America Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 46: North America Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 47: North America Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 48: North America Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 49: North America Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 50: North America Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 51: North America Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 52: North America Electric Motor Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 53: North America Electric Motor Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 54: North America Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 55: U.S. Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 56: U.S. Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 57: U.S. Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 58: U.S. Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Figure 59: U.S. Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Figure 60: U.S. Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Power Rating 2025 to 2035

Figure 61: U.S. Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Figure 62: U.S. Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Figure 63: U.S. Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Voltage 2025 to 2035

Figure 64: U.S. Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Figure 65: U.S. Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Figure 66: U.S. Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Speed 2025 to 2035

Figure 67: U.S. Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Figure 68: U.S. Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Figure 69: U.S. Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Output Power 2025 to 2035

Figure 70: U.S. Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 71: U.S. Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 72: U.S. Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 73: U.S. Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 74: U.S. Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 75: U.S. Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 76: U.S. Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 77: U.S. Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 78: U.S. Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 79: Canada Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 80: Canada Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 81: Canada Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 82: Canada Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Figure 83: Canada Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Figure 84: Canada Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Power Rating 2025 to 2035

Figure 85: Canada Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Figure 86: Canada Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Figure 87: Canada Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Voltage 2025 to 2035

Figure 88: Canada Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Figure 89: Canada Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Figure 90: Canada Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Speed 2025 to 2035

Figure 91: Canada Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Figure 92: Canada Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Figure 93: Canada Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Output Power 2025 to 2035

Figure 94: Canada Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 95: Canada Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 96: Canada Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 97: Canada Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 98: Canada Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 99: Canada Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 100: Canada Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 101: Canada Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 102: Canada Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 103: Europe Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 104: Europe Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 105: Europe Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 106: Europe Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Figure 107: Europe Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Figure 108: Europe Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Power Rating 2025 to 2035

Figure 109: Europe Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Figure 110: Europe Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Figure 111: Europe Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Voltage 2025 to 2035

Figure 112: Europe Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Figure 113: Europe Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Figure 114: Europe Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Speed 2025 to 2035

Figure 115: Europe Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Figure 116: Europe Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Figure 117: Europe Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Output Power 2025 to 2035

Figure 118: Europe Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 119: Europe Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 120: Europe Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 121: Europe Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 122: Europe Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 123: Europe Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 124: Europe Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 125: Europe Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 126: Europe Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 127: Europe Electric Motor Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 128: Europe Electric Motor Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 129: Europe Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 130: U.K. Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 131: U.K. Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 132: U.K. Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 133: U.K. Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Figure 134: U.K. Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Figure 135: U.K. Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Power Rating 2025 to 2035

Figure 136: U.K. Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Figure 137: U.K. Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Figure 138: U.K. Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Voltage 2025 to 2035

Figure 139: U.K. Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Figure 140: U.K. Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Figure 141: U.K. Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Speed 2025 to 2035

Figure 142: U.K. Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Figure 143: U.K. Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Figure 144: U.K. Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Output Power 2025 to 2035

Figure 145: U.K. Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 146: U.K. Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 147: U.K. Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 148: U.K. Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 149: U.K. Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 150: U.K. Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 151: U.K. Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 152: U.K. Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 153: U.K. Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 154: Germany Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 155: Germany Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 156: Germany Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 157: Germany Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Figure 158: Germany Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Figure 159: Germany Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Power Rating 2025 to 2035

Figure 160: Germany Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Figure 161: Germany Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Figure 162: Germany Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Voltage 2025 to 2035

Figure 163: Germany Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Figure 164: Germany Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Figure 165: Germany Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Speed 2025 to 2035

Figure 166: Germany Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Figure 167: Germany Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Figure 168: Germany Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Output Power 2025 to 2035

Figure 169: Germany Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 170: Germany Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 171: Germany Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 172: Germany Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 173: Germany Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 174: Germany Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 175: Germany Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 176: Germany Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 177: Germany Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 178: France Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 179: France Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 180: France Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 181: France Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Figure 182: France Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Figure 183: France Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Power Rating 2025 to 2035

Figure 184: France Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Figure 185: France Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Figure 186: France Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Voltage 2025 to 2035

Figure 187: France Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Figure 188: France Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Figure 189: France Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Speed 2025 to 2035

Figure 190: France Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Figure 191: France Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Figure 192: France Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Output Power 2025 to 2035

Figure 193: France Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 194: France Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 195: France Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 196: France Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 197: France Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 198: France Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 199: France Electric Motor Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 200: France Electric Motor Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 201: France Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 202: Italy Electric Motor Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 203: Italy Electric Motor Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 204: Italy Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 205: Italy Electric Motor Market Value (US$ Bn) Projection, By Power Rating 2020 to 2035

Figure 206: Italy Electric Motor Market Volume (Thousand Units) Projection, By Power Rating 2020 to 2035

Figure 207: Italy Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Power Rating 2025 to 2035

Figure 208: Italy Electric Motor Market Value (US$ Bn) Projection, By Voltage 2020 to 2035

Figure 209: Italy Electric Motor Market Volume (Thousand Units) Projection, By Voltage 2020 to 2035

Figure 210: Italy Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Voltage 2025 to 2035

Figure 211: Italy Electric Motor Market Value (US$ Bn) Projection, By Speed 2020 to 2035

Figure 212: Italy Electric Motor Market Volume (Thousand Units) Projection, By Speed 2020 to 2035

Figure 213: Italy Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Speed 2025 to 2035

Figure 214: Italy Electric Motor Market Value (US$ Bn) Projection, By Output Power 2020 to 2035

Figure 215: Italy Electric Motor Market Volume (Thousand Units) Projection, By Output Power 2020 to 2035

Figure 216: Italy Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Output Power 2025 to 2035

Figure 217: Italy Electric Motor Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 218: Italy Electric Motor Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 219: Italy Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 220: Italy Electric Motor Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 221: Italy Electric Motor Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 222: Italy Electric Motor Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035