Reports

Reports

Analysts’ Viewpoint on Market

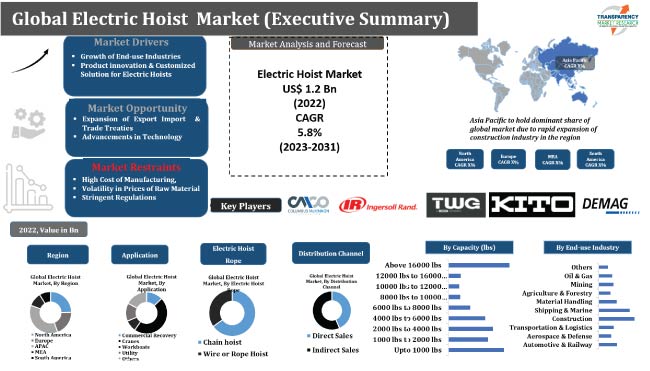

Demand for electric hoist is increasing from various end-use industries, as its helps boost productivity and efficiency of material handling. Key suppliers are investing significantly on R&D and focusing on the development of technologically improved hoists in order to provide high-value products to their clients. For instance, Columbus McKinnon Corporation introduced advanced electric chain hoists with higher capacities and equipped with Hoist Interface Technology, which is expected to help achieve precision load control along with easy access to other performance improvement parameters.

Moreover, key electric hoist manufacturers are also emphasizing on customer needs, such as product preferences, materials, and convenience, and offering a reasonable price range and custom-made product choices depending on consumer needs. Several companies are focusing their efforts on market expansion and mergers and acquisitions to ensure high product exposure, consumer recall, and to expand their customer base and their electric hoist market share.

Electric hoists, or power hoist, are a type of material handling tool used to lift, lower, and move and transport products. They usually include a controller to change the lifting parameters and are powered by an electric motor. Electric hoists are effective at lifting heavy objects that cannot be transported or lifted via conveyors and cranes. Pneumatic hoists, (also known as air hoists), hydraulic hoists, and manual hoists are the other types of hoists based on the driving mechanism.

Electric hoists are positioned overhead above the object to be lifted. They are typically installed indoors since they need access to a source of electrical power. These can frequently be found in factories, vehicle repair and machine shops, and warehouses. The majority of electric chain and wire hoists and electric cable hoist are designed to operate effectively in hazardous and high-temperature environments.

Electric hoist are employed in various end-use industries such as automotive & railway, aerospace & defense, transportation & logistics, construction, etc. Therefore, growth of these end-use industries around the globe is boosting the electric hoist market growth. Moreover, increased government investment in these industries to strengthen their respective economies and attract foreign direct investment (FDI) is another factor that is estimated to propel the global electric hoist industry.

Furthermore, electric hoists enhance operational efficiency by eliminating manual lifting and positioning tasks that require intense effort. Electric hoists also help maintain physical ergonomics in the workplace as compared to manual hoists. Additionally, hoists have faster operational efficiency than other types of hoists. They are also cost-effective and consume less space than conveying systems, which is expected to fuel the electric hoist market growth.

Technological improvements in electric hoists and innovations in material handling industry are projected to offer lucrative opportunities in the near future. According to the Material Handling Industry of America (MHI) annual industry report 2021, manufacturers of material handling equipment who invested in digital technology prior to the pandemic were better prepared to adapt, survive, and even thrive during the disruption. They would also be prepared when the next catastrophe occurs.

Use of automation and robotics in the manufacturing of electric hoists, as well as technological advancements in electric hoists such as motor temperature control, adjustable geared limit switch, overload protection, and other advancements, are likely to create significant future opportunities for manufacturers to strengthen their electric hoist market share.

Analysis of electric hoist market trends reveal that electric chain hoist witnessed highest demand in the market. Chain hoists are gaining popularity due to their higher weight-loading capacity than wire or rope hoists. Chain hoists are made of stainless steel, which gives them the strength they need to raise large machinery.

Moreover, cable-wire or rope hoists are also preferred in various industries due to their ability to withstand moisture and corrosion. Lubricant in a chain hoist can attract debris and dust, which can cause the hoist to wear out over time. Advancements in chain hoists, in terms of anti-corrosion hoists, is likely to augment the electric hoist market share in the next few years.

In the terms of end-use industry, the construction segment held a majority of the global electric hoist market. Rapid growth of the construction sector across the globe, primarily due to population growth and rise in globalization, has accelerated infrastructure construction and development. Investments, funding, and initiatives in the building industry by the federal, state, and municipal governments are all boosting the demand for hoists.

Rise in urbanization is significantly boosting various industries such as shipping and marine, automotive, and railways, which in turn is creating future opportunities in electric hoist industry. Demand for various types of hoists is estimated to rise in next few years due to the growth of these end-use industries.

According to analysis of the region-wise global electric hoist market segmentation, Asia Pacific is expected to be the fastest growing market for electric hoist. The region is dominated by the presence of most growing economies. China and India are the world's two major industrial centers in the region. The need for electric hoists is being fueled by significant growth in end-use industries such as building, shipping & marine, and mining. Significant presence of major industries in the region, such as automobiles and metals, is positively impacting the electric hoists market forecast.

North America and Europe are developed regions with a large number of global manufacturers working to improve technology and product quality, which is anticipated to drive the electric hoist industry in these regions during the forecast period.

The global electric hoist market witnesses the presence of a large number of players. Majority of the electric hoist manufacturers are spending significantly on comprehensive research and development of their product. Prominent entities operating in the electric hoist business include Tianjing Kunda Hoisting Equipment Co., Ltd, IMER International SpA, ABUS Kransysteme GmbH, Street Crane Company Limited, Ingersoll Rand, Konecranes. Columbus McKinnon Corporation, Hitachi Industrial Equipment Systems Co., Ltd, Kran Direkt GmbH & Co. KG, and Columbus McKinnon Corporation.

The electric hoist market research report includes profiles of key players who have been analyzed based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 1.2 Bn |

|

Market Forecast Value in 2031 |

US$ 1.9 Bn |

|

Growth Rate (CAGR) |

5.8% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 1.2 Bn in 2022.

It is estimated to expand at a CAGR of 5.8% during 2023-2031.

Growth of end-use industries increases and product innovation & customized solution for electric hoists.

The chain hoist segment accounted for the highest market share in 2022.

Asia Pacific is likely to be the most lucrative market for vendors in the next few years.

Tianjing Kunda Hoisting Equipment Co., Ltd, IMER International SpA, ABUS Kransysteme GmbH, Street Crane Company Limited, Ingersoll Rand, Konecranes. Columbus McKinnon Corporation, Hitachi Industrial Equipment Systems Co., Ltd, Kran Direkt GmbH & Co. KG, and Columbus McKinnon Corporation.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Value Chain Analysis

5.8. Covid-19 Impact Analysis

5.9. Regulatory Framework & Guidelines

5.10. Global Electric Hoist Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Bn)

5.10.2. Market Volume Projections (Thousand Units)

6. Global Electric Hoist Market Analysis and Forecast, by Hoist Rope Type

6.1. Electric Hoist Market Size (US$ Bn and Thousand Units), by Hoist Rope Type, 2017 - 2031

6.1.1. Chain hoist

6.1.2. Wire or Rope Hoist

6.2. Incremental Opportunity, by Hoist Rope Type

7. Global Electric Hoist Market Analysis and Forecast, by Capacity

7.1. Electric Hoist Market Size (US$ Bn and Thousand Units), by Capacity, 2017 - 2031

7.1.1. Up to 1000 lbs

7.1.2. 1000 lbs to 2000 lbs

7.1.3. 2000 lbs to 4000 lbs

7.1.4. 4000 lbs to 6000 lbs

7.1.5. 6000 lbs to 8000 lbs

7.1.6. 8000 lbs to 10000 lbs

7.1.7. 10000 lbs to 12000 lbs

7.1.8. 12000 lbs to 16000 lbs

7.1.9. Above 16000 lbs

7.2. Incremental Opportunity, by Capacity

8. Global Electric Hoist Market Analysis and Forecast, by End-use Industry

8.1. Electric Hoist Market Size (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

8.1.1. Automotive & Railway

8.1.2. Aerospace & Defense

8.1.3. Transportation & Logistics

8.1.4. Construction

8.1.5. Shipping & Marine

8.1.6. Material Handling

8.1.7. Agriculture & Forestry

8.1.8. Mining

8.1.9. Oil & Gas

8.1.10. Others

8.2. Incremental Opportunity, by End-use Industry

9. Global Electric Hoist Market Analysis and Forecast, by Application

9.1. Electric Hoist Market Size (US$ Bn and Thousand Units), by Application, 2017 - 2031

9.1.1. Commercial Recovery

9.1.2. Cranes

9.1.2.1. Fixed Cranes

9.1.2.2. Mobile Cranes

9.1.3. Workboats

9.1.4. Utility

9.1.5. Others

9.2. Incremental Opportunity, by Application

10. Global Electric Hoist Market Analysis and Forecast, by Distribution Channel

10.1. Electric Hoist Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

10.1.1. Direct Sales

10.1.2. Indirect Sales

10.2. Incremental Opportunity, by Distribution Channel

11. Global Electric Hoist Market Analysis and Forecast, by Region

11.1. Electric Hoist Market Size (US$ Bn and Thousand Units), by Region, 2017 - 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, by Region

12. North America Electric Hoist Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Price Trend Analysis

12.3.1. Weighted Average Selling Price (US$)

12.4. Key Trends Analysis

12.4.1. Demand Side Analysis

12.4.2. Supply Side Analysis

12.5. Electric Hoist Market Size (US$ Bn and Thousand Units), by Hoist Rope Type, 2017 - 2031

12.5.1. Chain hoist

12.5.2. Wire or Rope Hoist

12.6. Electric Hoist Market Size (US$ Bn and Thousand Units), by Capacity, 2017 - 2031

12.6.1. Up to 1000 lbs

12.6.2. 1000 lbs to 2000 lbs

12.6.3. 2000 lbs to 4000 lbs

12.6.4. 4000 lbs to 6000 lbs

12.6.5. 6000 lbs to 8000 lbs

12.6.6. 8000 lbs to 10000 lbs

12.6.7. 10000 lbs to 12000 lbs

12.6.8. 12000 lbs to 16000 lbs

12.6.9. Above 16000 lbs

12.7. Electric Hoist Market Size (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

12.7.1. Automotive & Railway

12.7.2. Aerospace & Defense

12.7.3. Transportation & Logistics

12.7.4. Construction

12.7.5. Shipping & Marine

12.7.6. Material Handling

12.7.7. Agriculture & Forestry

12.7.8. Mining

12.7.9. Oil & Gas

12.7.10. Others

12.8. Electric Hoist Market Size (US$ Bn and Thousand Units), by Application, 2017 - 2031

12.8.1. Commercial Recovery

12.8.2. Cranes

12.8.2.1. Fixed Cranes

12.8.2.2. Mobile Cranes

12.8.3. Workboats

12.8.4. Utility

12.8.5. Others

12.9. Electric Hoist Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

12.9.1. Direct Sales

12.9.2. Indirect Sales

12.10. Electric Hoist Market Size (US$ Bn) (Bn Units), by Country, 2017 - 2031

12.10.1. U.S.

12.10.2. Canada

12.10.3. Rest of North America

12.11. Incremental Opportunity Analysis

13. Europe Electric Hoist Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Electric Hoist Market Size (US$ Bn and Thousand Units), by Hoist Rope Type, 2017 - 2031

13.3.1. Chain hoist

13.3.2. Wire or Rope Hoist

13.4. Electric Hoist Market Size (US$ Bn and Thousand Units), by Capacity, 2017 - 2031

13.4.1. Up to 1000 lbs

13.4.2. 1000 lbs to 2000 lbs

13.4.3. 2000 lbs to 4000 lbs

13.4.4. 4000 lbs to 6000 lbs

13.4.5. 6000 lbs to 8000 lbs

13.4.6. 8000 lbs to 10000 lbs

13.4.7. 10000 lbs to 12000 lbs

13.4.8. 12000 lbs to 16000 lbs

13.4.9. Above 16000 lbs

13.5. Electric Hoist Market Size (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

13.5.1. Automotive & Railway

13.5.2. Aerospace & Defense

13.5.3. Transportation & Logistics

13.5.4. Construction

13.5.5. Shipping & Marine

13.5.6. Material Handling

13.5.7. Agriculture & Forestry

13.5.8. Mining

13.5.9. Oil & Gas

13.5.10. Others

13.6. Electric Hoist Market Size (US$ Bn and Thousand Units), by Application, 2017 - 2031

13.6.1. Commercial Recovery

13.6.2. Cranes

13.6.2.1. Fixed Cranes

13.6.2.2. Mobile Cranes

13.6.3. Workboats

13.6.4. Utility

13.6.5. Others

13.7. Electric Hoist Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

13.7.1. Direct Sales

13.7.2. Indirect Sales

13.8. Electric Hoist Market Size (US$ Bn) (Bn Units), by Country, 2017 - 2031

13.8.1. U.K.

13.8.2. Germany

13.8.3. France

13.8.4. Rest of Europe

13.9. Incremental Opportunity Analysis

14. Asia Pacific Electric Hoist Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Price Trend Analysis

14.3.1. Weighted Average Selling Price (US$)

14.4. Key Trends Analysis

14.4.1. Demand Side Analysis

14.4.2. Supply Side Analysis

14.5. Electric Hoist Market Size (US$ Bn and Thousand Units), by Hoist Rope Type, 2017 - 2031

14.5.1. Chain hoist

14.5.2. Wire or Rope Hoist

14.6. Electric Hoist Market Size (US$ Bn and Thousand Units), by Capacity, 2017 - 2031

14.6.1. Up to 1000 lbs

14.6.2. 1000 lbs to 2000 lbs

14.6.3. 2000 lbs to 4000 lbs

14.6.4. 4000 lbs to 6000 lbs

14.6.5. 6000 lbs to 8000 lbs

14.6.6. 8000 lbs to 10000 lbs

14.6.7. 10000 lbs to 12000 lbs

14.6.8. 12000 lbs to 16000 lbs

14.6.9. Above 16000 lbs

14.7. Electric Hoist Market Size (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

14.7.1. Automotive & Railway

14.7.2. Aerospace & Defense

14.7.3. Transportation & Logistics

14.7.4. Construction

14.7.5. Shipping & Marine

14.7.6. Material Handling

14.7.7. Agriculture & Forestry

14.7.8. Mining

14.7.9. Oil & Gas

14.7.10. Others

14.8. Electric Hoist Market Size (US$ Bn and Thousand Units), by Application, 2017 - 2031

14.8.1. Commercial Recovery

14.8.2. Cranes

14.8.2.1. Fixed Cranes

14.8.2.2. Mobile Cranes

14.8.3. Workboats

14.8.4. Utility

14.8.5. Others

14.9. Electric Hoist Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

14.9.1. Direct Sales

14.9.2. Indirect Sales

14.10. Electric Hoist Market Size (US$ Bn) (Bn Units), by Country, 2017 - 2031

14.10.1. India

14.10.2. Chain

14.10.3. Japan

14.10.4. Rest of Asia Pacific

15. Middle East & Africa Electric Hoist Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Price Trend Analysis

15.3.1. Weighted Average Selling Price (US$)

15.4. Key Trends Analysis

15.4.1. Demand Side Analysis

15.4.2. Supply Side Analysis

15.5. Electric Hoist Market Size (US$ Bn and Thousand Units), by Hoist Rope Type, 2017 - 2031

15.5.1. Chain hoist

15.5.2. Wire or Rope Hoist

15.6. Electric Hoist Market Size (US$ Bn and Thousand Units), by Capacity, 2017 - 2031

15.6.1. Up to 1000 lbs

15.6.2. 1000 lbs to 2000 lbs

15.6.3. 2000 lbs to 4000 lbs

15.6.4. 4000 lbs to 6000 lbs

15.6.5. 6000 lbs to 8000 lbs

15.6.6. 8000 lbs to 10000 lbs

15.6.7. 10000 lbs to 12000 lbs

15.6.8. 12000 lbs to 16000 lbs

15.6.9. Above 16000 lbs

15.7. Electric Hoist Market Size (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

15.7.1. Automotive & Railway

15.7.2. Aerospace & Defense

15.7.3. Transportation & Logistics

15.7.4. Construction

15.7.5. Shipping & Marine

15.7.6. Material Handling

15.7.7. Agriculture & Forestry

15.7.8. Mining

15.7.9. Oil & Gas

15.7.10. Others

15.8. Electric Hoist Market Size (US$ Bn and Thousand Units), by Application, 2017 - 2031

15.8.1. Commercial Recovery

15.8.2. Cranes

15.8.2.1. Fixed Cranes

15.8.2.2. Mobile Cranes

15.8.3. Workboats

15.8.4. Utility

15.8.5. Others

15.9. Electric Hoist Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

15.9.1. Direct Sales

15.9.2. Indirect Sales

15.10. Electric Hoist Market Size (US$ Bn) (Bn Units), by Country, 2017 - 2031

15.10.1. GCC

15.10.2. South Africa

15.10.3. Rest of Middle East & Africa

15.11. Incremental Opportunity Analysis

16. South America Electric Hoist Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Supplier Analysis

16.3. Price Trend Analysis

16.3.1. Weighted Average Selling Price (US$)

16.4. Key Trends Analysis

16.4.1. Demand Side Analysis

16.4.2. Supply Side Analysis

16.5. Electric Hoist Market Size (US$ Bn and Thousand Units), by Hoist Rope Type, 2017 - 2031

16.5.1. Chain hoist

16.5.2. Wire or Rope Hoist

16.6. Electric Hoist Market Size (US$ Bn and Thousand Units), by Capacity, 2017 - 2031

16.6.1. Up to 1000 lbs

16.6.2. 1000 lbs to 2000 lbs

16.6.3. 2000 lbs to 4000 lbs

16.6.4. 4000 lbs to 6000 lbs

16.6.5. 6000 lbs to 8000 lbs

16.6.6. 8000 lbs to 10000 lbs

16.6.7. 10000 lbs to 12000 lbs

16.6.8. 12000 lbs to 16000 lbs

16.6.9. Above 16000 lbs

16.7. Electric Hoist Market Size (US$ Bn and Thousand Units), by End-use Industry, 2017 - 2031

16.7.1. Automotive & Railway

16.7.2. Aerospace & Defense

16.7.3. Transportation & Logistics

16.7.4. Construction

16.7.5. Shipping & Marine

16.7.6. Material Handling

16.7.7. Agriculture & Forestry

16.7.8. Mining

16.7.9. Oil & Gas

16.7.10. Others

16.8. Electric Hoist Market Size (US$ Bn and Thousand Units), by Application, 2017 - 2031

16.8.1. Commercial Recovery

16.8.2. Cranes

16.8.2.1. Fixed Cranes

16.8.2.2. Mobile Cranes

16.8.3. Workboats

16.8.4. Utility

16.8.5. Others

16.9. Electric Hoist Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017 - 2031

16.9.1. Direct Sales

16.9.2. Indirect Sales

16.10. Electric Hoist Market Size (US$ Bn) (Bn Units), by Country, 2017 - 2031

16.10.1. Brazil

16.10.2. Rest of South America

16.11. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Market Player – Competition Dashboard

17.2. Market Share Analysis % (2022)

17.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview, Go-To-Market Strategy)

17.3.1. Tianjing Kunda Hoisting Equipment Co., Ltd

17.3.1.1. Company Overview

17.3.1.2. Sales Area/Geographical Presence

17.3.1.3. Revenue

17.3.1.4. Strategy & Business Overview

17.3.1.5. Go-To-Market Strategy

17.3.2. IMER International SpA

17.3.2.1. Company Overview

17.3.2.2. Sales Area/Geographical Presence

17.3.2.3. Revenue

17.3.2.4. Strategy & Business Overview

17.3.2.5. Go-To-Market Strategy

17.3.3. ABUS Kransysteme GmbH

17.3.3.1. Company Overview

17.3.3.2. Sales Area/Geographical Presence

17.3.3.3. Revenue

17.3.3.4. Strategy & Business Overview

17.3.3.5. Go-To-Market Strategy

17.3.4. Street Crane Company Limited

17.3.4.1. Company Overview

17.3.4.2. Sales Area/Geographical Presence

17.3.4.3. Revenue

17.3.4.4. Strategy & Business Overview

17.3.4.5. Go-To-Market Strategy

17.3.5. Ingersoll Rand

17.3.5.1. Company Overview

17.3.5.2. Sales Area/Geographical Presence

17.3.5.3. Revenue

17.3.5.4. Strategy & Business Overview

17.3.5.5. Go-To-Market Strategy

17.3.6. Konecranes

17.3.6.1. Company Overview

17.3.6.2. Sales Area/Geographical Presence

17.3.6.3. Revenue

17.3.6.4. Strategy & Business Overview

17.3.6.5. Go-To-Market Strategy

17.3.7. Columbus McKinnon Corporation

17.3.7.1. Company Overview

17.3.7.2. Sales Area/Geographical Presence

17.3.7.3. Revenue

17.3.7.4. Strategy & Business Overview

17.3.7.5. Go-To-Market Strategy

17.3.8. Hitachi Industrial Equipment Systems Co., Ltd

17.3.8.1. Company Overview

17.3.8.2. Sales Area/Geographical Presence

17.3.8.3. Revenue

17.3.8.4. Strategy & Business Overview

17.3.8.5. Go-To-Market Strategy

17.3.9. Kran Direkt GmbH & Co. KG

17.3.9.1. Company Overview

17.3.9.2. Sales Area/Geographical Presence

17.3.9.3. Revenue

17.3.9.4. Strategy & Business Overview

17.3.9.5. Go-To-Market Strategy

17.3.10. Columbus McKinnon Corporation

17.3.10.1. Company Overview

17.3.10.2. Sales Area/Geographical Presence

17.3.10.3. Revenue

17.3.10.4. Strategy & Business Overview

17.3.10.5. Go-To-Market Strategy

18. Key Takeaways

18.1. Identification of Potential Market Spaces

18.2. Understanding the Buying Process of the Customers

List of Tables

Tables 1: Global Electric Hoist Market Volume (Thousand Units) Share, by Hoist Rope Type, 2017-2031

Tables 2: Global Electric Hoist Market Value (US$ Bn) Share, by Hoist Rope Type, 2017-2031

Tables 3: Global Electric Hoist Market Volume (Thousand Units) Share, by Capacity, 2017-2031

Tables 4: Global Electric Hoist Market Value (US$ Bn) Share, by Capacity, 2017-2031

Tables 5: Global Electric Hoist Market Volume (Thousand Units) Share, by End-use Industry, 2017-2031

Tables 6: Global Electric Hoist Market Value (US$ Bn) Share, by End-use Industry, 2017-2031

Tables 7: Global Electric Hoist Market Volume (Thousand Units) Share, by Application 2017-2031

Tables 8: Global Electric Hoist Market Value (US$ Bn) Share, by Application 2017-2031

Tables 9: Global Electric Hoist Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Tables 10: Global Electric Hoist Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Tables 11: Global Electric Hoist Market Volume (Thousand Units) Share, by Region 2017-2031

Tables 12: Global Electric Hoist Market Value (US$ Bn) Share, by Region 2017-2031

Tables 13: North America Electric Hoist Market Volume (Thousand Units) Share, by Hoist Rope Type, 2017-2031

Tables 14: North America Electric Hoist Market Value (US$ Bn) Share, by Hoist Rope Type, 2017-2031

Tables 15: North America Electric Hoist Market Volume (Thousand Units) Share, by Capacity, 2017-2031

Tables 16: North America Electric Hoist Market Value (US$ Bn) Share, by Capacity, 2017-2031

Tables 17: North America Electric Hoist Market Volume (Thousand Units) Share, by End-use Industry, 2017-2031

Tables 18: North America Electric Hoist Market Value (US$ Bn) Share, by End-use Industry, 2017-2031

Tables 19: North America Electric Hoist Market Volume (Thousand Units) Share, by Application 2017-2031

Tables 20: North America Electric Hoist Market Value (US$ Bn) Share, by Application 2017-2031

Tables 21: North America Electric Hoist Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Tables 22: North America Electric Hoist Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Tables 23: North America Electric Hoist Market Volume (Thousand Units) Share, by Country, 2017-2031

Tables 24: North America Electric Hoist Market Value (US$ Bn) Share, by Country, 2017-2031

Tables 25: Europe Electric Hoist Market Volume (Thousand Units) Share, by Hoist Rope Type, 2017-2031

Tables 26: Europe Electric Hoist Market Value (US$ Bn) Share, by Hoist Rope Type, 2017-2031

Tables 27: Europe Electric Hoist Market Volume (Thousand Units) Share, by Capacity, 2017-2031

Tables 28: Europe Electric Hoist Market Value (US$ Bn) Share, by Capacity, 2017-2031

Tables 29: Europe Electric Hoist Market Volume (Thousand Units) Share, by End-use Industry, 2017-2031

Tables 30: Europe Electric Hoist Market Value (US$ Bn) Share, by End-use Industry, 2017-2031

Tables 31: Europe Electric Hoist Market Volume (Thousand Units) Share, by Application 2017-2031

Tables 32: Europe Electric Hoist Market Value (US$ Bn) Share, by Application 2017-2031

Tables 33: Europe Electric Hoist Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Tables 34: Europe Electric Hoist Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Tables 35: Europe Electric Hoist Market Volume (Thousand Units) Share, by Country, 2017-2031

Tables 36: Europe Electric Hoist Market Value (US$ Bn) Share, by Country, 2017-2031

Tables 37: Asia Pacific Electric Hoist Market Volume (Thousand Units) Share, by Hoist Rope Type, 2017-2031

Tables 38: Asia Pacific Electric Hoist Market Value (US$ Bn) Share, by Hoist Rope Type, 2017-2031

Tables 39: Asia Pacific Electric Hoist Market Volume (Thousand Units) Share, by Capacity, 2017-2031

Tables 40: Asia Pacific Electric Hoist Market Value (US$ Bn) Share, by Capacity, 2017-2031

Tables 41: Asia Pacific Electric Hoist Market Volume (Thousand Units) Share, by End-use Industry, 2017-2031

Tables 42: Asia Pacific Electric Hoist Market Value (US$ Bn) Share, by End-use Industry, 2017-2031

Tables 43: Asia Pacific Electric Hoist Market Volume (Thousand Units) Share, by Application 2017-2031

Tables 44: Asia Pacific Electric Hoist Market Value (US$ Bn) Share, by Application 2017-2031

Tables 45: Asia Pacific Electric Hoist Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Tables 46: Asia Pacific Electric Hoist Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Tables 47: Asia Pacific Electric Hoist Market Volume (Thousand Units) Share, by Country, 2017-2031

Tables 48: Asia Pacific Electric Hoist Market Value (US$ Bn) Share, by Country, 2017-2031

Tables 49: Middle East & Africa Electric Hoist Market Volume (Thousand Units) Share, by Hoist Rope Type, 2017-2031

Tables 50: Middle East & Africa Electric Hoist Market Value (US$ Bn) Share, by Hoist Rope Type, 2017-2031

Tables 51: Middle East & Africa Electric Hoist Market Volume (Thousand Units) Share, by Capacity, 2017-2031

Tables 52: Middle East & Africa Electric Hoist Market Value (US$ Bn) Share, by Capacity, 2017-2031

Tables 53: Middle East & Africa Electric Hoist Market Volume (Thousand Units) Share, by End-use Industry, 2017-2031

Tables 54: Middle East & Africa Electric Hoist Market Value (US$ Bn) Share, by End-use Industry, 2017-2031

Tables 55: Middle East & Africa Electric Hoist Market Volume (Thousand Units) Share, by Application 2017-2031

Tables 56: Middle East & Africa Electric Hoist Market Value (US$ Bn) Share, by Application 2017-2031

Tables 57: Middle East & Africa Electric Hoist Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Tables 58: Middle East & Africa Electric Hoist Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Tables 59: Middle East & Africa Electric Hoist Market Volume (Thousand Units) Share, by Country, 2017-2031

Tables 60: Middle East & Africa Electric Hoist Market Value (US$ Bn) Share, by Country, 2017-2031

Tables 61: South America Electric Hoist Market Volume (Thousand Units) Share, by Hoist Rope Type, 2017-2031

Tables 62: South America Electric Hoist Market Value (US$ Bn) Share, by Hoist Rope Type, 2017-2031

Tables 63: South America Electric Hoist Market Volume (Thousand Units) Share, by Capacity, 2017-2031

Tables 64: South America Electric Hoist Market Value (US$ Bn) Share, by Capacity, 2017-2031

Tables 65: South America Electric Hoist Market Volume (Thousand Units) Share, by End-use Industry, 2017-2031

Tables 66: South America Electric Hoist Market Value (US$ Bn) Share, by End-use Industry, 2017-2031

Tables 67: South America Electric Hoist Market Volume (Thousand Units) Share, by Application 2017-2031

Tables 68: South America Electric Hoist Market Value (US$ Bn) Share, by Application 2017-2031

Tables 69: South America Electric Hoist Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Tables 70: South America Electric Hoist Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Tables 71: South America Electric Hoist Market Volume (Thousand Units) Share, by Country, 2017-2031

Tables 72: South America Electric Hoist Market Value (US$ Bn) Share, by Country, 2017-2031

List of Figures

Figures 1: Global Electric Hoist Market Volume (Thousand Units) Share, by Hoist Rope Type, 2017-2031

Figures 2: Global Electric Hoist Market Value (US$ Bn) Share, by Hoist Rope Type, 2017-2031

Figures 3: Global Electric Hoist Market Incremental Opportunity (US$ Bn), by Hoist Rope Type, 2017-2031

Figures 4: Global Electric Hoist Market Volume (Thousand Units) Share, by Capacity, 2017-2031

Figures 5: Global Electric Hoist Market Value (US$ Bn) Share, by Capacity, 2017-2031

Figures 6: Global Electric Hoist Market Incremental Opportunity (US$ Bn), by Capacity, 2017-2031

Figures 7: Global Electric Hoist Market Volume (Thousand Units) Share, by End-use Industry, 2017-2031

Figures 8: Global Electric Hoist Market Value (US$ Bn) Share, by End-use Industry, 2017-2031

Figures 9: Global Electric Hoist Market Incremental Opportunity (US$ Bn), by End-use Industry, 2017-2031

Figures 10: Global Electric Hoist Market Volume (Thousand Units) Share, by Application 2017-2031

Figures 11: Global Electric Hoist Market Value (US$ Bn) Share, by Application 2017-2031

Figures 12: Global Electric Hoist Market Incremental Opportunity (US$ Bn), by Application 2017-2031

Figures 13: Global Electric Hoist Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Figures 14: Global Electric Hoist Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figures 15: Global Electric Hoist Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figures 16: Global Electric Hoist Market Volume (Thousand Units) Share, by Region 2017-2031

Figures 17: Global Electric Hoist Market Value (US$ Bn) Share, by Region 2017-2031

Figures 18: Global Electric Hoist Market Incremental Opportunity (US$ Bn), by Region 2017-2031

Figures 19: North America Electric Hoist Market Volume (Thousand Units) Share, by Hoist Rope Type, 2017-2031

Figures 20: North America Electric Hoist Market Value (US$ Bn) Share, by Hoist Rope Type, 2017-2031

Figures 21: North America Electric Hoist Market Incremental Opportunity (US$ Bn), by Hoist Rope Type, 2017-2031

Figures 22: North America Electric Hoist Market Volume (Thousand Units) Share, by Capacity, 2017-2031

Figures 23: North America Electric Hoist Market Value (US$ Bn) Share, by Capacity, 2017-2031

Figures 24: North America Electric Hoist Market Incremental Opportunity (US$ Bn), by Capacity, 2017-2031

Figures 25: North America Electric Hoist Market Volume (Thousand Units) Share, by End-use Industry, 2017-2031

Figures 26: North America Electric Hoist Market Value (US$ Bn) Share, by End-use Industry, 2017-2031

Figures 27: North America Electric Hoist Market Incremental Opportunity (US$ Bn), by End-use Industry, 2017-2031

Figures 28: North America Electric Hoist Market Volume (Thousand Units) Share, by Application 2017-2031

Figures 29: North America Electric Hoist Market Value (US$ Bn) Share, by Application 2017-2031

Figures 30: North America Electric Hoist Market Incremental Opportunity (US$ Bn), by Application 2017-2031

Figures 31: North America Electric Hoist Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Figures 32: North America Electric Hoist Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figures 33: North America Electric Hoist Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figures 34: North America Electric Hoist Market Volume (Thousand Units) Share, by Country, 2017-2031

Figures 35: North America Electric Hoist Market Value (US$ Bn) Share, by Country, 2017-2031

Figures 36: North America Electric Hoist Market Incremental Opportunity (US$ Bn), by Country, 2017-2031

Figures 37: Europe Electric Hoist Market Volume (Thousand Units) Share, by Hoist Rope Type, 2017-2031

Figures 38: Europe Electric Hoist Market Value (US$ Bn) Share, by Hoist Rope Type, 2017-2031

Figures 39: Europe Electric Hoist Market Incremental Opportunity (US$ Bn), by Hoist Rope Type, 2017-2031

Figures 40: Europe Electric Hoist Market Volume (Thousand Units) Share, by Capacity, 2017-2031

Figures 41: Europe Electric Hoist Market Value (US$ Bn) Share, by Capacity, 2017-2031

Figures 42: Europe Electric Hoist Market Incremental Opportunity (US$ Bn), by Capacity, 2017-2031

Figures 43: Europe Electric Hoist Market Volume (Thousand Units) Share, by End-use Industry, 2017-2031

Figures 44: Europe Electric Hoist Market Value (US$ Bn) Share, by End-use Industry, 2017-2031

Figures 45: Europe Electric Hoist Market Incremental Opportunity (US$ Bn), by End-use Industry, 2017-2031

Figures 46: Europe Electric Hoist Market Volume (Thousand Units) Share, by Application 2017-2031

Figures 47: Europe Electric Hoist Market Value (US$ Bn) Share, by Application 2017-2031

Figures 48: Europe Electric Hoist Market Incremental Opportunity (US$ Bn), by Application 2017-2031

Figures 49: Europe Electric Hoist Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Figures 50: Europe Electric Hoist Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figures 51: Europe Electric Hoist Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figures 52: Europe Electric Hoist Market Volume (Thousand Units) Share, by Country, 2017-2031

Figures 53: Europe Electric Hoist Market Value (US$ Bn) Share, by Country, 2017-2031

Figures 54: Europe Electric Hoist Market Incremental Opportunity (US$ Bn), by Country, 2017-2031

Figures 55: Asia Pacific Electric Hoist Market Volume (Thousand Units) Share, by Hoist Rope Type, 2017-2031

Figures 56: Asia Pacific Electric Hoist Market Value (US$ Bn) Share, by Hoist Rope Type, 2017-2031

Figures 57: Asia Pacific Electric Hoist Market Incremental Opportunity (US$ Bn), by Hoist Rope Type, 2017-2031

Figures 58: Asia Pacific Electric Hoist Market Volume (Thousand Units) Share, by Capacity, 2017-2031

Figures 59: Asia Pacific Electric Hoist Market Value (US$ Bn) Share, by Capacity, 2017-2031

Figures 60: Asia Pacific Electric Hoist Market Incremental Opportunity (US$ Bn), by Capacity, 2017-2031

Figures 61: Asia Pacific Electric Hoist Market Volume (Thousand Units) Share, by End-use Industry, 2017-2031

Figures 62: Asia Pacific Electric Hoist Market Value (US$ Bn) Share, by End-use Industry, 2017-2031

Figures 63: Asia Pacific Electric Hoist Market Incremental Opportunity (US$ Bn), by End-use Industry, 2017-2031

Figures 64: Asia Pacific Electric Hoist Market Volume (Thousand Units) Share, by Application 2017-2031

Figures 65: Asia Pacific Electric Hoist Market Value (US$ Bn) Share, by Application 2017-2031

Figures 66: Asia Pacific Electric Hoist Market Incremental Opportunity (US$ Bn), by Application 2017-2031

Figures 67: Asia Pacific Electric Hoist Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Figures 68: Asia Pacific Electric Hoist Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figures 69: Asia Pacific Electric Hoist Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figures 70: Asia Pacific Electric Hoist Market Volume (Thousand Units) Share, by Country, 2017-2031

Figures 71: Asia Pacific Electric Hoist Market Value (US$ Bn) Share, by Country, 2017-2031

Figures 72: Asia Pacific Electric Hoist Market Incremental Opportunity (US$ Bn), by Country, 2017-2031

Figures 73: Middle East & Africa Electric Hoist Market Volume (Thousand Units) Share, by Hoist Rope Type, 2017-2031

Figures 74: Middle East & Africa Electric Hoist Market Value (US$ Bn) Share, by Hoist Rope Type, 2017-2031

Figures 75: Middle East & Africa Electric Hoist Market Incremental Opportunity (US$ Bn), by Hoist Rope Type, 2017-2031

Figures 76: Middle East & Africa Electric Hoist Market Volume (Thousand Units) Share, by Capacity, 2017-2031

Figures 77: Middle East & Africa Electric Hoist Market Value (US$ Bn) Share, by Capacity, 2017-2031

Figures 78: Middle East & Africa Electric Hoist Market Incremental Opportunity (US$ Bn), by Capacity, 2017-2031

Figures 79: Middle East & Africa Electric Hoist Market Volume (Thousand Units) Share, by End-use Industry, 2017-2031

Figures 80: Middle East & Africa Electric Hoist Market Value (US$ Bn) Share, by End-use Industry, 2017-2031

Figures 81: Middle East & Africa Electric Hoist Market Incremental Opportunity (US$ Bn), by End-use Industry, 2017-2031

Figures 82: Middle East & Africa Electric Hoist Market Volume (Thousand Units) Share, by Application 2017-2031

Figures 83: Middle East & Africa Electric Hoist Market Value (US$ Bn) Share, by Application 2017-2031

Figures 84: Middle East & Africa Electric Hoist Market Incremental Opportunity (US$ Bn), by Application 2017-2031

Figures 85: Middle East & Africa Electric Hoist Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Figures 86: Middle East & Africa Electric Hoist Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figures 87: Middle East & Africa Electric Hoist Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figures 88: Middle East & Africa Electric Hoist Market Volume (Thousand Units) Share, by Country, 2017-2031

Figures 89: Middle East & Africa Electric Hoist Market Value (US$ Bn) Share, by Country, 2017-2031

Figures 90: Middle East & Africa Electric Hoist Market Incremental Opportunity (US$ Bn), by Country, 2017-2031

Figures 91: South America Electric Hoist Market Volume (Thousand Units) Share, by Hoist Rope Type, 2017-2031

Figures 92: South America Electric Hoist Market Value (US$ Bn) Share, by Hoist Rope Type, 2017-2031

Figures 93: South America Electric Hoist Market Incremental Opportunity (US$ Bn), by Hoist Rope Type, 2017-2031

Figures 94: South America Electric Hoist Market Volume (Thousand Units) Share, by Capacity, 2017-2031

Figures 95: South America Electric Hoist Market Value (US$ Bn) Share, by Capacity, 2017-2031

Figures 96: South America Electric Hoist Market Incremental Opportunity (US$ Bn), by Capacity, 2017-2031

Figures 97: South America Electric Hoist Market Volume (Thousand Units) Share, by End-use Industry, 2017-2031

Figures 98: South America Electric Hoist Market Value (US$ Bn) Share, by End-use Industry, 2017-2031

Figures 99: South America Electric Hoist Market Incremental Opportunity (US$ Bn), by End-use Industry, 2017-2031

Figures 100: South America Electric Hoist Market Volume (Thousand Units) Share, by Application 2017-2031

Figures 101: South America Electric Hoist Market Value (US$ Bn) Share, by Application 2017-2031

Figures 102: South America Electric Hoist Market Incremental Opportunity (US$ Bn), by Application 2017-2031

Figures 103: South America Electric Hoist Market Volume (Thousand Units) Share, by Distribution Channel, 2017-2031

Figures 104: South America Electric Hoist Market Value (US$ Bn) Share, by Distribution Channel, 2017-2031

Figures 105: South America Electric Hoist Market Incremental Opportunity (US$ Bn), by Distribution Channel, 2017-2031

Figures 106: South America Electric Hoist Market Volume (Thousand Units) Share, by Country, 2017-2031

Figures 107: South America Electric Hoist Market Value (US$ Bn) Share, by Country, 2017-2031

Figures 108: South America Electric Hoist Market Incremental Opportunity (US$ Bn), by Country, 2017-2031