Reports

Reports

Analysts’ Viewpoint on Market Scenario

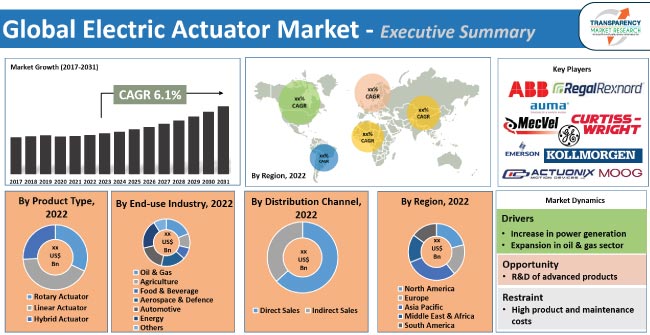

Expansion of the oil & gas, automotive, and power generation sectors is expected to propel the electric actuator market size during the forecast period. Electric actuators are widely employed in the power generation sector due to their ability to reduce downtime and provide precise control over various power generation systems.

Electric actuators can extend machine life, save time, reduce energy consumption, and enhance production capabilities. Vendors in the global electric actuator industry are allocating a major portion of their revenue to R&D activities to stay competitive in the market. They are also adopting various growth strategies, such as collaborations, partnerships, and M&As, to increase their electric actuator market share.

Electric actuator is a type of device that converts electrical energy into mechanical motion to control or move a mechanism or system. It plays an important role in a wide range of applications across various industries including manufacturing, automotive, aerospace, and robotics. Electric actuators have gained popularity due to their precision, controllability, and ability to be integrated into automated systems.

Electric actuators operate based on the principles of electromagnetism and the conversion of electrical energy into mechanical motion. The core components of an electric actuator typically include an electric motor, a gearbox, and a lead screw or ball screw mechanism. The electric motor is the primary source of motion in an electric actuator. It could be a DC motor, AC motor, stepper motor, or servo motor, depending on the application requirements. Linear, rotary, and hybrid are the three types of actuators.

Electric actuators offer excellent control and positioning capabilities, making them ideal for applications that require high precision and accuracy. They can be easily integrated into automated systems and controlled through various electronic interfaces. Electric actuators are especially beneficial for larger power plants that require efficient operation of valves and dampers. They are cost-effective and require less maintenance, making them an attractive option for use in power generation.

Electric actuators are increasingly used in power generation. They are employed in nuclear power plants to control the flow of steam, which, in turn, helps to maintain optimal levels of power output. Electric actuators provide precise control over the flow of water and steam in power plants. This helps to ensure that the power plant is running safely and efficiently. Actuators can be adjusted to maintain optimal levels of power output. Additionally, electric actuators are less expensive and more reliable than their hydraulic counterparts. Hence, surge in power generation is fueling the electric actuator market statistics.

The Central Electricity Authority (CEA) estimates India’s power requirement to grow to reach 817 GW by 2030. Moreover, electric power energy generation is projected to increase from 18% to 44% and thermal energy generation is expected to reduce from 78% to 52% by 2029-30. This is likely to require huge investments in the electric infrastructure, which involves the deployment of smart grids, renewable energy sources, and other technologies. Such investments are anticipated to spur the electric actuator market growth in the next few years.

Electric actuators require less maintenance than hydraulic actuators, which can lead to cost savings. They are also lighter and smaller, making them easier to move and install. Furthermore, they are often easier to control, allowing for more precise movements and adjustments. Electric actuators also have a longer life expectancy, meaning they can be used for a longer period of time before needing to be replaced. They can also be employed in more extreme conditions.

The oil & gas sector relies on precision and accuracy in electronic actuation to control the production process. Companies in the sector employ pipeline systems for most of their operations, from refining to distribution. Thus, it is critical to have reliable pipeline infrastructure and control systems. Electric actuators play a major role in pipeline safety. They are used to control the flow of oils and gases in pipelines. Electric actuators are also utilized to shut off the flow of oils and gases in the event of an emergency. This helps to ensure the safety of both the pipeline and the people living in the area. Hence, growth in the oil & gas sector is driving growth of the electric actuator industry.

Expansion in the global natural gas sector is also fueling demand for electric actuators. In the U.S., the sector makes up 8% of the country’s GDP. Presence of a favorable regulatory framework is propelling natural gas production in Europe. Moreover, the energy market in the region is becoming increasingly competitive, allowing more companies to enter the market. Additionally, technological advancements in electric actuators are enabling greater access to new sources of oils and gases. This, in turn, is boosting the electric actuator market revenue.

According to the latest electric actuator market forecast, Asia Pacific is anticipated to hold largest share from 2023 to 2031. Rise in investment in the power generation sector and increase in adoption of industrial automation are fueling market dynamics in the region.

Companies in oil & gas, power generation, food and beverage, automotive, and agriculture sectors are expanding their presence in Asia Pacific. China, Japan, and South Korea are witnessing rapid growth in the adoption of electric vehicles. These factors are augmenting market progress in the region.

The global industry is highly competitive and stagnant due to the presence of several global and regional electric actuator manufacturers. Investment in R&D activities is likely to offer emerging opportunities in the electric actuator market. Major electric actuator companies are capitalizing on growth in the trend toward electrification in various industries. They are also adopting various collaboration, partnership, and M&A strategies to broaden their customer base.

ABB, Actuonix Motion Devices Inc., Regal Rexnord, AUMA Riester Gmbh & Co. KG, Curtiss-Wright Corporation, Kollmorgen, Emerson Electric Co., General Electric, MecVel Srl, and Moog Inc. are key players in the electric actuator market.

Each of these players has been profiled in the electric actuator market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

12.3 Bn |

|

Market Forecast Value in 2031 |

20.9 Bn |

|

Growth Rate (CAGR) |

6.1% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, demographic overview, brand analysis, and consumer buying behavior analysis. |

|

Competition Landscape |

|

|

Format |

|

|

Market Segmentation |

|

|

Regions Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

|

|

Pricing |

|

It was valued at 12.3 Bn in 2022

It is projected to grow at a CAGR of 6.1% from 2023 to 2031

Increase in power generation and expansion in oil & gas sector

Oil & gas was the largest end-use industry segment in 2022

Asia Pacific is expected to record the highest demand during the forecast period

ABB, Actuonix Motion Devices Inc., Regal Rexnord, AUMA Riester Gmbh & Co. KG, Curtiss-Wright Corporation, Kollmorgen, Emerson Electric Co., General Electric, MecVel Srl, and Moog Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Regulations & Guidelines

5.5. Key Market Indicators

5.5.1. Overall Actuator Market Industry Overview

5.6. Covid-19 Impact Analysis

5.7. Technological Overview

5.8. Porter’s Five Forces Analysis

5.9. Value Chain Analysis

5.10. Industry SWOT Analysis

5.11. Global Electric Actuator Market Analysis and Forecast, 2017 - 2031

5.11.1. Market Revenue Projection (US$ Bn)

5.11.2. Market Revenue Projection (Thousand Units)

6. Global Electric Actuator Market Analysis and Forecast, By Product Type

6.1. Electric Actuator Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

6.1.1. Rotary Actuator

6.1.2. Linear Actuator

6.1.3. Hybrid Actuator

6.2. Incremental Opportunity, By Product Type

7. Global Electric Actuator Market Analysis and Forecast, By End-use Industry

7.1. Electric Actuator Market Size (US$ Bn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

7.1.1. Oil & Gas

7.1.2. Agriculture

7.1.3. Food & Beverage

7.1.4. Aerospace & Defense

7.1.5. Automotive

7.1.6. Energy

7.1.7. Others

7.2. Incremental Opportunity, By End-use Industry

8. Global Electric Actuator Market Analysis and Forecast, By Distribution Channel

8.1. Electric Actuator Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

8.1.1. Direct Sales

8.1.2. Indirect Sales

8.2. Incremental Opportunity, By Distribution Channel

9. Global Electric Actuator Market Analysis and Forecast, By Region

9.1. Electric Actuator Market Size (US$ Bn and Thousand Units), By Region, 2017 - 2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Global Incremental Opportunity, by Region

10. North America Electric Actuator Market Analysis and Forecast

10.1. Regional Snapshot

10.2. Key Supplier Analysis

10.3. Key Trend Analysis

10.4. Price Trend Analysis

10.4.1. Weighted Average Price

10.5. Electric Actuator Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

10.5.1. Rotary Actuator

10.5.2. Linear Actuator

10.5.3. Hybrid Actuator

10.6. Electric Actuator Market Size (US$ Bn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

10.6.1. Oil & Gas

10.6.2. Agriculture

10.6.3. Food & Beverage

10.6.4. Aerospace & Defense

10.6.5. Automotive

10.6.6. Energy

10.6.7. Others

10.7. Electric Actuator Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

10.7.1. Direct Sales

10.7.2. Indirect Sales

10.8. Electric Actuator Market Size (US$ Bn and Thousand Units), by Country, 2017 - 2031

10.8.1. U.S.

10.8.2. Canada

10.8.3. Rest of North America

10.9. Incremental Opportunity Analysis

11. Europe Electric Actuator Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. Key Trend Analysis

11.4. Price Trend Analysis

11.4.1. Weighted Average Price

11.5. Electric Actuator Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

11.5.1. Rotary Actuator

11.5.2. Linear Actuator

11.5.3. Hybrid Actuator

11.6. Electric Actuator Market Size (US$ Bn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

11.6.1. Oil & Gas

11.6.2. Agriculture

11.6.3. Food & Beverage

11.6.4. Aerospace & Defense

11.6.5. Automotive

11.6.6. Energy

11.6.7. Others

11.7. Electric Actuator Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

11.7.1. Direct Sales

11.7.2. Indirect Sales

11.8. Electric Actuator Market Size (US$ Bn and Thousand Units), by Country, 2017 - 2031

11.8.1. U.K.

11.8.2. Germany

11.8.3. France

11.8.4. Rest of Europe

11.9. Incremental Opportunity Analysis

12. Asia Pacific Electric Actuator Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Key Trend Analysis

12.4. Price Trend Analysis

12.4.1. Weighted Average Price

12.5. Electric Actuator Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

12.5.1. Rotary Actuator

12.5.2. Linear Actuator

12.5.3. Hybrid Actuator

12.6. Electric Actuator Market Size (US$ Bn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

12.6.1. Oil & Gas

12.6.2. Agriculture

12.6.3. Food & Beverage

12.6.4. Aerospace & Defense

12.6.5. Automotive

12.6.6. Energy

12.6.7. Others

12.7. Electric Actuator Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

12.7.1. Direct Sales

12.7.2. Indirect Sales

12.8. Electric Actuator Market Size (US$ Bn and Thousand Units), by Country, 2017 - 2031

12.8.1. India

12.8.2. China

12.8.3. Japan

12.8.4. Rest of Asia Pacific

12.9. Incremental Opportunity Analysis

13. Middle East & Africa Electric Actuator Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Key Trend Analysis

13.4. Price Trend Analysis

13.4.1. Weighted Average Price

13.5. Electric Actuator Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

13.5.1. Rotary Actuator

13.5.2. Linear Actuator

13.5.3. Hybrid Actuator

13.6. Electric Actuator Market Size (US$ Bn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

13.6.1. Oil & Gas

13.6.2. Agriculture

13.6.3. Food & Beverage

13.6.4. Aerospace & Defense

13.6.5. Automotive

13.6.6. Energy

13.6.7. Others

13.7. Electric Actuator Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

13.7.1. Direct Sales

13.7.2. Indirect Sales

13.8. Electric Actuator Market Size (US$ Bn and Thousand Units), by Country, 2017 - 2031

13.8.1. GCC

13.8.2. South Africa

13.8.3. Rest of Middle East & Africa

13.9. Incremental Opportunity Analysis

14. South America Electric Actuator Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trend Analysis

14.4. Price Trend Analysis

14.4.1. Weighted Average Price

14.5. Electric Actuator Market Size (US$ Bn and Thousand Units) Forecast, By Product Type, 2017 - 2031

14.5.1. Rotary Actuator

14.5.2. Linear Actuator

14.5.3. Hybrid Actuator

14.6. Electric Actuator Market Size (US$ Bn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

14.6.1. Oil & Gas

14.6.2. Agriculture

14.6.3. Food & Beverage

14.6.4. Aerospace & Defense

14.6.5. Automotive

14.6.6. Energy

14.6.7. Others

14.7. Electric Actuator Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

14.7.1. Direct Sales

14.7.2. Indirect Sales

14.8. Electric Actuator Market Size (US$ Bn and Thousand Units), by Country, 2017 - 2031

14.8.1. Brazil

14.8.2. Rest of South America

14.9. Incremental Opportunity Analysis

15. Competition Landscape

15.1. Market Player - Competition Dashboard

15.2. Market Share Analysis (%)-2022

15.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Product Portfolio, Manufacturing Location, Revenue, Strategy & Business Process Overview)

15.3.1. ABB

15.3.1.1. Company Overview

15.3.1.2. Sales Area/Geographical Presence

15.3.1.3. Product Portfolio

15.3.1.4. Manufacturing Location

15.3.1.5. Revenue

15.3.1.6. Strategy & Business Process Overview

15.3.2. Actuonix Motion Devices Inc.

15.3.2.1. Company Overview

15.3.2.2. Sales Area/Geographical Presence

15.3.2.3. Product Portfolio

15.3.2.4. Manufacturing Location

15.3.2.5. Revenue

15.3.2.6. Strategy & Business Process Overview

15.3.3. Regal Rexnord

15.3.3.1. Company Overview

15.3.3.2. Sales Area/Geographical Presence

15.3.3.3. Product Portfolio

15.3.3.4. Manufacturing Location

15.3.3.5. Revenue

15.3.3.6. Strategy & Business Process Overview

15.3.4. AUMA Riester GmbH & Co. KG

15.3.4.1. Company Overview

15.3.4.2. Sales Area/Geographical Presence

15.3.4.3. Product Portfolio

15.3.4.4. Manufacturing Location

15.3.4.5. Revenue

15.3.4.6. Strategy & Business Process Overview

15.3.5. Curtiss-Wright Corporation

15.3.5.1. Company Overview

15.3.5.2. Sales Area/Geographical Presence

15.3.5.3. Product Portfolio

15.3.5.4. Manufacturing Location

15.3.5.5. Revenue

15.3.5.6. Strategy & Business Process Overview

15.3.6. Kollmorgen

15.3.6.1. Company Overview

15.3.6.2. Sales Area/Geographical Presence

15.3.6.3. Product Portfolio

15.3.6.4. Manufacturing Location

15.3.6.5. Revenue

15.3.6.6. Strategy & Business Process Overview

15.3.7. Emerson Electric Co.

15.3.7.1. Company Overview

15.3.7.2. Sales Area/Geographical Presence

15.3.7.3. Product Portfolio

15.3.7.4. Manufacturing Location

15.3.7.5. Revenue

15.3.7.6. Strategy & Business Process Overview

15.3.8. General Electric

15.3.8.1. Company Overview

15.3.8.2. Sales Area/Geographical Presence

15.3.8.3. Product Portfolio

15.3.8.4. Manufacturing Location

15.3.8.5. Revenue

15.3.8.6. Strategy & Business Process Overview

15.3.9. MecVel Srl

15.3.9.1. Company Overview

15.3.9.2. Sales Area/Geographical Presence

15.3.9.3. Product Portfolio

15.3.9.4. Manufacturing Location

15.3.9.5. Revenue

15.3.9.6. Strategy & Business Process Overview

15.3.10. Moog Inc.

15.3.10.1. Company Overview

15.3.10.2. Sales Area/Geographical Presence

15.3.10.3. Product Portfolio

15.3.10.4. Manufacturing Location

15.3.10.5. Revenue

15.3.10.6. Strategy & Business Process Overview

16. Key Takeaway

16.1. Identification of Potential Market Spaces

16.1.1. By Product Type

16.1.2. By End-use Industry

16.1.3. By Distribution Channel

16.1.4. By Region

16.2. Understanding Procurement Process of End-users

16.3. Prevailing Market Risks

List of Tables

Table 1: Global Electric Actuator Market Value (US$ Bn), by Product Type, 2017-2031

Table 2: Global Electric Actuator Market Volume (Thousand Units), by Product Type 2017-2031

Table 3: Global Electric Actuator Market Value (US$ Bn), by End-use Industry 2017-2031

Table 4: Global Electric Actuator Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 5: Global Electric Actuator Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 6: Global Electric Actuator Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 7: Global Electric Actuator Market Value (US$ Bn), by Region, 2017-2031

Table 8: Global Electric Actuator Market Volume (Thousand Units), by Region 2017-2031

Table 9: North America Electric Actuator Market Value (US$ Bn), by Product Type, 2017-2031

Table 10: North America Electric Actuator Market Volume (Thousand Units), by Product Type 2017-2031

Table 11: North America Electric Actuator Market Value (US$ Bn), by End-use Industry 2017-2031

Table 12: North America Electric Actuator Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 13: North America Electric Actuator Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 14: North America Electric Actuator Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 15: North America Electric Actuator Market Value (US$ Bn), by Country, 2017-2031

Table 16: North America Electric Actuator Market Volume (Thousand Units), by Country 2017-2031

Table 17: Europe Electric Actuator Market Value (US$ Bn), by Product Type, 2017-2031

Table 18: Europe Electric Actuator Market Volume (Thousand Units), by Product Type 2017-2031

Table 19: Europe Electric Actuator Market Value (US$ Bn), by End-use Industry 2017-2031

Table 20: Europe Electric Actuator Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 21: Europe Electric Actuator Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 22: Europe Electric Actuator Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 23: Europe Electric Actuator Market Value (US$ Bn), by Country, 2017-2031

Table 24: Europe Electric Actuator Market Volume (Thousand Units), by Country 2017-2031

Table 25: Asia Pacific Electric Actuator Market Value (US$ Bn), by Product Type, 2017-2031

Table 26: Asia Pacific Electric Actuator Market Volume (Thousand Units), by Product Type 2017-2031

Table 27: Asia Pacific Electric Actuator Market Value (US$ Bn), by End-use Industry 2017-2031

Table 28: Asia Pacific Electric Actuator Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 29: Asia Pacific Electric Actuator Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 30: Asia Pacific Electric Actuator Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 31: Asia Pacific Electric Actuator Market Value (US$ Bn), by Country, 2017-2031

Table 32: Asia Pacific Electric Actuator Market Volume (Thousand Units), by Country 2017-2031

Table 33: Middle East & Africa Electric Actuator Market Value (US$ Bn), by Product Type, 2017-2031

Table 34: Middle East & Africa Electric Actuator Market Volume (Thousand Units), by Product Type 2017-2031

Table 35: Middle East & Africa Electric Actuator Market Value (US$ Bn), by End-use Industry 2017-2031

Table 36: Middle East & Africa Electric Actuator Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 37: Middle East & Africa Electric Actuator Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 38: Middle East & Africa Electric Actuator Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 39: Middle East & Africa Electric Actuator Market Value (US$ Bn), by Country, 2017-2031

Table 40: Middle East & Africa Electric Actuator Market Volume (Thousand Units), by Country 2017-2031

Table 41: South Africa Electric Actuator Market Value (US$ Bn), by Product Type, 2017-2031

Table 42: South Africa Electric Actuator Market Volume (Thousand Units), by Product Type 2017-2031

Table 43: South Africa Electric Actuator Market Value (US$ Bn), by End-use Industry 2017-2031

Table 44: South Africa Electric Actuator Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 45: South Africa Electric Actuator Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 46: South Africa Electric Actuator Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 47: South Africa Electric Actuator Market Value (US$ Bn), by Country, 2017-2031

Table 48: South Africa Electric Actuator Market Volume (Thousand Units), by Country 2017-2031

List of Figures

Figure 1: Global Electric Actuator Market Value (US$ Bn), by Product Type, 2017-2031

Figure 2: Global Electric Actuator Market Volume (Thousand Units), by Product Type 2017-2031

Figure 3: Global Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 4: Global Electric Actuator Market Value (US$ Bn), by End-use Industry 2017-2031

Figure 5: Global Electric Actuator Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 6: Global Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry 2023-2031

Figure 7: Global Electric Actuator Market Value (US$ Bn), by Distribution Channel 2017-2031

Figure 8: Global Electric Actuator Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 9: Global Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel 2023-2031

Figure 10: Global Electric Actuator Market Value (US$ Bn), by Region, 2017-2031

Figure 11: Global Electric Actuator Market Volume (Thousand Units), by Region 2017-2031

Figure 12: Global Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 13: North America Electric Actuator Market Value (US$ Bn), by Product Type, 2017-2031

Figure 14: North America Electric Actuator Market Volume (Thousand Units), by Product Type 2017-2031

Figure 15: North America Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 16: North America Electric Actuator Market Value (US$ Bn), by End-use Industry 2017-2031

Figure 17: North America Electric Actuator Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 18: North America Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry 2023-2031

Figure 19: North America Electric Actuator Market Value (US$ Bn), by Distribution Channel 2017-2031

Figure 20: North America Electric Actuator Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 21: North America Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel 2023-2031

Figure 22: North America Electric Actuator Market Value (US$ Bn), by Country, 2017-2031

Figure 23: North America Electric Actuator Market Volume (Thousand Units), by Country 2017-2031

Figure 24: North America Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by Country, 2023-2031

Figure 25: Europe Electric Actuator Market Value (US$ Bn), by Product Type, 2017-2031

Figure 26: Europe Electric Actuator Market Volume (Thousand Units), by Product Type 2017-2031

Figure 27: Europe Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 28: Europe Electric Actuator Market Value (US$ Bn), by End-use Industry 2017-2031

Figure 29: Europe Electric Actuator Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 30: Europe Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry 2023-2031

Figure 31: Europe Electric Actuator Market Value (US$ Bn), by Distribution Channel 2017-2031

Figure 32: Europe Electric Actuator Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 33: Europe Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel 2023-2031

Figure 34: Europe Electric Actuator Market Value (US$ Bn), by Country, 2017-2031

Figure 35: Europe Electric Actuator Market Volume (Thousand Units), by Country 2017-2031

Figure 36: Europe Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by Country, 2023-2031

Figure 37: Asia Pacific Electric Actuator Market Value (US$ Bn), by Product Type, 2017-2031

Figure 38: Asia Pacific Electric Actuator Market Volume (Thousand Units), by Product Type 2017-2031

Figure 39: Asia Pacific Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 40: Asia Pacific Electric Actuator Market Value (US$ Bn), by End-use Industry 2017-2031

Figure 41: Asia Pacific Electric Actuator Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 42: Asia Pacific Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry 2023-2031

Figure 43: Asia Pacific Electric Actuator Market Value (US$ Bn), by Distribution Channel 2017-2031

Figure 44: Asia Pacific Electric Actuator Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 45: Asia Pacific Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel 2023-2031

Figure 46: Asia Pacific Electric Actuator Market Value (US$ Bn), by Country, 2017-2031

Figure 47: Asia Pacific Electric Actuator Market Volume (Thousand Units), by Country 2017-2031

Figure 48: Asia Pacific Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by Country, 2023-2031

Figure 49: Middle East & Africa Electric Actuator Market Value (US$ Bn), by Product Type, 2017-2031

Figure 50: Middle East & Africa Electric Actuator Market Volume (Thousand Units), by Product Type 2017-2031

Figure 51: Middle East & Africa Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 52: Middle East & Africa Electric Actuator Market Value (US$ Bn), by End-use Industry 2017-2031

Figure 53: Middle East & Africa Electric Actuator Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 54: Middle East & Africa Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry 2023-2031

Figure 55: Middle East & Africa Electric Actuator Market Value (US$ Bn), by Distribution Channel 2017-2031

Figure 56: Middle East & Africa Electric Actuator Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 57: Middle East & Africa Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel 2023-2031

Figure 58: Middle East & Africa Electric Actuator Market Value (US$ Bn), by Country, 2017-2031

Figure 59: Middle East & Africa Electric Actuator Market Volume (Thousand Units), by Country 2017-2031

Figure 60: Middle East & Africa Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by Country, 2023-2031

Figure 61: South Africa Electric Actuator Market Value (US$ Bn), by Product Type, 2017-2031

Figure 62: South Africa Electric Actuator Market Volume (Thousand Units), by Product Type 2017-2031

Figure 63: South Africa Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 64: South Africa Electric Actuator Market Value (US$ Bn), by End-use Industry 2017-2031

Figure 65: South Africa Electric Actuator Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 66: South Africa Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry 2023-2031

Figure 67: South Africa Electric Actuator Market Value (US$ Bn), by Distribution Channel 2017-2031

Figure 68: South Africa Electric Actuator Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 69: South Africa Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel 2023-2031

Figure 70: South Africa Electric Actuator Market Value (US$ Bn), by Country, 2017-2031

Figure 71: South Africa Electric Actuator Market Volume (Thousand Units), by Country 2017-2031

Figure 72: South Africa Electric Actuator Market Incremental Opportunity (US$ Bn), Forecast, by Country, 2023-2031