Reports

Reports

Analysts’ Viewpoint

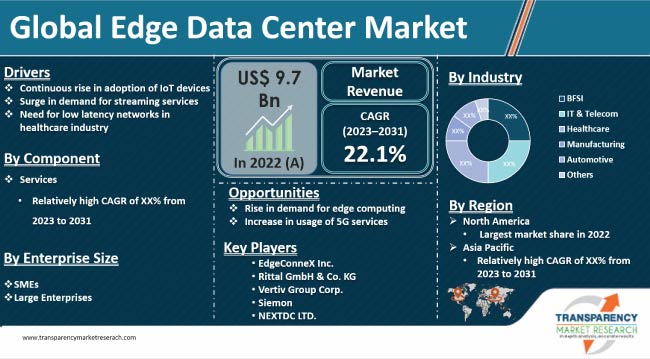

Edge data centers are small data centers that reside closer to the users and provide low latency services. Companies are therefore choosing to build edge data centers instead of traditional data centers.

Rise in demand for streaming services, and growth in the usage of IoT devices and their benefits in the healthcare industry have accelerated the demand for edge computing data centers. This is resulting in need for more edge data centers to provide low latency services to users.

The expected rise in number of autonomous vehicles in the future opens up opportunities for edge data centers. Prominent providers are investing in R&D activities to introduce advanced edge computing and IoT solutions that can meet the growing edge data center market demand.

An edge data center is a small data center that runs near to the edge network. The devices found in edge data centers are the same as devices found in the traditional data centers, but in a smaller footprint. Edge data centers have the ability to deliver cached content and cloud computing resources to these devices.

Devices in the edge data center collect and transmit data. The devices include edge caching hardware or software-based components that increase response time by temporarily storing the data. Edge data centers transform this collected data into actionable insights.

Awareness regarding data centers in rural areas is quite low, which can hinder the growth of the market. However, surge in demand for edge computing and continuous increase in usage of 5G are likely to create a plethora of opportunities for the market in the near future.

There is a significant increase in demand for streaming services. One of the biggest challenges in the streaming services is buffering. Edge data centers can tackle this issue through its low latency capabilities. They move streaming videos closer to the network, which reduces latency.

According to the Deloitte Digital Media Trends Study conducted in 2021, 85% of U.S. households have at least one video streaming subscription. Streaming services are provided in all types; some can be on-demand content and others can be TV and local channels. To stream these services, low latency and network scalability are needed, and edge data centers are able to cater to these requirements.

These data centers utilize their network capability and help in providing smooth streaming services by bringing the data closer to the users. For example, Netflix uses edge data centers to enhance user experience and reduce costs. Users of streaming services are increasing parallelly with data usage. More users means service providers need more latency, which results in more edge data centers. This is one of the key factors fueling market progress.

Latency is not the only reason service providers use these data centers; they also improve network security and reliability. Edge data centers are also easy to scale, which allows streaming service providers to quickly customize computing resources.

The COVID-19 period has seen a rise in subscriptions on major streaming services platforms. This has resulted in video streaming services investing more into new content and focusing on making their own platform-based content, also called “Originals.”

The rise in demand for edge computing is an excellent opportunity, which is likely to fuel the edge data center market share in the next few years. There is a significant rise in demand for edge computing due to its utilization in AI, content delivery, gaming industry, 5G infrastructure, and autonomous vehicles. Edge data centers are preferred to handle the high usage of edge computing.

Autonomous cars can generate up to 5 TB of data in an hour. This offers lucrative opportunities for market expansion, as the demand for edge data centers is likely to increase owing to the generation of such a huge amount of data. According to research conducted by Massachusetts Institute of Technology in 2022, there are more than 30 million autonomous vehicles globally. The number is estimated to grow further as more companies are looking to manufacture autonomous vehicles.

Video gaming business, and eSports, also needs low-latency connectivity, as lagging is disliked in eSports. More and more gaming platforms are being launched. This is likely to propel the demand for latency, which would also boost the edge data center market size. Even in the factory automation industry, floors are automated and instrumented as they produce an abundance of data. Numerous industrial sites are estimated to have the infrastructure in future, which is expected to increase the rate of data generation.

The reason for the constant increase in demand for edge computing is that it provides real-time agility and responsiveness at the edge. Usage of edge computing in such cases would significantly influence the market statistics.

North America is expected to dominate the global edge data center market during the forecast period. The U.S. is leading the regional landscape due to the increase in usage of 5G and IoT and rise in data traffic. North America has leading technological industries, and a significant presence of companies that provide edge data center services, which makes it the dominant regional market.

Asia Pacific is anticipated to witness the highest CAGR during the forecast period in terms of edge data center market growth. Presence of a large portion of the global population and emerging economies such as China and India influences the edge data center market forecast. These countries have a large and expanding base of businesses, organizations, and consumers. This is making Asia Pacific an emerging market for edge data centers.

The edge data center market research report profiles major service providers based on parameters such as financials, key product offerings, recent developments, and strategies.

365 Data Centers, Eaton Corporation plc, EdgeConneX Inc., Vertiv Group Corp., Reichle & De-Massari (R&M), Dätwyler Cabling Solutions AG, L&T Smart World, Siemon, Rittal GmbH & Co. KG, H5 Data Centers, and NEXTDC LTD. are the leading manufacturers in the edge data center market.

Service providers are tapping into the latest edge data center market trends to gain new opportunities and stay ahead of the competitive curve.

Key players have been profiled in the edge data center market report based on parameters such as product portfolio, recent developments, business strategies, financial overview, company overview, and business segments.

| Attribute | Detail |

|---|---|

|

Market Size Value in 2022 |

US$ 9.7 Bn |

|

Market Forecast Value in 2031 |

US$ 57.8 Bn |

|

Growth Rate (CAGR) |

22.1% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

Includes cross-segment analysis at global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 9.7 Bn in 2022

It is anticipated to reach US$ 57.8 Bn by the end of 2031

It is estimated to advance at a CAGR 22.1% from 2023 to 2031

Continuous rise in adoption of IoT devices, increased demand for streaming services, and need for low-latency in the healthcare industry

North America accounted for the largest share in 2022

365 Data Centers, Eaton Corporation plc, EdgeConneX Inc., Vertiv Group Corp., Reichle & De-Massari (R&M), Dätwyler IT Infra GmbH, L&T Smart World, Siemon, Rittal GmbH & Co. KG, H5 Data Centers, and NEXTDC LTD.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modeling

3. Executive Summary: Global Edge Data Center Market

4. Market Overview

4.1. Market Definition

4.2. Technology/Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on Edge Data Center Market

4.5. Market Opportunity Assessment – by Region (North America/Europe/Asia Pacific/Middle East & Africa/South America)

4.5.1. By Component

4.5.2. By Enterprise Size

4.5.3. By Industry

4.6. PORTERs Analysis

4.7. PEST Analysis

5. Global Edge Data Center Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Mn), 2016-2031

5.1.1. Historic Growth Trends, 2016-2022

5.1.2. Forecast Trends, 2023-2031

6. Global Edge Data Center Market Analysis, by Component

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. Edge Data Center Market Size (US$ Mn) Forecast, by Component, 2018 - 2031

6.3.1. Solutions

6.3.2. Services

6.3.2.1. Designing & Consulting

6.3.2.2. Implementation & Integration

6.3.2.3. Support & Maintenance

7. Global Edge Data Center Market Analysis, by Enterprise Size

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. Edge Data Center Market Size (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

7.3.1. SMEs

7.3.2. Large Enterprises

8. Global Edge Data Center Market Analysis, by Industry

8.1. Key Segment Analysis

8.2. Edge Data Center Market Size (US$ Mn) Forecast, by Industry, 2018 - 2031

8.2.1. BFSI

8.2.2. IT & Telecom

8.2.3. Healthcare

8.2.4. Manufacturing

8.2.5. Automotive

8.2.6. Others

9. Global Edge Data Center Market Analysis and Forecasts, by Region

9.1. Key Findings

9.2. Market Size (US$ Mn) Forecast by Region, 2018-2027

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. South America

10. North America Edge Data Center Market Analysis and Forecast

10.1. Regional Outlook

10.2. Edge Data Center Market Size (US$ Mn) Analysis and Forecast (2018 - 2031)

10.2.1. By Component

10.2.2. By Enterprise Size

10.2.3. By Industry

10.3. Edge Data Center Market Size (US$ Mn) Forecast, by Country, 2018 - 2031

10.3.1. U.S.

10.3.2. Canada

10.3.3. Mexico

11. Europe Edge Data Center Market Analysis and Forecast

11.1. Regional Outlook

11.2. Edge Data Center Market Size (US$ Mn) Analysis and Forecast (2018 - 2031)

11.2.1. By Component

11.2.2. By Enterprise Size

11.2.3. By Industry

11.3. Edge Data Center Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

11.3.1. Germany

11.3.2. U.K.

11.3.3. France

11.3.4. Italy

11.3.5. Spain

11.3.6. Rest of Europe

12. Asia Pacific Edge Data Center Market Analysis and Forecast

12.1. Regional Outlook

12.2. Edge Data Center Market Size (US$ Mn) Analysis and Forecast (2018 - 2031)

12.2.1. By Component

12.2.2. By Enterprise Size

12.2.3. By Industry

12.3. Edge Data Center Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

12.3.1. China

12.3.2. India

12.3.3. Japan

12.3.4. ASEAN

12.3.5. Rest of Asia Pacific

13. Middle East & Africa Edge Data Center Market Analysis and Forecast

13.1. Regional Outlook

13.2. Edge Data Center Market Size (US$ Mn) Analysis and Forecast (2018 - 2031)

13.2.1. By Component

13.2.2. By Enterprise Size

13.2.3. By industry

13.3. Edge Data Center Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

13.3.1. Saudi Arabia

13.3.2. U.A.E.

13.3.3. South Africa

13.3.4. Rest of Middle East & Africa

14. South America Edge Data Center Market Analysis and Forecast

14.1. Regional Outlook

14.2. Edge Data Center Market Size (US$ Mn) Analysis and Forecast (2018 - 2031)

14.2.1. By Component

14.2.2. By Enterprise Size

14.2.3. By Industry

14.3. Edge Data Center Market Size (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

14.3.1. Brazil

14.3.2. Argentina

14.3.3. Rest of South America

15. Competition Landscape

15.1. Market Competition Matrix, by Leading Players

15.2. Competitive Landscape, by Tier Structure of Companies

15.3. Scale of Competition, 2022

15.4. Scale of Competition at Regional Level, 2022

15.5. Market Revenue Share/Ranking Analysis, by Leading Players (2022)

15.6. List of Startups

15.7. Competition Evolution

15.8. Major Mergers & Acquisitions, Expansions, Partnership, Contacts, Deals, etc.

16. Company Profiles

16.1. 365 Data Centers

16.1.1. Business Overview

16.1.2. Company Revenue

16.1.3. Product Portfolio

16.1.4. Geographic Footprint

16.1.5. Recent Developments

16.1.6. Impact of COVID-19

16.1.7. TMR View

16.1.8. Competitive Threats and Weakness

16.2. Eaton Corporation plc

16.2.1. Business Overview

16.2.2. Company Revenue

16.2.3. Product Portfolio

16.2.4. Geographic Footprint

16.2.5. Recent Developments

16.2.6. Impact of COVID-19

16.2.7. TMR View

16.2.8. Competitive Threats and Weakness

16.3. EdgeConneX Inc.

16.3.1. Business Overview

16.3.2. Company Revenue

16.3.3. Product Portfolio

16.3.4. Geographic Footprint

16.3.5. Recent Developments

16.3.6. Impact of COVID-19

16.3.7. TMR View

16.3.8. Competitive Threats and Weakness

16.4. Vertiv Group Corp.

16.4.1. Business Overview

16.4.2. Company Revenue

16.4.3. Product Portfolio

16.4.4. Geographic Footprint

16.4.5. Recent Developments

16.4.6. Impact of COVID-19

16.4.7. TMR View

16.4.8. Competitive Threats and Weakness

16.5. Reichle & De-Massari (R&M)

16.5.1. Business Overview

16.5.2. Company Revenue

16.5.3. Product Portfolio

16.5.4. Geographic Footprint

16.5.5. Recent Developments

16.5.6. Impact of COVID-19

16.5.7. TMR View

16.5.8. Competitive Threats and Weakness

16.6. Dätwyler IT Infra GmbH

16.6.1. Business Overview

16.6.2. Company Revenue

16.6.3. Product Portfolio

16.6.4. Geographic Footprint

16.6.5. Recent Developments

16.6.6. Impact of COVID-19

16.6.7. TMR View

16.6.8. Competitive Threats and Weakness

16.7. L&T Smart World

16.7.1. Business Overview

16.7.2. Company Revenue

16.7.3. Product Portfolio

16.7.4. Geographic Footprint

16.7.5. Recent Developments

16.7.6. Impact of COVID-19

16.7.7. TMR View

16.7.8. Competitive Threats and Weakness

16.8. Siemon

16.8.1. Business Overview

16.8.2. Company Revenue

16.8.3. Product Portfolio

16.8.4. Geographic Footprint

16.8.5. Recent Developments

16.8.6. Impact of COVID-19

16.8.7. TMR View

16.8.8. Competitive Threats and Weakness

16.9. Rittal GmbH & Co. KG

16.9.1. Business Overview

16.9.2. Company Revenue

16.9.3. Product Portfolio

16.9.4. Geographic Footprint

16.9.5. Recent Developments

16.9.6. Impact of COVID-19

16.9.7. TMR View

16.9.8. Competitive Threats and Weakness

16.10. H5 Data Centers

16.10.1. Business Overview

16.10.2. Company Revenue

16.10.3. Product Portfolio

16.10.4. Geographic Footprint

16.10.5. Recent Developments

16.10.6. Impact of COVID-19

16.10.7. TMR View

16.10.8. Competitive Threats and Weakness

16.11. NEXTDC LTD.

16.11.1. Business Overview

16.11.2. Company Revenue

16.11.3. Product Portfolio

16.11.4. Geographic Footprint

16.11.5. Recent Developments

16.11.6. Impact of COVID-19

16.11.7. TMR View

16.11.8. Competitive Threats and Weakness

16.12. Others

16.12.1. Business Overview

16.12.2. Company Revenue

16.12.3. Product Portfolio

16.12.4. Geographic Footprint

16.12.5. Recent Developments

16.12.6. Impact of COVID-19

16.12.7. TMR View

16.12.8. Competitive Threats and Weakness

17. Key Takeaways

List of Tables

Table 1: Acronyms Used in Edge Data Center Market

Table 2: North America Edge Data Center Market Revenue Analysis, by Country, 2023 - 2031 (US$ Mn)

Table 3: Europe Edge Data Center Market Revenue Analysis, by Country/Sub-region, 2023 - 2031 (US$ Mn)

Table 4: Asia Pacific Edge Data Center Market Revenue Analysis, by Country/Sub-region, 2023 - 2031 (US$ Mn)

Table 5: Middle East & Africa Edge Data Center Market Revenue Analysis, by Country/Sub-region, 2023 and 2031 (US$ Mn)

Table 6: South America Edge Data Center Market Revenue Analysis, by Country/Sub-region, 2023 - 2031 (US$ Mn)

Table 7: Forecast Factors: Relevance and Impact (1/2)

Table 8: Forecast Factors: Relevance and Impact (2/2)

Table 9: Impact Analysis of Drivers & Restraints

Table 10: Global Edge Data Center Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 11: Global Edge Data Center Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 12: Global Edge Data Center Market Value (US$ Mn) Forecast, by Industry, 2018 - 2031

Table 13: Global Edge Data Center Market Volume (US$ Mn) Forecast, by Region, 2018 - 2031

Table 14: North America Edge Data Center Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 15: North America Edge Data Center Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 16: North America Edge Data Center Market Value (US$ Mn) Forecast, by Industry, 2018 - 2031

Table 17: North America Edge Data Center Market Value (US$ Mn) Forecast, by Country, 2018 - 2031

Table 18: U.S. Edge Data Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 19: Canada Edge Data Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 20: Mexico Edge Data Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 21: Europe Edge Data Center Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 22: Europe Edge Data Center Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 23: Europe Edge Data Center Market Value (US$ Mn) Forecast, by Industry, 2018 - 2031

Table 24: Europe Edge Data Center Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

Table 25: Germany Edge Data Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 26: U.K. Edge Data Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 27: France Edge Data Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 28: Italy Edge Data Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 29: Spain Edge Data Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 30: Asia Pacific Edge Data Center Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 31: Asia Pacific Edge Data Center Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 32: Asia Pacific Edge Data Center Market Value (US$ Mn) Forecast, by Industry, 2018 - 2031

Table 33: Asia Pacific Edge Data Center Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

Table 34: China Edge Data Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 35: India Edge Data Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 36: Japan Edge Data Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 37: ASEAN Edge Data Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 38: Middle East & Africa Edge Data Center Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 39: Middle East & Africa Edge Data Center Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 40: Middle East & Africa Edge Data Center Market Value (US$ Mn) Forecast, by Industry, 2018 - 2031

Table 41: Middle East & Africa Edge Data Center Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

Table 42: Saudi Arabia Edge Data Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 43: U.A.E Edge Data Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 44: South Africa Edge Data Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 45: South America Edge Data Center Market Value (US$ Mn) Forecast, by Component, 2018 - 2031

Table 46: South America Edge Data Center Market Value (US$ Mn) Forecast, by Enterprise Size, 2018 - 2031

Table 47: South America Edge Data Center Market Value (US$ Mn) Forecast, by Industry, 2018 - 2031

Table 48: South America Edge Data Center Market Value (US$ Mn) Forecast, by Country/Sub-region, 2018 - 2031

Table 49: Brazil Edge Data Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 50: Argentina Edge Data Center Market Revenue CAGR Breakdown (%), by Growth Term

Table 51: Mergers & Acquisitions, Partnerships (1/2)

Table 52: Mergers & Acquisitions, Partnership (2/2)

List of Figures

Figure 1: Global Edge Data Center Market Size (US$ Mn) Forecast, 2018-2031

Figure 2: Global Edge Data Center Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2023E

Figure 3: Top Segment Analysis of Edge Data Center Market

Figure 4: Global Edge Data Center Market Revenue (US$ Mn) Opportunity Assessment, by Region, 2031F

Figure 5: Global Edge Data Center Market Attractiveness Assessment, by Component

Figure 6: Global Edge Data Center Market Attractiveness Assessment, by Enterprise Size

Figure 7: Global Edge Data Center Market Attractiveness Assessment, by Component

Figure 8: Global Edge Data Center Market Attractiveness Assessment, by Industry

Figure 9: Global Edge Data Center Market Attractiveness Assessment, by Region

Figure 10: Global Edge Data Center Market Revenue (US$ Mn) Historic Trends, 2017 - 2022

Figure 11: Global Edge Data Center Market Revenue Opportunity (US$ Mn) Historic Trends, 2017 - 2022

Figure 12: Global Edge Data Center Market Value Share Analysis, by Component, 2023

Figure 13: Global Edge Data Center Market Value Share Analysis, by Component, 2031

Figure 14: Global Edge Data Center Market Absolute Opportunity (US$ Mn), by Solutions, 2023 - 2031

Figure 15: Global Edge Data Center Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 16: Global Edge Data Center Market Value Share Analysis, by Enterprise Size, 2023

Figure 17: Global Edge Data Center Market Value Share Analysis, by Enterprise Size, 2031

Figure 18: Global Edge Data Center Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 19: Global Edge Data Center Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2023 - 2031

Figure 20: Global Edge Data Center Market Value Share Analysis, by Industry, 2023

Figure 21: Global Edge Data Center Market Value Share Analysis, by Industry, 2031

Figure 22: Global Edge Data Center Market Absolute Opportunity (US$ Mn), by BFSI, 2023 - 2031

Figure 23: Global Edge Data Center Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2023 - 2031

Figure 24: Global Edge Data Center Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 25: Global Edge Data Center Market Absolute Opportunity (US$ Mn), by Manufacturing, 2023 - 2031

Figure 26: Global Edge Data Center Market Absolute Opportunity (US$ Mn), by Automotive, 2023 - 2031

Figure 27: Global Edge Data Center Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 28: Global Edge Data Center Market Opportunity (US$ Mn), by Region

Figure 29: Global Edge Data Center Market Opportunity Share (%), by Region, 2023-2031

Figure 30: Global Edge Data Center Market Size (US$ Mn), by Region, 2023 & 2031

Figure 31: Global Edge Data Center Market Value Share Analysis, by Region, 2023

Figure 32: Global Edge Data Center Market Value Share Analysis, by Region, 2031

Figure 33: North America Edge Data Center Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 34: Europe Edge Data Center Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 35: Asia Pacific Edge Data Center Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 36: Middle East & Africa Edge Data Center Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 37: South America Edge Data Center Market Absolute Opportunity (US$ Mn), 2023 - 2031

Figure 38: North America Edge Data Center Market Revenue Opportunity Share, by Component

Figure 39: North America Edge Data Center Market Revenue Opportunity Share, by Enterprise size

Figure 40: North America Edge Data Center Market Revenue Opportunity Share, by Industry

Figure 41: North America Edge Data Center Market Revenue Opportunity Share, by Country

Figure 42: North America Edge Data Center Market Value Share Analysis, by Component, 2023

Figure 43: North America Edge Data Center Market Value Share Analysis, by Component, 2031

Figure 44: North America Edge Data Center Market Absolute Opportunity (US$ Mn), by Solutions, 2023 - 2031

Figure 45: North America Edge Data Center Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 46: North America Edge Data Center Market Value Share Analysis, by Enterprise Size, 2023

Figure 47: North America Edge Data Center Market Value Share Analysis, by Enterprise Size, 2031

Figure 48: North America Edge Data Center Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 49: North America Edge Data Center Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2023 - 2031

Figure 50: North America Edge Data Center Market Value Share Analysis, by Industry, 2023

Figure 51: North America Edge Data Center Market Value Share Analysis, by Industry, 2031

Figure 52: North America Edge Data Center Market Absolute Opportunity (US$ Mn), by BFSI, 2023 - 2031

Figure 53: North America Edge Data Center Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2023 - 2031

Figure 54: North America Edge Data Center Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 55: North America Edge Data Center Market Absolute Opportunity (US$ Mn), by Manufacturing, 2023 - 2031

Figure 56: North America Edge Data Center Market Absolute Opportunity (US$ Mn), by Automotive, 2023 - 2031

Figure 57: North America Edge Data Center Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 58: North America Edge Data Center Market Value Share Analysis, by Country, 2023

Figure 59: North America Edge Data Center Market Value Share Analysis, by Country, 2031

Figure 60: U.S. Edge Data Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 61: Canada Edge Data Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 62: Mexico Edge Data Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 63: Europe Edge Data Center Market Revenue Opportunity Share, by Component

Figure 64: Europe Edge Data Center Market Revenue Opportunity Share, by Enterprise Size

Figure 65: Europe Edge Data Center Market Revenue Opportunity Share, by Industry

Figure 66: Europe Edge Data Center Market Revenue Opportunity Share, by Country/Sub-region

Figure 67: Europe Edge Data Center Market Value Share Analysis, by Component, 2023

Figure 68: Europe Edge Data Center Market Value Share Analysis, by Component, 2031

Figure 69: Europe Edge Data Center Market Absolute Opportunity (US$ Mn), by Solutions, 2023 - 2031

Figure 70: Europe Edge Data Center Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 71: Europe Edge Data Center Market Value Share Analysis, by Enterprise Size, 2023

Figure 72: Europe Edge Data Center Market Value Share Analysis, by Enterprise Size, 2031

Figure 73: Europe Edge Data Center Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 74: Europe Edge Data Center Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2023 - 2031

Figure 75: Europe Edge Data Center Market Value Share Analysis, by Industry, 2023

Figure 76: Europe Edge Data Center Market Value Share Analysis, by Industry, 2031

Figure 77: Europe Edge Data Center Market Absolute Opportunity (US$ Mn), by BFSI, 2023 - 2031

Figure 78: Europe Edge Data Center Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2023 - 2031

Figure 79: Europe Edge Data Center Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 80: Europe Edge Data Center Market Absolute Opportunity (US$ Mn), by Manufacturing, 2023 - 2031

Figure 81: Europe Edge Data Center Market Absolute Opportunity (US$ Mn), by Automotive, 2023 - 2031

Figure 82: Europe Edge Data Center Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 83: Europe Edge Data Center Market Value Share Analysis, by Country/Sub-region, 2023

Figure 84: Europe Edge Data Center Market Value Share Analysis, by Country/Sub-region, 2031

Figure 85: Germany Edge Data Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 86: U.K. Edge Data Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 87: France Edge Data Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 88: Italy Edge Data Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 89: Spain Edge Data Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 90: Asia Pacific Edge Data Center Market Revenue Opportunity Share, by Component

Figure 91: Asia Pacific Edge Data Center Market Revenue Opportunity Share, by Enterprise Size

Figure 92: Asia Pacific Edge Data Center Market Revenue Opportunity Share, by Industry

Figure 93: Asia Pacific Edge Data Center Market Revenue Opportunity Share, by Country/Sub-region

Figure 94: Asia Pacific Edge Data Center Market Value Share Analysis, by Component, 2023

Figure 95: Asia Pacific Edge Data Center Market Value Share Analysis, by Component, 2031

Figure 96: Asia Pacific Edge Data Center Market Absolute Opportunity (US$ Mn), by Solutions, 2023 - 2031

Figure 97: Asia Pacific Edge Data Center Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 98: Asia Pacific Edge Data Center Market Value Share Analysis, by Enterprise Size, 2023

Figure 99: Asia Pacific Edge Data Center Market Value Share Analysis, by Enterprise Size, 2031

Figure 100: Asia Pacific Edge Data Center Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 101: Asia Pacific Edge Data Center Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2023 - 2031

Figure 102: Asia Pacific Edge Data Center Market Value Share Analysis, by Industry, 2023

Figure 103: Asia Pacific Edge Data Center Market Value Share Analysis, by Industry, 2031

Figure 104: Asia Pacific Edge Data Center Market Absolute Opportunity (US$ Mn), by BFSI, 2023 - 2031

Figure 105: Asia Pacific Edge Data Center Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2023 - 2031

Figure 106: Asia Pacific Edge Data Center Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 107: Asia Pacific Edge Data Center Market Absolute Opportunity (US$ Mn), by Manufacturing, 2023 - 2031

Figure 108: Asia Pacific Edge Data Center Market Absolute Opportunity (US$ Mn), by Automotive, 2023 - 2031

Figure 109: Asia Pacific Edge Data Center Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 110: Asia Pacific Edge Data Center Market Value Share Analysis, by Country/Sub-region, 2023

Figure 111: Asia Pacific Edge Data Center Market Value Share Analysis, by Country/Sub-region, 2031

Figure 112: China Edge Data Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 113: India Edge Data Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 114: Japan Edge Data Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 115: ASEAN Edge Data Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 116: Middle East & Africa Edge Data Center Market Revenue Opportunity Share, by Component

Figure 117: Middle East & Africa Edge Data Center Market Revenue Opportunity Share, by Enterprise Size

Figure 118: Middle East & Africa Edge Data Center Market Revenue Opportunity Share, by Industry

Figure 119: Middle East & Africa Edge Data Center Market Revenue Opportunity Share, by Country/Sub-region

Figure 120: Middle East & Africa Edge Data Center Market Value Share Analysis, by Component, 2023

Figure 121: Middle East & Africa Edge Data Center Market Value Share Analysis, by Component, 2031

Figure 122: Middle East & Africa Edge Data Center Market Absolute Opportunity (US$ Mn), by Solutions, 2023 - 2031

Figure 123: Middle East & Africa Edge Data Center Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 124: Middle East & Africa Edge Data Center Market Value Share Analysis, by Enterprise Size, 2023

Figure 125: Middle East & Africa Edge Data Center Market Value Share Analysis, by Enterprise Size, 2031

Figure 126: Middle East & Africa Edge Data Center Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 127: Middle East & Africa Edge Data Center Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2023 - 2031

Figure 128: Middle East & Africa Edge Data Center Market Value Share Analysis, by Industry, 2023

Figure 129: Middle East & Africa Edge Data Center Market Value Share Analysis, by Industry, 2031

Figure 130: Middle East & Africa Edge Data Center Market Absolute Opportunity (US$ Mn), by BFSI, 2023 - 2031

Figure 131: Middle East & Africa Edge Data Center Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2023 - 2031

Figure 132: Middle East & Africa Edge Data Center Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 133: Middle East & Africa Edge Data Center Market Absolute Opportunity (US$ Mn), by Manufacturing, 2023 - 2031

Figure 134: Middle East & Africa Edge Data Center Market Absolute Opportunity (US$ Mn), by Automotive, 2023 - 2031

Figure 135: Middle East & Africa Edge Data Center Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 136: Middle East & Africa East & Africa East & Africa Edge Data Center Market Value Share Analysis, by Country/Sub-region, 2023

Figure 137: Middle East & Africa Edge Data Center Market Value Share Analysis, by Country/Sub-region, 2031

Figure 138: Saudi Arabia Edge Data Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 139: U.A.E. Edge Data Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 140: South Africa Edge Data Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 141: South America Edge Data Center Market Revenue Opportunity Share, by Component

Figure 142: South America Edge Data Center Market Revenue Opportunity Share, by Enterprise Size

Figure 143: South America Edge Data Center Market Revenue Opportunity Share, by Industry

Figure 144: South America Edge Data Center Market Revenue Opportunity Share, by Country/Sub-region

Figure 145: South America Edge Data Center Market Value Share Analysis, by Component, 2023

Figure 146: South America Edge Data Center Market Value Share Analysis, by Component, 2031

Figure 147: South America Edge Data Center Market Absolute Opportunity (US$ Mn), by Solutions, 2023 - 2031

Figure 148: South America Edge Data Center Market Absolute Opportunity (US$ Mn), by Services, 2023 - 2031

Figure 149: South America Edge Data Center Market Value Share Analysis, by Enterprise size, 2023

Figure 150: South America Edge Data Center Market Value Share Analysis, by Enterprise size, 2031

Figure 151: South America Edge Data Center Market Absolute Opportunity (US$ Mn), by SMEs, 2023 - 2031

Figure 152: South America Edge Data Center Market Absolute Opportunity (US$ Mn), by Large Enterprises, 2023 - 2031

Figure 153: South America Edge Data Center Market Value Share Analysis, by Industry, 2023

Figure 154: South America Edge Data Center Market Value Share Analysis, by Industry, 2031

Figure 155: South America Edge Data Center Market Absolute Opportunity (US$ Mn), by BFSI, 2023 - 2031

Figure 156: South America Edge Data Center Market Absolute Opportunity (US$ Mn), by IT & Telecom, 2023 - 2031

Figure 157: South America Edge Data Center Market Absolute Opportunity (US$ Mn), by Healthcare, 2023 - 2031

Figure 158: South America Edge Data Center Market Absolute Opportunity (US$ Mn), by Manufacturing, 2023 - 2031

Figure 159: South America Edge Data Center Market Absolute Opportunity (US$ Mn), by Automotive, 2023 - 2031

Figure 160: South America Edge Data Center Market Absolute Opportunity (US$ Mn), by Others, 2023 - 2031

Figure 161: South America Edge Data Center Market Value Share Analysis, by Country/Sub-region, 2023

Figure 162: South America Edge Data Center Market Value Share Analysis, by Country/Sub-region, 2031

Figure 163: Brazil Edge Data Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031

Figure 164: Argentina Edge Data Center Market Opportunity Growth Analysis (US$ Mn) Forecast, 2023 - 2031