Reports

Reports

Technological advancements in the sector are one of the key aspects that are likely aid in the growth of the global e-commerce logistics market. For instance, blockchain technology has helped improve e-commerce logistics by enabling customers to obtain reliable tracking information. This technology helps e-commerce logistics companies to run more streamlined as well as cost-effective operations. In addition to that, advances in printed electronics technology are cutting e-commerce shipping costs. Similarly, automated identification and data capture (AIDC) technologies aid in improving inventory accuracy, lowering data entry costs, and minimizing shipping errors and costs.

The growth of cross-border e-commerce activities is expected to fuel the global e-commerce logistics market in the coming years. Consumers are increasingly preferring cross-border e-commerce due to higher per capita income and greater access to foreign brands. Market participants can now expand their operations outside their often-saturated local market and get access to a newer markets, encouraging international trade and strengthening the country's global competitiveness, thanks to the development in cross-border e-commerce activities. In the coming years, the need for e-commerce logistics is projected to promote the rise of cross-border e-commerce operations.

Sellers are increasingly demanding more transparency and efficiency from the e-commerce logistics firms they use. This will also make it possible for e-commerce logistics services to be more customized. Simultaneously, providers of these services are attempting to find practical methods to minimize costs, particularly those related with reverse logistics. Warehousing and shipping, as well as various other types of specialist services, are among the major services provided by e-commerce logistics businesses.

In a variety of industries, recent technology improvements have enhanced operating productivity. E-commerce logistics is one of them. Massive increases in internet access, rising cross-border e-commerce operations, and a growing focus on emerging countries are all contributing to the expansion of the global e-commerce logistics market. Furthermore, a modern approach to B2C e-commerce is frequently used by a variety of businesses. This B2C e-commerce business model compels players to change their business plan at different points throughout the year. The rapid development of innovative technologies is a crucial component in the global e-commerce logistics market's expansion. Furthermore, the growing number of e-commerce firms in India, Brazil, and Mexico is predicted to provide the global e-commerce logistics market a boost.

The transportation service given to the online retail industry is known as e-commerce logistics. Receiving an online purchase, arranging for the item, packing, generating an invoice, organizing payment, dispatching, and delivering it to the customer's doorstep are all examples of forward logistics for an E-commerce firm.

With work from home (WFH), social isolation, and internet purchasing, the coronavirus epidemic has created a new normal for communities. Consumers are turning to e-commerce for daily essential needs like food and computer equipment as more people remain home due to virus worries. Before the COVID-19 outbreak, top companies in the sector supported this expansion by offering scalable, easily accessible platforms for smaller retail firms to trade online and reach new consumers all over the world.

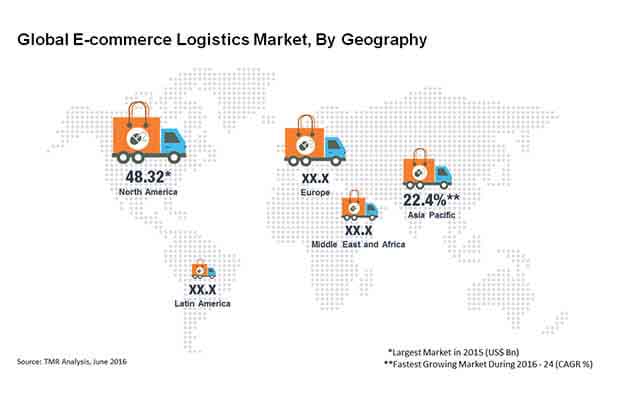

The Asia Pacific region's rapid population expansion has provided multibillion-dollar potential for e-commerce logistics firms. According to the World Population Review 2015, Asia Pacific is home to over 60% of the world's population. When you consider the significant increase in smartphone sales and internet connectivity, it is simple to see why businesses are seeing a huge potential.

Although some Asian countries are still in the early stages of development, their rising middle-income families constitute a lucrative target market for e-commerce businesses. Furthermore, as a result of road and infrastructure development projects in Asia Pacific, e-commerce enterprises are likely to expand their reach.

TMR anticipates North America to maintain its leading position in terms of revenue during the projection horizon. The region's superior digital infrastructure, as well as strong B2C sales, will continue to foster the expansion of the e-commerce logistics industry in North America.

E-commerce has transcended its fundamental nature to become an integral area of business today while spanning across a plethora of industries. The e-commerce industry has gained global recognition because of the spurring demand for e-commerce in a multitude of B2B and C2C exchanges. It has torn regional boundaries to connect various business entities from different geographical pockets, and hence, the global market for e-commerce logistics is expected to escalate over the coming years. Moreover,

The global E-commerce Logistics market is projected to register a moderate 20.6% CAGR in the forecast period.

Adopting Modern Way of Doing B2C E-Commerce Business to Fuel E-Commerce Logistics Market

Viz. FedEx Corporation and DHL International GmbH

Gobal e-commerce logistics market is anticipated to reach US$781 bn by the end of 2024

Table of Contents

1. Preface

1.1. Research Scope

1.2. Market Segmentation

1.3. Research Methodology

2. Executive Summary

2.1. Global E-commerce Logistics Market Snapshot

2.2. Global E-commerce Logistics Market Revenue, 2014 – 2024 (US$ Bn) and Year-on-Year Growth (%)

3. Global E-commerce Logistics Market Analysis, 2014 – 2024 (US$ Bn)

3.1. Overview

3.2. Key Trends Analysis

3.3. Market Dynamics

3.3.1. Drivers

3.3.2. Restraints

3.3.3. Opportunities

3.4. Global E-commerce Logistics Market Analysis, By Service Type, 2014 – 2024 (US$ Bn)

3.4.1. Warehousing

3.4.1.1. Mega Centers

3.4.1.2. Hubs/Delivery Centers

3.4.1.3. Returns Processing Centers

3.4.2. Transportation

3.4.2.1. Air/Express Delivery

3.4.2.2. Freight/Rail

3.4.2.3. Trucking/Over Road

3.4.2.4. Maritime

3.4.3. Others

3.5. Global E-commerce Logistics Market Analysis, By Operational Area, 2014 – 2024 (US$ Bn)

3.5.1. Domestic

3.5.2. International (Cross Border)

3.6. Competitive Landscape

3.6.1. Market Positioning of Key Players, 2015

3.6.2. Competitive Strategies Adopted by Leading Players

3.6.3. Market Share of Key Players, 2015

4. North America E-commerce Logistics Market Analysis, 2014 – 2024 (US$ Bn)

4.1. Key Trends Analysis

4.2. North America E-commerce Logistics Market Analysis, By Service Type, 2014 – 2024 (US$ Bn)

4.2.1. Warehousing

4.2.1.1. Mega Centers

4.2.1.2. Hubs/Delivery Centers

4.2.1.3. Returns Processing Centers

4.2.2. Transportation

4.2.2.1. Air/Express Delivery

4.2.2.2. Freight/Rail

4.2.2.3. Trucking/Over Road

4.2.2.4. Maritime

4.2.3. Others

4.3. North America E-commerce Logistics Market Analysis, By Operational Area, 2014 – 2024 (US$ Bn)

4.3.1. Domestic

4.3.2. International (Cross Border)

5. Europe E-commerce Logistics Market Analysis, 2014 – 2024 (US$ Bn)

5.1. Key Trends Analysis

5.2. Europe E-commerce Logistics Market Analysis, By Service Type, 2014 – 2024 (US$ Bn)

5.2.1. Warehousing

5.2.1.1. Mega Centers

5.2.1.2. Hubs/Delivery Centers

5.2.1.3. Returns Processing Centers

5.2.2. Transportation

5.2.2.1. Air/Express Delivery

5.2.2.2. Freight/Rail

5.2.2.3. Trucking/Over Road

5.2.2.4. Maritime

5.2.3. Others

5.3. Europe E-commerce Logistics Market Analysis, By Operational Area, 2014 – 2024 (US$ Bn)

5.3.1. Domestic

5.3.2. International (Cross Border)

6. Asia Pacific E-commerce Logistics Market Analysis, 2014 – 2024 (US$ Bn)

6.1. Key Trends Analysis

6.2. Asia Pacific E-commerce Logistics Market Analysis, By Service Type, 2014 – 2024 (US$ Bn)

6.2.1. Warehousing

6.2.1.1. Mega Centers

6.2.1.2. Hubs/Delivery Centers

6.2.1.3. Returns Processing Centers

6.2.2. Transportation

6.2.2.1. Air/Express Delivery

6.2.2.2. Freight/Rail

6.2.2.3. Trucking/Over Road

6.2.2.4. Maritime

6.2.3. Others

6.3. Asia Pacific E-commerce Logistics Market Analysis, By Operational Area, 2014 – 2024 (US$ Bn)

6.3.1. Domestic

6.3.2. International (Cross Border)

7. Middle-East and Africa (MEA) E-commerce Logistics Market Analysis, 2014 – 2024 (US$ Bn)

7.1. Key Trends Analysis

7.2. MEA E-commerce Logistics Market Analysis, By Service Type, 2014 – 2024 (US$ Bn)

7.2.1. Warehousing

7.2.1.1. Mega Centers

7.2.1.2. Hubs/Delivery Centers

7.2.1.3. Returns Processing Centers

7.2.2. Transportation

7.2.2.1. Air/Express Delivery

7.2.2.2. Freight/Rail

7.2.2.3. Trucking/Over Road

7.2.2.4. Maritime

7.2.3. Others

7.3. MEA E-commerce Logistics Market Analysis, By Operational Area, 2014 – 2024 (US$ Bn)

7.3.1. Domestic

7.3.2. International (Cross Border)

8. Latin America E-commerce Logistics Market Analysis, 2014 – 2024 (US$ Bn)

8.1. Key Trends Analysis

8.2. Latin America E-commerce Logistics Market Analysis, By Service Type, 2014 – 2024 (US$ Bn)

8.2.1. Warehousing

8.2.1.1. Mega Centers

8.2.1.2. Hubs/Delivery Centers

8.2.1.3. Returns Processing Centers

8.2.2. Transportation

8.2.2.1. Air/Express Delivery

8.2.2.2. Freight/Rail

8.2.2.3. Trucking/Over Road

8.2.2.4. Maritime

8.2.3. Others

8.3. Latin America E-commerce Logistics Market Analysis, By Operational Area, 2014 – 2024 (US$ Bn)

8.3.1. Domestic

8.3.2. International (Cross Border)

9. Company Profiles

9.1. FedEx Corporation

9.1.1. Company Details (HQ, Foundation Year, Employee Strength)

9.1.2. Market Presence, By Segment and Geography

9.1.3. Key Developments

9.1.4. Strategy and Historical Roadmap

9.1.5. Revenue and Operating Profits

9.2. DHL International GmbH

9.2.1. Company Details (HQ, Foundation Year, Employee Strength)

9.2.2. Market Presence, By Segment and Geography

9.2.3. Key Developments

9.2.4. Strategy and Historical Roadmap

9.2.5. Revenue and Operating Profits

9.3. Gati Limited

9.3.1. Company Details (HQ, Foundation Year, Employee Strength)

9.3.2. Market Presence, By Segment and Geography

9.3.3. Key Developments

9.3.4. Strategy and Historical Roadmap

9.3.5. Revenue and Operating Profits

9.4. Aramex International

9.4.1. Company Details (HQ, Foundation Year, Employee Strength)

9.4.2. Market Presence, By Segment and Geography

9.4.3. Key Developments

9.4.4. Strategy and Historical Roadmap

9.4.5. Revenue and Operating Profits

9.5. Kenco Group, Inc.

9.5.1. Company Details (HQ, Foundation Year, Employee Strength)

9.5.2. Market Presence, By Segment and Geography

9.5.3. Key Developments

9.5.4. Strategy and Historical Roadmap

9.5.5. Revenue and Operating Profits

9.6. Clipper Logistics Plc.

9.6.1. Company Details (HQ, Foundation Year, Employee Strength)

9.6.2. Market Presence, By Segment and Geography

9.6.3. Key Developments

9.6.4. Strategy and Historical Roadmap

9.6.5. Revenue and Operating Profit

9.7. XPO Logistics, Inc.

9.7.1. Company Details (HQ, Foundation Year, Employee Strength)

9.7.2. Market Presence, By Segment and Geography

9.7.3. Key Developments

9.7.4. Strategy and Historical Roadmap

9.7.5. Revenue and Operating Profits

9.8. Agility Public Warehousing Company K.S.C.P.

9.8.1. Company Details (HQ, Foundation Year, Employee Strength)

9.8.2. Market Presence, By Segment and Geography

9.8.3. Key Developments

9.8.4. Strategy and Historical Roadmap

9.8.5. Revenue and Operating Profits

9.9. United Parcel Service, Inc.

9.9.1. Company Details (HQ, Foundation Year, Employee Strength)

9.9.2. Market Presence, By Segment and Geography

9.9.3. Key Developments

9.9.4. Strategy and Historical Roadmap

9.9.5. Revenue and Operating Profits

9.10. Ceva Holdings LLC

9.10.1. Company Details (HQ, Foundation Year, Employee Strength)

9.10.2. Market Presence, By Segment and Geography

9.10.3. Key Developments

9.10.4. Strategy and Historical Roadmap

9.10.5. Revenue and Operating Profit

List of Tables

Table 1: Global E-commerce Logistics Market Snapshot

Table 2: Global E-commerce Logistics Market Size and Forecast, By Service Type, 2014 - 2024 (US$ Bn)

Table 3: Global E-commerce Logistics Warehousing Market Size and Forecast, By Type, 2014 - 2024 (US$ Bn)

Table 4: Global E-commerce Logistics Transportation Market Size and Forecast, By Type, 2014 - 2024 (US$ Bn)

Table 5: Global E-commerce Logistics Market Size and Forecast, By Operational Area, 2014 - 2024 (US$ Bn)

Table 6: TMR Competitive Benchmarking Matrix

Table 7: TMR Competitive Benchmarking Matrix

Table 8: North America E-commerce Logistics Market Size and Forecast, By Service Type, 2014 - 2024 (US$ Bn)

Table 9: North America E-commerce Logistics Warehousing Market Size and Forecast, By Type, 2014 - 2024 (US$ Bn)

Table 10: North America E-commerce Logistics Transportation Market Size and Forecast, By Type, 2014 - 2024 (US$ Bn)

Table 11: North America E-commerce Logistics Market Size and Forecast, By Operational Area, 2014 - 2024 (US$ Bn)

Table 12: North America E-commerce Logistics Market Size and Forecast, By Country, 2014 - 2024 (US$ Bn)

Table 13: Europe E-commerce Logistics Market Size and Forecast, By Service Type, 2014 - 2024 (US$ Bn)

Table 14: Europe E-commerce Logistics Warehousing Market, Size and Forecast, By Type, 2014 - 2024 (US$ Bn)

Table 15: Europe E-commerce Logistics Transportation Market Size and Forecast, By Type, 2014 - 2024 (US$ Bn)

Table 16: Europe E-commerce Logistics Market Size and Forecast, By Operational Area, 2014 - 2024 (US$ Bn)

Table 17: Europe E-commerce Logistics Market Size and Forecast, By Country, 2014 - 2024 (US$ Bn)

Table 18: Asia Pacific E-commerce Logistics Market Size and Forecast, By Service Type, 2014 - 2024 (US$ Bn)

Table 19: Asia Pacific E-commerce Logistics Warehousing Market Size and Forecast, By Type, 2014 - 2024 (US$ Bn)

Table 20: Asia Pacific E-commerce Logistics Transportation Market Size and Forecast, By Type, 2014 - 2024 (US$ Bn)

Table 21: Asia Pacific E-commerce Logistics Market Size and Forecast, By Operational Area, 2014 - 2024 (US$ Bn)

Table 22: Asia Pacific E-commerce Logistics Market Size and Forecast, By Country, 2014 - 2024 (US$ Bn)

Table 23: MEA E-commerce Logistics Market Size and Forecast, By Service Type, 2014 - 2024 (US$ Bn)

Table 24: MEA E-commerce Logistics Warehousing Market Size and Forecast, By Type, 2014 - 2024 (US$ Bn)

Table 25: MEA E-commerce Logistics Transportation Market Size and Forecast, By Type, 2014 - 2024 (US$ Bn)

Table 26: MEA E-commerce Logistics Market Size and Forecast, By Operational Area, 2014 - 2024 (US$ Bn)

Table 27: MEA E-commerce Logistics Market Size and Forecast, By Country, 2014 - 2024 (US$ Bn)

Table 28: Latin America E-commerce Logistics Market Size and Forecast, By Service Type, 2014 - 2024 (US$ Bn)

Table 29: Latin America E-commerce Logistics Warehousing Market Size and Forecast, By Type, 2014 - 2024 (US$ Bn)

Table 30: Latin America E-commerce Logistics Transportation Market Size and Forecast, By Type, 2014 - 2024 (US$ Bn)

Table 31: Latin America E-commerce Logistics Market Size and Forecast, By Operational Area, 2014 - 2024 (US$ Bn)

Table 32: Latin America E-commerce Logistics Market Size and Forecast, By Country, 2014 - 2024 (US$ Bn)

List of Figures

Figure 1: Global E-commerce Logistics Market Revenue, 2014 – 2024 (US$ Bn) and Year-on-Year Growth (%)

Figure 2: Global Internet Penetration Rate

Figure 3: Global Non Cash Transactions (US$ Bn) and Declining CoD Orders

Figure 4: Global Cross Border Opportunity for E-commerce Models

Figure 5: Global E-commerce Logistics Market, By Service Type, 2015 and 2024 (%)

Figure 6: Global E-commerce Logistics Warehousing Market, By Type, 2015 and 2024 (%)

Figure 7: Global E-commerce Logistics Transportation Market, By Type, 2015 and 2024 (%)

Figure 8: Global E-commerce Logistics Market, By Operational Area, 2015 and 2024 (%)

Figure 9: Percentage Share of Key Players in Global E-commerce Logistics Revenue, 2015

Figure 10: North America Market Dynamics

Figure 11: North America E-commerce Logistics Market Revenue, 2014-2024 (US$ Bn) and Y-o-Y Growth (%)

Figure 12: North America E-commerce Logistics Market, By Service Type, 2015 and 2024 (%)

Figure 13: North America E-commerce Logistics Warehousing Market, By Type, 2015 and 2024 (%)

Figure 14: North America E-commerce Logistics Transportation Market, By Type, 2015 and 2024 (%)

Figure 15: North America E-commerce Logistics Market, By Operational Area, 2015 and 2024 (%)

Figure 16: North America E-commerce Logistics Market, By Country, 2015 and 2024 (%)

Figure 17: Europe Market Dynamics

Figure 18: Europe E-commerce Logistics Market Revenue, 2014-2024 (US$ Bn) and Y-o-Y Growth (%)

Figure 19: Europe E-commerce Logistics Market, By Service Type, 2015 and 2024 (%)

Figure 20: Europe E-commerce Logistics Warehousing Market, By Type, 2015 and 2024 (%)

Figure 21: Europe E-commerce Logistics Transportation Market, By Type, 2015 and 2024 (%)

Figure 22: Europe E-commerce Logistics Market, By Operational Area, 2015 and 2024 (%)

Figure 23: Europe E-commerce Logistics Market, By Country, 2015 and 2024 (%)

Figure 24: Asia Pacific Market Dynamics

Figure 25: Asia Pacific E-commerce Logistics Market Revenue, 2014-2024 (US$ Bn) and Y-o-Y Growth (%)

Figure 26: Asia Pacific E-commerce Logistics Market, By Service Type, 2015 and 2024 (%)

Figure 27: Asia Pacific E-commerce Logistics Warehousing Market, By Type, 2015 and 2024 (%)

Figure 28: Asia Pacific E-commerce Logistics Transportation Market, By Type, 2015 and 2024 (%)

Figure 29: Asia Pacific E-commerce Logistics Market, By Operational Area, 2015 and 2024 (%)

Figure 30: Asia Pacific E-commerce Logistics Market, By Country, 2015 and 2024 (%)

Figure 31: MEA Market Dynamics

Figure 32: MEA E-commerce Logistics Market Revenue, 2014-2024 (US$ Bn) and Y-o-Y Growth (%)

Figure 33: MEA E-commerce Logistics Market, By Service Type, 2015 and 2024 (%)

Figure 34: MEA E-commerce Logistics Warehousing Market, By Type, 2015 and 2024 (%)

Figure 35: MEA E-commerce Logistics Transportation Market, By Type, 2015 and 2024 (%)

Figure 36: MEA E-commerce Logistics Market, By Operational Area, 2015 and 2024 (%)

Figure 37: MEA E-commerce Logistics Market, By Country, 2015 and 2024 (%)

Figure 38: Latin America Market Dynamics

Figure 39: Latin America E-commerce Logistics Market Revenue, 2014-2024 (US$ Bn) and Y-o-Y Growth (%)

Figure 40: Latin America E-commerce Logistics Market, By Service Type, 2015 and 2024 (%)

Figure 41: Latin America E-commerce Logistics Warehousing Market, By Type, 2015 and 2024 (%)

Figure 42: Latin America E-commerce Logistics Transportation Market, By Type, 2015 and 2024 (%)

Figure 43: Latin America E-commerce Logistics Market, By Operational Area, 2015 and 2024 (%)

Figure 44: Latin America E-commerce Logistics Market, By Country, 2015 and 2024 (%)