Reports

Reports

Analysts’ Viewpoint

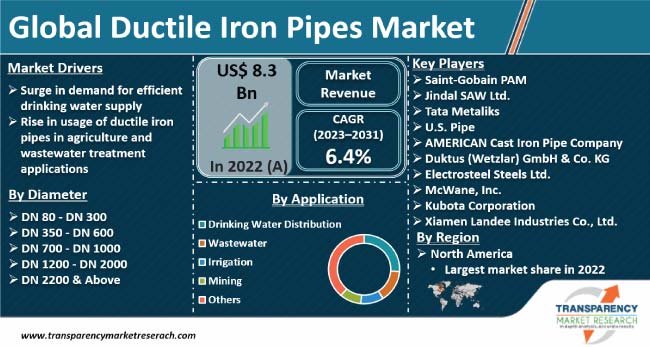

Rise in need for safe and clean drinking water, led by the surge in global population, is a significant factor augmenting the ductile iron pipes market value. Furthermore, innovations in wastewater treatment and continuous technological breakthroughs are driving market progress. Implementation of stringent irrigation and wastewater management laws and regulations is also projected to boost market dynamics in the near future.

Global ductile iron pipes industry players are concentrating on creating awareness about the advantages of adopting sustainable ductile iron pipe materials. Key vendors are following the latest ductile iron pipes market trends and developing novel ductile iron pipe construction processes to meet the increase in demand for products such as small-diameter iron ductile pipes.

Ductile iron pipe is a natural improvement on the cast iron pipe. Ductile iron is a superior pipe material, as it is stronger and more resistant to fracture. Typically, ductile iron pipes are produced using the metal centrifugal casting method. Interior lining and exterior coatings are placed on both surfaces of a pipe to prevent corrosion.

Ductile iron pipe has a reported average lifespan of more than 100 years. Organizations such as the American Water Works Association (AWWA) in the U.S., ISO 531/EN 545/598 in Europe, and AS/NZS 2280 (metric) in Australia standardize pipe diameters. Thus, depending on the climatic conditions and uses, various areas conform to different standards.

The global ductile iron pipes industry demand is anticipated to rise at a steady pace during the forecast period primarily due to the increase in need for these pipes in developing countries. Growth in urbanization and commercialization is boosting ductile iron pipes market revenue in countries such as India and China.

Ductile iron pipes are employed in diverse industries for purposes such as potable water distribution, irrigation, sewage and wastewater treatment, and mining. Corrosion-resistant ductile iron pipes are manufactured with external protection.

Advancements in ductile iron pipe coating technology has allowed vendors to achieve greater protection through usage of materials such as zinc, zinc-aluminum, epoxy, PE, PU, ceramic, and electro steel.

Ductile iron pipes market opportunities in sewage water-related applications have been rising owing to the increase in migration of the population to urban areas across the globe. A critical driver of market growth is the focus of governments of various countries on improvement of water sanitation capabilities. This trend is likely to hold steady throughout the forecast period.

Ductile iron pipes are often utilized as a water supply channel. Several countries throughout the world are currently dealing with water-related crisis that is adversely affecting communities and individual homes.

A number of industrialized economies rely on subterranean water pipes to provide a constant supply of water for commercial and drinking purposes. Rise in expenditure on high-end and modern ductile iron piping for industrial use and wastewater treatment systems is likely to boost ductile iron pipes market growth.

Based on ductile iron pipes market segmentation, water distribution is the most common application for these pipes. Ductile iron pipes are largely used in wastewater treatment plants, pump stations, and sewage outfall lines.

These pipelines are used to dump wastewater effluents. Irrigation is a major issue confronting water resources. Approximately 70% of the water is utilized for agricultural purposes. As a result, ductile iron pipes are used extensively for irrigation purposes. Agriculture is the primary emphasis of China, India, and South Africa. Thus, ductile iron pipes are widely used for irrigation in these countries.

As per ductile iron pipes market analysis, North America and Europe are key regions of the global industry. Presence of leading manufacturers is augmenting market trajectory in these regions. North America and Europe are also innovation hubs.

In terms of volume, Asia Pacific accounts for sizable portion of the global ductile iron pipes market. Demand for ductile iron pipes is likely to increase at a rapid pace in India and China during the forecast period owing to the surge in need for water supply and irrigation in these countries.

China is a significant market for ductile iron pipes in Asia Pacific. On the other hand, Middle East & Africa and Latin America are developing regions of the global industry.

Companies operating in the global landscape are investing substantially in R&D activities, essentially to develop cost-effective and innovative ductile iron pipe manufacturing processes. They are adopting strategies such as expansion of product portfolio and mergers & acquisitions to strengthen their customer base. These strategies are likely to propel the ductile iron pipes market size during the forecast period.

Key and emerging players profiled in this report include Saint-Gobain PAM, Jindal SAW Ltd, Tata Metaliks, U.S. Pipe, AMERICAN Cast Iron Pipe Company, Duktus (Wetzlar) GmbH & Co. KG, Electrosteel Steels Ltd., McWane, Inc., Kubota Corporation, and Xiamen Landee Industries Co., Ltd.

These companies have been summarized in the ductile iron pipes market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business strategies, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 8.3 Bn |

| Market Forecast Value in 2031 | US$ 13.6 Bn |

| Growth Rate (CAGR) | 6.4% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2020-2022 |

| Quantitative Units | US$ Bn for Value and Thousand Tons for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Prominent Players – Competition Dashboard and Revenue Share Analysis, 2023 Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 8.3 Bn in 2022

It is likely to grow at a CAGR of 6.4% from 2023 to 2031

Surge in demand for efficient drinking water supply and rise in usage of ductile iron pipes in agriculture and wastewater treatment applications

Water distribution is the most common application for ductile iron pipes

North America held significant share in 2022

Saint-Gobain PAM, Jindal SAW Ltd, Tata Metaliks, U.S. Pipe, AMERICAN Cast Iron Pipe Company, Duktus (Wetzlar) GmbH & Co. KG, Electrosteel Steels Ltd., McWane, Inc., Kubota Corporation, and Xiamen Landee Industries Co., Ltd.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Ductile Iron Pipes Market Analysis and Forecasts, 2023–2031

2.6.1. Global Ductile Iron Pipes Market Volume (Thousand Tons)

2.6.2. Global Ductile Iron Pipes Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of the Ductile Iron Pipes

3.2. Impact on the Demand of Ductile Iron Pipes– Pre & Post Crisis

4. Production Output Analysis (Tons), 2021

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2023–2031

6.1. Price Trend Analysis by Diameter

6.2. Price Trend Analysis by Region

7. Global Ductile Iron Pipes Market Analysis and Forecast, by Diameter, 2023–2031

7.1. Introduction and Definitions

7.2. Global Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

7.2.1. DN 80 - DN 300

7.2.2. DN 350 - DN 600

7.2.3. DN 700 - DN 1000

7.2.4. DN 1200 - DN 2000

7.2.5. DN 2200 & Above

7.3. Global Ductile Iron Pipes Market Attractiveness, by Diameter

8. Global Ductile Iron Pipes Market Analysis and Forecast, by Application, 2023–2031

8.1. Introduction and Definitions

8.2. Global Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

8.2.1. Drinking Water Distribution

8.2.2. Wastewater

8.2.3. Irrigation

8.2.4. Mining

8.2.5. Others (including pump stations and process and treatment works)

8.3. Global Ductile Iron Pipes Market Attractiveness, by Application

9. Global Ductile Iron Pipes Market Analysis and Forecast, by Region, 2023–2031

9.1. Key Findings

9.2. Global Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Region, 2023–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Ductile Iron Pipes Market Attractiveness, by Region

10. North America Ductile Iron Pipes Market Analysis and Forecast, 2023–2031

10.1. Key Findings

10.2. North America Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

10.3. North America Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.4. North America Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Country, 2023–2031

10.4.1. U.S. Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

10.4.2. U.S. Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, Application, 2023–2031

10.4.3. Canada Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

10.4.4. Canada Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, Application, 2023–2031

10.5. North America Ductile Iron Pipes Market Attractiveness Analysis

11. Europe Ductile Iron Pipes Market Analysis and Forecast, 2023–2031

11.1. Key Findings

11.2. Europe Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

11.3. Europe Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.4. Europe Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

11.4.1. Germany Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

11.4.2. Germany. Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, Application, 2023–2031

11.4.3. France Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

11.4.4. France. Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, Application, 2023–2031

11.4.5. U.K. Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

11.4.6. U.K. Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, Application, 2023–2031

11.4.7. Italy Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

11.4.8. Italy Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, Application, 2023–2031

11.4.9. Russia & CIS Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

11.4.10. Russia & CIS Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, Application, 2023–2031

11.4.11. Rest of Europe Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

11.4.12. Rest of Europe Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, Application, 2023–2031

11.5. Europe Ductile Iron Pipes Market Attractiveness Analysis

12. Asia Pacific Ductile Iron Pipes Market Analysis and Forecast, 2023–2031

12.1. Key Findings

12.2. Asia Pacific Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter

12.3. Asia Pacific Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.4. Asia Pacific Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

12.4.1. China Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

12.4.2. China Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, Application, 2023–2031

12.4.3. Japan Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

12.4.4. Japan Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, Application, 2023–2031

12.4.5. India Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

12.4.6. India Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, Application, 2023–2031

12.4.7. ASEAN Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

12.4.8. ASEAN Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, Application, 2023–2031

12.4.9. Rest of Asia Pacific Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

12.4.10. Rest of Asia Pacific Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, Application, 2023–2031

12.5. Asia Pacific Ductile Iron Pipes Market Attractiveness Analysis

13. Latin America Ductile Iron Pipes Market Analysis and Forecast, 2023–2031

13.1. Key Findings

13.2. Latin America Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

13.3. Latin America Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

13.4. Latin America Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

13.4.1. Brazil Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

13.4.2. Brazil Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, Application, 2023–2031

13.4.3. Mexico Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

13.4.4. Mexico Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, Application, 2023–2031

13.4.5. Rest of Latin America Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

13.4.6. Rest of Latin America Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, Application, 2023–2031

13.5. Latin America Ductile Iron Pipes Market Attractiveness Analysis

14. Middle East & Africa Ductile Iron Pipes Market Analysis and Forecast, 2023–2031

14.1. Key Findings

14.2. Middle East & Africa Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

14.3. Middle East & Africa Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

14.4. Middle East & Africa Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

14.4.1. GCC Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

14.4.2. GCC Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, Application, 2023–2031

14.4.3. South Africa Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

14.4.4. South Africa Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, Application, 2023–2031

14.4.5. Rest of Middle East & Africa Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, by Diameter, 2023–2031

14.4.6. Rest of Middle East & Africa Ductile Iron Pipes Market Volume (Thousand Tons) and Value (US$ Mn) Forecast, Application, 2023–2031

14.5. Middle East & Africa Ductile Iron Pipes Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Ductile Iron Pipes Company Market Share Analysis, 2021

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. Saint-Gobain PAM

15.2.1.1. Company Revenue

15.2.1.2. Business Overview

15.2.1.3. Product Segments

15.2.1.4. Geographic Footprint

15.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.2. Jindal SAW Ltd.

15.2.2.1. Company Revenue

15.2.2.2. Business Overview

15.2.2.3. Product Segments

15.2.2.4. Geographic Footprint

15.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.3. Tata Metaliks

15.2.3.1. Company Revenue

15.2.3.2. Business Overview

15.2.3.3. Product Segments

15.2.3.4. Geographic Footprint

15.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.4. U.S. Pipe

15.2.4.1. Company Revenue

15.2.4.2. Business Overview

15.2.4.3. Product Segments

15.2.4.4. Geographic Footprint

15.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.5. AMERICAN Cast Iron Pipe Company

15.2.5.1. Company Revenue

15.2.5.2. Business Overview

15.2.5.3. Product Segments

15.2.5.4. Geographic Footprint

15.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.6. Duktus (Wetzlar) GmbH & Co. KG

15.2.6.1. Company Revenue

15.2.6.2. Business Overview

15.2.6.3. Product Segments

15.2.6.4. Geographic Footprint

15.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.7. Electrosteel Steels Ltd.

15.2.7.1. Company Revenue

15.2.7.2. Business Overview

15.2.7.3. Product Segments

15.2.7.4. Geographic Footprint

15.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.8. McWane, Inc.

15.2.8.1. Company Revenue

15.2.8.2. Business Overview

15.2.8.3. Product Segments

15.2.8.4. Geographic Footprint

15.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.9. Kubota Corporation

15.2.9.1. Company Revenue

15.2.9.2. Business Overview

15.2.9.3. Product Segments

15.2.9.4. Geographic Footprint

15.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.10. Xiamen Landee Industries Co., Ltd.

15.2.10.1. Company Revenue

15.2.10.2. Business Overview

15.2.10.3. Product Segments

15.2.10.4. Geographic Footprint

15.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 2: Global Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 3: Global Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 4: Global Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 5: Global Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Region, 2023–2031

Table 6: Global Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Region, 2023–2031

Table 7: North America Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 8: North America Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 9: North America Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 10: North America Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 11: North America Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Country, 2023–2031

Table 12: North America Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Country, 2023–2031

Table 13: U.S. Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 14: U.S. Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 15: U.S. Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 16: U.S. Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 17: Canada Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 18: Canada Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 19: Canada Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 20: Canada Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 21: Europe Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 22: Europe Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 23: Europe Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 24: Europe Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 25: Europe Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Country and Sub-region, 2023–2031

Table 26: Europe Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 27: Germany Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 28: Germany Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 29: Germany Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 30: Germany Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 31: France Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 32: France Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 33: France Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 34: France Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 35: U.K. Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 36: U.K. Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 37: U.K. Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 38: U.K. Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 39: Italy Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 40: Italy Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 41: Italy Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 42: Italy Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 43: Spain Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 44: Spain Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 45: Spain Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 46: Spain Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 47: Russia & CIS Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 48: Russia & CIS Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 49: Russia & CIS Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 50: Russia & CIS Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 51: Rest of Europe Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 52: Rest of Europe Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 53: Rest of Europe Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 54: Rest of Europe Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 55: Asia Pacific Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 56: Asia Pacific Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 57: Asia Pacific Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 58: Asia Pacific Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 59: Asia Pacific Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Country and Sub-region, 2023–2031

Table 60: Asia Pacific Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 61: China Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 62: China Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter 2023–2031

Table 63: China Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 64: China Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 65: Japan Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 66: Japan Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 67: Japan Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 68: Japan Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 69: India Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 70: India Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 71: India Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 72: India Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 73: ASEAN Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 74: ASEAN Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 75: ASEAN Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 76: ASEAN Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 77: Rest of Asia Pacific Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 78: Rest of Asia Pacific Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 79: Rest of Asia Pacific Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 80: Rest of Asia Pacific Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 81: Latin America Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 82: Latin America Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 83: Latin America Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 84: Latin America Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 85: Latin America Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Country and Sub-region, 2023–2031

Table 86: Latin America Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 87: Brazil Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 88: Brazil Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 89: Brazil Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 90: Brazil Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 91: Mexico Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 92: Mexico Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 93: Mexico Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 94: Mexico Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 95: Rest of Latin America Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 96: Rest of Latin America Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 97: Rest of Latin America Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 98: Rest of Latin America Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 99: Middle East & Africa Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 100: Middle East & Africa Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 101: Middle East & Africa Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 102: Middle East & Africa Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 103: Middle East & Africa Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Country and Sub-region, 2023–2031

Table 104: Middle East & Africa Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 105: GCC Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 106: GCC Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 107: GCC Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 108: GCC Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 109: South Africa Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 110: South Africa Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 111: South Africa Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 112: South Africa Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 113: Rest of Middle East & Africa Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Diameter, 2023–2031

Table 114: Rest of Middle East & Africa Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Diameter, 2023–2031

Table 115: Rest of Middle East & Africa Ductile Iron Pipes Market Volume (Thousand Tons) Forecast, by Application, 2023–2031

Table 116: Rest of Middle East & Africa Ductile Iron Pipes Market Value (US$ Mn) Forecast, by Application 2023–2031

List of Figures

Figure 1: Global Ductile Iron Pipes Market Volume Share Analysis, by Diameter, 2021, 2027, and 2031

Figure 2: Global Ductile Iron Pipes Market Attractiveness, by Diameter

Figure 3: Global Ductile Iron Pipes Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 4: Global Ductile Iron Pipes Market Attractiveness, by Application

Figure 5: Global Ductile Iron Pipes Market Volume Share Analysis, by Region, 2021, 2027, and 2031

Figure 6: Global Ductile Iron Pipes Market Attractiveness, by Region

Figure 7: North America Ductile Iron Pipes Market Volume Share Analysis, by Diameter, 2021, 2027, and 2031

Figure 8: North America Ductile Iron Pipes Market Attractiveness, by Diameter

Figure 9: North America Ductile Iron Pipes Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 10: North America Ductile Iron Pipes Market Attractiveness, by Application

Figure 11: North America Ductile Iron Pipes Market Attractiveness, by Volume Share Analysis, by Country, 2021, 2027, and 2031

Figure 12: North America Ductile Iron Pipes Market Attractiveness, by Country

Figure 13: Europe Ductile Iron Pipes Market Volume Share Analysis, by Diameter, 2021, 2027, and 2031

Figure 14: Europe Ductile Iron Pipes Market Attractiveness, by Diameter

Figure 15: Europe Ductile Iron Pipes Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 16: Europe Ductile Iron Pipes Market Attractiveness, by Application

Figure 17: Europe Ductile Iron Pipes Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 18: Europe Ductile Iron Pipes Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Ductile Iron Pipes Market Volume Share Analysis, by Diameter, 2021, 2027, and 2031

Figure 20: Asia Pacific Ductile Iron Pipes Market Attractiveness, by Diameter

Figure 21: Asia Pacific Ductile Iron Pipes Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 22: Asia Pacific Ductile Iron Pipes Market Attractiveness, by Application

Figure 23: Asia Pacific Ductile Iron Pipes Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 24: Asia Pacific Ductile Iron Pipes Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Ductile Iron Pipes Market Volume Share Analysis, by Diameter, 2021, 2027, and 2031

Figure 26: Latin America Ductile Iron Pipes Market Attractiveness, by Diameter

Figure 27: Latin America Ductile Iron Pipes Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 28: Latin America Ductile Iron Pipes Market Attractiveness, by Application

Figure 29: Latin America Ductile Iron Pipes Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 30: Latin America Ductile Iron Pipes Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Ductile Iron Pipes Market Volume Share Analysis, by Diameter, 2021, 2027, and 2031

Figure 32: Middle East & Africa Ductile Iron Pipes Market Attractiveness, by Diameter

Figure 33: Middle East & Africa Ductile Iron Pipes Market Volume Share Analysis, by Application, 2021, 2027, and 2031

Figure 34: Middle East & Africa Ductile Iron Pipes Market Attractiveness, by Application

Figure 35: Middle East & Africa Ductile Iron Pipes Market Volume Share Analysis, by Country and Sub-region, 2021, 2027, and 2031

Figure 36: Middle East & Africa Ductile Iron Pipes Market Attractiveness, by Country and Sub-region