Reports

Reports

There are number of trends that are transforming the growth and operations of the global dry bulk shipping market. Rising demand of raw materials by the emerging economies, especially in Asia-Pacific, remains the forebear of bulk trade and iron ore, coal and grains remain the main commodities in terms of volume shipped. In the meantime, to increase operational efficiency and cost savings, digital fleet management, predictive analytics and automation are currently being adopted. It is also highly concerned with sustainability as shipping companies invest in more environmentally friendly ships, alternative energy sources, including LNG, and follow more rigorous decarburization regulations of the IMO.

With regards to competition, several measures have been employed by the key market players to ensure they maintain a lead in the market. They are involved in strategies such as advancements and partnerships with the other organizations that increase their market share.

The global dry bulk shipping market implies seaborne transportation of commodities that are not packaged, most commonly categorized into major bulks including coal, iron ore and grains, and minor bulks including steel products, fertilizers, and cement. These goods form the backbone of international trade and industrial supply chains, underpinning sectors ranging from energy and steel production to agriculture and construction.

Dry bulk carriers are special ships that transport large numbers of these raw materials effectively over international trade routes. With growing industrialization and infrastructural expansion across emerging economies, the demand for efficient and cost-effective bulk transport solutions continues to surge. Furthermore, fluctuations in global commodity demand, environmental regulations, and advancements in vessel design and fuel efficiency are reshaping the industry dynamics.

| Attribute | Detail |

|---|---|

| Drivers |

|

The increase in demand of commodities like coal, iron ore, cereals and fertilizers is one of the main factors driving the global dry bulk shipping business. The commodities are critical to the industrial, agricultural, and energy sectors of the world and without transportation, the economy will not grow. This is evidenced by the fact that coal remains a major source of power in most developing countries and iron ore is a raw material required to manufacture steel, which is less complex to construct and develop infrastructure. Likewise, grain exports play a critical role in food security and nourishing populations that are expanding in import-based areas.

Much of this demand has been driven by the Asia-Pacific region, especially India and China. For instance, according to India Brand Equity Foundation, India exported 198.65 lakh tons (19.86 million tons) of rice in FY25 as compared to 163.58 lakh tons in FY24. The fast-paced industrialization and urbanization and the growth of infrastructure in these economies have increased imports of raw materials. The steel sector, particularly in China, is a consumer of huge quantities of iron ore, and as Indian population becomes more energy-intensive, the frequency of coal transport rises.

This long-term increase in the demand of commodities is the direct cause of the growth and profitability of the dry bulk shipping business.

The growth of international trade is one of the major factors that have fueled the global dry bulk shipping market, as it enhances the transfer of raw materials that are needed on the whole. The liberalization policy of trade and cross-border agreements have enhanced trade relations among nations and increased seaborne trade due to globalization. Dry bulk shipping is considered an important factor in facilitating this trade, and it provides an economical and efficient method of transportation of high volumes of unpackaged material like coal, iron ore, grains, and fertilizers over extended distances.

Emerging economies are becoming more involved in the global supply chains and this is boosting the imports and exports of raw materials. A good example is how resource endowed countries in Latin America and Africa export large amounts of iron ore and grains to the industrial centers in Asia, and Asia.

Moreover, the current activities like the Belt and Road project of China and free trade agreements among the regions are creating new trade routes and enhancing trade flows. Dry bulk shipping companies also enjoy the benefit of larger cargo volumes and higher utilization rates as such routes increase. Therefore, international trade development will continue to be one of the pillars of the dry bulk shipping industry expansion in the long term.

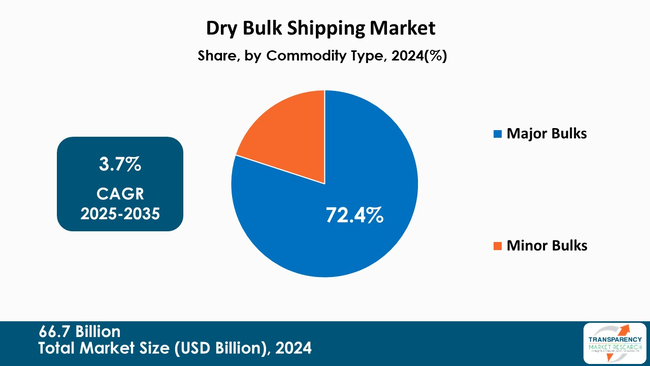

The largest and most dominant part of the global dry bulk shipping market include major bulks, which are coal, iron ore, and grains. These goods have a huge portion in the volumes of seaborne trade as they have vital roles in energy production, steel making, construction, and food security. Most bulk shipments are due to the high demand in the fast-growing industrializing countries, including China and India, and are made by iron ore and coal alone. The fact that these commodities play a vital role in the maintenance of industries world over has made major bulks remain the leading commodities in terms of volume and revenue.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The Asia-Pacific leads the dry bulk shipping market due to large commodity demands by the other countries like China, India, Japan, and South Korea. The massive steel industry in China demands large imports of iron ore and both - China and India count on imports of coal to fuel their increasing energy demand.

On the top of this, fast industrialization, infrastructure acquisition, and population explosion in the region leads to continuous demand for grains and the other bulk commodities. Well-developed port infrastructure, trade routes, and growing international trade also reinforce the leadership role of Asia-Pacific when it comes to defining market growth and dynamics, thereby making it the most influential region in terms of contributing to market growth and dynamics.

The companies forming the global dry bulk shipping market research report scope are spending significantly on advancing their vessels/shipping services, which in turn fuel the global market size during the forecast period.

Berge Bulk, Golden Ocean Group Ltd., Oldendorff Carriers, Star Bulk Carriers, Navios Maritime Partners, Maran Dry Management, Pacific Basin Shipping Limited, Genco Shipping & Trading Ltd., Diana Shipping, Safe Bulkers, and others are the key players in the dry bulk shipping market shaping the industry outlook.

Key players have been profiled in the global dry bulk shipping market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

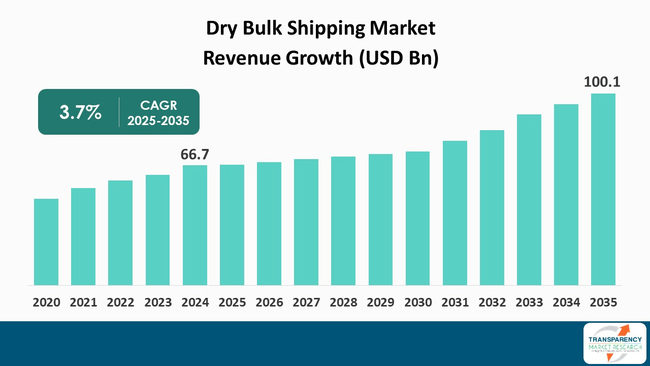

| Market Size Value in 2024 (Base Year) | US$ 66.7 Bn |

| Market Forecast Value in 2035 | US$ 100.1 Bn |

| Growth Rate (CAGR) | 3.7% |

| Forecast Period | 2025-2035 |

| Historical data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player - Competition Dashboard and Revenue Share Analysis 2024 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global dry bulk shipping market stood at US$ 66.7 Bn in 2024.

The global dry bulk shipping industry is expected to reach US$ 100.1 Bn by 2035.

Rising demand for commodities worldwide, and expansion of international trade are some of the driving factors of the market

Asia Pacific contributed about 41.0% in terms of share in the global dry bulk shipping market in 2024.

Berge Bulk, Golden Ocean Group Ltd., Oldendorff Carriers, Star Bulk Carriers, Navios Maritime Partners, Maran Dry Management, Pacific Basin Shipping Limited, Genco Shipping & Trading Ltd., Diana Shipping, Safe Bulkers, and other players.

Table 1: Global Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 2: Global Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 3: Global Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 4: Global Dry Bulk Shipping Market Value (US$ Bn) By Region, 2020 to 2035

Table 5: North America Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 6: North America Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 7: North America Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 8: North America Dry Bulk Shipping Market Value (US$ Bn) By Country, 2020 to 2035

Table 9: U.S. Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 10: U.S. Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 11: U.S. Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 12: Canada Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 13: Canada Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 14: Canada Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 15: Europe Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 16: Europe Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 17: Europe Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 18: Europe Dry Bulk Shipping Market Value (US$ Bn) By Country, 2020 to 2035

Table 19: U.K. Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 20: U.K. Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 21: U.K. Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 22: Germany Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 23: Germany Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 24: Germany Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 25: France Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 26: France Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 27: France Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 28: Italy Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 29: Italy Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 30: Italy Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 31: Spain Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 32: Spain Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 33: Spain Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 34: The Netherlands Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 35: The Netherlands Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 36: The Netherlands Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 37: Asia Pacific Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 38: Asia Pacific Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 39: Asia Pacific Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 40: Asia Pacific Dry Bulk Shipping Market Value (US$ Bn) By Country, 2020 to 2035

Table 41: China Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 42: China Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 43: China Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 44: India Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 45: India Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 46: India Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 47: Japan Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 48: Japan Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 49: Japan Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 50: Australia Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 51: Australia Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 52: Australia Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 53: South Korea Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 54: South Korea Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 55: South Korea Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 56: ASEAN Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 57: ASEAN Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 58: ASEAN Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 59: Middle East & Africa Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 60: Middle East & Africa Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 61: Middle East & Africa Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 62: Middle East & Africa Dry Bulk Shipping Market Value (US$ Bn) By Country, 2020 to 2035

Table 63: GCC Countries Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 64: GCC Countries Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 65: GCC Countries Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 66: South Africa Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 67: South Africa Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 68: South Africa Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 69: Latin America Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 70: Latin America Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 71: Latin America Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 72: Latin America Dry Bulk Shipping Market Value (US$ Bn) By Country, 2020 to 2035

Table 73: Brazil Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 74: Brazil Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 75: Brazil Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 76: Argentina Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 77: Argentina Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 78: Argentina Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Table 79: Mexico Dry Bulk Shipping Market Value (US$ Bn) By Commodity Type, 2020 to 2035

Table 80: Mexico Dry Bulk Shipping Market Value (US$ Bn) By Vessel Type, 2020 to 2035

Table 81: Mexico Dry Bulk Shipping Market Value (US$ Bn) By Charter Type, 2020 to 2035

Figure 1: Global Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 2: Global Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 3: Global Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 4: Global Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 5: Global Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 6: Global Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 7: Global Dry Bulk Shipping Market Value (US$ Bn), By Region 2020 to 2035

Figure 8: Global Dry Bulk Shipping Market Incremental Opportunity, By Region, 2025 to 2035

Figure 9: North America Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 10: North America Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 11: North America Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 12: North America Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 13: North America Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 14: North America Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 15: North America Dry Bulk Shipping Market Value (US$ Bn), By Country 2020 to 2035

Figure 16: North America Dry Bulk Shipping Market Incremental Opportunity, By Country, 2025 to 2035

Figure 17: U.S. Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 18: U.S. Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 19: U.S. Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 20: U.S. Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 21: U.S. Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 22: U.S. Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 23: Canada Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 24: Canada Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 25: Canada Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 26: Canada Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 27: Canada Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 28: Canada Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 29: Europe Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 30: Europe Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 31: Europe Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 32: Europe Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 33: Europe Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 34: Europe Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 35: Europe Dry Bulk Shipping Market Value (US$ Bn), By Country 2020 to 2035

Figure 36: Europe Dry Bulk Shipping Market Incremental Opportunity, By Country, 2025 to 2035

Figure 37: U.K. Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 38: U.K. Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 39: U.K. Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 40: U.K. Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 41: U.K. Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 42: U.K. Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 43: Germany Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 44: Germany Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 45: Germany Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 46: Germany Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 47: Germany Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 48: Germany Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 49: France Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 50: France Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 51: France Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 52: France Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 53: France Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 54: France Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 55: Italy Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 56: Italy Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 57: Italy Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 58: Italy Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 59: Italy Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 60: Italy Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 61: Spain Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 62: Spain Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 63: Spain Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 64: Spain Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 65: Spain Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 66: Spain Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 67: The Netherlands Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 68: The Netherlands Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 69: The Netherlands Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 70: The Netherlands Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 71: The Netherlands Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 72: The Netherlands Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 73: Asia Pacific Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 74: Asia Pacific Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 75: Asia Pacific Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 76: Asia Pacific Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 77: Asia Pacific Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 78: Asia Pacific Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 79: Asia Pacific Dry Bulk Shipping Market Value (US$ Bn), By Country 2020 to 2035

Figure 80: Asia Pacific Dry Bulk Shipping Market Incremental Opportunity, By Country, 2025 to 2035

Figure 81: China Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 82: China Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 83: China Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 84: China Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 85: China Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 86: China Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 87: India Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 88: India Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 89: India Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 90: India Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 91: India Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 92: India Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 93: Japan Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 94: Japan Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 95: Japan Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 96: Japan Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 97: Japan Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 98: Japan Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 99: Australia Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 100: Australia Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 101: Australia Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 102: Australia Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 103: Australia Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 104: Australia Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 105: South Korea Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 106: South Korea Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 107: South Korea Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 108: South Korea Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 109: South Korea Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 110: South Korea Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 111: ASEAN Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 112: ASEAN Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 113: ASEAN Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 114: ASEAN Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 115: ASEAN Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 116: ASEAN Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 117: Middle East & Africa Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 118: Middle East & Africa Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 119: Middle East & Africa Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 120: Middle East & Africa Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 121: Middle East & Africa Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 122: Middle East & Africa Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 123: Middle East & Africa Dry Bulk Shipping Market Value (US$ Bn), By Country 2020 to 2035

Figure 124: Middle East & Africa Dry Bulk Shipping Market Incremental Opportunity, By Country, 2025 to 2035

Figure 125: GCC Countries Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 126: GCC Countries Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 127: GCC Countries Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 128: GCC Countries Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 129: GCC Countries Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 130: GCC Countries Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 131: South Africa Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 132: South Africa Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 133: South Africa Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 134: South Africa Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 135: South Africa Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 136: South Africa Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 137: Latin America Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 138: Latin America Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 139: Latin America Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 140: Latin America Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 141: Latin America Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 142: Latin America Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 143: Latin America Dry Bulk Shipping Market Value (US$ Bn), By Country 2020 to 2035

Figure 144: Latin America Dry Bulk Shipping Market Incremental Opportunity, By Country, 2025 to 2035

Figure 145: Brazil Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 146: Brazil Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 147: Brazil Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 148: Brazil Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 149: Brazil Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 150: Brazil Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 151: Argentina Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 152: Argentina Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 153: Argentina Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 154: Argentina Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 155: Argentina Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 156: Argentina Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035

Figure 157: Mexico Dry Bulk Shipping Market Value (US$ Bn), By Commodity Type 2020 to 2035

Figure 158: Mexico Dry Bulk Shipping Market Incremental Opportunity, By Commodity Type 2025 to 2035

Figure 159: Mexico Dry Bulk Shipping Market Value (US$ Bn), By Vessel Type 2020 to 2035

Figure 160: Mexico Dry Bulk Shipping Market Incremental Opportunity, By Vessel Type, 2025 to 2035

Figure 161: Mexico Dry Bulk Shipping Market Value (US$ Bn), By Charter Type 2020 to 2035

Figure 162: Mexico Dry Bulk Shipping Market Incremental Opportunity, By Charter Type, 2025 to 2035