Reports

Reports

The drug-device combinations market is driven by the increasing incidences of chronic diseases such as diabetes, cardiovascular issues, and cancer, which contribute to demand for combination therapeutic solutions. In addition, technological advancements such as the emergence of smart drug delivery systems and wearable devices will contribute to better treatment results and increased patient adherence.

However, the markets for drug-device combinations face barriers such as regulatory requirements and high costs that increase the burden, and can often delay products from launching or limit entry into the market entirely for smaller companies.

.webp)

There are opportunities from supplementing targeted therapies with combination therapies, consumer-driven demand for personalized medicines, expanding biotechnology advancements, and the growth of self-administered drug delivery systems that limit healthcare burden and increase patient convenience

A drug-device combination product that consists of a drug and a device, or a biological product and a device, or a drug, device, and a biological product, where the drug or biological product is packaged with the device or included in the device. The fundamental aspect of a drug-device combination product is that it incorporates either a drug or biologic with a device with the aim of achieving a defined therapeutic or diagnostic effect.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The rise of chronic diseases drives the market for drug-device combination products. Chronic diseases such as cardiovascular diseases, diabetes, and respiratory diseases necessitate long-term management. This is often achieved with both - pharmaceutical products and medical devices.

Drug-device combination products include products like insulin pumps and drug-eluting stents that are used together and can combine the capabilities of both - the drug and device to create a more effective treatment series while also requiring less adherence by the patient. For example, insulin pumps combined with continuous glucose monitor systems will facilitate accurate insulin delivery and provide real-time data on the patient's blood glucose, which supports better blood sugar control by the patient.

Chronic diseases are becoming more frequent worldwide, making new treatment innovative solutions even more important. The increasing burden of chronic diseases creates demand in the drug-device combination products space.

Advancements in technology are driving the drug-device combination products market by facilitating smarter, better, and more patient-centered therapeutic solutions. Products like smart inhalers, transdermal patches with microneedles, wearable injectors, connected Bluetooth drug delivery pens, and digital pills change the way medications are delivered and often captured in real-time or on behalf of the patient.

These advancements improve treatment and patient outcomes by providing more precise treatment control through management of dosing, data collection, and monitoring, which promotes patient adherence and engagement. The presence of IoT-connectivity, AI-based analytics, and EHR solutions enable interoperability between devices and infrastructures for value-based care and personalized medicine.

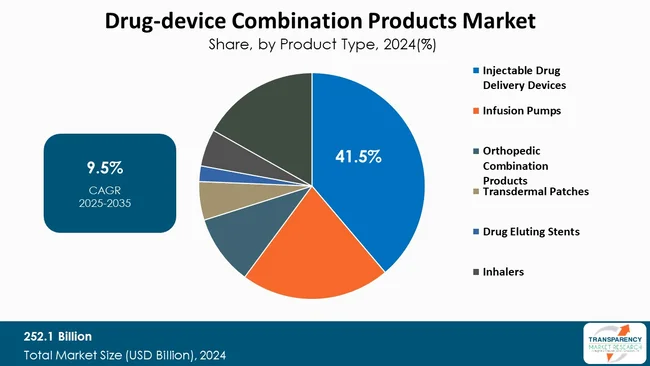

Injectable drug delivery devices are the leading force powering growth of the drug‑device combination products market. Their capability to deliver complex biologics and specialized targeted therapies that are not suitable for oral delivery has increased uptake of drug-device combination products, particularly user-friendly injectables that include autoinjectors, prefilled syringes, and pen injectors.

As patients seek convenience, the growing acceptance of self-administerable injectables is supported by designs that place patience comfort and adherence at the top of the list and with the move toward homecare and increasing patient self-management. In addition, the injectable drug delivery device area has the benefit of being able to accelerate innovations that are driven by technological advances such as wearable injectors, smart-delivery devices that are digitally connected, and innovative formulation products that provide accuracy in dosing and shelf life stability.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America is at the forefront of the drug-device combination products market as a result of several factors. These include the high prevalence of chronic conditions in the region (such as diabetes, cardiovascular diseases, and cancer), a robust healthcare system, a large amount of healthcare expenditures, and encouraging reimbursement policies and public support as well as major players in the industry and ongoing improvement in medical technology.

Having a positive regulatory environment and agencies such as the U.S. Food & Drug Administration (FDA) that creates clear definitions and guidelines for drug-device combination products leads to expedited approval processes in North America, creating the framework to develop and market drug-device combination products. All of these factors illustrate the significant advantages that North America has in the drug-device combination products market segment.

Abbott, Eli Lilly and Company, Medtronic, Novo Nordisk A/S, Novartis AG, Sanofi, Boston Scientific Corporation and its affiliates, BD, Merck KGaA, B. Braun SE, Stryker, Gerresheimer AG, Narang Medical Limited., and Sparsha Pharma International Pvt. Ltd. are some of the leading players operating in the global drug-device combination products market.

Each of these players has been profiled in the drug-device combination products market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 252.1 Bn |

| Forecast Value in 2035 | US$ 684.6 Bn |

| CAGR | 9.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 252.1 Bn in 2024.

It is projected to reach more than US$ 684.6 Bn by the end of 2035.

Increasing prevalence of chronic diseases and technological advancements.

The CAGR is anticipated to be 9.5% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Abbott, Eli Lilly and Company, Medtronic, Novo Nordisk A/S, Novartis AG, Sanofi, Boston Scientific Corporation or its affiliates., BD, Merck KGaA, B. Braun SE , Stryker, Gerresheimer AG, Narang Medical Limited., Sparsha Pharma International Pvt. Ltd., and the other prominent players.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Drug-device Combination Products Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Drug-device Combination Products Market Analysis and Forecasts, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Regulatory Landscape across Key Regions / Countries

5.2. Market Trends

5.3. PORTER’s Five Forces Analysis

5.4. PESTEL Analysis

5.5. Key Purchase Metrics for End-users

5.6. Brand and Pricing Analysis

5.7. Value Chain Analysis

5.8. Technological Advancement

6. Global Drug-device Combination Products Market Analysis and Forecasts, By Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Product Type, 2020 to 2035

6.3.1. Injectable Drug Delivery Devices

6.3.1.1. Pen Injectors

6.3.1.2. Autoinjectors

6.3.1.3. Pre-Filled Syringes

6.3.1.4. Others

6.3.2. Infusion Pumps

6.3.2.1. Volumetric

6.3.2.2. Syringes

6.3.2.3. Ambulatory

6.3.2.4. Implantable

6.3.2.5. Insulin

6.3.2.6. Others

6.3.3. Orthopedic Combination Products

6.3.3.1. Bone Graft Implants

6.3.3.2. Antibiotic Bone Cement

6.3.4. Transdermal Patches

6.3.5. Drug Eluting Stents

6.3.5.1. Peripheral Vascular Stents

6.3.5.2. Drug Eluting Stents

6.3.6. Inhalers

6.3.6.1. Dry Powder

6.3.6.2. Nebulizers

6.3.6.3. Metered Dose

6.3.7. Others

6.4. Market Attractiveness By Product Type

7. Global Drug-device Combination Products Market Analysis and Forecasts, By Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Application, 2020 to 2035

7.3.1. Diabetes Management

7.3.2. Respiratory Diseases

7.3.3. Eye Diseases

7.3.4. Autoimmune Diseases

7.3.5. Cancer

7.3.6. Pain Management

7.3.7. Infectious Diseases

7.3.8. Cardiovascular Diseases

7.3.9. Obesity Management

7.3.10. Others

7.4. Market Attractiveness By Application

8. Global Drug-device Combination Products Market Analysis and Forecasts, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By End-user, 2020 to 2035

8.3.1. Hospitals

8.3.2. Clinics

8.3.3. Ambulatory Surgical Centers

8.3.4. Home Care Centers

8.3.5. Others

8.4. Market Attractiveness By End-user

9. Global Drug-device Combination Products Market Analysis and Forecasts, By Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Region

10. North America Drug-device Combination Products Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Product Type, 2020 to 2035

10.2.1. Injectable Drug Delivery Devices

10.2.1.1. Pen Injectors

10.2.1.2. Autoinjectors

10.2.1.3. Pre-Filled Syringes

10.2.1.4. Others

10.2.2. Infusion Pumps

10.2.2.1. Volumetric

10.2.2.2. Syringes

10.2.2.3. Ambulatory

10.2.2.4. Implantable

10.2.2.5. Insulin

10.2.2.6. Others

10.2.3. Orthopedic Combination Products

10.2.3.1. Bone Graft Implants

10.2.3.2. Antibiotic Bone Cement

10.2.4. Transdermal Patches

10.2.5. Drug Eluting Stents

10.2.5.1. Peripheral Vascular Stents

10.2.5.2. Drug Eluting Stents

10.2.6. Inhalers

10.2.6.1. Dry Powder

10.2.6.2. Nebulizers

10.2.6.3. Metered Dose

10.2.7. Others

10.3. Market Value Forecast By Application, 2020 to 2035

10.3.1. Diabetes Management

10.3.2. Respiratory Diseases

10.3.3. Eye Diseases

10.3.4. Autoimmune Diseases

10.3.5. Cancer

10.3.6. Pain Management

10.3.7. Infectious Diseases

10.3.8. Cardiovascular Diseases

10.3.9. Obesity Management

10.3.10. Others

10.4. Market Value Forecast By End-user, 2020 to 2035

10.4.1. Hospitals

10.4.2. Clinics

10.4.3. Ambulatory Surgical Centers

10.4.4. Home Care Centers

10.4.5. Others

10.5. Market Value Forecast By Country, 2020 to 2035

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Drug-device Combination Products Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Product Type, 2020 to 2035

11.2.1. Injectable Drug Delivery Devices

11.2.1.1. Pen Injectors

11.2.1.2. Autoinjectors

11.2.1.3. Pre-Filled Syringes

11.2.1.4. Others

11.2.2. Infusion Pumps

11.2.2.1. Volumetric

11.2.2.2. Syringes

11.2.2.3. Ambulatory

11.2.2.4. Implantable

11.2.2.5. Insulin

11.2.2.6. Others

11.2.3. Orthopedic Combination Products

11.2.3.1. Bone Graft Implants

11.2.3.2. Antibiotic Bone Cement

11.2.4. Transdermal Patches

11.2.5. Drug Eluting Stents

11.2.5.1. Peripheral Vascular Stents

11.2.5.2. Drug Eluting Stents

11.2.6. Inhalers

11.2.6.1. Dry Powder

11.2.6.2. Nebulizers

11.2.6.3. Metered Dose

11.2.7. Others

11.3. Market Value Forecast By Application, 2020 to 2035

11.3.1. Diabetes Management

11.3.2. Respiratory Diseases

11.3.3. Eye Diseases

11.3.4. Autoimmune Diseases

11.3.5. Cancer

11.3.6. Pain Management

11.3.7. Infectious Diseases

11.3.8. Cardiovascular Diseases

11.3.9. Obesity Management

11.3.10. Others

11.4. Market Value Forecast By End-user, 2020 to 2035

11.4.1. Hospitals

11.4.2. Clinics

11.4.3. Ambulatory Surgical Centers

11.4.4. Home Care Centers

11.4.5. Others

11.5. Market Value Forecast By Country/Sub-region, 2020 to 2035

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Switzerland

11.5.7. The Netherlands

11.5.8. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Drug-device Combination Products Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Product Type, 2020 to 2035

12.2.1. Injectable Drug Delivery Devices

12.2.1.1. Pen Injectors

12.2.1.2. Autoinjectors

12.2.1.3. Pre-Filled Syringes

12.2.1.4. Others

12.2.2. Infusion Pumps

12.2.2.1. Volumetric

12.2.2.2. Syringes

12.2.2.3. Ambulatory

12.2.2.4. Implantable

12.2.2.5. Insulin

12.2.2.6. Others

12.2.3. Orthopedic Combination Products

12.2.3.1. Bone Graft Implants

12.2.3.2. Antibiotic Bone Cement

12.2.4. Transdermal Patches

12.2.5. Drug Eluting Stents

12.2.5.1. Peripheral Vascular Stents

12.2.5.2. Drug Eluting Stents

12.2.6. Inhalers

12.2.6.1. Dry Powder

12.2.6.2. Nebulizers

12.2.6.3. Metered Dose

12.2.7. Others

12.3. Market Value Forecast By Application, 2020 to 2035

12.3.1. Diabetes Management

12.3.2. Respiratory Diseases

12.3.3. Eye Diseases

12.3.4. Autoimmune Diseases

12.3.5. Cancer

12.3.6. Pain Management

12.3.7. Infectious Diseases

12.3.8. Cardiovascular Diseases

12.3.9. Obesity Management

12.3.10. Others

12.4. Market Value Forecast By End-user, 2020 to 2035

12.4.1. Hospitals

12.4.2. Clinics

12.4.3. Ambulatory Surgical Centers

12.4.4. Home Care Centers

12.4.5. Others

12.5. Market Value Forecast By Country/Sub-region, 2020 to 2035

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. South Korea

12.5.6. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Drug-device Combination Products Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Product Type, 2020 to 2035

13.2.1. Injectable Drug Delivery Devices

13.2.1.1. Pen Injectors

13.2.1.2. Autoinjectors

13.2.1.3. Pre-Filled Syringes

13.2.1.4. Others

13.2.2. Infusion Pumps

13.2.2.1. Volumetric

13.2.2.2. Syringes

13.2.2.3. Ambulatory

13.2.2.4. Implantable

13.2.2.5. Insulin

13.2.2.6. Others

13.2.3. Orthopedic Combination Products

13.2.3.1. Bone Graft Implants

13.2.3.2. Antibiotic Bone Cement

13.2.4. Transdermal Patches

13.2.5. Drug Eluting Stents

13.2.5.1. Peripheral Vascular Stents

13.2.5.2. Drug Eluting Stents

13.2.6. Inhalers

13.2.6.1. Dry Powder

13.2.6.2. Nebulizers

13.2.6.3. Metered Dose

13.2.7. Others

13.3. Market Value Forecast By Application, 2020 to 2035

13.3.1. Diabetes Management

13.3.2. Respiratory Diseases

13.3.3. Eye Diseases

13.3.4. Autoimmune Diseases

13.3.5. Cancer

13.3.6. Pain Management

13.3.7. Infectious Diseases

13.3.8. Cardiovascular Diseases

13.3.9. Obesity Management

13.3.10. Others

13.4. Market Value Forecast By End-user, 2020 to 2035

13.4.1. Hospitals

13.4.2. Clinics

13.4.3. Ambulatory Surgical Centers

13.4.4. Home Care Centers

13.4.5. Others

13.5. Market Value Forecast By Country/Sub-region, 2020 to 2035

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Argentina

13.5.4. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Drug-device Combination Products Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Product Type, 2020 to 2035

14.2.1. Injectable Drug Delivery Devices

14.2.1.1. Pen Injectors

14.2.1.2. Autoinjectors

14.2.1.3. Pre-Filled Syringes

14.2.1.4. Others

14.2.2. Infusion Pumps

14.2.2.1. Volumetric

14.2.2.2. Syringes

14.2.2.3. Ambulatory

14.2.2.4. Implantable

14.2.2.5. Insulin

14.2.2.6. Others

14.2.3. Orthopedic Combination Products

14.2.3.1. Bone Graft Implants

14.2.3.2. Antibiotic Bone Cement

14.2.4. Transdermal Patches

14.2.5. Drug Eluting Stents

14.2.5.1. Peripheral Vascular Stents

14.2.5.2. Drug Eluting Stents

14.2.6. Inhalers

14.2.6.1. Dry Powder

14.2.6.2. Nebulizers

14.2.6.3. Metered Dose

14.2.7. Others

14.3. Market Value Forecast By Application, 2020 to 2035

14.3.1. Diabetes Management

14.3.2. Respiratory Diseases

14.3.3. Eye Diseases

14.3.4. Autoimmune Diseases

14.3.5. Cancer

14.3.6. Pain Management

14.3.7. Infectious Diseases

14.3.8. Cardiovascular Diseases

14.3.9. Obesity Management

14.3.10. Others

14.4. Market Value Forecast By End-user, 2020 to 2035

14.4.1. Hospitals

14.4.2. Clinics

14.4.3. Ambulatory Surgical Centers

14.4.4. Home Care Centers

14.4.5. Others

14.5. Market Value Forecast By Country/Sub-region, 2020 to 2035

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2024)

15.3. Company Profiles

15.3.1. Abbott

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Eli Lilly and Company

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Medtronic

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Novo Nordisk A/S

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Novartis AG

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Sanofi

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Boston Scientific Corporation or its affiliates.

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. BD

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. Merck KGaA

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. B. Braun SE

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

15.3.11. Stryker

15.3.11.1. Company Overview

15.3.11.2. Financial Overview

15.3.11.3. Product Portfolio

15.3.11.4. Business Strategies

15.3.11.5. Recent Developments

15.3.12. Gerresheimer AG

15.3.12.1. Company Overview

15.3.12.2. Financial Overview

15.3.12.3. Product Portfolio

15.3.12.4. Business Strategies

15.3.12.5. Recent Developments

15.3.13. Narang Medical Limited.

15.3.13.1. Company Overview

15.3.13.2. Financial Overview

15.3.13.3. Product Portfolio

15.3.13.4. Business Strategies

15.3.13.5. Recent Developments

15.3.14. Sparsha Pharma International Pvt Ltd

15.3.14.1. Company Overview

15.3.14.2. Financial Overview

15.3.14.3. Product Portfolio

15.3.14.4. Business Strategies

15.3.14.5. Recent Developments

15.3.15. Other Prominent Players

15.3.15.1. Company Overview

15.3.15.2. Financial Overview

15.3.15.3. Product Portfolio

15.3.15.4. Business Strategies

15.3.15.5. Recent Developments

List of Tables

Table 01: Global Drug-device Combination Products Market Value (US$ Mn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Drug-device Combination Products Market Value (US$ Mn) Forecast, By Application, 2020 to 2035

Table 03: Global Drug-device Combination Products Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 04: Global Drug-device Combination Products Market Value (US$ Mn) Forecast, By Region, 2020 to 2035

Table 05: North America Drug-device Combination Products Market Value (US$ Mn) Forecast, by Country, 2020-2035

Table 06: North America Drug-device Combination Products Market Value (US$ Mn) Forecast, By Product Type, 2020 to 2035

Table 07: North America Drug-device Combination Products Market Value (US$ Mn) Forecast, By Application, 2020 to 2035

Table 08: North America Drug-device Combination Products Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 09: Europe Drug-device Combination Products Market Value (US$ Mn) Forecast, by Country / Sub-region, 2020-2035

Table 10: Europe Drug-device Combination Products Market Value (US$ Mn) Forecast, By Product Type, 2020 to 2035

Table 11: Europe Drug-device Combination Products Market Value (US$ Mn) Forecast, By Application, 2020 to 2035

Table 12: Europe Drug-device Combination Products Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 13: Asia Pacific Drug-device Combination Products Market Value (US$ Mn) Forecast, by Country / Sub-region, 2020-2035

Table 14: Asia Pacific Drug-device Combination Products Market Value (US$ Mn) Forecast, By Product Type, 2020 to 2035

Table 15 Asia Pacific Drug-device Combination Products Market Value (US$ Mn) Forecast, By Application, 2020 to 2035

Table 16: Asia Pacific Drug-device Combination Products Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 17: Latin America Drug-device Combination Products Market Value (US$ Mn) Forecast, by Country / Sub-region, 2020-2035

Table 18: Latin America Drug-device Combination Products Market Value (US$ Mn) Forecast, By Product Type, 2020 to 2035

Table 19: Latin America Drug-device Combination Products Market Value (US$ Mn) Forecast, By Application, 2020 to 2035

Table 20: Latin America Drug-device Combination Products Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 21: Middle East & Africa Drug-device Combination Products Market Value (US$ Mn) Forecast, by Country / Sub-region, 2020-2035

Table 22: Middle East & Africa Drug-device Combination Products Market Value (US$ Mn) Forecast, By Product Type, 2020 to 2035

Table 23: Middle East & Africa Drug-device Combination Products Market Value (US$ Mn) Forecast, By Application, 2020 to 2035

Table 24: Middle East & Africa Drug-device Combination Products Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

List of Figures

Figure 01: Global Drug-device Combination Products Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Drug-device Combination Products Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 03: Global Drug-device Combination Products Market Revenue (US$ Mn), by Injectable Drug Delivery Devices, 2020 to 2035

Figure 04: Global Drug-device Combination Products Market Revenue (US$ Mn), by Infusion Pumps, 2020 to 2035

Figure 05: Global Drug-device Combination Products Market Revenue (US$ Mn), By Orthopedic Combination Products, 2020 to 2035

Figure 06: Global Drug-device Combination Products Market Revenue (US$ Mn), By Transdermal Patches, 2020 to 2035

Figure 07: Global Drug-device Combination Products Market Revenue (US$ Mn), By Drug Eluting Stents, 2020 to 2035

Figure 08: Global Drug-device Combination Products Market Revenue (US$ Mn), By Inhalers, 2020 to 2035

Figure 09: Global Drug-device Combination Products Market Revenue (US$ Mn), By Others, 2020 to 2035

Figure 10: Global Drug-device Combination Products Market Value Share Analysis, By Application, 2024 and 2035

Figure 11: Global Drug-device Combination Products Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 12: Global Drug-device Combination Products Market Revenue (US$ Mn), by Diabetes Management, 2020 to 2035

Figure 13: Global Drug-device Combination Products Market Revenue (US$ Mn), By Respiratory Diseases, 2020 to 2035

Figure 14: Global Drug-device Combination Products Market Revenue (US$ Mn), By Eye Diseases, 2020 to 2035

Figure 15: Global Drug-device Combination Products Market Revenue (US$ Mn), By Autoimmune Diseases, 2020 to 2035

Figure 16: Global Drug-device Combination Products Market Revenue (US$ Mn), By Cancer, 2020 to 2035

Figure 17: Global Drug-device Combination Products Market Revenue (US$ Mn), By Pain Management, 2020 to 2035

Figure 18: Global Drug-device Combination Products Market Revenue (US$ Mn), By Infectious Diseases, 2020 to 2035

Figure 19: Global Drug-device Combination Products Market Revenue (US$ Mn), By Cardiovascular Diseases, 2020 to 2035

Figure 20: Global Drug-device Combination Products Market Revenue (US$ Mn), By Obesity Management, 2020 to 2035

Figure 21: Global Drug-device Combination Products Market Revenue (US$ Mn), By Others, 2020 to 2035

Figure 22: Global Drug-device Combination Products Market Value Share Analysis, By End-user, 2024 and 2035

Figure 23: Global Drug-device Combination Products Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 24: Global Drug-device Combination Products Market Revenue (US$ Mn), by Hospitals, 2020 to 2035

Figure 25: Global Drug-device Combination Products Market Revenue (US$ Mn), By Clinics, 2020 to 2035

Figure 26: Global Drug-device Combination Products Market Revenue (US$ Mn), By Ambulatory Surgical Centers, 2020 to 2035

Figure 27: Global Drug-device Combination Products Market Revenue (US$ Mn), By Home Care Centers, 2020 to 2035

Figure 28: Global Drug-device Combination Products Market Revenue (US$ Mn), By Others, 2020 to 2035

Figure 29: Global Drug-device Combination Products Market Value Share Analysis, By Region, 2024 and 2035

Figure 30: Global Drug-device Combination Products Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 31: North America Drug-device Combination Products Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 32: North America Drug-device Combination Products Market Value Share Analysis, by Country, 2024 and 2035

Figure 33: North America Drug-device Combination Products Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 34: North America Drug-device Combination Products Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 35: North America Drug-device Combination Products Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 36: North America Drug-device Combination Products Market Value Share Analysis, By Application, 2024 and 2035

Figure 37: North America Drug-device Combination Products Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 38: North America Drug-device Combination Products Market Value Share Analysis, By End-user, 2024 and 2035

Figure 39: North America Drug-device Combination Products Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 40: Europe Drug-device Combination Products Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 41: Europe Drug-device Combination Products Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 42: Europe Drug-device Combination Products Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 43: Europe Drug-device Combination Products Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 44: Europe Drug-device Combination Products Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 45: Europe Drug-device Combination Products Market Value Share Analysis, By Application, 2024 and 2035

Figure 46: Europe Drug-device Combination Products Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 47: Europe Drug-device Combination Products Market Value Share Analysis, By End-user, 2024 and 2035

Figure 48: Europe Drug-device Combination Products Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 49: Asia Pacific Drug-device Combination Products Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 50: Asia Pacific Drug-device Combination Products Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 51: Asia Pacific Drug-device Combination Products Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 52: Asia Pacific Drug-device Combination Products Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 53: Asia Pacific Drug-device Combination Products Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 54: Asia Pacific Drug-device Combination Products Market Value Share Analysis, By Application, 2024 and 2035

Figure 55: Asia Pacific Drug-device Combination Products Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 56: Asia Pacific Drug-device Combination Products Market Value Share Analysis, By End-user, 2024 and 2035

Figure 57: Asia Pacific Drug-device Combination Products Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 58: Latin America Drug-device Combination Products Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 59: Latin America Drug-device Combination Products Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 60: Latin America Drug-device Combination Products Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 61: Latin America Drug-device Combination Products Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 62: Latin America Drug-device Combination Products Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 63: Latin America Drug-device Combination Products Market Value Share Analysis, By Application, 2024 and 2035

Figure 64: Latin America Drug-device Combination Products Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 65: Latin America Drug-device Combination Products Market Value Share Analysis, By End-user, 2024 and 2035

Figure 66: Latin America Drug-device Combination Products Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 67: Middle East & Africa Drug-device Combination Products Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 68: Middle East & Africa Drug-device Combination Products Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 69: Middle East & Africa Drug-device Combination Products Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 70: Middle East & Africa Drug-device Combination Products Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 71: Middle East & Africa Drug-device Combination Products Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 72: Middle East & Africa Drug-device Combination Products Market Value Share Analysis, By Application, 2024 and 2035

Figure 73: Middle East & Africa Drug-device Combination Products Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 74: Middle East & Africa Drug-device Combination Products Market Value Share Analysis, By End-user, 2024 and 2035

Figure 75: Middle East & Africa Drug-device Combination Products Market Attractiveness Analysis, By End-user, 2025 to 2035