Reports

Reports

The drainage system market is witnessing steadiness due to urban infrastructure development, smart cities, and responsible water management initiatives. Smart drainage systems that utilize IoT sensor technology and data logging/real-time monitoring systems continue to accelerate, especially among municipal and commercial projects. The development of the market is also supported by regulatory organizations that are pressing water management. This is increasing the uptake of drainage from a residential, commercial, and industrial construction perspective.

Overall, the analyst outlook is very positive, given that medium- and long-term demand is supported by infrastructural upgrades, climate resiliency pressures and innovations. The integration of these intelligent systems with predictive analytics and AI-powered decision-making tools is facilitating preemptive flood control and maintenance scheduling. Furthermore, the installation of sensors and automatic valves in the current urban drainage systems is being adopted more and more, which is improving the operation, reducing the risk of waterlogging, and helping the companies to keep up with the constantly changing environmental and safety regulations.

The drainage system industry has been experiencing stronger traction from evolution toward modern infrastructure and sustainability. Governments and municipalities worldwide are strictly regulating urban runoff and pollution. This creates opportunities for traditional drainage solutions and advanced solutions that fall under a wide spectrum of applications.

Eco-friendly construction practices are being advocated for the increased use of permeable pavements, storm water detention systems, and types of sustainable drainage systems’ designs. Construction growth continues for residential construction and industrial construction, and product demand remains strong. The use of digital planning and monitoring tools for drainage infrastructure allows stakeholders to manage water flow, even as urban densities climb.

Additionally, the trending awareness regarding the long-term environmental and fiscal costs of improper drainage, including damage to properties and lake/river sedimentation due to erosion of development from improper drainage solutions, is forcing investments and the choice of innovators looking for long-term solutions for drainage issues.

There is a strong ground and foundation laid for continued growth of the drainage system market in every corner of the world, both - in developed and developing markets.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Urbanization has been widely regarded as the most significant impetus for growth of the drainage system market. As more people move toward urban centers, existing infrastructure becomes more of a problem than a solution, requiring both - upgrades and new application of drainage systems. For instance, newly created dense urban development tend to add more impermeable surfaces, like roads and buildings, making it harder for naturally occurring rainfall to be absorbed into the ground and increasing the overall surface runoff potential.

The Raw Materials Quality Assurance Scheme (RMQAS) has included all required specifications into an urban subcomponent, minimizing administrative burdens and risk to both - the contractor and client. The team has also collaborated with transport planning department to develop circular economy principles in construction industry materials procurement.

Urban infrastructure developments are fast-tracking the incorporation of modern drainage systems as necessary elements of both - sustainable urban planning and critical to proper management of storm water events, which can reduce flood damage risk, protect building foundations, and enhance lifecycle performance of roads and public infrastructure.

This focus on avoidance of heavy modular projects, ultimate advisory statements of works, avoidance of delayed scenario or trial and error processes, and incorporation of drainage system components is driving contractors, municipalities, and private developers to find more effective, efficient, cost- effective, and scalable solutions for drainage systems to meet the demands for urban development. Also, there is demand from the civil service to recover money lost through environmental damage.

Climate change is emerging as an important driver for the demand for new drainage systems. Flood management strategies are about planning for storm drainage networks that are best able to drain surplus storm water quickly and efficiently. The engineering of storm water management systems considers topography, fluvial-dynamics, and their long-term viability.

Increasingly, modular and/or smart drainage systems, which allow real-time monitoring of water levels and flow rate information in flood-prone areas, are being considered. For example, a low-lying urban neighborhood that experience flooding events routinely combine underground detention systems and smart water flow sensors to drastically improve their ability to manage sudden downpours and reduced property damage significantly while transforming the data into future planning considerations.

In addition to that, the public authorities and local governments are pouring a lot of money into superior drainage structures meant to counteract the impact of extreme weather. The combination of public and private money is going to develop ground-breaking methods, including the likes of paving that allows water to permeate, roofs that are landscaped, and settling ponds. This not only increases flood resistance but also makes cities more environmentally friendly and able to withstand hardships more easily in the long run.

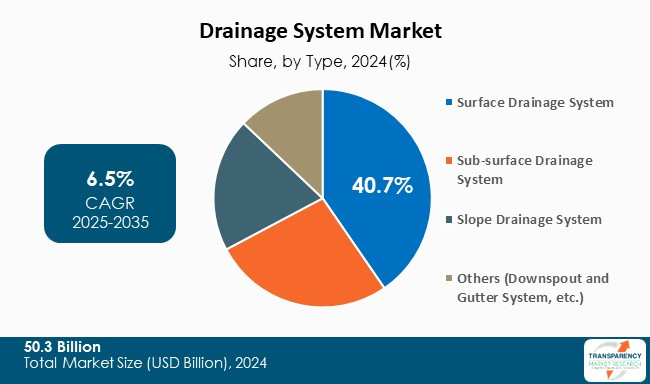

The global drainage system market is divided into several parts: surface drainage systems, sub-surface drainage systems, slope drainage systems, and other systems. The surface drainage system, with a 40.7% market share, is the leader of these segments because of the large-scale residential, commercial, and municipal infrastructural projects where it is used. Industrial and urban developments have selected surface drainage systems due to their cost-effectiveness, straightforward installation, and capability to manage stormwater and surface runoff efficiently. Besides, rapid urbanization, smart city concepts, and government-influenced infrastructure investments (especially in flood-prone areas) are persisting to fortify its market status.

Similarly, the sub-surface drainage system segment is witnessing growth on account of its efficiency in agricultural as well as sports field applications, ensuring proper soil stability and moisture regulation. In contrast, slope drainage management is getting significant recognition in hilly terrains and road construction to avert erosion and landslides. The 'others' segment, which includes downspouts and gutter systems, is also important as it caters to residential and small-scale applications, thereby helping to enhance the overall market diversity.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The world drainage system market shows significant differences from one region to another due to the varying priorities in the development of infrastructure, urbanization, and environmental management. The market is led by Asia Pacific region with a share of 38.5%, which is mainly attributable to the rapid urbanization coupled with smart city projects, and the enormous investments in the water management infrastructure by the countries of China, India, and Japan. Besides, government initiatives to improve stormwater and wastewater networks, along with the severe flooding occurrences, are the factors that are promoting the use of cutting-edge drainage systems even more.

On the other hand, North America and Europe are gradually gaining the benefits of the new drainage systems because of the increased regulatory pressure to modernize old infrastructures and the higher focus on sustainable water management. The areas like the Middle East & Africa and Latin America are slowly becoming more promising as the governments are directing their attention to urban planning and climate-resilient infrastructure. Nevertheless, Asia Pacific's combination of mega construction projects, dense population, and increasing environmental consciousness keeps on maintaining its dominance in the global drainage system market.

Atlantis Corporation, Australia Pty Ltd, Capteurs GR., Hydrotec Technologies AG, Jay R. Smith Mfg. Co., Inc., Josam Company, MIFAB, Inc., Neenah Enterprises, Inc., Neodrain Technologies, Turner Company, US Trench Drain are some of the leading manufacturers operating in the global drainage system market.

Each of these companies has been profiled in the drainage system market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

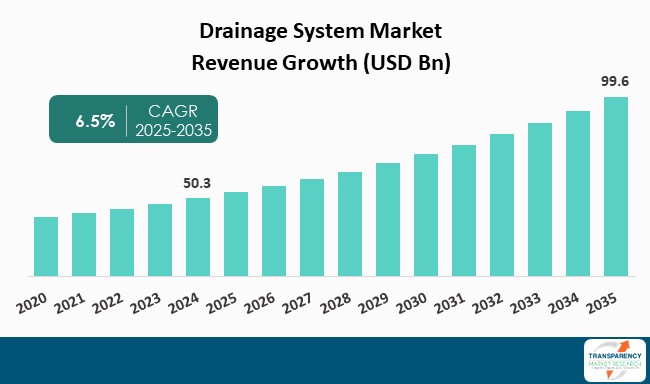

| Market Size Value in 2024 (Base Year) | US$ 50.3 Bn |

| Market Forecast Value in 2035 | US$ 99.6 Bn |

| Growth Rate (CAGR 2025 to 2035) | 6.5% |

| Forecast Period | 2025 - 2035 |

| Historical data Available for | 2020 - 2023 |

| Quantitative Units | US$ Bn for Value and Thousand Units for Volume |

| Market Analysis | Global qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Market Player - Competition Dashboard and Revenue Share Analysis 2024 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentation | By Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global drainage system market was valued at US$ 50.3 Bn in 2024

The global drainage system industry is projected to reach at US$ 99.6 Bn by the end of 2035

Urbanization & infrastructure growth and climate change & flood management are some of the factors driving the expansion of drainage system market.

The CAGR is anticipated to be 6.5% from 2025 to 2035

Atlantis Corporation Australia Pty Ltd, Capteurs GR., Hydrotec Technologies AG, Jay R. Smith Mfg. Co., Inc., Josam Company, MIFAB, Inc., Neenah Enterprises, Inc., Neodrain Technologies, Turner Company, and US Trench Drain and others are some of the leading manufacturers operating in the global Drainage system.

Table 01: Global Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 02: Global Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 03: Global Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 04: Global Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 05: Global Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 06: Global Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 07: Global Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 08: Global Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 09: Global Drainage System Market Value (US$ Bn) Projection, By Region 2020 to 2035

Table 10: Global Drainage System Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Table 11: North America Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 12: North America Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 13: North America Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 14: North America Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 15: North America Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 16: North America Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 17: North America Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 18: North America Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 19: North America Drainage System Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 20: North America Drainage System Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 21: U.S. Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 22: U.S. Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 23: U.S. Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 24: U.S. Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 25: U.S. Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 26: U.S. Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 27: U.S. Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 28: U.S. Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 29: Canada Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 30: Canada Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 31: Canada Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 32: Canada Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 33: Canada Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 34: Canada Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 35: Canada Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 36: Canada Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 37: Europe Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 38: Europe Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 39: Europe Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 40: Europe Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 41: Europe Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 42: Europe Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 43: Europe Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 44: Europe Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 45: Europe Drainage System Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 46: Europe Drainage System Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 47: U.K. Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 48: U.K. Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 49: U.K. Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 50: U.K. Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 51: U.K. Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 52: U.K. Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 53: U.K. Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 54: U.K. Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 55: Germany Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 56: Germany Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 57: Germany Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 58: Germany Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 59: Germany Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 60: Germany Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 61: Germany Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 62: Germany Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 63: France Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 64: France Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 65: France Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 66: France Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 67: France Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 68: France Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 69: France Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 70: France Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 71: Italy Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 72: Italy Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 73: Italy Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 74: Italy Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 75: Italy Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 76: Italy Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 77: Italy Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 78: Italy Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 79: Spain Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 80: Spain Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 81: Spain Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 82: Spain Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 83: Spain Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 84: Spain Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 85: Spain Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 86: Spain Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 87: The Netherlands Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 88: The Netherlands Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 89: The Netherlands Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 90: The Netherlands Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 91: The Netherlands Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 92: The Netherlands Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 93: The Netherlands Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 94: The Netherlands Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 95: Asia Pacific Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 96: Asia Pacific Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 97: Asia Pacific Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 98: Asia Pacific Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 99: Asia Pacific Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 100: Asia Pacific Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 101: Asia Pacific Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 102: Asia Pacific Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 103: Asia Pacific Drainage System Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 104: Asia Pacific Drainage System Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 105: China Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 106: China Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 107: China Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 108: China Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 109: China Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 110: China Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 111: China Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 112: China Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 113: India Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 114: India Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 115: India Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 116: India Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 117: India Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 118: India Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 119: India Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 120: India Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 121: Japan Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 122: Japan Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 123: Japan Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 124: Japan Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 125: Japan Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 126: Japan Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 127: Japan Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 128: Japan Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 129: Australia Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 130: Australia Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 131: Australia Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 132: Australia Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 133: Australia Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 134: Australia Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 135: Australia Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 136: Australia Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 137: South Korea Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 138: South Korea Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 139: South Korea Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 140: South Korea Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 141: South Korea Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 142: South Korea Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 143: South Korea Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 144: South Korea Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 145: ASEAN Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 146: ASEAN Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 147: ASEAN Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 148: ASEAN Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 149: ASEAN Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 150: ASEAN Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 151: ASEAN Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 152: ASEAN Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 153: Middle East & Africa Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 154: Middle East & Africa Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 155: Middle East & Africa Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 156: Middle East & Africa Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 157: Middle East & Africa Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 158: Middle East & Africa Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 159: Middle East & Africa Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 160: Middle East & Africa Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 161: Middle East & Africa Drainage System Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 162: Middle East & Africa Drainage System Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 163: GCC Countries Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 164: GCC Countries Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 165: GCC Countries Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 166: GCC Countries Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 167: GCC Countries Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 168: GCC Countries Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 169: GCC Countries Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 170: GCC Countries Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 171: South Africa Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 172: South Africa Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 173: South Africa Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 174: South Africa Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 175: South Africa Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 176: South Africa Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 177: South Africa Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 178: South Africa Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 179: Latin America Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 180: Latin America Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 181: Latin America Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 182: Latin America Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 183: Latin America Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 184: Latin America Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 185: Latin America Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 186: Latin America Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 187: Latin America Drainage System Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 188: Latin America Drainage System Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 189: Brazil Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 190: Brazil Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 191: Brazil Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 192: Brazil Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 193: Brazil Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 194: Brazil Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 195: Brazil Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 196: Brazil Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 197: Mexico Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 198: Mexico Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 199: Mexico Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 200: Mexico Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 201: Mexico Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 202: Mexico Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 203: Mexico Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 204: Mexico Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Table 205: Argentina Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Table 206: Argentina Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Table 207: Argentina Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Table 208: Argentina Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Table 209: Argentina Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Table 210: Argentina Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Table 211: Argentina Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Table 212: Argentina Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 01: Global Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 02: Global Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 03: Global Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 04: Global Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 05: Global Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 06: Global Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 07: Global Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 08: Global Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 09: Global Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 10: Global Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 11: Global Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 12: Global Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 13: Global Drainage System Market Value (US$ Bn) Projection, By Region 2020 to 2035

Figure 14: Global Drainage System Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Figure 15: Global Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Region 2025 to 2035

Figure 16: North America Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 17: North America Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 18: North America Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 19: North America Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 20: North America Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 21: North America Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 22: North America Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 23: North America Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 24: North America Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 25: North America Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 26: North America Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 27: North America Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 28: North America Drainage System Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 29: North America Drainage System Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 30: North America Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 31: U.S. Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 32: U.S. Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 33: U.S. Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 34: U.S. Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 35: U.S. Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 36: U.S. Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 37: U.S. Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 38: U.S. Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 39: U.S. Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 40: U.S. Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 41: U.S. Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 42: U.S. Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 43: Canada Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 44: Canada Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 45: Canada Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 46: Canada Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 47: Canada Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 48: Canada Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 49: Canada Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 50: Canada Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 51: Canada Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 52: Canada Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 53: Canada Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 54: Canada Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 55: Europe Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 56: Europe Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 57: Europe Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 58: Europe Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 59: Europe Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 60: Europe Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 61: Europe Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 62: Europe Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 63: Europe Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 64: Europe Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 65: Europe Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 66: Europe Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 67: Europe Drainage System Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 68: Europe Drainage System Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 69: Europe Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 70: U.K. Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 71: U.K. Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 72: U.K. Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 73: U.K. Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 74: U.K. Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 75: U.K. Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 76: U.K. Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 77: U.K. Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 78: U.K. Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 79: U.K. Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 80: U.K. Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 81: U.K. Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 82: Germany Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 83: Germany Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 84: Germany Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 85: Germany Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 86: Germany Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 87: Germany Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 88: Germany Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 89: Germany Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 90: Germany Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 91: Germany Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 92: Germany Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 93: Germany Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 94: France Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 95: France Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 96: France Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 97: France Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 98: France Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 99: France Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 100: France Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 101: France Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 102: France Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 103: France Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 104: France Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 105: France Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 106: Italy Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 107: Italy Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 108: Italy Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 109: Italy Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 110: Italy Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 111: Italy Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 112: Italy Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 113: Italy Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 114: Italy Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 115: Italy Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 116: Italy Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 117: Italy Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 118: Spain Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 119: Spain Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 120: Spain Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 121: Spain Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 122: Spain Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 123: Spain Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 124: Spain Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 125: Spain Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 126: Spain Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 127: Spain Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 128: Spain Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 129: Spain Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 130: The Netherlands Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 131: The Netherlands Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 132: The Netherlands Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 133: The Netherlands Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 134: The Netherlands Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 135: The Netherlands Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 136: The Netherlands Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 137: The Netherlands Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 138: The Netherlands Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 139: The Netherlands Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 140: The Netherlands Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 141: The Netherlands Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 142: Asia Pacific Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 143: Asia Pacific Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 144: Asia Pacific Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 145: Asia Pacific Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 146: Asia Pacific Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 147: Asia Pacific Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 148: Asia Pacific Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 149: Asia Pacific Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 150: Asia Pacific Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 151: Asia Pacific Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 152: Asia Pacific Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 153: Asia Pacific Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 154: Asia Pacific Drainage System Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 155: Asia Pacific Drainage System Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 156: Asia Pacific Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 157: China Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 158: China Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 159: China Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 160: China Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 161: China Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 162: China Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 163: China Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 164: China Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 165: China Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 166: China Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 167: China Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 168: China Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 169: India Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 170: India Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 171: India Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 172: India Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 173: India Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 174: India Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 175: India Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 176: India Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 177: India Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 178: India Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 179: India Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 180: India Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 181: Japan Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 182: Japan Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 183: Japan Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 184: Japan Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 185: Japan Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 186: Japan Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 187: Japan Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 188: Japan Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 189: Japan Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 190: Japan Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 191: Japan Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 192: Japan Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 193: Australia Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 194: Australia Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 195: Australia Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 196: Australia Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 197: Australia Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 198: Australia Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 199: Australia Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 200: Australia Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 201: Australia Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 202: Australia Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 203: Australia Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 204: Australia Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 205: South Korea Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 206: South Korea Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 207: South Korea Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 208: South Korea Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 209: South Korea Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 210: South Korea Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 211: South Korea Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 212: South Korea Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 213: South Korea Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 214: South Korea Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 215: South Korea Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 216: South Korea Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 217: ASEAN Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 218: ASEAN Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 219: ASEAN Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 220: ASEAN Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 221: ASEAN Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 222: ASEAN Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 223: ASEAN Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 224: ASEAN Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 225: ASEAN Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 226: ASEAN Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 227: ASEAN Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 228: ASEAN Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 229: Middle East & Africa Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 230: Middle East & Africa Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 231: Middle East & Africa Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 232: Middle East & Africa Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 233: Middle East & Africa Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 234: Middle East & Africa Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 235: Middle East & Africa Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 236: Middle East & Africa Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 237: Middle East & Africa Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 238: Middle East & Africa Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 239: Middle East & Africa Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 240: Middle East & Africa Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 241: Middle East & Africa Drainage System Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 242: Middle East & Africa Drainage System Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 243: Middle East & Africa Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 244: GCC Countries Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 245: GCC Countries Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 246: GCC Countries Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 247: GCC Countries Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 248: GCC Countries Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 249: GCC Countries Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 250: GCC Countries Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 251: GCC Countries Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 252: GCC Countries Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 253: GCC Countries Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 254: GCC Countries Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 255: GCC Countries Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 256: South Africa Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 257: South Africa Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 258: South Africa Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 259: South Africa Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 260: South Africa Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 261: South Africa Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 262: South Africa Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 263: South Africa Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 264: South Africa Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 265: South Africa Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 266: South Africa Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 267: South Africa Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 268: Latin America Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 269: Latin America Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 270: Latin America Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 271: Latin America Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 272: Latin America Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 273: Latin America Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 274: Latin America Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 275: Latin America Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 276: Latin America Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 277: Latin America Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 278: Latin America Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 279: Latin America Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 280: Latin America Drainage System Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 281: Latin America Drainage System Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 282: Latin America Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 283: Brazil Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 284: Brazil Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 285: Brazil Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 286: Brazil Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 287: Brazil Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 288: Brazil Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 289: Brazil Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 290: Brazil Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 291: Brazil Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 292: Brazil Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 293: Brazil Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 294: Brazil Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 295: Mexico Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 296: Mexico Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 297: Mexico Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 298: Mexico Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 299: Mexico Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 300: Mexico Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 301: Mexico Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 302: Mexico Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 303: Mexico Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 304: Mexico Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 305: Mexico Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 306: Mexico Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035

Figure 307: Argentina Drainage System Market Value (US$ Bn) Projection, By Type 2020 to 2035

Figure 308: Argentina Drainage System Market Volume (Thousand Units) Projection, By Type 2020 to 2035

Figure 309: Argentina Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Type 2025 to 2035

Figure 310: Argentina Drainage System Market Value (US$ Bn) Projection, By Category 2020 to 2035

Figure 311: Argentina Drainage System Market Volume (Thousand Units) Projection, By Category 2020 to 2035

Figure 312: Argentina Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Category 2025 to 2035

Figure 313: Argentina Drainage System Market Value (US$ Bn) Projection, By End-use 2020 to 2035

Figure 314: Argentina Drainage System Market Volume (Thousand Units) Projection, By End-use 2020 to 2035

Figure 315: Argentina Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By End-use 2025 to 2035

Figure 316: Argentina Drainage System Market Value (US$ Bn) Projection, By Distribution Channel 2020 to 2035

Figure 317: Argentina Drainage System Market Volume (Thousand Units) Projection, By Distribution Channel 2020 to 2035

Figure 318: Argentina Drainage System Market Incremental Opportunities (US$ Bn) Forecast, By Distribution Channel 2025 to 2035