Reports

Reports

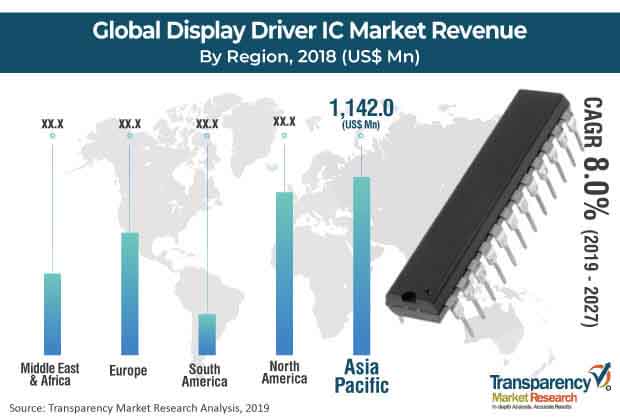

A display driver IC (DDIC) is used to operate display panels of hand-held devices such as mobile phones, wearable devices, laptops, and tablets. It receives digital data at a high speed (ranging from more than 500 Mbps to 1 Gbps) from the AP (application processor) and then converts it into analog voltage for operating the display panel. In electronics/computer hardware, a display driver is usually a semiconductor integrated circuit (IC) that provides an interface function between a microprocessor, microcontroller, ASIC (or general-purpose peripheral interface), and a particular type of display device such as LCD, LED, OLED, ePaper, or CRT. The global display driver IC market is projected to expand at a CAGR of 8.0% during the forecast period and reach value of US$ 6,842.2 Mn by 2027.

Significant sales of electronic devices, such as TVs, PCs, and mobile phones, are likely to significantly drive the global display driver IC market during the forecast period, as display driver ICs are used in the activation of pixels used in displays of TVs, PCs, and mobile phones. With the increasing use of smartphones across the globe, the demand for integration of touch and display controllers is likely to rise considerably in the next few years. This is expected to fuel the global display driver IC market between 2019 and 2027. In order to meet this risen demand, several display manufacturers have started acquiring manufacturers of display driver ICs. Additionally, touchscreen displays are efficient in terms of time required to process an order and other on-demand functions, owing to automation. As the global automotive display industry continues to expand, the demand for high-quality display drivers is expected to increase during the forecast period. Also, application of LCD-based display driver products is likely to be further extended to a wide range of automotive applications such as instrument cluster, GPS navigation, and car entertainment displays in the near future. OLED display drivers are also anticipated to be widely adopted for use in automotive applications in the next few years.

Raw materials required in the production of display drivers, such as doped indium tin oxide (ITO), are scantily available, owing to their low occurrence in the Earth’s crust itself. Additionally, owing to increasing mining activities, availability of doped ITO has been decreasing further, while its prices are rising. Owing to low availability of raw materials, prices for the display driver technology are currently high. Furthermore, software and interface solutions embedded in touchscreen displays add to costs further, thereby increasing the total price of displays. These barriers are hindering the rate of adoption of display driver ICs across various industries.

Attracted by the anticipated growth of the global display driver IC market and underlying latent demand, several players are expanding their business through strategic mergers and acquisitions as well as partnerships. For instance, in January 2017, Novatek Technology acquired Faraday Technology’s surveillance business. This acquisition enhanced the technology competitiveness of Novatek’s imaging SOC and IP cameras. Some of the prominent players operating in the global display driver IC market are Samsung Electronics, Novatek Microelectronics (U.S.), Himax Technologies, Silicon Works, Sitronix Technology, Raydium Semiconductor, Magnachip Semiconductor, MediaTek, and ROHM Semiconductor.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Display Driver IC Market

4. Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Key Trends Analysis

4.4. Global Display Driver IC Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projection (US$ Mn)

4.4.2. Market Volume Projection (Units)

4.5. Porter’s Five Forces Analysis - Global Display Driver IC Market

4.6. Value Chain Analysis - Global Display Driver IC Market

4.7. Market Outlook

5. Global Display Driver IC Market Analysis and Forecast, by Display Technology

5.1. Overview & Definitions

5.2. Global Display Driver IC Market Size (US$ Mn and Units) Forecast, by Display Technology, 2017–2027

5.2.1. LCD

5.2.2. LED

5.2.3. OLED

5.2.4. Others (Including CRT and Vacuum Fluorescent Display)

5.3. Display Technology Comparison Matrix

5.4. Global Display Driver IC Market Attractiveness, by Display Technology

6. Global Display Driver IC Market Analysis and Forecast, by Application

6.1. Overview & Definitions

6.2. Key Trends

6.3. Global Display Driver IC Market Value (US$ Mn) Forecast, by Application, 2017–2027

6.3.1. Mobile Phones

6.3.2. Televisions

6.3.3. Laptops

6.3.4. Tablets

6.3.5. Smart Watches

6.3.6. Automobile Consoles

6.3.7. Others (Including Wearable Devices and Video Walls)

6.4. Application Comparison Matrix

6.5. Global Display Driver IC Market Attractiveness, by Application

7. Global Display Driver IC Market Analysis and Forecast, by End-use Industry

7.1. Overview & Definitions

7.2. Global Display Driver IC Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

7.2.1. Consumer Electronics

7.2.2. Healthcare

7.2.3. Automotive

7.2.4. Others

7.3. End-use Industry Comparison Matrix

7.4. Global Display Driver IC Market Attractiveness, by End-use Industry

8. Global Display Driver IC Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Global Display Driver IC Market Size (US$ Mn and Units) Forecast, by Region, 2017–2027

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

8.3. Global Display Driver IC Market Attractiveness, by Region

9. North America Display Driver IC Market Analysis and Forecast

9.1. Key Findings

9.2. North America Display Driver IC Market Size (US$ Mn and Units) Forecast, by Display Technology, 2017–2027

9.2.1. LCD

9.2.2. LED

9.2.3. OLED

9.2.4. Others (Including CRT and Vacuum Fluorescent Display)

9.3. North America Display Driver IC Market Value (US$ Mn) Forecast, by Application, 2017–2027

9.3.1. Mobile Phones

9.3.2. Televisions

9.3.3. Laptops

9.3.4. Tablets

9.3.5. Smart Watches

9.3.6. Automobile Consoles

9.3.7. Others (Including Wearable Devices and Video Walls)

9.4. North America Display Driver IC Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

9.4.1. Consumer Electronics

9.4.2. Healthcare

9.4.3. Automotive

9.4.4. Others

9.5. North America Display Driver IC Market Size (US$ Mn and Units) Forecast, by Country/Sub-region, 2017–2027

9.5.1. U.S.

9.5.2. Canada

9.5.3. Rest of North America

9.6. North America Display Driver IC Market Attractiveness Analysis

9.6.1. By Display Technology

9.6.2. By Application

9.6.3. By End-use Industry

9.6.4. By Country/Sub-region

10. Europe Display Driver IC Market Analysis and Forecast

10.1. Key Findings

10.2. Europe Display Driver IC Market Size (US$ Mn and Units) Forecast, by Display Technology, 2017–2027

10.2.1. LCD

10.2.2. LED

10.2.3. OLED

10.2.4. Others (Including CRT and Vacuum Fluorescent Display)

10.3. Europe Display Driver IC Market Value (US$ Mn) Forecast, by Application, 2017–2027

10.3.1. Mobile Phones

10.3.2. Televisions

10.3.3. Laptops

10.3.4. Tablets

10.3.5. Smart Watches

10.3.6. Automobile Consoles

10.3.7. Others (Including Wearable Devices and Video Walls)

10.4. Europe Display Driver IC Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

10.4.1. Consumer Electronics

10.4.2. Healthcare

10.4.3. Automotive

10.4.4. Others

10.5. Europe Display Driver IC Market Size (US$ Mn and Units) Forecast, by Country/Sub-region, 2017–2027

10.5.1. Germany

10.5.2. U.K.

10.5.3. France

10.5.4. Rest of Europe

10.6. Europe Display Driver IC Market Attractiveness Analysis

10.6.1. By Display Technology

10.6.2. By Application

10.6.3. By End-use Industry

10.6.4. By Country/Sub-region

11. Asia Pacific Display Driver IC Market Analysis and Forecast

11.1. Key Findings

11.2. Asia Pacific Display Driver IC Market Size (US$ Mn and Units) Forecast, by Display Technology, 2017–2027

11.2.1. LCD

11.2.2. LED

11.2.3. OLED

11.2.4. Others (Including CRT and Vacuum Fluorescent Display)

11.3. Asia Pacific Display Driver IC Market Value (US$ Mn) Forecast, by Application, 2017–2027

11.3.1. Mobile Phones

11.3.2. Televisions

11.3.3. Laptops

11.3.4. Tablets

11.3.5. Smart Watches

11.3.6. Automobile Consoles

11.3.7. Others (Including Wearable Devices and Video Walls)

11.4. Asia Pacific Display Driver IC Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

11.4.1. Consumer Electronics

11.4.2. Healthcare

11.4.3. Automotive

11.4.4. Others

11.5. Asia Pacific Display Driver IC Market Size (US$ Mn and Units) Forecast, by Country/Sub-region, 2017–2027

11.5.1. China

11.5.2. Japan

11.5.3. Rest of Asia Pacific

11.6. Asia Pacific Display Driver IC Market Attractiveness Analysis

11.6.1. By Display Technology

11.6.2. By Application

11.6.3. By End-use Industry

11.6.4. By Country/Sub-region

12. Middle East & Africa Display Driver IC Market Analysis and Forecast

12.1. Key Findings

12.2. Middle East & Africa Display Driver IC Market Size (US$ Mn and Units) Forecast, by Display Technology, 2017–

2027

12.2.1. LCD

12.2.2. LED

12.2.3. OLED

12.2.4. Others (Including CRT and Vacuum Fluorescent Display)

12.3. Middle East & Africa Display Driver IC Market Value (US$ Mn) Forecast, by Application, 2017–2027

12.3.1. Mobile Phones

12.3.2. Televisions

12.3.3. Laptops

12.3.4. Tablets

12.3.5. Smart Watches

12.3.6. Automobile Consoles

12.3.7. Others (Including Wearable Devices and Video Walls)

12.4. Middle East & Africa Display Driver IC Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

12.4.1. Consumer Electronics

12.4.2. Healthcare

12.4.3. Automotive

12.4.4. Others

12.5. Middle East & Africa Display Driver IC Market Size (US$ Mn and Units) Forecast, by Country/Sub-region, 2017–

2027

12.5.1. GCC

12.5.2. South Africa

12.5.3. Rest of Middle East & Africa

12.6. Middle East & Africa Display Driver IC Market Attractiveness Analysis

12.6.1. By Display Technology

12.6.2. By Application

12.6.3. By End-use Industry

12.6.4. By Country/Sub-region

13. South America Display Driver IC Market Analysis and Forecast

13.1. Key Findings

13.2. South America Display Driver IC Market Size (US$ Mn and Units) Forecast, by Display Technology, 2017–2027

13.2.1. LCD

13.2.2. LED

13.2.3. OLED

13.2.4. Others (Including CRT and Vacuum Fluorescent Display)

13.3. South America Display Driver IC Market Value (US$ Mn) Forecast, by Application, 2017–2027

13.3.1. Mobile Phones

13.3.2. Televisions

13.3.3. Laptops

13.3.4. Tablets

13.3.5. Smart Watches

13.3.6. Automobile Consoles

13.3.7. Others (Including Wearable Devices and Video Walls)

13.4. South America Display Driver IC Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

13.4.1. Consumer Electronics

13.4.2. Healthcare

13.4.3. Automotive

13.4.4. Others

13.5. South America Display Driver IC Market Size (US$ Mn and Units) Forecast, by Country/Sub-region, 2017–2027

13.5.1. Brazil

13.5.2. Rest of South America

13.6. South America Display Driver IC Market Attractiveness Analysis

13.6.1. By Display Technology

13.6.2. By Application

13.6.3. By End-use Industry

13.6.4. By Country/Sub-region

14. Competition Landscape

14.1. Market Players – Competition Matrix

14.2. Global Display Driver IC Market Share Analysis, by Company (2018)

14.3. Company Profiles (Details – Overview, Financials, SWOT Analysis, Strategy)

14.3.1. Samsung Electronics

14.3.2. Novatek Microelectronics

14.3.3. Synaptics (U.S.)

14.3.4. Himax Technologies

14.3.5. Silicon Works

14.3.6. Sitronix Technology

14.3.7. Raydium Semiconductor

14.3.8. Magnachip Semiconductor

14.3.9. MediaTek

14.3.10. ROHM Semiconductor

15. Key Takeaways

Table 1: Global Display Driver IC Market Value (US$ Mn) Forecast, by Display Technology, 2017–2027

Table 2: Global Display Driver IC Market Volume (Units) Forecast, by Display Technology, 2017–2027

Table 3: Global Display Driver IC Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 4: Global Display Driver IC Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 5: Global Display Driver IC Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 6: Global Display Driver IC Market Volume (Units) Forecast, by Region, 2017–2027

Table 7: North America Display Driver IC Market Value (US$ Mn) Forecast, by Display Technology, 2017–2027

Table 8: North America Display Driver IC Market Volume (Units) Forecast, by Display Technology, 2017–2027

Table 9: North America Display Driver IC Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 10: North America Display Driver IC Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 11: North America Display Driver IC Market Size (US$ Mn and Units) Forecast, by Country, 2017–2027

Table 12: Europe Display Driver IC Market Value (US$ Mn) Forecast, by Display Technology, 2017–2027

Table 13: Europe Display Driver IC Market Volume (Units) Forecast, by Display Technology, 2017–2027

Table 14: Europe Display Driver IC Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 15: Europe Display Driver IC Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 16: Europe Display Driver IC Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 17: Europe Display Driver IC Market Volume (Units) Forecast, by Country/Sub-region, 2017–2027

Table 18: Asia Pacific Display Driver IC Market Value (US$ Mn) Forecast, by Display Technology, 2017–2027

Table 19: Asia Pacific Display Driver IC Market Volume (Units) Forecast, by Display Technology, 2017–2027

Table 20: Asia Pacific Display Driver IC Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 21: Asia Pacific Display Driver IC Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 22: Asia Pacific Display Driver IC Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 23: Asia Pacific Display Driver IC Market Volume (Units) Forecast, by Country/Sub-region, 2017–2027

Table 24: MEA Display Driver IC Market Value (US$ Mn) Forecast, by Display Technology, 2017–2027

Table 25: MEA Display Driver IC Market Volume (Units) Forecast, by Display Technology, 2017–2027

Table 26: MEA Display Driver IC Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 27: MEA Display Driver IC Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 28: MEA Display Driver IC Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 29: MEA Display Driver IC Market Volume (Units) Forecast, by Country/Sub-region, 2017–2027

Table 30: South America Display Driver IC Market Value (US$ Mn) Forecast, by Display Technology, 2017–2027

Table 31: South America Display Driver IC Market Volume (Units) Forecast, by Display Technology, 2017–2027

Table 32: South America Display Driver IC Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 33: South America Display Driver IC Market Value (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 34: South America Display Driver IC Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 35: South America Display Driver IC Market Volume (Units) Forecast, by Country/Sub-region, 2017–2027

Figure 1: Global Display Driver IC Market

Figure 2: Global Display Driver IC Market Revenue (US$ Mn) Projection and Y-O-Y Growth, 2017–2027

Figure 3: Global Display Driver IC Market Volume (Units) Projection and Y-O-Y Growth, 2017–2027

Figure 4: Global Display Driver IC Market Overview

Figure 5: Global Display Driver IC Market, by Application (2018)

Figure 6: Global Display Driver IC Market, by End-use Industry (2018)

Figure 7: Global Display Driver IC Market Value Share Analysis, by Display Technology, 2019 and 2027

Figure 8: Global Display Driver IC Market, by Display Technology, LCD

Figure 9: Global Display Driver IC Market, by Display Technology, LED

Figure 10: Global Display Driver IC Market, by Display Technology, OLED

Figure 11: Global Display Driver IC Market, by Display Technology, Others

Figure 12: Global Display Driver IC Market Comparison Matrix, by Display Technology

Figure 13: Global Display Driver IC Market Attractiveness Analysis, by Display Technology

Figure 14: Global Display Driver IC Market Value Share Analysis, by Application, 2019 and 2027

Figure 15: Global Display Driver IC Market, by Application, Mobile Phones

Figure 16: Global Display Driver IC Market, by Application, Televisions

Figure 17: Global Display Driver IC Market, by Application, Laptops

Figure 18: Global Display Driver IC Market, by Application, Tablets

Figure 19: Global Display Driver IC Market, by Application, Smart Watches

Figure 20: Global Display Driver IC Market, by Application, Automobile Consoles

Figure 21: Global Display Driver IC Market, by Application, Others

Figure 22: Global Display Driver IC Market Comparison Matrix, by Application

Figure 23: Global Display Driver IC Market Attractiveness Analysis, by Application

Figure 24: Global Display Driver IC Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 25: Global Display Driver IC Market, by End-use Industry, Consumer Electronics

Figure 26: Global Display Driver IC Market, by End-use Industry, Healthcare

Figure 27: Global Display Driver IC Market, by End-use Industry, Automotive

Figure 28: Global Display Driver IC Market, by End-use Industry, Others

Figure 29: Global Display Driver IC Market Comparison Matrix, by End-use Industry

Figure 30: Global Display Driver IC Market Attractiveness Analysis, by End-use Industry

Figure 32: Global Display Driver IC Market Value Share Analysis, by Region, 2019 and 2027

Figure 33: Global Display Driver IC Market, by Region, North America

Figure 34: Global Display Driver IC Market, by Region, Europe

Figure 35: Global Display Driver IC Market, by Region, Asia Pacific

Figure 36: Global Display Driver IC Market, by Region, Middle East & Africa

Figure 37: Global Display Driver IC Market, by Region, South America

Figure 38: Global Display Driver IC Market Attractiveness Analysis, by Region

Figure 39: North America Display Driver IC Market Value Share Analysis, by Display Technology, 2019 and 2027

Figure 40: North America Display Driver IC Market Value Share Analysis, by Application, 2019 and 2027

Figure 41: North America Display Driver IC Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 42: North America Display Driver IC Market Value Share Analysis, by Country, 2019 and 2027

Figure 43: North America Display Driver IC Market Attractiveness Analysis, by Display Technology

Figure 44: North America Display Driver IC Market Attractiveness Analysis, by Application

Figure 45: North America Display Driver IC Market Attractiveness Analysis, by End-use Industry

Figure 46: North America Display Driver IC Market Attractiveness Analysis, by Country

Figure 47: Europe Display Driver IC Market Value Share Analysis, by Display Technology, 2019 and 2027

Figure 48: Europe Display Driver IC Market Value Share Analysis, by Application, 2019 and 2027

Figure 49: Europe Display Driver IC Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 50: Europe Display Driver IC Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 51: Europe Display Driver IC Market Attractiveness Analysis, by Display Technology

Figure 52: Europe Display Driver IC Market Attractiveness Analysis, by Application

Figure 53: Europe Display Driver IC Market Attractiveness Analysis, by End-use Industry

Figure 54: Europe Display Driver IC Market Attractiveness Analysis, by Country/Sub-region

Figure 55: Asia Pacific Display Driver IC Market Value Share Analysis, by Display Technology, 2019 and 2027

Figure 56: Asia Pacific Display Driver IC Market Value Share Analysis, by Application, 2019 and 2027

Figure 57: Asia Pacific Display Driver IC Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 58: Asia Pacific Display Driver IC Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 59: Asia Pacific Display Driver IC Market Attractiveness Analysis, by Display Technology

Figure 60: Asia Pacific Display Driver IC Market Attractiveness Analysis, by Application

Figure 61: Asia Pacific Display Driver IC Market Attractiveness Analysis, by End-use Industry

Figure 62: Asia Pacific Display Driver IC Market Attractiveness Analysis, by Country/Sub-region

Figure 63: MEA Display Driver IC Market Value Share Analysis, by Display Technology, 2019 and 2027

Figure 64: MEA Display Driver IC Market Value Share Analysis, by Application, 2019 and 2027

Figure 65: MEA Display Driver IC Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 66: MEA Display Driver IC Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 67: MEA Display Driver IC Market Attractiveness Analysis, by Display Technology

Figure 68: MEA Display Driver IC Market Attractiveness Analysis, by Application

Figure 69: MEA Display Driver IC Market Attractiveness Analysis, by End-use Industry

Figure 70: MEA Display Driver IC Market Attractiveness Analysis, by Country/Sub-region

Figure 71: South America Display Driver IC Market Value Share Analysis, by Display Technology, 2019 and 2027

Figure 72: South America Display Driver IC Market Value Share Analysis, by Application, 2019 and 2027

Figure 73: South America Display Driver IC Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 74: South America Display Driver IC Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 75: South America Display Driver IC Market Attractiveness Analysis, by Display Technology

Figure 76: South America Display Driver IC Market Attractiveness Analysis, by Application

Figure 77: South America Display Driver IC Market Attractiveness Analysis, by End-use Industry

Figure 78: South America Display Driver IC Market Attractiveness Analysis, by Country/Sub-region