Reports

Reports

Analysts’ Viewpoint

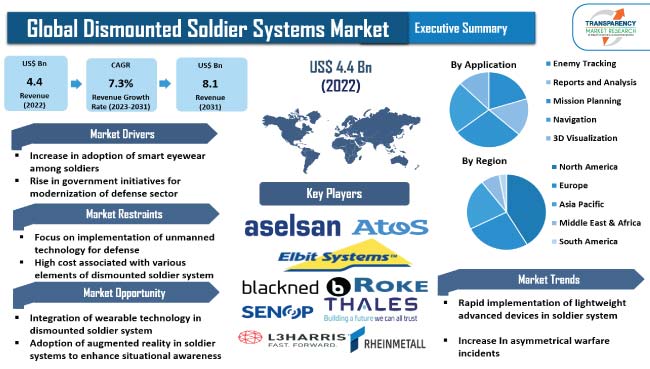

Continuous evolution of military operations has created the need for advanced dismounted soldier systems (DSS), enabling armies to execute operations in unstable and unconsolidated conditions. Extensive usage of communication network and sharing & merging of information from battlefield to command & control units is driving demand for DSS. Rise in adoption of advanced DSS in several countries is propelling the global dismounted soldier systems market size.

Lack of knowledge of precise geographical location of different force units in a mission is a major disadvantage for a Command and Control (C2) unit. Research & development of innovative solider systems to optimize the C2 unit offers lucrative opportunities to market players. Defense departments and companies in several countries are focusing on second generation of embedded military systems to enhance combat preparedness.

Dismounted soldier systems (DSS) comprise advanced devices such as high-capacity tactical computer, helmet-mounted display, antijam radios, GPS terminal, video capture & transfer device, monitoring & detection systems, laser rangefinder, target designators, and others. As the digital landscape continues to evolve rapidly, global defense forces are working hard to stay ahead and protect their borders and homelands. Dismounted soldier systems play a vital role in enhancing soldiers' capabilities in various terrains and environments.

Other essential elements of the DSS are dismounted digital architecture, augmented reality, GPS denied navigation, ballistic protection systems, and clothing & carrying solutions. Digital architecture performs key role during the mission and offers seamless connectivity and effectiveness for different end-user devices, communication devices, and power solutions in accordance with different mission profiles.

The need for adoption of new devices has increased, as modern warfare becomes more technologically driven and armies are integrating state-of-art systems for combat preparedness. Smart ballistic glasses are one of the devices used in modern warfare. During the Association of the United States Army's yearly gathering and exhibition, the Secretary of the Army unveiled a series of plans intended to enhance cooperation between large and small businesses, and to equip U.S. soldiers with vital, advanced technological solutions. The initiatives aim to widen the scope of collaboration among leading defense contractors, small enterprises, and the army.

In June 2021, the U.S. Army awarded Microsoft Corp. a contract worth US$ 21.88 Bn to supply over 120,000 headsets based on its HoloLens augmented reality technology. Additionally, Microsoft was offered a contract to produce prototype headsets for the army. Usage of these headsets will enable soldiers to have better visibility in smoky environments, view around corners, utilize holographic visuals for training purposes, and access 3D terrain maps instantly through the Integrated Vision Augmentation System (IVAS).

Smart eyewear, such as smart glasses, are designed to cater to the specific needs of close combat situations. These needs include improving the vision of soldiers in battle by enhancing depth perception beyond the limitations of human eyesight. Furthermore, integration of Augmented Reality (AR) technology can facilitate the implementation of Live, Virtual, and Constructive (LVC) training solutions, which can enhance the realism of training, especially in situations that are either too dangerous or costly to be conducted in real life.

A country must continually create new technologies to stay ahead of its competitors, making military technology development crucial. The latest Critical and Emerging Technologies (CETs) list, which was published by the U.S. National Science and Technology Council in February 2022, highlighted the technological fields that are seen as being crucial for the country’s national defense. Defense research, development, and acquisition initiatives and prioritization are guided by this list. Furthermore, the Defense Innovation Unit (DIU) of the U.S. is concentrating on accelerating the adoption of commercial technology for military applications. DIU awards contracts to businesses with innovative solutions.

Several countries are investing significantly in army equipment to bolster their military capabilities and maintain a competitive edge. For instance, in January 2023, Elbit Systems Ltd. disclosed that its subsidiary, Elbit Systems Sweden AB, was awarded a contract by the Swedish Defence Materiel Administration (FMV) to provide Technical High Mobility Shelters (THMS) to the Swedish Army. The contract is worth approximately US$ 48 Mn and will be spread over a three-year period, with the possibility of further extensions.

In terms of type, the laser target acquisition system segment is expected to account for largest global dismounted soldier systems market share in 2022. These systems improve the accuracy and efficiency of defense systems; hence, are widely used in the modern army. Laser target acquisition systems have various applications, including temporary blinding & disorienting of targets (laser dazzlers), laser guidance, laser sighting, target designation & ranging, and defensive countermeasures. These systems are utilized to identify, locate, recognize, mark, observe, and designate stationary or moving targets during both daytime and nighttime operations.

Based on application, the mission planning segment is anticipated to dominate the global dismounted soldier systems market in 2022. The dismounted soldier system enables speedy mission planning, effortless communication of orders, prompt & precise reporting, and situational awareness. Mission planning involves several steps that are necessary to execute a mission such as mission definition, equipment selection, analysis, and results. Mission definition pertains to where the soldier is, when they are there, and what they are supposed to do. Equipment selection is categorized into loads, energy harvesters, and batteries. A menu is provided to users, allowing them to choose equipment from the database. Hence, mission planning is a critical function of the soldier system.

As per dismounted soldier systems market trends, North America is expected to account for prominent share of 40.3% of the global industry in 2022. The market in the region is driven by rise in military spending, rapid adoption of new technologies, and presence of major players. For instance, the SIPRI Military Spending Database estimates that annual military spending in North America stood at US$ 827.12 Bn in 2021, up 3.2% from US$ 801.68 Bn in 2020. Furthermore, the U.S. spends more on defense than China, Russia, the U.K., India, Germany, Saudi Arabia, France, Japan, and South Korea put together.

The dismounted soldier systems industry in Europe is expanding rapidly, ascribed to lucrative opportunities provided by number of countries, including France, Germany, Russia, the U.K., and Italy. The French Army, with the goal of developing an adaptive and adaptable tactical warfare system that can support current and upcoming operational military objectives, started the Synergy of Contact Reinforced by Polyvalence and Digitalization initiative. The Government of Germany created a digital moving map display system that displays a soldier's location as well as locations of his teammates, minefields, and other danger zones.

The global dismounted soldier systems market is consolidated, with the presence of small number of large- and medium-scale vendors. Majority of the players are investing significantly in comprehensive research and development, and new product development. Expansion of product portfolio and merger & acquisition are the major strategies adopted by these players. Top dismounted soldier systems companies are ASELSAN A.Ş., Atos SE, Blackned GmbH, Collins Aerospace, Elbit Systems Ltd., Excelitas Technologies Corp., Instro Precision Limited, L3Harris Technologies, Inc., Rheinmetall AG, Roke, Rolta India Limited, Safran Electronics & Defense, SAVOX Communications Oy Ab (Ltd.), Senop Oy, TELDAT Sp. z o.o. sp.k., Teledyne FLIR LLC, Thales Group, and Viettel High Technology Industries Corporation.

Each of these players has been profiled in the dismounted soldier systems market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2022 |

US$ 4.4 Bn |

|

Forecast (Value) in 2031 |

US$ 8.1 Bn |

|

Growth Rate (CAGR) |

7.3% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Example: Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry size stood at US$ 4.4 Bn in 2022.

The CAGR is expected to be 7.3% from 2023 to 2031.

Increase in adoption of smart eyewear among soldiers and rise in government initiatives for modernization of the defense sector are driving the global market

The laser target acquisition system segment accounted for significant share of 15.5% of the market in 2022

North America is likely to be a highly attractive region for vendors during the forecast period.

ASELSAN A.Ş., Atos SE, Blackned GmbH, Collins Aerospace, Elbit Systems Ltd., Excelitas Technologies Corp., Instro Precision Limited, L3Harris Technologies, Inc., Rheinmetall AG, Roke, Rolta India Limited, Safran Electronics & Defense, SAVOX Communications Oy Ab (Ltd.), Senop Oy, TELDAT Sp. z o.o. sp.k., Teledyne FLIR LLC, Thales Group, and Viettel High Technology Industries Corporation are the key players in the global dismounted soldier systems market.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Dismounted Soldier Systems Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Industry Overview

4.2. Ecosystem Analysis

4.3. Technology Roadmap

4.4. Industry SWOT Analysis

4.5. Porter’s Five Forces Analysis

4.6. COVID-19 Impact and Recovery Analysis

5. Global Dismounted Soldier Systems Market Analysis, by Type

5.1. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by Type, 2017–2031

5.1.1. Augmented Reality (AR) Head Mounted Display (HMD)

5.1.2. Pre-shot Threat Detection (PTD) System

5.1.3. Smart Ballistic Glasses

5.1.4. Command and Control Information Systems (C2IS)

5.1.5. Smartwatch

5.1.6. Laser Target Acquisition System

5.1.7. Blue Force Tracking (BFT) Device

5.1.8. IP Radios

5.1.9. Tactical Terminal Tablet

5.1.10. Others

5.2. Market Attractiveness Analysis, by Type

6. Global Dismounted Soldier Systems Market Analysis, by Application

6.1. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

6.1.1. Enemy Tracking

6.1.2. Reports and Analysis

6.1.3. Mission Planning

6.1.4. Navigation

6.1.5. 3D Visualization

6.2. Market Attractiveness Analysis, by Application

7. Global Dismounted Soldier Systems Market Analysis, by End-user

7.1. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by End-user, 2017–2031

7.1.1. Defense

7.1.2. Homeland Security

7.2. Market Attractiveness Analysis, by End-user

8. Global Dismounted Soldier Systems Market Analysis and Forecast, by Region

8.1. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, by Region

9. North America Dismounted Soldier Systems Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by Type, 2017–2031

9.3.1. Augmented Reality (AR) Head Mounted Display (HMD)

9.3.2. Pre-shot Threat Detection (PTD) System

9.3.3. Smart Ballistic Glasses

9.3.4. Command and Control Information Systems (C2IS)

9.3.5. Smartwatch

9.3.6. Laser Target Acquisition System

9.3.7. Blue Force Tracking (BFT) Device

9.3.8. IP Radios

9.3.9. Tactical Terminal Tablet

9.3.10. Others

9.4. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

9.4.1. Enemy Tracking

9.4.2. Reports and Analysis

9.4.3. Mission Planning

9.4.4. Navigation

9.4.5. 3D Visualization

9.5. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by End-user, 2017–2031

9.5.1. Defense

9.5.2. Homeland Security

9.6. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of America

9.7. Market Attractiveness Analysis

9.7.1. By Type

9.7.2. By Application

9.7.3. By End-user

9.7.4. By Country and Sub-region

10. Europe Dismounted Soldier Systems Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by Type, 2017–2031

10.3.1. Augmented Reality (AR) Head Mounted Display (HMD)

10.3.2. Pre-shot Threat Detection (PTD) System

10.3.3. Smart Ballistic Glasses

10.3.4. Command and Control Information Systems (C2IS)

10.3.5. Smartwatch

10.3.6. Laser Target Acquisition System

10.3.7. Blue Force Tracking (BFT) Device

10.3.8. IP Radios

10.3.9. Tactical Terminal Tablet

10.3.10. Others

10.4. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

10.4.1. Enemy Tracking

10.4.2. Reports and Analysis

10.4.3. Mission Planning

10.4.4. Navigation

10.4.5. 3D Visualization

10.5. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by End-user, 2017–2031

10.5.1. Defense

10.5.2. Homeland Security

10.6. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.6.1. Germany

10.6.2. U.K.

10.6.3. France

10.6.4. Poland

10.6.5. Ukraine

10.6.6. Russia

10.6.7. Turkey

10.6.8. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Type

10.7.2. By Application

10.7.3. By End-user

10.7.4. By Country and Sub-region

11. Asia Pacific Dismounted Soldier Systems Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by Type, 2017–2031

11.3.1. Augmented Reality (AR) Head Mounted Display (HMD)

11.3.2. Pre-shot Threat Detection (PTD) System

11.3.3. Smart Ballistic Glasses

11.3.4. Command and Control Information Systems (C2IS)

11.3.5. Smartwatch

11.3.6. Laser Target Acquisition System

11.3.7. Blue Force Tracking (BFT) Device

11.3.8. IP Radios

11.3.9. Tactical Terminal Tablet

11.3.10. Others

11.4. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

11.4.1. Enemy Tracking

11.4.2. Reports and Analysis

11.4.3. Mission Planning

11.4.4. Navigation

11.4.5. 3D Visualization

11.5. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by End-user, 2017–2031

11.5.1. Defense

11.5.2. Homeland Security

11.6. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Type

11.7.2. By Application

11.7.3. By End-user

11.7.4. By Country and Sub-region

12. Middle East & Africa Dismounted Soldier Systems Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by Type, 2017–2031

12.3.1. Augmented Reality (AR) Head Mounted Display (HMD)

12.3.2. Pre-shot Threat Detection (PTD) System

12.3.3. Smart Ballistic Glasses

12.3.4. Command and Control Information Systems (C2IS)

12.3.5. Smartwatch

12.3.6. Laser Target Acquisition System

12.3.7. Blue Force Tracking (BFT) Device

12.3.8. IP Radios

12.3.9. Tactical Terminal Tablet

12.3.10. Others

12.4. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

12.4.1. Enemy Tracking

12.4.2. Reports and Analysis

12.4.3. Mission Planning

12.4.4. Navigation

12.4.5. 3D Visualization

12.5. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by End-user, 2017–2031

12.5.1. Defense

12.5.2. Homeland Security

12.6. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.6.1. GCC

12.6.2. Israel

12.6.3. Rest of Middle East & Africa

12.7. Market Attractiveness Analysis

12.7.1. By Type

12.7.2. By Application

12.7.3. By End-user

12.7.4. By Country and Sub-region

13. South America Dismounted Soldier Systems Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by Type, 2017–2031

13.3.1. Augmented Reality (AR) Head Mounted Display (HMD)

13.3.2. Pre-shot Threat Detection (PTD) System

13.3.3. Smart Ballistic Glasses

13.3.4. Command and Control Information Systems (C2IS)

13.3.5. Smartwatch

13.3.6. Laser Target Acquisition System

13.3.7. Blue Force Tracking (BFT) Device

13.3.8. IP Radios

13.3.9. Tactical Terminal Tablet

13.3.10. Others

13.4. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by Application, 2017–2031

13.4.1. Enemy Tracking

13.4.2. Reports and Analysis

13.4.3. Mission Planning

13.4.4. Navigation

13.4.5. 3D Visualization

13.5. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by End-user, 2017–2031

13.5.1. Defense

13.5.2. Homeland Security

13.6. Dismounted Soldier Systems Market Size (US$ Bn) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Type

13.7.2. By Application

13.7.3. By End-user

13.7.4. By Country and Sub-region

14. Competition Assessment

14.1. Global Dismounted Soldier Systems Market Competition Matrix - a Dashboard View

14.1.1. Global Dismounted Soldier Systems Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. ASELSAN A.Ş.

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Atos SE

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. Blackned GmbH

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Collins Aerospace

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Elbit Systems Ltd.

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Excelitas Technologies Corp.

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. INSTRO PRECISION LIMITED

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. L3Harris Technologies, Inc.

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Rheinmetall AG

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Roke

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. Rolta India Limited

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

15.12. Safran Electronics & Defense

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Key Subsidiaries or Distributors

15.12.5. Strategy and Recent Developments

15.12.6. Key Financials

15.13. SAVOX Communications Oy Ab (Ltd.)

15.13.1. Overview

15.13.2. Product Portfolio

15.13.3. Sales Footprint

15.13.4. Key Subsidiaries or Distributors

15.13.5. Strategy and Recent Developments

15.13.6. Key Financials

15.14. Senop Oy

15.14.1. Overview

15.14.2. Product Portfolio

15.14.3. Sales Footprint

15.14.4. Key Subsidiaries or Distributors

15.14.5. Strategy and Recent Developments

15.14.6. Key Financials

15.15. TELDAT Sp. z o.o. sp.k.

15.15.1. Overview

15.15.2. Product Portfolio

15.15.3. Sales Footprint

15.15.4. Key Subsidiaries or Distributors

15.15.5. Strategy and Recent Developments

15.15.6. Key Financials

15.16. Teledyne FLIR LLC

15.16.1. Overview

15.16.2. Product Portfolio

15.16.3. Sales Footprint

15.16.4. Key Subsidiaries or Distributors

15.16.5. Strategy and Recent Developments

15.16.6. Key Financials

15.17. Thales Group

15.17.1. Overview

15.17.2. Product Portfolio

15.17.3. Sales Footprint

15.17.4. Key Subsidiaries or Distributors

15.17.5. Strategy and Recent Developments

15.17.6. Key Financials

15.18. Viettel High Technology Industries Corporation

15.18.1. Overview

15.18.2. Product Portfolio

15.18.3. Sales Footprint

15.18.4. Key Subsidiaries or Distributors

15.18.5. Strategy and Recent Developments

15.18.6. Key Financials

16. Go To Market Strategy

16.1. Identification of Potential Market Spaces

16.2. Understanding Buying Process of Customers

16.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Dismounted Soldier Systems Market Size & Forecast, by Type, Value (US$ Bn), 2017-2031

Table 2: Global Dismounted Soldier Systems Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 3: Global Dismounted Soldier Systems Market Size & Forecast, by End-user, Value (US$ Bn), 2017-2031

Table 4: Global Dismounted Soldier Systems Market Size & Forecast, by Region, Value (US$ Bn), 2017-2031

Table 5: North America Dismounted Soldier Systems Market Size & Forecast, by Type, Value (US$ Bn), 2017-2031

Table 6: North America Dismounted Soldier Systems Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 7: North America Dismounted Soldier Systems Market Size & Forecast, by End-user, Value (US$ Bn), 2017-2031

Table 8: North America Dismounted Soldier Systems Market Size & Forecast, by Country, Value (US$ Bn), 2017-2031

Table 9: Europe Dismounted Soldier Systems Market Size & Forecast, by Type, Value (US$ Bn), 2017-2031

Table 10: Europe Dismounted Soldier Systems Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 11: Europe Dismounted Soldier Systems Market Size & Forecast, by End-user, Value (US$ Bn), 2017-2031

Table 12: Europe Dismounted Soldier Systems Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017-2031

Table 13: Asia Pacific Dismounted Soldier Systems Market Size & Forecast, by Type, Value (US$ Bn), 2017-2031

Table 14: Asia Pacific Dismounted Soldier Systems Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 15: Asia Pacific Dismounted Soldier Systems Market Size & Forecast, by End-user, Value (US$ Bn), 2017-2031

Table 16: Asia Pacific Dismounted Soldier Systems Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017-2031

Table 17: Middle East & Africa Dismounted Soldier Systems Market Size & Forecast, by Type, Value (US$ Bn), 2017-2031

Table 18: Middle East & Africa Dismounted Soldier Systems Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 19: Middle East & Africa Dismounted Soldier Systems Market Size & Forecast, by End-user, Value (US$ Bn), 2017-2031

Table 20: Middle East & Africa Dismounted Soldier Systems Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017-2031

Table 21: South America Dismounted Soldier Systems Market Size & Forecast, by Type, Value (US$ Bn), 2017-2031

Table 22: South America Dismounted Soldier Systems Market Size & Forecast, by Application, Value (US$ Bn), 2017-2031

Table 23: South America Dismounted Soldier Systems Market Size & Forecast, by End-user, Value (US$ Bn), 2017-2031

Table 24: South America Dismounted Soldier Systems Market Size & Forecast, by Country and Sub-region, Value (US$ Bn), 2017-2031

List of Figures

Figure 1: Global Dismounted Soldier Systems Market, Value (US$ Bn), 2017-2031

Figure 2: Global Dismounted Soldier Systems Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 3: Global Dismounted Soldier Systems Market Projections, by Type, Value (US$ Bn), 2017‒2031

Figure 4: Global Dismounted Soldier Systems Market, Incremental Opportunity, by Type, 2023‒2031

Figure 5: Global Dismounted Soldier Systems Market Share Analysis, by Type, 2023 and 2031

Figure 6: Global Dismounted Soldier Systems Market Projections, by Application, Value (US$ Bn), 2017‒2031

Figure 7: Global Dismounted Soldier Systems Market, Incremental Opportunity, by Application, 2023‒2031

Figure 8: Global Dismounted Soldier Systems Market Share Analysis, by Application, 2023 and 2031

Figure 9: Global Dismounted Soldier Systems Market Projections, by End-user, Value (US$ Bn), 2017‒2031

Figure 10: Global Dismounted Soldier Systems Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 11: Global Dismounted Soldier Systems Market Share Analysis, by End-user, 2023 and 2031

Figure 12: Global Dismounted Soldier Systems Market Projections, by Region, Value (US$ Bn), 2017‒2031

Figure 13: Global Dismounted Soldier Systems Market, Incremental Opportunity, by Region, 2023‒2031

Figure 14: Global Dismounted Soldier Systems Market Share Analysis, by Region, 2023 and 2031

Figure 15: North America Dismounted Soldier Systems Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 16: North America Dismounted Soldier Systems Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 17: North America Dismounted Soldier Systems Market Projections, by Type, Value (US$ Bn), 2017‒2031

Figure 18: North America Dismounted Soldier Systems Market, Incremental Opportunity, by Type, 2023‒2031

Figure 19: North America Dismounted Soldier Systems Market Share Analysis, by Type, 2023 and 2031

Figure 20: North America Dismounted Soldier Systems Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 21: North America Dismounted Soldier Systems Market, Incremental Opportunity, by Application, 2023‒2031

Figure 22: North America Dismounted Soldier Systems Market Share Analysis, by Application, 2023 and 2031

Figure 23: North America Dismounted Soldier Systems Market Projections by End-user, Value (US$ Bn), 2017‒2031

Figure 24: North America Dismounted Soldier Systems Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 25: North America Dismounted Soldier Systems Market Share Analysis, by End-user, 2023 and 2031

Figure 26: North America Dismounted Soldier Systems Market Projections by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 27: North America Dismounted Soldier Systems Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 28: North America Dismounted Soldier Systems Market Share Analysis, by Country and Sub-region 2023 and 2031

Figure 29: Europe Dismounted Soldier Systems Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 30: Europe Dismounted Soldier Systems Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 31: Europe Dismounted Soldier Systems Market Projections, by Type, Value (US$ Bn), 2017‒2031

Figure 32: Europe Dismounted Soldier Systems Market, Incremental Opportunity, by Type, 2023‒2031

Figure 33: Europe Dismounted Soldier Systems Market Share Analysis, by Type, 2023 and 2031

Figure 34: Europe Dismounted Soldier Systems Market Projections, by Application, Value (US$ Bn), 2017‒2031

Figure 35: Europe Dismounted Soldier Systems Market, Incremental Opportunity, by Application, 2023‒2031

Figure 36: Europe Dismounted Soldier Systems Market Share Analysis, by Application, 2023 and 2031

Figure 37: Europe Dismounted Soldier Systems Market Projections by End-user, Value (US$ Bn), 2017‒2031

Figure 38: Europe Dismounted Soldier Systems Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 39: Europe Dismounted Soldier Systems Market Share Analysis, by End-user, 2023 and 2031

Figure 40: Europe Dismounted Soldier Systems Market Projections, by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 41: Europe Dismounted Soldier Systems Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 42: Europe Dismounted Soldier Systems Market Share Analysis, by Country and Sub-region, 2023 and 2031

Figure 43: Asia Pacific Dismounted Soldier Systems Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 44: Asia Pacific Dismounted Soldier Systems Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 45: Asia Pacific Dismounted Soldier Systems Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 46: Asia Pacific Dismounted Soldier Systems Market, Incremental Opportunity, by Type, 2023‒2031

Figure 47: Asia Pacific Dismounted Soldier Systems Market Share Analysis, by Type, 2023 and 2031

Figure 48: Asia Pacific Dismounted Soldier Systems Market Projections by Application, Value (US$ Bn), 2017‒2031

Figure 49: Asia Pacific Dismounted Soldier Systems Market, Incremental Opportunity, by Application, 2023‒2031

Figure 50: Asia Pacific Dismounted Soldier Systems Market Share Analysis, by Application, 2023 and 2031

Figure 51: Asia Pacific Dismounted Soldier Systems Market Projections, by End-user, Value (US$ Bn), 2017‒2031

Figure 52: Asia Pacific Dismounted Soldier Systems Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 53: Asia Pacific Dismounted Soldier Systems Market Share Analysis, by End-user, 2023 and 2031

Figure 54: Asia Pacific Dismounted Soldier Systems Market Projections, by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 55: Asia Pacific Dismounted Soldier Systems Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 56: Asia Pacific Dismounted Soldier Systems Market Share Analysis, by Country and Sub-region, 2023 and 2031

Figure 57: Middle East & Africa Dismounted Soldier Systems Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 58: Middle East & Africa Dismounted Soldier Systems Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 59: Middle East & Africa Dismounted Soldier Systems Market Projections by Type, Value (US$ Bn), 2017‒2031

Figure 60: Middle East & Africa Dismounted Soldier Systems Market, Incremental Opportunity, by Type, 2023‒2031

Figure 61: Middle East & Africa Dismounted Soldier Systems Market Share Analysis, by Type, 2023 and 2031

Figure 62: Middle East & Africa Dismounted Soldier Systems Market Projections, by Application, Value (US$ Bn), 2017‒2031

Figure 63: Middle East & Africa Dismounted Soldier Systems Market, Incremental Opportunity, by Application, 2023‒2031

Figure 64: Middle East & Africa Dismounted Soldier Systems Market Share Analysis, by Application, 2023 and 2031

Figure 65: Middle East & Africa Dismounted Soldier Systems Market Projections, by End-user, Value (US$ Bn), 2017‒2031

Figure 66: Middle East & Africa Dismounted Soldier Systems Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 67: Middle East & Africa Dismounted Soldier Systems Market Share Analysis, by End-user, 2023 and 2031

Figure 68: Middle East & Africa Dismounted Soldier Systems Market Projections, by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 69: Middle East & Africa Dismounted Soldier Systems Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 70: Middle East & Africa Dismounted Soldier Systems Market Share Analysis, by Country and Sub-region, 2023 and 2031

Figure 71: South America Dismounted Soldier Systems Market Size & Forecast, Value (US$ Bn), 2017‒2031

Figure 72: South America Dismounted Soldier Systems Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017‒2031

Figure 73: South America Dismounted Soldier Systems Market Projections, by Type, Value (US$ Bn), 2017‒2031

Figure 74: South America Dismounted Soldier Systems Market, Incremental Opportunity, by Type, 2023‒2031

Figure 75: South America Dismounted Soldier Systems Market Share Analysis, by Type, 2023 and 2031

Figure 76: South America Dismounted Soldier Systems Market Projections, by Application, Value (US$ Bn), 2017‒2031

Figure 77: South America Dismounted Soldier Systems Market, Incremental Opportunity, by Application, 2023‒2031

Figure 78: South America Dismounted Soldier Systems Market Share Analysis, by Application, 2023 and 2031

Figure 79: South America Dismounted Soldier Systems Market Projections, by End-user, Value (US$ Bn), 2017‒2031

Figure 80: South America Dismounted Soldier Systems Market, Incremental Opportunity, by End-user, 2023‒2031

Figure 81: South America Dismounted Soldier Systems Market Share Analysis, by End-user, 2023 and 2031

Figure 82: South America Dismounted Soldier Systems Market Projections, by Country and Sub-region, Value (US$ Bn), 2017‒2031

Figure 83: South America Dismounted Soldier Systems Market, Incremental Opportunity, by Country and Sub-region, 2023‒2031

Figure 84: South America Dismounted Soldier Systems Market Share Analysis, by Country and Sub-region 2023 and 2031