Reports

Reports

Analyst Viewpoint

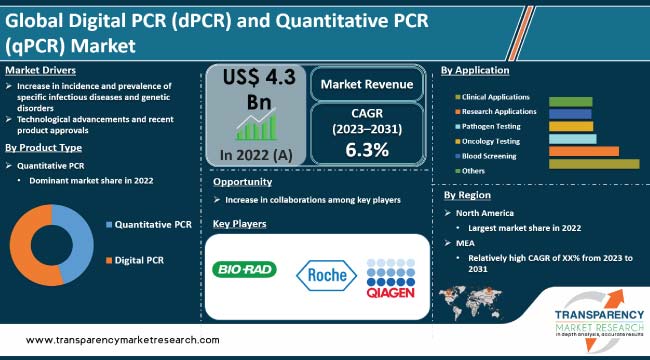

Increase in incidence and prevalence of specific infectious diseases and genetic disorders is driving the global digital PCR (dPCR) and quantitative PCR (qPCR) market. dPCR and qPCR offer precise nucleic acid quantification across diagnostics, research, and forensics. Technological advancements and recent product approvals are the other major factors driving market development. Furthermore, expansion of molecular biology applications in genomics and personalized medicine is expected to bolster the global digital PCR (dPCR) and quantitative PCR (qPCR) industry growth during the forecast period.

Technological advancements, including high-throughput systems and integrated software solutions, to increase efficiency and accuracy offer lucrative opportunities to market players. Companies are focusing on increasing investment in life sciences research and infectious disease diagnostics in order to increase digital PCR (dPCR) and quantitative PCR (qPCR) market revenue.

Digital PCR is a molecular biology technique used to quantify and analyze nucleic acids. It is a digital version of the polymerase chain reaction (PCR) that partitions a sample into thousands or millions of individual reactions. Each reaction occurs in its own micro-scale chamber, such as a droplet or well, allowing for precise quantification of nucleic acid targets.

Digital PCR is particularly useful for applications requiring high sensitivity, accuracy, and the detection of rare events, such as the analysis of rare mutations or copy number variations.

Quantitative PCR, also known as real-time PCR, is a widely used molecular biology technique for the amplification and quantification of DNA. Unlike traditional PCR, qPCR allows for the monitoring of the amplification process in real-time.

Fluorescent dyes or probes are used to detect the accumulating PCR product during each cycle, enabling the measurement of the starting amount of the target nucleic acid. Quantitative PCR is highly sensitive and provides relative quantification by comparing the amplification of the target to that of a reference or control sample. It is commonly employed for gene expression analysis, viral load quantification, and other applications requiring accurate quantification of nucleic acid levels.

The global digital PCR (dPCR) and quantitative PCR (qPCR) market for genomic analysis techniques has witnessed substantial growth, propelled by increase in incidence of infectious diseases and genetic disorders. Steady rise in demand for genomic analysis in the last decade has led to increase in application of techniques such as microbial identification and detection of genetic mutations.

These techniques play a pivotal role in diagnosing major infectious diseases, such as HIV, tuberculosis, malaria, hepatitis, and Staph-related diseases, as well as genetic disorders including cancer and fragile X syndrome.

According to the American Cancer Society, around 1.9 million new cancer cases are projected to be diagnosed in the U.S. in 2022, along with an estimated 609,360 cancer-related deaths. These statistics underscore the ongoing challenges posed by cancer and emphasize the need for comprehensive approaches to prevention, early detection, and effective treatment.

The proven efficacy of PCR analysis in diagnosing and estimating disease-causing microbes has further fueled the adoption of clinical diagnostic tests, including qPCR and dPCR analysis. Particularly noteworthy is the impact on regions, such as eastern and southern Africa, where the prevalence of HIV is significant. The advent of modern dPCR technologies has contributed to a substantial increase in awareness and early detection, exemplified by four in five cases of HIV patients being aware of their condition. This transformative impact underscores the vital role of advanced genomic analysis in driving digital PCR (dPCR) and quantitative PCR (qPCR) market growth.

Ongoing technological advancements and recent product approvals are driving digital PCR (dPCR) and quantitative PCR (qPCR) market demand. Continuous evolution of innovative technologies, coupled with regulatory approvals for new products, enhances the capabilities of dPCR and qPCR, meeting the growing needs of precise nucleic acid quantification across various applications.

In October 2022, Roche secured FDA clearance for its COVID-19 PCR test designed for use on cobas 6800/8800 systems. This automated, high-throughput cobas SARS-CoV-2 Qualitative test is among the first FDA-cleared PCR tests for COVID-19, reflecting advancements in automated testing.

This dynamic landscape highlights the digital PCR (dPCR) and quantitative PCR (qPCR) market's resilience and its ability to meet evolving requirements in diagnostics, research, and forensics. The combination of advanced features and regulatory milestones contributes to the persistent and robust demand for dPCR and qPCR solutions.

In terms of product type, the quantitative PCR segment accounted for the largest global digital PCR (dPCR) and quantitative PCR (qPCR) market share in 2022. The trend is expected to continue during the forecast period.

The diagnostic industry is undergoing a transformative phase, spurred by rapid technological advancements and surge in demand for automated systems and point-of-care diagnostics. This growth is exemplified by the swift integration of cutting-edge solutions such as real-time PCR for COVID-19 screening and diagnosis.

In February 2023, Huwel Lifesciences, a key player in this evolution, demonstrated its commitment by developing a portable RT-PCR system capable of testing various virus types. This innovation aligns with the industry's trajectory toward more efficient and versatile diagnostic tools.

Based on application, the clinical applications segment dominated the global digital PCR (dPCR) and quantitative PCR (qPCR) industry in 2022. The segment is driven by the evolving landscape of PCR influenced by the increasing demand in clinical settings. Rise in need for precise, reproducible, and reliable quantitative measurements of viral levels is another factor propelling the clinical applications segment.

Quantitative real-time PCR assumes a pivotal role in monitoring individuals with HIV and those undergoing antiretroviral therapy (ART). Monitoring is crucial to ensure the effective suppression of viral replication and the timely detection of any potential development of viral resistance to medication.

Demand for more sensitive assays for HIV has led to the innovation of diagnostic tests, continually pushing the boundaries of the limit of detection (LOD) and limit of quantification (LOQ) to lower thresholds. This persistent pursuit of heightened sensitivity emphasizes on the ongoing commitment to meet the evolving needs of clinical practice, enhancing the capabilities to manage and treat viral infections effectively.

In terms of end-user, the laboratories & academic institutes segment held significant share of the global digital PCR (dPCR) and quantitative PCR (qPCR) market in 2022.

Research laboratories & academic institutes are poised to play a substantial role in advancing the market. These institutions serve as hubs for innovation, continually pushing the boundaries of PCR technology.

In the dynamic landscape of research, demand for precise and advanced molecular diagnostic tools has driven the adoption of dPCR and qPCR methodologies. Versatility of these techniques in quantifying nucleic acids makes them invaluable in various academic disciplines and research domains.

Research laboratories, in particular, leverage dPCR and qPCR for applications ranging from gene expression studies to the detection of rare genetic mutations. Academic institutes, being at the forefront of scientific exploration, contribute to the development and refinement of these PCR technologies.

Continuous collaboration between academia and industry fosters advancements, leading to improved sensitivity, accuracy, and efficiency in nucleic acid analysis. As these institutions drive the evolution of PCR applications, their pivotal role is expected to expand, cementing their significance in shaping the trajectory of the dPCR and qPCR market.

As per digital PCR (dPCR) and quantitative PCR (qPCR) market forecast, the industry in North America is experiencing significant growth, driven by favorable regulations, government initiatives to develop healthcare infrastructure, and high disease prevalence in the region.

Presence of key manufacturers and increase in demand for rapid diagnostic tests are expected to contribute to digital PCR (dPCR) and quantitative PCR (qPCR) market expansion in the region during the forecast period. Major players, recognizing the potential in the region, are adopting strategies such as geographical expansion, partnerships, collaborations, and mergers & acquisitions.

According to digital PCR (dPCR) and quantitative PCR (qPCR) market analysis, the industry in Asia Pacific is experiencing significant growth, fueled by factors such as increase in awareness, rise in healthcare expenditure, and surge in emphasis on molecular diagnostics in the region.

The prevalence of infectious diseases, coupled with a large and diverse population, contributes to the demand for advanced diagnostic technologies. Government initiatives aimed at improving healthcare infrastructure and access to diagnostic services, such as dPCR products & services, also play a pivotal role in propelling the digital PCR (dPCR) and quantitative PCR (qPCR) market.

Asia Pacific has witnessed rise in research activities and collaborations, fostering innovation in PCR technologies. This has led to the development of more sensitive and accurate assays for various applications, including infectious disease monitoring and genetic testing.

The global digital PCR (dPCR) and quantitative PCR (qPCR) market is fragmented, with the presence of large number of players. Companies are adopting strategies such as investment in R&D and merger & collaborations in order to increase market share.

Bio Rad Laboratories, Thermo Fisher Scientific, Inc., Qiagen, F. Hoffmann La Roche Ltd, Abbott Laboratories, Agilent Technologies, BD, Danaher Corporation, Merck KGaA, and Takara Bio, Inc., are the prominent players in the global market.

The digital PCR (dPCR) and quantitative PCR (qPCR) report profiles key players based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent Peptide therapeutics market developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 4.3 Bn |

| Forecast Value in 2031 | More than US$ 7.5 Bn |

| CAGR - 2022–2031 | 6.3% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Mn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 4.3 Bn in 2022

It is projected to reach more than US$ 7.5 Bn by 2031

It is anticipated to grow at a CAGR of 6.3% from 2023 to 2031

Increase in incidence and prevalence of specific infectious diseases & genetic disorders and technological advancements & recent product approvals.

North America is expected to account for largest share during the forecast period.

Bio Rad Laboratories, Thermo Fisher Scientific, Inc., Qiagen, F. Hoffmann La Roche Ltd., Abbott Laboratories, Agilent Technologies, BD, Danaher Corporation, Merck KGaA, and Takara Bio, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market

4. Market Overview

4.1. Introduction

4.1.1. Product Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Analysis and Forecast, 2023–2031

5. Key Insights

5.1. Applications of real-time PCR in the continuum of care and patient management.

5.2. Strengths of dPCR and qPCR

5.3. Key product/brand Analysis

5.4. Technological Advancements

5.5. Top 3 players operating in the market space

5.6. COVID Impact Analysis

6. Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2023–2031

6.3.1. Quantitative PCR

6.3.1.1. Reagents & Consumables

6.3.1.2. Instruments

6.3.1.3. Software

6.3.2. Digital PCR

6.3.2.1. Reagents & Consumables

6.3.2.2. Instruments

6.3.2.3. Software

6.4. Market Attractiveness Analysis, by Product Type

7. Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2023–2031

7.3.1. Clinical Applications

7.3.2. Research Applications

7.3.3. Pathogen Testing

7.3.4. Oncology Testing

7.3.5. Blood Screening

7.3.6. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2023–2031

8.3.1. Hospitals & Diagnostic Centers

8.3.2. Research Laboratories & Academic Institutes

8.3.3. Pharmaceutical & Biotechnology Companies

8.3.4. Clinical Research Organizations

8.3.5. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2023–2031

10.2.1. Quantitative PCR

10.2.1.1. Reagents & Consumables

10.2.1.2. Instruments

10.2.1.3. Software

10.2.2. Digital PCR

10.2.2.1. Reagents & Consumables

10.2.2.2. Instruments

10.2.2.3. Software

10.3. Market Value Forecast, by Application, 2023–2031

10.3.1. Clinical Applications

10.3.2. Research Applications

10.3.3. Pathogen Testing

10.3.4. Oncology Testing

10.3.5. Blood Screening

10.3.6. Others

10.4. Market Value Forecast, by End-user, 2023–2031

10.4.1. Hospitals & Diagnostic Centers

10.4.2. Research Laboratories & Academic Institutes

10.4.3. Pharmaceutical & Biotechnology Companies

10.4.4. Clinical Research Organizations

10.4.5. Others

10.5. Market Value Forecast, by Country, 2023–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2023–2031

11.2.1. Quantitative PCR

11.2.1.1. Reagents & Consumables

11.2.1.2. Instruments

11.2.1.3. Software

11.2.2. Digital PCR

11.2.2.1. Reagents & Consumables

11.2.2.2. Instruments

11.2.2.3. Software

11.3. Market Value Forecast, by Application, 2023–2031

11.3.1. Clinical Applications

11.3.2. Research Applications

11.3.3. Pathogen Testing

11.3.4. Oncology Testing

11.3.5. Blood Screening

11.3.6. Others

11.4. Market Value Forecast, by End-user, 2023–2031

11.4.1. Hospitals & Diagnostic Centers

11.4.2. Research Laboratories & Academic Institutes

11.4.3. Pharmaceutical & Biotechnology Companies

11.4.4. Clinical Research Organizations

11.4.5. Others

11.5. Market Value Forecast, by Country/Sub-region, 2023–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2023–2031

12.2.1. Quantitative PCR

12.2.1.1. Reagents & Consumables

12.2.1.2. Instruments

12.2.1.3. Software

12.2.2. Digital PCR

12.2.2.1. Reagents & Consumables

12.2.2.2. Instruments

12.2.2.3. Software

12.3. Market Value Forecast, by Application, 2023–2031

12.3.1. Clinical Applications

12.3.2. Research Applications

12.3.3. Pathogen Testing

12.3.4. Oncology Testing

12.3.5. Blood Screening

12.3.6. Others

12.4. Market Value Forecast, by End-user, 2023–2031

12.4.1. Hospitals & Diagnostic Centers

12.4.2. Research Laboratories & Academic Institutes

12.4.3. Pharmaceutical & Biotechnology Companies

12.4.4. Clinical Research Organizations

12.4.5. Others

12.5. Market Value Forecast, by Country/Sub-region, 2023–2031

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2023–2031

13.2.1. Quantitative PCR

13.2.1.1. Reagents & Consumables

13.2.1.2. Instruments

13.2.1.3. Software

13.2.2. Digital PCR

13.2.2.1. Reagents & Consumables

13.2.2.2. Instruments

13.2.2.3. Software

13.3. Market Value Forecast, by Application, 2023–2031

13.3.1. Clinical Applications

13.3.2. Research Applications

13.3.3. Pathogen Testing

13.3.4. Oncology Testing

13.3.5. Blood Screening

13.3.6. Others

13.4. Market Value Forecast, by End-user, 2023–2031

13.4.1. Hospitals & Diagnostic Centers

13.4.2. Research Laboratories & Academic Institutes

13.4.3. Pharmaceutical & Biotechnology Companies

13.4.4. Clinical Research Organizations

13.4.5. Others

13.5. Market Value Forecast, by Country/Sub-region, 2023–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2023–2031

14.2.1. Quantitative PCR

14.2.1.1. Reagents & Consumables

14.2.1.2. Instruments

14.2.1.3. Software

14.2.2. Digital PCR

14.2.2.1. Reagents & Consumables

14.2.2.2. Instruments

14.2.2.3. Software

14.3. Market Value Forecast, by Application, 2023–2031

14.3.1. Clinical Applications

14.3.2. Research Applications

14.3.3. Pathogen Testing

14.3.4. Oncology Testing

14.3.5. Blood Screening

14.3.6. Others

14.4. Market Value Forecast, by End-user, 2023–2031

14.4.1. Hospitals & Diagnostic Centers

14.4.2. Research Laboratories & Academic Institutes

14.4.3. Pharmaceutical & Biotechnology Companies

14.4.4. Clinical Research Organizations

14.4.5. Others

14.5. Market Value Forecast, by Country/Sub-region, 2023–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company (2021)

15.3. Company Profiles

15.3.1. Bio Rad Laboratories

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Thermo Fisher Scientific, Inc.

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Qiagen

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. F. Hoffmann La Roche Ltd.

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Abbott Laboratories

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Agilent Technologies

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. BD

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Danaher Corporation

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Merck KGaA

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. Takara Bio, Inc.

15.3.10.1. Company Overview

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

List of Tables

Table 01: Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 02: Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 03: Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 04: Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by Region, 2023–2031

Table 05: North America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 06: North America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 07: North America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 08: North America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by Country, 2023–2031

Table 09: Europe Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 10: Europe Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 11: Europe Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 12: Europe Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 13: Asia Pacific Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 14: Asia Pacific Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 15: Asia Pacific Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 16: Asia Pacific Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 17: Latin America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 18: Latin America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 19: Latin America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 20: Latin America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

Table 21: Middle East & Africa Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by Product Type, 2023–2031

Table 22: Middle East & Africa Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 23: Middle East & Africa Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by End-user, 2023–2031

Table 24: Middle East & Africa Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast, by Country/Sub-region, 2023–2031

List of Figures

Figure 1 : Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast 2023–2031

Figure 2 : Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share by Product Type 2022

Figure 3 : Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share by Application 2022

Figure 4 : Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share by End-user 2022

Figure 5 : Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by Product Type 2022 and 2031

Figure 6 : Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Revenue (US$ Mn) by Quantitative PCR 2017–2031

Figure 7 : Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Revenue (US$ Mn) by Digital PCR 2017–2031

Figure 8 : Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness Analysis, by Application 2023–2031

Figure 9 : Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by Application 2022 and 2031

Figure 10: Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Revenue (US$ Mn) by Clinical Applications 2017–2031

Figure 11: Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Revenue (US$ Mn) by Pathogen Testing 2017–2031

Figure 12: Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Revenue (US$ Mn) by Oncology Testing 2017–2031

Figure 13: Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Revenue (US$ Mn) by Research Applications 2017–2031

Figure 14: Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Revenue (US$ Mn) by Blood Screening 2017–2031

Figure 15: Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Revenue (US$ Mn) by Others 2017–2031

Figure 16: Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness Analysis, by End-user 2023–2031

Figure 17: Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by End-user 2022 and 2031

Figure 18: Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Revenue (US$ Mn) by Hospitals & Diagnostic Centers 2017–2031

Figure 19: Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Revenue (US$ Mn) by Research Laboratories & Academic Institutes 2017–2031

Figure 20: Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Revenue (US$ Mn) by Pharmaceutical & Biotechnology Companies 2017–2032

Figure 21: Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Revenue (US$ Mn) by Clinical Research Organizations 2017–2032

Figure 22: Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Revenue (US$ Mn) by Others 2017–2032

Figure 23: Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by Region 2022 and 2031

Figure 24: Global Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness Analysis, by Region 2023–2031

Figure 25: North America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast 2017–2031

Figure 26: North America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by Country 2022 and 2031

Figure 27: North America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness Analysis, by Country 2023–2031

Figure 28: North America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by Product Type 2022 and 2031

Figure 29: North America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness Analysis, by Product Type 2023–2031

Figure 30: North America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by Application 2022 and 2031

Figure 31: North America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness Analysis, by Application 2023–2031

Figure 32: North America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by End-user 2022 and 2031

Figure 33: North America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness Analysis, by End-user 2023–2031

Figure 34: Europe Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast 2023–2031

Figure 35: Europe Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by Country/Sub-region, 2022 and 2031

Figure 36: Europe Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 37: Europe Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by Product Type 2022 and 2031

Figure 38: Europe Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness Analysis, by Product Type 2023–2031

Figure 39: Europe Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by Application 2022 and 2031

Figure 40: Europe Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness Analysis, by Application 2023–2031

Figure 41: Europe Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by End-user 2022 and 2031

Figure 42: Europe Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness Analysis, by End-user 2023–2031

Figure 43: Asia Pacific Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast 2023–2031

Figure 44: Asia Pacific Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by Country/Sub-region, 2022 and 2031

Figure 45: Asia Pacific Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 46: Asia Pacific Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by Product Type 2022 and 2031

Figure 47: Asia Pacific Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness Analysis, by Product Type 2023–2031

Figure 48: Asia Pacific Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by Application 2022 and 2031

Figure 49: Asia Pacific Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness Analysis, by Application 2023–2031

Figure 50: Asia Pacific Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by End-user 2022 and 2031

Figure 51: Asia Pacific Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness Analysis, by End-user 2023–2031

Figure 52: Latin America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) Forecast 2023–2031

Figure 53: Latin America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by Country/Sub-region, 2022 and 2031

Figure 54: Latin America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 55: Latin America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by Product Type 2022 and 2031

Figure 56: Latin America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness Analysis, by Product Type 2023–2031

Figure 57: Latin America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by Application 2022 and 2031

Figure 58: Latin America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness Analysis, by Application 2023–2031

Figure 59: Latin America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by End-user 2022 and 2031

Figure 60: Latin America Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness Analysis, by End-user 2023–2031

Figure 61: Middle East & Africa Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value (US$ Mn) 2017–2031

Figure 62: Middle East & Africa Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by Country/Sub-region 2022 and 2031

Figure 63: Middle East & Africa Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness by Country/Sub-region 2023–2031

Figure 64: Middle East & Africa Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by Product Type 2022 and 2031

Figure 65: Middle East & Africa Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness by Product Type 2023–2031

Figure 66: Middle East & Africa Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by Application 2022 and 2031

Figure 67: Middle East & Africa Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness by Application 2023–2031

Figure 68: Middle East & Africa Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Value Share Analysis by End-user 2022 and 2031

Figure 69: Middle East & Africa Digital PCR (dPCR) and Quantitative PCR (qPCR) Market Attractiveness by End-user 2023–2031