Reports

Reports

Analyst Viewpoint

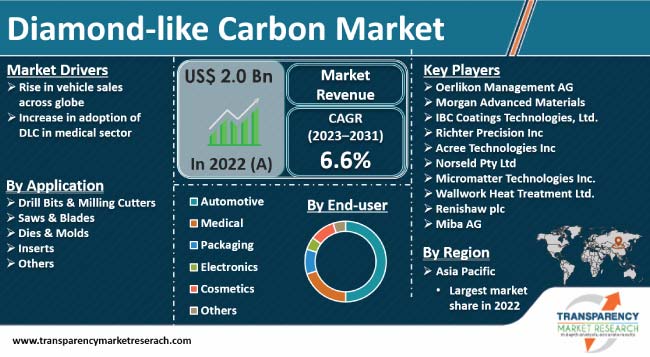

Expansion in automotive and automobile sectors is a crucial factor that is driving diamond-like carbon (DLC) market size. DLC is utilized in the manufacture of several vehicle components such as diesel fuel injectors, door hinges, and differential gears. Surge in adoption of two-wheelers and electric vehicles is also boosting the global diamond-like carbon (DLC) industry value. Application of diamond-like carbon in blood pumps, stents, and artificial heart valves helps reduce the possibility of severe allergies and inflammatory reactions.

In line with the recent diamond-like carbon (DLC) market trends, key players are investing in equipment manufacturing technology to cater to wide range of end-use industries. Need for inert and strong coating offerings in electronics, biomedical, and packaging sectors is creating lucrative diamond-like carbon market opportunities for companies.

Diamond-like carbon is a class of carbon-based material that displays certain typical characteristics of diamonds such as hardness, wear resistance, and corrosion resistance. Diamond-like carbon offers enhanced properties such as high biocompatibility, chemical inertness, and optical transparency.

Diamond-like carbon is widely employed in automotive, medical, electronics, packaging, and cosmetics sectors. It consists of several other elements such as sulfur, fluorine, titanium, hydrogen, and silicon.

Surge in need for magnetic hard disks, scratch-resistant glass, invasive medical devices, mechanical face seals, and razor blades is driving market statistics. Products such as saws and blades, drill bits, and milling cutters also employ diamond-like carbon-related raw materials. In industries such as electronics and semiconductors, diamond-like carbon offers a protective layer to micro-components, while acting as a wide-gap semiconductor.

Increase in disposable income, rise in popularity of lighter vehicles, and improvement in service network for electric vehicles are bolstering the automotive sector. This growth in the highly competitive automotive sector is resulting in innovation and rapid investment in research for products that can extend vehicle life and functionality, thus augmenting diamond-like carbon (DLC) market demand.

DLC coatings are used in a wide range of applications in the automotive sector. For instance, they are employed in the manufacture of components such as automotive tappets, diesel fuel injectors, door hinges, differential gears, wrist pins, and valve lifters.

Two-wheeler adoption is gaining significant traction across the globe, especially in Asia Pacific. This is likely to drive the demand for hard carbon coatings in the region. On the other hand, e-bikes have gained popularity in Europe. Around 4.3 million electric bicycles were sold in Germany in in 2020.

DLC possesses beneficial properties such as exceptional brittleness, low friction, and biological inertness. These properties render coatings extremely valuable to healthcare and biomedical sectors.

Diamond-like carbon coatings are employed in cardiovascular implants such as artificial heart valves, blood pumps, and stents. As per a research data, more than 2 million stents are implanted in the U.S. every year. Furthermore, nearly 182,000 heart valve replacements are performed annually in the country.

DLC coatings tend to support cellular growth, increase the material lifecycle, and prevent allergies and inflammatory reactions. They are also utilized in guidewires, urinary tract catheters, and orthodontic archwires. Thus, diamond-like carbon is gaining traction in the global biomedical and intensive healthcare sectors.

As per the latest diamond-like carbon (DLC) market analysis, Asia Pacific held significant share of the global landscape in 2022. Demand for carbon-based protective coatings is set to rise substantially in the region during the forecast period owing to growth in automobile and electronics sectors.

Hard coating services are employed extensively in the electronic manufacturing sector in developing economies such as China and India. According to data made public by China’s Ministry of Industry and Information Technology, operating revenue of the electronic manufacturing sector in the country stood at about US$ 2.2 Trn in 2021. Thus, growth in the electronic manufacturing sector is fueling market expansion in Asia Pacific.

The diamond-like carbon (DLC) industry in North America and Europe is projected to grow at a steady pace in the near future. DLC coatings are used in industrial packaging to extend the lifespan of metallic items such as knives and compacting tools. Strong presence of packaging and biomedical industries is the key market driver in these regions.

Leading diamond-like carbon (DLC) market manufacturers are investing significantly in advancements in hard carbon coatings and equipment manufacturing. Constant innovation in material and design allows vendors to expand their product portfolio and deploy the products in wider end-use applications.

Oerlikon Management AG, Morgan Advanced Materials, IBC Coatings Technologies, Ltd., Richter Precision Inc., Acree Technologies Inc., Norseld Pty Ltd., Micromatter Technologies Inc., Wallwork Heat Treatment Ltd., Renishaw plc, and Miba AG are key companies operating in the global landscape.

The firms mentioned above have been profiled in the diamond-like carbon (DLC) market report based on parameters such as company overview, product portfolio, financial overview, business strategies, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 2.0 Bn |

| Market Forecast Value in 2031 | US$ 3.6 Bn |

| Growth Rate (CAGR) | 6.6% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 2.0 Bn in 2022

It is projected to grow at a CAGR of 6.6 % from 2023 to 2031

Rise in vehicle sales across globe and increase in adoption of DLC in the medical sector

The automotive segment accounted for the largest share in 2022

Asia Pacific was the leading region in 2022

Oerlikon Management AG, Morgan Advanced Materials, IBC Coatings Technologies, Ltd., Richter Precision Inc., Acree Technologies Inc., Norseld Pty Ltd., Micromatter Technologies Inc., Wallwork Heat Treatment Ltd., Renishaw plc, and Miba AG

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Raw Type Suppliers

2.6.2. List of Key Manufacturers

2.6.3. List of Suppliers/ Distributors

2.6.4. List of Potential Customers

2.7. End-user Specification Analysis

2.8. Overview of Manufacturing Process

2.9. Cost Structure Analysis

3. COVID-19 Impact Analysis

4. Price Trend Analysis

5. Global Diamond-like Carbon [DLC] Market Analysis and Forecast, by Type, 2020–2031

5.1. Introduction and Definitions

5.2. Global Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

5.2.1. Pure DLC

5.2.2. Mixed DLC

5.3. Global Diamond-like Carbon [DLC] Market Attractiveness, by Type

6. Global Diamond-like Carbon [DLC] Market Analysis and Forecast, by End-user, 2020–2031

6.1. Introduction and Definitions

6.2. Global Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

6.2.1. Automotive

6.2.2. Medical

6.2.3. Packaging

6.2.4. Electronics

6.2.5. Cosmetics

6.2.6. Others

6.3. Global Diamond-like Carbon [DLC] Market Attractiveness, by End-user

7. Global Diamond-like Carbon [DLC] Market Analysis and Forecast, by Application, 2020–2031

7.1. Introduction and Definitions

7.2. Global Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

7.2.1. Drill Bits & Milling Cutters

7.2.2. Saws & Blades

7.2.3. Dies & Molds

7.2.4. Inserts

7.2.5. Others

7.3. Global Diamond-like Carbon [DLC] Market Attractiveness, by Application

8. Global Diamond-like Carbon [DLC] Market Analysis and Forecast, by Region, 2020–2031

8.1. Key Findings

8.2. Global Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Region, 2020–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. Latin America

8.3. Global Diamond-like Carbon [DLC] Market Attractiveness, by Region

9. North America Diamond-like Carbon [DLC] Market Analysis and Forecast, 2020–2031

9.1. Key Findings

9.2. North America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

9.3. North America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

9.4. North America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

9.5. North America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Country, 2020–2031

9.5.1. U.S. Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

9.5.2. U.S. Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

9.5.3. U.S. Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

9.5.4. Canada Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

9.5.5. Canada Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

9.5.6. Canada Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

9.6. North America Diamond-like Carbon [DLC] Market Attractiveness Analysis

10. Europe Diamond-like Carbon [DLC] Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. Europe Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

10.3. Europe Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

10.4. Europe Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

10.5. Europe Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

10.5.1. Germany Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

10.5.2. Germany Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

10.5.3. Germany Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

10.5.4. France Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

10.5.5. France Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

10.5.6. France Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

10.5.7. U.K. Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

10.5.8. U.K. Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

10.5.9. U.K. Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

10.5.10. Italy Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

10.5.11. Italy. Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

10.5.12. Italy Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

10.5.13. Russia & CIS Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

10.5.14. Russia & CIS Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

10.5.15. Russia & CIS Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

10.5.16. Rest of Europe Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

10.5.17. Rest of Europe Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

10.5.18. Rest of Europe Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

10.6. Europe Diamond-like Carbon [DLC] Market Attractiveness Analysis

11. Asia Pacific Diamond-like Carbon [DLC] Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Asia Pacific Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type

11.3. Asia Pacific Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

11.4. Asia Pacific Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

11.5. Asia Pacific Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

11.5.1. China Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

11.5.2. China Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

11.5.3. China Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.4. Japan Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

11.5.5. Japan Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

11.5.6. Japan Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.7. India Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

11.5.8. India Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

11.5.9. India Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.10. ASEAN Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

11.5.11. ASEAN Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

11.5.12. ASEAN Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

11.5.13. Rest of Asia Pacific Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

11.5.14. Rest of Asia Pacific Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

11.5.15. Rest of Asia Pacific Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

11.6. Asia Pacific Diamond-like Carbon [DLC] Market Attractiveness Analysis

12. Latin America Diamond-like Carbon [DLC] Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Latin America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

12.3. Latin America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

12.4. Latin America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

12.5. Latin America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

12.5.1. Brazil Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

12.5.2. Brazil Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

12.5.3. Brazil Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.4. Mexico Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

12.5.5. Mexico Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

12.5.6. Mexico Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

12.5.7. Rest of Latin America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

12.5.8. Rest of Latin America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

12.5.9. Rest of Latin America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

12.6. Latin America Diamond-like Carbon [DLC] Market Attractiveness Analysis

13. Middle East & Africa Diamond-like Carbon [DLC] Market Analysis and Forecast, 2020–2031

13.1. Key Findings

13.2. Middle East & Africa Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

13.3. Middle East & Africa Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

13.4. Middle East & Africa Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

13.5. Middle East & Africa Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

13.5.1. GCC Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

13.5.2. GCC Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

13.5.3. GCC Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

13.5.4. South Africa Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

13.5.5. South Africa Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

13.5.6. South Africa Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

13.5.7. Rest of Middle East & Africa Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

13.5.8. Rest of Middle East & Africa Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

13.5.9. Rest of Middle East & Africa Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

13.6. Middle East & Africa Diamond-like Carbon [DLC] Market Attractiveness Analysis

14. Competition Landscape

14.1. Global Diamond-like Carbon [DLC] Market Company Share Analysis, 2022

14.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

14.2.1. Oerlikon Management AG

14.2.1.1. Company Description

14.2.1.2. Business Overview

14.2.1.3. Financial Overview

14.2.1.4. Strategic Overview

14.2.2. Morgan Advanced Materials

14.2.2.1. Company Description

14.2.2.2. Business Overview

14.2.2.3. Financial Overview

14.2.2.4. Strategic Overview

14.2.3. IBC Coatings Technologies, Ltd.

14.2.3.1. Company Description

14.2.3.2. Business Overview

14.2.3.3. Financial Overview

14.2.3.4. Strategic Overview

14.2.4. Richter Precision Inc.

14.2.4.1. Company Description

14.2.4.2. Business Overview

14.2.4.3. Financial Overview

14.2.4.4. Strategic Overview

14.2.5. Acree Technologies Inc.

14.2.5.1. Company Description

14.2.5.2. Business Overview

14.2.5.3. Financial Overview

14.2.5.4. Strategic Overview

14.2.6. Norseld Pty Ltd.

14.2.6.1. Company Description

14.2.6.2. Business Overview

14.2.6.3. Financial Overview

14.2.6.4. Strategic Overview

14.2.7. Micromatter Technologies Inc.

14.2.7.1. Company Description

14.2.7.2. Business Overview

14.2.7.3. Financial Overview

14.2.7.4. Strategic Overview

14.2.8. Wallwork Heat Treatment Ltd.

14.2.8.1. Company Description

14.2.8.2. Business Overview

14.2.8.3. Financial Overview

14.2.8.4. Strategic Overview

14.2.9. Renishaw plc

14.2.9.1. Company Description

14.2.9.2. Business Overview

14.2.9.3. Financial Overview

14.2.9.4. Strategic Overview

14.2.10. Miba AG

14.2.10.1. Company Description

14.2.10.2. Business Overview

14.2.10.3. Financial Overview

14.2.10.4. Strategic Overview

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 1: Global Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 2: Global Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 3: Global Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 4: Global Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 5: Global Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 6: Global Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 7: Global Diamond-like Carbon [DLC] Market Forecast, by Region, 2020–2031

Table 8: Global Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Region, 2020–2031

Table 9: North America Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 10: North America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 11: North America Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 12: North America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 13: North America Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 14: North America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 15: North America Diamond-like Carbon [DLC] Market Forecast, by Country, 2020–2031

Table 16: North America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 17: U.S. Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 18: U.S. Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 19: U.S. Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 20: U.S. Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 21: U.S. Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 22: U.S. Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 23: Canada Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 24: Canada Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 25: Canada Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 26: Canada Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 27: Canada Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 28: Canada Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 29: Europe Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 30: Europe Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 31: Europe Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 32: Europe Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 33: Europe Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 34: Europe Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 35: Europe Diamond-like Carbon [DLC] Market Forecast, by Country and Sub-region, 2020–2031

Table 36: Europe Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 37: Germany Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 38: Germany Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 39: Germany Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 40: Germany Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 41: Germany Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 42: Germany Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 43: France Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 44: France Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 45: France Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 46: France Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 47: France Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 48: France Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 49: U.K. Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 50: U.K. Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 51: U.K. Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 52: U.K. Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 53: U.K. Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 54: U.K. Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 55: Italy Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 56: Italy Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 57: Italy Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 58: Italy Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 59: Italy Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 60: Italy Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 61: Spain Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 62: Spain Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 63: Spain Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 64: Spain Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 65: Spain Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 66: Spain Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 67: Russia & CIS Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 68: Russia & CIS Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 69: Russia & CIS Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 70: Russia & CIS Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 71: Russia & CIS Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 72: Russia & CIS Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 73: Rest of Europe Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 74: Rest of Europe Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 75: Rest of Europe Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 76: Rest of Europe Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 77: Rest of Europe Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 78: Rest of Europe Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 79: Asia Pacific Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 80: Asia Pacific Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 81: Asia Pacific Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 82: Asia Pacific Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 83: Asia Pacific Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 84: Asia Pacific Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 85: Asia Pacific Diamond-like Carbon [DLC] Market Forecast, by Country and Sub-region, 2020–2031

Table 86: Asia Pacific Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 87: China Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 88: China Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type 2020–2031

Table 89: China Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 90: China Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 91: China Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 92: China Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 93: Japan Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 94: Japan Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 95: Japan Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 96: Japan Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 97: Japan Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 98: Japan Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 99: India Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 100: India Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 101: India Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 102: India Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 103: India Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 104: India Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 105: India Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 106: India Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 107: ASEAN Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 108: ASEAN Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 109: ASEAN Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 110: ASEAN Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 111: ASEAN Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 112: ASEAN Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 113: Rest of Asia Pacific Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 114: Rest of Asia Pacific Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 115: Rest of Asia Pacific Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 116: Rest of Asia Pacific Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 117: Rest of Asia Pacific Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 118: Rest of Asia Pacific Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 119: Latin America Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 120: Latin America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 121: Latin America Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 122: Latin America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 123: Latin America Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 124: Latin America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 125: Latin America Diamond-like Carbon [DLC] Market Forecast, by Country and Sub-region, 2020–2031

Table 126: Latin America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 127: Brazil Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 128: Brazil Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 129: Brazil Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 130: Brazil Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 131: Brazil Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 132: Brazil Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 133: Mexico Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 134: Mexico Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 135: Mexico Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 136: Mexico Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 137: Mexico Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 138: Mexico Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 139: Rest of Latin America Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 140: Rest of Latin America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 141: Rest of Latin America Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 142: Rest of Latin America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 143: Rest of Latin America Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 144: Rest of Latin America Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 145: Middle East & Africa Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 146: Middle East & Africa Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 147: Middle East & Africa Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 148: Middle East & Africa Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 149: Middle East & Africa Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 150: Middle East & Africa Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 151: Middle East & Africa Diamond-like Carbon [DLC] Market Forecast, by Country and Sub-region, 2020–2031

Table 152: Middle East & Africa Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 153: GCC Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 154: GCC Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 155: GCC Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 156: GCC Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 157: GCC Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 158: GCC Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 159: South Africa Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 160: South Africa Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 161: South Africa Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 162: South Africa Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 163: South Africa Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 164: South Africa Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 165: Rest of Middle East & Africa Diamond-like Carbon [DLC] Market Forecast, by Type, 2020–2031

Table 166: Rest of Middle East & Africa Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Type, 2020–2031

Table 167: Rest of Middle East & Africa Diamond-like Carbon [DLC] Market Forecast, by End-user, 2020–2031

Table 168: Rest of Middle East & Africa Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 169: Rest of Middle East & Africa Diamond-like Carbon [DLC] Market Forecast, by Application, 2020–2031

Table 170: Rest of Middle East & Africa Diamond-like Carbon [DLC] Market Value (US$ Mn) Forecast, by Application, 2020–2031

List of Figures

Figure 1: Global Diamond-like Carbon [DLC] Market Value Share Analysis, by Type, 2022, 2027, and 2031

Figure 2: Global Diamond-like Carbon [DLC] Market Attractiveness, by Type

Figure 3: Global Diamond-like Carbon [DLC] Market Value Share Analysis, by End-user, 2022, 2027, and 2031

Figure 4: Global Diamond-like Carbon [DLC] Market Attractiveness, by End-user

Figure 5: Global Diamond-like Carbon [DLC] Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 6: Global Diamond-like Carbon [DLC] Market Attractiveness, by Application

Figure 7: Global Diamond-like Carbon [DLC] Market Value Share Analysis, by Region, 2022, 2027, and 2031

Figure 8: Global Diamond-like Carbon [DLC] Market Attractiveness, by Region

Figure 9: North America Diamond-like Carbon [DLC] Market Value Share Analysis, by Type, 2022, 2027, and 2031

Figure 10: North America Diamond-like Carbon [DLC] Market Attractiveness, by Type

Figure 11: North America Diamond-like Carbon [DLC] Market Value Share Analysis, by End-user, 2022, 2027, and 2031

Figure 12: North America Diamond-like Carbon [DLC] Market Attractiveness, by End-user

Figure 13: North America Diamond-like Carbon [DLC] Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 14: North America Diamond-like Carbon [DLC] Market Attractiveness, by Application

Figure 15: North America Diamond-like Carbon [DLC] Market Value Share Analysis, by Country, 2022, 2027, and 2031

Figure 16: North America Diamond-like Carbon [DLC] Market Attractiveness, by Country

Figure 17: Europe Diamond-like Carbon [DLC] Market Value Share Analysis, by Type, 2022, 2027, and 2031

Figure 18: Europe Diamond-like Carbon [DLC] Market Attractiveness, by Type

Figure 19: Europe Diamond-like Carbon [DLC] Market Value Share Analysis, by End-user, 2022, 2027, and 2031

Figure 20: Europe Diamond-like Carbon [DLC] Market Attractiveness, by End-user

Figure 21: Europe Diamond-like Carbon [DLC] Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 22: Europe Diamond-like Carbon [DLC] Market Attractiveness, by Application

Figure 23: Europe Diamond-like Carbon [DLC] Market Value Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Europe Diamond-like Carbon [DLC] Market Attractiveness, by Country and Sub-region

Figure 25: Asia Pacific Diamond-like Carbon [DLC] Market Value Share Analysis, by Type, 2022, 2027, and 2031

Figure 26: Asia Pacific Diamond-like Carbon [DLC] Market Attractiveness, by Type

Figure 27: Asia Pacific Diamond-like Carbon [DLC] Market Value Share Analysis, by End-user, 2022, 2027, and 2031

Figure 28: Asia Pacific Diamond-like Carbon [DLC] Market Attractiveness, by End-user

Figure 29: Asia Pacific Diamond-like Carbon [DLC] Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 30: Asia Pacific Diamond-like Carbon [DLC] Market Attractiveness, by Application

Figure 31: Asia Pacific Diamond-like Carbon [DLC] Market Value Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 32: Asia Pacific Diamond-like Carbon [DLC] Market Attractiveness, by Country and Sub-region

Figure 33: Latin America Diamond-like Carbon [DLC] Market Value Share Analysis, by Type, 2022, 2027, and 2031

Figure 34: Latin America Diamond-like Carbon [DLC] Market Attractiveness, by Type

Figure 35: Latin America Diamond-like Carbon [DLC] Market Value Share Analysis, by End-user, 2022, 2027, and 2031

Figure 36: Latin America Diamond-like Carbon [DLC] Market Attractiveness, by End-user

Figure 37: Latin America Diamond-like Carbon [DLC] Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 38: Latin America Diamond-like Carbon [DLC] Market Attractiveness, by Application

Figure 39: Latin America Diamond-like Carbon [DLC] Market Value Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 40: Latin America Diamond-like Carbon [DLC] Market Attractiveness, by Country and Sub-region

Figure 41: Middle East & Africa Diamond-like Carbon [DLC] Market Value Share Analysis, by Type, 2022, 2027, and 2031

Figure 42: Middle East & Africa Diamond-like Carbon [DLC] Market Attractiveness, by Type

Figure 43: Middle East & Africa Diamond-like Carbon [DLC] Market Value Share Analysis, by End-user, 2022, 2027, and 2031

Figure 44: Middle East & Africa Diamond-like Carbon [DLC] Market Attractiveness, by End-user

Figure 45: Middle East & Africa Diamond-like Carbon [DLC] Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 46: Middle East & Africa Diamond-like Carbon [DLC] Market Attractiveness, by Application

Figure 47: Middle East & Africa Diamond-like Carbon [DLC] Market Value Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 48: Middle East & Africa Diamond-like Carbon [DLC] Market Attractiveness, by Country and Sub-region