Reports

Reports

Analysts’ Viewpoint on Diagnostic Reagents Market Scenario

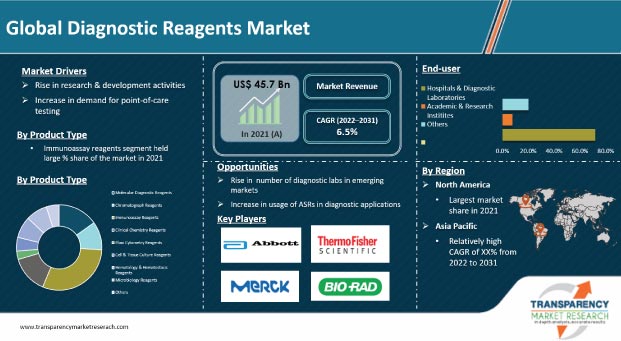

Health systems across the world seek to address unmet patient health needs for a range of acute and chronic diseases. Infectious diseases are a major cause of morbidity and mortality throughout the world. Discussions of laboratory innovations are often focused on automation and other advanced technologies that optimize and accelerate the work of scientists. Biomarkers and chemical reagents, however, play an equally important role in modern clinical laboratories. Manufacturers in the diagnostic reagents market are focusing on R&D activities and partnerships with academic institutes to maximize their gains. Additionally, development of new diagnostic tests is driving the demand for diagnostic reagents.

Diagnostics are the mainstay of detection, diagnosis, and assessment of any type of disease. More than 60% to 70% of medical decisions regarding disease treatment, management, and prevention are based on diagnostics. Diagnostics play a key role in preventive healthcare.

Diagnostics deliver information that can benefit patients by enabling the selection of the right treatment. They enable health professionals to choose appropriate preventive interventions and provide vital prognostic data that can optimize care pathways and management. In diagnostic testing, diagnostic reagents play a major role in medical labs, helping produce test results through diagnostic testing assays. Clinical diagnostic reagents are the most basic reagents. They use one or two reagent systems. These could be used for various tests including measuring serum albumin concentrations.

Diagnosis of infectious and chronic diseases is one of the leading applications of in vitro diagnostics reagents. Diagnostic reagents (both biological and chemical reagents) are an integral and vital part of any diagnostic test. Emergence and outbreak of various infectious diseases have created challenges and new opportunities for researchers to develop new diagnostic tools and tests for early diagnosis and prevention of diseases, and IVD reagents play a crucial role in it.

On March 11, 2020, the WHO declared the novel coronavirus (COVID-19) outbreak a global pandemic. Outbreak of new diseases such as COVID 19 and rise in demand for quick and better diagnosis of infectious diseases through in vitro diagnostics are likely to boost the demand for diagnostic reagents, especially IVD reagents, in the market.

Laboratory development test could become more common as we move toward new technologies and new approaches to clinical testing such as mass spectrometry. Researchers have characterized the effects of poor quality reagents in development of tests for diagnosis of diseases. Here, the importance of being able to trust the quality of reagents is amplified significantly.

Even within regulated markets, we cannot always be sure of ongoing quality; a quick search of the U.S. FDA Medical Device Recalls database shows multiple reagent recalls every year. This makes the pathway of small-scale diagnostic reagent manufacturers quite different to maintain the strict regulatory quality for reagents in the diagnostic reagents facility due to requirement of large capital investment to maintain the stock. Hence, they are unable to cater to the big diagnostic players who always look for good quality reagents.

In terms of end-user, the global diagnostic reagents market has been divided into hospitals & diagnostic laboratories, academic & research institutes, and others. Rise in number of hospitals with diagnostic labs in developing countries, increase in patient preference to visit hospitals for reimbursement facilities, availability of advanced diagnostic services, and ability to perform various types of tests are expected to drive the hospitals & diagnostic laboratories segment during the forecast period. As of February 2019, there were a total of 33,000 hospitals in China, an increase of 1,866 compared to the same period in 2018.

North America accounted for a prominent share of the global diagnostic reagents market in 2021. The trend is projected to continue during the forecast period due to the rise in healthcare care spending for prevention of diseases, adoption of quick innovative tests, and high degree of awareness about routine tests to maintain healthy life in the region.

The diagnostic reagents market in Asia Pacific is anticipated to grow at a high CAGR from 2022 to 2031. This can be ascribed to the increase in popularity of molecular test over traditional tests such as microbiology test, surge in incidence of lifestyle-related & chronic illnesses, and technical developments in countries such as India, Indonesia, Thailand, and South Korea.

The global diagnostic reagents market is fragmented, with the presence of large number of players. Key players operating in the global diagnostic reagents market include Abbott Laboratories, Becton, Dickinson and Company, Siemens Healthineers AG, F. Hoffmann-La Roche AG, DiaSorin S.p.A., Sysmex Corporation, bioMerieux SA, Ortho Clinical Diagnostics, Thermo Fisher Scientific, Inc., and Agilent Technologies, Inc. Leading diagnostic reagents manufacturers are adopting growth strategies such as new product development, product launches, product approval, agreement, partnerships, and mergers.

Each of these players has been profiled in the diagnostics reagents market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 45.7 Bn |

|

Market Forecast Value in 2031 |

More than US$ 85.8 Bn |

|

Growth Rate (CAGR) |

6.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, regulatory scenario, list of major reagents, and risk entry analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global diagnostic reagents market was valued at US$ 45.7 Bn in 2021

The global diagnostic reagents market is projected to reach more than US$ 85.8 Bn by 2031

The global diagnostic reagents market is anticipated to grow at a CAGR of 6.5% from 2022 to 2031

Rise in research & development activities, increase in demand for point-of-care testing, and surge in number of diagnostic labs are driving the global diagnostic reagents market

The immunoassays segment held more than 27% share of the global diagnostic reagents market in 2021

North America is expected to account for major share of the global diagnostic reagents market during the forecast period

Abbott Laboratories, Becton, Dickinson and Company, Siemens Healthineers AG, F. Hoffmann-La Roche AG, DiaSorin S.p.A., Sysmex Corporation, bioMerieux SA, Ortho Clinical Diagnostics, Thermo Fisher Scientific, Inc. and Agilent Technologies, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Diagnostic Reagents Market

4. Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Global Diagnostic Reagents Market Analysis and Forecast, 2017–2031

4.3.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. List of Mostly Used Diagnostic Reagents

5.2. Key Industry Development

5.3. COVID-19 Impact Analysis

6. Global Diagnostic Reagents Market Analysis and Forecast, by Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product, 2017–2031

6.3.1. Chromatography Reagents

6.3.2. Molecular Diagnostic Reagents

6.3.3. Immunoassay Reagents

6.3.4. Clinical Chemistry Reagents

6.3.5. Flow Cytometry Reagents

6.3.6. Cell & Tissue Culture Reagents

6.3.7. Hematology & Hemostasis Reagents

6.3.8. Microbiology Reagents

6.3.9. Others

6.4. Market Attractiveness Analysis, by Product

7. Global Diagnostic Reagents Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. Hospitals & Diagnostics Laboratories

7.3.2. Academic & Research Institutes

7.3.3. Others

7.4. Market Attractiveness Analysis, by End-user

8. Global Diagnostic Reagents Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region/Country

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Diagnostic Reagents Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Product, 2017–2031

9.2.1. Chromatography Reagents

9.2.2. Molecular Diagnostic Reagents

9.2.3. Immunoassay Reagents

9.2.4. Clinical Chemistry Reagents

9.2.5. Flow Cytometry Reagents

9.2.6. Cell & Tissue Culture Reagents

9.2.7. Hematology & Hemostasis Reagents

9.2.8. Microbiology Reagents

9.2.9. Others

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospitals & Diagnostics Laboratories

9.3.2. Academic & Research Institutes

9.3.3. Others

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By End-user

9.5.3. By Country

10. Europe Diagnostic Reagents Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product, 2017–2031

10.2.1. Chromatography Reagents

10.2.2. Molecular Diagnostic Reagents

10.2.3. Immunoassay Reagents

10.2.4. Clinical Chemistry Reagents

10.2.5. Flow Cytometry Reagents

10.2.6. Cell & Tissue Culture Reagents

10.2.7. Hematology & Hemostasis Reagents

10.2.8. Microbiology Reagents

10.2.9. Others

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Hospitals & Diagnostics Laboratories

10.3.2. Academic & Research Institutes

10.3.3. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Diagnostic Reagents Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product, 2017–2031

11.2.1. Chromatography Reagents

11.2.2. Molecular Diagnostic Reagents

11.2.3. Immunoassay Reagents

11.2.4. Clinical Chemistry Reagents

11.2.5. Flow Cytometry Reagents

11.2.6. Cell & Tissue Culture Reagents

11.2.7. Hematology & Hemostasis Reagents

11.2.8. Microbiology Reagents

11.2.9. Others

11.3. Market Value Forecast, by End-user, 2017–2031

11.3.1. Hospitals & Diagnostics Laboratories

11.3.2. Academic & Research Institutes

11.3.3. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Diagnostic Reagents Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product, 2017–2031

12.2.1. Chromatography Reagents

12.2.2. Molecular Diagnostic Reagents

12.2.3. Immunoassay Reagents

12.2.4. Clinical Chemistry Reagents

12.2.5. Flow Cytometry Reagents

12.2.6. Cell & Tissue Culture Reagents

12.2.7. Hematology & Hemostasis Reagents

12.2.8. Microbiology Reagents

12.2.9. Others

12.3. Market Value Forecast, by End-user, 2017–2031

12.3.1. Hospitals & Diagnostics Laboratories

12.3.2. Academic & Research Institutes

12.3.3. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Diagnostic Reagents Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product, 2017–2031

13.2.1. Chromatography Reagents

13.2.2. Molecular Diagnostic Reagents

13.2.3. Immunoassay Reagents

13.2.4. Clinical Chemistry Reagents

13.2.5. Flow Cytometry Reagents

13.2.6. Cell & Tissue Culture Reagents

13.2.7. Hematology & Hemostasis Reagents

13.2.8. Microbiology Reagents

13.2.9. Others

13.3. Market Value Forecast, by End-user, 2017–2031

13.3.1. Hospitals & Diagnostics Laboratories

13.3.2. Academic & Research Institutes

13.3.3. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Product

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Global & India IVD Reagents Market Analysis and Forecast, by Chemical Type

14.1. Market Value Forecast, by Chemical Type, 2017–2031

14.1.1. Bio-chemical

14.1.2. Immunochemical

14.2. Value Chain Analysis

14.3. Market Value Forecast, India & Global

14.4. Key Trends

14.5. Winning Imperative and Key Entry Barriers

14.6. Regulatory Requirements

14.7. List of Global and Indian Players

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Company Market Share (2021)

15.3. Company Profiles

15.3.1. Abbott Laboratories

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. BD

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. F. Hoffmann-La Roche AG

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Siemens Healthineers AG

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. DiaSorin S.p.A

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. Sysmex Corporation

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. bioMerieux SA

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Ortho Clinical Diagnostics

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Thermo Fisher Scientific, Inc.

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. Agilent Technologies, Inc.

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

List of Tables

Table 01: Global Diagnostic Reagents Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 02: Global Diagnostic Reagents Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 03: Global Diagnostic Reagents Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Diagnostic Reagents Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 05: North America Diagnostic Reagents Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 06: North America Diagnostic Reagents Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 07: Europe Diagnostic Reagents Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 08: Europe Diagnostic Reagents Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 09: Europe Diagnostic Reagents Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 10: Asia Pacific Diagnostic Reagents Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 11: Asia Pacific Diagnostic Reagents Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 12: Asia Pacific Diagnostic Reagents Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 13: China Diagnostic Reagents Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 14: China Diagnostic Reagents Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 15: India Diagnostic Reagents Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 16: India Diagnostic Reagents Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 17: Latin America Diagnostic Reagents Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America Diagnostic Reagents Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 19: Latin America Diagnostic Reagents Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 20: Middle East & Africa Diagnostic Reagents Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 21: Middle East & Africa Diagnostic Reagents Market Value (US$ Mn) Forecast, by Product, 2017–2031

Table 22: Middle East & Africa Diagnostic Reagents Market Value (US$ Mn) Forecast, by End-user, 2017‒2031

Table 23: Global Chemical Reagents Market Value (US$ Mn) Forecast, by Chemical Type, 2017‒2031

Table 24: India Chemical Reagents Market Value (US$ Mn) Forecast, by Chemical Type, 2017‒2031

List of Figures

Figure 01: Global Diagnostic Reagents Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Diagnostic Reagents Market Value Share, by Product, 2021

Figure 03: Global Diagnostic Reagents Market Value Share, by End-user, 2021

Figure 04: Global Diagnostic Reagents Market Value Share, by Region, 2021

Figure 05: Global Diagnostic Reagents Market Attractiveness Analysis, by Product, 2022–2031

Figure 06: Global Diagnostic Reagents Market Value Share Analysis, by Product, 2021 and 2031

Figure 08: Global Diagnostic Reagents Market Value (US$ Mn), by Molecular Diagnostic Reagents, 2017–2031

Figure 09: Global Diagnostic Reagents Market Value (US$ Mn), by Chromatography Reagents, 2017–2031

Figure 10: Global Diagnostic Reagents Market Value (US$ Mn), by Immunoassay Reagents, 2017–2031

Figure 11: Global Diagnostic Reagents Market Value (US$ Mn), by Clinical Chemistry Reagents, 2017–2031

Figure 12: Global Diagnostic Reagents Market Value (US$ Mn), by Flow Cytometry Reagents, 2017–2031

Figure 13: Global Diagnostic Reagents Market Value (US$ Mn), by Cell & Tissue Culture Reagents, 2017–2031

Figure 14: Global Diagnostic Reagents Market Value (US$ Mn), by Hematology & Hematostasis Reagents, 2017–2031

Figure 15: Global Diagnostic Reagents Market Value (US$ Mn), by Microbiology Reagents, 2017–2031

Figure 16: Global Diagnostic Reagents Market Value (US$ Mn), by Others, 2017–2031

Figure 17: Global Diagnostic Reagents Market, by End-user, 2021 and 2031

Figure 18: Global Diagnostic Reagents Market, by End-user, 2022-2031

Figure 19: Global Diagnostic Reagents Market Value (US$ Mn), by Hospital & Diagnostic Laboratories, 2017–2031

Figure 20: Global Diagnostic Reagents Market Value (US$ Mn), by Academic & Research Institutes, 2017–2031

Figure 21: Global Diagnostic Reagents Market Value (US$ Mn), by Others, 2017–2031

Figure 22: Global Diagnostic Reagents Market Value Share Analysis, by Region, 2021 and 2031

Figure 23: Global Diagnostic Reagents Market Attractiveness Analysis, by Region, 2022-2031

Figure 24: North America Diagnostic Reagents Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 25: North America Diagnostic Reagents Market Value Share Analysis, by Country, 2021 and 2031

Figure 26: North America Diagnostic Reagents Market Attractiveness Analysis, by Country, 2022–2031

Figure 27: North America Diagnostic Reagents Market Value Share Analysis, by Product, 2021 and 2031

Figure 28: North America Diagnostic Reagents Market Attractiveness Analysis, by Product, 2022–2031

Figure 29: North America Diagnostic Reagents Market, by End-user, 2021 and 2031

Figure 30: North America Diagnostic Reagents Market Attractiveness Analysis, by End-user, 2022-2031

Figure 31: Europe Diagnostic Reagents Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 32: Europe Diagnostic Reagents Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 33: Europe Diagnostic Reagents Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 34: Europe Diagnostic Reagents Market Value Share Analysis, by Product, 2021 and 2031

Figure 35: Europe Diagnostic Reagents Market Attractiveness Analysis, by Product, 2022–2031

Figure 36: Europe Diagnostic Reagents Market, by End-user, 2021 and 2031

Figure 37: Europe Diagnostic Reagents Market Attractiveness Analysis, by End-user, 2022-2031

Figure 38: Asia Pacific Diagnostic Reagents Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 39: Asia Pacific Diagnostic Reagents Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 40: Asia Pacific Diagnostic Reagents Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 41: Asia Pacific Diagnostic Reagents Market Value Share Analysis, by Product, 2021 and 2031

Figure 42: Asia Pacific Diagnostic Reagents Market Attractiveness Analysis, by Product, 2022–2031

Figure 43: Asia Pacific Diagnostic Reagents Value Share Analysis, by End-user, 2021 and 2031

Figure 44: Asia Pacific Diagnostic Reagents Market Attractiveness Analysis, by End-user, 2022-2031

Figure 45: China Diagnostic Reagents Market Attractiveness Analysis, by Product, 2022–2031

Figure 46: China Diagnostic Reagents Market Value Share Analysis, by Product, 2021 and 2031

Figure 47: China Diagnostic Reagents Market Value Share Analysis, by End-user, 2021 and 2031

Figure 48: China Diagnostic Reagents Market Attractiveness Analysis, by End-user, 2022 - 2031

Figure 49: India Diagnostic Reagents Market Attractiveness Analysis, by Product, 2022–2031

Figure 50: India Diagnostic Reagents Market Value Share Analysis, by Product, 2021 and 2031

Figure 51: India Diagnostic Reagents Market Value Share Analysis, by End-user, 2021 and 2031

Figure 52: India Diagnostic Reagents Market Attractive Analysis, by End-user, 2022-2031

Figure 53: Latin America Diagnostic Reagents Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 54: Latin America Diagnostic Reagents Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 55: Latin America Diagnostic Reagents Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 56: Latin America Diagnostic Reagents Market Value Share Analysis, by Product, 2021 and 2031

Figure 57: Latin America Diagnostic Reagents Market Attractiveness Analysis, by Product, 2022–2031

Figure 58: Latin America Diagnostic Reagents Market, by End-user, 2021 and 2031

Figure 59: Latin America Diagnostic Reagents Market Attractiveness Analysis, by End-user, 2022–2031

Figure 60: Middle East & Africa Diagnostic Reagents Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 61: Middle East & Africa Diagnostic Reagents Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 62: Middle East & Africa Diagnostic Reagents Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 63: Middle East & Africa Diagnostic Reagents Market Value Share Analysis, by Product, 2021 and 2031

Figure 64: Middle East & Africa Diagnostic Reagents Market Attractiveness Analysis, by Product, 2022–2031

Figure 65: Middle East & Africa Diagnostic Reagents Market, by End-user, 2021 and 2031

Figure 66: Middle East & Africa Diagnostic Reagents Market Attractiveness Analysis, by End-user, 2022-2031

Figure 67: Global Chemical Reagents Market Value (US$ Mn) Forecast, 2017–2031

Figure 68: India Chemical Reagents Market Value (US$ Mn) Forecast, 2017–2031

Figure 69: Global Chemical Reagents Market Share Value Analysis- by Chemical Type, 2021

Figure 70: India Chemical Reagents Market Share Value Analysis- by Chemical Type, 2021