Reports

Reports

The in vitro diagnostics (IVD) market globally continues to grow steadily driven by increased prevalence of chronic and infectious disease, increased cognition and demand for earlier and more accurate disease detection, along with rapid advancement in IVD technologies including molecular diagnostics, next-gen sequencing (NGS), and point-of-care testing (POCT). The growing global population and the transition toward personalized medicine will continue to accelerate adoption of IVD testing, especially in oncology, cardiology, and infectious disease domains. Additionally, growing healthcare infrastructure in developing nations and increasing government spending on healthcare diagnostics will spur new growth opportunities. Technology convergence - which includes artificial intelligence, digital platforms, and at home/testing - are reshaping the diagnostic experience, making it faster and more accessible for diagnosis and patient-centred.

While there are considerable growth drivers in the market, there are also challenges. The development and implementation costs of advanced diagnostic tools are high, and regulatory complexity in different regions (i.e. the EU IVDR and the FDA’s regulation of laboratory developed tests) can obstruct smooth market penetration. Limited skilled workforce in certain markets and concerns around data privacy also hamper widespread buy-in. However, these barriers also create opportunities for innovation. There are opportunities in the development of smart, decentralized diagnostic solutions, localizing reagent manufacturing (specifically in Asian markets), and joint collaboration between diagnostics companies and digital health platforms. The analyst view is that while the in vitro diagnostic industry is undergoing restructuring and increased regulation, the long-term outlook remains strong due to the rising clinical demand and continued innovation across the diagnostic value chain.

In vitro diagnostics (IVD) are tests done on samples such as blood or tissue that have been taken from the human body. In vitro diagnostics can detect diseases or other conditions, and can be used to monitor a person's overall health to help cure, treat, or prevent diseases.

In vitro diagnostics also be used in precision medicine to identify patients who are likely to benefit from specific treatments or therapies. These in vitro diagnostics can include next generation sequencing tests, which scan a person’s DNA to detect genomic variations.

Some tests are used in laboratory or other health professional settings and other tests are for consumers to use at home.

IVD is a key player in the broader health care ecosystem, delivering early and effective diagnoses, supporting personalized medicine approaches with specific treatments, and producing various evidence-based treatment approaches. With continued focus on chronic disease, and larger changes in threats to global health (e.g. pandemics), IVD is becoming more important in public health strategies. The industry is changing rapidly and significantly, with multiple advances in automation and miniaturization, digital health, and artificial intelligence increasing accuracy, speed and access to testing especially with point-of-care diagnostics and diagnostics at home. As healthcare changes to more preventive and personalized models, the medical community will associate more strategic value to IVD testing in all global markets.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

An increase in the frequency of chronic and infectious diseases is projected to propel growth in the in-vitro diagnostics (IVD) market in recent years. Chronic diseases such as diabetes, cardiovascular disease, and cancer are becoming more prevalent due to aging populations, sedentary lifestyles, and poor dietary habits. Furthermore, the global infectious disease burden, inclusive of emerging viral infections like COVID-19, along with re-emerging infectious diseases such as tuberculosis and hepatitis, drives the need for early, precise, and rapid diagnostic solutions. As per the data published by Centers for Disease Control and Prevention in October 2024, 6 in 10 Americans are suffering from at least one chronic disease, and 4 in 10 have two or more chronic illnesses. It further states that sexually transmitted infections (STIs) continue to increase in the United States with more than 2.5 million cases of gonorrhea, chlamydia, and syphilis in 2022.

The rising need for rapid and accurate, non-invasive diagnostic instruments offers an impetus to growth of the In-Vitro diagnostics (IVD) market. More number of patients and healthcare providers prefer tests that rapidly and precisely detect disease and are devoid of invasive elements. New technologies now allow for creating tests or diagnostic methods that require small samples of blood or saliva, diagnose in record time, and offer non-invasive testing, thereby causing minimal discomfort.

As reproducible diagnostic results are typically attained, this allows researchers and clinicians to better manage diseases and allow for timely treatment decisions, thereby fostering the adoption of IVD technologies in hospitals, clinics, and in-home testing.

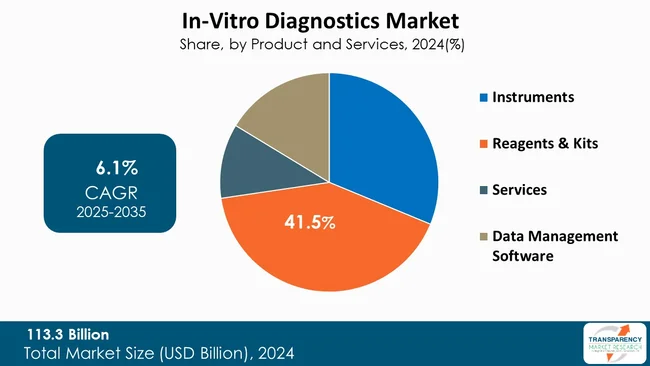

The reagents and kits category significantly contributes in advancing the In Vitro Diagnostics (IVD) market because reagents, in particular, or kits in their entirety, are consumed to perform many diagnostic tests. Reagents, which comprise enzymes, antibodies, buffers, and chemical reagents, are the working substances that respond to the patient samples to produce measurable responses. Kits include reagents and instructions, and often accessories, such as instruments, and are purposefully designed for efficiency and dependability for a laboratory, hospital or even home use.

The increase in demand for diagnostic testing, due to the increase in chronic diseases and infectious diseases, the growth of point-of-care testing, and the acceptance of personalized medicine are all contributing to the greater demand for consumable reagents and kits, either in hospitals, at the point of care, or at home. For example, consumables, especially high-quality reagents, are used regularly and repeatedly in molecular diagnostics and immunoassays; when an instrument is installed, the expected demand for consumables continues afterward. Furthermore, companies are investing significantly to develop kits that are even more sensitive, faster and affordable to meet existing market demands, and further extending growth opportunities in reagents and kits. As testing becomes widespread and decentralized, the reagents and kits category will remain an indispensable component for patients and laboratories to further develop and scale diagnostic services and assuredly, none too soon in trusted and available diagnostic services, no matter where they are around the world

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America is leading the In-Vitro Diagnostics (IVD) market due to its sophisticated healthcare system, speedy uptake of next-generation diagnostic technology, and persistent commitment to research & development funding.

The U.S. is the torchbearer, supported by a vibrant network of diagnostic firms, a strict yet supportive regulatory environment led by the U.S. FDA, and almost universal access to diagnostic services.

A strategic national focus on early detection and preventative healthcare accelerates the upward trajectory of the IVD market, thereby effectively cementing its position as the worldwide benchmark for In-Vitro diagnostic innovation and application.

Siemens Healthineers AG, Abbott, Chembio Diagnostics, Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific, Becton, Dickinson and Company, QIAGEN N.V., Sysmex Corporation, bioMérieux, Devyser, Accelerate Diagnostics, Inc., Caris Life Sciences, Illumina, Inc., Bio-Rad Laboratories, Inc., QuidelOrtho Corporation, Agilent Technologies, Inc., Werfen are the prominent players in the In-Vitro diagnostics market.

Each of these players has been profiled in the In-Vitro diagnostics market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 113.3 Bn |

| Forecast Value in 2035 | More than US$ 216.9 Bn |

| CAGR | 6.1% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Product & Services

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 113.3 Bn in 2024

It is projected to cross US$ 216.9 Bn by the end of 2035

Rising prevalence of chronic and infectious diseases, growing demand for early, accurate, and non-invasive diagnostic tools, and technological advancements in molecular diagnostics and point-of-care testing

It is anticipated to grow at a CAGR of 6.1% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Siemens Healthineers AG, Abbott, Chembio Diagnostics, Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific, Becton, Dickinson and Company, QIAGEN N.V., Sysmex Corporation, bioMérieux, Devyser, Accelerate Diagnostics, Inc., Caris Life Sciences, Illumina, Inc., Bio-Rad Laboratories, Inc., QuidelOrtho Corporation, Agilent Technologies, Inc., Werfen, and other prominent players

Table 01: Global In-Vitro Diagnostics Market Value (US$ Bn) Forecast, By Product & Services, 2020 to 2035

Table 02: Global In-Vitro Diagnostics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 03: Global In-Vitro Diagnostics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 04: Global In-Vitro Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 05: Global In-Vitro Diagnostics Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 07: North America - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, By Product & Services, 2020 to 2035

Table 08: North America - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 09: North America - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 10: North America - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020-2036

Table 11: Europe - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 12: Europe - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, By Product & Services, 2020 to 2035

Table 13: Europe - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 14: Europe - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 15: Europe - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 16: Asia Pacific - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 17: Asia Pacific - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, By Product & Services, 2020 to 2035

Table 18: Asia Pacific - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 19: Asia Pacific - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 20: Asia Pacific - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 21: Latin America - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 22: Latin America - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, By Product & Services, 2020 to 2035

Table 23: Latin America - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 24: Latin America - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 25: Latin America - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 26: Middle East & Africa - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 27: Middle East & Africa - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, By Product & Services, 2020 to 2035

Table 28: Middle East & Africa - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, by Technology, 2020 to 2035

Table 29: Middle East & Africa - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 30: Middle East & Africa - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global In-Vitro Diagnostics Market Value Share Analysis, By Product & Services, 2024 and 2035

Figure 02: Global In-Vitro Diagnostics Market Attractiveness Analysis, By Product & Services, 2025 to 2035

Figure 03: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Instruments, 2020 to 2035

Figure 04: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Reagents & Kits, 2020 to 2035

Figure 05: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Services, 2020 to 2035

Figure 06: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Data Management Software, 2020 to 2035

Figure 07: Global In-Vitro Diagnostics Market Value Share Analysis, by Technology, 2024 and 2035

Figure 08: Global In-Vitro Diagnostics Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 09: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Immunoassay, 2020 to 2035

Figure 10: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Clinical Chemistry, 2020 to 2035

Figure 11: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Molecular Diagnostics, 2020 to 2035

Figure 12: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Hematology, 2020 to 2035

Figure 13: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Coagulation & Hematostatis, 2020 to 2035

Figure 14: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Microbiology, 2020 to 2035

Figure 15: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Urinalysis, 2020 to 2035

Figure 16: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 17: Global In-Vitro Diagnostics Market Value Share Analysis, by Application, 2024 and 2035

Figure 18: Global In-Vitro Diagnostics Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 19: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Oncology, 2020 to 2035

Figure 20: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Infectious Diseases, 2020 to 2035

Figure 21: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Diabetes, 2020 to 2035

Figure 22: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Cardiology, 2020 to 2035

Figure 23: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Nephrology, 2020 to 2035

Figure 24: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Drug Testing/pharmacogenomics, 2020 to 2035

Figure 25: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Autoimmune Diseases, 2020 to 2035

Figure 26: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 27: Global In-Vitro Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 28: Global In-Vitro Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 29: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Hospital laboratories, 2020 to 2035

Figure 30: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Point-of-Care Testing Centers, 2020 to 2035

Figure 31: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Academic Institutes, 2020 to 2035

Figure 32: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Clinical laboratories, 2020 to 2035

Figure 33: Global In-Vitro Diagnostics Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 34: Global In-Vitro Diagnostics Market Value Share Analysis, By Region, 2024 and 2035

Figure 35: Global In-Vitro Diagnostics Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 36: North America - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 37: North America - In-Vitro Diagnostics Market Value Share Analysis, by Country, 2024 and 2035

Figure 38: North America - In-Vitro Diagnostics Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 39: North America - In-Vitro Diagnostics Market Value Share Analysis, By Product & Services, 2024 and 2035

Figure 40: North America - In-Vitro Diagnostics Market Attractiveness Analysis, By Product & Services, 2025 to 2035

Figure 41: North America - In-Vitro Diagnostics Market Value Share Analysis, by Technology, 2024 and 2035

Figure 42: North America - In-Vitro Diagnostics Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 43: North America - In-Vitro Diagnostics Market Value Share Analysis, by Application, 2024 and 2035

Figure 44: North America - In-Vitro Diagnostics Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 45: North America - In-Vitro Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 46: North America - In-Vitro Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 47: Europe - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 48: Europe - In-Vitro Diagnostics Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 49: Europe - In-Vitro Diagnostics Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 50: Europe - In-Vitro Diagnostics Market Value Share Analysis, By Product & Services, 2024 and 2035

Figure 51: Europe - In-Vitro Diagnostics Market Attractiveness Analysis, By Product & Services, 2025 to 2035

Figure 52: Europe - In-Vitro Diagnostics Market Value Share Analysis, by Technology, 2024 and 2035

Figure 53: Europe - In-Vitro Diagnostics Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 54: Europe - In-Vitro Diagnostics Market Value Share Analysis, by Application, 2024 and 2035

Figure 55: Europe - In-Vitro Diagnostics Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 56: Europe - In-Vitro Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 57: Europe - In-Vitro Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 58: Asia Pacific - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 59: Asia Pacific - In-Vitro Diagnostics Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 60: Asia Pacific - In-Vitro Diagnostics Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 61: Asia Pacific - In-Vitro Diagnostics Market Value Share Analysis, By Product & Services, 2024 and 2035

Figure 62: Asia Pacific - In-Vitro Diagnostics Market Attractiveness Analysis, By Product & Services, 2025 to 2035

Figure 63: Asia Pacific - In-Vitro Diagnostics Market Value Share Analysis, by Technology, 2024 and 2035

Figure 64: Asia Pacific - In-Vitro Diagnostics Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 65: Asia Pacific - In-Vitro Diagnostics Market Value Share Analysis, by Application, 2024 and 2035

Figure 66: Asia Pacific - In-Vitro Diagnostics Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 67: Asia Pacific - In-Vitro Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 68: Asia Pacific - In-Vitro Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 69: Latin America - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 70: Latin America - In-Vitro Diagnostics Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 71: Latin America - In-Vitro Diagnostics Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 72: Latin America - In-Vitro Diagnostics Market Value Share Analysis, By Product & Services, 2024 and 2035

Figure 73: Latin America - In-Vitro Diagnostics Market Attractiveness Analysis, By Product & Services, 2025 to 2035

Figure 74: Latin America - In-Vitro Diagnostics Market Value Share Analysis, by Technology, 2024 and 2035

Figure 75: Latin America - In-Vitro Diagnostics Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 76: Latin America - In-Vitro Diagnostics Market Value Share Analysis, by Application, 2024 and 2035

Figure 77: Latin America - In-Vitro Diagnostics Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 78: Latin America - In-Vitro Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 79: Latin America - In-Vitro Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 80: Middle East & Africa - In-Vitro Diagnostics Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 81: Middle East & Africa - In-Vitro Diagnostics Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 82: Middle East & Africa - In-Vitro Diagnostics Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 83: Latin America - In-Vitro Diagnostics Market Value Share Analysis, By Product & Services, 2024 and 2035

Figure 84: Latin America - In-Vitro Diagnostics Market Attractiveness Analysis, By Product & Services, 2025 to 2035

Figure 85: Latin America - In-Vitro Diagnostics Market Value Share Analysis, by Technology, 2024 and 2035

Figure 86: Latin America - In-Vitro Diagnostics Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 87: Latin America - In-Vitro Diagnostics Market Value Share Analysis, by Application, 2024 and 2035

Figure 88: Latin America - In-Vitro Diagnostics Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 89: Latin America - In-Vitro Diagnostics Market Value Share Analysis, By End-user, 2024 and 2035

Figure 90: Latin America - In-Vitro Diagnostics Market Attractiveness Analysis, By End-user, 2025 to 2035