Reports

Reports

Analysts’ Viewpoint on Market Scenario

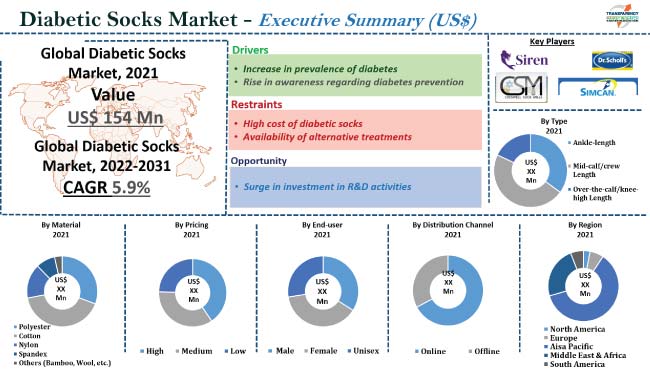

Increase in prevalence of diabetes and rise in awareness regarding diabetes management are driving the global diabetic socks market. Diabetic socks improve blood circulation, keep feet warm and dry, and prevent the risk of foot injury. Smart diabetes management is gaining traction among the populace. This is boosting the preference for socks that cater to diabetic needs instead of mainstream socks. Compression socks with diabetes-specific features can aid in the management of diabetic neuropathy.

Prominent companies operating in the market are investing in R&D activities to expand their revenue streams. They are also fueling their export volumes to enhance their market share.

Diabetic socks are close-fitting, non-binding socks that relieve pressure on the foot or leg. People with diabetes suffer from high blood sugar levels and increased risk of foot ulcers. They have poor circulation and experience swelling in the feet or legs. Diabetic compression socks are available in different types such as mid-calf length, over-the-calf length, and diabetic ankle socks.

Diabetes patients are more likely to develop neuropathy, vascular diseases, and infections, particularly in the legs. Thus, neuropathy socks and footwear are essential, as they lessen or remove pressure or hotspots. Diabetic socks for men have loose fitting non-binding tops that maximize blood flow to the legs. Best diabetic socks for women are made with soft fibers such as bamboo or wool.

Diabetes is a global public health concern. Rapid urbanization, nutrition shift, and sedentary lifestyle are major factors that increase the risk of diabetes. According to the World Health Organization (WHO), 8.5% of people aged 18 years and above were diagnosed with diabetes in 2014. Diabetes was the direct cause of 1.5 million fatalities in 2019, with 48% of all diabetes-related deaths occurring before the age of 70 years. Another 460,000 kidney disease deaths were caused by diabetes, whereas higher blood glucose levels led to 20% of cardiovascular deaths. There was a 3% increase in age-standardized mortality rates from diabetes from 2000 to 2019. Mortality rate due to diabetes has increased by 13% in lower-middle-income countries.

Increase in awareness about diabetes and related complications has led to a rise in demand for products that can help avoid or manage the illness. Diabetes socks provide comfort and support for individuals. These socks are gaining popularity, as people are becoming more aware of the need for specialist footwear in diabetes management.

Various organizations are undertaking awareness programs for diabetes prevention. In April 2021, the WHO launched the Global Diabetes Compact, a global project aimed at long-term improvements in diabetes prevention and care, with a special emphasis on low- and middle-income nations. The program brings together all stakeholders to work toward a common goal of lowering the risk of diabetes and ensuring that all persons diagnosed with diabetes get fair, comprehensive, inexpensive, and high-quality treatment.

In terms of material, the global diabetic socks industry has been segmented into polyester, cotton, nylon, spandex, and others. The cotton segment dominated the global market in 2021. It is expected to maintain its position during the forecast period. Cotton is used in manufacturing lightweight diabetic socks. It has an excellent moisture-absorbing ability. Cotton diabetic socks are breathable, washable, and long-lasting. Cotton is usually combined with nylon, a non-absorbent material, to boost its moisture-absorbing ability. Demand for socks made from wool is also projected to be high during the forecast period.

Based on distribution channel, the global diabetic socks market has been bifurcated into online and offline. The offline segment accounted for major share of the global market in 2021. The segment is further subdivided into mega retail stores, specialty stores, and others (individual stores, departmental stores, etc.).

The online segment is expected to grow at a significant rate in the next few years due to the rapid expansion of the e-commerce sector. Consumers are increasingly shifting toward online shopping owing to discount offers and the availability of various products. Thus, top diabetic socks manufacturers are collaborating with e-commerce companies to increase their consumer base.

Asia Pacific dominated the global diabetic socks market in 2021. The market in the region is likely to grow at the fastest CAGR during the forecast period. High prevalence of diabetes and increase in disposable income are driving the market in the region. The market size in North America is anticipated to grow at a significant CAGR in the next few years due to the surge in awareness regarding diabetes management in the region.

The global diabetic socks market is consolidated, with a few large-scale vendors controlling majority of the share. Most of the firms are investing significantly in comprehensive R&D activities to develop environment-friendly products. Expansion of product portfolios and mergers & acquisitions are major strategies adopted by key players. BSN Medical GmbH, Therafirm, Sigvaris Group, Simcan Enterprises Inc., Siren, Intersocks S.R.L., Thorlo Inc., Cupron, Inc., Cresswell Sock Mills, and Scholl’s Wellness Co. are prominent entities operating in this market.

Key players have been profiled in the diabetic socks market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 154.0 Mn |

|

Market Forecast Value in 2031 |

US$ 268.2 Mn |

|

Growth Rate (CAGR) |

5.9% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value & Thousand Units for Volume |

|

Market Analysis |

Includes cross-segment analysis at the region as well as country level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market stood at US$ 154.0 Mn in 2021

The market is estimated to grow at a CAGR of 5.9% during 2022-2031

The global industry is likely to reach US$ 268.2 Mn by 2031

The cotton segment is expected to grow at the highest CAGR during the forecast period

The market in Asia Pacific is expected to record the highest CAGR during the forecast period

Rise in prevalence of diabetes and surge in awareness regarding diabetes prevention

BSN Medical GmbH, Therafirm, Sigvaris Group, Simcan Enterprises Inc., Siren, Intersocks S.R.L., Thorlo Inc., Cupron, Inc., Cresswell Sock Mills, and Scholl’s Wellness Co.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overall Socks Industry Overview

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.6.1. Managing Supply Chain Risk and Disruption – Considering Impact of COVID-19

5.7. Industry SWOT Analysis

5.8. Prevalence of Diabetes

5.9. Key Trends Analysis

5.9.1. Supplier Side

5.9.2. Demand Side

5.10. Diabetic Socks Market Analysis and Forecast, 2017-2031

5.10.1. Market Revenue Projections (US$ Mn)

5.10.2. Market Volume Projections (Thousand Units)

6. Global Diabetic Socks Market Analysis and Forecast, By Type

6.1. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Type, 2017-2031

6.1.1. Ankle-length

6.1.2. Mid-calf/crew Length

6.1.3. Over-the-calf/knee-high Length

6.2. Incremental Opportunity, By Type

7. Global Diabetic Socks Market Analysis and Forecast, By Material

7.1. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Material, 2017-2031

7.1.1. Polyester

7.1.2. Cotton

7.1.3. Nylon

7.1.4. Spandex

7.1.5. Others (Bamboo, Wool, etc.)

7.2. Incremental Opportunity, By Material

8. Global Diabetic Socks Market Analysis and Forecast, By Pricing

8.1. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Pricing, 2017-2031

8.1.1. High

8.1.2. Medium

8.1.3. Low

8.2. Incremental Opportunity, By Pricing

9. Global Diabetic Socks Market Analysis and Forecast, By End-user

9.1. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By End-user, 2017-2031

9.1.1. Male

9.1.2. Female

9.1.3. Unisex

9.2. Incremental Opportunity, By End-user

10. Global Diabetic Socks Market Analysis and Forecast, By Distribution Channel

10.1. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Distribution Channel, 2017-2031

10.1.1. Online

10.1.1.1. Company Website

10.1.1.2. E-commerce Website

10.1.2. Offline

10.1.2.1. Mega Retail Stores

10.1.2.2. Specialty Stores

10.1.2.3. Others (Individual Stores, Departmental Stores, etc.)

10.2. Incremental Opportunity, By Distribution Channel

11. Global Diabetic Socks Market Analysis and Forecast, By Region

11.1. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Region, 2017-2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, By Region

12. North America Diabetic Socks Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Trends Analysis

12.2.1. Supplier Side

12.2.2. Demand Side

12.3. COVID-19 Impact Analysis

12.4. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Type, 2017-2031

12.4.1. Ankle-length

12.4.2. Mid-calf/crew Length

12.4.3. Over-the-calf/knee-high Length

12.5. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Material, 2017-2031

12.5.1. Polyester

12.5.2. Cotton

12.5.3. Nylon

12.5.4. Spandex

12.5.5. Others (Bamboo, Wool, etc.)

12.6. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Pricing, 2017-2031

12.6.1. High

12.6.2. Medium

12.6.3. Low

12.7. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By End-user, 2017-2031

12.7.1. Male

12.7.2. Female

12.7.3. Unisex

12.8. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Distribution Channel, 2017-2031

12.8.1. Online

12.8.1.1. Company Website

12.8.1.2. E-commerce Website

12.8.2. Offline

12.8.2.1. Mega Retail Stores

12.8.2.2. Specialty Stores

12.8.2.3. Others (Individual Stores, Departmental Stores, etc.)

12.9. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Country, 2017-2031

12.9.1. U.S.

12.9.2. Canada

12.9.3. Rest of North America

12.10. Incremental Opportunity Analysis

13. Europe Diabetic Socks Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Trends Analysis

13.2.1. Supplier Side

13.2.2. Demand Side

13.3. COVID-19 Impact Analysis

13.4. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Type, 2017-2031

13.4.1. Ankle-length

13.4.2. Mid-calf/crew Length

13.4.3. Over-the-calf/knee-high Length

13.5. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Material, 2017-2031

13.5.1. Polyester

13.5.2. Cotton

13.5.3. Nylon

13.5.4. Spandex

13.5.5. Others (Bamboo, Wool, etc.)

13.6. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Pricing, 2017-2031

13.6.1. High

13.6.2. Medium

13.6.3. Low

13.7. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By End-user, 2017-2031

13.7.1. Male

13.7.2. Female

13.7.3. Unisex

13.8. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Distribution Channel, 2017-2031

13.8.1. Online

13.8.1.1. Company Website

13.8.1.2. E-commerce Website

13.8.2. Offline

13.8.2.1. Mega Retail Stores

13.8.2.2. Specialty Stores

13.8.2.3. Others (Individual Stores, Departmental Stores, etc.)

13.9. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Country, 2017-2031

13.9.1. U.K.

13.9.2. Germany

13.9.3. France

13.9.4. Rest of Europe

13.10. Incremental Opportunity Analysis

14. Asia Pacific Diabetic Socks Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Trends Analysis

14.2.1. Supplier Side

14.2.2. Demand Side

14.3. COVID-19 Impact Analysis

14.4. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Type, 2017-2031

14.4.1. Ankle-length

14.4.2. Mid-calf/crew Length

14.4.3. Over-the-calf/knee-high Length

14.5. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Material, 2017-2031

14.5.1. Polyester

14.5.2. Cotton

14.5.3. Nylon

14.5.4. Spandex

14.5.5. Others (Bamboo, Wool, etc.)

14.6. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Pricing, 2017-2031

14.6.1. High

14.6.2. Medium

14.6.3. Low

14.7. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By End-user, 2017-2031

14.7.1. Male

14.7.2. Female

14.7.3. Unisex

14.8. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Distribution Channel, 2017-2031

14.8.1. Online

14.8.1.1. Company Website

14.8.1.2. E-commerce Website

14.8.2. Offline

14.8.2.1. Mega Retail Stores

14.8.2.2. Specialty Stores

14.8.2.3. Others (Individual Stores, Departmental Stores, etc.)

14.9. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Country, 2017-2031

14.9.1. China

14.9.2. India

14.9.3. Japan

14.9.4. Rest of Asia Pacific

14.10. Incremental Opportunity Analysis

15. Middle East & Africa Diabetic Socks Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Trends Analysis

15.2.1. Supplier Side

15.2.2. Demand Side

15.3. COVID-19 Impact Analysis

15.4. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Type, 2017-2031

15.4.1. Ankle-length

15.4.2. Mid-calf/crew Length

15.4.3. Over-the-calf/knee-high Length

15.5. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Material, 2017-2031

15.5.1. Polyester

15.5.2. Cotton

15.5.3. Nylon

15.5.4. Spandex

15.5.5. Others (Bamboo, Wool, etc.)

15.6. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Pricing, 2017-2031

15.6.1. High

15.6.2. Medium

15.6.3. Low

15.7. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By End-user, 2017-2031

15.7.1. Male

15.7.2. Female

15.7.3. Unisex

15.8. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Distribution Channel, 2017-2031

15.8.1. Online

15.8.1.1. Company Website

15.8.1.2. E-commerce Website

15.8.2. Offline

15.8.2.1. Mega Retail Stores

15.8.2.2. Specialty Stores

15.8.2.3. Others (Individual Stores, Departmental Stores, etc.)

15.9. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Country, 2017-2031

15.9.1. GCC

15.9.2. South Africa

15.9.3. Rest of Middle East & Africa

15.10. Incremental Opportunity Analysis

16. South America Diabetic Socks Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Key Trends Analysis

16.2.1. Supplier Side

16.2.2. Demand Side

16.3. COVID-19 Impact Analysis

16.4. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Type, 2017-2031

16.4.1. Ankle-length

16.4.2. Mid-calf/crew Length

16.4.3. Over-the-calf/knee-high Length

16.5. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Material, 2017-2031

16.5.1. Polyester

16.5.2. Cotton

16.5.3. Nylon

16.5.4. Spandex

16.5.5. Others (Bamboo, Wool, etc.)

16.6. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Pricing, 2017-2031

16.6.1. High

16.6.2. Medium

16.6.3. Low

16.7. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By End-user, 2017-2031

16.7.1. Male

16.7.2. Female

16.7.3. Unisex

16.8. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Distribution Channel, 2017-2031

16.8.1. Online

16.8.1.1. Company Website

16.8.1.2. E-commerce Website

16.8.2. Offline

16.8.2.1. Mega Retail Stores

16.8.2.2. Specialty Stores

16.8.2.3. Others (Individual Stores, Departmental Stores, etc.)

16.9. Diabetic Socks Market Size (US$ Mn & Thousand Units) Forecast, By Country, 2017-2031

16.9.1. Brazil

16.9.2. Rest of South America

16.10. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Market Player – Competition Dashboard

17.2. Market Revenue Share Analysis (%), by Company, (2019)

17.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

17.3.1. BSN Medical GmbH

17.3.1.1. Company Overview

17.3.1.2. Sales Area/Geographical Presence

17.3.1.3. Revenue

17.3.1.4. Strategy & Business Overview

17.3.2. Cresswell Sock Mills

17.3.2.1. Company Overview

17.3.2.2. Sales Area/Geographical Presence

17.3.2.3. Revenue

17.3.2.4. Strategy & Business Overview

17.3.3. Cupron, Inc.

17.3.3.1. Company Overview

17.3.3.2. Sales Area/Geographical Presence

17.3.3.3. Revenue

17.3.3.4. Strategy & Business Overview

17.3.4. Intersocks S.R.L

17.3.4.1. Company Overview

17.3.4.2. Sales Area/Geographical Presence

17.3.4.3. Revenue

17.3.4.4. Strategy & Business Overview

17.3.5. Scholl’s Wellness Co.

17.3.5.1. Company Overview

17.3.5.2. Sales Area/Geographical Presence

17.3.5.3. Revenue

17.3.5.4. Strategy & Business Overview

17.3.6. Sigvaris Group

17.3.6.1. Company Overview

17.3.6.2. Sales Area/Geographical Presence

17.3.6.3. Revenue

17.3.6.4. Strategy & Business Overview

17.3.7. Simcan Enterprises Inc.

17.3.7.1. Company Overview

17.3.7.2. Sales Area/Geographical Presence

17.3.7.3. Revenue

17.3.7.4. Strategy & Business Overview

17.3.8. Siren

17.3.8.1. Company Overview

17.3.8.2. Sales Area/Geographical Presence

17.3.8.3. Revenue

17.3.8.4. Strategy & Business Overview

17.3.9. Therafirm

17.3.9.1. Company Overview

17.3.9.2. Sales Area/Geographical Presence

17.3.9.3. Revenue

17.3.9.4. Strategy & Business Overview

17.3.10. Thorlo Inc.

17.3.10.1. Company Overview

17.3.10.2. Sales Area/Geographical Presence

17.3.10.3. Revenue

17.3.10.4. Strategy & Business Overview

18. Key Takeaway

18.1. Identification of Potential Market Spaces

18.1.1. Type

18.1.2. Material

18.1.3. Pricing

18.1.4. End-user

18.1.5. Distribution Channel

18.1.6. Geography

18.2. Understanding the Buying Process of the Customers

18.2.1. Preferred Type

18.2.2. Preferred Sales Channels

18.2.3. Target Audience

18.3. Prevailing Market Risks

List of Table

Table 1: Global Diabetic Socks Market Value, by Type, US$ Mn, 2017-2031

Table 2: Global Diabetic Socks Market Volume, by Type, Thousand Units,2017-2031

Table 3: Global Diabetic Socks Market Value, by Material, US$ Mn, 2017-2031

Table 4: Global Diabetic Socks Market Volume, by Material, Thousand Units,2017-2031

Table 5: Global Diabetic Socks Market Value, by Pricing, US$ Mn, 2017-2031

Table 6: Global Diabetic Socks Market Volume, by Pricing, Thousand Units,2017-2031

Table 7: Global Diabetic Socks Market Value, By End-user, US$ Mn, 2017-2031

Table 8: Global Diabetic Socks Market Volume, By End-user, Thousand Units,2017-2031

Table 9: Global Diabetic Socks Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 10: Global Diabetic Socks Market Volume, by Distribution Channel, Thousand Units,2017-2031

Table 11: Global Diabetic Socks Market Value, by Region, US$ Mn, 2017-2031

Table 12: Global Diabetic Socks Market Volume, by Region, Thousand Units,2017-2031

Table 13: North America Diabetic Socks Market Value, by Type, US$ Mn, 2017-2031

Table 14: North America Diabetic Socks Market Volume, by Type, Thousand Units,2017-2031

Table 15: North America Diabetic Socks Market Value, by Material, US$ Mn, 2017-2031

Table 16: North America Diabetic Socks Market Volume, by Material, Thousand Units,2017-2031

Table 17: North America Diabetic Socks Market Value, by Pricing, US$ Mn, 2017-2031

Table 18: North America Diabetic Socks Market Volume, by Pricing, Thousand Units,2017-2031

Table 19: North America Diabetic Socks Market Value, By End-user, US$ Mn, 2017-2031

Table 20: North America Diabetic Socks Market Volume, By End-user, Thousand Units,2017-2031

Table 21: North America Diabetic Socks Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 22: North America Diabetic Socks Market Volume, by Distribution Channel, Thousand Units,2017-2031

Table 23: North America Diabetic Socks Market Value, by Country, US$ Mn, 2017-2031

Table 24: North America Diabetic Socks Market Volume, by Country, Thousand Units,2017-2031

Table 25: Europe Diabetic Socks Market Value, by Type, US$ Mn, 2017-2031

Table 26: Europe Diabetic Socks Market Volume, by Type, Thousand Units,2017-2031

Table 27: Europe Diabetic Socks Market Value, by Material, US$ Mn, 2017-2031

Table 28: Europe Diabetic Socks Market Volume, by Material, Thousand Units,2017-2031

Table 29: Europe Diabetic Socks Market Value, by Pricing, US$ Mn, 2017-2031

Table 30: Europe Diabetic Socks Market Volume, by Pricing, Thousand Units,2017-2031

Table 31: Europe Diabetic Socks Market Value, By End-user, US$ Mn, 2017-2031

Table 32: Europe Diabetic Socks Market Volume, By End-user, Thousand Units,2017-2031

Table 33: Europe Diabetic Socks Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 34: Europe Diabetic Socks Market Volume, by Distribution Channel, Thousand Units,2017-2031

Table 35: Europe Diabetic Socks Market Value, by Country, US$ Mn, 2017-2031

Table 36: Europe Diabetic Socks Market Volume, by Country, Thousand Units,2017-2031

Table 37: Asia Pacific Diabetic Socks Market Value, by Type, US$ Mn, 2017-2031

Table 40: Asia Pacific Diabetic Socks Market Volume, by Material, Thousand Units,2017-2031

Table 41: Asia Pacific Diabetic Socks Market Value, by Pricing, US$ Mn, 2017-2031

Table 42: Asia Pacific Diabetic Socks Market Volume, by Pricing, Thousand Units,2017-2031

Table 43: Asia Pacific Diabetic Socks Market Value, By End-user, US$ Mn, 2017-2031

Table 44: Asia Pacific Diabetic Socks Market Volume, By End-user, Thousand Units,2017-2031

Table 45: Asia Pacific Diabetic Socks Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 46: Asia Pacific Diabetic Socks Market Volume, by Distribution Channel, Thousand Units,2017-2031

Table 47: Asia Pacific Diabetic Socks Market Value, by Country, US$ Mn, 2017-2031

Table 48: Asia Pacific Diabetic Socks Market Volume, by Country, Thousand Units,2017-2031

Table 49: Middle East & Africa Diabetic Socks Market Value, by Type, US$ Mn, 2017-2031

Table 50: Middle East & Africa Diabetic Socks Market Volume, by Type, Thousand Units,2017-2031

Table 51: Middle East & Africa Diabetic Socks Market Value, by Material, US$ Mn, 2017-2031

Table 52: Middle East & Africa Diabetic Socks Market Volume, by Material, Thousand Units,2017-2031

Table 53: Middle East & Africa Diabetic Socks Market Value, by Pricing, US$ Mn, 2017-2031

Table 54: Middle East & Africa Diabetic Socks Market Volume, by Pricing, Thousand Units,2017-2031

Table 55: Middle East & Africa Diabetic Socks Market Value, By End-user, US$ Mn, 2017-2031

Table 56: Middle East & Africa Diabetic Socks Market Volume, By End-user, Thousand Units,2017-2031

Table 57: Middle East & Africa Diabetic Socks Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 58: Middle East & Africa Diabetic Socks Market Volume, by Distribution Channel, Thousand Units,2017-2031

Table 59: Middle East & Africa Diabetic Socks Market Value, by Country, US$ Mn, 2017-2031

Table 60: Middle East & Africa Diabetic Socks Market Volume, by Country, Thousand Units,2017-2031

Table 61: South America Diabetic Socks Market Value, by Type, US$ Mn, 2017-2031

Table 62: South America Diabetic Socks Market Volume, by Type, Thousand Units,2017-2031

Table 63: South America Diabetic Socks Market Value, by Material, US$ Mn, 2017-2031

Table 64: South America Diabetic Socks Market Volume, by Material, Thousand Units,2017-2031

Table 65: South America Diabetic Socks Market Value, by Pricing, US$ Mn, 2017-2031

Table 66: South America Diabetic Socks Market Volume, by Pricing, Thousand Units,2017-2031

Table 67: South America Diabetic Socks Market Value, By End-user, US$ Mn, 2017-2031

Table 68: South America Diabetic Socks Market Volume, By End-user, Thousand Units,2017-2031

Table 69: South America Diabetic Socks Market Value, by Distribution Channel, US$ Mn, 2017-2031

Table 70: South America Diabetic Socks Market Volume, by Distribution Channel, Thousand Units,2017-2031

Table 71: South America Diabetic Socks Market Value, by Country, US$ Mn, 2017-2031

Table 72: South America Diabetic Socks Market Volume, by Country, Thousand Units,2017-2031

List of Figures

Figure 1: Global Diabetic Socks Market Value, by Type, US$ Mn, 2017-2031

Figure 2: Global Diabetic Socks Market Volume, by Type, Thousand Units,2017-2031

Figure 3: Global Diabetic Socks Market Incremental Opportunity, by Type, 2021-2031

Figure 4: Global Diabetic Socks Market Value, by Material, US$ Mn, 2017-2031

Figure 5: Global Diabetic Socks Market Volume, by Material, Thousand Units,2017-2031

Figure 6: Global Diabetic Socks Market Incremental Opportunity, by Material, 2021-2031

Figure 7: Global Diabetic Socks Market Value, by Pricing, US$ Mn, 2017-2031

Figure 8: Global Diabetic Socks Market Volume, by Pricing, Thousand Units,2017-2031

Figure 9: Global Diabetic Socks Market Incremental Opportunity, by Pricing, 2021-2031

Figure 10: Global Diabetic Socks Market Value, By End-user, US$ Mn, 2017-2031

Figure 11: Global Diabetic Socks Market Volume, By End-user, Thousand Units,2017-2031

Figure 12: Global Diabetic Socks Market Incremental Opportunity, By End-user, 2021-2031

Figure 13: Global Diabetic Socks Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 14: Global Diabetic Socks Market Volume, by Distribution Channel, Thousand Units,2017-2031

Figure 15: Global Diabetic Socks Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 16: Global Diabetic Socks Market Value, by Region, US$ Mn, 2017-2031

Figure 17: Global Diabetic Socks Market Volume, by Region, Thousand Units,2017-2031

Figure 18: Global Diabetic Socks Market Incremental Opportunity, by Region,2021-2031

Figure 19: North America Diabetic Socks Market Value, by Type, US$ Mn, 2017-2031

Figure 20: North America Diabetic Socks Market Volume, by Type, Thousand Units,2017-2031

Figure 21: North America Diabetic Socks Market Incremental Opportunity, by Type, 2021-2031

Figure 22: North America Diabetic Socks Market Value, by Material, US$ Mn, 2017-2031

Figure 23: North America Diabetic Socks Market Volume, by Material, Thousand Units,2017-2031

Figure 24: North America Diabetic Socks Market Incremental Opportunity, by Material, 2021-2031

Figure 25: North America Diabetic Socks Market Value, by Pricing, US$ Mn, 2017-2031

Figure 26: North America Diabetic Socks Market Volume, by Pricing, Thousand Units,2017-2031

Figure 27: North America Diabetic Socks Market Incremental Opportunity, by Pricing, 2021-2031

Figure 28: North America Diabetic Socks Market Value, By End-user, US$ Mn, 2017-2031

Figure 29: North America Diabetic Socks Market Volume, By End-user, Thousand Units,2017-2031

Figure 30: North America Diabetic Socks Market Incremental Opportunity, By End-user, 2021-2031

Figure 31: North America Diabetic Socks Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 32: North America Diabetic Socks Market Volume, by Distribution Channel, Thousand Units,2017-2031

Figure 33: North America Diabetic Socks Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 34: North America Diabetic Socks Market Value, by Country, US$ Mn, 2017-2031

Figure 35: North America Diabetic Socks Market Volume, by Country, Thousand Units,2017-2031

Figure 36: North America Diabetic Socks Market Incremental Opportunity, by Country, 2021-2031

Figure 37: Europe Diabetic Socks Market Value, by Type, US$ Mn, 2017-2031

Figure 38: Europe Diabetic Socks Market Volume, by Type, Thousand Units,2017-2031

Figure 39: Europe Diabetic Socks Market Incremental Opportunity, by Type, 2021-2031

Figure 40: Europe Diabetic Socks Market Value, by Material, US$ Mn, 2017-2031

Figure 41: Europe Diabetic Socks Market Volume, by Material, Thousand Units,2017-2031

Figure 42: Europe Diabetic Socks Market Incremental Opportunity, by Material, 2021-2031

Figure 43: Europe Diabetic Socks Market Value, by Pricing, US$ Mn, 2017-2031

Figure 44: Europe Diabetic Socks Market Volume, by Pricing, Thousand Units,2017-2031

Figure 45: Europe Diabetic Socks Market Incremental Opportunity, by Pricing, 2021-2031

Figure 46: Europe Diabetic Socks Market Value, By End-user, US$ Mn, 2017-2031

Figure 47: Europe Diabetic Socks Market Volume, By End-user, Thousand Units,2017-2031

Figure 48: Europe Diabetic Socks Market Incremental Opportunity, By End-user, 2021-2031

Figure 49: Europe Diabetic Socks Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 50: Europe Diabetic Socks Market Volume, by Distribution Channel, Thousand Units,2017-2031

Figure 51: Europe Diabetic Socks Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 52: Asia Pacific Diabetic Socks Market Value, by Type, US$ Mn, 2017-2031

Figure 53: Asia Pacific Diabetic Socks Market Volume, by Type, Thousand Units,2017-2031

Figure 54: Asia Pacific Diabetic Socks Market Incremental Opportunity, by Type, 2021-2031

Figure 55: Asia Pacific Diabetic Socks Market Value, by Material, US$ Mn, 2017-2031

Figure 56: Asia Pacific Diabetic Socks Market Volume, by Material, Thousand Units,2017-2031

Figure 57: Asia Pacific Diabetic Socks Market Incremental Opportunity, by Material, 2021-2031

Figure 58: Asia Pacific Diabetic Socks Market Value, by Pricing, US$ Mn, 2017-2031

Figure 59: Asia Pacific Diabetic Socks Market Volume, by Pricing, Thousand Units,2017-2031

Figure 60: Asia Pacific Diabetic Socks Market Incremental Opportunity, by Pricing, 2021-2031

Figure 61: Asia Pacific Diabetic Socks Market Value, By End-user, US$ Mn, 2017-2031

Figure 62: Asia Pacific Diabetic Socks Market Volume, By End-user, Thousand Units,2017-2031

Figure 63: Asia Pacific Diabetic Socks Market Incremental Opportunity, By End-user, 2021-2031

Figure 64: Asia Pacific Diabetic Socks Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 65: Asia Pacific Diabetic Socks Market Volume, by Distribution Channel, Thousand Units,2017-2031

Figure 66: Asia Pacific Diabetic Socks Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 67: Asia Pacific Diabetic Socks Market Value, by Country, US$ Mn, 2017-2031

Figure 68: Asia Pacific Diabetic Socks Market Volume, by Country, Thousand Units,2017-2031

Figure 69: Asia Pacific Diabetic Socks Market Incremental Opportunity, by Country, 2021-2031

Figure 70: Middle East & Africa Diabetic Socks Market Value, by Type, US$ Mn, 2017-2031

Figure 71: Middle East & Africa Diabetic Socks Market Volume, by Type, Thousand Units,2017-2031

Figure 72: Middle East & Africa Diabetic Socks Market Incremental Opportunity, by Type, 2021-2031

Figure 73: Middle East & Africa Diabetic Socks Market Value, by Material, US$ Mn, 2017-2031

Figure 74: Middle East & Africa Diabetic Socks Market Volume, by Material, Thousand Units,2017-2031

Figure 75: Middle East & Africa Diabetic Socks Market Incremental Opportunity, by Material, 2021-2031

Figure 76: Middle East & Africa Diabetic Socks Market Value, by Pricing, US$ Mn, 2017-2031

Figure 77: Middle East & Africa Diabetic Socks Market Volume, by Pricing, Thousand Units,2017-2031

Figure 78: Middle East & Africa Diabetic Socks Market Incremental Opportunity, by Pricing, 2021-2031

Figure 79: Middle East & Africa Diabetic Socks Market Value, By End-user, US$ Mn, 2017-2031

Figure 80: Middle East & Africa Diabetic Socks Market Volume, By End-user, Thousand Units,2017-2031

Figure 81: Middle East & Africa Diabetic Socks Market Incremental Opportunity, By End-user, 2021-2031

Figure 82: Middle East & Africa Diabetic Socks Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 83: Middle East & Africa Diabetic Socks Market Volume, by Distribution Channel, Thousand Units,2017-2031

Figure 84: Middle East & Africa Diabetic Socks Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 85: Middle East & Africa Diabetic Socks Market Value, by Country, US$ Mn, 2017-2031

Figure 86: Middle East & Africa Diabetic Socks Market Volume, by Country, Thousand Units,2017-2031

Figure 87: Middle East & Africa Diabetic Socks Market Incremental Opportunity, by Country, 2021-2031

Figure 88: South America Diabetic Socks Market Value, by Type, US$ Mn, 2017-2031

Figure 89: South America Diabetic Socks Market Volume, by Type, Thousand Units,2017-2031

Figure 90: South America Diabetic Socks Market Incremental Opportunity, by Type, 2021-2031

Figure 91: South America Diabetic Socks Market Value, by Material, US$ Mn, 2017-2031

Figure 92: South America Diabetic Socks Market Volume, by Material,Thousand Units,2017-2031

Figure 93: South America Diabetic Socks Market Incremental Opportunity, by Material, 2021-2031

Figure 94: South America Diabetic Socks Market Value, by Pricing, US$ Mn, 2017-2031

Figure 95: South America Diabetic Socks Market Volume, by Pricing, Thousand Units,2017-2031

Figure 96: South America Diabetic Socks Market Incremental Opportunity, by Pricing, 2021-2031

Figure 97: South America Diabetic Socks Market Value, By End-user, US$ Mn, 2017-2031

Figure 98: South America Diabetic Socks Market Volume, By End-user, Thousand Units,2017-2031

Figure 99: South America Diabetic Socks Market Incremental Opportunity, By End-user, 2021-2031

Figure 100: South America Diabetic Socks Market Value, by Distribution Channel, US$ Mn, 2017-2031

Figure 101: South America Diabetic Socks Market Volume, by Distribution Channel, Thousand Units,2017-2031

Figure 102: South America Diabetic Socks Market Incremental Opportunity, by Distribution Channel, 2021-2031

Figure 103: South America Diabetic Socks Market Value, by Country, US$ Mn, 2017-2031

Figure 104: South America Diabetic Socks Market Volume, by Country, Thousand Units,2017-2031

Figure 105: South America Diabetic Socks Market Incremental Opportunity, by Country, 2021-2031