Reports

Reports

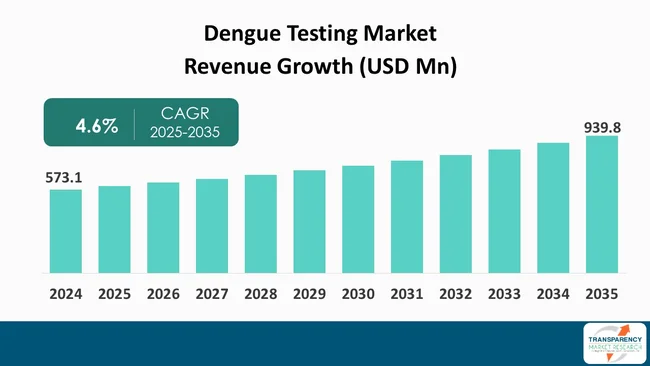

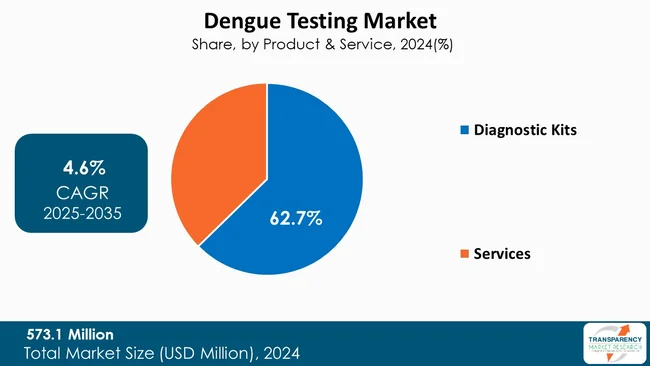

The global dengue testing market size was valued at US$ 573.1 Mn in 2024 and is projected to reach US$ 939.8 Mn by 2035, expanding at a CAGR of 4.6% from 2025 to 2035. The market growth is driven by rising global incidence of dengue fever due to climate change and urbanization, advancements in diagnostic technologies, and increased government initiatives and public health awareness.

Exponentially rising government initiatives and public health programs toward vector-borne disease control continue to be the key drivers to the dengue testing market. Enhanced funding for early diagnostic programs and surveillance initiatives enhances testing capacity, especially in tropical areas. Improved awareness campaigns and compulsory screening rules are boosting detection rates of the disease and driving market growth.

Expanding healthcare infrastructure in emerging economies is further driving demand for dengue testing. Improved laboratory access, investment in diagnostic centers, and public–private partnerships are making it easier to conduct early testing. Furthermore, cross-border partnerships for low-income country distribution of low-cost test kits are supporting the adoption rate of dengue diagnostics and enhancing global disease surveillance.

The ongoing trends include point-of-care testing expansion and combination test kits for the detection of more than one marker like NS1 antigen, IgM, and IgG antibodies. Use of self-contained rapid diagnostic devices, digital-based reporting platforms, and mobile-based data tracking tools is transforming dengue surveillance by facilitating quicker diagnosis and real-time epidemiological data.

Market competition is marked by diversification of products, local manufacturing, and collaborative alliances. Firms spend on low-cost quick test kits, creating distribution channels, and obtaining foreign regulatory clearance. Firms are also concentrating on clinical confirmation, scalable production, and converging technologies in order to increase diagnostic effectiveness, geographic reach, and operational efficiency.

Dengue tests involve laboratory tests that is usually performed to detect the presence of dengue virus directly or the body's immune response to it. The disease is spread by mosquitoes and is caused by one of four serotypes-the DENV-1 to DENV-4 viruses. Hence, quick and precise testing plays a major role not only in the confirmation of the infection but also for accurate clinical management of the disease, to avert the development of severe complications such as hemorrhagic fever or shock syndrome type of dengue.

Diagnosis of dengue is performed through numerous diagnostic tests, with each test detecting a different infection marker. NS1 antigen tests detect the presence of dengue virus through the identification of the viral protein during the first days of infection, generally within the first five days from the onset of symptoms. These serological tests, such as IgG and IgM antibody tests, document the immune response to an infection in either the acute or the past setting. Molecular diagnostic techniques, including RT-PCR, are highly sensitive to viral RNA detection and are highly accurate.

Dengue testing is vital for both - public health and medicine. An early and correct diagnosis allows healthcare professionals implement timely treatment, observation of disease progression, and interruption of its aggravated course. In endemic regions, mass screening is an epidemiologic tool of control and hence aids local authorities to demarcate outbreaks and institute vector control measures accordingly.

The current state of dengue diagnostics has made it possible to deliver the tests more quickly and efficiently. The use of rapid point-of-care tests, automated assays, and multiplex testing options facilitate the obtaining of results in a short time and patients' compliance. Hence, dengue testing is essential for disease management, outbreak control, and reducing morbidity and mortality associated with dengue infections worldwide.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The increasing prevalence of dengue fever worldwide is a considerable factor for growth of the dengue testing market. The increasing reported cases will drive the need for diagnosis in order to manage cases effectively and mitigate disease complications, including severe dengue and death.

Higher incidence leads to an increased surveillance by public health agencies and establishment of routine screening in endemic regions. Increased screening needs force diagnostic laboratories and clinics to implement mass dengue testing methods, such as NS1 antigen, IgM/IgG antibody, and molecular tests.

The rising dengue disease is necessitating more funds to be channeled toward the healthcare system and its management. As a result, there is an improvement in laboratories, staff training, as well as rapid diagnostic updates in hospitals and clinics to enhance the patient's condition. Public education campaigns will encourage people to get timely testing with also contributes to growth of the market.

Additionally, repeated outbreaks and seasonal peaks outline the need for preventive diagnostics. Real-time epidemiological monitoring through widespread testing enables authorities to implement vector control measures and allocate resources strategically. Therefore, the increase of dengue fever cases worldwide is leading to a higher demand for diagnostic devices that directly results in the rapid pace of innovation, wider adoption, and general growth of dengue testing market globally.

Innovations in diagnostic technologies have a major influence in the dengue testing market through improved accuracy, efficiency, and access to detection. Diagnostic technologies like molecular assays and sensitive immunoassays allow for detection of dengue virus infection at an earlier stage, even in asymptomatic or mild infections. The effectiveness of patient management and outbreak control is enhanced by these innovations.

The use of rapid diagnostic tests (RDTs) that are more sensitive and specific has made it possible to identify dengue in less accessible or resource-limited areas. Simple, inexpensive kits with results that can be repeated and obtained within a few minutes allow the rapid diagnosis and treatment of the disease and thus, reduce the need for sophisticated laboratory facilities.

Automation and digitalization are changing in-vitro diagnostics techniques. Fully automated ELISA platforms, multiplex assays, and molecular testing systems are being used for the simultaneous detection of different dengue markers such as NS1 antigen and IgM/IgG antibodies. These newer technologies offer a quicker, less error-prone process with high throughput and thus find greater acceptance among healthcare professionals.

In addition, next-generation technologies including portable diagnostic devices, biosensors, and AI-based data interpretation technology are paving the way forward for the market of dengue diagnostics. These devices provide the potential for real-time monitoring, data integration, and precision diagnostics. Collectively, these technical advances are enhancing the volume of tests that can be performed, improving accuracy of diagnostics, and enabling a transition to more effective, early, and broad detection of dengue globally.

The section for Diagnostic Kits captures the largest share in the dengue testing market, due to their availability, fast turnaround time, and ease of use in clinical and field settings. RDTs and ELISA kits allow for quick and accurate detection of dengue infection to facilitate timely clinical decision making and outbreaks. These kits are cost-effective, require minimal infrastructure, and can be used even in resource-limited regions of high dengue prevalence. Governmental initiatives for early detection and the rising demand for point-of-care tests further enhance the dominance of diagnostic kits over service-based testing.

| Attribute | Detail |

|---|---|

| Leading Region |

|

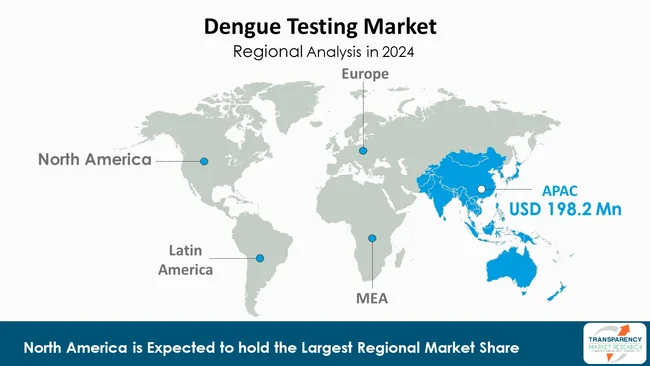

As per the latest dengue testing market analysis, Asia Pacific dominated in 2024, capturing a market share of 34.6%. This is due to a high rate of dengue fever occurrence in the tropics and the subtropics. A combination of humid weather, urbanization, and densely populated areas has led to frequent outbreaks, thus the need for early and accurate diagnostic testing has risen in both public and private healthcare sectors.

Moreover, governments in this region are investing on strengthening the healthcare system, public health projects, and universal health education to fight diseases spread by vectors. RDT implementation, laboratory network development, and cross-border agreements for low-cost test distribution are some of the factors that not only fuel the market growth but also consolidate Asia Pacific's position as a leader in the dengue testing industry.

The companies operating in the dengue testing market are primarily oriented towards the creation of swift, affordable diagnostic kits. They are also involved in the extension of their distribution networks and in the acquisition of regulatory approvals. To facilitate accessibility, knowledge, and acceptance, these companies allocate their resources in the development of point-of-care solutions, collaboration with public health sectors, and partnership with different regions. The ongoing product innovation and various training initiatives further contribute to their global market presence.

Abbott, F. Hoffmann-La Roche AG, Alpine Biomedical Pvt. Ltd., Trivitron Healthcare, Q-Line Biotech Limited, AdvaCare Pharma, Quest Diagnostics Incorporated, BIOMÉRIEUX, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Meridian Bioscience, Inc., InBios International, Inc., SD Biosensor, INC., Certest Biotec S.L. and DiaSorin S.p.A. are some of the leading players operating in the global dengue testing market.

Each of these players has been profiled in the dengue testing market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 573.1 Mn |

| Forecast Value in 2035 | US$ 939.8 Mn |

| CAGR | 4.6% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Mn |

| Dengue Testing Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product & Service

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global dengue testing market was valued at US$ 573.1 Mn in 2024

The global dengue testing industry is projected to reach more than US$ 939.8 Mn by the end of 2035

The rising global incidence of dengue fever due to climate change and urbanization, advancements in diagnostic technologies, increased government initiatives and public health awareness, and a growing need for early and rapid diagnosis are some of the factors driving the expansion of dengue testing market.

The CAGR is anticipated to be 4.6% from 2025 to 2035

Abbott, F. Hoffmann-La Roche Ltd, Alpine Biomedical Pvt. Ltd., Trivitron Healthcare, Q-Line Biotech Limited, AdvaCare Pharma, Quest Diagnostics Incorporated, BIOMÉRIEUX, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Meridian Bioscience, Inc., InBios International, Inc., SD Biosensor, INC., Certest Biotec S.L., and DiaSorin S.p.A.

Table 01: Global Dengue Testing Market Value (US$ Mn) Forecast, By Product & Service, 2020 to 2035

Table 02: Global Dengue Testing Market Value (US$ Mn) Forecast, By Diagnostic Kits, 2020 to 2035

Table 03: Global Dengue Testing Market Value (US$ Mn) Forecast, By Services, 2020 to 2035

Table 04: Global Dengue Testing Market Value (US$ Mn) Forecast, By Technology, 2020 to 2035

Table 05: Global Dengue Testing Market Value (US$ Mn) Forecast, By Sample Type, 2020 to 2035

Table 06: Global Dengue Testing Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 07: Global Dengue Testing Market Value (US$ Mn) Forecast, By Region, 2020 to 2035

Table 08: North America Dengue Testing Market Value (US$ Mn) Forecast, by Country, 2020-2035

Table 09: North America Dengue Testing Market Value (US$ Mn) Forecast, By Product & Service, 2020 to 2035

Table 10: North America Dengue Testing Market Value (US$ Mn) Forecast, By Diagnostic Kits, 2020 to 2035

Table 11: North America Dengue Testing Market Value (US$ Mn) Forecast, By Services, 2020 to 2035

Table 12: North America Dengue Testing Market Value (US$ Mn) Forecast, By Technology, 2020 to 2035

Table 13: North America Dengue Testing Market Value (US$ Mn) Forecast, By Sample Type, 2020 to 2035

Table 14: North America Dengue Testing Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 15: Europe Dengue Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020-2035

Table 16: Europe Dengue Testing Market Value (US$ Mn) Forecast, By Product & Service, 2020 to 2035

Table 17: Europe Dengue Testing Market Value (US$ Mn) Forecast, By Diagnostic Kits, 2020 to 2035

Table 18: Europe Dengue Testing Market Value (US$ Mn) Forecast, By Services, 2020 to 2035

Table 19: Europe Dengue Testing Market Value (US$ Mn) Forecast, By Technology, 2020 to 2035

Table 20: Europe Dengue Testing Market Value (US$ Mn) Forecast, By Sample Type, 2020 to 2035

Table 21: Europe Dengue Testing Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 22: Asia Pacific Dengue Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020-2035

Table 23: Asia Pacific Dengue Testing Market Value (US$ Mn) Forecast, By Product & Service, 2020 to 2035

Table 24: Asia Pacific Dengue Testing Market Value (US$ Mn) Forecast, By Diagnostic Kits, 2020 to 2035

Table 25: Asia Pacific Dengue Testing Market Value (US$ Mn) Forecast, By Services, 2020 to 2035

Table 26: Asia Pacific Dengue Testing Market Value (US$ Mn) Forecast, By Technology, 2020 to 2035

Table 27: Asia Pacific Dengue Testing Market Value (US$ Mn) Forecast, By Sample Type, 2020 to 2035

Table 28: Asia Pacific Dengue Testing Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 29: Latin America Dengue Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020-2035

Table 30: Latin America Dengue Testing Market Value (US$ Mn) Forecast, By Product & Service, 2020 to 2035

Table 31: Latin America Dengue Testing Market Value (US$ Mn) Forecast, By Diagnostic Kits, 2020 to 2035

Table 32: Latin America Dengue Testing Market Value (US$ Mn) Forecast, By Services, 2020 to 2035

Table 33: Latin America Dengue Testing Market Value (US$ Mn) Forecast, By Technology, 2020 to 2035

Table 34: Latin America Dengue Testing Market Value (US$ Mn) Forecast, By Sample Type, 2020 to 2035

Table 35: Latin America Dengue Testing Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 36: Middle East & Africa Dengue Testing Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020-2035

Table 37: Middle East & Africa Dengue Testing Market Value (US$ Mn) Forecast, By Product & Service, 2020 to 2035

Table 38: Middle East & Africa Dengue Testing Market Value (US$ Mn) Forecast, By Diagnostic Kits, 2020 to 2035

Table 39: Middle East & Africa Dengue Testing Market Value (US$ Mn) Forecast, By Services, 2020 to 2035

Table 40: Middle East & Africa Dengue Testing Market Value (US$ Mn) Forecast, By Technology, 2020 to 2035

Table 41: Middle East & Africa Dengue Testing Market Value (US$ Mn) Forecast, By Sample Type, 2020 to 2035

Table 42: Middle East & Africa Dengue Testing Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Dengue Testing Market Value Share Analysis, By Product & Service, 2024 and 2035

Figure 02: Global Dengue Testing Market Attractiveness Analysis, By Product & Service, 2025 to 2035

Figure 03: Global Dengue Testing Market Revenue (US$ Mn), by Diagnostic Kits, 2020 to 2035

Figure 04: Global Dengue Testing Market Revenue (US$ Mn), by Services, 2020 to 2035

Figure 05: Global Dengue Testing Market Value Share Analysis, By Technology, 2024 and 2035

Figure 06: Global Dengue Testing Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 07: Global Dengue Testing Market Revenue (US$ Mn), by Molecular Diagnostics, 2020 to 2035

Figure 08: Global Dengue Testing Market Revenue (US$ Mn), by Serological Tests, 2020 to 2035

Figure 09: Global Dengue Testing Market Revenue (US$ Mn), by Antigen Detection Tests, 2020 to 2035

Figure 10: Global Dengue Testing Market Value Share Analysis, By Sample Type, 2024 and 2035

Figure 11: Global Dengue Testing Market Attractiveness Analysis, By Sample Type, 2025 to 2035

Figure 12: Global Dengue Testing Market Revenue (US$ Mn), by Whole Blood, 2020 to 2035

Figure 13: Global Dengue Testing Market Revenue (US$ Mn), by Serum / Plasma, 2020 to 2035

Figure 14: Global Dengue Testing Market Revenue (US$ Mn), by Saliva, 2020 to 2035

Figure 15: Global Dengue Testing Market Revenue (US$ Mn), by Cerebrospinal Fluid, 2020 to 2035

Figure 16: Global Dengue Testing Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 17: Global Dengue Testing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 18: Global Dengue Testing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 19: Global Dengue Testing Market Revenue (US$ Mn), by Hospitals and Clinics, 2020 to 2035

Figure 20: Global Dengue Testing Market Revenue (US$ Mn), by Diagnostic Laboratories, 2020 to 2035

Figure 21: Global Dengue Testing Market Revenue (US$ Mn), by Home Care Settings, 2020 to 2035

Figure 22: Global Dengue Testing Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 23: Global Dengue Testing Market Value Share Analysis, By Region, 2024 and 2035

Figure 24: Global Dengue Testing Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 25: North America Dengue Testing Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 26: North America Dengue Testing Market Value Share Analysis, by Country, 2024 and 2035

Figure 27: North America Dengue Testing Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 28: North America Dengue Testing Market Value Share Analysis, By Product & Service, 2024 and 2035

Figure 29: North America Dengue Testing Market Attractiveness Analysis, By Product & Service, 2025 to 2035

Figure 30: North America Dengue Testing Market Value Share Analysis, By Technology, 2024 and 2035

Figure 31: North America Dengue Testing Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 32: North America Dengue Testing Market Value Share Analysis, By Sample Type, 2024 and 2035

Figure 33: North America Dengue Testing Market Attractiveness Analysis, By Sample Type, 2025 to 2035

Figure 34: North America Dengue Testing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 35: North America Dengue Testing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 36: Europe Dengue Testing Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 37: Europe Dengue Testing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 38: Europe Dengue Testing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 39: Europe Dengue Testing Market Value Share Analysis, By Product & Service, 2024 and 2035

Figure 40: Europe Dengue Testing Market Attractiveness Analysis, By Product & Service, 2025 to 2035

Figure 41: Europe Dengue Testing Market Value Share Analysis, By Technology, 2024 and 2035

Figure 42: Europe Dengue Testing Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 43: Europe Dengue Testing Market Value Share Analysis, By Sample Type, 2024 and 2035

Figure 44: Europe Dengue Testing Market Attractiveness Analysis, By Sample Type, 2025 to 2035

Figure 45: Europe Dengue Testing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 46: Europe Dengue Testing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 47: Asia Pacific Dengue Testing Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 48: Asia Pacific Dengue Testing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 49: Asia Pacific Dengue Testing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 50: Asia Pacific Dengue Testing Market Value Share Analysis, By Product & Service, 2024 and 2035

Figure 51: Asia Pacific Dengue Testing Market Attractiveness Analysis, By Product & Service, 2025 to 2035

Figure 52: Asia Pacific Dengue Testing Market Value Share Analysis, By Technology, 2024 and 2035

Figure 53: Asia Pacific Dengue Testing Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 54: Asia Pacific Dengue Testing Market Value Share Analysis, By Sample Type, 2024 and 2035

Figure 55: Asia Pacific Dengue Testing Market Attractiveness Analysis, By Sample Type, 2025 to 2035

Figure 56: Asia Pacific Dengue Testing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 57: Asia Pacific Dengue Testing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 58: Latin America Dengue Testing Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 59: Latin America Dengue Testing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 60: Latin America Dengue Testing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 61: Latin America Dengue Testing Market Value Share Analysis, By Product & Service, 2024 and 2035

Figure 62: Latin America Dengue Testing Market Attractiveness Analysis, By Product & Service, 2025 to 2035

Figure 63: Latin America Dengue Testing Market Value Share Analysis, By Technology, 2024 and 2035

Figure 64: Latin America Dengue Testing Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 65: Latin America Dengue Testing Market Value Share Analysis, By Sample Type, 2024 and 2035

Figure 66: Latin America Dengue Testing Market Attractiveness Analysis, By Sample Type, 2025 to 2035

Figure 67: Latin America Dengue Testing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 68: Latin America Dengue Testing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 69: Middle East & Africa Dengue Testing Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 70: Middle East & Africa Dengue Testing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 71: Middle East & Africa Dengue Testing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 72: Middle East & Africa Dengue Testing Market Value Share Analysis, By Product & Service, 2024 and 2035

Figure 73: Middle East & Africa Dengue Testing Market Attractiveness Analysis, By Product & Service, 2025 to 2035

Figure 74: Middle East & Africa Dengue Testing Market Value Share Analysis, By Technology, 2024 and 2035

Figure 75: Middle East & Africa Dengue Testing Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 76: Middle East & Africa Dengue Testing Market Value Share Analysis, By Sample Type, 2024 and 2035

Figure 77: Middle East & Africa Dengue Testing Market Attractiveness Analysis, By Sample Type, 2025 to 2035

Figure 78: Middle East & Africa Dengue Testing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 79: Middle East & Africa Dengue Testing Market Attractiveness Analysis, By End-user, 2025 to 2035