Reports

Reports

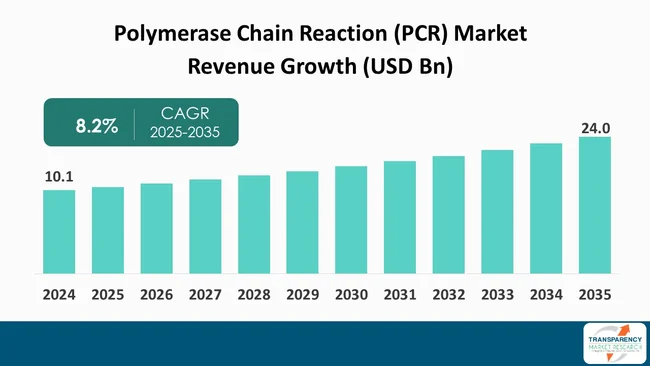

The global polymerase chain reaction (PCR) market size was valued at US$ 10.1 Bn in 2024 and is projected to reach US$ 24.0 Bn by 2035, expanding at a CAGR of 8.2% from 2025 to 2035. Growth is driven by rising demand for molecular diagnostics, rise in frequency of infectious-disease testing, and increasing adoption of PCR in research and clinical applications.

Increase in PCR’s usage has allowed it to be a key part of the ongoing expansion of molecular diagnostics and biomedical research. The use of PCR for the identification of nucleic acids with a high level of specificity has made it a vital part of the testing for infectious diseases, genetic analysis of diseases, the study of cancer, and for the development of new treatments based on the characteristics of individual patients. The dependability and versatility of this technology have led to a continued and increasing demand for its use in clinical laboratories, the other research institutions, and in the biotechnology sector.

In addition, the growth of the PCR market has also been supported by more advanced technologies now available in the market. Examples of advancements in PCR technology are real-time PCR, digital PCR, automation, and the use of high-throughput methods for the production of PCR products.

These new technologies offer improvements in the sensitivity, speed, and efficiency of PCR procedures. This, along with the increased capability of PCR to support such a wide variety of applications (pathogen detection; research into gene expression), continues to reinforce the use of PCR in modern laboratories.

The growth of the PCR market has also been encouraged by the increased investments being made into molecular diagnostics as well as the trend toward precision medicine.

Polymerase chain reaction (abbreviated PCR) is a laboratory technique for speedy production (amplification) of millions to billions of copies of a specific segment of DNA, which can then be studied in detail. PCR involves using short synthetic DNA fragments called primers to select a segment of the genome to be amplified, and then multiple rounds of DNA synthesis to amplify that segment.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Increased demand for accurate and rapid molecular diagnostics is expected to boost the polymerase chain reaction (PCR) market. One reason for this growth is that PCR has been recognized as a means to identify small amounts of genetic material with high accuracy. This attribute makes PCR an essential part of the diagnostic process in the detection and diagnosis of infectious diseases and genetic mutations, and as such supports a wide range of clinical investigations.

In addition, as healthcare systems continue to place more emphasis on early diagnosis and improved patient outcomes, the demand for reliable testing procedures has increased. With the ability to rapidly provide reliable diagnostic results in both - routine diagnostics and emergency public health situations, PCR has emerged as a leading testing tool.

As molecular diagnostics have expanded into areas such as oncology, prenatal testing, and personalized medicine, PCR's prominence has increased. This has driven many laboratories to increasingly utilize PCR's robustness, flexibility, and compatibility with emerging technologies such as digital PCR and real-time PCR. Expansion of the diagnostic infrastructure investment and increasing awareness of genetic and infectious disease has also contributed to the increasing use of PCR by hospitals, research institutions, and biotechnology companies

The increase in the number of cases of infectious diseases and genetic disorders result in rapid development of the polymerase chain reaction (PCR) market. With a growing number of viral and bacterial infections, and hereditary disorders being reported worldwide. All of these healthcare systems are seeking increasingly reliable and rapid diagnostic tools to help control and manage the growing number of these diseases.

PCR plays a vital part in the process of accurately identifying these diseases due to its ability to provide sensitive testing for both - infectious agents and genetic abnormalities, frequently prior to the onset of severe symptoms.

Advancements in genomics and the increasing emphasis on understanding genetic disorders will continue to contribute significantly to the increasing need for precise molecular tests, thus making PCR an even more important technology. PCR is widely used by laboratories, hospitals, and research institutions for applications that vary from detecting pathogens to analyzing mutations, and identifying biomarkers.

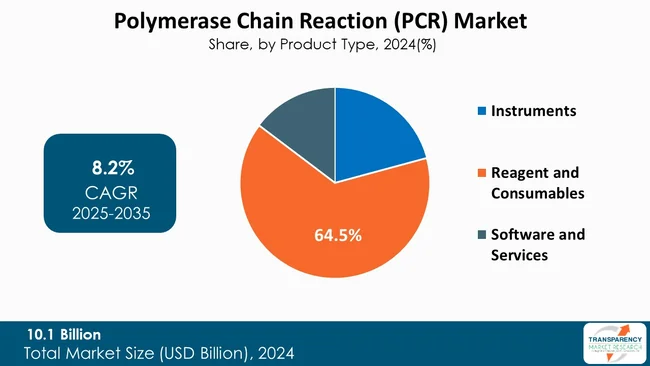

The reagents and consumables segment of the global polymerase chain reaction (PCR) market has been driving growth as it contains the essential components needed to conduct and repeat purchased for each PCR test. The reagents and consumables include enzymes, buffers, primers, master mixes, dNTPs, plastics (e.g. tubes and plates), and a wide variety of one-time use products that require replacement; both - in laboratory research as well as in clinical settings.

As molecular diagnostics continue to diversify due to increased use by hospitals, healthcare facilities, and laboratories for identification of infectious diseases, cancer detection, genetic screening, and individualized care, the volume of PCR testing will continue to grow, which will correlate with the increasing demand for reagents and consumables.

Additionally, advancements in PCR technology such as digital PCR, multiplex assays, and real-time PCR have created a need for high-quality specialized reagents and consumables manufactured to ensure sensitivity and the highest degree of accuracy when performing a PCR analysis. Unlike PCR instruments, which are typically large capital investments made once, reagents and consumables are high-consumption products that generate recurring and steady revenue and therefore provide the largest stable contribution to overall growth in the PCR marketplace.

The continued expansion of research activity, biotechnology production, and global networks for laboratory services (especially in developing markets) has contributed to the accelerating consumption of these reagents and consumables. The reagents and consumables segment of the PCR market thus provides the backbone of ongoing, explosive growth in the PCR market in general.

| Attribute | Detail |

|---|---|

| Leading Region |

|

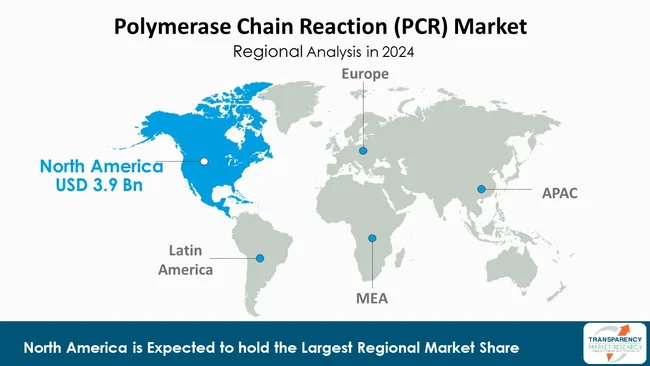

North America dominates the polymerase chain reaction (PCR) market, accounting for a considerable 38.7% share. This is attributed to its well-established healthcare system, a strong research ecosystem, and an abundance of large-scale biotechnology and pharmaceutical companies.

The United States and Canada - both have extensive hospital, diagnostic laboratory, and university networks that use PCR extensively in the detection of infectious diseases, diagnosis of cancers, conduction of genetic testing and doing forensic analysis, and life science research. Furthermore, the rapid adoption of innovative technologies such as real-time PCR, digital PCR, and multiplex PCR has helped to solidify North America’s top position in the global PCR market.

Additionally, North America is home to several players in the industry, including, but not limited to: Thermo Fisher Scientific, Bio-Rad Laboratories and Agilent Technologies. In addition, the increase in government spending on molecular biology, genomics, and public health initiatives supports the increase in the use of PCR technology in clinical and research laboratories in North America.

Abbott, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc. Illumina, Inc. bioMérieux, DiaSorin S.p.A., Meridian Bioscience, Inc., QIAGEN, QuidelOrtho Corporation, Siemens Healthineers AG, Becton, Dickinson and Company (BD), Bruker, Cosmos Biomedical Ltd., Agilent Technologies, Inc., PCR Biosystems Inc., Quantabio, Promega Corporation, and others are the key players governing the global polymerase chain reaction (PCR) market.

Each of these players has been profiled in the polymerase chain reaction (PCR) market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 10.1 Bn |

| Forecast Value in 2035 | US$ 24.0 Bn |

| CAGR | 8.2% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The polymerase chain reaction (PCR) market was valued at US$ 10.1 Bn in 2024

The polymerase chain reaction (PCR) market is projected to cross US$ 24.0 Bn by the end of 2035

Increasing demand for accurate and rapid molecular diagnostics and growing prevalence of infectious and genetic diseases

The polymerase chain reaction (PCR) market is anticipated to grow at a CAGR 8.2% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Abbott, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc. Illumina, Inc. bioMérieux, DiaSorin S.p.A., Meridian Bioscience, Inc., QIAGEN, QuidelOrtho Corporation, Siemens Healthineers AG, Becton, Dickinson and Company (BD), Bruker, Cosmos Biomedical Ltd., Agilent Technologies, Inc., PCR Biosystems Inc., Quantabio, Promega Corporation, and other prominent players

Table 01: Global Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 02: Global Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 03: Global Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 04: Global Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 05: Global Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 06: North America Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 07: North America Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 08: North America Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 09: North America Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 10: North America Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 11: U.S. Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 12: U.S. Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 13: U.S. Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 14: U.S. Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 15: Canada Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 16: Canada Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 17: Canada Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 18: Canada Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 19: Europe Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 20: Europe Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 21: Europe Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 22: Europe Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 23: Europe Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 24: Germany Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 25: Germany Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 26: Germany Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 27: Germany Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 28: U.K. Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 29: U.K. Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 30: U.K. Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 31: U.K. Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 32: France Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 33: France Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 34: France Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 35: France Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 36: Italy Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 37: Italy Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 38: Italy Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 39: Italy Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 40: Spain Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 41: Spain Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 42: Spain Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 43: Spain Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 44: The Netherlands Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 45: The Netherlands Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 46: The Netherlands Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 47: The Netherlands Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 48: Rest of Europe Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 49: Rest of Europe Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 50: Rest of Europe Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 51: Rest of Europe Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 52: Asia Pacific Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 53: Asia Pacific Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 54: Asia Pacific Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 55: Asia Pacific Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 56: Asia Pacific Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 57: China Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 58: China Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 59: China Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 60: China Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 61: Japan Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 62: Japan Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 63: Japan Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 64: Japan Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 65: India Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 66: India Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 67: India Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 68: India Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 69: South Korea Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 70: South Korea Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 71: South Korea Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 72: South Korea Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 73: Australia Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 74: Australia Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 75: Australia Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 76: Australia Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 77: ASEAN Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 78: ASEAN Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 79: ASEAN Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 80: ASEAN Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 81: Rest of Asia Pacific Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 82: Rest of Asia Pacific Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 83: Rest of Asia Pacific Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 84: Rest of Asia Pacific Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 85: Latin America Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 86: Latin America Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 87: Latin America Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 88: Latin America Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 89: Latin America Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 90: Brazil Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 91: Brazil Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 92: Brazil Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 93: Brazil Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 94: Mexico Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 95: Mexico Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 96: Mexico Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 97: Mexico Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 98: Argentina Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 99: Argentina Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 100: Argentina Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 101: Argentina Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 102: Rest of Latin America Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 103: Rest of Latin America Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 104: Rest of Latin America Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 105: Rest of Latin America Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 106: Middle East and Africa Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 107: Middle East and Africa Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 108: Middle East and Africa Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 109: Middle East and Africa Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 110: Middle East and Africa Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 111: GCC Countries Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 112: GCC Countries Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 113: GCC Countries Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 114: GCC Countries Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 115: South Africa Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 116: South Africa Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 117: South Africa Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 118: South Africa Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 119: Rest of Middle East and Africa Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 120: Rest of Middle East and Africa Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Technique, 2020 to 2035

Table 121: Rest of Middle East and Africa Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 122: Rest of Middle East and Africa Polymerase Chain Reaction (PCR) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Figure 01: Global Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 02: Global Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 03: Global Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 04: Global Polymerase Chain Reaction (PCR) Market Revenue (US$ Mn), by Instruments, 2020 to 2035

Figure 05: Global Polymerase Chain Reaction (PCR) Market Revenue (US$ Mn), by Reagent and Consumables, 2020 to 2035

Figure 06: Global Polymerase Chain Reaction (PCR) Market Revenue (US$ Mn), by Software and Services, 2020 to 2035

Figure 07: Global Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 08: Global Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 09: Global Polymerase Chain Reaction (PCR) Market Revenue (US$ Mn), by Conventional PCR, 2020 to 2035

Figure 10: Global Polymerase Chain Reaction (PCR) Market Revenue (US$ Mn), by Real-Time PCR, 2020 to 2035

Figure 11: Global Polymerase Chain Reaction (PCR) Market Revenue (US$ Mn), by Reverse Transcriptase PCR, 2020 to 2035

Figure 12: Global Polymerase Chain Reaction (PCR) Market Revenue (US$ Mn), by Digital PCR, 2020 to 2035

Figure 13: Global Polymerase Chain Reaction (PCR) Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 14: Global Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 15: Global Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 16: Global Polymerase Chain Reaction (PCR) Market Revenue (US$ Mn), by Clinical, 2020 to 2035

Figure 17: Global Polymerase Chain Reaction (PCR) Market Revenue (US$ Mn), by Research, 2020 to 2035

Figure 18: Global Polymerase Chain Reaction (PCR) Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 19: Global Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 20: Global Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 21: Global Polymerase Chain Reaction (PCR) Market Revenue (US$ Mn), by Hospitals and Clinics, 2020 to 2035

Figure 22: Global Polymerase Chain Reaction (PCR) Market Revenue (US$ Mn), by Biotechnology and Pharmaceutical Companies, 2020 to 2035

Figure 23: Global Polymerase Chain Reaction (PCR) Market Revenue (US$ Mn), by Diagnostic Centers, 2020 to 2035

Figure 24: Global Polymerase Chain Reaction (PCR) Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 25: Global Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 26: Global Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 27: North America Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 28: North America Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 29: North America Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 30: North America Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 31: North America Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 32: North America Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 33: North America Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 34: North America Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 35: North America Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 36: North America Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 37: North America Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 38: U.S. Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 39: U.S. Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 40: U.S. Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 41: U.S. Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 42: U.S. Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 43: U.S. Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 44: U.S. Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 45: U.S. Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 46: U.S. Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 47: Canada Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 48: Canada Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 49: Canada Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 50: Canada Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 51: Canada Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 52: Canada Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 53: Canada Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 54: Canada Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 55: Canada Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 56: Europe Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 57: Europe Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 58: Europe Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 59: Europe Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 60: Europe Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 61: Europe Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 62: Europe Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 63: Europe Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 64: Europe Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 65: Europe Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 66: Europe Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 67: Germany Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 68: Germany Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 69: Germany Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 70: Germany Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 71: Germany Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 72: Germany Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 73: Germany Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 74: Germany Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 75: Germany Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 76: U.K. Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 77: U.K. Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 78: U.K. Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 79: U.K. Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 80: U.K. Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 81: U.K. Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 82: U.K. Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 83: U.K. Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 84: U.K. Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 85: France Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 86: France Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 87: France Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 88: France Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 89: France Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 90: France Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 91: France Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 92: France Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 93: France Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 94: Italy Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 95: Italy Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 96: Italy Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 97: Italy Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 98: Italy Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 99: Italy Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 100: Italy Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 101: Italy Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 102: Italy Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 103: Spain Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 104: Spain Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 105: Spain Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 106: Spain Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 107: Spain Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 108: Spain Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 109: Spain Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 110: Spain Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 111: Spain Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 112: The Netherlands Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 113: The Netherlands Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 114: The Netherlands Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 115: The Netherlands Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 116: The Netherlands Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 117: The Netherlands Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 118: The Netherlands Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 119: The Netherlands Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 120: The Netherlands Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 121: Rest of Europe Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 122: Rest of Europe Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 123: Rest of Europe Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 124: Rest of Europe Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 125: Rest of Europe Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 126: Rest of Europe Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 127: Rest of Europe Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 128: Rest of Europe Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 129: Rest of Europe Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 130: Asia Pacific Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 131: Asia Pacific Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 132: Asia Pacific Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 133: Asia Pacific Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 134: Asia Pacific Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 135: Asia Pacific Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 136: Asia Pacific Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 137: Asia Pacific Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 138: Asia Pacific Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 139: Asia Pacific Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 140: Asia Pacific Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 141: China Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 142: China Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 143: China Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 144: China Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 145: China Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 146: China Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 147: China Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 148: China Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 149: China Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 150: Japan Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 151: Japan Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 152: Japan Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 153: Japan Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 154: Japan Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 155: Japan Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 156: Japan Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 157: Japan Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 158: Japan Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 159: India Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 160: India Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 161: India Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 162: India Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 163: India Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 164: India Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 165: India Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 166: India Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 167: India Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 168: South Korea Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 169: South Korea Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 170: South Korea Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 171: South Korea Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 172: South Korea Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 173: South Korea Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 174: South Korea Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 175: South Korea Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 176: South Korea Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 177: Australia Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 178: Australia Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 179: Australia Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 180: Australia Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 181: Australia Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 182: Australia Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 183: Australia Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 184: Australia Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 185: Australia Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 186: Rest of Asia Pacific Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 187: Rest of Asia Pacific Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 188: Rest of Asia Pacific Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 189: Rest of Asia Pacific Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 190: Rest of Asia Pacific Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 191: Rest of Asia Pacific Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 192: Rest of Asia Pacific Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 193: Rest of Asia Pacific Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 194: Rest of Asia Pacific Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 195: Latin America Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 196: Latin America Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 197: Latin America Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 198: Latin America Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 199: Latin America Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 200: Latin America Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 201: Latin America Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 202: Latin America Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 203: Latin America Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 204: Latin America Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 205: Latin America Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 206: Brazil Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 207: Brazil Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 208: Brazil Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 209: Brazil Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 210: Brazil Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 211: Brazil Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 212: Brazil Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 213: Brazil Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 214: Brazil Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 215: Mexico Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 216: Mexico Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 217: Mexico Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 218: Mexico Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 219: Mexico Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 220: Mexico Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 221: Mexico Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 222: Mexico Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 223: Mexico Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 224: Argentina Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 225: Argentina Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 226: Argentina Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 227: Argentina Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 228: Argentina Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 229: Argentina Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 230: Argentina Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 231: Argentina Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 232: Argentina Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 233: Rest of Latin America Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 234: Rest of Latin America Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 235: Rest of Latin America Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 236: Rest of Latin America Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 237: Rest of Latin America Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 238: Rest of Latin America Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 239: Rest of Latin America Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 240: Rest of Latin America Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 241: Rest of Latin America Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 242: Middle East and Africa Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 243: Middle East and Africa Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 244: Middle East and Africa Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 245: Middle East and Africa Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 246: Middle East and Africa Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 247: Middle East and Africa Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 248: Middle East and Africa Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 249: Middle East and Africa Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 250: Middle East and Africa Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 251: Middle East and Africa Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 252: Middle East and Africa Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 253: GCC Countries Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 254: GCC Countries Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 255: GCC Countries Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 256: GCC Countries Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 257: GCC Countries Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 258: GCC Countries Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 259: GCC Countries Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 260: GCC Countries Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 261: GCC Countries Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 262: South Africa Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 263: South Africa Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 264: South Africa Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 265: South Africa Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 266: South Africa Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 267: South Africa Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 268: South Africa Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 269: South Africa Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 270: South Africa Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 271: Rest of Middle East and Africa Polymerase Chain Reaction (PCR) Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 272: Rest of Middle East and Africa Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Product Type, 2024 and 2035

Figure 273: Rest of Middle East and Africa Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Product Type, 2025 to 2035

Figure 274: Rest of Middle East and Africa Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Technique, 2024 and 2035

Figure 275: Rest of Middle East and Africa Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Technique, 2025 to 2035

Figure 276: Rest of Middle East and Africa Polymerase Chain Reaction (PCR) Market Value Share Analysis, by Application, 2024 and 2035

Figure 277: Rest of Middle East and Africa Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 278: Rest of Middle East and Africa Polymerase Chain Reaction (PCR) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 279: Rest of Middle East and Africa Polymerase Chain Reaction (PCR) Market Attractiveness Analysis, by End-user, 2025 to 2035