Reports

Reports

Analysts’ Viewpoint on Cubitainers Market Scenario

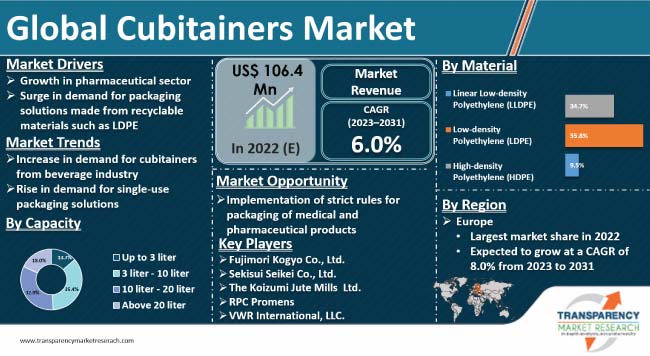

Growth in pharmaceutical sector and surge in demand for packaging solutions made from recyclable materials, such as LDPE, are the key cubitainers market drivers. Moreover, increase in demand for specialized, portable, and convenient packaging solutions is also contributing to market expansion. Growth in the beverage industry and rise in demand for single-use packaging solutions are expected to fuel market growth during the forecast period.

Furthermore, rise in disposable income and the improving lifestyles of consumers are creating value-grab opportunities for manufacturers. Manufacturers in the global cubitainers market should focus on the development of innovative, environment-friendly, and cost-effective products to cater to several end-use industries and gain a strong foothold in the current market landscape.

Cubitainers are chemically compatible with a wide range of compounds, including chemicals, acids, solvents, and oils. They can also be designed to provide a light barrier and UV protection, extending the life and quality of light-sensitive products.

Cubitainers market have gained traction as a sustainable packaging alternative with growing consciousness about the environment among consumers worldwide. LDPE is a recyclable material, contributing to waste reduction efforts. The collapsible nature of LDPE cubitainers minimizes the use of packaging material and reduces carbon emissions associated with transportation, aligning with eco-friendly initiatives.

Cubitainers, also known as flexitanks or box storage containers, are uniquely designed to combine the benefits of a flexible bag with the structural support of a rigid outer box. This innovative packaging solution offers several benefits to the beverage industry. The popularity of cubitainers is growing due to their high performance and safety benefits. Cubitainers are used for beverages that are sensitive to oxidation or require a controlled environment to maintain quality and flavor.

Demand for cubitainers industry is rising in the beverage sector due to their versatility and stability. The flexible nature of the inner pouch allows it to be easily filled, sealed, and stored, reducing the need for bottles and packaging equipment.

The pharmaceutical industry is witnessing a significant increase in the use of cubitainers, as this flexible packaging format helps maintain the quality of sensitive drugs and pharmaceutical products.

The flexible pouch inside the cubitainers market provides an excellent barrier against external elements such as light, air, and moisture. This feature is especially important for drugs that are very sensitive to degradation or require a controlled environment to maintain their efficiency. Cubitainer offers attractive opportunities to pharmaceutical manufacturers due to its ability to maintain product integrity, ease of handling and transportation, compatibility with packaging processes, and versatility in accommodating different types of drugs.

Cubitainers market, with flexible inner bags and protective outer cartons, create a controlled environment that helps preserve the freshness and quality of dairy products. This is especially important for products such as milk, cream, and yogurt, which are perishable and very sensitive to environmental factors.

Cost-saving benefits, lightweight design, mounting options, and operational efficiency of cubitainers allow for cost-effective storage and transportation of dairy products. This results in reduced logistics costs, improved supply chain management, and increased overall productivity for dairy farmers. Easy-to-fill and seal cubitainers help speed up the production process and save time and labor costs. Sustainability benefits offered by cubitainers resonate with the dairy industry's focus on environmentally friendly practices.

Cubitainers offer a hygienic and non-contaminating packaging solution, which helps reduce the risk of infection. The combination of an inner bag and a protective outer box provides a sealed environment, reducing the possibility of external contamination contacting the contents of the package.

The healthcare and medical industry has implemented stringent requirements for sterile packaging to ensure the safety of pharmaceuticals, medical devices, and other healthcare products. Cubitainers are increasingly being used in this industry due to their ability to maintain sterility, thus reducing the risk of contamination.

Cubitainers provide an effective barrier against external factors such as air, moisture, light, and microorganisms. These factors can damage product quality. Packaging equipment, by maintaining a controlled environment, helps extend the shelf-life of packaged products and ensures integrity in the distribution chain. This advantage is valuable in industries where product damage or deterioration can cause health risks or financial losses. Cubitainers offers a unique packaging solution that allows products to be stored safely and shipped without the risk of cross-contamination.

Increase in on-the-go consumption along with convenient consumer preferences have fueled the demand for disposable packaging. Cubitainers are portable and easy to use. Dispensing features of these cubitainers are attracting consumers across the globe. Demand for cubitainers is rising for beverages, personal care products, and home products.

Single-use packaging saves time and resources in product preparation and handling, eliminating the need for cleaning and sterilization. It enables fast and efficient packaging, especially in high-volume production environments. Fast-moving industries such as food service, hospitality, and e-commerce benefit from the convenience and time savings of single-use packaging solutions including cubitainers.

Disposable cubitainers offer improved hygiene and safety benefits as compared to reusable packaging options. The risk of contamination and the spread of pathogens is reduced by using new, uncontaminated packaging cubitainers.

Cubitainers made with low-density polyethylene (LDPE) material have been widely adopted in industries such as pharmaceutical, chemical, food & beverage, agriculture, and automotive. LDPE cubitainers are increasingly being used to store and transport liquids and chemicals. Their convenience, cost-effectiveness, and performance make them the preferred choice for companies looking for an efficient and reliable liquid packaging solution.

LDPE material provides excellent chemical resistance, ensuring the integrity and safety of the packaged contents. Cubitainers can easily collapse when empty, resulting in significant savings in transportation and storage. This feature is ideal for companies who want to optimize logistics and reduce shipping costs. LDPE cubitainers are especially suitable for products such as solvents, detergents, cleaning agents, agricultural chemicals, and various industrial fluids.

LDPE cubitainers are equipped with an internal dispensing system consisting of an internal cap and screw. This design allows for controlled feeding and eliminates the need for additional chargers or pumps. The dispensing cap can be easily opened and closed, providing convenience and preventing spills or leaks.

Rapid urbanization and modernization in developing countries lead to higher disposable income for individuals and families. Cubitainers provides innovative and practical packaging solutions for various products, meeting the needs of urban consumers.

Growth in middle-class population, especially in developing countries, has a direct impact on the purchasing power of consumers. Cubitainers offers attractive packaging solutions for this growing consumer segment with affordability and versatility.

Changing lifestyles and hygiene practices are fueling the demand for cubitainers. Consumers are becoming more aware about the importance of cleanliness and hygiene, especially in the personal care and healthcare industries. Increase in demand for liquid packaging is contributing to the rapid increase in adoption of cubitainers across the globe. Cubitainers are ideal for packaging liquid products such as hand sanitizers, disinfectants, and other health solutions. Cubitainers are a globally recognized packaging solution that can be easily exported and serves a diverse customer market.

Europe is estimated to register high demand for cubitainers during the forecast period. Growth in pharmaceutical and food & beverage industries is contributing to the cubitainers market statistics in the region. Moreover, increase in demand for environment-friendly packaging solutions is driving the market in Europe.

North America is also a major market for cubitainers. Rapid development of new packaging solutions and increase in shift toward sustainable packaging products in the U.S. are key factors augmenting cubitainers market dynamics in North America.

The U.S. plays a major role in international trade and exports various products globally. Cubitainers offer lucrative export opportunities for manufacturers in the U.S. The export of cubitainers from the U.S. contributes to the global supply chain. Cubitainers meet sustainability initiatives introduced in the U.S. with a lightweight, reusable design and reduced carbon footprint. The U.S. cubitainer manufacturers use the latest technology and advancements to improve the performance, functionality, and durability of their products.

Fujimori Kogyo Co., Ltd., Sekisui Seikei Co., Ltd., The Koizumi Jute Mills Ltd., RPC Promens, VWR International, LLC., Kaufman Container, CICH Co., Ltd., Basco, Pipeline Packaging, Changzhou Fengdi Plastic Technology Co., Ltd., Container and Packaging, and Qorpak are some of the leading players operating in the cubitainers market. As per the cubitainers market analysis, these players are implementing innovative strategies including launching of new products and investing in R&D launches to gain revenue opportunities.

Key players in the cubitainers market report have been profiled based on various parameters such as company overview, latest developments, business strategies, application portfolio, business segments, and financial overview.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 106.4 Mn |

|

Market Forecast Value in 2031 |

US$ 204.0 Mn |

|

Growth Rate (CAGR) |

6.0% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Mn for Value and Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional levels. Moreover, the qualitative analysis includes drivers, restraints, opportunities, key trends, and a parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 106.4 Mn

It is anticipated to grow at a CAGR of 6.0% during 2023-2031

It would be worth US$ 204.0 Mn in 2031

Growth in pharmaceutical sector and surge in demand for packaging solutions made from recyclable materials such as LDPE to reduce carbon emissions

The 3 liter - 10 liter capacity segment is majorly preferred by cubitainer manufacturers

Europe is estimated to showcase high demand for cubitainers during the forecast period

Fujimori Kogyo Co., Ltd., Sekisui Seikei Co., Ltd., The Koizumi Jute Mills Ltd., RPC Promens, VWR International, LLC., Kaufman Container, CICH Co., Ltd., Basco, Pipeline Packaging, Changzhou Fengdi Plastic Technology Co., Ltd., Container and Packaging, and Qorpak

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. Global Cubitainers Market Overview

3.1. Introduction

3.2. Macro-economic Factors - Correlation Analysis

3.3. Forecast Factors - Relevance & Impact

3.4. Cubitainers Market Value Chain Analysis

3.4.1. Exhaustive List of Active Participants

3.4.1.1. Manufacturers

3.4.1.2. Distributors/Retailers

3.4.1.3. End-users

3.4.2. Profitability Margins

4. Impact of COVID-19

4.1. Current Statistics and Probable Future Impact

4.2. Current Economic Projection - GDP/GVA and Probable Impact

4.3. Impact of COVID-19 on Cubitainers Market

5. Global Cubitainers Market Analysis

5.1. Pricing Analysis

5.1.1. Pricing Assumption

5.1.2. Price Projections By Region

5.2. Market Size (US$ Mn) and Forecast

5.2.1. Market Size and Y-o-Y Growth

5.2.2. Absolute $ Opportunity

6. Global Cubitainers Market Dynamics

6.1. Drivers

6.2. Restraints

6.3. Opportunity Analysis

6.4. Trends

7. Global Cubitainers Market Analysis and Forecast, by Capacity

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis, by Capacity

7.1.2. Y-o-Y Growth Projections, By Capacity

7.2. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by Capacity

7.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031, by Capacity

7.3.1. Up to 3 liter

7.3.2. 3 liter - 10 liter

7.3.3. 10 liter - 20 liter

7.3.4. Above 20 liter

7.4. Market Attractiveness Analysis, by Capacity

8. Global Cubitainers Market Analysis and Forecast, by Material

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis, by Material

8.1.2. Y-o-Y Growth Projections, By Material

8.2. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by Material

8.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031, by Material

8.3.1. Low-density Polyethylene (LDPE)

8.3.2. Linear Low-density Polyethylene (LLDPE)

8.3.3. High-density Polyethylene (HDPE)

8.4. Market Attractiveness Analysis, by Material

9. Global Cubitainers Market Analysis and Forecast, by End-use

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis, by End-use

9.1.2. Y-o-Y Growth Projections, By End-use

9.2. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by End-use

9.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031, by End-use

9.3.1. Food & Beverages

9.3.2. Pharmaceuticals

9.3.3. Chemicals

9.3.4. Other Industrial Goods

9.4. Market Attractiveness Analysis, by End-use

9.5. Prominent Trends

10. Global Cubitainers Market Analysis and Forecast, by Region

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis By Region

10.1.2. Y-o-Y Growth Projections By Region

10.2. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by Region

10.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031 By Region

10.3.1. North America

10.3.2. Latin America

10.3.3. Europe

10.3.4. Asia Pacific

10.3.5. Japan

10.3.6. Middle East & Africa (MEA)

10.4. Market Attractiveness Analysis By Region

10.5. Prominent Trends

11. North America Cubitainers Market Analysis and Forecast

11.1. Introduction

11.1.1. Market share and Basis Points (BPS) Analysis, by Country

11.1.2. Y-o-Y Growth Projections, By Country

11.2. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by Country

11.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031, by Country

11.3.1. U.S.

11.3.2. Canada

11.4. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by Capacity

11.5. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031, by Capacity

11.5.1. Up to 3 liter

11.5.2. 3 liter - 10 liter

11.5.3. 10 liter - 20 liter

11.5.4. Above 20 liter

11.6. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by Material

11.7. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031, by Material

11.7.1. Low-density Polyethylene (LDPE)

11.7.2. Linear Low-density Polyethylene (LLDPE)

11.7.3. High-density Polyethylene (HDPE)

11.8. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by End-use

11.9. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031, by End-use

11.9.1. Food & Beverages

11.9.2. Pharmaceuticals

11.9.3. Chemicals

11.9.4. Other Industrial Goods

11.10. Market Attractiveness Analysis

11.10.1. By Country

11.10.2. By Material

11.10.3. By Capacity

11.10.4. By End-use

11.11. Prominent Trends

11.12. Drivers and Restraints: Impact Analysis

12. Latin America Cubitainers Market Analysis and Forecast

12.1. Introduction

12.1.1. Market share and Basis Points (BPS) Analysis, by Country

12.1.2. Y-o-Y Growth Projections, By Country

12.2. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by Country

12.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031 By Country

12.3.1. Brazil

12.3.2. Mexico

12.3.3. Argentina

12.3.4. Rest of Latin America

12.4. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by Capacity

12.5. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031, by Capacity

12.5.1. Up to 3 liter

12.5.2. 3 liter - 10 liter

12.5.3. 10 liter - 20 liter

12.5.4. Above 20 liter

12.6. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by Material

12.7. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031, by Material

12.7.1. Low-density Polyethylene (LDPE)

12.7.2. Linear Low-density Polyethylene (LLDPE)

12.7.3. High-density Polyethylene (HDPE)

12.8. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by End-use

12.9. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031, by End-use

12.9.1. Food & Beverages

12.9.2. Pharmaceuticals

12.9.3. Chemicals

12.9.4. Other Industrial Goods

12.10. Market Attractiveness Analysis

12.10.1. By Country

12.10.2. By Material

12.10.3. By Capacity

12.10.4. By End-use

12.11. Prominent Trends

12.12. Drivers and Restraints: Impact Analysis

13. Europe Cubitainers Market Analysis and Forecast

13.1. Introduction

13.1.1. Market share and Basis Points (BPS) Analysis, by Country

13.1.2. Y-o-Y Growth Projections, By Country

13.2. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by Country

13.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031 By Country

13.3.1. Germany

13.3.2. Spain

13.3.3. Italy

13.3.4. France

13.3.5. U.K.

13.3.6. BENELUX

13.3.7. Nordic

13.3.8. Russia

13.3.9. Poland

13.3.10. Rest of Europe

13.4. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by Capacity

13.5. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031, by Capacity

13.5.1. Up to 3 liter

13.5.2. 3 liter - 10 liter

13.5.3. 10 liter - 20 liter

13.5.4. Above 20 liter

13.6. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by Material

13.7. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031, by Material

13.7.1. Low-density Polyethylene (LDPE)

13.7.2. Linear Low-density Polyethylene (LLDPE)

13.7.3. High-density Polyethylene (HDPE)

13.8. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by End-use

13.9. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031, by End-use

13.9.1. Food & Beverages

13.9.2. Pharmaceuticals

13.9.3. Chemicals

13.9.4. Other Industrial Goods

13.10. Market Attractiveness Analysis

13.10.1. By Country

13.10.2. By Material

13.10.3. By Capacity

13.10.4. By End-use

13.11. Prominent Trends

13.12. Drivers and Restraints: Impact Analysis

14. Asia Pacific Cubitainers Market Analysis and Forecast

14.1. Introduction

14.1.1. Market share and Basis Points (BPS) Analysis, by Country

14.1.2. Y-o-Y Growth Projections, By Country

14.2. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by Country

14.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031 By Country

14.3.1. China

14.3.2. India

14.3.3. Japan

14.3.4. ASEAN

14.3.5. Australia and New Zealand

14.3.6. Rest of APAC

14.4. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by Capacity

14.5. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031, by Capacity

14.5.1. Up to 3 liter

14.5.2. 3 liter - 10 liter

14.5.3. 10 liter - 20 liter

14.5.4. Above 20 liter

14.6. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by Material

14.7. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031, by Material

14.7.1. Low-density Polyethylene (LDPE)

14.7.2. Linear Low-density Polyethylene (LLDPE)

14.7.3. High-density Polyethylene (HDPE)

14.8. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by End-use

14.9. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031, by End-use

14.9.1. Food & Beverages

14.9.2. Pharmaceuticals

14.9.3. Chemicals

14.9.4. Other Industrial Goods

14.10. Market Attractiveness Analysis

14.10.1. By Country

14.10.2. By Material

14.10.3. By Capacity

14.10.4. By End-use

14.11. Prominent Trends

14.12. Drivers and Restraints: Impact Analysis

15. Middle East & Africa Cubitainers Market Analysis and Forecast

15.1. Introduction

15.1.1. Market share and Basis Points (BPS) Analysis, by Country

15.1.2. Y-o-Y Growth Projections, By Country

15.2. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by Country

15.3. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031, by Country

15.3.1. North Africa

15.3.2. GCC countries

15.3.3. South Africa

15.3.4. Turkey

15.3.5. Rest of MEA

15.4. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by Capacity

15.5. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031, by Capacity

15.5.1. Up to 3 liter

15.5.2. 3 liter - 10 liter

15.5.3. 10 liter - 20 liter

15.5.4. Above 20 liter

15.6. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by Material

15.7. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031, by Material

15.7.1. Low-density Polyethylene (LDPE)

15.7.2. Linear Low-density Polyethylene (LLDPE)

15.7.3. High-density Polyethylene (HDPE)

15.8. Historical Market Value (US$ Mn) and Volume (Tons), 2018-2022, by End-use

15.9. Market Size (US$ Mn) and Volume (Tons) Forecast Analysis 2023-2031, by End-use

15.9.1. Food & Beverages

15.9.2. Pharmaceuticals

15.9.3. Chemicals

15.9.4. Other Industrial Goods

15.10. Market Attractiveness Analysis

15.10.1. By Country

15.10.2. By Material

15.10.3. By Capacity

15.10.4. By End-use

15.11. Prominent Trends

15.12. Drivers and Restraints: Impact Analysis

16. Competitive Landscape

16.1. Market Structure

16.2. Competition Dashboard

16.3. Company Market Share Analysis

16.4. Company Profiles (Details - Overview, Financials, Strategy, Recent Developments, SWOT analysis)

16.5. Competition Deep Dive (Global Players)

16.5.1. Fujimori Kogyo Co., Ltd.

16.5.1.1. Overview

16.5.1.2. Financials

16.5.1.3. Strategy

16.5.1.4. Recent Developments

16.5.1.5. SWOT Analysis

16.5.2. Sekisui Seikei Co., Ltd.

16.5.2.1. Overview

16.5.2.2. Financials

16.5.2.3. Strategy

16.5.2.4. Recent Developments

16.5.2.5. SWOT Analysis

16.5.3. The Koizumi Jute Mills Ltd.

16.5.3.1. Overview

16.5.3.2. Financials

16.5.3.3. Strategy

16.5.3.4. Recent Developments

16.5.3.5. SWOT Analysis

16.5.4. RPC Promens

16.5.4.1. Overview

16.5.4.2. Financials

16.5.4.3. Strategy

16.5.4.4. Recent Developments

16.5.4.5. SWOT Analysis

16.5.5. VWR International, LLC.

16.5.5.1. Overview

16.5.5.2. Financials

16.5.5.3. Strategy

16.5.5.4. Recent Developments

16.5.5.5. SWOT Analysis

16.5.6. Kaufman Container

16.5.6.1. Overview

16.5.6.2. Financials

16.5.6.3. Strategy

16.5.6.4. Recent Developments

16.5.6.5. SWOT Analysis

16.5.7. CICH Co., Ltd.

16.5.7.1. Overview

16.5.7.2. Financials

16.5.7.3. Strategy

16.5.7.4. Recent Developments

16.5.7.5. SWOT Analysis

16.5.8. Basco

16.5.8.1. Overview

16.5.8.2. Financials

16.5.8.3. Strategy

16.5.8.4. Recent Developments

16.5.8.5. SWOT Analysis

16.5.9. Pipeline Packaging

16.5.9.1. Overview

16.5.9.2. Financials

16.5.9.3. Strategy

16.5.9.4. Recent Developments

16.5.9.5. SWOT Analysis

16.5.10. Changzhou Fengdi Plastic Technology Co., Ltd.

16.5.10.1. Overview

16.5.10.2. Financials

16.5.10.3. Strategy

16.5.10.4. Recent Developments

16.5.10.5. SWOT Analysis

16.5.11. Container and Packaging

16.5.11.1. Overview

16.5.11.2. Financials

16.5.11.3. Strategy

16.5.11.4. Recent Developments

16.5.11.5. SWOT Analysis

16.5.12. Qorpak

16.5.12.1. Overview

16.5.12.2. Financials

16.5.12.3. Strategy

16.5.12.4. Recent Developments

16.5.12.5. SWOT Analysis

*The list of companies is indicative in nature and is subject to change during the course of research

17. Assumptions and Acronyms Used

18. Research Methodology

List of Tables

Table 01: Global Cubitainers Market Value (US$ Mn) and Volume (Units) 2017-2031, by Capacity

Table 02: Global Cubitainers Market Value (US$ Mn) and Volume (Units) 2017-2031, by Material

Table 03: Global Cubitainers Market Value (US$ Mn) and Volume (Units) 2017-2031, by End-use

Table 04: Global Cubitainers Market Value (US$ Mn) and Volume (Units) 2017-2031, by Region

Table 05: North America Cubitainers Market Value (US$ Mn) and Volume (Units) 2017-2031, by Capacity

Table 06: North America Cubitainers Market Value (US$ Mn) and Volume (Units) 2017-2031, by Material

Table 07: North America Cubitainers Market Value (US$ Mn) and Volume (Units) 2017-2031, by End-use

Table 08: Latin America Cubitainers Market Value (US$ Mn) and Volume (Units) 2017-2031, by Capacity

Table 09: Latin America Cubitainers Market Value (US$ Mn) and Volume (Units) 2017-2031, by Material

Table 10: Latin America Cubitainers Market Value (US$ Mn) and Volume (Units) 2017-2031, by End-use

Table 11: Europe Cubitainers Market Value (US$ Mn) and Volume (Units) 2017-2031, by Capacity

Table 12: Europe Cubitainers Market Value (US$ Mn) and Volume (Units) 2017-2031, by Material

Table 13: Europe Cubitainers Market Value (US$ Mn) and Volume (Units) 2017-2031, by End-use

Table 14: Asia Pacific Cubitainers Market Value (US$ Mn) and Volume (Units) 2017-2031, by Capacity

Table 15: Asia Pacific Cubitainers Market Value (US$ Mn) and Volume (Units) 2017-2031, by Material

Table 16: Asia Pacific Cubitainers Market Value (US$ Mn) and Volume (Units) 2017-2031, by End-use

Table 17: Middle East & Africa Cubitainers Market Value (US$ Mn) and Volume (Units) 2017-2031, by Capacity

Table 18: Middle East & Africa Cubitainers Market Value (US$ Mn) and Volume (Units) 2017-2031, by Material

Table 19: Middle East & Africa Cubitainers Market Value (US$ Mn) and Volume (Units) 2017-2031, by End-use

List of Figures

Figure 01: Global Cubitainers Market Value Share Analysis, 2023 & 2031, by Capacity

Figure 02: Global Cubitainers Market Attractiveness Analysis 2023 & 2031, by Capacity

Figure 03: Global Cubitainers Market Value Share Analysis, 2023 & 2031, by Material

Figure 04: Global Cubitainers Market Attractiveness Analysis 2023 & 2031, by Material

Figure 05: Global Cubitainers Market Value Share Analysis, 2023 & 2031, by End-use

Figure 06: Global Cubitainers Market Attractiveness Analysis 2023 & 2031, by End-use

Figure 07: Global Cubitainers Market Value Share Analysis, 2023 & 2031, by Region

Figure 08: Global Cubitainers Market Attractiveness Analysis 2023 & 2031, by Region

Figure 09: North America Cubitainers Market Attractiveness Analysis 2023 & 2031, by Capacity

Figure 10: North America Cubitainers Market Attractiveness Analysis 2023 & 2031, by Material

Figure 11: North America Cubitainers Market Attractiveness Analysis 2023 & 2031, by End-use

Figure 12: Latin America Cubitainers Market Attractiveness Analysis 2023 & 2031, by Capacity

Figure 13: Latin America Cubitainers Market Attractiveness Analysis 2023 & 2031, by Material

Figure 14: Latin America Cubitainers Market Attractiveness Analysis 2023 & 2031, by End-use

Figure 15: Europe Cubitainers Market Attractiveness Analysis 2023 & 2031, by Capacity

Figure 16: Europe Cubitainers Market Attractiveness Analysis 2023 & 2031, by Material

Figure 17: Europe Cubitainers Market Attractiveness Analysis 2023 & 2031, by End-use

Figure 18: Asia Pacific Cubitainers Market Attractiveness Analysis 2023 & 2031, by Capacity

Figure 19: Asia Pacific Cubitainers Market Attractiveness Analysis 2023 & 2031, by Material

Figure 20: Asia Pacific Cubitainers Market Attractiveness Analysis 2023 & 2031, by End-use

Figure 21: Middle East & Africa Cubitainers Market Attractiveness Analysis 2023 & 2031, by Capacity

Figure 22: Middle East & Africa Cubitainers Market Attractiveness Analysis 2023 & 2031, by Material