Reports

Reports

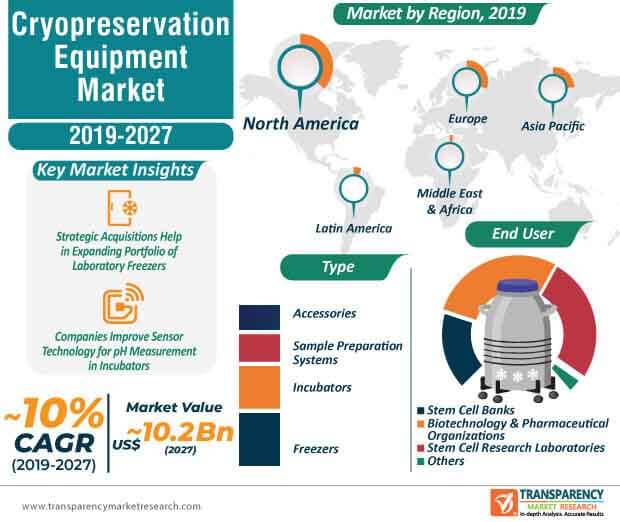

Companies in the cryopreservation equipment market are focusing on strategic acquisitions to expand their product portfolio. For instance, BioLife - a manufacturer of cryopreservation freeze media, announced its acquisition of Custom Biogenic Solutions - a producer of cryopreservation equipment for the biotech industry, to expand its portfolio of liquid nitrogen laboratory freezers and other cryogenic equipment.

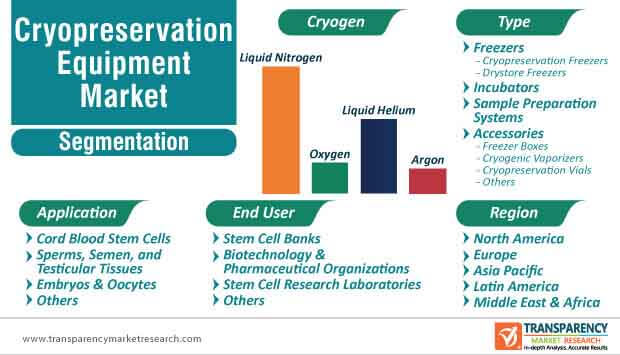

Strategic acquisitions have led to rise in investments in improving the technology of freezers. As such, freezers segment is expected to account for the highest revenue of the cryopreservation equipment market. The segment is projected to reach a value of ~US$ 3.5 Bn by the end of 2027. Companies are increasing efficacy of cloud-based monitoring systems that help in evaluating biologic sample storage conditions.

Developments in cryogen techniques have led to innovations in liquid nitrogen laboratory freezers. As such, liquid nitrogen cryogen segment dominates the cryopreservation equipment market and is projected to reach a value of ~US$ 5.1 Bn by 2027. Companies are tapping into opportunities for the development of tools for bioproduction of cell and gene therapies.

The cryopreservation equipment market is witnessing innovations in advanced sample preparation systems. For instance, TTP Labtech - a manufacturer of products within sample management, announced the launch of its next-gen automated system for sample-prep. Companies are making efforts to innovate in cryogenic electron microscopy (cryo-EM) in advanced sample preparation systems. As such, sample preparation systems are projected for exponential growth in the cryopreservation equipment market.

Innovations in sample-prep systems are paving the way for cryo-EM analysis, which is instrumental in protein research and drug discovery. High-quality foil grids in systems for cryo-EM analysis are increasingly replacing manual processes in the healthcare industry. Thus, stakeholders in biotechnology and research laboratories are benefitting from these advanced systems to assess structure of biomolecules and support protein research. Advanced sample-prep systems are pervasively replacing conventional methods of NMR (Nuclear Magnetic Resonance) and X ray crystallography. These systems offer areas for researchers to solve complex protein structures, which was not possible with conventional methods. Improved 3D imaging and high speed blot-free plunging are key attributes that are attracting research companies in the cryopreservation equipment market landscape.

Emergence of new cell manufacturing plants is complementing the growth of the cryopreservation equipment market. For instance, Cellex Incorporated - a biotechnology company, announced the launch of its cell manufacturing plant in Cologne, Germany to produce advanced therapy medicinal products for cryopreservation and cell purification, among others.

Companies in the cryopreservation equipment market are expanding their services in long-term cryo-storage of advanced therapy medicinal products. Thus, manufacturing innovative cell therapy products for cancer is beneficial for creating new income opportunities for manufacturers of cryopreservation equipment. However, growth of the stem cells industry is another driver of the cryopreservation equipment market growth. Growing awareness about stem cell storage at birth is gaining importance in the cryopreservation equipment market landscape.

The cryopreservation equipment market is largely consolidated with three dominant players accounting for a combined share of ~66% of the cryopreservation equipment market. However, difficulty to establish the right culture environment and incubator conditions for laboratories and IVF clinics are some of the challenges faced by emerging players. Hence, manufacturers in the cryopreservation equipment market are increasing production capabilities to develop equipment that provide insights on pH measurement. For instance, Planer — a supplier of controlled temperature products, innovated in PetriSense®ST, a sensor that provides monitoring of pH and CO2 in benchtop incubators.

Incubators type segment dominates the cryopreservation equipment market and is projected to reach a value of ~US$ 2.9 Bn by 2027. Hence, equipment companies are increasing technical expertise in sensor technology to support incubator applications in laboratories and IVF clinics. Portability and flexibility of petri dish-sized sensors is gaining application in laboratory equipment. Thus, manufacturers in the cryopreservation equipment market are expected to increase their scope for incremental opportunities by developing advanced sensor equipment to cater to the needs of end users in labs and clinics.

Analysts’ Viewpoint

Technological innovations in new sample-prep systems are gaining importance for the study of biological and non-biological materials.

However, the process of obtaining vitrified samples of appropriate thickness on foil grids presents as a challenge for researchers in the cryo-EM analysis. Hence, stakeholders in research and laboratory institutes are investing in automated cryo-EM systems for sample-prep of complex proteins and biomolecules.

Manufacturers should target cryopreservation equipment in countries of Asia Pacific, such as India, due to increased efforts of Indian stakeholders for establishment of new biotechnology facilities with cryo-EM and other instruments. Moreover, emergence of bioclusters for connecting university and academic researchers and technology management units is another driver that is creating lucrative opportunities for companies in the cryopreservation equipment market.

Cryopreservation Equipment Market: Introduction

Cryopreservation Equipment Market: Key Driver and Restraint

Cryopreservation Equipment Market: Segmentation

Geographic Overview: Cryopreservation Equipment Market

Cryopreservation Equipment Market: Key Players

Cryopreservation equipment market to reach a valuation of ~US$ 10.2 Bn by 2027

Cryopreservation equipment market is driven by increase in demand for regenerative medicines

The freezers segment dominated the global cryopreservation equipment market

The end-use segments in cryopreservation equipment market are stem cell banks, biotechnology & pharmaceutical organizations, and stem cell research laboratories

Key players in the global cryopreservation equipment market include Thermo Fisher Scientific, Inc., Beckman Coulter, Inc., Brooks Automation, Inc., VWR International, LLC

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. 3. Executive Summary: Global Cryopreservation Equipment Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Cryopreservation Equipment Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projections (US$ Mn)

5. Global Cryopreservation Equipment Market Analysis and Forecast, by Equipment Type

5.1. Introduction

5.2. Key Findings

5.3. Global Cryopreservation Equipment Market Value Forecast, by Equipment Type, 2017–2027

5.3.1. Freezers

5.3.1.1. Cryopreservation Freezers

5.3.1.2. Drystore Freezers

5.3.2. Incubators

5.3.3. Sample Preparation Systems

5.3.4. Accessories

5.3.4.1. Freezer Box

5.3.4.2. Cryogenic Vaporizer

5.3.4.3. Cryopreservation Vials

5.3.4.4. Others

5.4. Global Cryopreservation Equipment Market Attractiveness, by Equipment Type

6. Global Cryopreservation Equipment Market Analysis and Forecast, by Cryogen

6.1. Introduction & Definition

6.2. Key Findings

6.3. Global Cryopreservation Equipment Market Value Forecast, by Cryogen, 2017–2027

6.3.1. Liquid Nitrogen

6.3.2. Oxygen

6.3.3. Liquid Helium

6.3.4. Argon

6.4. Global Cryopreservation Equipment Market Attractiveness, by Cryogen

7. Global Cryopreservation Equipment Market Analysis and Forecast, by Application

7.1. Introduction

7.2. Key Findings

7.3. Global Cryopreservation Equipment Market Value Forecast, by Application, 2017–2027

7.3.1. Cord Blood Stem Cells

7.3.2. Sperms, Semen, and Testicular Tissues

7.3.3. Embryos & Oocytes

7.3.4. Others

7.4. Global Cryopreservation Equipment Market Attractiveness, by Application

8. Global Cryopreservation Equipment Market Analysis and Forecast, by End-user

8.1. Introduction

8.2. Key Findings

8.3. Global Cryopreservation Equipment Market Value Forecast, by End-user, 2017–2027

8.3.1. Stem Cell Banks

8.3.2. Biotechnology & Pharmaceutical Organizations

8.3.3. Stem Cell Research Laboratories

8.3.4. Others

8.4. Global Cryopreservation Equipment Market Attractiveness, by End-user

9. Global Cryopreservation Equipment Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Global Cryopreservation Equipment Market Value Forecast, by Region, 2017–2027

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Cryopreservation Equipment Market Attractiveness, by Region

10. North America Cryopreservation Equipment Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. North America Cryopreservation Equipment Market Value Forecast, by Equipment Type, 2015–2027

10.2.1. Freezers

10.2.1.1. Cryopreservation Freezers

10.2.1.2. Drystore Freezers

10.2.2. Incubators

10.2.3. Sample Preparation Systems

10.2.4. Accessories

10.2.4.1. Freezer Box

10.2.4.2. Cryogenic Vaporizer

10.2.4.3. Cryopreservation Vials

10.2.4.4. Others

10.3. North America Cryopreservation Equipment Market Value Forecast, by Cryogen, 2017–2027

10.3.1. Liquid Nitrogen

10.3.2. Oxygen

10.3.3. Liquid Helium

10.3.4. Argon

10.4. North America Cryopreservation Equipment Market Value Forecast, by Application, 2017–2027

10.4.1. Cord Blood Stem Cells

10.4.2. Sperms, Semen, and Testicular Tissues

10.4.3. Embryos & Oocytes

10.4.4. Others

10.5. North America Cryopreservation Equipment Market Value Forecast, by End-user, 2017–2027

10.5.1. Stem Cell Banks

10.5.2. Biotechnology & Pharmaceutical Organizations

10.5.3. Stem Cell Research Laboratories

10.5.4. Others

10.6. North America Cryopreservation Equipment Market Value Forecast, by Country, 2017–2027

10.6.1. U.S.

10.6.2. Canada

10.7. North America Cryopreservation Equipment Market Attractiveness Analysis

10.7.1. By Equipment Type

10.7.2. By Cryogen

10.7.3. By Application

10.7.4. By End-user

10.7.5. By Country

11. Europe Cryopreservation Equipment Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Europe Cryopreservation Equipment Market Value Forecast, by Equipment Type, 2017–2027

11.2.1. Freezers

11.2.1.1. Cryopreservation Freezers

11.2.1.2. Drystore Freezers

11.2.2. Incubators

11.2.3. Sample Preparation Systems

11.2.4. Accessories

11.2.4.1. Freezer Box

11.2.4.2. Cryogenic Vaporizer

11.2.4.3. Cryopreservation Vials

11.2.4.4. Others

11.3. Europe Cryopreservation Equipment Market Value Forecast, by Cryogen, 2017–2027

11.3.1. Liquid Nitrogen

11.3.2. Oxygen

11.3.3. Liquid Helium

11.3.4. Argon

11.4. Europe Cryopreservation Equipment Market Value Forecast, by Application, 2017–2027

11.4.1. Cord Blood Stem Cells

11.4.2. Sperms, Semen, and Testicular Tissues

11.4.3. Embryos & Oocytes

11.4.4. Others

11.5. Europe Cryopreservation Equipment Market Value Forecast, by End-user, 2017–2027

11.5.1. Stem Cell Banks

11.5.2. Biotechnology & Pharmaceutical Organizations

11.5.3. Stem Cell Research Laboratories

11.5.4. Others

11.6. Europe Cryopreservation Equipment Market Value Forecast, by Country/Sub-region, 2017–2027

11.6.1. Germany

11.6.2. U.K.

11.6.3. France

11.6.4. Spain

11.6.5. Italy

11.6.6. Rest of Europe

11.7. Europe Cryopreservation Equipment Market Attractiveness Analysis

11.7.1. By Equipment Type

11.7.2. By Cryogen

11.7.3. By Application

11.7.4. By End-user

11.7.5. By Country/Sub-region

12. Asia Pacific Cryopreservation Equipment Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Asia Pacific Cryopreservation Equipment Market Value Forecast, by Equipment Type, 2017–2027

12.2.1. Freezers

12.2.1.1. Cryopreservation Freezers

12.2.1.2. Drystore Freezers

12.2.2. Incubators

12.2.3. Sample Preparation Systems

12.2.4. Accessories

12.2.4.1. Freezer Box

12.2.4.2. Cryogenic Vaporizer

12.2.4.3. Cryopreservation Vials

12.2.4.4. Others

12.3. Asia Pacific Cryopreservation Equipment Market Value Forecast, by Cryogen, 2017–2027

12.3.1. Liquid Nitrogen

12.3.2. Oxygen

12.3.3. Liquid Helium

12.3.4. Argon

12.4. Asia Pacific Cryopreservation Equipment Market Value Forecast, by Application, 2017–2027

12.4.1. Cord Blood Stem Cells

12.4.2. Sperms, Semen, and Testicular Tissues

12.4.3. Embryos & Oocytes

12.4.4. Others

12.5. Asia Pacific Cryopreservation Equipment Market Value Forecast, by End-user, 2017–2027

12.5.1. Stem Cell Banks

12.5.2. Biotechnology & Pharmaceutical Organizations

12.5.3. Stem Cell Research Laboratories

12.5.4. Others

12.6. Asia Pacific Cryopreservation Equipment Market Value Forecast, by Country/Sub-region, 2017–2027

12.6.1. China

12.6.2. Japan

12.6.3. India

12.6.4. Australia & New Zealand

12.6.5. Rest of Asia Pacific

12.7. Asia Pacific Cryopreservation Equipment Market Attractiveness Analysis

12.7.1. By Equipment Type

12.7.2. By Cryogen

12.7.3. By Application

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Latin America Cryopreservation Equipment Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Latin America Cryopreservation Equipment Market Value Forecast, by Equipment Type, 2017–2027

13.2.1. Freezers

13.2.1.1. Cryopreservation Freezers

13.2.1.2. Drystore Freezers

13.2.2. Incubators

13.2.3. Sample Preparation Systems

13.2.4. Accessories

13.2.4.1. Freezer Box

13.2.4.2. Cryogenic Vaporizer

13.2.4.3. Cryopreservation Vials

13.2.4.4. Others

13.3. Latin America Cryopreservation Equipment Market Value Forecast, by Cryogen, 2017–2027

13.3.1. Liquid Nitrogen

13.3.2. Oxygen

13.3.3. Liquid Helium

13.3.4. Argon

13.4. Latin America Cryopreservation Equipment Market Value Forecast, by Application, 2017–2027

13.4.1. Cord Blood Stem Cells

13.4.2. Sperms, Semen, and Testicular Tissues

13.4.3. Embryos & Oocytes

13.4.4. Others

13.5. Latin America Cryopreservation Equipment Market Value Forecast, by End-user, 2017–2027

13.5.1. Stem Cell Banks

13.5.2. Biotechnology & Pharmaceutical Organizations

13.5.3. Stem Cell Research Laboratories

13.5.4. Others

13.6. Latin America Cryopreservation Equipment Market Attractiveness Analysis

13.6.1. By Equipment Type

13.6.2. By Cryogen

13.6.3. By Application

13.6.4. By End-user

13.6.5. By Country/Sub-region

14. Middle East & Africa Cryopreservation Equipment Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Middle East & Africa Cryopreservation Equipment Market Value Forecast, by Equipment Type, 2017–2027

14.2.1. Freezers

14.2.1.1. Cryopreservation Freezers

14.2.1.2. Drystore Freezers

14.2.2. Incubators

14.2.3. Sample Preparation Systems

14.2.4. Accessories

14.2.4.1. Freezer Box

14.2.4.2. Cryogenic Vaporizer

14.2.4.3. Cryopreservation Vials

14.2.4.4. Others

14.3. Middle East & Africa Cryopreservation Equipment Market Value Forecast, by Cryogen, 2017–2027

14.3.1. Liquid Nitrogen

14.3.2. Oxygen

14.3.3. Liquid Helium

14.3.4. Argon

14.4. Middle East & Africa Cryopreservation Equipment Market Value Forecast, by Application, 2017–2027

14.4.1. Cord Blood Stem Cells

14.4.2. Sperms, Semen, and Testicular Tissues

14.4.3. Embryos & Oocytes

14.4.4. Others

14.5. Middle East & Africa Cryopreservation Equipment Market Value Forecast, by End-user, 2017–2027

14.5.1. Stem Cell Banks

14.5.2. Biotechnology & Pharmaceutical Organizations

14.5.3. Stem Cell Research Laboratories

14.5.4. Others

14.6. Middle East & Africa Cryopreservation Equipment Market Value Forecast, by Country/Sub-region, 2017–2027

14.6.1. GCC Countries

14.6.2. South Africa

14.6.3. Rest of Middle East & Africa

14.7. Middle East & Africa Cryopreservation Equipment Market Attractiveness Analysis

14.7.1. By Equipment Type

14.7.2. By Cryogen

14.7.3. By Application

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Competition Landscape

15.1. Market Players - Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis, by Company, 2018

15.3. Company Profiles

15.3.1. Thermo Fisher Scientific, Inc.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Beckman Coulter, Inc.

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Brooks Automation, Inc.

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. VWR International, LLC.

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. Merck KGaA

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. BioLifeSolutions, Inc.

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. Bluechiip Ltd.

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Custom Biogenic Systems

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Hamilton Company

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. PHC Corporation

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

List of Tables

Table 01: Global Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Equipment Type, 2017–2027

Table 02: Global Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Freezers, 2017–2027

Table 03: Global Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Accessories, 2017–2027

Table 04: Global Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Cryogen, 2017–2027

Table 05: Global Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 06: Global Cryopreservation Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 07: Global Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Region, 2017–2027

Table 08: North America Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Country, 2017–2027

Table 09: North America Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Equipment Type, 2017–2027

Table 10: North America Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Freezers, 2017–2027

Table 11: North America Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Accessories, 2017–2027

Table 12: North America Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Cryogen, 2017–2027

Table 13: North America Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 14: North America Cryopreservation Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 15: Europe Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 16: Europe Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Equipment Type, 2017–2027

Table 17: Europe Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Freezers, 2017–2027

Table 18: Europe Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Accessories, 2017–2027

Table 19: Europe Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Cryogen, 2017–2027

Table 20: Europe Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 21: Europe Cryopreservation Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 22: Asia Pacific Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 23: Asia Pacific Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Equipment Type, 2017–2027

Table 24: Asia Pacific Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Freezers, 2017–2027

Table 25: Asia Pacific Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Accessories, 2017–2027

Table 26: Asia Pacific Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Cryogen, 2017–2027

Table 27: Asia Pacific Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 28: Asia Pacific Cryopreservation Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 29: Latin America Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 30: Latin America Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Equipment Type, 2017–2027

Table 31: Latin America Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Freezers, 2017–2027

Table 32: Latin America Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Accessories, 2017–2027

Table 33: Latin America Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Cryogen, 2017–2027

Table 34: Latin America Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 35: Latin America Cryopreservation Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

Table 36: Middle East & Africa Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 37: Middle East & Africa Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Equipment Type, 2017–2027

Table 38: Middle East & Africa Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Freezers, 2017–2027

Table 39: Middle East & Africa Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Accessories, 2017–2027

Table 40: Middle East & Africa Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Cryogen, 2017–2027

Table 41: Middle East & Africa Cryopreservation Equipment Market Value (US$ Mn) Forecast, by Application, 2017–2027

Table 42: Middle East & Africa Cryopreservation Equipment Market Value (US$ Mn) Forecast, by End-user, 2017–2027

List of Figures

Figure 01: Global Cryopreservation Equipment Market Value (US$ Mn) Forecast, 2017–2027

Figure 02: Global Cryopreservation Equipment Market Value Share, by Equipment Type, 2018

Figure 03: Global Cryopreservation Equipment Market Value Share, by Application, 2018

Figure 04: Global Cryopreservation Equipment Market Value Share, by Cryogen, 2018

Figure 05: Global Cryopreservation Equipment Market Value Share, by End-user, 2018

Figure 06: Global Cryopreservation Equipment Market Value Share, by Equipment Type, 2018 and 2027

Figure 07: Global Cryopreservation Equipment Market Attractiveness, by Equipment Type, 2019–2027

Figure 08: Global Cryopreservation Equipment Market Value (US$ Mn) and Y-o-Y Growth (%), by Freezers, 2017–2027

Figure 09: Global Cryopreservation Equipment Market Value (US$ Mn) and Y-o-Y Growth (%), by Incubators, 2017–2027

Figure 10: Global Cryopreservation Equipment Market Value (US$ Mn) and Y-o-Y Growth (%), by Sample Preparation Systems, 2017–2027

Figure 11: Global Cryopreservation Equipment Market Value (US$ Mn) and Y-o-Y Growth (%), by Accessories, 2017–2027

Figure 12: Global Cryopreservation Equipment Market Value Share Analysis, by Cryogen, 2018 and 2027

Figure 13: Global Cryopreservation Equipment Market Attractiveness Analysis, by Cryogen, 2019–2027

Figure 14: Global Cryopreservation Equipment Market Value (US$ Mn) and Y-o-Y Growth (%), by Liquid Nitrogen, 2017–2027

Figure 15: Global Cryopreservation Equipment Market Value (US$ Mn) and Y-o-Y Growth (%), by Oxygen, 2017–2027

Figure 16: Global Cryopreservation Equipment Market Value (US$ Mn) and Y-o-Y Growth (%), by Liquid Helium, 2017–2027

Figure 17: Global Cryopreservation Equipment Market Value (US$ Mn) and Y-o-Y Growth (%), by Argon, 2017- 2027

Figure 18: Global Cryopreservation Equipment Market Value Share Analysis, by Application, 2018 and 2027

Figure 19: Global Cryopreservation Equipment Market Attractiveness Analysis, by Application, 2019–2027

Figure 20: Global Cryopreservation Equipment Market Value (US$ Mn) and Y-o-Y Growth (%), by Cord Blood Stem Cells, 2017–2027

Figure 21: Global Cryopreservation Equipment Market Value (US$ Mn) and Y-o-Y Growth (%), by Sperms, Semen, and Testicular Tissues, 2017-2027

Figure 22: Global Cryopreservation Equipment Market Value (US$ Mn) and Y-o-Y Growth (%), by Embryos & Oocytes, 2017–2027

Figure 23: Global Cryopreservation Equipment Market Value (US$ Mn) and Y-o-Y Growth (%), by Others, 2017-2027

Figure 24: Global Cryopreservation Equipment Market Value Share Analysis, by End-user, 2018 and 2027

Figure 25: Global Cryopreservation Equipment Market Attractiveness Analysis, by End-user, 2019–2027

Figure 26: Global Cryopreservation Equipment Market Value (US$ Mn) and Y-o-Y Growth (%), by Stem Cell Banks, 2017–2027

Figure 27: Global Cryopreservation Equipment Market Value (US$ Mn) and Y-o-Y Growth (%), by Biotechnology and Pharmaceutical Organizations, 2017–2027

Figure 28: Global Cryopreservation Equipment Market Value (US$ Mn) and Y-o-Y Growth (%), by Stem Cell Research Laboratories, 2017–2027

Figure 29: Global Cryopreservation Equipment Market Value (US$ Mn) and Y-o-Y Growth (%), by Others, 2017-2027

Figure 30: Global Cryopreservation Equipment Market Value Share Analysis, by Region, 2018 and 2027

Figure 31: Cryopreservation Equipment Market Attractiveness Analysis, by Region, 2019–2027

Figure 32: North America Cryopreservation Equipment Market Value (US$ Mn) Forecast, 2017–2027

Figure 33: North America Market Attractiveness Analysis,

Figure 34: North America Cryopreservation Equipment Market Value Share Analysis, by Country, 2018–2027

Figure 35: North America Cryopreservation Equipment Market Value Share Analysis, by Equipment Type, 2018–2027

Figure 36: North America Cryopreservation Equipment Market Attractiveness, by Equipment Type, 2019–2027

Figure 37: North America Cryopreservation Equipment Market Value Share Analysis, by Cryogen, 2018– 2027

Figure 38: North America Cryopreservation Equipment Market Attractiveness Analysis, by Cryogen, 2019–2027

Figure 39: North America Cryopreservation Equipment Market Value Share Analysis, by Application, 2018 and 2027

Figure 40: North America Cryopreservation Equipment Market Attractiveness Analysis, by Application, 2018

Figure 41: North America Cryopreservation Equipment Market Value Share Analysis, by End-user, 2018 and 2027

Figure 42: North America Cryopreservation Equipment Market Attractiveness Analysis, by End-user, 2019–2027

Figure 43: Europe Cryopreservation Equipment Market Value (US$ Mn) Forecast, 2017–2027

Figure 44: Europe Cryopreservation Equipment Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 45: Europe Cryopreservation Equipment Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 46: Europe Cryopreservation Equipment Market Value Share Analysis, by Equipment Type, 2018–2027

Figure 47: Europe Cryopreservation Equipment Market Attractiveness, by Equipment Type, 2019–2027

Figure 48: Europe Cryopreservation Equipment Market Value Share Analysis, by Cryogen, 2018–2027

Figure 49: Europe Cryopreservation Equipment Market Attractiveness Analysis, by Cryogen, 2019–2027

Figure 50: Europe Cryopreservation Equipment Market Value Share Analysis, by Application, 2018 and 2027

Figure 51: Europe Cryopreservation Equipment Market Attractiveness Analysis, by Application, 2019–2027

Figure 52: Europe Cryopreservation Equipment Market Value Share Analysis, by End-user, 2018 and 2027

Figure 53: Europe Cryopreservation Equipment Market Attractiveness Analysis, by End-user, 2019–2027

Figure 54: Asia Pacific Cryopreservation Equipment Market Value (US$ Mn) Forecast, 2017–2027

Figure 55: Asia Pacific Cryopreservation Equipment Market Attractiveness Analysis, by Country/Sub-region, 2019–2027

Figure 56: Asia Pacific Cryopreservation Equipment Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

Figure 57: Asia Pacific Cryopreservation Equipment Market Value Share Analysis, by Equipment Type, 2018–2027

Figure 58: Asia Pacific Cryopreservation Equipment Market Attractiveness, by Equipment Type, 2019–2027

Figure 59: Asia Pacific Cryopreservation Equipment Market Value Share Analysis, by Cryogen, 2018–2027

Figure 60: Asia Pacific Cryopreservation Equipment Market Attractiveness Analysis, by Cryogen, 2019–2027

Figure 61: Asia Pacific Cryopreservation Equipment Market Value Share Analysis, by Application, 2018 and 2027

Figure 62: Asia Pacific Cryopreservation Equipment Market Attractiveness Analysis, by Application, 2019–2027

Figure 63: Asia Pacific Cryopreservation Equipment Market Value Share Analysis, by End-user, 2018 and 2027

Figure 64: Asia Pacific Cryopreservation Equipment Market Attractiveness Analysis, by End-user, 2019–2027

Figure 65: Latin America Cryopreservation Equipment Market Value (US$ Mn) Forecast, 2017–2027

Figure 66: Latin America Cryopreservation Equipment Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 67: Latin America Cryopreservation Equipment Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 68: Latin America Cryopreservation Equipment Market Value Share Analysis, by Equipment Type, 2018–2027

Figure 69: Latin America Cryopreservation Equipment Market Attractiveness, by Equipment Type, 2019–2027

Figure 70: Latin America Cryopreservation Equipment Market Value Share Analysis, by Cryogen, 2018– 2027

Figure 71: Latin America Cryopreservation Equipment Market Attractiveness Analysis, by Cryogen, 2019–2027

Figure 72: Latin America Cryopreservation Equipment Market Value Share Analysis, by Application, 2018 and 2027

Figure 73: Latin America Cryopreservation Equipment Market Attractiveness Analysis, by Application, 2019–2027

Figure 74: Latin America Cryopreservation Equipment Market Value Share Analysis, by End-user, 2018 and 2027

Figure 75: Latin America Cryopreservation Equipment Market Attractiveness Analysis, by End-user, 2019–2027

Figure 76: Middle East & Africa Cryopreservation Equipment Market Value (US$ Mn) Forecast, 2017–2027

Figure 77: Middle East & Africa Cryopreservation Equipment Market Attractiveness, by Country/Sub-region, 2019–2027

Figure 78: Middle East & Africa Cryopreservation Equipment Market Value Share, by Country/Sub-region, 2018 and 2027

Figure 79: Middle East & Africa Cryopreservation Equipment Market Value Share Analysis, by Equipment Type, 2018–2027

Figure 80: Middle East & Africa Cryopreservation Equipment Market Attractiveness, by Equipment Type, 2019–2027

Figure 81: Middle East & Africa Cryopreservation Equipment Market Value Share Analysis, by Cryogen, 2018–2027

Figure 82: Middle East & Africa Cryopreservation Equipment Market Attractiveness Analysis, by Cryogen, 2019–2027

Figure 83: Middle East & Africa Cryopreservation Equipment Market Value Share Analysis, by Application, 2018 and 2027

Figure 84: Middle East & Africa Cryopreservation Equipment Market Attractiveness Analysis, by Application, 2019–2027

Figure 85: Middle East & Africa Cryopreservation Equipment Market Value Share Analysis, by End-user, 2018 and 2027

Figure 86: Middle East & Africa Cryopreservation Equipment Market Attractiveness Analysis, by End-user, 2019–2027

Figure 87: Global Cryopreservation Equipment Market Share Analysis, by Company, 2018