Reports

Reports

Analysts’ Viewpoint

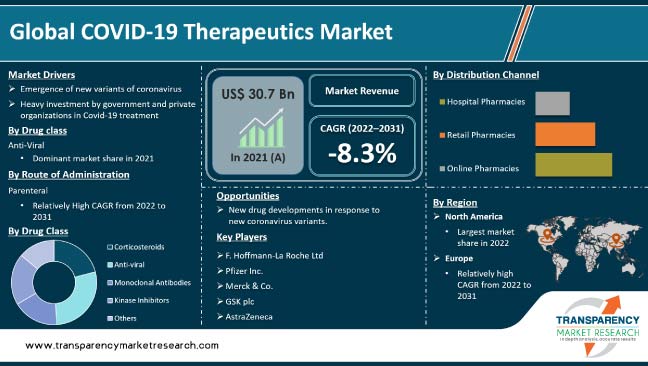

The emergence of SARS-CoV-2, which triggered the COVID-19 pandemic with overall 662,735,182 cases to date, is widely regarded as the greatest medical emergency of the twentieth century. COVID-19 has highlighted health disparities with 6,706,305 death cases, both within and between countries, and its impact on global society would be felt for a long time. Nonetheless, significant investment in life sciences in the last few decades has facilitated a rapid scientific response through advances in viral characterization, testing, and sequencing.

The coronavirus treatment, and vaccination market witnessed significant increase in demand due to the desire of governments and people to safeguard themselves and their loved ones from the virus. Technology advancements have facilitated the rapid development of COVID medications therapies and vaccinations. In a relatively short amount of time, emerging technologies, such as CRISPR and mRNA, have made it possible to develop new medicines. Pharmaceutical corporations, biotech companies, academic institutions, and governmental entities have worked closely together to create COVID-19 treatments. New therapies and vaccines have been developed and distributed more rapidly because of this collaboration.

Demand for COVID-19 treatments may be influenced by the ongoing coronavirus mutational alterations that are currently affecting parts of the world, including China. The need for COVID-19 vaccines and therapies has boosted spending on research and development as well as the manufacturing and distribution of medications. Governments across the globe have taken steps to guarantee that people have access to COVID-19 treatments, which has further fueled the COVID-19 therapeutics industry.

Monoclonal antibodies such as bamlanivimab, casirivimab and imdevimab, developed by companies such as Eli Lilly, Regeneron, and AstraZeneca, have been authorized for emergency use by the FDA and EMA for the treatment of mild to moderate COVID-19 in high-risk patients.

Furthermore, according to the industry analysis of COVID-19 therapeutics, increase in the number of clinical trials for COVID-19 therapeutics, including phase III clinical trials for vaccines and phase II/III clinical trials for therapeutics, such as monoclonal antibodies and antiviral drugs, are likely to be responsible for COVID-19 therapeutics market growth in the near future.

Demand for drugs that can effectively treat new strains of the virus is likely to be significantly high, as these new variants may be less susceptible to existing therapeutics. This is projected to boost the COVID-19 therapeutics market size, as pharmaceutical companies race to develop new drugs and treatments to address these new variants.

Even after the pandemic is under control, there would still be a need for treatments and therapies to help those who have been affected by the virus, including those with long-term effects. This is anticipated to continue to drive COVID-19 therapeutics market demand. Additionally, emergence of new variants of the virus and the possibility of future outbreaks are anticipated to prompt governments and private organizations to be better prepared for future pandemics.

Government and private organizations have been investing heavily in the development of new therapeutics for COVID-19 treatment. This is due in part to the urgency of the pandemic and the need for effective treatments and vaccines. These investments have helped accelerate the development and availability of new therapeutics and have driven the COVID-19 therapeutics market value.

Governments and private organizations have also formed public-private partnerships to accelerate the development of COVID-19 therapeutics. For instance, in April 2020, Gilead Sciences received an investment of US$ 483 Mn from the U.S. government to develop and produce remdesivir, an antiviral drug that was granted Emergency Use Authorization (EUA) by the FDA for the treatment of COVID-19. Furthermore, the U.S. government invested US$ 1.95 Bn in Moderna for the creation and production of their COVID-19 mRNA vaccine.

Governments have also authorized Emergency Use Authorization (EUA) for some drugs and vaccines as a measure to speed up their availability to the public. Therefore, these investments have played a key role in the rapid development and distribution of new treatments and vaccines for COVID-19. This has helped to mitigate the impact of the pandemic on global economies and healthcare systems. Moreover, this is expected to continue to drive COVID-19 therapeutics market developments in the future.

According to the global COVID-19 therapeutics market segmentation, the antiviral drug class segment is expected to account for a considerable COVID-19 therapeutics market share during the forecast period.

Antiviral drugs are used in the treatment of COVID-19 because they can target and inhibit the replication of the virus that causes the disease, SARS-CoV-2. Antiviral drugs can help reduce the severity of symptoms and the duration of illness by slowing or stopping the replication of the virus. These drugs can be used as a monotherapy or in combination with other medications and therapies to improve treatment outcomes.

The approval and distribution of antiviral drugs for COVID-19 have been faster than that of vaccines and monoclonal antibodies. This made them one of the first lines of defense in treating the virus. Furthermore, the WHO and other health organizations have recommended the use of antiviral drugs in the treatment of COVID-19. These factors are driving market growth of COVID-19 therapeutics.

According to the latest COVID-19 therapeutics market trends, the parenteral route of administration is highly preferred for the treatment of COVID-19, as it allows for rapid medication delivery to the patient. The medication is administered directly into the bloodstream, bypassing the digestive system, which can help to ensure that the patient receives the full dose of medication on time.

Furthermore, patients with severe cases of COVID-19 may require high doses of medication to be administered rapidly, and the parenteral route of administration is ideal, as it does not depend on the patient's ability to swallow or absorb the medication. It also allows for the delivery of the drugs in a controlled and accurate manner, which is important for effective treatment and avoiding potential side-effects.

According to the WHO, North America has been one of the regions most affected by the COVID-19 pandemic, as the US has high numbers of confirmed cases of 100,304,472 and deaths of 1,088,854. This has led to an increased demand for medication and other therapeutics to treat the disease. Furthermore, regional analysis of research insights of the COVID-19 therapeutics market reveal that this region has a well-developed healthcare infrastructure, with a high concentration of hospitals, clinics, and pharmacies. This has allowed for the efficient distribution and administration of medication and other therapeutics to patients in need.

Europe has also been affected by the COVID-19 pandemic, as it also has a large population and high expenditure on healthcare, which has enabled the region to invest in research and development of new therapeutics, as well as in the distribution and administration of existing treatments.

The Asia Pacific market is expected to grow at a rapid pace in the next few years due to the rising incidence of COVID-19 cases and the increasing government support for the treatment and prevention of the disease.

The global market is fragmented, with the presence of a large number of players according to the COVID-19 therapeutics market forecast. Key players operating in the industry are F. Hoffmann-La Roche Ltd, Gilead Sciences, Inc., Eli Lilly and Company, Pfizer Inc., Merck & Co., Inc. GSK plc. Celltrion Healthcare Co., Ltd., Sorrento Therapeutics, Inc., and AstraZeneca.

|

Attribute |

Detail |

|

Size in 2021 |

US$ 30.7 Bn |

|

Forecast Value in 2031 |

More than US$ 16.2 Bn |

|

CAGR - 2022–2031 |

-8.3 % |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

.Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

The global market was valued at US$ 30.7 Bn in 2021.

It is projected to reach more than US$ 16.2 Bn by 2031.

It is anticipated to be - 8.3% from 2022 to 2031.

The parenteral segment held more than 80.0% share in 2021.

North America is expected to account for largest share from 2022 to 2031.

F. Hoffmann-La Roche Ltd, Gilead Sciences, Inc., Eli Lilly and Company, Pfizer Inc., Merck & Co., Inc. GSK plc. Celltrion Healthcare Co., Ltd., Sorrento Therapeutics, Inc., and AstraZeneca.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global COVID-19 Therapeutics Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global COVID-19 Therapeutics Market Analysis and Forecasts, 2017 - 2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Pipeline Analysis

5.3. Regulatory Scenario by Region/globally

5.4. COVID-19 Impact Analysis

6. Global COVID-19 Therapeutics Market Analysis and Forecast, by Drug Class

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Drug Class, 2017 - 2031

6.3.1. Corticosteroids

6.3.2. Anti-viral

6.3.3. Monoclonal Antibodies

6.3.4. Kinase Inhibitors

6.3.5. Others (Anti-inflammatory Drugs, Convalescent Plasma, Others)

6.4. Market Attractiveness, by Drug Class

7. Global COVID-19 Therapeutics Market Analysis and Forecast, by Route of Administration

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Route of Administration, 2017 - 2031

7.3.1. Oral

7.3.2. Parenteral

7.4. Market Attractiveness, by Route of Administration

8. Global COVID-19 Therapeutics Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Distribution Channel, 2017 - 2031

8.3.1. Hospital Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Online Pharmacies

8.4. Market Attractiveness, by Distribution Channel

9. Global COVID-19 Therapeutics Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness, by Country/Region

10. North America COVID-19 Therapeutics Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Drug Class, 2017 - 2031

10.2.1. Corticosteroids

10.2.2. Anti-viral

10.2.3. Monoclonal Antibodies

10.2.4. Kinase Inhibitors

10.2.5. Others (Anti-inflammatory Drugs, Convalescent Plasma, Others)

10.3. Market Value Forecast, by Route of Administration, 2017 - 2031

10.3.1. Oral

10.3.2. Parenteral

10.4. Market Value Forecast, by Distribution Channel, 2017 - 2031

10.4.1. Hospital Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Online Pharmacies

10.5. Market Value Forecast, by Country, 2017 - 2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Drug Class

10.6.2. By Route of Administration

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe COVID-19 Therapeutics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Drug Class, 2017 - 2031

11.2.1. Corticosteroids

11.2.2. Anti-viral

11.2.3. Monoclonal Antibodies

11.2.4. Kinase Inhibitors

11.2.5. Others (Anti-inflammatory Drugs, Convalescent Plasma, Others)

11.3. Market Value Forecast, by Route of Administration, 2017 - 2031

11.3.1. Oral

11.3.2. Parenteral

11.4. Market Value Forecast, by Distribution Channel, 2017 - 2031

11.4.1. Hospital Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Online Pharmacies

11.5. Market Value Forecast, by Country/Sub-region, 2017 - 2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Drug Class

11.6.2. By Route of Administration

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific COVID-19 Therapeutics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Drug Class, 2017 - 2031

12.2.1. Corticosteroids

12.2.2. Anti-viral

12.2.3. Monoclonal Antibodies

12.2.4. Kinase Inhibitors

12.2.5. Others (Anti-inflammatory Drugs, Convalescent Plasma, Others)

12.3. Market Value Forecast, by Route of Administration, 2017 - 2031

12.3.1. Oral

12.3.2. Parenteral

12.4. Market Value Forecast, by Distribution Channel, 2017 - 2031

12.4.1. Hospital Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Online Pharmacies

12.5. Market Value Forecast, by Country/Sub-region, 2017 - 2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Drug Class

12.6.2. By Route of Administration

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America COVID-19 Therapeutics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Drug Class, 2017 - 2031

13.2.1. Corticosteroids

13.2.2. Anti-viral

13.2.3. Monoclonal Antibodies

13.2.4. Kinase Inhibitors

13.2.5. Others (Anti-inflammatory Drugs, Convalescent Plasma, Others)

13.3. Market Value Forecast, by Route of Administration, 2017 - 2031

13.3.1. Oral

13.3.2. Parenteral

13.4. Market Value Forecast, by Distribution Channel, 2017 - 2031

13.4.1. Hospital Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Online Pharmacies

13.5. Market Value Forecast, by Country/Sub-region, 2017 - 2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Drug Class

13.6.2. By Route of Administration

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa COVID-19 Therapeutics Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Drug Class, 2017 - 2031

14.2.1. Corticosteroids

14.2.2. Anti-viral

14.2.3. Monoclonal Antibodies

14.2.4. Kinase Inhibitors

14.2.5. Others (Anti-inflammatory Drugs, Convalescent Plasma, Others)

14.3. Market Value Forecast, by Route of Administration, 2017 - 2031

14.3.1. Oral

14.3.2. Parenteral

14.4. Market Value Forecast, by Distribution Channel, 2017 - 2031

14.4.1. Hospital Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Online Pharmacies

14.5. Market Value Forecast, by Country/Sub-region, 2017 - 2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & South Africa

14.6. Market Attractiveness Analysis

14.6.1. By Drug Class

14.6.2. By Route of Administration

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2021)

15.3. Company Profiles

15.3.1. F. Hoffmann-La Roche Ltd

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Gilead Sciences, Inc.

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Eli Lilly and Company

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Pfizer Inc.

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Merck & Co., Inc.

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. GSK plc.

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Recent Developments

15.3.7. Celltrion Healthcare Co., Ltd.

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Sorrento Therapeutics, Inc.

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. AstraZeneca

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

List of Tables

Table 01: Global COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 02: Global COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 03: Global COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel 2017–2031

Table 04: Global COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 07: North America COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 08: North America COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel 2017–2031

Table 09: Europe COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 10: Europe COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 11: Europe COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 12: Europe COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel 2017–2031

Table 13: Asia Pacific COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 15: Asia Pacific COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 16: Asia Pacific COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel 2017–2031

Table 17: Latin America COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 18: Latin America COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 19: Latin America COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 20: Latin America COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 21: Middle East & Africa COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 22: Middle East & Africa COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 23: Middle East & Africa COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Route of Administration, 2017‒2031

Table 24: Middle East & Africa COVID-19 Therapeutics Market Value (US$ Mn) Forecast, by Distribution Channel 2017–2031

List of Figures

Figure 01: Global COVID-19 Therapeutics Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: COVID-19 Therapeutics Market Value Share, by Drug Class, 2021

Figure 03: COVID-19 Therapeutics Market Value Share, by Route of Administration, 2021

Figure 04: COVID-19 Therapeutics Market Value Share, by Distribution Channel, 2021

Figure 05: COVID-19 Therapeutics Market Value Share, by Region, 2021

Figure 06: Global COVID-19 Therapeutics Market Value Share Analysis, by Drug Class, 2021 and 2031

Figure 07: Global COVID-19 Therapeutics Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 08: Global COVID-19 Therapeutics Market Value (US$ Mn), by Corticosteroids, 2017‒2031

Figure 09: Global COVID-19 Therapeutics Market Value (US$ Mn), by Anti-viral, 2017‒2031

Figure 10: Global COVID-19 Therapeutics Market Value (US$ Mn), by Monoclonal Antibodies, 2017‒2031

Figure 11: Global COVID-19 Therapeutics Market Value (US$ Mn), by Kinase Inhibitors, 2017‒2031

Figure 12: Global COVID-19 Therapeutics Market Value (US$ Mn), by Others (Anti-inflammatory Drugs, Convalescent Plasma, Others) 2017‒2031

Figure 13: Global COVID-19 Therapeutics Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 14: Global COVID-19 Therapeutics Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 15: Global COVID-19 Therapeutics Market Value (US$ Mn), by Parenteral, 2017‒2031

Figure 16: Global COVID-19 Therapeutics Market Value (US$ Mn), by Oral, 2017‒2031

Figure 17: Global COVID-19 Therapeutics Market Value Share Analysis, by Distribution Channel 2021 and 2031

Figure 18: Global COVID-19 Therapeutics Market Attractiveness Analysis, by Distribution Channel 2022–2031

Figure 19: Global COVID-19 Therapeutics Market Revenue (US$ Mn), by Hospital Pharmacies, 2017–2031

Figure 20: Global COVID-19 Therapeutics Market Revenue (US$ Mn), by Retail Pharmacies, 2017–2031

Figure 21: Global COVID-19 Therapeutics Market Revenue (US$ Mn), by Online Pharmacies, 2017–2031

Figure 22: Global COVID-19 Therapeutics Market Value Share Analysis, by Region, 2021 and 2031

Figure 23: Global COVID-19 Therapeutics Market Attractiveness Analysis, by Region, 2022–2031

Figure 24: North America COVID-19 Therapeutics Market Value (US$ Mn) Forecast, 2017–2031

Figure 25: North America COVID-19 Therapeutics Market Value Share Analysis, by Country, 2021 and 2031

Figure 26: North America COVID-19 Therapeutics Market Attractiveness Analysis, by Country, 2022–2031

Figure 27: North America COVID-19 Therapeutics Market Value Share Analysis, by Drug Class, 2021 and 2031

Figure 28: North America COVID-19 Therapeutics Market Attractiveness Analysis, by Drug Class 2022–2031

Figure 29: North America COVID-19 Therapeutics Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 30: North America COVID-19 Therapeutics Market Attractiveness Analysis, by Route of Administration 2022–2031

Figure 31: North America COVID-19 Therapeutics Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 32: North America COVID-19 Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 33: Europe COVID-19 Therapeutics Market Value (US$ Mn) Forecast, 2017–2031

Figure 34: Europe COVID-19 Therapeutics Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 35: Europe COVID-19 Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 36: Europe COVID-19 Therapeutics Market Value Share Analysis, by Drug Class, 2021 and 2031

Figure 37: Europe COVID-19 Therapeutics Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 38: Europe COVID-19 Therapeutics Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 39: Europe COVID-19 Therapeutics Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 40: Europe COVID-19 Therapeutics Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 41: Europe COVID-19 Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 42: Asia Pacific COVID-19 Therapeutics Market Value (US$ Mn) Forecast, 2017–2031

Figure 43: Asia Pacific COVID-19 Therapeutics Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 44: Asia Pacific COVID-19 Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 45: Asia Pacific COVID-19 Therapeutics Market Value Share Analysis, by Drug Class, 2021 and 2031

Figure 46: Asia Pacific COVID-19 Therapeutics Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 47: Asia Pacific COVID-19 Therapeutics Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 48: Asia Pacific COVID-19 Therapeutics Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 49: Asia Pacific COVID-19 Therapeutics Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 50: Asia Pacific COVID-19 Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 51: Latin America COVID-19 Therapeutics Market Value (US$ Mn) Forecast, 2017–2031

Figure 52: Latin America COVID-19 Therapeutics Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 53: Latin America COVID-19 Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 54: Latin America COVID-19 Therapeutics Market Value Share Analysis, by Drug Class, 2021 and 2031

Figure 55: Latin America COVID-19 Therapeutics Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 56: Latin America COVID-19 Therapeutics Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 57: Latin America COVID-19 Therapeutics Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 58: Latin America COVID-19 Therapeutics Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 59: Latin America COVID-19 Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 60: Middle East & Africa COVID-19 Therapeutics Market Value (US$ Mn) Forecast, 2017–2031

Figure 61: Middle East & Africa COVID-19 Therapeutics Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 62: Middle East & Africa COVID-19 Therapeutics Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 63: Middle East & Africa COVID-19 Therapeutics Market Value Share Analysis, by Drug Class, 2021 and 2031

Figure 64: Middle East & Africa COVID-19 Therapeutics Market Attractiveness Analysis, by Drug Class, 2022–2031

Figure 65: Middle East & Africa COVID-19 Therapeutics Market Value Share Analysis, by Route of Administration, 2021 and 2031

Figure 66: Middle East & Africa COVID-19 Therapeutics Market Attractiveness Analysis, by Route of Administration, 2022–2031

Figure 67: Middle East & Africa COVID-19 Therapeutics Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 68: Middle East & Africa COVID-19 Therapeutics Market Attractiveness Analysis, by Distribution Channel, 2022–2031

Figure 69: Company Share Analysis