Reports

Reports

Rise in awareness about health and wellness among employers and employees and surge in technological advancements enhancing accessibility and engagement in corporate wellness programs are significant factors driving the global corporate wellness market. Furthermore, surge in healthcare costs is prompting businesses to invest in wellness programs to manage healthcare expenses.

However, corporate wellness market also faces some of the challenges, including high costs of setup, especially for SMBs, and low worker engagement, which can ruin program success. Privacy concerns regarding sensitive health data, lack of program customization, and weak management support also hinder success.

In line with the latest corporate wellness trends, key players operating in the industry are are forming collaborations with medical providers, fitness instructors, and mental health professionals in order to become more effective programs. Through collaborations, companies can offer health seminars guided by professionals, personalized exercise plans, and mental health benefits through counseling and therapy sessions.

Corporate Wellness is a comprehensive approach adopted by organizations to promote the physical, mental, and emotional well-being of their employees. The programs aim to create a healthier, more efficient workforce by integrating wellness programs into the workplace and includes fitness challenges, stress management classes, health screening, nutrition counseling, smoking cessation programs, and mental health counseling.

Furthermore, corporate wellness programs help reduce hospitalization expense, emergency room, specialist office visit, and surgery. The programs help in reduced absenteeism, improved productivity, and overall improvement in the quality of life. Workplace or corporate wellness programs can be utilized to define employer-sponsored services aimed at promoting and maintaining the optimal well-being of employees.

The primary intent of these efforts is to generate a positive return on investment through reduced absenteeism and lower costs for health insurance. The ultimate benefit, though, is the building of a healthier workforce, and this is one aspect of a healthier population.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

One of the major forces driving the corporate wellness business is the growing acknowledgement of well-being and health by employers and employees. Organizations are recognizing the importance of employee well-being and its effect on productivity, engagement, and overall business performance, leading to greater investment in comprehensive wellness initiatives.

One of the key factor contributing to this trend is growing focus among employers on the tangible benefits of workplace wellness programs. Several studies have shown that well-designed wellness initiatives can result to numerous positive outcomes such as improved employee health, enhanced productivity and engagement, and reduced healthcare expenditures.

By encouraging healthier habits, corporate well-being programs lower the risk of long-term ailments such as diabetes, obesity, chronic pain, and cardiovascular illness. This proactive approach can lead to lower absenteeism and higher levels of workplace performance. For instance, a study by Corporate Executive Board stated that businesses with particularly engaged employees report 21% better profitability.

Moreover, healthier employees incur lower healthcare expenses, as they require fewer clinical interventions and hospitalizations. A Centers for Disease Control and Prevention (CDC) study discovered that organizations can save $3.27 in medical costs and $2.73 in absenteeism-related savings for each $1 spent on workplace wellness programs.

With growing recognition of these benefits, increasing numbers of companies are prioritizing implementing wellness programs. In its latest survey, the International Foundation of Employee Benefit Plans found that 73% of U.S. employers offered some form of wellness program in 2021, compared to 58% in 2018, indicating the increasing importance of employee wellness within the corporate world today.

Another key driver of corporate wellness industry growth is the rapid development of digital health technologies. The convergence of mobile health apps, wearable technologies, virtual wellness platforms, and AI-powered health monitoring has revolutionized the way wellness programs are delivered and monitored. These technologies have made it easier for companies to roll out scalable, cost-effective, and targeted wellness programs, especially in hybrid and remote workforce environments.

Wearable devices such as smartwatches and fitness trackers allow employees to monitor physical activity, sleep patterns, and heart rate in real time, and mobile apps provide features such as guided meditation, personalized exercise routines, and mental health support. Employers are also able to aggregate data to identify health trends and tailor programs to address the needs of the population.

This technology-based approach not only boosts employee involvement and participation but also offers continuous access to wellness tools, regardless of geography. The more individuals use digital technologies, the more technology will become the vehicle for bringing corporate wellness programs to more people and enhancing their effectiveness.

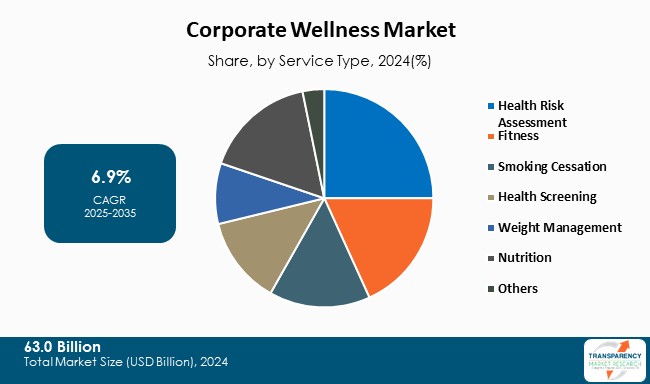

In terms of service type, the global corporate wellness market is segmented into health risk assessment, fitness, smoking cessation, health screening, weight management, nutrition, and others (including stress management, disease management, vaccination, etc.). Among these, the health risk assessment segment is projected to hold a significant share of the global market by 2028 and is expected to expand at a high CAGR during the forecast period.

Health risk tests provide an immediate and efficient method to check the present state of physical fitness of an employee, identify risk for disease, and provide a general indication of their fitness and health level. These tests provide individual feedback to employees, enabling them to understand their health level and offering them actionable recommendations to improve their health.

As a preventive form of medical practice, health risk assessments are gaining popularity since they have been found to result in healthier lifestyles and reduce long-term healthcare costs for both employers and employees.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

According to the latest corporate wellness market analysis, North America held the largest share in 2024. Rising healthcare costs, increased focus on employee productivity and engagement, growing mental health awareness, and government incentives and regulations are some of the leading factors driving corporate wellness industry share in the region.

The U.S. has dominated the corporate wellness market in North America as a result of increased investment in wellness programs, the expense of healthcare, and increasing rates of chronic disease. Companies have sought corporate wellness services as a remedy to these ailments, with increasing numbers implementing them in a bid to improve the health of employees, reduce healthcare costs, and increase productivity.

Besides, the U.S. market is propelled further by the growing use of newly introduced wellness plans, which are most prevalent across categories like fitness, weight loss, and nutrition. These programs are helping companies create healthier employees, leading to lower absenteeism, greater employee satisfaction, and cost savings in the long run.

Leading key players in the corporate wellness industry are enhancing their services by incorporating a wide range of services ranging from fitness activities, mental wellness services, dietary advice, stress management programs, and health risk assessments. Along with these services, some industry leaders are rolling out bundled packages of integrated well-being aimed at creating more active employee participation.

Through the offering of overall wellness solutions, these companies are meeting the diverse needs of the workforce and offering employees access to full health programs that promote better overall well-being and create a healthier, more productive workforce.

EXOS, Central Corporate Wellness, Cigna Healthcare, ComPsych Corporation, CXA Group Pte. Limited, Guia da Alma, JLT Risk Solutions Pty Ltd, Mantra Care Health, Optum, Inc. (United Health Group), WellRight Inc., Truworth Wellness, Vibe Saúde, Wellness Corporate Solutions, Wellsource, Inc., are some of the major key players operating in the industry.

Each of these players has been profiled in the corporate wellness market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

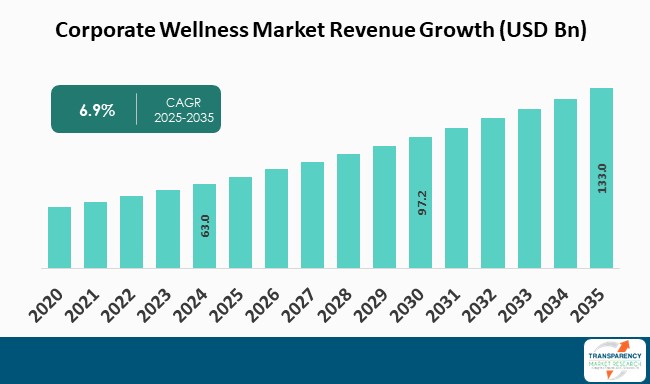

| Size in 2024 | US$ 63.0 Bn |

| Forecast Value in 2035 | US$ 133.0 Bn |

| CAGR | 6.9% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2024 |

| Quantitative Units | US$ Bn |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 63.0 Bn in 2024.

It is projected to reach around US$ 133.0 Bn by the end of 2035.

Rise in awareness about health and wellness among employers and employees and surge in technological advancements enhancing accessibility and engagement in corporate wellness programs.

It is anticipated to grow at a 6.9% from 2025 to 2035.

North America is expected to account the largest share during 2025 to 2035.

EXOS, Central Corporate Wellness, Cigna Healthcare, ComPsych Corporation, CXA Group Pte. Limited, Guia da Alma, JLT Risk Solutions Pty Ltd, Mantra Care Health, Optum, Inc. (United Health Group), OrienteMe, WellRight Inc., Truworth Wellness, Vibe Saúde, Wellness Corporate Solutions, and Wellsource, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Corporate Wellness Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Corporate Wellness Market Analysis and Forecasts, 2020-2035

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Advancements in Corporate Wellness Market

5.2. Regulatory Scenario by Country/Sub-region

5.3. Pestle Analysis

5.4. PORTER’s Five Forces Analysis

5.5. Unmet Needs of Corporate Wellness Market

5.6. Key Industry Events

5.7. Rise in Awareness about Health and Wellness among Employers & Employees

6. Global Corporate Wellness Market Analysis and Forecasts, By Service Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Service Type, 2020-2035

6.3.1. Health Risk Assessment

6.3.2. Fitness

6.3.3. Smoking Cessation

6.3.4. Health Screening

6.3.5. Weight Management

6.3.6. Nutrion

6.3.7. Others (Stress Management, etc.)

6.4. Market Attractiveness By Service Type

7. Global Corporate Wellness Market Analysis and Forecasts, By Mode of Delivery

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Mode of Delivery, 2020-2035

7.3.1. Onsite

7.3.2. Offsite

7.4. Market Attractiveness By Mode of Delivery

8. Global Corporate Wellness Market Analysis and Forecasts, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By End-user, 2020-2035

8.3.1. Small Scale Organizations

8.3.2. Medium Scale Organizations

8.3.3. Large Scale Organizations

8.4. Market Attractiveness By End-user

9. Global Corporate Wellness Market Analysis and Forecasts, By Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Region

10. North America Corporate Wellness Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Service Type, 2020-2035

10.2.1. Health Risk Assessment

10.2.2. Fitness

10.2.3. Smoking Cessation

10.2.4. Health Screening

10.2.5. Weight Management

10.2.6. Nutrition

10.2.7. Others (Stress Management, etc.)

10.3. Market Value Forecast By Mode of Delivery, 2020-2035

10.3.1. Onsite

10.3.2. Offsite

10.4. Market Value Forecast By End-user, 2020-2035

10.4.1. Small Scale Organizations

10.4.2. Medium Scale Organizations

10.4.3. Large Scale Organizations

10.5. Market Value Forecast By Country, 2020-2035

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Service Type

10.6.2. By Mode of Delivery

10.6.3. By End-user

10.6.4. By Country

11. Europe Corporate Wellness Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Service Type, 2020-2035

11.2.1. Health Risk Assessment

11.2.2. Fitness

11.2.3. Smoking Cessation

11.2.4. Health Screening

11.2.5. Weight Management

11.2.6. Nutrition

11.2.7. Others (Stress Management, etc.)

11.3. Market Value Forecast By Mode of Delivery, 2020-2035

11.3.1. Onsite

11.3.2. Offsite

11.4. Market Value Forecast By End-user, 2020-2035

11.4.1. Small Scale Organizations

11.4.2. Medium Scale Organizations

11.4.3. Large Scale Organizations

11.5. Market Value Forecast By Country/Sub-region, 2020-2035

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Service Type

11.6.2. By Mode of Delivery

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Corporate Wellness Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Service Type, 2020-2035

12.2.1. Health Risk Assessment

12.2.2. Fitness

12.2.3. Smoking Cessation

12.2.4. Health Screening

12.2.5. Weight Management

12.2.6. Nutrition

12.2.7. Others (Stress Management, etc.)

12.3. Market Value Forecast By Mode of Delivery, 2020-2035

12.3.1. Onsite

12.3.2. Offsite

12.4. Market Value Forecast By End-user, 2020-2035

12.4.1. Small Scale Organizations

12.4.2. Medium Scale Organizations

12.4.3. Large Scale Organizations

12.5. Market Value Forecast By Country/Sub-region, 2020-2035

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Service Type

12.6.2. By Mode of Delivery

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Corporate Wellness Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Service Type, 2020-2035

13.2.1. Health Risk Assessment

13.2.2. Fitness

13.2.3. Smoking Cessation

13.2.4. Health Screening

13.2.5. Weight Management

13.2.6. Nutrition

13.2.7. Others (Stress Management, etc.)

13.3. Market Value Forecast By Mode of Delivery, 2020-2035

13.3.1. Onsite

13.3.2. Offsite

13.4. Market Value Forecast By End-user, 2020-2035

13.4.1. Small Scale Organizations

13.4.2. Medium Scale Organizations

13.4.3. Large Scale Organizations

13.5. Market Value Forecast By Country/Sub-region, 2020-2035

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Service Type

13.6.2. By Mode of Delivery

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Corporate Wellness Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Service Type, 2020-2035

14.2.1. Health Risk Assessment

14.2.2. Fitness

14.2.3. Smoking Cessation

14.2.4. Health Screening

14.2.5. Weight Management

14.2.6. Nutrition

14.2.7. Others (Stress Management, etc.)

14.3. Market Value Forecast By Mode of Delivery, 2020-2035

14.3.1. Onsite

14.3.2. Offsite

14.4. Market Value Forecast By End-user, 2020-2035

14.4.1. Small Scale Organizations

14.4.2. Medium Scale Organizations

14.4.3. Large Scale Organizations

14.5. Market Value Forecast By Country/Sub-region, 2020-2035

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Service Type

14.6.2. By Mode of Delivery

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2024)

15.3. Company Profiles

15.3.1. EXOS

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Central Corporate Wellness

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Cigna Healthcare

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. ComPsych Corporation

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. CXA Group Pte. Limited

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Guia da Alma

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. JLT Risk Solutions Pty Ltd

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Mantra Care Health

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. Optum, Inc. (United Health Group)

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. OrienteMe

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

15.3.11. Truworth Wellness

15.3.11.1. Company Overview

15.3.11.2. Financial Overview

15.3.11.3. Product Portfolio

15.3.11.4. Business Strategies

15.3.11.5. Recent Developments

15.3.12. Vibe Saúde

15.3.12.1. Company Overview

15.3.12.2. Financial Overview

15.3.12.3. Product Portfolio

15.3.12.4. Business Strategies

15.3.12.5. Recent Developments

15.3.13. Wellness Corporate Solutions

15.3.13.1. Company Overview

15.3.13.2. Financial Overview

15.3.13.3. Product Portfolio

15.3.13.4. Business Strategies

15.3.13.5. Recent Developments

15.3.14. Wellsource, Inc.

15.3.14.1. Company Overview

15.3.14.2. Financial Overview

15.3.14.3. Product Portfolio

15.3.14.4. Business Strategies

15.3.14.5. Recent Developments

15.3.15. WellRight Inc.

15.3.15.1. Company Overview

15.3.15.2. Financial Overview

15.3.15.3. Product Portfolio

15.3.15.4. Business Strategies

15.3.15.5. Recent Developments

List of Tables

Table 01: Global Corporate Wellness Market Value (US$ Bn) Forecast, By Service Type, 2020-2035

Table 02: Global Corporate Wellness Market Value (US$ Bn) Forecast, By Mode of Delivery, 2020-2035

Table 03: Global Corporate Wellness Market Value (US$ Bn) Forecast, By End-user, 2020-2035

Table 04: Global Corporate Wellness Market Value (US$ Bn) Forecast, By Region, 2020-2035

Table 05: North America - Corporate Wellness Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 06: North America - Corporate Wellness Market Value (US$ Bn) Forecast, By Service Type, 2020-2035

Table 07: North America - Corporate Wellness Market Value (US$ Bn) Forecast, By Mode of Delivery, 2020-2035

Table 08: North America - Corporate Wellness Market Value (US$ Bn) Forecast, By End-user, 2020-2035

Table 09: Europe - Corporate Wellness Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 10: Europe - Corporate Wellness Market Value (US$ Bn) Forecast, By Service Type, 2020-2035

Table 11: Europe - Corporate Wellness Market Value (US$ Bn) Forecast, By Mode of Delivery, 2020-2035

Table 12: Europe - Corporate Wellness Market Value (US$ Bn) Forecast, By End-user, 2020-2035

Table 13: Asia Pacific - Corporate Wellness Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 14: Asia Pacific - Corporate Wellness Market Value (US$ Bn) Forecast, By Service Type, 2020-2035

Table 15: Asia Pacific - Corporate Wellness Market Value (US$ Bn) Forecast, By Mode of Delivery, 2020-2035

Table 16: Asia Pacific - Corporate Wellness Market Value (US$ Bn) Forecast, By End-user, 2020-2035

Table 17: Latin America - Corporate Wellness Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 18: Latin America - Corporate Wellness Market Value (US$ Bn) Forecast, By Service Type, 2020-2035

Table 19: Latin America - Corporate Wellness Market Value (US$ Bn) Forecast, By Mode of Delivery, 2020-2035

Table 20: Latin America - Corporate Wellness Market Value (US$ Bn) Forecast, By End-user, 2020-2035

Table 21: Middle East & Africa - Corporate Wellness Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 22: Middle East & Africa - Corporate Wellness Market Value (US$ Bn) Forecast, By Service Type, 2020-2035

Table 23: Middle East & Africa - Corporate Wellness Market Value (US$ Bn) Forecast, By Mode of Delivery, 2020-2035

Table 24: Middle East & Africa - Corporate Wellness Market Value (US$ Bn) Forecast, By End-user, 2020-2035

List of Figures

Figure 01: Global Corporate Wellness Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 02: Global Corporate Wellness Market Attractiveness Analysis, By Service Type, 2025-2035

Figure 03: Global Corporate Wellness Market Revenue (US$ Bn), by Health Risk Assessment, 2020-2035

Figure 04: Global Corporate Wellness Market Revenue (US$ Bn), by Fitness, 2020-2035

Figure 05: Global Corporate Wellness Market Revenue (US$ Bn), by Smoking Cessation, 2020-2035

Figure 06: Global Corporate Wellness Market Revenue (US$ Bn), by Health Screening, 2020-2035

Figure 07: Global Corporate Wellness Market Revenue (US$ Bn), by Weight Management, 2020-2035

Figure 08: Global Corporate Wellness Market Revenue (US$ Bn), by Nutrition, 2020-2035

Figure 09: Global Corporate Wellness Market Revenue (US$ Bn), by Others, 2020-2035

Figure 10: Global Corporate Wellness Market Value Share Analysis, By Mode of Delivery, 2024 and 2035

Figure 11: Global Corporate Wellness Market Attractiveness Analysis, By Mode of Delivery, 2025-2035

Figure 12: Global Corporate Wellness Market Revenue (US$ Bn), by Onsite, 2020-2035

Figure 13: Global Corporate Wellness Market Revenue (US$ Bn), by Offsite, 2020-2035

Figure 14: Global Corporate Wellness Market Value Share Analysis, By End-user, 2024 and 2035

Figure 15: Global Corporate Wellness Market Attractiveness Analysis, By End-user, 2025-2035

Figure 16: Global Corporate Wellness Market Revenue (US$ Bn), by Small Scale Organizations, 2020-2035

Figure 17: Global Corporate Wellness Market Revenue (US$ Bn), by Medium Scale Organizations, 2020-2035

Figure 18: Global Corporate Wellness Market Revenue (US$ Bn), by Large Scale Organizations, 2020-2035

Figure 19: Global Corporate Wellness Market Value Share Analysis, By Region, 2024 and 2035

Figure 20: Global Corporate Wellness Market Attractiveness Analysis, By Region, 2025-2035

Figure 21: North America - Corporate Wellness Market Value (US$ Bn) Forecast, 2020-2035

Figure 22: North America - Corporate Wellness Market Value Share Analysis, by Country, 2024 and 2035

Figure 23: North America - Corporate Wellness Market Attractiveness Analysis, by Country, 2025-2035

Figure 24: North America - Corporate Wellness Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 25: North America - Corporate Wellness Market Attractiveness Analysis, By Service Type, 2025-2035

Figure 26: North America - Corporate Wellness Market Value Share Analysis, By Mode of Delivery, 2024 and 2035

Figure 27: North America - Corporate Wellness Market Attractiveness Analysis, By Mode of Delivery, 2025-2035

Figure 28: North America - Corporate Wellness Market Value Share Analysis, By End-user, 2024 and 2035

Figure 29: North America - Corporate Wellness Market Attractiveness Analysis, By End-user, 2025-2035

Figure 30: Europe - Corporate Wellness Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 31: Europe - Corporate Wellness Market Value (US$ Bn) Forecast, 2020-2035

Figure 32: Europe - Corporate Wellness Market Attractiveness Analysis, by Country / Sub-region, 2025-2035

Figure 33: Europe - Corporate Wellness Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 34: Europe - Corporate Wellness Market Attractiveness Analysis, By Service Type, 2025-2035

Figure 35: Europe - Corporate Wellness Market Value Share Analysis, By Mode of Delivery, 2024 and 2035

Figure 36: Europe - Corporate Wellness Market Attractiveness Analysis, By Mode of Delivery, 2025-2035

Figure 37: Europe - Corporate Wellness Market Value Share Analysis, By End-user, 2024 and 2035

Figure 38: Europe - Corporate Wellness Market Attractiveness Analysis, By End-user, 2025-2035

Figure 39: Asia Pacific - Corporate Wellness Market Value (US$ Bn) Forecast, 2020-2035

Figure 40: Asia Pacific - Corporate Wellness Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 41: Asia Pacific - Corporate Wellness Market Attractiveness Analysis, by Country/Sub-region, 2025-2035

Figure 42: Asia Pacific - Corporate Wellness Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 43: Asia Pacific - Corporate Wellness Market Attractiveness Analysis, By Service Type, 2025-2035

Figure 44: Asia Pacific - Corporate Wellness Market Value Share Analysis, By Mode of Delivery, 2024 and 2035

Figure 45: Asia Pacific - Corporate Wellness Market Attractiveness Analysis, By Mode of Delivery, 2025-2035

Figure 46: Asia Pacific - Corporate Wellness Market Value Share Analysis, By End-user, 2024 and 2035

Figure 47: Asia Pacific - Corporate Wellness Market Attractiveness Analysis, By End-user, 2025-2035

Figure 48: Latin America - Corporate Wellness Market Value (US$ Bn) Forecast, 2020-2035

Figure 49: Latin America - Corporate Wellness Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 50: Latin America - Corporate Wellness Market Attractiveness Analysis, by Country / Sub-region, 2025-2035

Figure 51: Latin America - Corporate Wellness Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 52: Latin America - Corporate Wellness Market Attractiveness Analysis, By Service Type, 2025-2035

Figure 53: Latin America - Corporate Wellness Market Value Share Analysis, By Mode of Delivery, 2024 and 2035

Figure 54: Latin America - Corporate Wellness Market Attractiveness Analysis, By Mode of Delivery, 2025-2035

Figure 55: Latin America - Corporate Wellness Market Value Share Analysis, By End-user, 2024 and 2035

Figure 56: Latin America - Corporate Wellness Market Attractiveness Analysis, By End-user, 2025-2035

Figure 57: Middle East & Africa - Corporate Wellness Market Value (US$ Bn) Forecast, 2020-2035

Figure 58: Middle East & Africa - Corporate Wellness Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 59: Middle East & Africa - Corporate Wellness Market Attractiveness Analysis, by Country / Sub-region, 2025-2035

Figure 60: Middle East & Africa - Corporate Wellness Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 61: Middle East & Africa - Corporate Wellness Market Attractiveness Analysis, By Service Type, 2025-2035

Figure 62: Middle East & Africa - Corporate Wellness Market Value Share Analysis, By Mode of Delivery, 2024 and 2035

Figure 63: Middle East & Africa - Corporate Wellness Market Attractiveness Analysis, By Mode of Delivery, 2025-2035

Figure 64: Middle East & Africa - Corporate Wellness Market Value Share Analysis, By End-user, 2024 and 2035

Figure 65: Middle East & Africa - Corporate Wellness Market Attractiveness Analysis, By End-user, 2025-2035