Reports

Reports

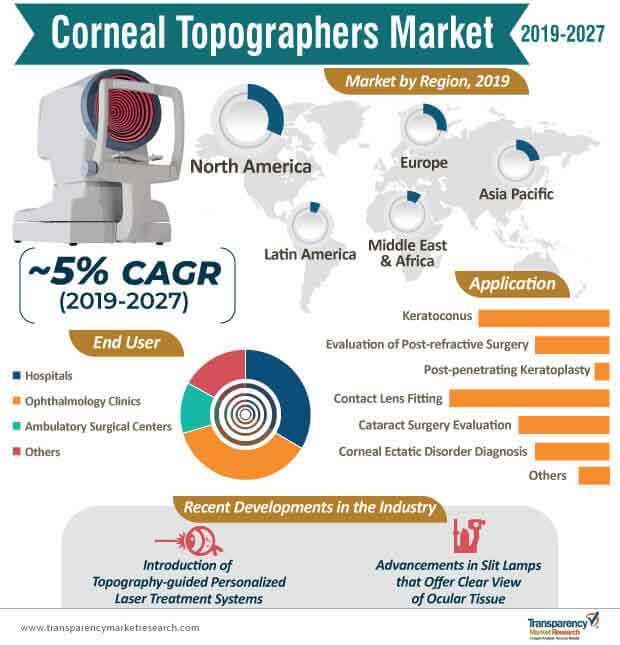

The technology-intensive corneal topographers market is tracing a steady growth trajectory, despite unfavorable growth conditions brought in by the cost-prohibitive nature of these systems and the shortage of ophthalmologists. As found by several researches, there has been a staggering rise in ophthalmic incidences and ocular conditions. The National Eye Institute has found that, 36 Mn people in the U.S. were detected with ocular diseases in 2016. The rapid rise in the number of patients opting for vision correction procedures is likely to exert a profound influence on the vertical movement of the market.

Yet another cause of poor vision can be associated with the growing diabetic populace, since they are highly susceptible to developing cataract. With masses leading unhealthy and demanding lifestyles, regular consumption of packaged food and beverages is found to be the leading cause of diabetes. Growth in the patient base has attracted market players to leverage technology to develop topography-guided personalized laser treatment systems, with increased efficiency.

Keratometers have long been used as the standard instruments for assessing corneal curvature; however, the advent of computer-assisted photokeratoscopy in ophthalmology practice is improving the performance of corneal topography. With the increasing penetration of corneal topographers, it is uncommon for ophthalmologists to use keratometers, as the former can capture data from the entire cornea and offer valuable information to assist the diagnosis of corneal problems.

The future scope of computer-assisted corneal topographers extends towards the designing of custom-fitted contact lenses to ensure better convenience for patients, which is shown by a report presented by Transparency Market Research (TMR). The study shows that, corneal topographers are significantly used for contact lens fitting applications, while their use for the evaluation of cataract is growing at an exponential rate.

Regulatory norms for the development and approval of medical devices differ from country to country. However, the base of approval for any medical device is dependent on efficiency and safety. With innovation moving beyond its current range and making rapid penetration in the form of novel corneal topographers, the scrutiny of these systems has been stricter in developed countries as compared to developing countries. At the same time, the technological revolution in developing countries underpinned by increasing government initiatives in the healthcare sector is likely to complement the corneal topographers markets in these regions.

The corneal topographers market has been growing at an exponential pace in China and India, as the focus of the governments of these nations has been shifting towards quality care. In China, the supervision and administration of medical devices is governed by the China State Food and Drug Administration (SFDA). The regulatory scenario in the country is of a lenient nature, and non-contact viewing devices used for ophthalmic procedures are categorized as class-1. These devices are deemed low-risk devices, and they need only general control, thereby offering ease of use to ophthalmologists.

Analysts’ Opinion on Market Growth

Authors of the report opine that, 2020 will be a crucial year for the corneal topographers market, as the sales of these systems will cross the US$ 1 Bn mark, and reach a value of ~US$ 1.4 Bn by 2027. Market players will continue to invest in research & development activities by leveraging technology, and establish their products as new gold standards in the corneal topographers landscape. For instance, in 2017, Carl Zeiss Meditec AG invested ~12% of its 2016-17 revenue for the development of technologically-advanced medical devices. Besides this, market players are also looking to make strategic acquisitions to move towards a consolidated market position.

Corneal Topographers Market: Overview

Corneal Topographers Market: Trends

High Demand for Corneal Topographers and OCT Devices

Awareness Programs on Ocular Diseases and Training Programs on New Ophthalmic Diagnostic Devices

Increase in Incidence of Cataract and Glaucoma in Asia Pacific

Corneal Topographers Market: Key Strategies

Increase in Trade and Export Facilities of Medical Devices in Latin America

Awareness Programs on Pre-surgery Checkup Demonstration among Patients

Corneal Topographers Market: Competition

The global corneal topographers market was worth US$ 920 Mn and is projected to reach a value of US$ 1.4 Bn by the end of 2027

Corneal topographers market is anticipated to grow at a CAGR of 5% during the forecast period

North America accounted for a major share of the global corneal topographers market

Corneal topographers market is driven by an increase in the awareness and acceptance of corneal topographers due to the advent of new technologies, and increase in incidence of ophthalmic and ocular conditions

Key players in the global corneal topographers market include Carl Zeiss Meditec AG, NIDEK CO., LTD., Topcon Corporation, Essilor, Bausch Health Companies, Inc., OCULUS Optikgeräte GmbH, Tomey Corporation, Tracey Technologies, and SCHWIND eye-tech-solutions GmbH

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary

3.1. Global Corneal Topographers Market Size (US$ Mn) and Distribution, by Region, 2018 and 2027

3.2. Global Corneal Topographers Market: Market Snapshot

4. Market Overview

4.1. Global Corneal Topographers Market: Product Overview

4.2. Global Corneal Topographers Market: Key Industry Developments

4.3. Market Dynamics

4.4. Drivers and Restraints Snapshot Analysis

4.5. Drivers

4.5.1. Increase in incidence of ophthalmic and ocular conditions

4.5.2. Aging population and rise in number of vision correction procedures

4.6. Restraints

4.6.1. High cost of advanced corneal topographer systems

4.6.2. Shortage of ophthalmologists

4.7. Opportunities

4.8. Global Corneal Topographers Market Revenue Projections (US$ Mn), 2017–2027

5. Key Insights

5.1. Global Corneal Topographers Market - Regulatory Scenario

5.2. Pathophysiology of Keratoconus

5.3. Keratoconus Disease Prevalence & Incidence Rate in Key Countries

5.4. Technological Advancements In Corneal Topography

5.5. History of Corneal Topography Devices

5.6. Corneal Topographers Market Trends

5.7. Corneal Topographers and OCT System Unit Sales, 2018

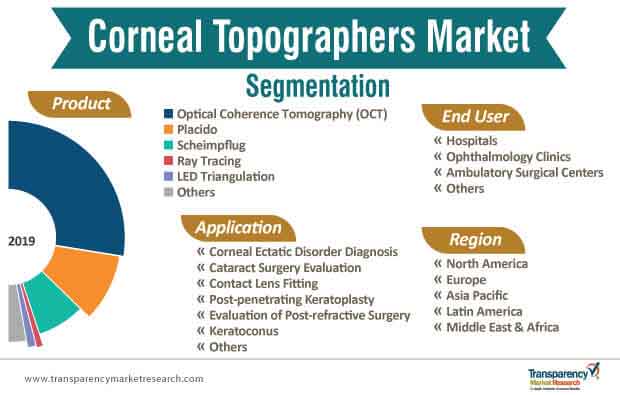

6. Global Corneal Topographers Market Analysis, by Product

6.1. Introduction

6.2. Global Corneal Topographers Market Size and Forecast, by Product

6.2.1. Optical Coherence Tomography (OCT)

6.2.2. Placido

6.2.3. Scheimpflug

6.2.4. Ray Tracing

6.2.5. LED Triangulation

6.2.6. Others

6.3. Global Corneal Topographers Market Analysis, by Product

6.4. Global Corneal Topographers Market Attractiveness Analysis, by Product

7. Global Corneal Topographers Market Analysis, by Application

7.1. Introduction

7.2. Global Corneal Topographers Market Size and Forecast, by Application

7.2.1. Corneal Ectatic Disorder Diagnosis

7.2.2. Cataract Surgery Evaluation

7.2.3. Contact Lens Fitting

7.2.4. Post-penetrating Keratoplasty

7.2.5. Evaluation of Post-refractive Surgery

7.2.6. Keratoconus

7.2.7. Others

7.3. Global Corneal Topographers Market Analysis, by Application

7.4. Global Corneal Topographers Market Attractiveness Analysis, by Application

8. Global Corneal Topographers Market Analysis, by End User

8.1. Introduction

8.2. Global Corneal Topographers Market Size and Forecast, by End User

8.2.1. Hospitals

8.2.2. Ophthalmology Clinics

8.2.3. Ambulatory Surgical Centers

8.2.4. Others

8.3. Global Corneal Topographers Market Analysis, by End User

8.4. Global Corneal Topographers Market Attractiveness Analysis, by End User

9. Global Corneal Topographers Market Analysis, by Region

9.1. Global Corneal Topographers Market Size and Forecast, by Region, 2017–2027

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Latin America

9.1.5. Middle East & Africa

9.2. Global Corneal Topographers Market Analysis, by Region

9.3. Global Corneal Topographers Market Attractiveness Analysis, by Region

10. North America Corneal Topographers Market Analysis

10.1. North America Corneal Topographers Market

10.2. North America Corneal Topographers Market Overview

10.3. North America Corneal Topographers Market Size and Forecast, by Product

10.3.1. Optical Coherence Tomography (OCT)

10.3.2. Placido

10.3.3. Scheimpflug

10.3.4. Ray Tracing

10.3.5. LED Triangulation

10.3.6. Others

10.4. North America Corneal Topographers Market Size and Forecast, by Application

10.4.1. Corneal Ectatic Disorder Diagnosis

10.4.2. Cataract Surgery Evaluation

10.4.3. Contact Lens Fitting

10.4.4. Post-penetrating Keratoplasty

10.4.5. Evaluation of Post-refractive Surgery

10.4.6. Keratoconus

10.4.7. Others

10.5. North America Corneal Topographers Market Size and Forecast, by End User

10.5.1. Hospitals

10.5.2. Ophthalmology Clinics

10.5.3. Ambulatory Surgical Centers

10.5.4. Others

10.6. North America Corneal Topographers Market Forecast, by Country

10.6.1. U.S.

10.6.2. Canada

10.7. North America Corneal Topographers Market Attractiveness Analysis

10.7.1. By Product

10.7.2. By Application

10.7.3. By End User

10.7.4. By Country

11. Europe Corneal Topographers Market Analysis

11.1. Europe Corneal Topographers Market

11.2. Europe Corneal Topographers Market Overview

11.3. Europe Corneal Topographers Market Size and Forecast, by Product

11.3.1. Optical Coherence Tomography (OCT)

11.3.2. Placido

11.3.3. Scheimpflug

11.3.4. Ray Tracing

11.3.5. LED Triangulation

11.3.6. Others

11.4. Europe Corneal Topographers Market Size and Forecast, by Application

11.4.1. Corneal Ectatic Disorder Diagnosis

11.4.2. Cataract Surgery Evaluation

11.4.3. Contact Lens Fitting

11.4.4. Post-penetrating Keratoplasty

11.4.5. Evaluation of Post-refractive Surgery

11.4.6. Keratoconus

11.4.7. Others

11.5. Europe Corneal Topographers Market Size and Forecast, by End User

11.5.1. Hospitals

11.5.2. Ophthalmology Clinics

11.5.3. Ambulatory Surgical Centers

11.5.4. Others

11.6. Europe Corneal Topographers Market Forecast, by Country/Sub-region

11.6.1. U.K.

11.6.2. France

11.6.3. Germany

11.6.4. Spain

11.6.5. Italy

11.6.6. Rest of Europe

11.7. Europe Corneal Topographers Market Attractiveness Analysis

11.7.1. By Product

11.7.2. By Application

11.7.3. By End User

11.7.4. By Country/Sub-region

12. Asia Pacific Corneal Topographers Market Analysis

12.1. Asia Pacific Corneal Topographers Market Key Findings

12.2. Asia Pacific Corneal Topographers Market Overview

12.3. Asia Pacific Corneal Topographers Market Size and Forecast, by Product

12.3.1. Optical Coherence Tomography (OCT)

12.3.2. Placido

12.3.3. Scheimpflug

12.3.4. Ray Tracing

12.3.5. LED Triangulation

12.3.6. Others

12.4. Asia Pacific Corneal Topographers Market Size and Forecast, by Application

12.4.1. Corneal Ectatic Disorder Diagnosis

12.4.2. Cataract Surgery Evaluation

12.4.3. Contact Lens Fitting

12.4.4. Post-penetrating Keratoplasty

12.4.5. Evaluation of Post-refractive Surgery

12.4.6. Keratoconus

12.4.7. Others

12.5. Asia Pacific Corneal Topographers Market Size and Forecast, by End User

12.5.1. Hospitals

12.5.2. Ophthalmology Clinics

12.5.3. Ambulatory Surgical Centers

12.5.4. Others

12.6. Asia Pacific Corneal Topographers Market Forecast, by Country/Sub-region

12.6.1. China

12.6.2. India

12.6.3. Japan

12.6.4. Australia & New Zealand

12.6.5. Rest of Asia Pacific

12.7. Asia Pacific Corneal Topographers Market Attractiveness Analysis

12.7.1. By Product

12.7.2. By Application

12.7.3. By End User

12.7.4. By Country/Sub-region

13. Latin America Corneal Topographers Market Analysis

13.1. Latin America Corneal Topographers Market Key Findings

13.2. Latin America Corneal Topographers Market Overview

13.3. Latin America Corneal Topographers Market Size and Forecast, by Product

13.3.1. Optical Coherence Tomography (OCT)

13.3.2. Placido

13.3.3. Scheimpflug

13.3.4. Ray Tracing

13.3.5. LED Triangulation

13.3.6. Others

13.4. Latin America Corneal Topographers Market Size and Forecast, by Application

13.4.1. Corneal Ectatic Disorder Diagnosis

13.4.2. Cataract Surgery Evaluation

13.4.3. Contact Lens Fitting

13.4.4. Post-penetrating Keratoplasty

13.4.5. Evaluation of Post-refractive Surgery

13.4.6. Keratoconus

13.4.7. Others

13.5. Latin America Corneal Topographers Market Size and Forecast, by End User

13.5.1. Hospitals

13.5.2. Ophthalmology Clinics

13.5.3. Ambulatory Surgical Centers

13.5.4. Others

13.6. Latin America Corneal Topographers Market Forecast, by Country/Sub-region

13.6.1. Brazil

13.6.2. Mexico

13.6.3. Rest of Latin America

13.7. Latin America Corneal Topographers Market Attractiveness Analysis

13.7.1. By Product

13.7.2. By Application

13.7.3. By End User

13.7.4. By Country/Sub-region

14. Middle East & Africa Corneal Topographers Market Analysis

14.1. Middle East & Africa Corneal Topographers Market

14.2. Middle East & Africa Corneal Topographers Market Overview

14.3. Middle East & Africa Corneal Topographers Market Size and Forecast, by Product

14.3.1. Optical Coherence Tomography (OCT)

14.3.2. Placido

14.3.3. Scheimpflug

14.3.4. Ray Tracing

14.3.5. LED Triangulation

14.3.6. Others

14.4. Middle East & Africa Corneal Topographers Market Size and Forecast, by Application

14.4.1. Corneal Ectatic Disorder Diagnosis

14.4.2. Cataract Surgery Evaluation

14.4.3. Contact Lens Fitting

14.4.4. Post-penetrating Keratoplasty

14.4.5. Evaluation of Post-refractive Surgery

14.4.6. Keratoconus

14.4.7. Others

14.5. Middle East & Africa Corneal Topographers Market Size and Forecast, by End User

14.5.1. Hospitals

14.5.2. Ophthalmology Clinics

14.5.3. Ambulatory Surgical Centers

14.5.4. Others

14.6. Middle East & Africa Corneal Topographers Market Forecast, by Country/Sub-region

14.6.1. GCC Countries

14.6.2. South Africa

14.6.3. Rest of Middle East & Africa

14.7. Middle East & Africa Corneal Topographers Market Attractiveness Analysis

14.7.1. By Product

14.7.2. By Application

14.7.3. By End User

14.7.4. By Country/Sub-region

15. Competitive Landscape

15.1. Company Profiles

15.1.1. Carl Zeiss Meditec AG

15.1.1.1. Overview (HQ, Employee Strength, Business Segments)

15.1.1.2. Financials

15.1.1.3. Recent Developments

15.1.1.4. Strategy

15.1.2. NIDEK CO., LTD.

15.1.2.1. Overview (HQ, Employee Strength, Business Segments)

15.1.2.2. Financials

15.1.2.3. Recent Developments

15.1.2.4. Strategy

15.1.3. Topcon Corporation

15.1.3.1. Overview (HQ, Employee Strength, Business Segments)

15.1.3.2. Financials

15.1.3.3. Recent Developments

15.1.3.4. Strategy

15.1.4. Essilor

15.1.4.1. Overview (HQ, Employee Strength, Business Segments)

15.1.4.2. Financials

15.1.4.3. Recent Developments

15.1.4.4. Strategy

15.1.5. Bausch Health Companies, Inc.

15.1.5.1. Overview (HQ, Employee Strength, Business Segments)

15.1.5.2. Financials

15.1.5.3. Recent Developments

15.1.5.4. Strategy

15.1.6. OCULUS Optikgeräte GmbH

15.1.6.1. Overview (HQ, Employee Strength, Business Segments)

15.1.6.2. Financials

15.1.6.3. Recent Developments

15.1.6.4. Strategy

15.1.7. Tomey Corporation

15.1.7.1. Overview (HQ, Employee Strength, Business Segments)

15.1.7.2. Financials

15.1.7.3. Recent Developments

15.1.7.4. Strategy

15.1.8. Optikon 2000 SpA

15.1.8.1. Overview (HQ, Employee Strength, Business Segments)

15.1.8.2. Financials

15.1.8.3. Recent Developments

15.1.8.4. Strategy

15.1.9. Tracey Technologies

15.1.9.1. Overview (HQ, Employee Strength, Business Segments)

15.1.9.2. Financials

15.1.9.3. Recent Developments

15.1.9.4. Strategy

15.1.10. SCHWIND eye-tech-solutions GmbH

15.1.10.1. Overview (HQ, Employee Strength, Business Segments)

15.1.10.2. Financials

15.1.10.3. Recent Developments

15.1.10.4. Strategy

List of Tables

TABLE 1 Keratoconus Disease Prevalence & Incidence Rate in Key Countries

TABLE 2 History of Corneal Topography Devices

TABLE 3 Corneal Topographers and OCT System Unit Sales, Optical Coherence Topography, 2018

TABLE 4 Corneal Topographers and OCT System Unit Sales, Placido, 2018

TABLE 5 Corneal Topographers and OCT System Unit Sales, 2018

TABLE 6 Corneal Topographers and OCT System Unit Sales, Placido, Scheimpflug (Combined Technology), 2018

TABLE 7 Global Corneal Topographers Market Size (US$ Mn) Forecast, by Product, 2017–2027

TABLE 8 Global Corneal Topographers Market Size (US$ Mn) Forecast, by Application, 2017–2027

TABLE 9 Global Corneal Topographers Market Size (US$ Mn) Forecast, by End User, 2017–2027

TABLE 10 Global Corneal Topographers Market Size (US$ Mn) Forecast, by Region, 2017–2027

TABLE 11 North America Corneal Topographers Market Size (US$ Mn) Forecast, by Country, 2017–2027

TABLE 12 North America Corneal Topographers Market Size (US$ Mn) Forecast, by Product, 2017–2027

TABLE 13 North America Corneal Topographers Market Size (US$ Mn) Forecast, by Application, 2017–2027

TABLE 14 North America Corneal Topographers Market Size (US$ Mn) Forecast, by End User, 2017–2027

TABLE 15 Europe Corneal Topographers Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

TABLE 16 Europe Corneal Topographers Market Size (US$ Mn) Forecast, by Product, 2017–2027

TABLE 17 Europe Corneal Topographers Market Size (US$ Mn) Forecast, by Application, 2017–2027

TABLE 18 Europe Corneal Topographers Market Size (US$ Mn) Forecast, by End User, 2017–2027

TABLE 19 Asia Corneal Topographers Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

TABLE 20 Asia Pacific Corneal Topographers Market Size (US$ Mn) Forecast, by Product, 2017–2027

TABLE 21 Asia Pacific Corneal Topographers Market Size (US$ Mn) Forecast, by Application, 2017–2027

TABLE 22 Asia Pacific Corneal Topographers Market Size (US$ Mn) Forecast, by End User, 2017–2027

TABLE 23 Latin America Corneal Topographers Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

TABLE 24 Latin America Corneal Topographers Market Size (US$ Mn) Forecast, by Product, 2017–2027

TABLE 25 Latin America Corneal Topographers Market Size (US$ Mn) Forecast, by Application, 2017–2027

TABLE 26 Latin America Corneal Topographers Market Size (US$ Mn) Forecast, by End User, 2017–2027

TABLE 27 Middle East & Africa Corneal Topographers Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

TABLE 28 Middle East & Africa Corneal Topographers Market Size (US$ Mn) Forecast, by Product, 2017–2027

TABLE 29 Middle East & Africa Corneal Topographers Market Size (US$ Mn) Forecast, by Application, 2017–2027

TABLE 30 Middle East & Africa Corneal Topographers Market Size (US$ Mn) Forecast, by End User, 2017–2027

List of Figures

FIG. 1 Global Corneal Topographers Market Size (US$ Mn) and Distribution, by Region, 2018 and 2027

FIG. 2 Global Corneal Topographers Market Revenue Projection (US$ Mn), 2017–2027

FIG. 3 Global Corneal Topographers Market Value Share, by Product, 2018

FIG. 4 Global Corneal Topographers Market Value Share, by Application, 2018

FIG. 5 Global Corneal Topographers Market Value Share, by Region, 2018

FIG. 6 Global Corneal Topographers Market Value Share, by End User, 2018

FIG. 7 Global Corneal Topographers Market Value Share Analysis, by Product, 2018 and 2027

FIG. 8 Global Corneal Topographers Market Revenue (US$ Mn), by Optical Coherence Tomography (OCT), 2017–2027

FIG. 9 Global Corneal Topographers Market Revenue (US$ Mn), by Placido, 2017–2027

FIG. 10 Global Corneal Topographers Market Revenue (US$ Mn), by Scheimpflug, 2017–2027

FIG. 11 Global Corneal Topographers Market Revenue (US$ Mn), by Ray Tracing, 2017–2027

FIG. 12 Global Corneal Topographers Market Revenue (US$ Mn), by LED Triangulation, 2017–2027

FIG. 13 Global Corneal Topographers Market Revenue (US$ Mn), by Others, 2017–2027

FIG. 14 Global Corneal Topographers Market Attractiveness Analysis, by Product, 2019–2027

FIG. 15 Global Corneal Topographers Market Value Share Analysis, by Application, 2018 and 2027

FIG. 16 Global Corneal Topographers Market Revenue (US$ Mn), by Corneal Ectatic Disorder Diagnosis, 2017–2027

FIG. 17 Global Corneal Topographers Market Revenue (US$ Mn), by Cataract Surgery Evaluation, 2017–2027

FIG. 18 Global Corneal Topographers Market Revenue (US$ Mn), by Contact Lens Fitting, 2017–2027

FIG. 19 Global Corneal Topographers Market Revenue (US$ Mn), by Post-penetrating Keratoplasty, 2017–2027

FIG. 20 Global Corneal Topographers Market Revenue (US$ Mn), by Evaluation of Post-refractive Surgery, 2017–2027

FIG. 21 Global Corneal Topographers Market Revenue (US$ Mn), by Keratoconus, 2017–2027

FIG. 22 Global Corneal Topographers Market Revenue (US$ Mn), by Others, 2017–2027

FIG. 23 Global Corneal Topographers Market Attractiveness Analysis, by Application, 2019–2027

FIG. 24 Global Corneal Topographers Market Value Share Analysis, by End User, 2018 and 2027

FIG. 25 Global Corneal Topographers Market Revenue (US$ Mn), by Hospitals, 2017–2027

FIG. 26 Global Corneal Topographers Market Revenue (US$ Mn), by Ophthalmology Clinics, 2017–2027

FIG. 27 Global Corneal Topographers Market Revenue (US$ Mn), by Ambulatory Surgical Centers, 2017–2027

FIG. 28 Global Corneal Topographers Market Revenue (US$ Mn), by Others, 2017–2027

FIG. 29 Global Corneal Topographers Market Attractiveness Analysis, by End User 2019–2027

FIG. 30 Global Corneal Topographers Market Value Share, by Region, 2018 and 2027

FIG. 31 Global Corneal Topographers Market Attractiveness, by Region, 2019–2027

FIG. 32 North America Corneal Topographers Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2019–2027

FIG. 33 North America Corneal Topographers Market Value Share Analysis, by Country, 2018 and 2027

FIG. 34 North America Corneal Topographers Market Attractiveness, by Country, 2019–2027

FIG. 35 North America Corneal Topographers Market Value Share Analysis, by Product, 2018 and 2027

FIG. 36 North America Corneal Topographers Market Attractiveness, by Product, 2019–2027

FIG. 37 North America Corneal Topographers Market Value Share Analysis, by Application, 2018 and 2027

FIG. 38 North America Corneal Topographers Market Attractiveness, by Application, 2019–2027

FIG. 39 North America Corneal Topographers Market Value Share Analysis, by End User, 2018 and 2027

FIG. 40 North America Corneal Topographers Market Attractiveness, by End User, 2019–2027

FIG. 41 Europe Corneal Topographers Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2019–2027

FIG. 42 Europe Corneal Topographers Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

FIG. 43 Europe Corneal Topographers Market Attractiveness, by Country/Sub-region, 2019–2027

FIG. 44 Europe Corneal Topographers Market Value Share Analysis, by Product, 2018 and 2027

FIG. 45 Europe Corneal Topographers Market Attractiveness, by Product, 2019–2027

FIG. 46 Europe Corneal Topographers Market Value Share Analysis, by Application, 2018 and 2027

FIG. 47 Europe Corneal Topographers Market Attractiveness, by Application, 2019–2027

FIG. 48 Europe Corneal Topographers Market Value Share Analysis, by End User, 2018 and 2027

FIG. 49 Europe Corneal Topographers Market Attractiveness, by End User, 2019–2027

FIG. 50 Asia Pacific Corneal Topographers Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2019–2027

FIG. 51 Asia Pacific Corneal Topographers Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

FIG. 52 Asia Pacific Corneal Topographers Market Attractiveness, by Country/Sub-region, 2019–2027

FIG. 53 Asia Pacific Corneal Topographers Market Value Share Analysis, by Product, 2018 and 2027

FIG. 54 Asia Pacific Corneal Topographers Market Attractiveness, by Product, 2019–2027

FIG. 55 Asia Pacific Corneal Topographers Market Value Share Analysis, by Application, 2018 and 2027

FIG. 56 Asia Pacific Corneal Topographers Market Attractiveness, by Application, 2019–2027

FIG. 57 Asia Pacific Corneal Topographers Market Value Share Analysis, by End User, 2018 and 2027

FIG. 58 Asia Pacific Corneal Topographers Market Attractiveness, by End User, 2019–2027

FIG. 59 Latin America Corneal Topographers Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2019–2027

FIG. 60 Latin America Corneal Topographers Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

FIG. 61 Latin America Corneal Topographers Market Attractiveness, by Country/Sub-region, 2019–2027

FIG. 62 Latin America Corneal Topographers Market Value Share Analysis, by Product, 2018 and 2027

FIG. 63 Latin America Corneal Topographers Market Attractiveness, by Product, 2019–2027

FIG. 64 Latin America Corneal Topographers Market Value Share Analysis, by Application, 2018 and 2027

FIG. 65 Latin America Corneal Topographers Market Attractiveness, by Application, 2019–2027

FIG. 66 Latin America Corneal Topographers Market Value Share Analysis, by End User, 2018 and 2027

FIG. 67 Latin America Corneal Topographers Market Attractiveness, by End User, 2019–2027

FIG. 68 Middle East & Africa Corneal Topographers Market Size (US$ Mn) and Y-o-Y Growth (%) Forecast, 2019–2027

FIG. 69 Middle East & Africa Corneal Topographers Market Value Share Analysis, by Country/Sub-region, 2018 and 2027

FIG. 70 Middle East & Africa Corneal Topographers Market Attractiveness, by Country/Sub-region, 2019–2027

FIG. 71 Middle East & Africa Corneal Topographers Market Value Share Analysis, by Product, 2018 and 2027

FIG. 72 Middle East & Africa Corneal Topographers Market Attractiveness, by Product, 2019–2027

FIG. 73 Middle East & Africa Corneal Topographers Market Value Share Analysis, by Application, 2018 and 2027

FIG. 74 Middle East & Africa Corneal Topographers Market Attractiveness, by Application, 2019–2027

FIG. 75 Middle East & Africa Corneal Topographers Market Value Share Analysis, by End User, 2018 and 2027

FIG. 76 Middle East & Africa Corneal Topographers Market Attractiveness, by End User, 2019–2027