Reports

Reports

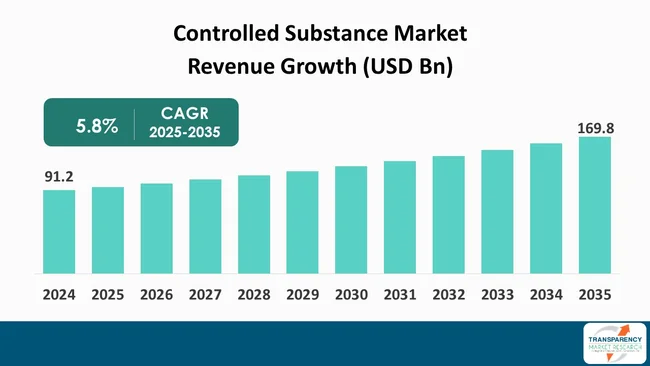

The global controlled substance market size was valued at US$ 91.2 billion in 2024 and is projected to reach US$ 169.8 billion by 2035, expanding at a CAGR of 5.8 % from 2025 to 2035. The main factors that are increasing the market over the last several years are the increased occurrence of chronic pain and mental disorders all over the globe, together with the growing use of prescription medications for their treatment. Moreover, the market is being driven by the progress in pharmaceutical research resulting in new formulations with better effectiveness and safety as well as by the increasing acceptance of controlled substances in the treatment of cancer, neurology, and palliative care.

The global market for controlled drugs steadily expands with the main driver being the escalating cases of chronic pain, neurological disorders, and psychiatric conditions that need medications that are regulated by the authorities. Strict government regulations and necessary compliance requirements are a hurdles to manufacturers and distributors, the latter, however, it assure the safety of patients as well as a usage that is well controlled, which is very important as far as the credibility of the market is concerned.

Growth is being driven by increasing investment for research and development, the wide usage of telemedicine, and digital prescription monitoring. But the issue of drug addiction, as well as the stringent regulatory frameworks, continue to be significant influences on the market trend. The trend for such a market would most likely indicate the development of a more balanced approach with both greater access to patients and closer supervision to reduce drug misuse.

Additionally the differences in the regions concerning ways of drug approval and control that to both openings and obstacles for players that operate globally. The increasing emphasis on non-addictive formulations and the use of alternative therapies is also likely to have an impact on the competitive strategies in the industry. The pharmaceutical sector's sustained expansion will depend on its capacity to innovate and at the same time, adhere to public health priorities and meet the changing standards of compliance.

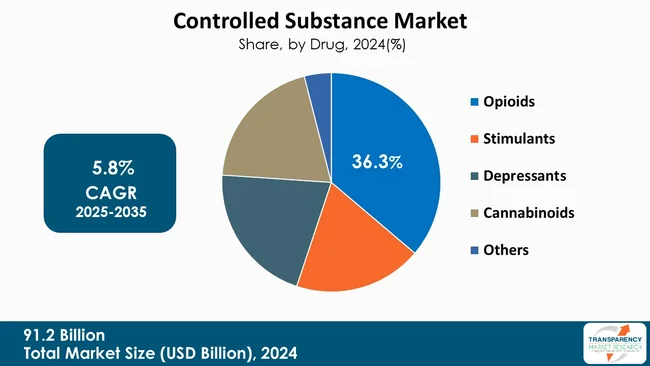

The market for controlled substances includes drugs and chemicals that are subject to strict regulations by the authorities due to their possible harmful use, addiction, or negative health effects. Medications that fall under the categories of opioids, stimulants, depressants, and partly hallucinogens are the most common ones in the treatment of chronic pain, anxiety, sleeping disorders, and attention-deficit disorders, among other diseases.

For instance, the World Health Organization (WHO) highlights that 2.6 Mn deaths per year were attributed to alcohol consumption, accounting for 4.7% of all deaths, and 0.6 Mn deaths to psychoactive drug use. Notably, 2 Mn of alcohol and 0.4 Mn of drug-attributable deaths were among men.

The demand for the product is caused by the rising influence of chronic and neurological diseases, the increasing availability of healthcare, and the progress made in drug formulations. However, these market dynamics are also significantly impacted by the worries about the misuse, dependence, and tough approval procedures that continue to be concerns in the pharmaceutical field.

Consequently, the market still manages to weigh up the two main aspects of allowing safe drug use through treatment, at the same time not allowing the drugs to be diverted or misused. For instance, according to Crime Survey for England and Wales (CSEW), 3.0% of people (approximately 1 Mn people) reported using a Class A drug in the last 12 months; there was no statistically significant change from 2023.

| Attribute | Detail |

|---|---|

| Controlled Substance Market Drivers |

|

One of the major causes that have been responsible for the growth of the controlled substance market is the increasing number of the chronic diseases such as cardiovascular disorders, cancer, and diabetes. According to World Health Organization, in 2022, there were an estimated 20 Mn new cancer cases and 9.7 Mn deaths. The estimated number of people who were alive within 5 years following a cancer diagnosis was 53.5 Mn.

These types of diseases in most cases are connected to the necessity of prolonged treatment and efficient pain relief. As a result, patients are likely to require larger amounts of drugs that are under strict control such as opioids, stimulants, and the other therapeutic classes. The frequency of chronic diseases related to lifestyle changes, aging, and urbanization has dramatically risen globally, leading to significant challenges for healthcare systems. Consequently, these systems require to ensure the uninterrupted provision of basic medicines.

To meet growing therapeutic needs, governments and healthcare providers have been concentrating on managing accessibility along with regulatory control. Besides, the progress in drug formulations is enabling the proper and efficient use of the substances under strict control, in the treatment of chronic diseases. For instance, in 2020, worldwide, an estimated 523 Mn people reported some form of CVD, and approximately 19 Mn deaths were attributed to CVD. This represents ∼32% of all global deaths and is an absolute increase of 18.7% from 2010.

The use of controlled substances market is influenced in a major way by continuous research and development of safer and non-addictive formulations that are being recognized as a significant driver of the growth in that market. Drug companies and scientific research agencies are progressively allocating more resources towards the development of novel drug delivery technologies, formulations that prevent abuse, and new treatment options that lower the risk of dependency while keeping the drug effective.

For instance, in September 2025, the FDA came out with revised instructions that were regulated to extend the availability of non-opioid remedies for persistent pain. These directions open up the possibility of many new non-opioid treatments and also require modifications in the safety labeling of opioid drugs to make the latest research findings more accessible.

Reduced risks associated with the use of controlled substances are some of the advantages that the market trust anticipates to increase and to open up new opportunities for sustainable growth.

Different departments of the government as well as the authorities in charge of administration are backing these kinds of innovations as one of the means to guarantee the safety of the patients and to lessen the abuse of drugs. For instance, the U.S. Food and Drug Administration approved Journavx (suzetrigine) 50 milligram oral tablets, a first-in-class non-opioid analgesic, to treat moderate to severe acute pain in adults. The FDA has long supported development of non-opioid pain treatment.

In drug type segment, opioids hold the highest market share of 36.3%. Opioids are the leading class of drugs in the controlled substance market, where the use of drugs is most widespread, as they are the preferred treatment for most conditions causing moderate to severe pain, particularly in patients suffering from a chronic condition, those having undergone surgery, and those with cancer-related pain.

Due to their efficient pain relief effect, these drugs have been prescribed globally in large quantities, thus becoming one of the most important agents in the treatment of various therapeutic regimens. Though there has been strict regulatory supervision and rising anxiety about misuse and addiction, the craving for opioids remains higher than other controlled substances. This trend is sustained by continuous advancements in abuse-deterrent formulations and safer delivery methods.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America holds the highest market share of 41.2% of global controlled substance market. The market for controlled substances is still significantly dominated by the North American region, which basically is a result of several factors including the high rate of prescriptions, the presence of a well-established healthcare infrastructure, and the prevalent use of opioids, stimulants, and sedatives in the U.S.

The dominance of the region is also supported by the presence of major pharmaceutical manufacturers, favorable reimbursement policies, and advanced distribution networks. Moreover, the market in the United States has undergone a significant transformation due to these factors; increased oversight by regulators, the fear of the misuse of prescription drugs, and the lawsuits concerning opioids, which have been in existence for a while. For instance, the U.S. Food and Drug Administration took a bold step to protect Americans from dangerous, illegal opioids by recommending a scheduling action to control certain 7-hydroxymitragynine (also known as 7-OH1) products under the Controlled Substances Act (CSA).

Although North America is at the forefront, Europe and Asia-Pacific are gaining importance as notable markets that are going to have a positive impact on the access to healthcare, the increasing patient awareness and the prevalence of chronic and neurological disorders.

For instance, the DEA announced new rule of special registrations that will permit a patient to receive prescribed medications through telemedicine visits without ever having an in-person medical evaluation from a medical provider. The special registration is available to medical providers who treat patients for whom they will prescribe Schedule III-V controlled substances.

UPM Pharmaceuticals, Johnson & Johnson, Merck & Co., Inc., AbbVie Inc, Grünenthal, Novartis AG, Pfizer Inc., F. Hoffmann-La Roche Ltd, Purdue Pharma L.P., AstraZeneca, Sanofi, Mallinckrodt plc, Sun Pharmaceutical Industries Ltd., Lannett, Teva Pharmaceutical Industries Ltd. are some of the leading manufacturers operating in the global controlled substance market.

Each of these companies has been profiled in the Controlled Substance market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 91.2 Bn |

| Forecast Value in 2035 | More than US$ 169.8 Bn |

| CAGR | 5.8 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Drug

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global controlled substance market was valued at US $ 91.2 Bn in 2024

The global controlled substance industry is projected to reach more than US $ 169.8 Bn by the end of 2035

Rising cases of chronic disease and growing R&D of non-addictive and safer formulations are driving market growth.

The CAGR is anticipated to be 5.8% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

UPM Pharmaceuticals, Johnson & Johnson, Merck & Co., Inc., AbbVie Inc, Grünenthal, Novartis AG, Pfizer Inc., F. Hoffmann-La Roche Ltd, Purdue Pharma L.P., AstraZeneca, Sanofi, Mallinckrodt plc, Sun Pharmaceutical Industries Ltd., Lannett, Teva Pharmaceutical Industries Ltd. and other prominent players

Table 01: Global Controlled Substance Market Value (US$ Bn) Forecast, by Drug, 2020 to 2035

Table 02: Global Controlled Substance Market Value (US$ Bn), by Opioids, 2020 to 2035

Table 03: Global Controlled Substance Market Value (US$ Bn), by Stimulant, 2020 to 2035

Table 04: Global Controlled Substance Market Value (US$ Bn), by Depressants, 2020 to 2035

Table 05: Global Controlled Substance Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 06: Global Controlled Substance Market Value (US$ Bn) Forecast, By Distribution Channel, 2020 to 2035

Table 07: Global Controlled Substance Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 08: North America Controlled Substance Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 09: North America Controlled Substance Market Value (US$ Bn) Forecast, by Drug, 2020 to 2035

Table 10: North America Controlled Substance Market Value (US$ Bn), by Opioids, 2020 to 2035

Table 11: North America Controlled Substance Market Value (US$ Bn), by Stimulant, 2020 to 2035

Table 12: North America Controlled Substance Market Value (US$ Bn), by Depressants, 2020 to 2035

Table 13: North America Controlled Substance Market Value (US$ Bn) Forecast, by Indication, 2020 to 2035

Table 14: North America Controlled Substance Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 15: Europe Controlled Substance Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 16: Europe Controlled Substance Market Value (US$ Bn) Forecast, by Drug, 2020 to 2035

Table 17: Europe Controlled Substance Market Value (US$ Bn), by Opioids, 2020 to 2035

Table 18: Europe Controlled Substance Market Value (US$ Bn), by Stimulant, 2020 to 2035

Table 19: Europe Controlled Substance Market Value (US$ Bn), by Depressants, 2020 to 2035

Table 20: Europe Controlled Substance Market Value (US$ Bn) Forecast, by Indication, 2020 to 2035

Table 21: Europe Controlled Substance Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 22: Asia Pacific Controlled Substance Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 23: Asia Pacific Controlled Substance Market Value (US$ Bn) Forecast, by Drug, 2020 to 2035

Table 24: Asia Pacific Controlled Substance Market Value (US$ Bn), by Opioids, 2020 to 2035

Table 25: Asia Pacific Controlled Substance Market Value (US$ Bn), by Stimulant, 2020 to 2035

Table 26: Asia Pacific Controlled Substance Market Value (US$ Bn), by Depressants, 2020 to 2035

Table 27: Asia Pacific Controlled Substance Market Value (US$ Bn) Forecast, by Indication, 2020 to 2035

Table 28: Asia Pacific Controlled Substance Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 29: Latin America Controlled Substance Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 30: Latin America Controlled Substance Market Value (US$ Bn) Forecast, by Drug, 2020 to 2035

Table 31: Latin America Controlled Substance Market Value (US$ Bn), by Opioids, 2020 to 2035

Table 32: Latin America Controlled Substance Market Value (US$ Bn), by Stimulant, 2020 to 2035

Table 33: Latin America Controlled Substance Market Value (US$ Bn), by Depressants, 2020 to 2035

Table 34: Latin America Controlled Substance Market Value (US$ Bn) Forecast, by Indication, 2020 to 2035

Table 35: Latin America Controlled Substance Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Table 36: Middle East and Africa Controlled Substance Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 37: Middle East and Africa Controlled Substance Market Value (US$ Bn) Forecast, by Drug, 2020 to 2035

Table 38: Middle East and Africa Controlled Substance Market Value (US$ Bn), by Opioids, 2020 to 2035

Table 39: Middle East and Africa Controlled Substance Market Value (US$ Bn), by Stimulant, 2020 to 2035

Table 40: Middle East and Africa Controlled Substance Market Value (US$ Bn), by Depressants, 2020 to 2035

Table 41: Middle East and Africa Controlled Substance Market Value (US$ Bn) Forecast, by Indication, 2020 to 2035

Table 42: Middle East and Africa Controlled Substance Market Value (US$ Bn) Forecast, by Distribution Channel, 2020 to 2035

Figure 01: Global Controlled Substance Market Value Share Analysis, by Drug, 2024 and 2035

Figure 02: Global Controlled Substance Market Attractiveness Analysis, by Drug, 2025 to 2035

Figure 03: Global Controlled Substance Market Revenue (US$ Bn), by Opioids, 2020 to 2035

Figure 04: Global Controlled Substance Market Revenue (US$ Bn), by Stimulant, 2020 to 2035

Figure 05: Global Controlled Substance Market Revenue (US$ Bn), by Depressants, 2020 to 2035

Figure 06: Global Controlled Substance Market Revenue (US$ Bn), by Cannabinoids, 2020 to 2035

Figure 07: Global Controlled Substance Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 08: Global Controlled Substance Market Value Share Analysis, by Indication, 2024 and 2035

Figure 09: Global Controlled Substance Market Attractiveness Analysis, by Indication, 2025 to 2035

Figure 10: Global Controlled Substance Market Revenue (US$ Bn), by ADHD, 2020 to 2035

Figure 11: Global Controlled Substance Market Revenue (US$ Bn), by Pain Management, 2020 to 2035

Figure 12: Global Controlled Substance Market Revenue (US$ Bn), by Cough Suppression, 2020 to 2035

Figure 13: Global Controlled Substance Market Revenue (US$ Bn), by Anesthesia, 2020 to 2035

Figure 14: Global Controlled Substance Market Revenue (US$ Bn), by Sleep disorder, 2020 to 2035

Figure 15: Global Controlled Substance Market Revenue (US$ Bn), by Seizure Control, 2020 to 2035

Figure 16: Global Controlled Substance Market Revenue (US$ Bn), by Muscle Relaxation, 2020 to 2035

Figure 17: Global Controlled Substance Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 18: Global Controlled Substance Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 19: Global Controlled Substance Market Attractiveness Analysis, by Distribution Channel, 2024 and 2035

Figure 20: Global Controlled Substance Market Revenue (US$ Bn), by Hospitals Pharmacies, 2025 to 2035

Figure 21: Global Controlled Substance Market Revenue (US$ Bn), by Retail Pharmacies, 2020 to 2035

Figure 22: Global Controlled Substance Market Revenue (US$ Bn), by Online Pharmacies, 2020 to 2035

Figure 23: Global Controlled Substance Market Value Share Analysis, By Region, 2024 and 2035

Figure 24: Global Controlled Substance Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 25: North America Controlled Substance Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 26: North America Controlled Substance Market Value Share Analysis, by Country, 2024 and 2035

Figure 27: North America Controlled Substance Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 28: North America Controlled Substance Market Value Share Analysis, by Drug, 2024 and 2035

Figure 29: North America Controlled Substance Market Attractiveness Analysis, by Drug, 2025 to 2035

Figure 30: North America Controlled Substance Market Value Share Analysis, by Indication, 2024 and 2035

Figure 31: North America Controlled Substance Market Attractiveness Analysis, by Indication, 2025 to 2035

Figure 32: North America Controlled Substance Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 33: North America Controlled Substance Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 34: Europe Controlled Substance Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 35: Europe Controlled Substance Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 36: Europe Controlled Substance Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 37: Europe Controlled Substance Market Value Share Analysis, by Drug, 2024 and 2035

Figure 38: Europe Controlled Substance Market Attractiveness Analysis, by Drug, 2025 to 2035

Figure 39: Europe Controlled Substance Market Value Share Analysis, By Indication, 2024 and 2035

Figure 40: Europe Controlled Substance Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 41: Europe Controlled Substance Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 42: Europe Controlled Substance Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 43: Asia Pacific Controlled Substance Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 44: Asia Pacific Controlled Substance Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 45: Asia Pacific Controlled Substance Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 46: Asia Pacific Controlled Substance Market Value Share Analysis, by Drug, 2024 and 2035

Figure 47: Asia Pacific Controlled Substance Market Attractiveness Analysis, by Drug, 2025 to 2035

Figure 48: Asia Pacific Controlled Substance Market Value Share Analysis, By Indication, 2024 and 2035

Figure 49: Asia Pacific Controlled Substance Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 50: Asia Pacific Controlled Substance Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 51: Asia Pacific Controlled Substance Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 52: Latin America Controlled Substance Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 53: Latin America Controlled Substance Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 54: Latin America Controlled Substance Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 55: Latin America Controlled Substance Market Value Share Analysis, by Drug, 2024 and 2035

Figure 56: Latin America Controlled Substance Market Attractiveness Analysis, by Drug, 2025 to 2035

Figure 57: Latin America Controlled Substance Market Value Share Analysis, By Indication, 2024 and 2035

Figure 58: Latin America Controlled Substance Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 59: Latin America Controlled Substance Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 60: Latin America Controlled Substance Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 61: Middle East and Africa Controlled Substance Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 62: Middle East and Africa Controlled Substance Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 63: Middle East and Africa Controlled Substance Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 64: Middle East and Africa Controlled Substance Market Value Share Analysis, by Drug, 2024 and 2035

Figure 65: Middle East and Africa Controlled Substance Market Attractiveness Analysis, by Drug, 2025 to 2035

Figure 66: Middle East and Africa Controlled Substance Market Value Share Analysis, by Indication, 2024 and 2035

Figure 67: Middle East and Africa Controlled Substance Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 68: Middle East and Africa Controlled Substance Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 69: Middle East and Africa Controlled Substance Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035