Reports

Reports

The container fleet market’s growth is driven by rising e-Commerce and globalization that supports international trade and shipment. Players in the industry are focused on diversifying their product mix and invest in modernized ports, intermodal transport links, and logistic efficiency. The technological advancements and rising adoption of IoT-enabled smart container are capable of tracking the location, temperature, and real-time condition. Hence, these logistics companies are preferring technology-enabled containers, which does not affect the product’s physical and qualitative properties.

In addition, the rise in demand for cargo transportation through ships and increase in trade-related agreements have boosted the growth of the global shipping containers market. Growing trading of goods between two or more countries via road, sea, and airways is driving the market for container fleets.

These days’ companies are more centric toward operational efficiency, maintenance, and sustainability. That’s why advanced technology shifts toward eco-friendly material and bio-methanol-powered ships to align with environmental regulation.

Container fleet allow shipping form small-level production to international import and export. This container fleet industry is largely responsible for global trade economy. Container fleet plays a vital role international trade it is helps business to send and receive products efficiently at lower cost.

Rise in international and intra-national trading of goods is likely to witness the major growth in container fleet market in terms of volume and revenue during the forecast period. This growth is seen in various regions for their rapid industrialization 4.0 and expansion of automotive industry.

Economies like India, China are majorly responsible for import and export of raw materials and goods that create the global market demand for the container fleet market. In addition, expansion of automotive industry is increasing rapidly in these countries, which will impel the demand for containers.

Container fleet is the most effective and efficient way for transportation via trucks, cargo ships or cargo planes to import and export goods across the world. There are various shapes and sizes with their fleet capacity unit of container fleet that companies use according to the requirement.

| Attribute | Detail |

|---|---|

| Container Fleet Market Drivers |

|

Rise in international trade among countries is boosting the logistics sector. Containerization through sea in an intermodal transportation process that enhances the productivity and improves the overall profitability due to its high load bearing capacity, which is driving the market for container fleets. Safety of goods is the priority for any logistics player. For instance - by review of maritime transport, in 2023, the global fleet and container ship capacity grew faster than trade volumes, and this trend is expected to continue in 2025.

Container fleet are the backbone of modern-day global trade, powering the movement of goods across continents. They facilitate efficient, large-scale transportation that connects producers as well as consumers worldwide. It has transformed global trade by providing a cost-effective, reliable, and efficient way to move goods across oceans.

Additionally, global trade routes play a vital role in global economy, thereby carrying majority of the containerized trade and connecting key production regions with consumer markets across the globe such as Asia-Europe, Trans-pacific and Transatlantic. Also, critical chokepoints including the Suez Canal, Panama Canal, and Straits of Malacca are vital arteries of global container fleet shipping. These global routes and narrow routes visibly reduce sailing distances and costs, but disruptions—whether due to drought, geopolitical events, or technical issues—can force vessels to take longer, more expensive detours.

Technological advancements and automation enable faster cargo handling and shipping of container fleet globally. Technologies such as block chain, artificial intelligence (AI), and automation are transforming the port operations. Ports that have adopted these tools report reduced vessel waiting times, enhanced cargo tracking accuracy, and more efficient transshipment processes.

Additionally, the adoption of smart container fleet withy integrated IoTs and smart sensors elevates the service quality standards and strengthening the supply chain. They help to detect real time data and GPS with smart monitoring feature. Hence, Smart container analyzes the temperature, fleet capacity and measures the volume accordingly.

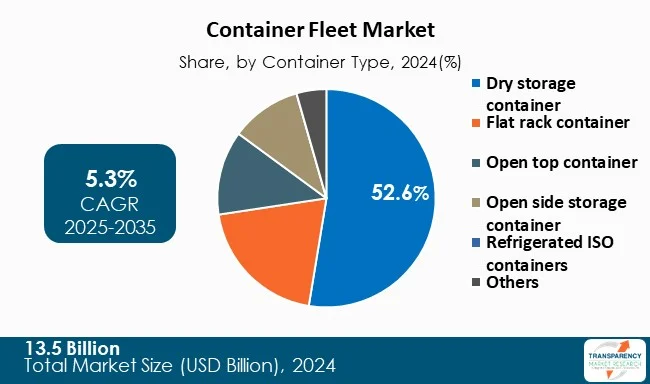

Dry storage container holds the largest share in container fleet market due to efficient loading and unloading of perishable packaged items while providing them protection during overseas shipment. The demand for dry container fleet increases due to rapid expansion of e-Commerce and international trade across the globe. Dry container fleet are used by various industry verticals such as retail, manufacturing, and consumer goods.

Currently, market is experiencing pivotal growth in global logistics and shipping industry with a wide range of management, which includes container fleet. Due to increasing demand for containerized shipping, the dry container fleet segment has become the market leader for cargo shipment. Also, seamless connectivity across the globe strengthens the demand for dry container fleet market.

Dry container fleet are safe handling for industrial chemicals and hazardous material, reliable for the transportation of edible oils, syrups and dairy products, and efficient for the movement of fuel and industrial gases. Hence, dry container fleet gives cost-effective bulk transportation and damage-free transportation for delicate cargo.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia Pacific has a significant impact on the global market due to its huge revenue share. Another facet of growth in the Asia Pacific regional markets is growing industrialization in metropolitan areas. In India, for example, an increase in transportation activity is expected to result in a significant increase in revenue. North America is a booming market with promising growth prospects in the upcoming period. The other variables that drive regional market expansion include the presence of significant competitors, existence of large maritime businesses, and technological advantage.

Rise in international and intra-national trading of goods is likely to witness a major growth of container fleet market in China, India, and Japan. Also, leading shipment companies such as COSCO, CMA CGM, MSC (Mediterranean Shipping Company) come from Asia-pacific region.

Asia-Pacific’s container fleet market growth is driven by technological advancement, international trade activities and industrialization 4.0.

Key players operating in the container fleet market are investing into innovation, strategic partnerships, and technological advancements. They focus on improving imaging clarity and expanding product portfolios, thereby ensuring sustained growth and leadership in the evolving healthcare landscape.

COSCO, CMA CGM, MSC (Mediterranean shipping company), Hapag Lloyd, Maersk Line, Westfal-Larsen Shipping A/S, Kawasaki Kisen Kaisha Ltd., Evergreen Marine Corporation Ltd., Mitsui O.S.K. Lines, Ltd, CMA CGM, PIL (Pacific International Lines), HMM (Hyundai Merchant Marine Co. Ltd.), Wan Hai Lines, Matson are the key players in container fleet market.

Each of these players has been profiled in the container fleet market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

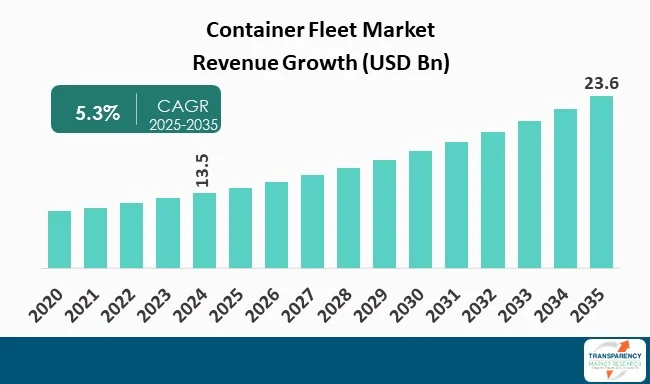

| Size in 2024 | US$ 13.5 Bn |

| Forecast Value in 2035 | US$ 23.6 Bn |

| CAGR | 5.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Container Fleet Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Container Type:

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global Container fleet market was valued at US$ 13.5 Bn in 2024

The global container fleet industry is projected to reach US$ 23.6 Bn by 2035

Rise of international trade, expansion of global supply chain and logistics, and technological advancements in manufacturing durable containers are some of the factors driving the expansion of container fleet market.

The CAGR is anticipated to be 5.3% from 2025 to 2035

Asia Pacific is expected to account for the largest share from 2025 to 2035

COSCO, CMA CGM, MSC (Mediterranean shipping company), Hapag Lloyd, Maersk Line, Westfal-Larsen Shipping A/S, Kawasaki Kisen Kaisha Ltd., Evergreen Marine Corporation Ltd., Mitsui O.S.K. Lines, Ltd, CMA CGM, PIL (Pacific International Lines), HMM (Hyundai Merchant Marine Co. Ltd.), Wan Hai Lines, and Matson among others.

Table 01: Global Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 02: Global Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 03: Global Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 04: Global Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 05: Global Container Fleet Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 06: North America Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 07: North America Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 08: North America Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 09: North America Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 10: North America Container Fleet Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 11: U.S. Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 12: U.S. Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 13: U.S. Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 14: U.S. Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 15: Canada Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 16: Canada Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 17: Canada Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 18: Canada Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 19: Europe Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 20: Europe Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 21: Europe Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 22: Europe Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 23: Europe Container Fleet Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 24: Germany Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 25: Germany Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 26: Germany Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 27: Germany Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 28: U.K. Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 29: U.K. Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 30: U.K. Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 31: U.K. Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 32: France Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 33: France Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 34: France Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 35: France Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 36: Italy Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 37: Italy Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 38: Italy Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 39: Italy Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 40: Spain Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 41: Spain Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 42: Spain Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 43: Spain Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 44: Switzerland Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 45: Switzerland Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 46: Switzerland Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 47: Switzerland Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 48: The Netherlands Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 49: The Netherlands Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 50: The Netherlands Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 51: The Netherlands Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 52: Rest of Europe Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 53: Rest of Europe Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 54: Rest of Europe Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 55: Rest of Europe Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 56: Asia Pacific Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 57: Asia Pacific Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 58: Asia Pacific Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 59: Asia Pacific Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 60: Asia Pacific Container Fleet Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 61: China Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 62: China Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 63: China Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 64: China Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 65: Japan Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 66: Japan Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 67: Japan Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 68: Japan Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 69: India Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 70: India Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 71: India Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 72: India Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 73: South Korea Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 74: South Korea Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 75: South Korea Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 76: South Korea Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 77: Australia and New Zealand Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 78: Australia and New Zealand Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 79: Australia and New Zealand Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 80: Australia and New Zealand Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 81: Rest of Asia Pacific Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 82: Rest of Asia Pacific Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 83: Rest of Asia Pacific Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 84: Rest of Asia Pacific Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 85: Latin America Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 86: Latin America Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 87: Latin America Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 88: Latin America Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 89: Latin America Container Fleet Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 90: Brazil Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 91: Brazil Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 92: Brazil Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 93: Brazil Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 94: Mexico Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 95: Mexico Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 96: Mexico Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 97: Mexico Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 98: Argentina Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 99: Argentina Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 100: Argentina Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 101: Argentina Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 102: Rest of Latin America Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 103: Rest of Latin America Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 104: Rest of Latin America Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 105: Rest of Latin America Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 106: Middle East and Africa Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 107: Middle East and Africa Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 108: Middle East and Africa Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 109: Middle East and Africa Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 110: Middle East and Africa Container Fleet Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 111: GCC Countries Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 112: GCC Countries Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 113: GCC Countries Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 114: GCC Countries Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 115: South Africa Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 116: South Africa Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 117: South Africa Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 118: South Africa Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 119: Rest of Middle East and Africa Container Fleet Market Value (US$ Bn) Forecast, by Container Type, 2020 to 2035

Table 120: Rest of Middle East and Africa Container Fleet Market Value (US$ Bn) Forecast, by Material Type, 2020 to 2035

Table 121: Rest of Middle East and Africa Container Fleet Market Value (US$ Bn) Forecast, by Size, 2020 to 2035

Table 122: Rest of Middle East and Africa Container Fleet Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Figure 01: Global Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 03: Global Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 04: Global Container Fleet Market Revenue (US$ Bn), by Dry storage container, 2020 to 2035

Figure 05: Global Container Fleet Market Revenue (US$ Bn), by Flat rack container, 2020 to 2035

Figure 06: Global Container Fleet Market Revenue (US$ Bn), by Open top container, 2020 to 2035

Figure 07: Global Container Fleet Market Revenue (US$ Bn), by Open side storage container, 2020 to 2035

Figure 08: Global Container Fleet Market Revenue (US$ Bn), by Refrigerated ISO containers, 2020 to 2035

Figure 09: Global Container Fleet Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 10: Global Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 11: Global Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 12: Global Container Fleet Market Revenue (US$ Bn), by Metal, 2020 to 2035

Figure 13: Global Container Fleet Market Revenue (US$ Bn), by Wood, 2020 to 2035

Figure 14: Global Container Fleet Market Revenue (US$ Bn), by Bamboo, 2020 to 2035

Figure 15: Global Container Fleet Market Revenue (US$ Bn), by Vinyl, 2020 to 2035

Figure 16: Global Container Fleet Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 17: Global Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 18: Global Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 19: Global Container Fleet Market Revenue (US$ Bn), by Small Containers (20 feet), 2020 to 2035

Figure 20: Global Container Fleet Market Revenue (US$ Bn), by Large Containers (40 feet), 2020 to 2035

Figure 21: Global Container Fleet Market Revenue (US$ Bn), by High Cube Containers (40 feet), 2020 to 2035

Figure 22: Global Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 23: Global Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 24: Global Container Fleet Market Revenue (US$ Bn), by Food & Beverages, 2020 to 2035

Figure 25: Global Container Fleet Market Revenue (US$ Bn), by Consumer Goods, 2020 to 2035

Figure 26: Global Container Fleet Market Revenue (US$ Bn), by Healthcare, 2020 to 2035

Figure 27: Global Container Fleet Market Revenue (US$ Bn), by Industrial Products, 2020 to 2035

Figure 28: Global Container Fleet Market Revenue (US$ Bn), by Vehicle Transport, 2020 to 2035

Figure 29: Global Container Fleet Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 30: Global Container Fleet Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 31: Global Container Fleet Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 32: North America Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 33: North America Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 34: North America Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 35: North America Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 36: North America Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 37: North America Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 38: North America Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 39: North America Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 40: North America Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 41: North America Container Fleet Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 42: North America Container Fleet Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 43: U.S. Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 44: U.S. Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 45: U.S. Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 46: U.S. Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 47: U.S. Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 48: U.S. Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 49: U.S. Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 50: U.S. Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 51: U.S. Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 52: Canada Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 53: Canada Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 54: Canada Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 55: Canada Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 56: Canada Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 57: Canada Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 58: Canada Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 59: Canada Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 60: Canada Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 61: Europe Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 62: Europe Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 63: Europe Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 64: Europe Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 65: Europe Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 66: Europe Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 67: Europe Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 68: Europe Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 69: Europe Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 70: Europe Container Fleet Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 71: Europe Container Fleet Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 72: Germany Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 73: Germany Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 74: Germany Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 75: Germany Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 76: Germany Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 77: Germany Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 78: Germany Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 79: Germany Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 80: Germany Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 81: U.K. Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 82: U.K. Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 83: U.K. Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 84: U.K. Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 85: U.K. Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 86: U.K. Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 87: U.K. Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 88: U.K. Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 89: U.K. Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 90: France Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 91: France Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 92: France Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 93: France Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 94: France Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 95: France Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 96: France Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 97: France Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 98: France Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 99: Italy Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 100: Italy Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 101: Italy Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 102: Italy Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 103: Italy Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 104: Italy Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 105: Italy Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 106: Italy Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 107: Italy Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 108: Spain Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 109: Spain Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 110: Spain Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 111: Spain Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 112: Spain Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 113: Spain Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 114: Spain Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 115: Spain Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 116: Spain Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 117: Switzerland Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 118: Switzerland Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 119: Switzerland Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 120: Switzerland Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 121: Switzerland Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 122: Switzerland Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 123: Switzerland Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 124: Switzerland Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 125: Switzerland Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 126: The Netherlands Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 127: The Netherlands Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 128: The Netherlands Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 129: The Netherlands Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 130: The Netherlands Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 131: The Netherlands Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 132: The Netherlands Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 133: The Netherlands Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 134: The Netherlands Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 135: Rest of Europe Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 136: Rest of Europe Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 137: Rest of Europe Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 138: Rest of Europe Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 139: Rest of Europe Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 140: Rest of Europe Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 141: Rest of Europe Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 142: Rest of Europe Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 143: Rest of Europe Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 144: Asia Pacific Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 145: Asia Pacific Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 146: Asia Pacific Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 147: Asia Pacific Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 148: Asia Pacific Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 149: Asia Pacific Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 150: Asia Pacific Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 151: Asia Pacific Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 152: Asia Pacific Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 153: Asia Pacific Container Fleet Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 154: Asia Pacific Container Fleet Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 155: China Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 156: China Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 157: China Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 158: China Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 159: China Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 160: China Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 161: China Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 162: China Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 163: China Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 164: Japan Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 165: Japan Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 166: Japan Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 167: Japan Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 168: Japan Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 169: Japan Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 170: Japan Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 171: Japan Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 172: Japan Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 173: India Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 174: India Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 175: India Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 176: India Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 177: India Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 178: India Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 179: India Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 180: India Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 181: India Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 182: South Korea Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 183: South Korea Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 184: South Korea Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 185: South Korea Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 186: South Korea Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 187: South Korea Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 188: South Korea Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 189: South Korea Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 190: South Korea Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 191: Australia and New Zealand Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 192: Australia and New Zealand Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 193: Australia and New Zealand Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 194: Australia and New Zealand Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 195: Australia and New Zealand Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 196: Australia and New Zealand Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 197: Australia and New Zealand Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 198: Australia and New Zealand Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 199: Australia and New Zealand Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 200: Rest of Asia Pacific Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 201: Rest of Asia Pacific Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 202: Rest of Asia Pacific Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 203: Rest of Asia Pacific Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 204: Rest of Asia Pacific Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 205: Rest of Asia Pacific Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 206: Rest of Asia Pacific Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 207: Rest of Asia Pacific Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 208: Rest of Asia Pacific Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 209: Latin America Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 210: Latin America Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 211: Latin America Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 212: Latin America Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 213: Latin America Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 214: Latin America Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 215: Latin America Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 216: Latin America Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 217: Latin America Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 218: Latin America Container Fleet Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 219: Latin America Container Fleet Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 220: Brazil Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 221: Brazil Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 222: Brazil Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 223: Brazil Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 224: Brazil Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 225: Brazil Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 226: Brazil Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 227: Brazil Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 228: Brazil Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 229: Mexico Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 230: Mexico Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 231: Mexico Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 232: Mexico Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 233: Mexico Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 234: Mexico Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 235: Mexico Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 236: Mexico Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 237: Mexico Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 238: Argentina Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 239: Argentina Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 240: Argentina Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 241: Argentina Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 242: Argentina Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 243: Argentina Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 244: Argentina Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 245: Argentina Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 246: Argentina Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 247: Rest of Latin America Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 248: Rest of Latin America Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 249: Rest of Latin America Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 250: Rest of Latin America Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 251: Rest of Latin America Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 252: Rest of Latin America Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 253: Rest of Latin America Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 254: Rest of Latin America Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 255: Rest of Latin America Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 256: Middle East and Africa Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 257: Middle East and Africa Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 258: Middle East and Africa Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 259: Middle East and Africa Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 260: Middle East and Africa Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 261: Middle East and Africa Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 262: Middle East and Africa Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 263: Middle East and Africa Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 264: Middle East and Africa Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 265: Middle East and Africa Container Fleet Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 266: Middle East and Africa Container Fleet Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 267: GCC Countries Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 268: GCC Countries Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 269: GCC Countries Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 270: GCC Countries Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 271: GCC Countries Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 272: GCC Countries Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 273: GCC Countries Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 274: GCC Countries Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 275: GCC Countries Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 276: South Africa Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 277: South Africa Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 278: South Africa Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 279: South Africa Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 280: South Africa Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 281: South Africa Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 282: South Africa Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 283: South Africa Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 284: South Africa Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 285: Rest of Middle East and Africa Container Fleet Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 286: Rest of Middle East and Africa Container Fleet Market Value Share Analysis, by Container Type, 2024 and 2035

Figure 287: Rest of Middle East and Africa Container Fleet Market Attractiveness Analysis, by Container Type, 2025 to 2035

Figure 288: Rest of Middle East and Africa Container Fleet Market Value Share Analysis, by Material Type, 2024 and 2035

Figure 289: Rest of Middle East and Africa Container Fleet Market Attractiveness Analysis, by Material Type, 2025 to 2035

Figure 290: Rest of Middle East and Africa Container Fleet Market Value Share Analysis, by Size, 2024 and 2035

Figure 291: Rest of Middle East and Africa Container Fleet Market Attractiveness Analysis, by Size, 2025 to 2035

Figure 292: Rest of Middle East and Africa Container Fleet Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 293: Rest of Middle East and Africa Container Fleet Market Attractiveness Analysis, by End-use Industry, 2025 to 2035