Reports

Reports

Analysts’ Viewpoint on Market Scenario

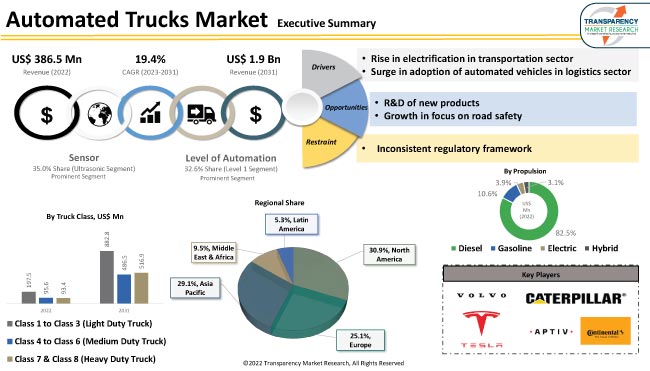

Rise in electrification in the transportation sector and surge in adoption of automated vehicles in the logistics sector are expected to propel the automated trucks market size during the forecast period. Automated trucks are gaining traction in numerous industries such as agriculture, building & construction, mining, and infrastructure.

R&D of new products and growth in focus on road safety are likely to offer lucrative opportunities to players in the global automated trucks industry. However, high price and maintenance requirements are projected to limit the automated trucks market growth in the near future. Thus, automated truck manufacturers are investing in the development of affordable products.

Automated trucks, also known as autonomous trucks, are operated using various technologies such as LiDAR, RADAR, and optical cameras. These technologies gather data from the surroundings and make decisions based on the algorithms under certain environmental conditions. These trucks are integrated with different levels of automation including level 1, level 2, level 3, level 4, and level 5. Level 1 to level 3 vehicles are semi-automated while level 4 and level 5 are fully automated and are often considered as self-driving vehicles.

Automated trucks are gaining attraction in various end-use industries including packaging, logistics, and food & beverage. Rise in demand for last-mile delivery and growth in e-commerce and construction sectors are anticipated to augment the automated trucks market development. Automated trucks are also gaining popularity in waste management.

Regulatory organizations across the globe are enforcing stringent emission standards to cut down on carbon emissions. Traditional trucks that run on fuel emit carbon dioxide. Thus, major feel operators are shifting to automated trucks to meet their sustainability targets.

Electrification in the transportation sector has led to the development of self-driving technologies. Most automated truck companies are testing driverless vehicles to increase their market revenue. In 2019, Daimler AG began testing its level 4 autonomous trucks in Virginia, U.S. Ford, GMC, and Tesla are also testing their autonomous trucks. Semi-autonomous pickup trucks are gaining traction in the U.S. which is anticipated to propel the automated trucks market value in the next few years.

Electric and hybrid electric vehicles offer various benefits including cheaper operating and maintenance expenses as well as reduced pollution. Hence, major countries worldwide are promoting the use of electric trucks and other hybrid vehicles.

Commercial trucks play an important role in the logistics sector as they are used for various processes such as docking, undocking, and transporting goods. These processes require enormous time and labor. Growth in the logistics sector is fueling the automated trucks market statistics. According to Armstrong & Associates, the logistics sector contributes around 12% of the global GDP. Additionally, the trucking sector currently accounts for 43% of total global logistics costs, which is approximately US$ 4.1 trn. This is projected to reach US$ 5.5 trn by 2027.

According to the American Trucking Association (ATA), inland freight transport accounts for 80.7% of the trucking sector in the U.S. The sector was valued at US$ 940.8 Bn and was responsible for moving around 11.46 billion tons of freights in 2022. As per the ATA, the sector is expected to grow by 40% in the near future. Hence, expansion in the trucking sector is driving the automated trucks market progress.

Automation in the transport sector can significantly decrease goods transport and labor costs. Hence, companies in the sector are focused on automating freight forwarding and other processes. Automation in logistics trucks helps record real-time data and track location. It also aids in avoiding collisions and accidents with the help of collision detection, ADAS, driver monitoring, and other advanced systems.

According to the latest automated trucks market trends, level 1 was the largest level of automation segment in 2022. Level 1 automation offers truck cruise control and automated braking systems. Level 3 automated trucks are also gaining traction among end-users as they are a cleaner, safer, and more efficient mode of transportation.

According to the latest automated trucks market analysis, the Automatic Emergency Braking (AEB) ADAS feature segment accounted for major share in 2022. Growth of the segment can be ascribed to rise in focus on truck safety. Government authorities and OEMs are implementing necessary actions to improve the logistics and transportation sectors. They are focused on addressing a wide range of challenges including traffic congestion and road accidents. This, in turn, is projected to boost demand for AEB systems in the next few years.

According to the Motor & Equipment Manufacturers Association (MEMA), Adaptive Cruise Control (ACC), Automatic Emergency Braking (AEB), Blind Spot Detection (BSD), Traffic Jam Assist (TJA), and Intelligent Park Assist (IPA) have the potential to prevent approximately 40% of accidents or crashes on roads every year.

According to the latest automated trucks market forecast, North America is expected to hold largest share from 2023 to 2031. Presence of major OEMs and tier-1 suppliers is driving the market dynamics of North America and Europe. Rise in investment in the R&D of driverless cars as well as sensors and components, such as cameras, RADAR, and LiDAR, is also propelling market expansion in these regions.

Lack of infrastructure is a major factor limiting the automated trucks industry growth in Asia Pacific. However, rapid economic development and surge in government investment in infrastructure development, especially in China and India, are anticipated to offer lucrative automated trucks market opportunities to vendors. The sector in Middle East & Africa is driven by the increase in investment in infrastructure development and mining activities.

Most firms are investing significantly in the R&D of new products to expand their product portfolio. They are also adopting various growth strategies, such as M&As, partnerships, and collaborations, to broaden their customer base.

AB Volvo, Aptiv, Autonomous Solutions Inc., Caterpillar Inc., Continental AG, Daimler AG, Denso Corporation, Embark Trucks, Inc., Hitachi Ltd., Intel Corporation, Komatsu Corporation, NVIDIA Corporation, PACCAR, Inc., Qualcomm Technologies, Inc., Robert Bosch GmbH, Valeo, Waymo LLC, Tesla, and ZF Friedrichshafen AG are major companies operating in the market.

Each of these players has been profiled in the automated trucks market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 386.5 Mn |

| Market Forecast Value in 2031 | US$ 1.9 Bn |

| Growth Rate (CAGR) | 19.4% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Mn/Bn for Value and Units for Volume |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, Value chain analysis, industry trend analysis, etc. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 386.5 Mn in 2022

It is projected to advance at a CAGR of 19.4% from 2023 to 2031

It is anticipated to reach US$ 1.9 Bn by the end of 2031

Rise in electrification in transportation sector and surge in adoption of automated vehicles in logistics sector

The Automatic Emergency Braking (AEB) segment held largest share in 2022

North America is projected to hold largest share from 2023 to 2031

AB Volvo, Aptiv, Autonomous Solutions Inc., Caterpillar Inc., Continental AG, Daimler AG, Denso Corporation, Embark Trucks, Inc., Hitachi Ltd., Intel Corporation, Komatsu Corporation, NVIDIA Corporation, PACCAR, Inc., Qualcomm Technologies, Inc., Robert Bosch GmbH, Valeo, Waymo LLC, Tesla, and ZF Friedrichshafen AG

1. Global Automated Trucks Market - Executive Summary

1.1. Market Size, US$ Mn, 2017-2031

1.2. Market Analysis and Key Segment Analysis

1.3. TMR Analysis and Recommendations

2. Market Overview

2.1. Macro-economic Factors

2.2. Market Dynamics

2.2.1. Drivers

2.2.2. Restraints

2.2.3. Opportunity

2.3. Market Factor Analysis

2.3.1. Porter’s Five Force Analysis

2.3.2. PESTEL Analysis

2.3.3. Value Chain Analysis

2.3.3.1. List of Key Manufacturers

2.3.3.2. List of Customers

2.3.3.3. Level of Integration

2.3.4. SWOT Analysis

2.4. Key Trend Analysis

2.4.1. Automotive Industry Trend

2.4.2. Level of Automation/ Product Trend

2.5. Regulatory Scenario

2.6. Price Trend Analysis & Forecast, 2017-2031

2.7. Automated Trucks Market: Impact Factors

2.8. Automated Trucks Market: High Potential Markets

3. Global Automated Trucks Market, by Level of Automation

3.1. Market Snapshot

3.1.1. Introduction & Definition

3.1.2. Market Growth & Y-o-Y Projections

3.1.3. Base Point Share Analysis

3.2. Global Automated Trucks Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, by Level of Automation, 2017-2031

3.2.1. Level 1

3.2.2. Level 2

3.2.3. Level 3

3.2.4. Level 4

3.2.5. Level 5

4. Global Automated Trucks Market, by ADAS Feature

4.1. Market Snapshot

4.1.1. Introduction & Definition

4.1.2. Market Growth & Y-o-Y Projections

4.1.3. Base Point Share Analysis

4.2. Global Automated Trucks Automated Trucks Market Size Revenue (US$ Mn) Analysis & Forecast, by ADAS Feature, 2017-2031

4.2.1. Adaptive Cruise Control (ACC)

4.2.2. Automatic Emergency Braking (AEB)

4.2.3. Blind Spot Detection (BSD)

4.2.4. Intelligent Park Assist (IPA)

4.2.5. Lane Keep Assist (LKA)

4.2.6. Traffic Jam Assist (TJA)

4.2.7. Others

5. Global Automated Trucks Market, by Truck Class

5.1. Market Snapshot

5.1.1. Introduction & Definition

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Automated Trucks Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, by Truck Class, 2017-2031

5.2.1. Class 1 to Class 3 (Light Duty Truck)

5.2.2. Class 4 to Class 6 (Medium Duty Truck)

5.2.3. Class 7 & Class 8 (Heavy Duty Truck)

6. Global Automated Trucks Market, by Sensor

6.1. Market Snapshot

6.1.1. Introduction & Definition

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Automated Trucks Automated Trucks Market Size Revenue (US$ Mn) Analysis & Forecast, by Sensor, 2017-2031

6.2.1. Camera

6.2.2. RADAR

6.2.3. LiDAR

6.2.4. Ultrasonic

6.2.5. Others

7. Global Automated Trucks Market, by Propulsion

7.1. Market Snapshot

7.1.1. Introduction & Definition

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Automated Trucks Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, by Propulsion, 2017-2031

7.2.1. Diesel

7.2.2. Gasoline

7.2.3. Electric

7.2.4. Hybrid

8. Global Automated Trucks Market, by Region

8.1. Market Snapshot

8.1.1. Introduction & Definition

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Automated Trucks Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, by Region, 2017-2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. Latin America

9. North America Automated Trucks Market

9.1. Market Snapshot

9.1.1. Introduction & Definition

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Automated Trucks Market Size Volume (Units) & Revenue (US$ Mn) Analysis & Forecast, by Level of Automation, 2017-2031

9.2.1. Level 1

9.2.2. Level 2

9.2.3. Level 3

9.2.4. Level 4

9.2.5. Level 5

9.3. Automated Trucks Market Size Revenue (US$ Mn) Analysis & Forecast, by ADAS Feature, 2017-2031

9.3.1. Adaptive Cruise Control (ACC)

9.3.2. Automatic Emergency Braking (AEB)

9.3.3. Blind Spot Detection (BSD)

9.3.4. Intelligent Park Assist (IPA)

9.3.5. Lane Keep Assist (LKA)

9.3.6. Traffic Jam Assist (TJA)

9.3.7. Others

9.4. Automated Trucks Market Size Volume (Units) & Revenue (US$ Mn) Analysis & Forecast, by Truck Class, 2017-2031

9.4.1. Class 1 to Class 3 (Light Duty Truck)

9.4.2. Class 4 to Class 6 (Medium Duty Truck)

9.4.3. Class 7 & Class 8 (Heavy Duty Truck)

9.5. Automated Trucks Market Size Revenue (US$ Mn) Analysis & Forecast, by Sensor, 2017-2031

9.5.1. Camera

9.5.2. RADAR

9.5.3. LiDAR

9.5.4. Ultrasonic

9.5.5. Others

9.6. Automated Trucks Market Size Volume (Units) & Revenue (US$ Mn) Analysis & Forecast, by Propulsion, 2017-2031

9.6.1. Diesel

9.6.2. Gasoline

9.6.3. Electric

9.6.4. Hybrid

9.7. Automated Trucks Market Size Volume (Units) & Revenue (US$ Mn) Analysis & Forecast, by Country, 2017-2031

9.7.1. U.S.

9.7.2. Canada

10. Europe Automated Trucks Market

10.1. Market Snapshot

10.1.1. Introduction & Definition

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Automated Trucks Market Size Volume (Units) & Revenue (US$ Mn) Analysis & Forecast, by Level of Automation, 2017-2031

10.2.1. Level 1

10.2.2. Level 2

10.2.3. Level 3

10.2.4. Level 4

10.2.5. Level 5

10.3. Automated Trucks Market Size Revenue (US$ Mn) Analysis & Forecast, by ADAS Feature, 2017-2031

10.3.1. Adaptive Cruise Control (ACC)

10.3.2. Automatic Emergency Braking (AEB)

10.3.3. Blind Spot Detection (BSD)

10.3.4. Intelligent Park Assist (IPA)

10.3.5. Lane Keep Assist (LKA)

10.3.6. Traffic Jam Assist (TJA)

10.3.7. Others

10.4. Automated Trucks Market Size Volume (Units) & Revenue (US$ Mn) Analysis & Forecast, by Truck Class, 2017-2031

10.4.1. Class 1 to Class 3 (Light Duty Truck)

10.4.2. Class 4 to Class 6 (Medium Duty Truck)

10.4.3. Class 7 & Class 8 (Heavy Duty Truck)

10.5. Automated Trucks Market Size Revenue (US$ Mn) Analysis & Forecast, by Sensor, 2017-2031

10.5.1. Camera

10.5.2. RADAR

10.5.3. LiDAR

10.5.4. Ultrasonic

10.5.5. Others

10.6. Automated Trucks Market Size Volume (Units) & Revenue (US$ Mn) Analysis & Forecast, by Propulsion, 2017-2031

10.6.1. Diesel

10.6.2. Gasoline

10.6.3. Electric

10.6.4. Hybrid

10.7. Automated Trucks Market Size Volume (Units) & Revenue (US$ Mn) Analysis & Forecast, by Country, 2017-2031

10.7.1. Germany

10.7.2. U.K.

10.7.3. France

10.7.4. Italy

10.7.5. Spain

10.7.6. Russia & CIS

10.7.7. Rest of Europe

11. Asia Pacific Automated Trucks Market

11.1. Market Snapshot

11.1.1. Introduction & Definition

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Automated Trucks Market Size Volume (Units) & Revenue (US$ Mn) Analysis & Forecast, by Level of Automation, 2017-2031

11.2.1. Level 1

11.2.2. Level 2

11.2.3. Level 3

11.2.4. Level 4

11.2.5. Level 5

11.3. Automated Trucks Market Size Revenue (US$ Mn) Analysis & Forecast, by ADAS Feature, 2017-2031

11.3.1. Adaptive Cruise Control (ACC)

11.3.2. Automatic Emergency Braking (AEB)

11.3.3. Blind Spot Detection (BSD)

11.3.4. Intelligent Park Assist (IPA)

11.3.5. Lane Keep Assist (LKA)

11.3.6. Traffic Jam Assist (TJA)

11.3.7. Others

11.4. Automated Trucks Market Size Volume (Units) & Revenue (US$ Mn) Analysis & Forecast, by Truck Class, 2017-2031

11.4.1. Class 1 to Class 3 (Light Duty Truck)

11.4.2. Class 4 to Class 6 (Medium Duty Truck)

11.4.3. Class 7 & Class 8 (Heavy Duty Truck)

11.5. Automated Trucks Market Size Revenue (US$ Mn) Analysis & Forecast, by Sensor, 2017-2031

11.5.1. Camera

11.5.2. RADAR

11.5.3. LiDAR

11.5.4. Ultrasonic

11.5.5. Others

11.6. Automated Trucks Market Size Volume (Units) & Revenue (US$ Mn) Analysis & Forecast, by Propulsion, 2017-2031

11.6.1. Diesel

11.6.2. Gasoline

11.6.3. Electric

11.6.4. Hybrid

11.7. Automated Trucks Market Size Volume (Units) & Revenue (US$ Mn) Analysis & Forecast, by Country, 2017-2031

11.7.1. China

11.7.2. India

11.7.3. Japan

11.7.4. ASEAN

11.7.5. ANZ

11.7.6. South Korea

11.7.7. Rest of Asia Pacific

12. Middle East & Africa Automated Trucks Market

12.1. Market Snapshot

12.1.1. Introduction & Definition

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Automated Trucks Market Size Volume (Units) & Revenue (US$ Mn) Analysis & Forecast, by Level of Automation, 2017-2031

12.2.1. Level 1

12.2.2. Level 2

12.2.3. Level 3

12.2.4. Level 4

12.2.5. Level 5

12.3. Automated Trucks Market Size Revenue (US$ Mn) Analysis & Forecast, by ADAS Feature, 2017-2031

12.3.1. Adaptive Cruise Control (ACC)

12.3.2. Automatic Emergency Braking (AEB)

12.3.3. Blind Spot Detection (BSD)

12.3.4. Intelligent Park Assist (IPA)

12.3.5. Lane Keep Assist (LKA)

12.3.6. Traffic Jam Assist (TJA)

12.3.7. Others

12.4. Automated Trucks Market Size Volume (Units) & Revenue (US$ Mn) Analysis & Forecast, by Truck Class, 2017-2031

12.4.1. Class 1 to Class 3 (Light Duty Truck)

12.4.2. Class 4 to Class 6 (Medium Duty Truck)

12.4.3. Class 7 & Class 8 (Heavy Duty Truck)

12.5. Automated Trucks Market Size Revenue (US$ Mn) Analysis & Forecast, by Sensor, 2017-2031

12.5.1. Camera

12.5.2. RADAR

12.5.3. LiDAR

12.5.4. Ultrasonic

12.5.5. Others

12.6. Automated Trucks Market Size Volume (Units) & Revenue (US$ Mn) Analysis & Forecast, by Propulsion, 2017-2031

12.6.1. Diesel

12.6.2. Gasoline

12.6.3. Electric

12.6.4. Hybrid

12.7. Automated Trucks Market Size Volume (Units) & Revenue (US$ Mn) Analysis & Forecast, by Country, 2017-2031

12.7.1. GCC

12.7.2. South Africa

12.7.3. Turkey

12.7.4. Rest of Middle East & Africa

13. Latin America Automated Trucks Market

13.1. Market Snapshot

13.1.1. Introduction & Definition

13.1.2. Market Growth & Y-o-Y Projections

13.1.3. Base Point Share Analysis

13.2. Automated Trucks Market Size Volume (Units) & Revenue (US$ Mn) Analysis & Forecast, by Level of Automation, 2017-2031

13.2.1. Level 1

13.2.2. Level 2

13.2.3. Level 3

13.2.4. Level 4

13.2.5. Level 5

13.3. Automated Trucks Market Size Revenue (US$ Mn) Analysis & Forecast, by ADAS Feature, 2017-2031

13.3.1. Adaptive Cruise Control (ACC)

13.3.2. Automatic Emergency Braking (AEB)

13.3.3. Blind Spot Detection (BSD)

13.3.4. Intelligent Park Assist (IPA)

13.3.5. Lane Keep Assist (LKA)

13.3.6. Traffic Jam Assist (TJA)

13.3.7. Others

13.4. Automated Trucks Market Size Volume (Units) & Revenue (US$ Mn) Analysis & Forecast, by Truck Class, 2017-2031

13.4.1. Class 1 to Class 3 (Light Duty Truck)

13.4.2. Class 4 to Class 6 (Medium Duty Truck)

13.4.3. Class 7 & Class 8 (Heavy Duty Truck)

13.5. Automated Trucks Market Size Revenue (US$ Mn) Analysis & Forecast, by Sensor, 2017-2031

13.5.1. Camera

13.5.2. RADAR

13.5.3. LiDAR

13.5.4. Ultrasonic

13.5.5. Others

13.6. Automated Trucks Market Size Volume (Units) & Revenue (US$ Mn) Analysis & Forecast, by Propulsion, 2017-2031

13.6.1. Diesel

13.6.2. Gasoline

13.6.3. Electric

13.6.4. Hybrid

13.7. Automated Trucks Market Size Volume (Units) & Revenue (US$ Mn) Analysis & Forecast, by Country, 2017-2031

13.7.1. Brazil

13.7.2. Mexico

13.7.3. Rest of Latin America

14. Competition Assessment

14.1. Target Market Competition - a Dashboard View

14.2. Target Market Structure Analysis

14.3. Target Market Company Share Analysis

14.3.1. For Tier 1 Market Players, 2022

15. Company Profile (**Company Overview, Company Footprints, Product Portfolio, Strategy Overview, Recent Developments, Financial Analysis, Revenue Share, Executive Bios)

15.1. AB Volvo

15.1.1. Company Overview

15.1.2. Company Footprints

15.1.3. Product Portfolio

15.1.4. Strategy Overview

15.1.5. Recent Developments

15.1.6. Financial Analysis

15.1.7. Revenue Share

15.1.8. Executive Bios

15.2. Aptiv

15.2.1. Company Overview

15.2.2. Company Footprints

15.2.3. Product Portfolio

15.2.4. Strategy Overview

15.2.5. Recent Developments

15.2.6. Financial Analysis

15.2.7. Revenue Share

15.2.8. Executive Bios

15.3. Autonomous Solutions Inc.

15.3.1. Company Overview

15.3.2. Company Footprints

15.3.3. Product Portfolio

15.3.4. Strategy Overview

15.3.5. Recent Developments

15.3.6. Financial Analysis

15.3.7. Revenue Share

15.3.8. Executive Bios

15.4. Caterpillar Inc.

15.4.1. Company Overview

15.4.2. Company Footprints

15.4.3. Product Portfolio

15.4.4. Strategy Overview

15.4.5. Recent Developments

15.4.6. Financial Analysis

15.4.7. Revenue Share

15.4.8. Executive Bios

15.5. Continental AG

15.5.1. Company Overview

15.5.2. Company Footprints

15.5.3. Product Portfolio

15.5.4. Strategy Overview

15.5.5. Recent Developments

15.5.6. Financial Analysis

15.5.7. Revenue Share

15.5.8. Executive Bios

15.6. Daimler AG

15.6.1. Company Overview

15.6.2. Company Footprints

15.6.3. Product Portfolio

15.6.4. Strategy Overview

15.6.5. Recent Developments

15.6.6. Financial Analysis

15.6.7. Revenue Share

15.6.8. Executive Bios

15.7. Denso Corporation

15.7.1. Company Overview

15.7.2. Company Footprints

15.7.3. Product Portfolio

15.7.4. Strategy Overview

15.7.5. Recent Developments

15.7.6. Financial Analysis

15.7.7. Revenue Share

15.7.8. Executive Bios

15.8. Embark Trucks, Inc.

15.8.1. Company Overview

15.8.2. Company Footprints

15.8.3. Product Portfolio

15.8.4. Strategy Overview

15.8.5. Recent Developments

15.8.6. Financial Analysis

15.8.7. Revenue Share

15.8.8. Executive Bios

15.9. Hitachi Ltd.

15.9.1. Company Overview

15.9.2. Company Footprints

15.9.3. Product Portfolio

15.9.4. Strategy Overview

15.9.5. Recent Developments

15.9.6. Financial Analysis

15.9.7. Revenue Share

15.9.8. Executive Bios

15.10. Intel Corporation

15.10.1. Company Overview

15.10.2. Company Footprints

15.10.3. Product Portfolio

15.10.4. Strategy Overview

15.10.5. Recent Developments

15.10.6. Financial Analysis

15.10.7. Revenue Share

15.10.8. Executive Bios

15.11. Komatsu Corporation

15.11.1. Company Overview

15.11.2. Company Footprints

15.11.3. Product Portfolio

15.11.4. Strategy Overview

15.11.5. Recent Developments

15.11.6. Financial Analysis

15.11.7. Revenue Share

15.11.8. Executive Bios

15.12. NVIDIA Corporation

15.12.1. Company Overview

15.12.2. Company Footprints

15.12.3. Product Portfolio

15.12.4. Strategy Overview

15.12.5. Recent Developments

15.12.6. Financial Analysis

15.12.7. Revenue Share

15.12.8. Executive Bios

15.13. PACCAR, Inc.

15.13.1. Company Overview

15.13.2. Company Footprints

15.13.3. Product Portfolio

15.13.4. Strategy Overview

15.13.5. Recent Developments

15.13.6. Financial Analysis

15.13.7. Revenue Share

15.13.8. Executive Bios

15.14. Qualcomm Technologies, Inc.

15.14.1. Company Overview

15.14.2. Company Footprints

15.14.3. Product Portfolio

15.14.4. Strategy Overview

15.14.5. Recent Developments

15.14.6. Financial Analysis

15.14.7. Revenue Share

15.14.8. Executive Bios

15.15. Robert Bosch GmbH

15.15.1. Company Overview

15.15.2. Company Footprints

15.15.3. Product Portfolio

15.15.4. Strategy Overview

15.15.5. Recent Developments

15.15.6. Financial Analysis

15.15.7. Revenue Share

15.15.8. Executive Bios

15.16. Valeo

15.16.1. Company Overview

15.16.2. Company Footprints

15.16.3. Product Portfolio

15.16.4. Strategy Overview

15.16.5. Recent Developments

15.16.6. Financial Analysis

15.16.7. Revenue Share

15.16.8. Executive Bios

15.17. Tesla

15.17.1. Company Overview

15.17.2. Company Footprints

15.17.3. Product Portfolio

15.17.4. Strategy Overview

15.17.5. Recent Developments

15.17.6. Financial Analysis

15.17.7. Revenue Share

15.17.8. Executive Bios

15.18. Waymo LLC

15.18.1. Company Overview

15.18.2. Company Footprints

15.18.3. Product Portfolio

15.18.4. Strategy Overview

15.18.5. Recent Developments

15.18.6. Financial Analysis

15.18.7. Revenue Share

15.18.8. Executive Bios

15.19. ZF Friedrichshafen AG

15.19.1. Company Overview

15.19.2. Company Footprints

15.19.3. Product Portfolio

15.19.4. Strategy Overview

15.19.5. Recent Developments

15.19.6. Financial Analysis

15.19.7. Revenue Share

15.19.8. Executive Bios

15.20. Other Players

15.20.1. Company Overview

15.20.2. Company Footprints

15.20.3. Product Portfolio

15.20.4. Strategy Overview

15.20.5. Recent Developments

15.20.6. Financial Analysis

15.20.7. Revenue Share

15.20.8. Executive Bios

List of Tables

Table 1: Levels of Automation Definitions

Table 2: Global Automated Trucks Market Volume (Units) Forecast, by Level of Automation, 2017-2031

Table 3: Global Automated Trucks Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Table 4: Global Automated Trucks Market Value (US$ Mn) Forecast, by ADAS Feature, 2017-2031

Table 5: Global Automated Trucks Market Volume (Units) Forecast, by Truck Class, 2017-2031

Table 6: Global Automated Trucks Market Value (US$ Mn) Forecast, by Truck Class, 2017-2031

Table 7: Global Automated Trucks Market Value (US$ Mn) Forecast, by Sensors, 2017-2031

Table 8: Global Automated Trucks Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 9: Global Automated Trucks Market Value (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 10: Global Automated Trucks Market Volume (Units) Forecast, by Region, 2017-2031

Table 11: Global Automated Trucks Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 12: North America Automated Trucks Market Volume (Units) Forecast, by Level of Automation, 2017-2031

Table 13: North America Automated Trucks Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Table 14: North America Automated Trucks Market Value (US$ Mn) Forecast, by ADAS Feature, 2017-2031

Table 15: North America Automated Trucks Market Volume (Units) Forecast, by Truck Class, 2017-2031

Table 16: North America Automated Trucks Market Value (US$ Mn) Forecast, by Truck Class, 2017-2031

Table 17: North America Automated Trucks Market Value (US$ Mn) Forecast, by Sensors, 2017-2031

Table 18: North America Automated Trucks Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 19: North America Automated Trucks Market Value (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 20: North America Automated Trucks Market Volume (Units) Forecast, by Country, 2017-2031

Table 21: North America Automated Trucks Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 22: Europe Automated Trucks Market Volume (Units) Forecast, by Level of Automation, 2017-2031

Table 23: Europe Automated Trucks Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Table 24: Europe Automated Trucks Market Value (US$ Mn) Forecast, by ADAS Feature, 2017-2031

Table 25: Europe Automated Trucks Market Volume (Units) Forecast, by Truck Class, 2017-2031

Table 26: Europe Automated Trucks Market Value (US$ Mn) Forecast, by Truck Class, 2017-2031

Table 27: Europe Automated Trucks Market Value (US$ Mn) Forecast, by Sensors, 2017-2031

Table 28: Europe Automated Trucks Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 29: Europe Automated Trucks Market Value (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 30: Europe Automated Trucks Market Volume (Units) Forecast, by Country & Sub-region, 2017-2031

Table 31: Europe Automated Trucks Market Value (US$ Mn) Forecast, by Country & Sub-region, 2017-2031

Table 32: Asia Pacific Automated Trucks Market Volume (Units) Forecast, by Level of Automation, 2017-2031

Table 33: Asia Pacific Automated Trucks Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Table 34: Asia Pacific Automated Trucks Market Value (US$ Mn) Forecast, by ADAS Feature, 2017-2031

Table 35: Asia Pacific Automated Trucks Market Volume (Units) Forecast, by Truck Class, 2017-2031

Table 36: Asia Pacific Automated Trucks Market Value (US$ Mn) Forecast, by Truck Class, 2017-2031

Table 37: Asia Pacific Automated Trucks Market Value (US$ Mn) Forecast, by Sensors, 2017-2031

Table 38: Asia Pacific Automated Trucks Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 39: Asia Pacific Automated Trucks Market Value (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 40: Asia Pacific Automated Trucks Market Volume (Units) Forecast, by Country & Sub-region, 2017-2031

Table 41: Asia Pacific Automated Trucks Market Value (US$ Mn) Forecast, by Country & Sub-region, 2017-2031

Table 42: Middle East & Africa Automated Trucks Market Volume (Units) Forecast, by Level of Automation, 2017-2031

Table 43: Middle East & Africa Automated Trucks Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Table 44: Middle East & Africa Automated Trucks Market Value (US$ Mn) Forecast, by ADAS Feature, 2017-2031

Table 45: Middle East & Africa Automated Trucks Market Volume (Units) Forecast, by Truck Class, 2017-2031

Table 46: Middle East & Africa Automated Trucks Market Value (US$ Mn) Forecast, by Truck Class, 2017-2031

Table 47: Middle East & Africa Automated Trucks Market Value (US$ Mn) Forecast, by Sensors, 2017-2031

Table 48: Middle East & Africa Automated Trucks Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 49: Middle East & Africa Automated Trucks Market Value (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 50: Middle East & Africa Automated Trucks Market Volume (Units) Forecast, by Country & Sub-region, 2017-2031

Table 51: Middle East & Africa Automated Trucks Market Value (US$ Mn) Forecast, by Country & Sub-region, 2017-2031

Table 52: Latin America Automated Trucks Market Volume (Units) Forecast, by Level of Automation, 2017-2031

Table 53: Latin America Automated Trucks Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Table 54: Latin America Automated Trucks Market Value (US$ Mn) Forecast, by ADAS Feature, 2017-2031

Table 55: Latin America Automated Trucks Market Volume (Units) Forecast, by Truck Class, 2017-2031

Table 56: Latin America Automated Trucks Market Value (US$ Mn) Forecast, by Truck Class, 2017-2031

Table 57: Latin America Automated Trucks Market Value (US$ Mn) Forecast, by Sensors, 2017-2031

Table 58: Latin America Automated Trucks Market Volume (Units) Forecast, by Propulsion, 2017-2031

Table 59: Latin America Automated Trucks Market Value (US$ Mn) Forecast, by Propulsion, 2017-2031

Table 60: Latin America Automated Trucks Market Volume (Units) Forecast, by Country & Sub-region, 2017-2031

List of Figures

Figure 1: Global Automated Trucks Market Volume (Units) Forecast, 2017-2031

Figure 2: Global Automated Trucks Market Value (US$ Mn) Forecast, 2017-2031

Figure 3: Global Automated Trucks Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Figure 4: Global Automated Trucks Market Attractiveness, Value (US$ Mn), by Level of Automation, 2023-2031

Figure 5: Global Automated Trucks Market Value (US$ Mn) Forecast, by ADAS Feature, 2017-2031

Figure 6: Global Automated Trucks Market Attractiveness, Value (US$ Mn), by ADAS Feature, 2023-2031

Figure 7: Global Automated Trucks Market Value (US$ Mn) Forecast, by Truck Class, 2017-2031

Figure 8: Global Automated Trucks Market Attractiveness, Value (US$ Mn), by Truck Class, 2023-2031

Figure 9: Global Automated Trucks Market Value (US$ Mn) Forecast, by Sensor, 2017-2031

Figure 10: Global Automated Trucks Market Attractiveness, Value (US$ Mn), by Sensor, 2023-2031

Figure 11: Global Automated Trucks Market Value (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 12: Global Automated Trucks Market Attractiveness, Value (US$ Mn), by Propulsion, 2023-2031

Figure 13: Global Automated Trucks Market Value (US$ Mn) Forecast, by Region, 2017-2031

Figure 14: Global Automated Trucks Market Attractiveness, Value (US$ Mn), by Region, 2023-2031

Figure 15: North America Automated Trucks Market Value (US$ Mn) Forecast, 2017-2031

Figure 16: North America Automated Trucks Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Figure 17: North America Automated Trucks Market Attractiveness, Value (US$ Mn), by Level of Automation, 2023-2031

Figure 18: North America Automated Trucks Market Value (US$ Mn) Forecast, by ADAS Feature, 2017-2031

Figure 19: North America Automated Trucks Market Attractiveness, Value (US$ Mn), by ADAS Feature, 2023-2031

Figure 20: North America Automated Trucks Market Value (US$ Mn) Forecast, by Truck Class, 2017-2031

Figure 21: North America Automated Trucks Market Attractiveness, Value (US$ Mn), by Truck Class, 2023-2031

Figure 22: North America Automated Trucks Market Value (US$ Mn) Forecast, by Sensor, 2017-2031

Figure 23: North America Automated Trucks Market Attractiveness, Value (US$ Mn), by Sensor, 2023-2031

Figure 24: North America Automated Trucks Market Value (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 25: North America Automated Trucks Market Attractiveness, Value (US$ Mn), by Propulsion, 2023-2031

Figure 26: North America Automated Trucks Market Value (US$ Mn) Forecast, by Country, 2017-2031

Figure 27: North America Automated Trucks Market Attractiveness, Value (US$ Mn), by Country, 2023-2031

Figure 28: Europe Automated Trucks Market Value (US$ Mn) Forecast, 2017-2031

Figure 29: Europe Automated Trucks Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Figure 30: Europe Automated Trucks Market Attractiveness, Value (US$ Mn), by Level of Automation, 2023-2031

Figure 31: Europe Automated Trucks Market Value (US$ Mn) Forecast, by ADAS Feature, 2017-2031

Figure 32: Europe Automated Trucks Market Attractiveness, Value (US$ Mn), by ADAS Feature, 2023-2031

Figure 33: Europe Automated Trucks Market Value (US$ Mn) Forecast, by Truck Class, 2017-2031

Figure 34: Europe Automated Trucks Market Attractiveness, Value (US$ Mn), by Truck Class, 2023-2031

Figure 35: Europe Automated Trucks Market Value (US$ Mn) Forecast, by Sensor, 2017-2031

Figure 36: Europe Automated Trucks Market Attractiveness, Value (US$ Mn), by Sensor, 2023-2031

Figure 37: Europe Automated Trucks Market Value (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 38: Europe Automated Trucks Market Attractiveness, Value (US$ Mn), by Propulsion, 2023-2031

Figure 39: Europe Automated Trucks Market Value (US$ Mn) Forecast, by Country & Sub-region, 2017-2031

Figure 40: Europe Automated Trucks Market Attractiveness, Value (US$ Mn), by Country, 2023-2031

Figure 41: Asia Pacific Automated Trucks Market Value (US$ Mn) Forecast, 2017-2031

Figure 42: Asia Pacific Automated Trucks Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Figure 43: Asia Pacific Automated Trucks Market Attractiveness, Value (US$ Mn), by Level of Automation, 2023-2031

Figure 44: Asia Pacific Automated Trucks Market Value (US$ Mn) Forecast, by ADAS Feature, 2017-2031

Figure 45: Asia Pacific Automated Trucks Market Attractiveness, Value (US$ Mn), by ADAS Feature, 2023-2031

Figure 46: Asia Pacific Automated Trucks Market Value (US$ Mn) Forecast, by Truck Class, 2017-2031

Figure 47: Asia Pacific Automated Trucks Market Attractiveness, Value (US$ Mn), by Truck Class, 2023-2031

Figure 48: Asia Pacific Automated Trucks Market Value (US$ Mn) Forecast, by Sensor, 2017-2031

Figure 49: Asia Pacific Automated Trucks Market Attractiveness, Value (US$ Mn), by Sensor, 2023-2031

Figure 50: Asia Pacific Automated Trucks Market Value (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 51: Asia Pacific Automated Trucks Market Attractiveness, Value (US$ Mn), by Propulsion, 2023-2031

Figure 52: Asia Pacific Automated Trucks Market Value (US$ Mn) Forecast, by Country & Sub-region, 2017-2031

Figure 53: Asia Pacific Automated Trucks Market Attractiveness, Value (US$ Mn), by Country & Sub-region, 2023-2031

Figure 54: Middle East & Africa Automated Trucks Market Value (US$ Mn) Forecast, 2017-2031

Figure 55: Middle East & Africa Automated Trucks Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Figure 56: Middle East & Africa Automated Trucks Market Attractiveness, Value (US$ Mn), by Level of Automation, 2023-2031

Figure 57: Middle East & Africa Automated Trucks Market Value (US$ Mn) Forecast, by ADAS Feature, 2017-2031

Figure 58: Middle East & Africa Automated Trucks Market Attractiveness, Value (US$ Mn), by ADAS Feature, 2023-2031

Figure 59: Middle East & Africa Automated Trucks Market Value (US$ Mn) Forecast, by Truck Class, 2017-2031

Figure 60: Middle East & Africa Automated Trucks Market Attractiveness, Value (US$ Mn), by Truck Class, 2023-2031

Figure 61: Middle East & Africa Automated Trucks Market Value (US$ Mn) Forecast, by Sensor, 2017-2031

Figure 62: Middle East & Africa Automated Trucks Market Attractiveness, Value (US$ Mn), by Sensor, 2023-2031

Figure 63: Middle East & Africa Automated Trucks Market Value (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 64: Middle East & Africa Automated Trucks Market Attractiveness, Value (US$ Mn), by Propulsion, 2023-2031

Figure 65: Middle East & Africa Automated Trucks Market Value (US$ Mn) Forecast, by Country & Sub-region, 2017-2031

Figure 66: Middle East & Africa Automated Trucks Market Attractiveness, Value (US$ Mn), by Country & Sub-region, 2023-2031

Figure 67: Latin America Automated Trucks Market Value (US$ Mn) Forecast, 2017-2031

Figure 68: Latin America Automated Trucks Market Value (US$ Mn) Forecast, by Level of Automation, 2017-2031

Figure 69: Latin America Automated Trucks Market Attractiveness, Value (US$ Mn), by Level of Automation, 2023-2031

Figure 70: Latin America Automated Trucks Market Value (US$ Mn) Forecast, by ADAS Feature, 2017-2031

Figure 71: Latin America Automated Trucks Market Attractiveness, Value (US$ Mn), by ADAS Feature, 2023-2031

Figure 72: Latin America Automated Trucks Market Value (US$ Mn) Forecast, by Truck Class, 2017-2031

Figure 73: Latin America Automated Trucks Market Attractiveness, Value (US$ Mn), by Truck Class, 2023-2031

Figure 74: Latin America Automated Trucks Market Value (US$ Mn) Forecast, by Sensor, 2017-2031

Figure 75: Latin America Automated Trucks Market Attractiveness, Value (US$ Mn), by Sensor, 2023-2031

Figure 76: Latin America Automated Trucks Market Value (US$ Mn) Forecast, by Propulsion, 2017-2031

Figure 77: Latin America Automated Trucks Market Attractiveness, Value (US$ Mn), by Propulsion, 2023-2031

Figure 78: Latin America Automated Trucks Market Value (US$ Mn) Forecast, by Country & Sub-region, 2017-2031

Figure 79: Latin America Automated Trucks Market Attractiveness, Value (US$ Mn), by Country & Sub-region, 2023-2031