Reports

Reports

Analysts’ Viewpoint on Global Construction Robots Market Scenario

The construction industry is lagging behind in terms of integration of robots, and it intensively depends on manual labor. Presently, need for more affordable and environment-friendly construction (housing) with reduced environmental impact and labor & skills shortage have prompted the adoption of the advanced construction robotics across the globe. Only a few construction businesses have currently adopted automation, which, in turn, indicates a significant potential for manufacturers of construction robots and service providers to transform the industry through robotics. Moreover, rising shortage of labor, owing to dangers of the construction occupation, and increasing number of fatal accidents at construction sites have created the need for the deployment of robotic construction equipment. Robots play a key role in construction, demolition, or renovation, and thus, construction companies are looking toward automation to increase efficiency and productivity.

Robotic systems on construction sites drastically reduce construction time and enhance safety by replacing construction workers engaged in monotonous or dangerous operations. The inherent complexity of construction tasks, labor-intensive modeling, and uniqueness of design require significant human effort and expertise. These construction challenges can be overcome with the development of machine learning and computer vision to increase the level of automation of construction robots.

Robots in the construction industry refer to robotic systems developed for construction operations, which typically take place in dynamic environments. Repetitive and labor-intense tasks, such as bricklaying, painting, loading, and bulldozing tasks can easily be carried out by automation, and the use of robots can assist in reducing labor force and create safer work environments. Furthermore, robots can function 24×7 in a wide range of conditions.

Robots in the construction industry offers considerable potential to enhance productivity, efficiency, and manufacturing flexibility. It primarily includes automating the fabrication of modular homes, robotic welding & material handling on building sites, and 3D printing of houses and customized structures. Construction bots improve sustainability and help reduce environmental impact to make the industry safer and more cost-effective.

Robotics and automation in the construction industry also reduce waste by improving quality and consistency. Automation enables builders to design waste out at the beginning of a project through effective building design. Robots can make construction safer by carrying heavy loads, operating in hazardous environments, and enabling new, safer construction techniques. Automation can solve the industry's labor & skills crisis and attract young people toward construction jobs by using robots for repetitive and hazardous work that people increasingly do not want to do. Thus, increasing usage of construction bots across several functions such as bricklaying, tying rebar, drywall finishing, painting of construction, automated architectural and structural layout, and site inspection is projected to fuel the market during the forecast period.

The growing urbanization is fueling the demand for construction in various sectors such as housing, transportation, education, water supply, sewage systems, workplaces, etc., which, in turn, is boosting the construction industry. Buildings are necessary for businesses to operate, and factories are necessary for manufacturers to produce their goods. The construction industry must build the infrastructure necessary to support all of this, and this is how the construction industry evolves.

Urbanization is the migration of people from rural to urban locations, and as everyone needs a place to live, housing projects are required. Along with housing projects, a supply of potable water, an efficient sewage system, and electricity infrastructure are also required. Cities are becoming denser, owing to a rise in population; thus, the construction industry needs to be more inventive and creative to cater to the demands of this enormous population.

The urban population of the U.S. was around 82.9% in 2021, which improved by 0.25% from 82.7% in 2020. The spending on construction is also increasing consistently across the U.S. For instance, according to the U.S. Census Bureau, construction spending during April 2022 was estimated to be US$ 1,744.8 Bn, which was 12.3% above from the spending in April 2021. Hence, increase in urbanization and construction spending is anticipated fuel the adoption of advanced construction robotics during the forecast period.

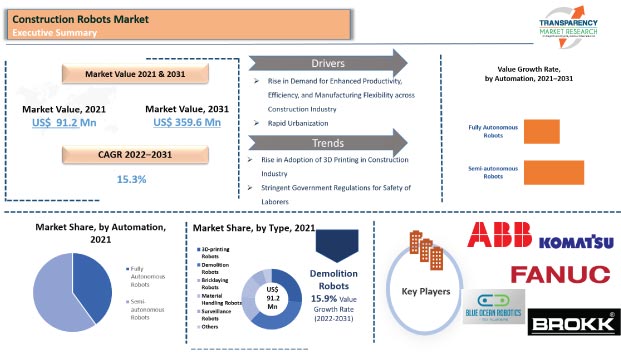

In terms of type, the global construction robots market has been segmented into 3D-printing robots, demolition robots, bricklaying robots, material handling robots, surveillance robots, and others (paint robots, welding, etc.). The demolition robots segment held a key share of 35.4% of the global market in 2021.

One of the riskiest jobs in the construction business is demolition; manual laborers are susceptible to fatal incidents and severe harm. The use of robotics in demolition operations improves worker productivity and safety, which helps construction businesses reduce the cost of the overall operation. In February 2021, Brokk launched Brokk Connect; an online platform for the company’s connected demolition robots. This online platform helps users to track and manage their machines by connecting the firm’s robots to an online portal.

In terms of automation, the global construction robots market has been bifurcated into fully autonomous robots and semi-autonomous robots. The semi-autonomous robots segment dominated the global construction robots market and held 58.4% share in 2021. Furthermore, this segment is expected to advance at a notable CAGR of 14.5% during the forecast period.

Semi-autonomous machinery works effectively in the construction industry. Most tasks do not involve original or creative thinking, as they are repetitive, tactile, precise, and time-sensitive. Manufacturers often automate these operations, and the industry is rapidly accepting this development.

North America dominated the global construction robots market and accounted for around 36.1% share in 2021. Primary factors influencing the growth of the market in the region include growing investments in public infrastructure and rising spending on construction across commercial and residential sectors in the region. In November 2021, the U.S. Congress approved the Infrastructure Investment and Jobs Act, and this bill carries a price tag of US$ 1.2 Trn, which includes US$ 550 Bn for transportation, broadband and utilities; US$ 110 Bn for roads, bridges, and other major infrastructure projects; and US$ 40 Bn for repair and replacement of bridges.

Europe and Asia Pacific are also key markets for construction robots, and they held shares of 26.5% and 20.1%, respectively, in 2021. Growing labor shortage and rising fatal accidents & workplace injuries are significant factors boosting the adoption of construction robots in these regions.

Middle East & Africa is a larger market for construction robots as compared to the market in South America, and the market in Middle East & Africa is projected to advance at a CAGR of 13.4% during the forecast period.

The global construction robots market is highly consolidated with numerous large-scale and small-scale vendors controlling majority of the market share. Several firms are spending significantly on comprehensive research and development, primarily to develop environment-friendly products. Diversification of product portfolios and mergers & acquisitions are strategies adopted by key players. ABB Ltd., Advanced Construction Robotics Inc., ANYbotics AG, Blue Ocean Robotics, Brokk AB, Construction Robotics LLC, FANUC America Corporation, Fujita Corporation, Giant Hydraulic Tech, and Komatsu are prominent entities operating in the market.

Each of these players has been profiled in the construction robots market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 91.2 Mn |

|

Market Forecast Value in 2031 |

US$ 359.6 Mn |

|

Growth Rate (CAGR) |

15.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The construction robots market stood at US$ 91.2 Mn in 2021.

The construction robots market estimated to grow at a CAGR of 15.3% during the forecast period.

The construction robots market is expected to reach US$ 359.6 Mn by 2031.

Prominent players operating in the construction robots market are ABB Ltd., Advanced Construction Robotics Inc., ANYbotics AG, Blue Ocean Robotics, Brokk AB, Construction Robotics LLC, FANUC America Corporation, Fujita Corporation, Giant Hydraulic Tech, and Komatsu.

The U.S. accounted for around 26.4% share of the global construction robots market in 2021.

The demolition robots segment dominated the market, in terms of revenue, and accounted for around 35.4% market share in 2021.

Rising adoption of 3D printing in the construction industry and stringent government regulations for the safety of laborers are the prominent trends in the market.

North America is a highly lucrative region for the global construction robots market.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Construction Robots Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Scenario

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Building & Construction Industry Overview

4.2. Supply Chain Analysis

4.3. Technology Roadmap Analysis

4.4. Industry SWOT Analysis

4.5. Porter Five Forces Analysis

4.6. Covid-19 Impact and Recovery Analysis

5. Construction Robots Market Analysis, by Type

5.1. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Type, 2017–2031

5.1.1. 3D-printing Robots

5.1.2. Demolition Robots

5.1.3. Bricklaying Robots

5.1.4. Material Handling Robots

5.1.5. Surveillance Robots

5.1.6. Others (Paint Robots, Welding, etc.)

5.2. Market Attractiveness Analysis, by Type

6. Construction Robots Market Analysis, by Automation

6.1. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Automation, 2017–2031

6.1.1. Fully Autonomous Robots

6.1.2. Semi-autonomous Robots

6.2. Market Attractiveness Analysis, by Automation

7. Construction Robots Market Analysis, by Application

7.1. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

7.1.1. Commercial Buildings

7.1.2. Residential Buildings

7.1.3. Public Infrastructure

7.2. Market Attractiveness Analysis, by Application

8. Construction Robots Market Analysis and Forecast, by Region

8.1. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Region, 2017–2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, by Region

9. North America Construction Robots Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Type, 2017–2031

9.3.1. 3D-printing Robots

9.3.2. Demolition Robots

9.3.3. Bricklaying Robots

9.3.4. Material Handling Robots

9.3.5. Surveillance Robots

9.3.6. Others (Paint Robots, Welding, etc.)

9.4. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Automation, 2017–2031

9.4.1. Fully Autonomous Robots

9.4.2. Semi-autonomous Robots

9.5. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

9.5.1. Commercial Buildings

9.5.2. Residential Buildings

9.5.3. Public Infrastructure

9.6. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Type

9.7.2. By Automation

9.7.3. By Application

9.7.4. By Country and Sub-region

10. Europe Construction Robots Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Type, 2017–2031

10.3.1. 3D-printing Robots

10.3.2. Demolition Robots

10.3.3. Bricklaying Robots

10.3.4. Material Handling Robots

10.3.5. Surveillance Robots

10.3.6. Others (Paint Robots, Welding, etc.)

10.4. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Automation, 2017–2031

10.4.1. Fully Autonomous Robots

10.4.2. Semi-autonomous Robots

10.5. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

10.5.1. Commercial Buildings

10.5.2. Residential Buildings

10.5.3. Public Infrastructure

10.6. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.6.1. U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Type

10.7.2. By Automation

10.7.3. By Application

10.7.4. By Country and Sub-region

11. Asia Pacific Construction Robots Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Type, 2017–2031

11.3.1. 3D-printing Robots

11.3.2. Demolition Robots

11.3.3. Bricklaying Robots

11.3.4. Material Handling Robots

11.3.5. Surveillance Robots

11.3.6. Others (Paint Robots, Welding, etc.)

11.4. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Automation, 2017–2031

11.4.1. Fully Autonomous Robots

11.4.2. Semi-autonomous Robots

11.5. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

11.5.1. Commercial Buildings

11.5.2. Residential Buildings

11.5.3. Public Infrastructure

11.6. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Type

11.7.2. By Automation

11.7.3. By Application

11.7.4. By Country and Sub-region

12. Middle East and Africa Construction Robots Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Type, 2017–2031

12.3.1. 3D-printing Robots

12.3.2. Demolition Robots

12.3.3. Bricklaying Robots

12.3.4. Material Handling Robots

12.3.5. Surveillance Robots

12.3.6. Others (Paint Robots, Welding, etc.)

12.4. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Automation, 2017–2031

12.4.1. Fully Autonomous Robots

12.4.2. Semi-autonomous Robots

12.5. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

12.5.1. Commercial Buildings

12.5.2. Residential Buildings

12.5.3. Public Infrastructure

12.6. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East and Africa

12.7. Market Attractiveness Analysis

12.7.1. By Type

12.7.2. By Automation

12.7.3. By Application

12.7.4. By Country and Sub-region

13. South America Construction Robots Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Type, 2017–2031

13.3.1. 3D-printing Robots

13.3.2. Demolition Robots

13.3.3. Bricklaying Robots

13.3.4. Material Handling Robots

13.3.5. Surveillance Robots

13.3.6. Others (Paint Robots, Welding, etc.)

13.4. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Automation, 2017–2031

13.4.1. Fully Autonomous Robots

13.4.2. Semi-autonomous Robots

13.5. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Application, 2017–2031

13.5.1. Commercial Buildings

13.5.2. Residential Buildings

13.5.3. Public Infrastructure

13.6. Construction Robots Market Size (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Type

13.7.2. By Automation

13.7.3. By Application

13.7.4. By Country and Sub-region

14. Competition Assessment

14.1. Global Construction Robots Market Competition Matrix - a Dashboard View

14.1.1. Global Construction Robots Market Company Share Analysis, by Value (2021)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. ABB Ltd.

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Advanced Construction Robotics Inc.

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. ANYbotics AG

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. Blue Ocean Robotics

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Brokk AB

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. Construction Robotics LLC

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. FANUC America Corporation

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Fujita Corporation

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Giant Hydraulic Tech

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. Komatsu

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

16. Recommendation

16.1. Opportunity Assessment

16.1.1. By Type

16.1.2. By Automation

16.1.3. By Application

16.1.4. By Region

List of Tables

Table 01: Global Construction Robots Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 02: Global Construction Robots Market Value (US$ Mn) & Forecast, by Automation, 2017‒2031

Table 03: Global Construction Robots Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 04: Global Construction Robots Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 05: North America Construction Robots Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 06: North America Construction Robots Market Value (US$ Mn) & Forecast, by Automation, 2017‒2031

Table 07: North America Construction Robots Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 08: North America Construction Robots Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 09: Europe Construction Robots Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 10: Europe Construction Robots Market Value (US$ Mn) & Forecast, by Automation, 2017‒2031

Table 11: Europe Construction Robots Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 12: Europe Construction Robots Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 13: Asia Pacific Construction Robots Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 14: Asia Pacific Construction Robots Market Value (US$ Mn) & Forecast, by Automation, 2017‒2031

Table 15: Asia Pacific Construction Robots Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 16: Asia Pacific Construction Robots Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 17: Middle East & Africa Construction Robots Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 18: Middle East & Africa Construction Robots Market Value (US$ Mn) & Forecast, by Automation, 2017‒2031

Table 19: Middle East & Africa Construction Robots Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 20: Middle East & Africa Construction Robots Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 21: South America Construction Robots Market Value (US$ Mn) & Forecast, by Type, 2017‒2031

Table 22: South America Construction Robots Market Value (US$ Mn) & Forecast, by Automation, 2017‒2031

Table 23: South America Construction Robots Market Value (US$ Mn) & Forecast, by Application, 2017‒2031

Table 24: South America Construction Robots Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 01: Global Construction Robots Market, Value (US$ Mn), 2017‒2031

Figure 02: Global Construction Robots Market Size & Forecast, by Type, Revenue (US$ Mn), 2017‒2031

Figure 03: Global Construction Robots Market Attractiveness, by Type, Value (US$ Mn), 2022‒2031

Figure 04: Global Construction Robots Market Share Analysis, by Type, 2022 and 2031

Figure 05: Global Construction Robots Market Size & Forecast, by Automation, Revenue (US$ Mn), 2017‒2031

Figure 06: Global Construction Robots Market Attractiveness, by Automation, Value (US$ Mn), 2022‒2031

Figure 07: Global Construction Robots Market Share Analysis, by Automation, 2022 and 2031

Figure 08: Global Construction Robots Market Size & Forecast, by Application, Revenue (US$ Mn), 2017‒2031

Figure 09: Global Construction Robots Market Attractiveness, by Application, Value (US$ Mn), 2022‒2031

Figure 10: Global Construction Robots Market Share Analysis, by Application, 2022 and 2031

Figure 11: Global Construction Robots Market Size & Forecast, by Region, Revenue (US$ Mn), 2017‒2031

Figure 12: Global Construction Robots Market Attractiveness, by Region, Value (US$ Mn), 2022‒2031

Figure 13: Global Construction Robots Market Share Analysis, by Region, 2022 and 2031

Figure 14: North America Construction Robots Market, Value (US$ Mn), 2017‒2031

Figure 15: North America Construction Robots Market Size & Forecast, by Type, Revenue (US$ Mn), 2017‒2031

Figure 16: North America Construction Robots Market Attractiveness, by Type, Value (US$ Mn), 2022‒2031

Figure 17: North America Construction Robots Market Share Analysis, by Type, 2022 and 2031

Figure 18: North America Construction Robots Market Size & Forecast, by Automation, Revenue (US$ Mn), 2017‒2031

Figure 19: North America Construction Robots Market Attractiveness, by Automation, Value (US$ Mn), 2022‒2031

Figure 20: North America Construction Robots Market Share Analysis, by Automation, 2022 and 2031

Figure 21: North America Construction Robots Market Size & Forecast, by Application, Revenue (US$ Mn), 2017‒2031

Figure 22: North America Construction Robots Market Attractiveness, by Application, Value (US$ Mn), 2022‒2031

Figure 23: North America Construction Robots Market Share Analysis, by Application, 2022 and 2031

Figure 24: North America Construction Robots Market Size & Forecast, by Country and Sub-region, Revenue (US$ Mn), 2017‒2031

Figure 25: North America Construction Robots Market Attractiveness, by Country and Sub-region, Value (US$ Mn), 2022‒2031

Figure 26: North America Construction Robots Market Share Analysis, by Country and Sub-region, 2022 and 2031

Figure 27: Europe Construction Robots Market, Value (US$ Mn), 2017‒2031

Figure 28: Europe Construction Robots Market Size & Forecast, by Type, Revenue (US$ Mn), 2017‒2031

Figure 29: Europe Construction Robots Market Attractiveness, by Type, Value (US$ Mn), 2022‒2031

Figure 30: Europe Construction Robots Market Share Analysis, by Type, 2022 and 2031

Figure 31: Europe Construction Robots Market Size & Forecast, by Automation, Revenue (US$ Mn), 2017‒2031

Figure 32: Europe Construction Robots Market Attractiveness, by Automation, Value (US$ Mn), 2022‒2031

Figure 33: Europe Construction Robots Market Share Analysis, by Automation, 2022 and 2031

Figure 34: Europe Construction Robots Market Size & Forecast, by Application, Revenue (US$ Mn), 2017‒2031

Figure 35: Europe Construction Robots Market Attractiveness, by Application, Value (US$ Mn), 2022‒2031

Figure 36: Europe Construction Robots Market Share Analysis, by Application, 2022 and 2031

Figure 37:Europe Construction Robots Market Size & Forecast, by Country and Sub-region, Revenue (US$ Mn), 2017‒2031

Figure 38: Europe Construction Robots Market Attractiveness, by Country and Sub-region, Value (US$ Mn), 2022‒2031

Figure 39: Europe Construction Robots Market Share Analysis, by Country and Sub-region, 2022 and 2031

Figure 40: Asia Pacific Construction Robots Market, Value (US$ Mn), 2017‒2031

Figure 41: Asia Pacific Construction Robots Market Size & Forecast, by Type, Revenue (US$ Mn), 2017‒2031

Figure 42: Asia Pacific Construction Robots Market Attractiveness, by Type, Value (US$ Mn), 2022‒2031

Figure 43: Asia Pacific Construction Robots Market Share Analysis, by Type, 2022 and 2031

Figure 44: Asia Pacific Construction Robots Market Size & Forecast, by Automation, Revenue (US$ Mn), 2017‒2031

Figure 45: Asia Pacific Construction Robots Market Attractiveness, by Automation, Value (US$ Mn), 2022‒2031

Figure 46: Asia Pacific Construction Robots Market Share Analysis, by Automation, 2022 and 2031

Figure 47: Asia Pacific Construction Robots Market Size & Forecast, by Application, Revenue (US$ Mn), 2017‒2031

Figure 48: Asia Pacific Construction Robots Market Attractiveness, by Application, Value (US$ Mn), 2022‒2031

Figure 49: Asia Pacific Construction Robots Market Share Analysis, by Application, 2022 and 2031

Figure 50: Asia Pacific Construction Robots Market Size & Forecast, by Country and Sub-region, Revenue (US$ Mn), 2017‒2031

Figure 51: Asia Pacific Construction Robots Market Attractiveness, by Country and Sub-region, Value (US$ Mn), 2022‒2031

Figure 52: Asia Pacific Construction Robots Market Share Analysis, by Country and Sub-region, 2022 and 2031

Figure 53: Middle East & Africa Construction Robots Market, Value (US$ Mn), 2017‒2031

Figure 54: Middle East & Africa Construction Robots Market Size & Forecast, by Type, Revenue (US$ Mn), 2017‒2031

Figure 55: Middle East & Africa Construction Robots Market Attractiveness, by Type, Value (US$ Mn), 2022‒2031

Figure 56: Middle East & Africa Construction Robots Market Share Analysis, by Type, 2022 and 2031

Figure 57: Middle East & Africa Construction Robots Market Size & Forecast, by Automation, Revenue (US$ Mn), 2017‒2031

Figure 58: Middle East & Africa Construction Robots Market Attractiveness, by Automation, Value (US$ Mn), 2022‒2031

Figure 59: Middle East & Africa Construction Robots Market Share Analysis, by Automation, 2022 and 2031

Figure 60: Middle East & Africa Construction Robots Market Size & Forecast, by Application, Revenue (US$ Mn), 2017‒2031

Figure 61: Middle East & Africa Construction Robots Market Attractiveness, by Application, Value (US$ Mn), 2022‒2031

Figure 62: Middle East & Africa Construction Robots Market Share Analysis, by Application, 2022 and 2031

Figure 63: Middle East & Africa Construction Robots Market Size & Forecast, by Country and Sub-region, Revenue (US$ Mn), 2017‒2031

Figure 64: Middle East & Africa Construction Robots Market Attractiveness, by Country and Sub-region, Value (US$ Mn), 2022‒2031

Figure 65: Middle East & Africa Construction Robots Market Share Analysis, by Country and Sub-region, 2022 and 2031

Figure 66: South America Construction Robots Market, Value (US$ Mn), 2017‒2031

Figure 67: South America Construction Robots Market Size & Forecast, by Type, Revenue (US$ Mn), 2017‒2031

Figure 68: South America Construction Robots Market Attractiveness, by Type, Value (US$ Mn), 2022‒2031

Figure 69: South America Construction Robots Market Share Analysis, by Type, 2022 and 2031

Figure 70: South America Construction Robots Market Size & Forecast, by Automation, Revenue (US$ Mn), 2017‒2031

Figure 71: South America Construction Robots Market Attractiveness, by Automation, Value (US$ Mn), 2022‒2031

Figure 72: South America Construction Robots Market Share Analysis, by Automation, 2022 and 2031

Figure 73: South America Construction Robots Market Size & Forecast, by Application, Revenue (US$ Mn), 2017‒2031

Figure 74: South America Construction Robots Market Attractiveness, by Application, Value (US$ Mn), 2022‒2031

Figure 75: South America Construction Robots Market Share Analysis, by Application, 2022 and 2031

Figure 76: South America Construction Robots Market Size & Forecast, by Country and Sub-region, Revenue (US$ Mn), 2017‒2031

Figure 77: South America Construction Robots Market Attractiveness, by Country and Sub-region, Value (US$ Mn), 2022‒2031

Figure 78: South America Construction Robots Market Share Analysis, by Country and Sub-region, 2022 and 2031