Reports

Reports

Analysts’ Viewpoint

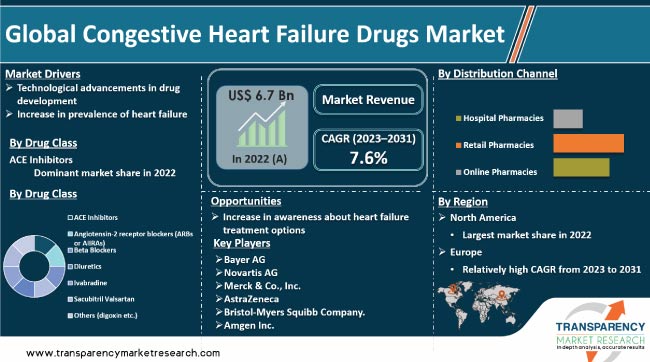

Increase in the geriatric population and rise in prevalence of diabetes, obesity, and hypertension are driving the global congestive heart failure drugs market. Poor diet, sedentary lifestyle, and tobacco consumption could increase the risk of developing congestive heart failure (CHF). Furthermore, rise in healthcare expenditure, increase in awareness about heart health, and surge in access to healthcare services are expected to bolster market expansion during the forecast period.

Development of innovative treatments and technologies, such as implantable devices and stem cell therapy, for the treatment of CHF offers lucrative opportunities to market players. Manufacturers are focusing on launch of efficient and low cost products and services such as medications, medical devices, and surgical procedures to increase market share.

Congestive heart failure is a chronic condition, where the heart cannot pump enough blood to meet the body's needs. CHF drugs are used to manage the symptoms and improve the quality of life of patients. Major drug classes used to treat CHF are diuretics, ACE inhibitors, ARBs, beta-blockers, aldosterone antagonists, and digitalis. These drugs work by reducing the workload on the heart, improving blood flow, and preventing the buildup of fluid in the lungs and other parts of the body.

Heart failure, also known as congestive heart failure, is a medical condition, in which the heart is unable to pump enough blood to meet the body's needs. It is a chronic and progressive condition that affects millions of people globally. According to the American Heart Association, the prevalence of heart failure is increasing, and affects nearly 6.5 million people aged 20 years and older in the U.S. Rise in the prevalence of heart failure is propelling the global congestive heart failure market size.

Aging population is another factor contributing to surging in prevalence of heart failure. Risk of developing heart failure increases as people age. The aging baby boomer population, in particular, is expected to contribute significantly to rise in prevalence of heart failure. Increase in incidence of obesity and diabetes is another factor contributing to rising in the prevalence of heart failure.

Technological advancements in drug development are driving the global congestive heart failure drugs market. These advancements are enabling the identification of new drug targets and biomarkers for CHF, which could lead to development of more effective and targeted therapies. For instance, advances in genetics and molecular biology have enabled researchers to identify specific genes, proteins, and signaling pathways involved in the development and progression of congestive heart failure. This has led to the development of drugs that target these specific molecules or pathways, such as angiotensin receptor blockers, which affect the renin-angiotensin system.

Technological advancements are improving drug discovery and development processes. High-throughput screening methods, which use robotics and automation to quickly test large number of compounds, have accelerated the drug discovery process. Advances in computational modeling and simulation are helping researchers to design and optimize drug candidates more efficiently, thereby reducing the time and costs involved in drug development.

Technological advancements are also enhancing the delivery of congestive heart failure drugs to patients. Development of nanotechnology-based drug delivery systems has enabled targeted delivery of drugs to specific tissues or cells, thus improving drug efficacy and reducing side effects. Furthermore, usage of implantable devices such as pacemakers and implantable cardioverter-defibrillators (ICDs) are helping to manage the symptoms of congestive heart failure and reduce the risk of sudden cardiac death.

In terms of type of congestive heart failure, the left-sided heart failure segment accounted for largest global congestive heart failure drugs market share in 2022. This is ascribed to higher prevalence compared to right-sided heart failure. Additionally, left-sided heart failure can lead to more severe symptoms and complications, which could require more aggressive treatment with medication.

Based on drug class, the ACE inhibitors segment dominated the global market in 2022. ACE inhibitors are highly effective in reducing the symptoms and progression of the disease. Numerous clinical trials have shown that ACE inhibitors can reduce hospitalizations and mortality rates in CHF patients. These are also well-tolerated and have a relatively low risk of side effects compared to other CHF drugs. ACE inhibitors are available in generic forms, which are much cheaper than branded drugs, making them accessible to a wider patient population. Additionally, long-term usage of ACE inhibitors is cost-effective, as these can help prevent hospitalization and other expensive medical procedures associated with CHF.

In terms of distribution channel, the retail pharmacies segment held the leading share of the global congestive heart failure drugs market in 2022. Retail pharmacies are easily accessible to patients and are spread across various geographies. This makes it convenient for CHF patients to purchase medications easily and regularly, without having to travel far or face any logistical difficulties.

Retail pharmacies offer a range of CHF medications from different manufacturers, giving patients the opportunity to compare prices and choose the most affordable option. These channels have strong relationships with health insurance providers, which enables them to provide patients with insurance coverage information, co-pay assistance programs, and other cost-saving measures. This can be a significant advantage for CHF patients, as the cost of medication can be a major barrier to accessing and adhering to treatment.

As per congestive heart failure drugs industry trends, North America accounted for the leading share of the global market in 2022. This is ascribed to high prevalence of heart diseases, well-developed healthcare infrastructure, and increase in investment in research & development activities in the region. According to the Centers for Disease Control and Prevention (CDC), cardiovascular diseases claim the life of one individual in the U.S. every 34 seconds. Furthermore, heart diseases accounted for approximately 697,000 deaths in the country in 2020, which equates to one in every five fatalities.

The market is Europe is driven by surge in prevalence of CHF, aging population, and development of novel therapies. Pharmaceutical companies are investing significantly in research & development to bring innovative therapies and drugs to market. For example, Entresto, a novel drug developed by Novartis, has been shown to improve patient outcomes in clinical trials and has received regulatory approval in Europe. Additionally, there has been a growing interest in precision medicine for CHF, with the usage of biomarkers and genetic testing to tailor treatments to individual patients.

The global market is fragmented, with the presence of large number of players. Companies in the congestive heart failure drugs market are Bayer AG, Novartis AG, Merck & Co., Inc., AstraZeneca, Bristol-Myers Squibb Company, Amgen, Inc., Boehringer Ingelheim International GmbH., Pfizer, Inc., Johnson & Johnson Services, Inc., and Eli Lilly and Company. Major players have adopted strategies such merger & acquisition, collaboration, and portfolio expansion to increase market share and presence.

Each of these players in the congestive heart failure drugs market has been profiled in the report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2022 |

US$ 6.7 Bn |

|

Forecast (Value) in 2031 |

More than US$ 13.5 Bn |

|

CAGR |

7.6% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

The global industry was valued at US$ 6.7 Bn in 2022

It is projected to reach more than US$ 13.5 Bn by 2031

The CAGR is anticipated to be 7.6% from 2023 to 2031

The ACE inhibitors segment held more than 50.0% share in 2022

North America is expected to account for significant share from 2022 to 2031

Bayer AG, Novartis AG, Merck & Co., Inc., AstraZeneca, Bristol-Myers Squibb Company, Amgen, Inc., Boehringer Ingelheim International GmbH., Pfizer, Inc., Johnson & Johnson Services, Inc., and Eli Lilly and Company are the prominent players in the market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Congestive Heart Failure Drugs Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Congestive Heart Failure Drugs Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Key Industry Events

5.2. Pipeline Analysis

5.3. Heart Failure Diseases Prevalence: Overview

6. Global Congestive Heart Failure Drugs Market Analysis and Forecast, by Type of Digestive Heart Failure

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Type of Digestive Heart Failure, 2017–2031

6.3.1. Left-sided Heart Failure

6.3.2. Right-sided Heart Failure

6.3.3. High-output Heart Failure

6.4. Market Attractiveness Analysis, by Type of Digestive Heart Failure

7. Global Congestive Heart Failure Drugs Market Analysis and Forecast, by Drug Class

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Drug Class, 2017–2031

7.3.1. ACE Inhibitors

7.3.2. Angiotensin-2 Receptor Blockers

7.3.3. Beta Blockers

7.3.4. Mineralocorticoid Receptor Antagonists

7.3.5. Diuretics

7.3.6. Ivabradine

7.3.7. Sacubitril Valsartan

7.3.8. Others (digoxin etc.)

7.4. Market Attractiveness Analysis, by Drug Class

8. Global Congestive Heart Failure Drugs Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Distribution Channel, 2017–2031

8.3.1. Hospitals Pharmacies

8.3.2. Retail Pharmacies

8.3.3. Online Pharmacies

8.4. Market Attractiveness Analysis, by Distribution Channel

9. Global Congestive Heart Failure Drugs Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Congestive Heart Failure Drugs Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type of Digestive Heart Failure, 2017–2031

10.2.1. Left-sided Heart Failure

10.2.2. Right-sided Heart Failure

10.2.3. High-output Heart Failure

10.3. Market Value Forecast, by Drug Class, 2017–2031

10.3.1. ACE Inhibitors

10.3.2. Angiotensin-2 Receptor Blockers

10.3.3. Beta Blockers

10.3.4. Mineralocorticoid Receptor Antagonists

10.3.5. Diuretics

10.3.6. Ivabradine

10.3.7. Sacubitril Valsartan

10.3.8. Others (digoxin etc.)

10.4. Market Value Forecast, by Distribution Channel, 2017–2031

10.4.1. Hospitals Pharmacies

10.4.2. Retail Pharmacies

10.4.3. Online Pharmacies

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Type of Digestive Heart Failure

10.6.2. By Drug Class

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Congestive Heart Failure Drugs Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type of Digestive Heart Failure, 2017–2031

11.2.1. Left-sided Heart Failure

11.2.2. Right-sided Heart Failure

11.2.3. High-output Heart Failure

11.3. Market Value Forecast, by Drug Class, 2017–2031

11.3.1. ACE Inhibitors

11.3.2. Angiotensin-2 Receptor Blockers

11.3.3. Beta Blockers

11.3.4. Mineralocorticoid Receptor Antagonists

11.3.5. Diuretics

11.3.6. Ivabradine

11.3.7. Sacubitril Valsartan

11.3.8. Others (digoxin etc.)

11.4. Market Value Forecast, by Distribution Channel, 2017–2031

11.4.1. Hospitals Pharmacies

11.4.2. Retail Pharmacies

11.4.3. Online Pharmacies

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Type of Digestive Heart Failure

11.6.2. By Drug Class

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Congestive Heart Failure Drugs Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type of Digestive Heart Failure, 2017–2031

12.2.1. Left-sided Heart Failure

12.2.2. Right-sided Heart Failure

12.2.3. High-output Heart Failure

12.3. Market Value Forecast, by Drug Class, 2017–2031

12.3.1. ACE Inhibitors

12.3.2. Angiotensin-2 Receptor Blockers

12.3.3. Beta Blockers

12.3.4. Mineralocorticoid Receptor Antagonists

12.3.5. Diuretics

12.3.6. Ivabradine

12.3.7. Sacubitril Valsartan

12.3.8. Others (digoxin etc.)

12.4. Market Value Forecast, by Distribution Channel, 2017–2031

12.4.1. Hospitals Pharmacies

12.4.2. Retail Pharmacies

12.4.3. Online Pharmacies

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Type of Digestive Heart Failure

12.6.2. By Drug Class

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Congestive Heart Failure Drugs Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type of Digestive Heart Failure, 2017–2031

13.2.1. Left-sided Heart Failure

13.2.2. Right-sided Heart Failure

13.2.3. High-output Heart Failure

13.3. Market Value Forecast, by Drug Class, 2017–2031

13.3.1. ACE Inhibitors

13.3.2. Angiotensin-2 Receptor Blockers

13.3.3. Beta Blockers

13.3.4. Mineralocorticoid Receptor Antagonists

13.3.5. Diuretics

13.3.6. Ivabradine

13.3.7. Sacubitril Valsartan

13.3.8. Others (digoxin etc.)

13.4. Market Value Forecast, by Distribution Channel, 2017–2031

13.4.1. Hospitals Pharmacies

13.4.2. Retail Pharmacies

13.4.3. Online Pharmacies

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Type of Digestive Heart Failure

13.6.2. By Drug Class

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Congestive Heart Failure Drugs Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type of Digestive Heart Failure, 2017–2031

14.2.1. Left-sided Heart Failure

14.2.2. Right-sided Heart Failure

14.2.3. High-output Heart Failure

14.3. Market Value Forecast, by Drug Class, 2017–2031

14.3.1. ACE Inhibitors

14.3.2. Angiotensin-2 Receptor Blockers

14.3.3. Beta Blockers

14.3.4. Mineralocorticoid Receptor Antagonists

14.3.5. Diuretics

14.3.6. Ivabradine

14.3.7. Sacubitril Valsartan

14.3.8. Others (digoxin etc.)

14.4. Market Value Forecast, by Distribution Channel, 2017–2031

14.4.1. Hospitals Pharmacies

14.4.2. Retail Pharmacies

14.4.3. Online Pharmacies

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Type of Digestive Heart Failure

14.6.2. By Drug Class

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Bayer AG

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Novartis AG

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Merck & Co., Inc.

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. AstraZeneca

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Bristol-Myers Squibb Company

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Amgen, Inc.

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Boehringer Ingelheim International GmbH

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Pfizer, Inc.

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. Johnson & Johnson Services, Inc.

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. Eli Lilly and Company

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

List of Tables

Table 01: Global Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Type Congestive Heart Failure Drugs, 2017‒2031

Table 02: Global Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 03: Global Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 04: Global Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 06: North America Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Type Congestive Heart Failure Drugs, 2017‒2031

Table 07: North America Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 08: North America Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 09: Europe Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Europe Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Type Congestive Heart Failure Drugs, 2017‒2031

Table 11: Europe Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 12: Europe Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 13: Asia Pacific Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Asia Pacific Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Type Congestive Heart Failure Drugs, 2017‒2031

Table 15: Asia Pacific Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 16: Asia Pacific Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 17: Latin America Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 18: Latin America Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Type Congestive Heart Failure Drugs, 2017‒2031

Table 19: Latin America Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 20: Latin America Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 21: Middle East & Africa Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Middle East & Africa Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Type Congestive Heart Failure Drugs, 2017‒2031

Table 23: Middle East & Africa Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Drug Class, 2017‒2031

Table 24: Middle East & Africa Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

List of Figures

Figure 01: Global Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Congestive Heart Failure Drugs Market Value Share, by Type of Congestive Heart Failure, 2022

Figure 03: Global Congestive Heart Failure Drugs Market Value Share, by Drug Class, 2022

Figure 04: Global Congestive Heart Failure Drugs Market Value Share, by Distribution Channel, 2022

Figure 05: Global Congestive Heart Failure Drugs Market Value Share Analysis, by Type of Congestive Heart Failure, 2022 and 2031

Figure 06: Global Congestive Heart Failure Drugs Market Attractiveness Analysis, by Type of Congestive Heart Failure, 2023–2031

Figure 07: Global Congestive Heart Failure Drugs Market Value (US$ Mn), by Left-sided Heart Failure, 2017‒2031

Figure 08: Global Congestive Heart Failure Drugs Market Value (US$ Mn), by Right-sided Heart Failure, 2017‒2031

Figure 09: Global Congestive Heart Failure Drugs Market Value (US$ Mn), by High-output Heart Failure, 2017‒2031

Figure 10: Global Congestive Heart Failure Drugs Market Value Share Analysis, by Drug Class 2022 and 2031

Figure 11: Global Congestive Heart Failure Drugs Market Attractiveness Analysis, by Drug Class 2023–2031

Figure 12: Global Congestive Heart Failure Drugs Market Revenue (US$ Mn), by ACE Inhibitors, 2017–2031

Figure 13: Global Congestive Heart Failure Drugs Market Revenue (US$ Mn), by Angiotensin-2 Receptor Blockers (ARBs or AIIRAs), 2017–2031

Figure 14: Global Congestive Heart Failure Drugs Market Revenue (US$ Mn), by Beta Blockers, 2017–2031

Figure 15: Global Congestive Heart Failure Drugs Market Revenue (US$ Mn), by Mineralocorticoid Receptor Antagonists, 2017–2031

Figure 16: Global Congestive Heart Failure Drugs Market Revenue (US$ Mn), by Diuretics, 2017–2031

Figure 17: Global Congestive Heart Failure Drugs Market Revenue (US$ Mn), by Ivabradine, 2017–2031

Figure 18: Global Congestive Heart Failure Drugs Market Revenue (US$ Mn), by Sacubitril Valsartan, 2017–2031

Figure 19: Global Congestive Heart Failure Drugs Market Revenue (US$ Mn), by others (digoxin etc.), 2017–2031

Figure 20: Global Congestive Heart Failure Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 21: Global Congestive Heart Failure Drugs Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 22: Global Congestive Heart Failure Drugs Market Revenue (US$ Mn), by Hospitals Pharmacies, 2017–2031

Figure 23: Global Congestive Heart Failure Drugs Market Revenue (US$ Mn), by Retail Pharmacies, 2017–2031

Figure 24: Global Congestive Heart Failure Drugs Market Revenue (US$ Mn), by Online Pharmacies, 2017–2031

Figure 25: Global Congestive Heart Failure Drugs Market Value Share Analysis, by Region, 2022 and 2031

Figure 26: Global Congestive Heart Failure Drugs Market Attractiveness Analysis, by Region, 2023–2031

Figure 27: North America Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 28: North America Congestive Heart Failure Drugs Market Value Share Analysis, by Country, 2022 and 2031

Figure 29: North America Congestive Heart Failure Drugs Market Attractiveness Analysis, by Country, 2023–2031

Figure 30: North America Congestive Heart Failure Drugs Market Value Share Analysis, by Type of Congestive Heart Failure, 2022 and 2031

Figure 31: North America Congestive Heart Failure Drugs Market Attractiveness Analysis, by Type of Congestive Heart Failure, 2023–2031

Figure 32: North America Congestive Heart Failure Drugs Market Value Share Analysis, by Drug Class 2022 and 2031

Figure 33: North America Congestive Heart Failure Drugs Market Attractiveness Analysis, by Drug Class 2023–2031

Figure 34: North America Congestive Heart Failure Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 35: North America Congestive Heart Failure Drugs Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 36: Europe Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: Europe Congestive Heart Failure Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 38: Europe Congestive Heart Failure Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 39: Europe Congestive Heart Failure Drugs Market Value Share Analysis, by Type of Congestive Heart Failure, 2022 and 2031

Figure 40: Europe Congestive Heart Failure Drugs Market Attractiveness Analysis, by Type of Congestive Heart Failure, 2023–2031

Figure 41: Europe Congestive Heart Failure Drugs Market Value Share Analysis, by Drug Class 2022 and 2031

Figure 42: Europe Congestive Heart Failure Drugs Market Attractiveness Analysis, by Drug Class 2023–2031

Figure 43: Europe Congestive Heart Failure Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 44: Europe Congestive Heart Failure Drugs Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 45: Asia Pacific Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 46: Asia Pacific Congestive Heart Failure Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 47: Asia Pacific Congestive Heart Failure Drugs Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 48: Asia Pacific Congestive Heart Failure Drugs Market Value Share Analysis, by Type of Congestive Heart Failure, 2022 and 2031

Figure 49: Asia Pacific Congestive Heart Failure Drugs Market Attractiveness Analysis, by Type of Congestive Heart Failure, 2023–2031

Figure 50: Asia Pacific Congestive Heart Failure Drugs Market Value Share Analysis, by Drug Class 2022 and 2031

Figure 51: Asia Pacific Congestive Heart Failure Drugs Market Attractiveness Analysis, by Drug Class 2023–2031

Figure 52: Asia Pacific Congestive Heart Failure Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 53: Asia Pacific Congestive Heart Failure Drugs Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 54: Latin America Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 55: Latin America Congestive Heart Failure Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 56: Latin America Congestive Heart Failure Drugs Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 57: Latin America Congestive Heart Failure Drugs Market Value Share Analysis, by Type of Congestive Heart Failure, 2022 and 2031

Figure 58: Latin America Congestive Heart Failure Drugs Market Attractiveness Analysis, by Type of Congestive Heart Failure, 2023–2031

Figure 59: Latin America Congestive Heart Failure Drugs Market Value Share Analysis, by Drug Class 2022 and 2031

Figure 60: Latin America Congestive Heart Failure Drugs Market Attractiveness Analysis, by Drug Class 2023–2031

Figure 61: Latin America Congestive Heart Failure Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 62: Latin America Congestive Heart Failure Drugs Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 63: Middle East & Africa Congestive Heart Failure Drugs Market Value (US$ Mn) Forecast, 2017–2031

Figure 64: Middle East & Africa Congestive Heart Failure Drugs Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 65: Middle East & Africa Congestive Heart Failure Drugs Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 66: Middle East & Africa Congestive Heart Failure Drugs Market Value Share Analysis, by Type of Congestive Heart Failure, 2022 and 2031

Figure 67: Middle East & Africa Congestive Heart Failure Drugs Market Attractiveness Analysis, by Type of Congestive Heart Failure, 2023–2031

Figure 68: Middle East & Africa Congestive Heart Failure Drugs Market Value Share Analysis, by Drug Class 2022 and 2031

Figure 69: Middle East & Africa Congestive Heart Failure Drugs Market Attractiveness Analysis, by Drug Class 2023–2031

Figure 70: Middle East & Africa Congestive Heart Failure Drugs Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 71: Middle East & Africa Congestive Heart Failure Drugs Market Attractiveness Analysis, by Distribution Channel, 2023–2031

Figure 72: Company Share Analysis, 2022