Reports

Reports

Analysts’ Viewpoint

The shift toward electric commercial vehicles to reduce emissions and operating costs is driving the demand for advanced wiring harness systems that are capable of handling higher voltage and current requirements. Electric commercial vehicles require high-voltage wiring systems to support their powertrains. This trend necessitates the development of specialized wiring harnesses capable of handling the higher voltages. Commercial vehicle manufacturers are seeking modular and customizable wiring solutions to adapt to the diverse needs of different vehicle types and applications. This is likely to drive the commercial vehicle wiring harness industry growth in the next few years.

Copper is likely to continue to be the material of choice in wiring harnesses over aluminum. Trends in favor of fuel economy regulation, weight reduction, and miniaturization are still driving the demand for copper (versus aluminum). Some OEMs and suppliers are testing and starting to implement aluminum; however, experts maintain that aluminum penetration would remain low. Aluminum bus bars are a threat to copper wire harnesses within the battery pack, but still have plenty of downfalls as compared to the reliability of copper.

A wiring harness, also known as a cable harness, wire harness, or wiring assembly, is a standardized arrangement of multiple electrical wires or cables that transmits signals and power to various components and systems within a vehicle. Wiring harnesses are crucial components in commercial vehicles and play a significant role in ensuring proper electrical connectivity and functionality. Commercial vehicles, including trucks, buses, and construction equipment, are equipped with a wide array of electrical components and systems such as engines, lighting, navigation, entertainment, safety features, and more. Wiring harnesses are essential for connecting and providing power to these components.

Demand for commercial vehicles, including trucks and buses, is influenced by economic conditions, urbanization, and logistics requirements. The trend toward electrification in commercial vehicles, including electric buses and delivery trucks, requires specialized wiring harnesses to handle high-voltage components, battery systems, and electric propulsion systems. Governments and safety agencies often impose stringent safety standards for commercial vehicles. Compliance with these regulations necessitates the use of advanced wiring harnesses with safety features and redundancy.

Governments worldwide are implementing stringent emission standards and encouraging the use of electric and hybrid vehicles to reduce greenhouse gas emissions. Commercial vehicle manufacturers are increasingly developing electric and hybrid models to comply with these regulations. Wiring harnesses for electric and hybrid vehicles are more complex and sophisticated to handle high-voltage components, battery systems, and electric propulsion systems. Therefore, rapid increase in adoption of electric and hybrid vehicles is projected to boost the commercial vehicle wiring harness market growth in the coming years.

Innovations in battery technology, including higher energy density and faster charging capabilities, are making electric and hybrid vehicles more practical and appealing for commercial applications. Several governments provide incentives, subsidies, and tax breaks to promote the adoption of electric and hybrid commercial vehicles. This further incentivizes businesses to invest in these vehicles, leading to a higher demand for specialized wiring harnesses designed to meet the unique requirements of these vehicles.

Commercial vehicles are being increasingly equipped with advanced driver assistance systems (ADAS) such as adaptive cruise control, lane-keeping assist, and collision avoidance systems. These systems require extensive electrical wiring and sensors, leading to the need for more comprehensive wiring harnesses. Fleet management and real-time monitoring are critical for commercial vehicle operators. Telematics systems provide essential data for route optimization, maintenance, and driver performance. Wiring harnesses support the connectivity of these systems, enabling data transfer between the vehicle and fleet management software.

Government regulations related to safety and emissions often require the installation of electronic systems and sensors in commercial vehicles. Comfort and entertainment features are gaining traction in commercial vehicles, especially in long-haul trucks and buses. Advanced electronics and telematics systems enhance the efficiency and productivity of commercial vehicles. This, in turn, can lead to cost savings and improved operational performance, making investments in advanced wiring harnesses worthwhile for commercial vehicle operators. Therefore, integration of advanced electronics and telematics systems is driving the demand for more sophisticated and specialized wiring harnesses and consequently, fueling the commercial vehicle wiring harness market demand.

The commercial vehicle industry is witnessing a growing demand for advanced dashboard electronics, including digital instrument clusters, infotainment systems, navigation displays, and safety features such as airbag systems and driver assistance systems, which enhance the driving experience. These features necessitate complex and specialized dashboard/cabin wiring harnesses to support electrical connections and data transfer between these systems.

According to analysis of the market segmentation, in terms of application, the dashboard/cabin wiring harnesses segment held a dominant market share in 2022. Modern dashboards serve as a hub for providing essential information to the driver, such as vehicle performance data, fuel efficiency metrics, and maintenance alerts. Rise in demand for these features in dashboards is estimated to positively influence the commercial vehicle wiring harnesses market value in the next few years.

North America has a well-established commercial vehicle market, and the demand for commercial vehicle wiring harnesses is driven by the presence of leading commercial vehicle manufacturers. Stringent safety and emission standards, the presence of major commercial vehicle manufacturers, and the adoption of electric and hybrid commercial vehicles are significant factors driving the commercial vehicle wiring harness market progress in the region.

Europe is a significant market for commercial vehicle wiring harnesses, with a focus on heavy-duty trucks, buses, and delivery vehicles. The market in Europe is characterized by strong environmental regulations, which drive the integration of advanced technologies in vehicles. Stringent emissions standards, the shift toward electric and hybrid commercial vehicles, and demand for advanced safety and connectivity features are augmenting the market in the region

Asia Pacific is a rapidly growing market for commercial vehicles, including heavy trucks, buses, and construction equipment. China, India, and Japan are key players in this market. Rapid economic growth, urbanization, expanding logistics and construction sectors, and the transition to cleaner and more advanced vehicles are prominent factors boosting the Asia Pacific market outlook.

The market in Latin America faces challenges related to economic volatility and regulatory variations across countries. One of the key commercial vehicle wiring harness market trends witnessed in the region is the influence of economic stability, infrastructure development projects, and compliance with local regulations on the demand for wiring harness.

Middle East & Africa features a mix of established and emerging markets for commercial vehicles. The commercial vehicle wiring harnesses business is primarily driven by expansion of the construction and transportation sectors, infrastructure development, and the need for robust and reliable commercial vehicles in the region.

The global commercial vehicle wiring harnesses market is highly competitive with the presence of several small and large players across the globe. Top players focus on innovation and R&D activities to offer advanced product portfolio and consolidate their commercial vehicle wiring harnesses market share. A few of the prominent players operating in the global market are Motherson Sumi Systems Limited, Aptiv, Borg Warner Inc., Continental AG, CTS Corporation, DENSO Corporation, Dhoot Transmission, Furakawa Electric Co., Ltd., Hella GmbH & Co., KGaA, Hitachi Ltd., Johnson Electric, Lear Corporation, Spark Minda, Sumitomo Electric Industries, Ltd., TE Connectivity, THB Group, Valeo, WABCO, Yazaki Corporation.

Key players in the commercial vehicle wiring harness market report have been profile based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2022 | US$ 14.3 Bn |

| Market Forecast Value in 2031 | US$ 25.3 Bn |

| Growth Rate (CAGR) | 6.3% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profile |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

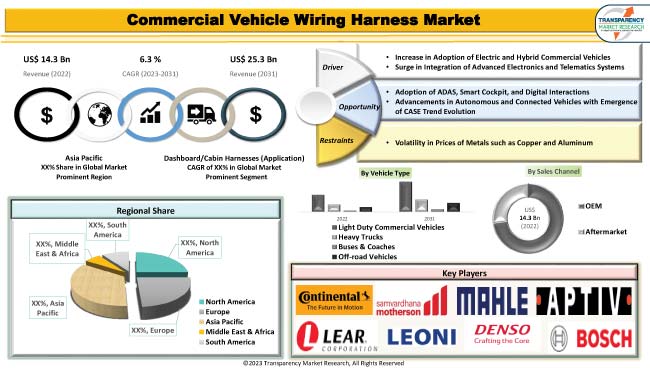

The global market was valued at US$ 14.3 Bn in 2022

It is expected to expand at a CAGR of 6.3% by 2031

The global business is estimated to reach a value of US$ 25.3 Bn in 2031

Increase in adoption of electric and hybrid commercial vehicles and surge in integration of advanced electronics and telematics systems

In terms of application, the dashboard/cabin wiring harnesses segment held largest share in 2022

Asia Pacific was a highly lucrative region in 2022

Motherson Sumi Systems Limited, Aptiv, Borg Warner Inc., Continental AG, CTS Corporation, DENSO Corporation, Dhoot Transmission, Furakawa Electric Co., Ltd., Hella GmbH & Co., KGaA, Hitachi Ltd., Johnson Electric, Lear Corporation, Leoni AG, MAHLE GmbH, Martin Technologies, Mitsubishi Corporation, Nidec Motors & Actuators, Robert Bosch GmbH, Robertshaw Controls Pvt. Ltd., Spark Minda, Sumitomo Electric Industries, Ltd., TE Connectivity, THB Group, Valeo, WABCO, Yazaki Corporation.

1. Preface

1.1. Market Segmentation

1.2. Key Research Objectives

1.3. Report Assumptions

1.4. Research Methodology

1.4.1. Primary Research and List of Primary Sources

1.4.1.1. Sampling Techniques & Data Collection Methods

1.4.1.2. Primary Participants

1.4.2. Desk Research

1.4.2.1. Key Secondary Sources

1.4.2.2. Data from Secondary Sources

2. Global Wiring Harness Market - Executive Summary

2.1. Market Size, US$ Bn, 2017-2031

2.2. Market Analysis and Key Segment Analysis

2.3. TMR Analysis and Recommendations

2.4. Go to Market Strategy

2.4.1. Identification of Potential Market Spaces

2.4.2. Understanding the Buying Process of the Customers

2.4.3. Preferred Sales & Marketing Strategy

3. Premium Insights

3.1. Market Attractiveness Opportunity

3.2. Key Trend Analysis

3.2.1. Product Trend

3.2.2. Industry Trend

3.3. Supply-Demand Scenario

3.3.1. Supply Side Analysis

3.3.2. Demand Trend Analysis

3.4. OEM Vs Aftermarket – Automotive Wiring Harness Analysis

3.5. Competitive Scenario & Trends

3.5.1. Market Concentration Rate

3.5.2. List of Emerging, Leading Players

3.5.3. Merger & Acquisition, Expansion

4. Market Overview

4.1. Macro-economic Factors

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunity

4.3. Market Factor Analysis

4.3.1. Porter’s Five Force Analysis

4.3.2. PESTEL Analysis

4.3.3. Value Chain Analysis

4.3.3.1. List of Key Manufacturers

4.3.3.2. List of Customers

4.3.3.3. Level of Integration

4.3.4. SWOT Analysis

4.4. Key Regulations by Regions

4.4.1. Installation Standards for HV Wiring

4.5. Technology Roadmap

4.6. Impact Analysis of Wiring Harness Market due to:

4.6.1. 48 V Architecture

4.6.2. Electrification in vehicles

4.6.3. Introduction of Electric

4.6.4. Introduction of Semiautonomous and Autonomous Vehicle

4.7. Wiring Harness Market - Technological Impact

4.7.1. Impact of technology on Automotive Wiring Harness

4.8. Wiring Harness Market – Advancement in Materials

4.8.1. Changes in Material

4.8.2. Pricing analysis of materials

4.8.2.1. Metal

4.8.2.2. Optical Fiber

5. Who Supplies Whom

5.1. Key Suppliers

5.2. Key Customers

5.3. Integration of available Suppliers and Customers and Suppliers

5.4. List of Potential Customers, by Vehicle Type

5.4.1. Light Duty Commercial Vehicles

5.4.2. Heavy Trucks

5.4.3. Buses & Coaches

5.4.4. Off-road Vehicles

5.4.4.1. Agriculture Tractors and Equipment

5.4.4.2. Construction and Mining Vehicles

5.4.4.3. Recreational Vehicles

6. Global Wiring Harness Market, by Vehicle Type

6.1. Market Snapshot

6.1.1. Introduction & Definition

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

6.2.1. Light Duty Commercial Vehicles

6.2.2. Heavy Trucks

6.2.3. Buses & Coaches

6.2.4. Off-road Vehicles

6.2.4.1. Agriculture Tractors and Equipment

6.2.4.2. Construction and Mining Vehicles

6.2.4.3. Recreational Vehicles

7. Global Wiring Harness Market, by Application

7.1. Market Snapshot

7.1.1. Introduction & Definition

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Application

7.2.1. Engine Harness

7.2.2. Chassis Automotive Wiring Harness

7.2.3. Body & Lighting Harness

7.2.4. HVAC Automotive Wiring Harness

7.2.5. Dashboard/ Cabin Harness

7.2.6. Battery Automotive Wiring Harness

7.2.7. Seat Automotive Wiring Harness

7.2.8. Sunroof Automotive Wiring Harness

7.2.9. Door Automotive Wiring Harness

8. Global Wiring Harness Market, by Material Type

8.1. Market Snapshot

8.1.1. Introduction & Definition

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Material Type

8.2.1. Metallic

8.2.1.1. Copper

8.2.1.2. Aluminum

8.2.1.3. Other Metals

8.2.2. Optical Fiber

8.2.2.1. Plastic Optical Fiber

8.2.2.2. Glass Optical Fiber

9. Global Wiring Harness Market, by Sales Channel

9.1. Market Snapshot

9.1.1. Introduction & Definition

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

9.2.1. OEM

9.2.2. Aftermarket

10. Global Wiring Harness Market, by Category

10.1. Market Snapshot

10.1.1. Introduction & Definition

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Category

10.2.1. General Wires

10.2.2. Heat Resistant Wires

10.2.3. Shielded Wires

10.2.4. Tubed Wires

11. Global Wiring Harness Market, by Vehicle Propulsion

11.1. Market Snapshot

11.1.1. Introduction & Definition

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Propulsion

11.2.1. IC Engine

11.2.1.1. Diesel

11.2.1.2. Gasoline

11.2.2. Electric

11.2.2.1. Battery Electric

11.2.2.2. Plug-in Hybrid Electric

11.2.2.3. Fuel-cell Electric

11.2.2.4. Hydrogen-fuel Vehicles

12. Global Wiring Harness Market, by Transmission

12.1. Market Snapshot

12.1.1. Introduction & Definition

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Global Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Transmission

12.2.1. Data Transmission

12.2.2. Electricity Transmission

13. Global Wiring Harness Market, by Component

13.1. Market Snapshot

13.1.1. Introduction & Definition

13.1.2. Market Growth & Y-o-Y Projections

13.1.3. Base Point Share Analysis

13.2. Global Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Component

13.2.1. Connectors

13.2.2. Terminals

13.2.3. Clamps

13.2.4. Sheaths

13.2.5. Tape

13.2.6. Others

14. Global Wiring Harness Market, by Voltage Type

14.1. Market Snapshot

14.1.1. Introduction & Definition

14.1.2. Market Growth & Y-o-Y Projections

14.1.3. Base Point Share Analysis

14.2. Global Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Voltage Type

14.2.1. High Voltage Wiring

14.2.2. Low Voltage Wiring

15. Global Wiring Harness Market, by Region

15.1. Market Snapshot

15.1.1. Market Growth & Y-o-Y Projections

15.1.2. Base Point Share Analysis

15.2. Global Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Region

15.2.1. North America

15.2.2. Latin America

15.2.3. Europe

15.2.4. Asia Pacific

15.2.5. Middle East & Africa

16. North America Wiring Harness Market Analysis & Forecast, 2017-2031

16.1. North America Market Snapshot

16.1.1. Market Growth & Y-o-Y Projections

16.1.2. Base Point Share Analysis

16.2. North America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

16.2.1. Light Duty Commercial Vehicles

16.2.2. Heavy Trucks

16.2.3. Buses & Coaches

16.2.4. Off-road Vehicles

16.2.4.1. Agriculture Tractors and Equipment

16.2.4.2. Construction and Mining Vehicles

16.2.4.3. Recreational Vehicles

16.3. North America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Application

16.3.1. Engine Harness

16.3.2. Chassis Automotive Wiring Harness

16.3.3. Body & Lighting Harness

16.3.4. HVAC Automotive Wiring Harness

16.3.5. Dashboard/ Cabin Harness

16.3.6. Battery Automotive Wiring Harness

16.3.7. Seat Automotive Wiring Harness

16.3.8. Sunroof Automotive Wiring Harness

16.3.9. Door Automotive Wiring Harness

16.4. North America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Material Type

16.4.1. Metallic

16.4.1.1. Copper

16.4.1.2. Aluminum

16.4.1.3. Other Metals

16.4.2. Optical Fiber

16.4.2.1. Plastic Optical Fiber

16.4.2.2. Glass Optical Fiber

16.5. North America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

16.5.1. OEM

16.5.2. Aftermarket

16.6. North America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Category

16.6.1. General Wires

16.6.2. Heat Resistant Wires

16.6.3. Shielded Wires

16.6.4. Tubed Wires

16.7. North America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Propulsion

16.7.1. IC Engine

16.7.1.1. Diesel

16.7.1.2. Gasoline

16.7.2. Electric

16.7.2.1. Battery Electric

16.7.2.2. Plug-in Hybrid Electric

16.7.2.3. Fuel-cell Electric

16.7.2.4. Hydrogen-fuel Vehicles

16.8. North America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Transmission

16.8.1. Data Transmission

16.8.2. Electricity Transmission

16.9. North America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Component

16.9.1. Connectors

16.9.2. Terminals

16.9.3. Clamps

16.9.4. Sheaths

16.9.5. Tape

16.9.6. Others

16.10. North America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Voltage Type

16.10.1. High Voltage Wiring

16.10.2. Low Voltage Wiring

16.11. North America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Country

16.11.1. U. S.

16.11.2. Canada

17. Latin America Wiring Harness Market Analysis & Forecast, 2017-2031

17.1. Latin America Market Snapshot

17.1.1. Market Growth & Y-o-Y Projections

17.1.2. Base Point Share Analysis

17.2. Latin America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

17.2.1. Light Duty Commercial Vehicles

17.2.2. Heavy Trucks

17.2.3. Buses & Coaches

17.2.4. Off-road Vehicles

17.2.4.1. Agriculture Tractors and Equipment

17.2.4.2. Construction and Mining Vehicles

17.2.4.3. Recreational Vehicles

17.3. Latin America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Application

17.3.1. Engine Harness

17.3.2. Chassis Automotive Wiring Harness

17.3.3. Body & Lighting Harness

17.3.4. HVAC Automotive Wiring Harness

17.3.5. Dashboard/ Cabin Harness

17.3.6. Battery Automotive Wiring Harness

17.3.7. Seat Automotive Wiring Harness

17.3.8. Sunroof Automotive Wiring Harness

17.3.9. Door Automotive Wiring Harness

17.4. Latin America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Material Type

17.4.1. Metallic

17.4.1.1. Copper

17.4.1.2. Aluminum

17.4.1.3. Other Metals

17.4.2. Optical Fiber

17.4.2.1. Plastic Optical Fiber

17.4.2.2. Glass Optical Fiber

17.5. Latin America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

17.5.1. OEM

17.5.2. Aftermarket

17.6. Latin America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Category

17.6.1. General Wires

17.6.2. Heat Resistant Wires

17.6.3. Shielded Wires

17.6.4. Tubed Wires

17.7. Latin America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Propulsion

17.7.1. IC Engine

17.7.1.1. Diesel

17.7.1.2. Gasoline

17.7.2. Electric

17.7.2.1. Battery Electric

17.7.2.2. Plug-in Hybrid Electric

17.7.2.3. Fuel-cell Electric

17.7.2.4. Hydrogen-fuel Vehicles

17.8. Latin America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Transmission

17.8.1. Data Transmission

17.8.2. Electricity Transmission

17.9. Latin America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Component

17.9.1. Connectors

17.9.2. Terminals

17.9.3. Clamps

17.9.4. Sheaths

17.9.5. Tape

17.9.6. Others

17.10. Latin America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Voltage Type

17.10.1. High Voltage Wiring

17.10.2. Low Voltage Wiring

17.11. Latin America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Country

17.11.1. Brazil

17.11.2. Mexico

17.11.3. Rest of Latin America

18. Europe Wiring Harness Market Analysis & Forecast, 2017-2031

18.1. Europe Market Snapshot

18.1.1. Market Growth & Y-o-Y Projections

18.1.2. Base Point Share Analysis

18.2. Europe Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

18.2.1. Light Duty Commercial Vehicles

18.2.2. Heavy Trucks

18.2.3. Buses & Coaches

18.2.4. Off-road Vehicles

18.2.4.1. Agriculture Tractors and Equipment

18.2.4.2. Construction and Mining Vehicles

18.2.4.3. Recreational Vehicles

18.3. Europe Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Application

18.3.1. Engine Harness

18.3.2. Chassis Automotive Wiring Harness

18.3.3. Body & Lighting Harness

18.3.4. HVAC Automotive Wiring Harness

18.3.5. Dashboard/ Cabin Harness

18.3.6. Battery Automotive Wiring Harness

18.3.7. Seat Automotive Wiring Harness

18.3.8. Sunroof Automotive Wiring Harness

18.3.9. Door Automotive Wiring Harness

18.4. Europe Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Material Type

18.4.1. Metallic

18.4.1.1. Copper

18.4.1.2. Aluminum

18.4.1.3. Other Metals

18.4.2. Optical Fiber

18.4.2.1. Plastic Optical Fiber

18.4.2.2. Glass Optical Fiber

18.5. Europe Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

18.5.1. OEM

18.5.2. Aftermarket

18.6. Europe Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Category

18.6.1. General Wires

18.6.2. Heat Resistant Wires

18.6.3. Shielded Wires

18.6.4. Tubed Wires

18.7. Europe Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Propulsion

18.7.1. IC Engine

18.7.1.1. Diesel

18.7.1.2. Gasoline

18.7.2. Electric

18.7.2.1. Battery Electric

18.7.2.2. Plug-in Hybrid Electric

18.7.2.3. Fuel-cell Electric

18.7.2.4. Hydrogen-fuel Vehicles

18.8. Europe Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Transmission

18.8.1. Data Transmission

18.8.2. Electricity Transmission

18.9. Europe Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Component

18.9.1. Connectors

18.9.2. Terminals

18.9.3. Clamps

18.9.4. Sheaths

18.9.5. Tape

18.9.6. Others

18.10. Europe Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Voltage Type

18.10.1. High Voltage Wiring

18.10.2. Low Voltage Wiring

18.11. Europe Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Country

18.11.1. Germany

18.11.2. U. K.

18.11.3. France

18.11.4. Italy

18.11.5. Spain

18.11.6. Rest of Europe

19. Asia Pacific Wiring Harness Market Analysis & Forecast, 2017-2031

19.1. Asia Pacific Market Snapshot

19.1.1. Market Growth & Y-o-Y Projections

19.1.2. Base Point Share Analysis

19.2. Asia Pacific Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

19.2.1. Light Duty Commercial Vehicles

19.2.2. Heavy Trucks

19.2.3. Buses & Coaches

19.2.4. Off-road Vehicles

19.2.4.1. Agriculture Tractors and Equipment

19.2.4.2. Construction and Mining Vehicles

19.2.4.3. Recreational Vehicles

19.3. Asia Pacific Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Application

19.3.1. Engine Harness

19.3.2. Chassis Automotive Wiring Harness

19.3.3. Body & Lighting Harness

19.3.4. HVAC Automotive Wiring Harness

19.3.5. Dashboard/ Cabin Harness

19.3.6. Battery Automotive Wiring Harness

19.3.7. Seat Automotive Wiring Harness

19.3.8. Sunroof Automotive Wiring Harness

19.3.9. Door Automotive Wiring Harness

19.4. Asia Pacific Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Material Type

19.4.1. Metallic

19.4.1.1. Copper

19.4.1.2. Aluminum

19.4.1.3. Other Metals

19.4.2. Optical Fiber

19.4.2.1. Plastic Optical Fiber

19.4.2.2. Glass Optical Fiber

19.5. Asia Pacific Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

19.5.1. OEM

19.5.2. Aftermarket

19.6. Asia Pacific Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Category

19.6.1. General Wires

19.6.2. Heat Resistant Wires

19.6.3. Shielded Wires

19.6.4. Tubed Wires

19.7. Asia Pacific Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Propulsion

19.7.1. IC Engine

19.7.1.1. Diesel

19.7.1.2. Gasoline

19.7.2. Electric

19.7.2.1. Battery Electric

19.7.2.2. Plug-in Hybrid Electric

19.7.2.3. Fuel-cell Electric

19.7.2.4. Hydrogen-fuel Vehicles

19.8. Asia Pacific Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Transmission

19.8.1. Data Transmission

19.8.2. Electricity Transmission

19.9. Asia Pacific Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Component

19.9.1. Connectors

19.9.2. Terminals

19.9.3. Clamps

19.9.4. Sheaths

19.9.5. Tape

19.9.6. Others

19.10. Asia Pacific Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Voltage Type

19.10.1. High Voltage Wiring

19.10.2. Low Voltage Wiring

19.11. Asia Pacific Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Country

19.11.1. China

19.11.2. India

19.11.3. Japan

19.11.4. South Korea

19.11.5. ASEAN

19.11.6. Rest of Asia Pacific

20. Middle East & Africa Wiring Harness Market Analysis & Forecast, 2017-2031

20.1. Middle East & Africa Market Snapshot

20.1.1. Market Growth & Y-o-Y Projections

20.1.2. Base Point Share Analysis

20.2. Middle East & Africa Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Type

20.2.1. Light Duty Commercial Vehicles

20.2.2. Heavy Trucks

20.2.3. Buses & Coaches

20.2.4. Off-road Vehicles

20.2.4.1. Agriculture Tractors and Equipment

20.2.4.2. Construction and Mining Vehicles

20.2.4.3. Recreational Vehicles

20.3. Middle East & Africa Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Application

20.3.1. Engine Harness

20.3.2. Chassis Automotive Wiring Harness

20.3.3. Body & Lighting Harness

20.3.4. HVAC Automotive Wiring Harness

20.3.5. Dashboard/ Cabin Harness

20.3.6. Battery Automotive Wiring Harness

20.3.7. Seat Automotive Wiring Harness

20.3.8. Sunroof Automotive Wiring Harness

20.3.9. Door Automotive Wiring Harness

20.4. Middle East & Africa Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Material Type

20.4.1. Metallic

20.4.1.1. Copper

20.4.1.2. Aluminum

20.4.1.3. Other Metals

20.4.2. Optical Fiber

20.4.2.1. Plastic Optical Fiber

20.4.2.2. Glass Optical Fiber

20.5. Middle East & Africa Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Sales Channel

20.5.1. OEM

20.5.2. Aftermarket

20.6. Middle East & Africa Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Category

20.6.1. General Wires

20.6.2. Heat Resistant Wires

20.6.3. Shielded Wires

20.6.4. Tubed Wires

20.7. Middle East & Africa Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Vehicle Propulsion

20.7.1. IC Engine

20.7.1.1. Diesel

20.7.1.2. Gasoline

20.7.2. Electric

20.7.2.1. Battery Electric

20.7.2.2. Plug-in Hybrid Electric

20.7.2.3. Fuel-cell Electric

20.7.2.4. Hydrogen-fuel Vehicles

20.8. Middle East & Africa Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Transmission

20.8.1. Data Transmission

20.8.2. Electricity Transmission

20.9. Middle East & Africa Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Component

20.9.1. Connectors

20.9.2. Terminals

20.9.3. Clamps

20.9.4. Sheaths

20.9.5. Tape

20.9.6. Others

20.10. Middle East & Africa Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Voltage Type

20.10.1. High Voltage Wiring

20.10.2. Low Voltage Wiring

20.11. Middle East & Africa Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Country

20.11.1. GCC

20.11.2. South Africa

20.11.3. Rest of Middle East & Africa

21. Competition Assessment

21.1. Global Target Market Competition - a Dashboard View

21.2. Global Target Market Structure Analysis

21.3. Global Target Market Company Share Analysis

21.3.1. For Tier 1 Market Players, 2022

22. Company Profile

22.1. Motherson Sumi Systems Limited

22.1.1. Company Overview

22.1.2. Product Portfolio

22.1.3. Strategy Overview

22.1.4. Recent Developments

22.1.5. Financial Analysis

22.1.6. Revenue Share

22.1.7. Executive Bios

22.2. Aptiv

22.2.1. Company Overview

22.2.2. Product Portfolio

22.2.3. Strategy Overview

22.2.4. Recent Developments

22.2.5. Financial Analysis

22.2.6. Revenue Share

22.2.7. Executive Bios

22.3. Borg Warner Inc.

22.3.1. Company Overview

22.3.2. Product Portfolio

22.3.3. Strategy Overview

22.3.4. Recent Developments

22.3.5. Financial Analysis

22.3.6. Revenue Share

22.3.7. Executive Bios

22.4. Continental AG

22.4.1. Company Overview

22.4.2. Product Portfolio

22.4.3. Strategy Overview

22.4.4. Recent Developments

22.4.5. Financial Analysis

22.4.6. Revenue Share

22.4.7. Executive Bios

22.5. CTS Corporation

22.5.1. Company Overview

22.5.2. Product Portfolio

22.5.3. Strategy Overview

22.5.4. Recent Developments

22.5.5. Financial Analysis

22.5.6. Revenue Share

22.5.7. Executive Bios

22.6. DENSO Corporation

22.6.1. Company Overview

22.6.2. Product Portfolio

22.6.3. Strategy Overview

22.6.4. Recent Developments

22.6.5. Financial Analysis

22.6.6. Revenue Share

22.6.7. Executive Bios

22.7. Dhoot Transmission

22.7.1. Company Overview

22.7.2. Product Portfolio

22.7.3. Strategy Overview

22.7.4. Recent Developments

22.7.5. Financial Analysis

22.7.6. Revenue Share

22.7.7. Executive Bios

22.8. Furakawa Electric Co., Ltd.

22.8.1. Company Overview

22.8.2. Product Portfolio

22.8.3. Strategy Overview

22.8.4. Recent Developments

22.8.5. Financial Analysis

22.8.6. Revenue Share

22.8.7. Executive Bios

22.9. Hella GmbH & Co., KGaA

22.9.1. Company Overview

22.9.2. Product Portfolio

22.9.3. Strategy Overview

22.9.4. Recent Developments

22.9.5. Financial Analysis

22.9.6. Revenue Share

22.9.7. Executive Bios

22.10. Hitachi Ltd.

22.10.1. Company Overview

22.10.2. Product Portfolio

22.10.3. Strategy Overview

22.10.4. Recent Developments

22.10.5. Financial Analysis

22.10.6. Revenue Share

22.10.7. Executive Bios

22.11. Johnson Electric

22.11.1. Company Overview

22.11.2. Product Portfolio

22.11.3. Strategy Overview

22.11.4. Recent Developments

22.11.5. Financial Analysis

22.11.6. Revenue Share

22.11.7. Executive Bios

22.12. Lear Corporation

22.12.1. Company Overview

22.12.2. Product Portfolio

22.12.3. Strategy Overview

22.12.4. Recent Developments

22.12.5. Financial Analysis

22.12.6. Revenue Share

22.12.7. Executive Bios

22.13. Leoni AG

22.13.1. Company Overview

22.13.2. Product Portfolio

22.13.3. Strategy Overview

22.13.4. Recent Developments

22.13.5. Financial Analysis

22.13.6. Revenue Share

22.13.7. Executive Bios

22.14. MAHLE GmbH

22.14.1. Company Overview

22.14.2. Product Portfolio

22.14.3. Strategy Overview

22.14.4. Recent Developments

22.14.5. Financial Analysis

22.14.6. Revenue Share

22.14.7. Executive Bios

22.15. Martin Technologies

22.15.1. Company Overview

22.15.2. Product Portfolio

22.15.3. Strategy Overview

22.15.4. Recent Developments

22.15.5. Financial Analysis

22.15.6. Revenue Share

22.15.7. Executive Bios

22.16. Mitusbishi Corporation

22.16.1. Company Overview

22.16.2. Product Portfolio

22.16.3. Strategy Overview

22.16.4. Recent Developments

22.16.5. Financial Analysis

22.16.6. Revenue Share

22.16.7. Executive Bios

22.17. Nidec Motors & Actuators

22.17.1. Company Overview

22.17.2. Product Portfolio

22.17.3. Strategy Overview

22.17.4. Recent Developments

22.17.5. Financial Analysis

22.17.6. Revenue Share

22.17.7. Executive Bios

22.18. Robert Bosch GmbH

22.18.1. Company Overview

22.18.2. Product Portfolio

22.18.3. Strategy Overview

22.18.4. Recent Developments

22.18.5. Financial Analysis

22.18.6. Revenue Share

22.18.7. Executive Bios

22.19. Robertshaw Controls Pvt. Ltd.

22.19.1. Company Overview

22.19.2. Product Portfolio

22.19.3. Strategy Overview

22.19.4. Recent Developments

22.19.5. Financial Analysis

22.19.6. Revenue Share

22.19.7. Executive Bios

22.20. Spark Minda

22.20.1. Company Overview

22.20.2. Product Portfolio

22.20.3. Strategy Overview

22.20.4. Recent Developments

22.20.5. Financial Analysis

22.20.6. Revenue Share

22.20.7. Executive Bios

22.21. Sumitomo Electric Industries, Ltd.

22.21.1. Company Overview

22.21.2. Product Portfolio

22.21.3. Strategy Overview

22.21.4. Recent Developments

22.21.5. Financial Analysis

22.21.6. Revenue Share

22.21.7. Executive Bios

22.22. TE Connectivity

22.22.1. Company Overview

22.22.2. Product Portfolio

22.22.3. Strategy Overview

22.22.4. Recent Developments

22.22.5. Financial Analysis

22.22.6. Revenue Share

22.22.7. Executive Bios

22.23. THB Group

22.23.1. Company Overview

22.23.2. Product Portfolio

22.23.3. Strategy Overview

22.23.4. Recent Developments

22.23.5. Financial Analysis

22.23.6. Revenue Share

22.23.7. Executive Bios

22.24. Valeo

22.24.1. Company Overview

22.24.2. Product Portfolio

22.24.3. Strategy Overview

22.24.4. Recent Developments

22.24.5. Financial Analysis

22.24.6. Revenue Share

22.24.7. Executive Bios

22.25. WABCO

22.25.1. Company Overview

22.25.2. Product Portfolio

22.25.3. Strategy Overview

22.25.4. Recent Developments

22.25.5. Financial Analysis

22.25.6. Revenue Share

22.25.7. Executive Bios

22.26. Yazaki Corporation

22.26.1. Company Overview

22.26.2. Product Portfolio

22.26.3. Strategy Overview

22.26.4. Recent Developments

22.26.5. Financial Analysis

22.26.6. Revenue Share

22.26.7. Executive Bios

22.27. Other Key Players

22.27.1. Company Overview

22.27.2. Product Portfolio

22.27.3. Strategy Overview

22.27.4. Recent Developments

22.27.5. Financial Analysis

22.27.6. Revenue Share

22.27.7. Executive Bios

**This is not exhaustive list and we have provided few of players, while doing research report, we cover more number of key players

List of Tables

Table 1: Global Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 2: Global Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 3: Global Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Table 4: Global Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 5: Global Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Category, 2017-2031

Table 6: Global Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Propulsion, 2017-2031

Table 7: Global Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Transmission Type 2017-2031

Table 8: Global Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 9: Global Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Voltage Type, 2017-2031

Table 10: Global Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Region, 2017-2031

Table 11: North America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 12: North America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 13: North America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Table 14: North America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 15: North America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Category, 2017-2031

Table 16: North America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Propulsion, 2017-2031

Table 17: North America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Transmission Type 2017-2031

Table 18: North America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 19: North America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Voltage Type, 2017-2031

Table 20: North America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 21: Europe Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 22: Europe Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 23: Europe Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Table 24: Europe Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 25: Europe Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Category, 2017-2031

Table 26: Europe Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Propulsion, 2017-2031

Table 27: Europe Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Transmission Type 2017-2031

Table 28: Europe Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 29: Europe Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Voltage Type, 2017-2031

Table 30: Europe Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 31: Asia Pacific Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 32: Asia Pacific Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 33: Asia Pacific Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Table 34: Asia Pacific Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 35: Asia Pacific Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Category, 2017-2031

Table 36: Asia Pacific Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Propulsion, 2017-2031

Table 37: Asia Pacific Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Transmission Type 2017-2031

Table 38: Asia Pacific Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 39: Asia Pacific Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Voltage Type, 2017-2031

Table 40: Asia Pacific Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 41: Middle East & Africa Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 42: Middle East & Africa Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 43: Middle East & Africa Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Table 44: Middle East & Africa Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 45: Middle East & Africa Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Category, 2017-2031

Table 46: Middle East & Africa Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Propulsion, 2017-2031

Table 47: Middle East & Africa Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Transmission Type 2017-2031

Table 48: Middle East & Africa Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 49: Middle East & Africa Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Voltage Type, 2017-2031

Table 50: Middle East & Africa Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Country, 2017-2031

Table 51: Latin America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Table 52: Latin America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Table 53: Latin America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Table 54: Latin America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Table 55: Latin America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Category, 2017-2031

Table 56: Latin America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Propulsion, 2017-2031

Table 57: Latin America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Transmission Type 2017-2031

Table 58: Latin America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Table 59: Latin America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Voltage Type, 2017-2031

Table 60: Latin America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 2: Global Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 3: Global Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 4: Global Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 5: Global Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 6: Global Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2023-2031

Figure 7: Global Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 8: Global Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 9: Global Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Category, 2017-2031

Figure 10: Global Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Category, Value (US$ Bn), 2023-2031

Figure 11: Global Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Propulsion, 2017-2031

Figure 12: Global Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Vehicle Propulsion, Value (US$ Bn), 2023-2031

Figure 13: Global Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Transmission Type 2017-2031

Figure 14: Global Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Transmission Type, Value (US$ Bn), 2023-2031

Figure 15: Global Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 16: Global Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 17: Global Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Voltage Type, 2017-2031

Figure 18: Global Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Voltage Type, Value (US$ Bn), 2023-2031

Figure 19: Global Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 20: Global Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 21: North America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 22: North America Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 23: North America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 24: North America Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 25: North America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 26: North America Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2023-2031

Figure 27: North America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 28: North America Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 29: North America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Category, 2017-2031

Figure 30: North America Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Category, Value (US$ Bn), 2023-2031

Figure 31: North America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Propulsion, 2017-2031

Figure 32: North America Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Vehicle Propulsion, Value (US$ Bn), 2023-2031

Figure 33: North America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Transmission Type 2017-2031

Figure 34: North America Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Transmission Type, Value (US$ Bn), 2023-2031

Figure 35: North America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 36: North America Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 37: North America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Voltage Type, 2017-2031

Figure 38: North America Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Voltage Type, Value (US$ Bn), 2023-2031

Figure 39: North America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 40: North America Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 41: Europe Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 42: Europe Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 43: Europe Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 44: Europe Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 45: Europe Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 46: Europe Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2023-2031

Figure 47: Europe Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 48: Europe Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 49: Europe Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Category, 2017-2031

Figure 50: Europe Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Category, Value (US$ Bn), 2023-2031

Figure 51: Europe Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Propulsion, 2017-2031

Figure 52: Europe Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Vehicle Propulsion, Value (US$ Bn), 2023-2031

Figure 53: Europe Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Transmission Type 2017-2031

Figure 54: Europe Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Transmission Type, Value (US$ Bn), 2023-2031

Figure 55: Europe Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 56: Europe Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 57: Europe Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Voltage Type, 2017-2031

Figure 58: Europe Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Voltage Type, Value (US$ Bn), 2023-2031

Figure 59: Europe Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 60: Europe Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 61: Asia Pacific Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 62: Asia Pacific Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 63: Asia Pacific Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 64: Asia Pacific Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 65: Asia Pacific Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 66: Asia Pacific Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2023-2031

Figure 67: Asia Pacific Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 68: Asia Pacific Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 69: Asia Pacific Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Category, 2017-2031

Figure 70: Asia Pacific Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Category, Value (US$ Bn), 2023-2031

Figure 71: Asia Pacific Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Propulsion, 2017-2031

Figure 72: Asia Pacific Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Vehicle Propulsion, Value (US$ Bn), 2023-2031

Figure 73: Asia Pacific Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Transmission Type 2017-2031

Figure 74: Asia Pacific Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Transmission Type, Value (US$ Bn), 2023-2031

Figure 75: Asia Pacific Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 76: Asia Pacific Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 77: Asia Pacific Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Voltage Type, 2017-2031

Figure 78: Asia Pacific Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Voltage Type, Value (US$ Bn), 2023-2031

Figure 79: Asia Pacific Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 80: Asia Pacific Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 81: Middle East & Africa Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 82: Middle East & Africa Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 83: Middle East & Africa Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 84: Middle East & Africa Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 85: Middle East & Africa Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 86: Middle East & Africa Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2023-2031

Figure 87: Middle East & Africa Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 88: Middle East & Africa Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 89: Middle East & Africa Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Category, 2017-2031

Figure 90: Middle East & Africa Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Category, Value (US$ Bn), 2023-2031

Figure 91: Middle East & Africa Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Propulsion, 2017-2031

Figure 92: Middle East & Africa Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Vehicle Propulsion, Value (US$ Bn), 2023-2031

Figure 93: Middle East & Africa Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Transmission Type 2017-2031

Figure 94: Middle East & Africa Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Transmission Type, Value (US$ Bn), 2023-2031

Figure 95: Middle East & Africa Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 96: Middle East & Africa Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 97: Middle East & Africa Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Voltage Type, 2017-2031

Figure 98: Middle East & Africa Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Voltage Type, Value (US$ Bn), 2023-2031

Figure 99: Middle East & Africa Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 100: Middle East & Africa Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 101: Latin America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 102: Latin America Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 103: Latin America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 104: Latin America Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 105: Latin America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 106: Latin America Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2023-2031

Figure 107: Latin America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 108: Latin America Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2023-2031

Figure 109: Latin America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Category, 2017-2031

Figure 110: Latin America Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Category, Value (US$ Bn), 2023-2031

Figure 111: Latin America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Propulsion, 2017-2031

Figure 112: Latin America Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Vehicle Propulsion, Value (US$ Bn), 2023-2031

Figure 113: Latin America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Transmission Type 2017-2031

Figure 114: Latin America Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Transmission Type, Value (US$ Bn), 2023-2031

Figure 115: Latin America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Component, 2017-2031

Figure 116: Latin America Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Component, Value (US$ Bn), 2023-2031

Figure 117: Latin America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Voltage Type, 2017-2031

Figure 118: Latin America Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Voltage Type, Value (US$ Bn), 2023-2031

Figure 119: Latin America Commercial Vehicle Wiring Harness Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 120: Latin America Commercial Vehicle Wiring Harness Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031