Reports

Reports

The success of a commercial kitchen depends on a range of factors of which, holding and warming food equipment are critical. Full service and quick service restaurants make use of commercial warming & holding equipment to keep food at the optimum serving temperature and retain its freshness. The restaurant sector has consistently expanded over the past couple of decades – opening up new avenues for participants in the commercial food warming & holding equipment market. Due to the expanding restaurant sector and the number of supermarkets and delis worldwide, the commercial food warming & holding equipment market is projected to witness considerable growth during the forecast period (2019-2027) and attain a value of ~US$ 7 Bn by the end of 2027. Some of the other factors that are expected to contribute toward this growth include growing evolving consumer lifestyle, ascending demand from developing economies, and rapid technological advancements.

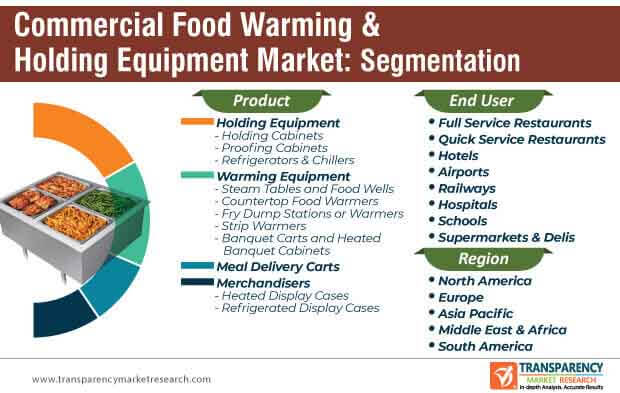

Various end users of commercial food warming & holding equipment are increasingly focusing on improving the safety of large quantities of cooked food. Warming equipment have emerged as one of the most effective solutions to ensure protection from harmful bacteria and pathogens. Pathogens are likely to multiply in numbers between 5 ºC and 63 ºC and thus, the demand for warming equipment is poised to grow at a consistent rate during the forecast period. The warming equipment product segment is projected to account for ~30% of the total food warming and holding equipment market share, in terms of value in 2019, lagging slightly behind the holding equipment product segment, which is likely to hold a share of 34%. The Food Safety Regulations 1995 and similar other regulations have been laid down to ensure safety of consumers. Food service participants are continually putting efforts to ensure that the cooked food is free from harmful bacteria and remains at the desired temperature level through the use of holding and warming equipment.

Hot holding equipment have garnered significant popularity over the past few years, owing to fluctuating consumer preferences. Although hot holding is not a new concept, advancements in temperature control and humidity precision have led to the development of improved holding equipment. Presently, the demand for convenience food is witnessing growth, which, in turn, has propelled the need for energy-efficient holding equipment. In addition, evolving consumer lifestyle patterns are driving innovations in the commercial food warming & holding equipment market. Players operating in the global commercial food warming & holding equipment market landscape are leveraging advancements in technology to launch new products and gain competitive advantage. For instance, in September 2018, Unox launched a new hot refrigerator that was specially designed to preserve dishes at the desired serving temperature for weeks. In their quest toward achieving resource and energy efficiency, several companies in the commercial food warming & holding equipment market are focusing on research and development activities.

Over the past decade, improving energy efficiency across the global industrial sector has received immense importance. A similar trend can be observed within the global commercial food warming & holding equipment market wherein stringent regulations are shaping the course for a greener future. The U.S. Environmental Protection Agency (EPA) has defined the expected efficiency levels pertaining to hot food holding equipment on its ENERGY STAR website. Operators within the commercial food warming & holding equipment market that adhere to these requirements can display the ENERGY STAR label on their equipment. As per the insights on their website, by complying with these regulations, end users could potentially save as much as 30% on their electricity bills. Modern day consumers are highly in favor of energy-efficient warming and holding equipment, owing to the rising awareness related to green technologies. As consumer continue to adopt greener alternatives, old generation warming and holding equipment are likely to be replaced with newer products, especially in developing regions of South America and Asia Pacific.

The commercial food warming & holding equipment market is steadily heading toward a greener future, as end users are required to comply with stringent environmental regulations. Innovations and technological advancements are expected to continue during the forecast period, as companies strive to achieve higher energy efficiency levels. Operators in the commercial food warming & holding equipment market should focus on improving the functional aspects of their products and align their operations with evolving industry trends. Consumer inclination toward on-the-go and convenience food items will present lucrative opportunities for players in the commercial food warming & holding equipment market during the forecast period.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Commercial Food Warming and Holding Equipment Market

4. Market Overview

4.1. Introduction

4.2. Key Market Indicators

4.2.1. Global Food & Beverages Industry Overview

4.3. Worldwide Industrial Production Index, by Top Countries

4.4. Market Dynamics

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunity

4.4.4. Trends

4.5. Global Commercial Food Warming and Holding Equipment Market Analysis and Forecasts, 2017-2027

4.5.1. Global Commercial Food Warming and Holding Equipment Market Size (Thousand Units)

4.5.2. Global Commercial Food Warming and Holding Equipment Market Revenue (US$ Mn)

4.6. Porter’s Five Forces Analysis

4.7. PEST Analysis

4.8. Market Outlook

4.9. Regulation & Policies, by top Countries

4.10. Value Chain Analysis

4.10.1. List of Commercial Food Warming and Holding Equipment Manufacturers

4.10.2. List of Potential Customers

5. Pricing Analysis, 2018

5.1. Price Comparison Analysis, by Product

6. Global Commercial Food Warming and Holding Equipment Market Analysis and Forecasts, by Product

6.1. Definition & Key Findings

6.2. Market Size (Thousand Units) (US$ Mn) Forecast by Product , 2017-2027

6.2.1. Holding Equipment

6.2.1.1. Holding Cabinets

6.2.1.2. Proofing Cabinets

6.2.1.3. Refrigerators & Chillers

6.2.2. Warming Equipment

6.2.2.1. Steam Tables and Food Wells

6.2.2.2. Countertop Food Warmers

6.2.2.3. Fry Dump Stations or warmer

6.2.2.4. Strip Warmers

6.2.2.5. Banquet Carts and Heated Banquet Cabinets

6.2.3. Meal Delivery Carts

6.2.4. Merchandisers

6.2.4.1. Heated display cases

6.2.4.2. Refrigerated display cases

6.3. Market Attractiveness, by Product

7. Global Commercial Food Warming and Holding Equipment Market Analysis and Forecasts, by End User

7.1. Definition & Key Findings

7.2. Market Size (Thousand Units) (US$ Mn) Forecast by End User, 2017-2027

7.2.1. Full service Restaurants

7.2.2. Quick Service Restaurant

7.2.3. Hotels

7.2.4. Airports

7.2.5. Railways

7.2.6. Hospitals

7.2.7. Schools

7.2.8. Supermarkets & Delis

7.3. Market Attractiveness, by End User

8. Global Commercial Food Warming and Holding Equipment Market Analysis and Forecasts, by Region

8.1. Key Findings, by Region

8.2. Market Size (Thousand Units) (US$ Mn) Forecast by Region, 2017-2027

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Commercial Food Warming and Holding Equipment Market Analysis and Forecasts, by Product

9.1. Key Findings

9.2. Market Size (Thousand Units) (US$ Mn) Forecast by Product , 2017-2027

9.2.1. Holding Equipment

9.2.1.1. Holding Cabinets

9.2.1.2. Proofing Cabinets

9.2.1.3. Refrigerators & Chillers

9.2.2. Warming Equipment

9.2.2.1. Steam Tables and Food Wells

9.2.2.2. Countertop Food Warmers

9.2.2.3. Fry Dump Stations or warmer

9.2.2.4. Strip Warmers

9.2.2.5. Banquet Carts and Heated Banquet Cabinets

9.2.3. Meal Delivery Carts

9.2.4. Merchandisers

9.2.4.1. Heated display cases

9.2.4.2. Refrigerated display cases

10. North America Commercial Food Warming and Holding Equipment Market Analysis and Forecasts, by End User

10.1. Key Findings

10.2. Market Size (Thousand Units) (US$ Mn) Forecast by End User, 2017-2027

10.2.1. Full service Restaurants

10.2.2. Quick Service Restaurant

10.2.3. Hotels

10.2.4. Airports

10.2.5. Railways

10.2.6. Hospitals

10.2.7. Schools

10.2.8. Supermarkets & Delis

11. North America Commercial Food Warming and Holding Equipment Market Analysis and Forecasts, by Country & Sub-region

11.1. Key Findings

11.2. Market Size (Thousand Units) (US$ Mn) Forecast by Country, 2017-2027

11.2.1. U.S.

11.2.2. Canada

11.2.3. Mexico

11.2.4. Rest of North America

12. Europe Commercial Food Warming and Holding Equipment Market Analysis and Forecasts, by Product

12.1. Key Findings

12.2. Market Size (Thousand Units) (US$ Mn) Forecast by Product , 2017-2027

12.2.1. Holding Equipment

12.2.1.1. Holding Cabinets

12.2.1.2. Proofing Cabinets

12.2.1.3. Refrigerators & Chillers

12.2.2. Warming Equipment

12.2.2.1. Steam Tables and Food Wells

12.2.2.2. Countertop Food Warmers

12.2.2.3. Fry Dump Stations or warmer

12.2.2.4. Strip Warmers

12.2.2.5. Banquet Carts and Heated Banquet Cabinets

12.2.3. Meal Delivery Carts

12.2.4. Merchandisers

12.2.4.1. Heated display cases

12.2.4.2. Refrigerated display cases

13. Europe Commercial Food Warming and Holding Equipment Market Analysis and Forecasts, by End User

13.1. Key Findings

13.2. Market Size (Thousand Units) (US$ Mn) Forecast by Application, 2018-2027

13.2.1. Full service Restaurants

13.2.2. Quick Service Restaurant

13.2.3. Hotels

13.2.4. Airports

13.2.5. Railways

13.2.6. Hospitals

13.2.7. Schools

13.2.8. Supermarkets & Delis

14. Europe Commercial Food Warming and Holding Equipment Market Analysis and Forecasts, by Country & Sub-region

14.1. Key Findings

14.2. Market Size (Thousand Units) (US$ Mn) Forecast by Country, 2018-2027

14.2.1. The U.K.

14.2.2. Italy

14.2.3. Germany

14.2.4. France

14.2.5. Rest of Europe

15. Asia Pacific Commercial Food Warming and Holding Equipment Market Analysis and Forecasts, by Product

15.1. Key Findings

15.2. Market Size (Thousand Units) (US$ Mn) Forecast by Product , 2017-2027

15.2.1. Holding Equipment

15.2.1.1. Holding Cabinets

15.2.1.2. Proofing Cabinets

15.2.1.3. Refrigerators & Chillers

15.2.2. Warming Equipment

15.2.2.1. Steam Tables and Food Wells

15.2.2.2. Countertop Food Warmers

15.2.2.3. Fry Dump Stations or warmer

15.2.2.4. Strip Warmers

15.2.2.5. Banquet Carts and Heated Banquet Cabinets

15.2.3. Meal Delivery Carts

15.2.4. Merchandisers

15.2.4.1. Heated display cases

15.2.4.2. Refrigerated display cases

16. Asia Pacific Commercial Food Warming and Holding Equipment Market Analysis and Forecasts, by End User

16.1. Key Findings

16.2. Market Size (Thousand Units) (US$ Mn) Forecast by Application, 2018-2027

16.2.1. Full service Restaurants

16.2.2. Quick Service Restaurant

16.2.3. Hotels

16.2.4. Airports

16.2.5. Railways

16.2.6. Hospitals

16.2.7. Schools

16.2.8. Supermarkets & Delis

17. Asia Pacific Commercial Food Warming and Holding Equipment Market Analysis and Forecasts, by Country & Sub-region

17.1. Key Findings

17.2. Market Size (Thousand Units) (US$ Mn) Forecast by Country, 2018-2027

17.2.1. China

17.2.2. Japan

17.2.3. India

17.2.4. Australia

17.2.5. Singapore

17.2.6. Rest of Asia Pacific

18. Middle East & Africa Commercial Food Warming and Holding Equipment Market Analysis and Forecasts, by Product

18.1. Key Findings

18.2. Market Size (Thousand Units) (US$ Mn) Forecast by Product , 2017-2027

18.2.1. Holding Equipment

18.2.1.1. Holding Cabinets

18.2.1.2. Proofing Cabinets

18.2.1.3. Refrigerators & Chillers

18.2.2. Warming Equipment

18.2.2.1. Steam Tables and Food Wells

18.2.2.2. Countertop Food Warmers

18.2.2.3. Fry Dump Stations or warmer

18.2.2.4. Strip Warmers

18.2.2.5. Banquet Carts and Heated Banquet Cabinets

18.2.3. Meal Delivery Carts

18.2.4. Merchandisers

18.2.4.1. Heated display cases

18.2.4.2. Refrigerated display cases

19. Middle East & Africa Commercial Food Warming and Holding Equipment Market Analysis and Forecasts, by End User

19.1. Key Findings

19.2. Market Size (Thousand Units) (US$ Mn) Forecast by Application, 2018-2027

19.2.1. Full service Restaurants

19.2.2. Quick Service Restaurant

19.2.3. Hotels

19.2.4. Airports

19.2.5. Railways

19.2.6. Hospitals

19.2.7. Schools

19.2.8. Supermarkets & Delis

20. Middle East & Africa Commercial Food Warming and Holding Equipment Market Analysis and Forecasts, by Country & Sub-region

20.1. Key Findings

20.2. Market Size (Thousand Units) (US$ Mn) Forecast by Country, 2018-2027

20.2.1. U.A.E.

20.2.2. Saudi Arabia

20.2.3. South Africa

20.2.4. Rest of Middle East & Africa

21. South America Commercial Food Warming and Holding Equipment Market Analysis and Forecasts, by Product

21.1. Key Findings

21.2. Market Size (Thousand Units) (US$ Mn) Forecast by Product , 2017-2027

21.2.1. Holding Equipment

21.2.1.1. Holding Cabinets

21.2.1.2. Proofing Cabinets

21.2.1.3. Refrigerators & Chillers

21.2.2. Warming Equipment

21.2.2.1. Steam Tables and Food Wells

21.2.2.2. Countertop Food Warmers

21.2.2.3. Fry Dump Stations or warmer

21.2.2.4. Strip Warmers

21.2.2.5. Banquet Carts and Heated Banquet Cabinets

21.2.3. Meal Delivery Carts

21.2.4. Merchandisers

21.2.4.1. Heated display cases

21.2.4.2. Refrigerated display cases

22. South America Commercial Food Warming and Holding Equipment Market Analysis and Forecasts, by End User

22.1. Key Findings

22.2. Market Size (Thousand Units) (US$ Mn) Forecast by Application, 2018-2027

22.2.1. Full service Restaurants

22.2.2. Quick Service Restaurant

22.2.3. Hotels

22.2.4. Airports

22.2.5. Railways

22.2.6. Hospitals

22.2.7. Schools

22.2.8. Supermarkets & Delis

23. South America Commercial Food Warming and Holding Equipment Market Analysis and Forecasts, by Country & Sub-region

23.1. Key Findings

23.2. Market Size (Thousand Units) (US$ Mn) Forecast by Country, 2018-2027

23.2.1. Brazil

23.2.2. Rest of South America

24. Competitive Landscape

24.1. Market Players - Competition Matrix (by Tier and Size of Companies)

24.2. Market Share Analysis, 2018

24.3. Company Profiles

24.3.1. Middleby Corporation

24.3.1.1. Company Revenue

24.3.1.2. Business Overview

24.3.1.3. Product Segments

24.3.1.4. Geographic Footprint

24.3.1.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

24.3.2. Dover Corporation

24.3.2.1. Company Revenue

24.3.2.2. Business Overview

24.3.2.3. Product Segments

24.3.2.4. Geographic Footprint

24.3.2.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

24.3.3. Welbilt Inc.( Manitowoc Foodservice, Inc.)

24.3.3.1. Company Revenue

24.3.3.2. Business Overview

24.3.3.3. Product Segments

24.3.3.4. Geographic Footprint

24.3.3.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

24.3.4. Illinois Tool Works Inc.

24.3.4.1. Company Revenue

24.3.4.2. Business Overview

24.3.4.3. Product Segments

24.3.4.4. Geographic Footprint

24.3.4.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

24.3.5. Hatco Corporation

24.3.5.1. Company Revenue

24.3.5.2. Business Overview

24.3.5.3. Product Segments

24.3.5.4. Geographic Footprint

24.3.5.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

24.3.6. Alto-Shaam Inc.

24.3.6.1. Company Revenue

24.3.6.2. Business Overview

24.3.6.3. Product Segments

24.3.6.4. Geographic Footprint

24.3.6.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

24.3.7.Victor Manufacturing Ltd

24.3.7.1. Company Revenue

24.3.7.2. Business Overview

24.3.7.3. Product Segments

24.3.7.4. Geographic Footprint

24.3.7.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

24.3.8. Ali Group S.r.l.

24.3.8.1. Company Revenue

24.3.8.2. Business Overview

24.3.8.3. Product Segments

24.3.8.4. Geographic Footprint

24.3.8.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

24.3.9. MKN Maschinenfabrik Kurt Neubauer GmbH & Co KG?

24.3.9.1. Company Revenue

24.3.9.2. Business Overview

24.3.9.3. Product Segments

24.3.9.4. Geographic Footprint

24.3.9.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

24.3.10. Al-Halabi Refrigeration & Steel LLC

24.3.10.1. Company Revenue

24.3.10.2. Business Overview

24.3.10.3. Product Segments

24.3.10.4. Geographic Footprint

24.3.10.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

24.3.11. Fujimak Corporation

24.3.11.1. Company Revenue

24.3.11.2. Business Overview

24.3.11.3. Product Segments

24.3.11.4. Geographic Footprint

24.3.11.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

24.3.12. Duke Manufacturing Co. Inc.

24.3.12.1. Company Revenue

24.3.12.2. Business Overview

24.3.12.3. Product Segments

24.3.12.4. Geographic Footprint

24.3.12.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

24.3.13. Food Warming Equipment Company, Inc.

24.3.13.1. Company Revenue

24.3.13.2. Business Overview

24.3.13.3. Product Segments

24.3.13.4. Geographic Footprint

24.3.13.5. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

List of Tables

Table 1: Global Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by Product , 2017–2027

Table 2: Global Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by Product , 2017–2027

Table 3: Global Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by Product , 2017–2027

Table 4: Global Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by Product , 2017–2027

Table 5: Global Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by End User, 2017–2027

Table 6: Global Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by End User, 2017–2027

Table 7: Global Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by Region, 2017–2027

Table 8: Global Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by Region, 2017–2027

Table 9: North America Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by Product , 2017–2027

Table 10: North America Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by Product , 2017–2027

Table 11: North America Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by Product , 2017–2027

Table 12: North America Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by Product , 2017–2027

Table 13: North America Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by End User, 2017–2027

Table 14: North America Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by End User, 2017–2027

Table 15: North America Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by Country, 2017–2027

Table 16: North America Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by Country, 2017–2027

Table 17: Europe Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by Product , 2017–2027

Table 18: Europe Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by Product , 2017–2027

Table 19: Europe Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by Product , 2017–2027

Table 20: Europe Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by Product , 2017–2027

Table 21: Europe Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by End User, 2017–2027

Table 22: Europe Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by End User, 2017–2027

Table 23: Europe Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by Country, 2017–2027

Table 24: Europe Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by Country, 2017–2027

Table 25: Asia Pacific Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by Product , 2017–2027

Table 26: Asia Pacific Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by Product , 2017–2027

Table 27: Asia Pacific Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by Product , 2017–2027

Table 28: Asia Pacific Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by Product , 2017–2027

Table 29: Asia Pacific Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by End User, 2017–2027

Table 30: Asia Pacific Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by End User, 2017–2027

Table 31: Asia Pacific Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by Country, 2017–2027

Table 32: Asia Pacific Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by Country, 2017–2027

Table 33: MEA Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by Product , 2017–2027

Table 34: MEA Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by Product , 2017–2027

Table 35: MEA Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by Product , 2017–2027

Table 36: MEA Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by Product , 2017–2027

Table 37: MEA Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by End User, 2017–2027

Table 38: MEA Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by End User, 2017–2027

Table 39: MEA Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by Country, 2017–2027

Table 40: MEA Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by Country, 2017–2027

Table 41: South America Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by Product , 2017–2027

Table 42: South America Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by Product , 2017–2027

Table 43: South America Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by Product , 2017–2027

Table 44: South America Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by Product , 2017–2027

Table 45: South America Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by End User, 2017–2027

Table 46: South America Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by End User, 2017–2027

Table 47: South America Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, by Country, 2017–2027

Table 48: South America Commercial Food Warming & Holding Equipment Market Revenue (US$ Mn) Forecast, by Country, 2017–2027

List of Figures

Figure 1: Global Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, 2017–2027

Figure 2: Global Commercial Food Warming & Holding Equipment Market Volume CAGR Forecast, by Region, 2019–2027

Figure 3: Global Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast, 2017–2027, by Region

Figure 4: Commercial Food Warming & Holding Equipment Market Size (US$ Mn) and Volume (Thousand Units) Forecast, 2017–2027

Figure 5: Global Commercial Food Warming & Holding Equipment Market Outlook (Volume %), by Product , 2019

Figure 6: Global Commercial Food Warming & Holding Equipment Market Outlook (Volume %), by Product , 2027

Figure 7: Global Commercial Food Warming & Holding Equipment Market Outlook (Volume %), by End User, 2019

Figure 8: Global Commercial Food Warming & Holding Equipment Market Outlook (Volume %), by End User, 2027

Figure 9: Global Commercial Food Warming & Holding Equipment Market Outlook (Volume %), by Region, 2019

Figure 10: Global Commercial Food Warming & Holding Equipment Market Outlook (Volume %), by Region, 2027

Figure 11: Global Commercial Food Warming & Holding Equipment Market Outlook (Value %), by Product , 2019

Figure 12: Global Commercial Food Warming & Holding Equipment Market Outlook (Value %), by Product , 2027

Figure 13: Global Commercial Food Warming & Holding Equipment Market Outlook (Value %), by End User, 2019

Figure 14: Global Commercial Food Warming & Holding Equipment Market Outlook (Value %), by End User, 2027

Figure 15: Global Commercial Food Warming & Holding Equipment Market Outlook (Value %), by Region, 2019

Figure 16: Global Commercial Food Warming & Holding Equipment Market Outlook (Value %), by Region, 2027

Figure 17: Pricing Analysis (Average Price) : Product (US$), 2018

Figure 18: Pricing Analysis (Average Price) : Product (US$), 2018

Figure 19: Global Commercial Food Warming & Holding Equipment Market Volume Share by Product , 2019

Figure 20: Global Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast by Product , 2019–2027

Figure 21: Global Commercial Food Warming & Holding Equipment Market Opportunity Assessment, by Product

Figure 22: Global Commercial Food Warming & Holding Equipment Market Relative Attractiveness Assessment, by Product

Figure 23: Global Commercial Food Warming & Holding Equipment Market Volume Share by End User, 2019

Figure 24: Global Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) Forecast by End User, 2019–2027

Figure 25: Global Commercial Food Warming & Holding Equipment Market Opportunity Assessment, by End User

Figure 26: Global Commercial Food Warming & Holding Equipment Market Relative Attractiveness Assessment, by End User

Figure 27: North America Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) and Size (US$ Mn) Forecast, 2017–2027

Figure 28: North America Commercial Food Warming & Holding Equipment Market Opportunity Share Analysis, 2019

Figure 29: Europe Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) and Size (US$ Mn) Forecast, 2017–2027

Figure 30: Europe Commercial Food Warming & Holding Equipment Market Opportunity Share Analysis, 2019

Figure 31: Asia Pacific Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) and Size (US$ Mn) Forecast, 2017–2027

Figure 32: Asia Pacific Commercial Food Warming & Holding Equipment Market Opportunity Share Analysis, 2019

Figure 33: MEA Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) and Size (US$ Mn) Forecast, 2017–2027

Figure 34: MEA Commercial Food Warming & Holding Equipment Market Opportunity Share Analysis, 2019

Figure 35: South America Commercial Food Warming & Holding Equipment Market Volume (Thousand Units) and Size (US$ Mn) Forecast, 2017–2027

Figure 36: South America Commercial Food Warming & Holding Equipment Market Opportunity Share Analysis, 2019

Figure 37: Global Commercial Food Warming & Holding Equipment Market Opportunity Assessment, by Region

Figure 38: Global Commercial Food Warming & Holding Equipment Market Relative Attractiveness Assessment, by Region

Figure 39: North America Commercial Food Warming & Holding Equipment Market Share, by Product , 2019

Figure 40: North America Commercial Food Warming & Holding Equipment Market Share, by End User, 2019

Figure 41: North America Commercial Food Warming & Holding Equipment Market Share, by Country, 2019

Figure 42: Europe Commercial Food Warming & Holding Equipment Market Share, by Product , 2019

Figure 43: Europe Commercial Food Warming & Holding Equipment Market Share, by End User, 2019

Figure 44: Europe Commercial Food Warming & Holding Equipment Market Share, by Country, 2019

Figure 45: Asia Pacific Commercial Food Warming & Holding Equipment Market Share, by Product , 2019

Figure 46: Asia Pacific Commercial Food Warming & Holding Equipment Market Share, by End User, 2019

Figure 47: Asia Pacific Commercial Food Warming & Holding Equipment Market Share, by Country, 2019

Figure 48: MEA Commercial Food Warming & Holding Equipment Market Share, by Product , 2019

Figure 49: MEA Commercial Food Warming & Holding Equipment Market Share, by End User, 2019

Figure 50: MEA Commercial Food Warming & Holding Equipment Market Share, by Country, 2019

Figure 51: South America Commercial Food Warming & Holding Equipment Market Share, by Product , 2019

Figure 52: South America Commercial Food Warming & Holding Equipment Market Share, by End User, 2019

Figure 53: South America Commercial Food Warming & Holding Equipment Market Share, by Country, 2019